Summary and Price Action Rundown

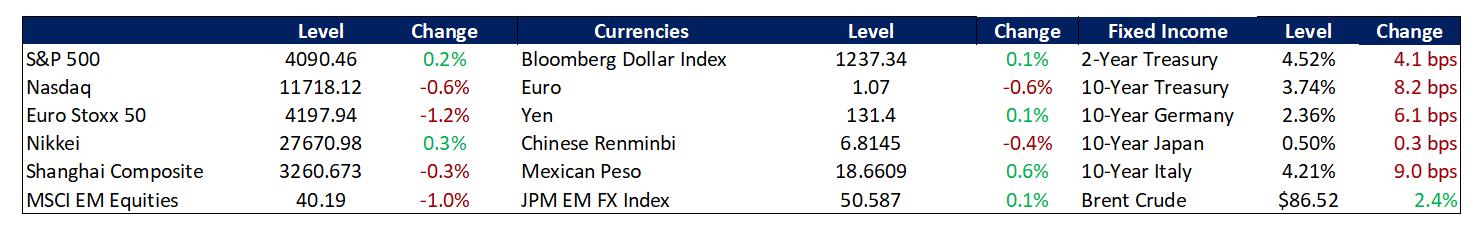

US equities were mixed and Treasuries remained under pressure as economic uncertainty deepens ahead of next week’s consequential US inflation, retail sales, and industrial production data. The S&P 500 recouped early losses to gain 0.2% today, upping its gain on the year to 6.5%, though the Nasdaq lost 0.6% to cut its early 2023 rally to 12.0%. Overseas, the Euro Stoxx Index underperformed, erasing yesterday’s outperformance, while Asian equities were mostly lower overnight. Longer-dated Treasury yields continued to climb, with the 10-year rising to 3.74%, while the policy-sensitive 2-year yield ascended to 4.52%. The growth-sensitive 2/10 Treasury yield became less inverted, but is still sending an alarming recession signal. The broad dollar hovered above seven-month lows, fluctuating well below its recent multi-decade peak of late September. Oil prices jumped as Russia cut production, with Brent crude climbing above $86 per barrel.

US Consumers Cheer Up but Sentiment Remains Subdued Overall

With investors pondering the crosscurrents and contradictions in US growth and inflation figures, a prominent survey showed some positive signals, but overall conditions remain challenging. The University of Michigan consumer sentiment for the US jumped to a thirteen-month high of 66.4 in February from 64.9 in January, beating market forecasts of 65, preliminary estimates showed. The gauge for current economic conditions improved to 72.6 from 68.4 in the previous month, but the expectations subindex fell to 62.3 from 62.7. After three consecutive months of increases, sentiment is now 6% above a year ago but still 14% below two years ago, prior to the current inflationary episode. Meanwhile, inflation expectations for the year ahead went up to 4.2% from 3.9% while the five-year outlook remained steady at 2.9%. Overall, high prices continue to weigh on consumers despite the recent moderation in inflation, and sentiment remains more than 22% below its historical average since 1978. Combined with concerns over rising unemployment on the horizon, consumers are poised to exercise greater caution with their spending in the months ahead. – MPP view: Growth data around the world has been mixed but we think the trend is to the downside, despite very noisy and idiosyncratic US labor market data. Our base case has been that risk assets will remain in a relatively placid period into Q1 this year as inflation peaks while growth is still positive, but the risk is that the recession arrives more quickly than we have anticipated. Global recession is our base case for 2023 with the lagged effects of the current tightening and US dollar spike really beginning to bite with a 6-12 month lag. We are more concerned about length of the recession and lack of stimulus and support for the recovery than we are about the severity of the retrenchment.

Rent Eases Ahead of Key Inflation Data Next Week

The median US rent increased by 2.4% annually to $1,942 in January, representing the smallest annual rise since May of 2021 and cheapest level in about a year. January’s number reflected the eighth consecutive decline in rent growth rate, and median rent also decreased by 1.9% from the previous month. Signs of increasing supply and reducing demand have possibly contributed to the fall in rent growth. On the demand side, broader economic pressure makes renters hesitant to sign leases. On the supply side, the increase in the number of real estate projects and homeowners deciding to rent out their properties has oversupplied the market. Additionally, the nationwide rental vacancy rate has reached near bottom in the fourth quarter of 2022 and is projected to increase in 2023. The cooling in rent prices is expected to help reduce inflation in the US. – MPP view: We think inflation continues to improve but the moderation tapers off through midyear and price pressures remains sticky, eventually driving home the point that the Fed keeps trying to make that it is not going to be in a position to cut rates later this year even if growth is weak and a recession is underway.

Additional Themes

Canadian Labor Markets Also Post an Upside Surprise in January – The Canadian economy created 150 thousand jobs in January, the most since February last year and much more than the market expectations of a 15 thousand increase. Gains were driven primarily by people aged 25 to 54, split evenly between women and men in this group. Additionally, the unemployment rate held steady at 5%, just shy of the record-low 4.9% observed in June and July 2022, and below market forecasts of 5.1%, signaling that the Canadian labor market remains stubbornly tight. The total number of unemployed people stood at 1.0 million, similar to the level observed since the summer of 2022. Meanwhile, employment increased by 150,000 and the size of the labor force has continued to grow, as an additional 153,000 people joined the labor force, boosting the participation rate to 65.7%.

Adidas Suffers from a Promotional Disaster – Adidas, the German sportswear giant, said late Thursday that it is assessing what to do with the Yeezy inventory, adding it has already accounted for the “significant adverse impact” of not selling the products. Operating profit would drop by about 500 million euros if the company fails to shift the products, and Adidas expects sales to decline at a high single-digit rate in 2023. The company also forecasted one-off costs of up to 200 million euros, leaving Adidas’ worst-case scenario for the year as a 700 million euro loss for 2023. Based on unaudited numbers, Adidas’ revenues increased by 1% in 2022, while operating profit dropped from almost 2 billion euros in 2021 to 669 million euros in 2022. Meanwhile, the company could lose around 1.2 billion euros ($1.3 billion) in revenue in 2023 if it is unable to sell its existing Yeezy stock. Shares sank 11% Friday morning as traders reacted to the announcements. “The numbers speak for themselves. We are currently not performing the way we should,” Adidas CEO Bjørn Gulden said in a press release.

Looking Ahead – Next week’s macro calendar centers around the highly-anticipated US Consumer Price Index figures for January, with the Producer Price Index also due. US retail sales and industrial production data for last month will be scrutinized for any signs of additional slowing. UK inflation and retail sales are also on the calendar, along with EU industrial production, Australian business and consumer confidence, and Japan GDP.

Latest Macrocast: America runs on trucking – On today’s Macrocast, hosts Meghan Pennington and John Fagan are joined by Loren Smith of Skyline Policy Risk Group to discuss the latest on the IRA and infrastructure spending, permitting reform and its impact on energy production, the debt ceiling, and more. Tune in here! https://marketspolicy.com/podcast-2/