|

Summary and Price Action Rundown

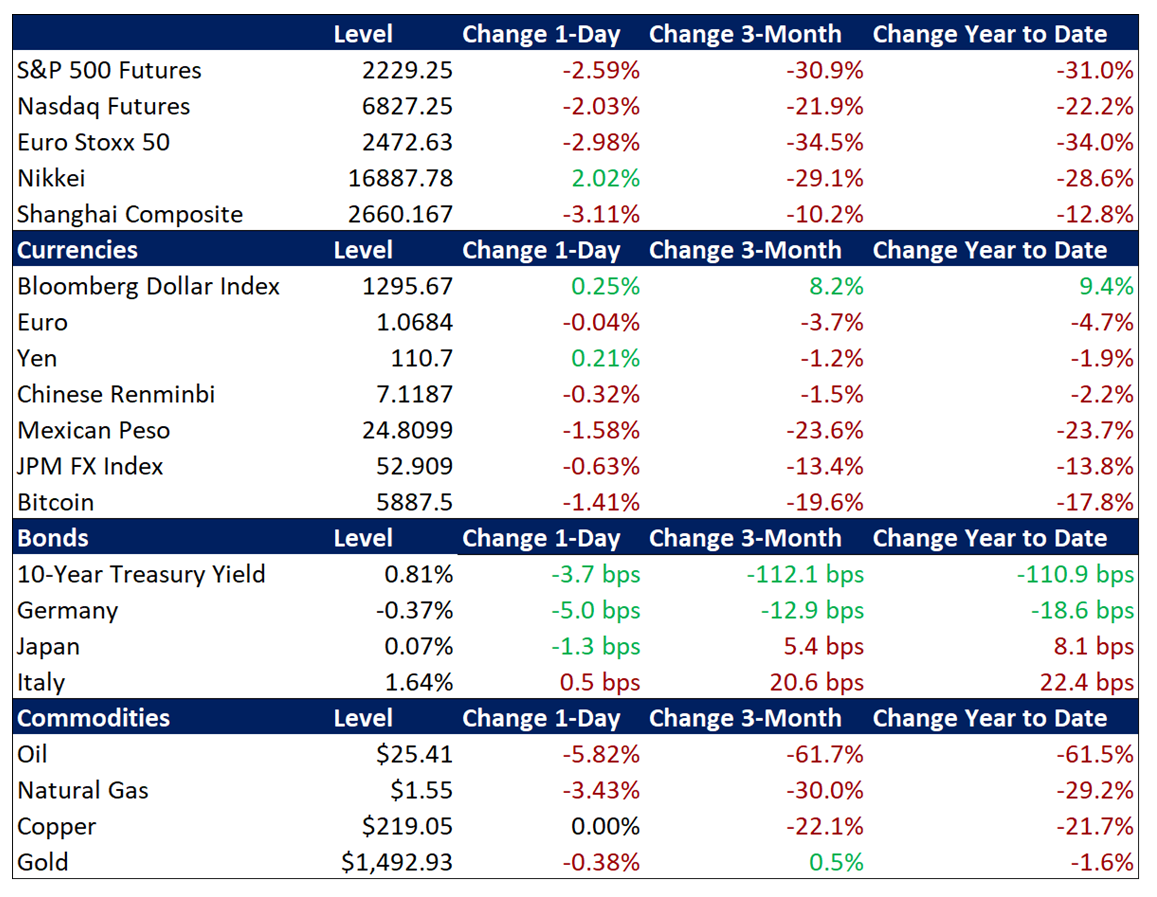

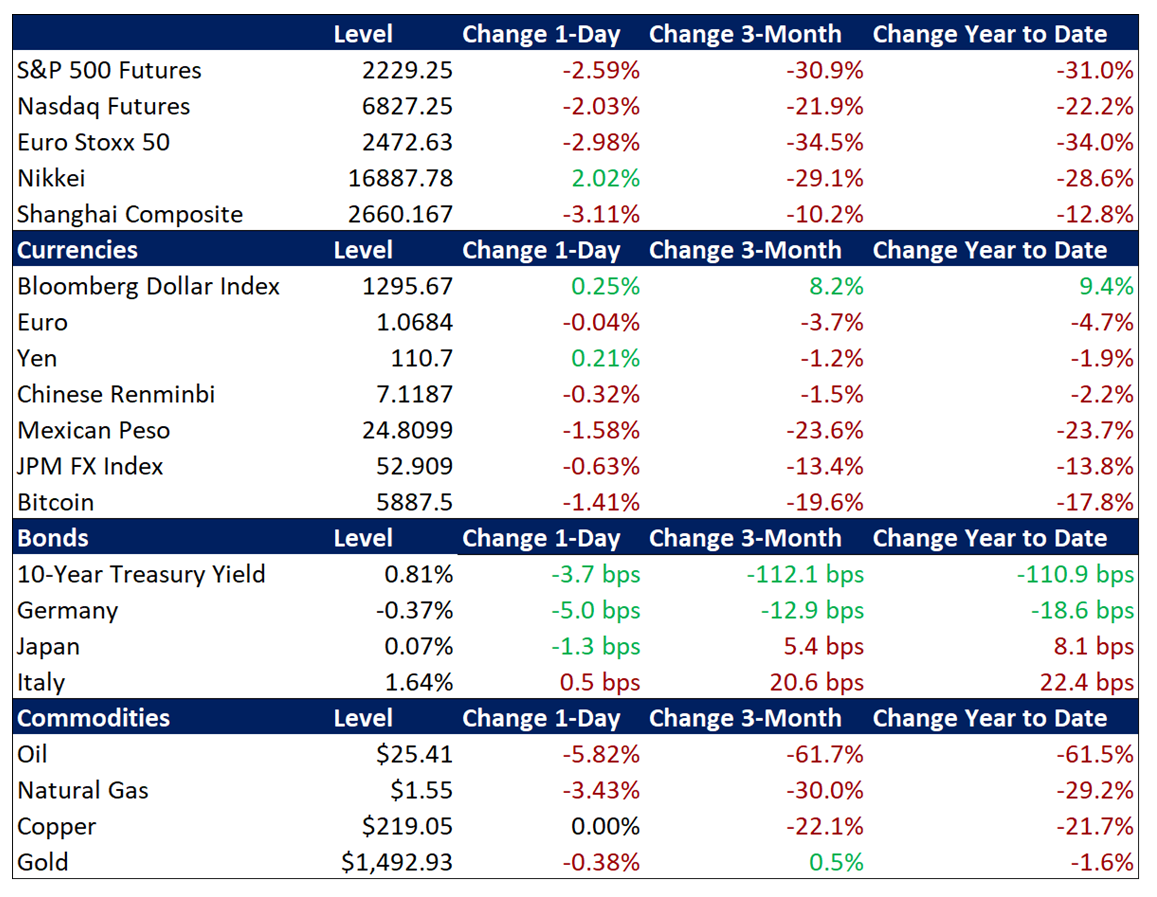

Global financial markets are under pressure this morning as Congressional wrangling further delays US fiscal measures aimed at cushioning the unprecedented economic impact from the pandemic over the coming months. S&P 500 futures point to a 2.6% loss at the open, with the downtrend continuing, though at a somewhat more moderate pace so far after registering the largest one-week decline since 2008. Heading into today’s opening bell, the index is down 15.0% over the past week, which puts year-to-date downside at 28.7% and the decline from mid-February’s record high at 31.9%. EU equities are also posting losses this morning while Asian stocks were mixed overnight. Amid the ongoing risk aversion, Treasuries remain bid, with the 10-year yield at 0.81%, while EU sovereign bonds are steadying after rallying significantly late last week following aggressive measures by the European Central Bank on Wednesday. The dollar is strengthening again, re-approaching multi-year highs. Lastly, oil prices are sliding back toward last week’s nearly multi-decade lows, with Brent crude back below $26 per barrel.

Markets Under Pressure as US Fiscal Stimulus Stalls

Risk aversion remains heightened this morning as the third US spending bill aimed at providing government support to households and businesses during the coming peak of the pandemic bogs down in Congress, while analysts ponder whether even this $2 trillion package will prove to be too little, too late. Senate Democrats held up a vote over the weekend on the latest stimulus bill aimed at providing support to workers, companies, and the economy in general during the sharp contraction of activity amid the pandemic response. Citing differences over the bill’s allocations, Democrats are intent on redirecting more dollars toward workers than companies. House Leader Pelosi is working to draft an alternative version, which analysts estimate could be finished midweek. This follows the rapid expansion of the size of the fiscal package last week from $1.3 trillion to roughly $2 trillion last week, as Congress and the Trump administration reacted to the soaring estimates of economic damage of the pandemic and sought to avoid having to immediately start on a fourth stimulus bill. Meanwhile, reports suggested that once the spending bill is finalized, actual disbursement of the checks could take months instead of weeks. With social distancing giving way to more draconian lockdowns in a growing number of areas, alongside a grim tally of new cases and fatality figures, particularly in Italy, investors are struggling to comprehend how much fiscal firepower might be necessary to even partially cushion severe impact of the pandemic on the balance sheets of businesses and households. This gradually unfolding solvency crisis will remain a challenge for the coming months, even as central bank liquidity injections appear to be addressing at least some of the most acute liquidity and systemic stresses.

Investors Monitor Gauges of Systemic Stress for Signs of Easing

With the Federal Reserve and European Central Bank (ECB), among other global central banks, enacting forceful measures to ease liquidity strains and address systemic risks last week, analysts are highly attuned to nascent signs of improvement. This morning, risk aversion remains extreme, but some gauges of systemic risk are showing signs of stabilization after a week of unprecedented central bank measures. Analysts are citing diminished evidence of stress in offshore dollar funding markets, while short-term funding (repo) markets and interbank markets similarly appear incrementally more orderly. Commercial paper and municipal bonds will be in the spotlight this week as traders suggest that additional Fed support may be needed. Over the weekend, St. Louis Fed President Bullard and Minneapolis Fed President Kashkari both indicated that the Fed stands ready to do more. For context, the Fed continued to augment its liquidity facilities on Friday, announcing an expansion of its money market mutual fund program to include some municipal bonds and upping the its injections into short-term funding markets to up to $1 trillion per day through month-end. This comes after a series of rapid and forceful easing efforts throughout last week, including a 100 basis point (bps) rate cut to the zero bound, $700 billion in quantitative easing, expanded dollar swap lines with overseas central banks, and liquidity support facilities for commercial paper markets, primary dealers, and money market mutual funds. Other global central banks engaged in extraordinary easing last week as well, including the European Central Bank, Bank of England, Reserve Bank of Australia, and the Bank of Japan.

Additional Themes

Economic Impact Estimates Continue Rising – St. Louis Fed President Bullard warned that US growth in the second quarter could contract by 50% and unemployment could hit 30%.

Oil Prices Deeply Depressed – Some suggestions that US producers could join with OPEC to restrict crude output were met with a cool response from the industry, as dwindling prospects for support have sent oil prices back near the nearly 18-year lows they hit last week.

|