Summary and Price Action Rundown

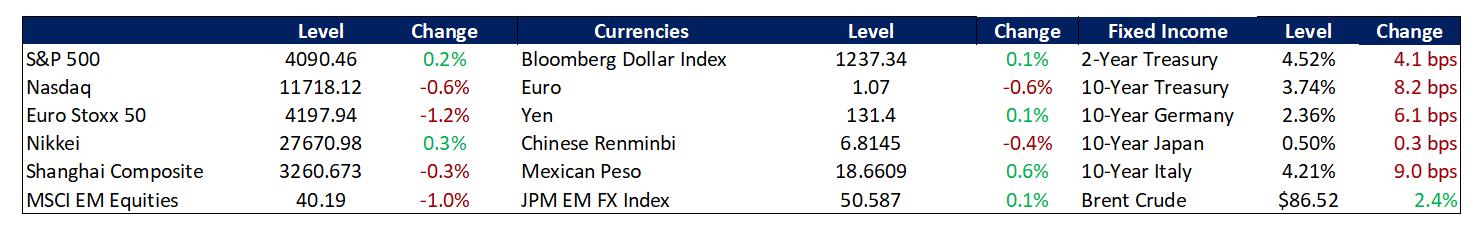

US equities retraced a modest bit of their recent rally as investors digested more Fed commentary and signs of intensifying growth fears in Treasury markets, while oil prices slid amid rising demand fears. The S&P 500 declined 0.3% today, deepening the index’s year-to-date loss to 13.6%, while the Nasdaq also edged lower, taking its 2022 performance to -20.9%. Overseas, the Euro Stoxx Index closed flat, while Asian stocks were mostly higher overnight. Longer-dated Treasuries extended their rally, with the 10-year yield dropping to 2.58%, the lowest level since April, while the growth-sensitive 2/10 yield curve deepened its inversion, continuing to convey a classic recession signal. The broad dollar continued to retreat below last month’s cycle high, which was its strongest level in twenty years. Oil prices were hit by demand fears ahead of this week’s OPEC+ meeting, with Brent crude sinking below $100 per barrel. – MPP upgraded US equities / downgraded the dollar: Our base case for topping inflation and slowing (but not crashing) growth with a downshifting Fed is the recipe for a second half 2022 tradable risk asset rally. With this past week’s developments increasingly aligning with this view, **we are upgrading stocks from neutral to 70% overweight and downgrading the dollar to a tactical sell, though we are still neutral on the Treasury market and curve. ** We still believe that summer markets will be choppy, and we just had a very positive week and a meaningful July rally, hence we are leaving some headroom to go further overweight if upside catalysts, like peaking CPI figures, materialize between now and the September FOMC decision.

Recession Warning from the Treasury Market Grows Louder

Longer-dated Treasury yields extended lower today, further inverting the yield curve as investors weighed the prospects of a recession and the path for future Fed rate hikes. While Fed Chair Powell said last week that the pace of rate increases could slow “at some point,” hawkish comments from Minneapolis Fed President Neel Kashkari on Sunday indicated that the economy still has a long way to go before inflation comes down to the bank’s target of 2%. Kashkari said the central bank will do whatever is necessary to bring inflation down, even if it leads to a recession, although they will try to avoid it. “Whether we are technically in a recession or not doesn’t change the fact that the Federal Reserve has its own work to do, and we are committed to doing it,” he said. Kashkari’s comments imply that he is willing to continue supporting an aggressive path for rate hikes, which also raises the likelihood of the Fed overtightening and inducing a recession. The 10-year Treasury yield fell to 2.58% today, as investors likely reacted in part to the hawkish stance from the Fed official in addition to the ISM manufacturing data for July that showed a bigger-than-expected drop in the prices paid component. Bank of America analysts believe that the 10-year yield could reach 2% in the next 6-12 months amid a “globally synchronized slowdown” that could exacerbate demand for US Treasuries. Meanwhile, the policy-sensitive 2-year Treasury yield fluctuated on Monday and finished roughly flat at 2.89%. The inverted 2-year/10-year yield curve, which is a classic signal of an impending recession, reached its most extreme negativity in decades of -0.32 at one point. – MPP view: While we are sympathetic to the view that the global synchronized slowdown will keep longer-dated Treasury yields capped, we think there is only so much downside possible given our expectation that the Fed will ease off its rate hike trajectory and help re-steepen the yield curve to some degree. This push-pull dynamic is behind our reasoning for staying neutral on Treasury markets at these levels (for context, we turned neutral on Treasuries in mid-May, which has been insufficiently bullish).

Increasing Signs of Deterioration in US Housing Market Metrics

Rising mortgage rates and inflation in the broader economy caused housing demand to drop sharply in June, forcing home prices to cool down. Home prices are still higher than they were a year ago, but the gains slowed faster in June, according to Black Knight, a mortgage software, data, and analytics firm that began tracking this metric in the early 1970s. The annual rate of price appreciation fell from 19.3% to 17.3%. Price gains are still substantial because of an imbalance between supply and demand. The housing market has had a severe shortage for years. Strong demand during the coronavirus pandemic exacerbated it.

Prices are not expected to fall nationally, given a stronger overall housing market, but higher mortgage rates are taking their toll. According to Mortgage News Daily, the average rate on the 30-year fixed mortgage crossed over 6% in June. It has since dropped back to the lower 5% range, but that is still significantly higher than the 3% range rates at the start of this year. “25% of major U.S. markets saw growth slow by three percentage points in June, with four decelerating by four or more points in that month alone,” said Ben Graboske, president of Black Knight Data & Analytics. Still, while this was the sharpest cooling nationally, the market would have to see six more months of this deceleration for price growth to return to long-run averages, according to Graboske. He calculates that it takes about five months for interest rate impacts to be fully reflected in home prices. So far, markets seeing the sharpest drops are those that previously had the highest prices in the nation. Average home values in San Jose, California, have fallen 5.1% in the last two months, the biggest drop of any of the top markets. That chopped $75,000 off the price. Seattle, San Francisco, San Diego, and Denver round out the top five markets with the most significant price reductions.

The cooling in prices coincides with a sharp jump in the supply of homes for sale, up 22% over the last two months, according to Black Knight. Inventory is still, however, 54% lower than 2017-19 levels. Price drops will not affect the average homeowner as much as they did during the Great Recession because homeowners today have considerably more equity. Tight underwriting and several years of strong price appreciation caused home equity levels to hit record highs. – MPP view: As we have noted, increasingly manifest weakness in US economic indicators and housing data is a necessary condition for the Fed downshift, making bad news (though not too bad) on the growth front good news on the monetary outlook. In short, the new Goldilocks macro formulation is “weak but not too weak,” which we think will be the story of the second half of this year. This data only generally fits this Goldilocks formulation, and we think more economic readings will fall into this Goldilocks category over the current quarter and into Q4.

Additional Themes

Crude Hit by Demand Fears – Oil prices fell sharply on Monday, as poor manufacturing data from key markets trigger demand concerns. Specifically, the latest manufacturing datapoints from China and Japan both indicated a slowdown in economic expansion. China’s Caixin/Markit PMI index dropped to 50.4 in July from 51.7 in June, well below market forecasts of 51.5. Japan’s Jibun Bank PMI index decreased slightly to 52.1 in July from 52.7 in the previous month. Japan’s slowdown in manufacturing activity was mainly caused by inflation and supply chain disruptions; China’s weak factory data was mainly due to domestic Covid-19 lockdowns. Other key markets, such as South Korea and some members of the Euro Area, also reported discouraging manufacturing numbers. Not only do global PMI results drag oil prices down, but recessionary pressures from major economies are also making oil prices drop. The US economy shrank for a second quarter, which is traditionally a key indication of an economic recession. Additionally, a rise in Libyan oil production has also helped drive oil prices down. The North African nation is now producing 1.2 million barrels per day, up from 800,000 bpd on 22 July, after the lifting of a blockade on several oil facilities. Furthermore, the amount of rigs in the US was also climbing to help increase US oil production. Meanwhile, OPEC+ will meet on Wednesday to determine the output target for September. Output policy is likely going to remain unchanged, although US President Biden called for more production during his trip to Saudi Arabia. Currently, the OPEC+ group is actually almost 3 million bpd short of its quotas due to sanctions and a lack of investment. OPEC’s new secretary general, Haitham al-Ghais, said during an interview ahead of Wednesday’s meeting that “OPEC doesn’t control oil prices, but it practices what is called tuning the markets in terms of supply and demand.” – MPP view: Our view is that slowing growth and correspondingly weakening demand for crude will cap Brent/WTI upside but not result in significant price relief. We have seen pre-OPEC+ declines in crude oil quickly priced out after the meeting and we doubt this week will be any different. Persistently elevated oil prices despite other disinflationary impulses will allow a Fed downshift in its tightening cycle and a peak in rates by year-end but, further out, will keep the bar very high for FOMC rate cuts, even as growth continues to deteriorate in 2023, which we think is the recipe for a rebound for risk assets in 2H2022 and relapse to the downside in 1H2023.

Concerns Surround Speaker Pelosi’s Planned Taiwan Visit – House Speaker Nancy Pelosi arrived in Singapore today, where she is set to kick off a planned tour of Asia that has raised tensions between Washington and Beijing over reports that it will include a stop in Taiwan despite increasingly sharp warnings from Chinese authorities that a visit to the island could provoke a military response. The People’s Liberation Army “won’t sit idly by,” said Chinese Foreign Ministry Spokesman Zhao Lijian in a regular press conference last Friday. “Her stature as the No. 3 US official means a trip would be highly sensitive… As to what measures, let’s wait and see whether she insists on this visit.” For context, Speaker Pelosi’s official trip itinerary made no specific mention of Taiwan, but reports from CNN and Taiwanese media outlets citing both US and Taiwanese officials say that she is planning to meet with Taiwanese President Tsai Ing-wen on Wednesday and that several hotels in downtown Taipei had been booked in advance of her arrival. The Biden administration has reportedly voiced some opposition to the trip, but aides said the President is declining to directly ask Pelosi to cancel the visit out of respect for the independence of Congress.

In response to the Chinese threats, US officials have cautioned China against escalating the situation. “There is no reason for Beijing to turn a potential visit consistent with longstanding US policy into some sort of crisis or use it as a pretext to increase aggressive military activity in or around the Taiwan Strait,” said Pentagon spokesman John F. Kirby at a White House briefing. “Our actions are not threatening and they break no new ground. Nothing about this potential visit — potential visit — which by the way has precedent, would change the status quo.” American officials are reportedly betting that China will not risk a direct confrontation by interfering with Speaker Pelosi’s ability to land safely on the island, but they say that Chinese planes may “escort” her Air Force plane as a demonstration of their control over air routes, and yesterday, a spokesman for the Chinese air force said the country’s fighter jets would fly around the island to showcase its ability to defend what Beijing considers to be Chinese territory, although he did not specify dates for the exercise. “The Chinese side has repeatedly made clear to the US side our serious concern over Speaker Pelosi’s potential visit to Taiwan and our firm opposition to the visit,” Zhao said. “If the US side challenges China’s red line, it will be met with resolute countermeasures. The US must bear all consequences arising thereof.” The New Taiwan dollar fell to a two-year low on the news. – MPP view: This seems like an unfavorable risk/reward for the Speaker’s trip, and presents a “small probability but potentially major impact” event that is basically impossible to hedge.

Latest Macrocast: Breaking Down the Fed’s Big Week with Howard Schneider – On today’s Macrocast, Tony, John, and Brendan welcome Howard Schneider, Federal Reserve reporter at Thomson Reuters, to the show. As an expert on all things Fed and monetary policy, Howard breaks down the Fed’s latest rate hike and inflation’s impact on food consumption. Plus, the group analyzes the concerning PCE and GDP data released this week. Tune in here! https://marketspolicy.com/podcast-2/

Read Howard Schneider’s recent piece on food prices and rising hunger here.

Find more of Howard’s work here.

Read HPS’ Q2 GDP Fact Sheet here.

Macrocast Special: A Conversation with Megan Greene on the Anti-Inflation Toolkit – In this special edition of the Macrocast, Tony and John welcome Megan Greene, Harvard Kennedy School Senior Fellow and Kroll Institute Global Chief Economist, to the show. Megan expands on her recent column in the Financial Times, where she makes an important point few pundits have acknowledged: There’s not much policymakers outside the Federal Reserve can do about inflation. The group walks through various policy responses to inflation and the supply- and demand-driven forces behind rising prices. Plus, the group discusses energy prices, the methodology for measuring inflation, and more. Tune in here! https://marketspolicy.com/podcast-2/

Read Megan’s Financial Times column here.

Read the rest of Megan’s FT columns here.

Read Megan’s bio and check out her site here.

Looking Ahead – Next week’s macro calendar features the US nonfarm payroll figures for July, which is expected to reflect continued resilience in the US labor market with 250k jobs and steady unemployment at 3.6%. Other notable data includes global Purchasing Managers’ Indexes (PMIs), EU and Australian retail sales, German factory orders and industrial production, and Turkish inflation figures. The Bank of England and Reserve Bank of Australia have decisions. OPEC+ conducts its monthly meeting on supply curbs and earnings reporting season continues with results from Aflac, Caterpillar, Cigna, ConocoPhillips, CVS Health, Electronic Arts, Eli Lily, Lyft, Marathon Petroleum, Marriott, MetLife, PayPal, Prudential, Starbucks, and Yum! Brands.