Summary and Price Action Rundown

Global risk assets are retreating this morning as news that President Trump has contracted Covid-19 compounds investor concerns over the outlook for US politics and policy. S&P 500 futures indicate a 1.6% lower open after the index closed 0.5% higher yesterday, upping its year-to-date gain to 4.6%, which is about 5.5% below early September’s record high. Equities in the EU are also down, while Asian markets were mixed amid widespread holiday closures. Demand for safe haven assets is providing modest support for the dollar, while longer-dated Treasury yields are also reflecting rising demand, with the 10-year yield at 0.66%. Brent crude prices are extending this week’s steep downtrend, falling below $40 per barrel.

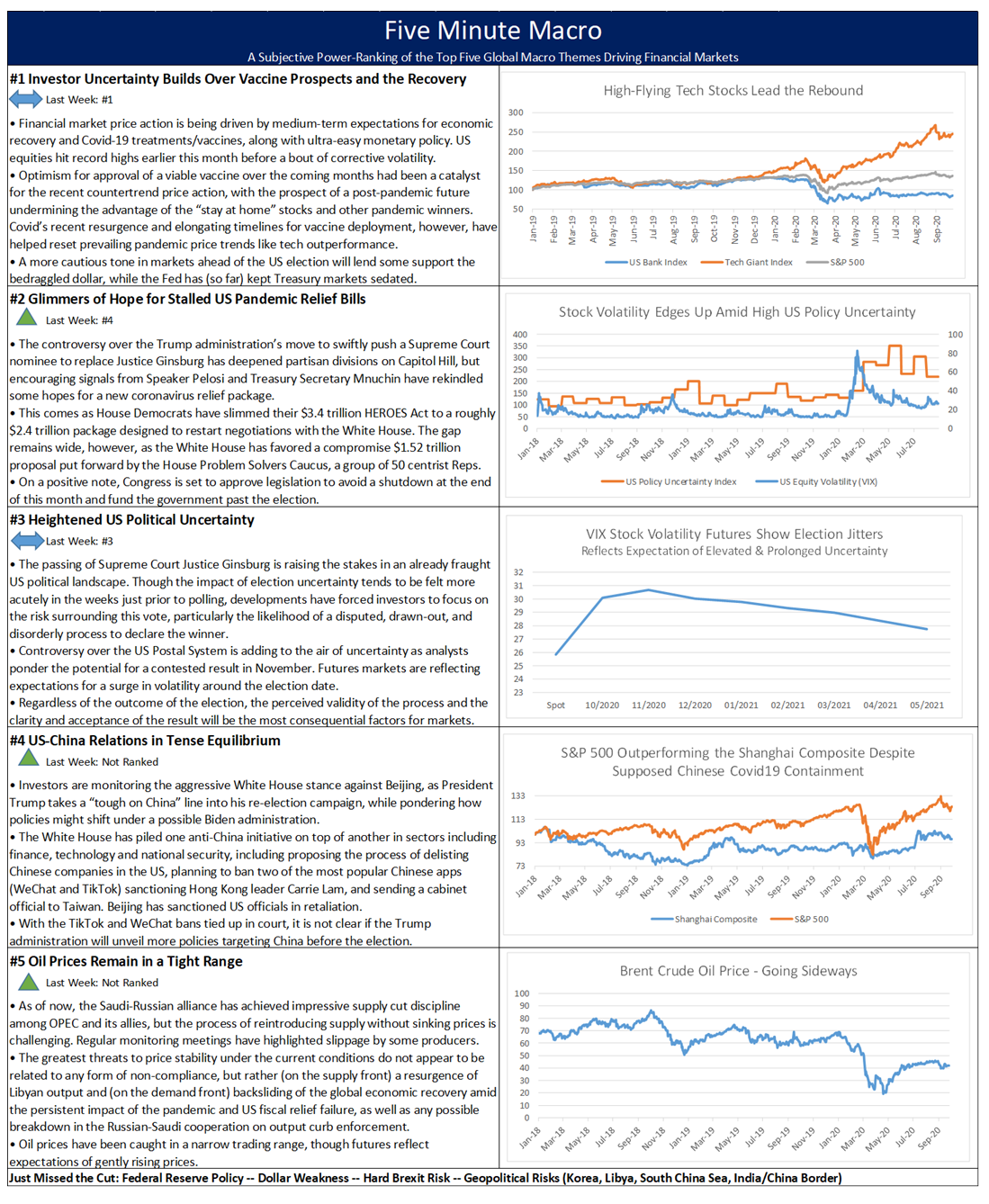

Political Uncertainty Intensifies Following President Trump’s Covid-19 Diagnosis

In an already fraught election season, last evening’s news that President Trump, the First Lady, and a key White House staffer have tested positive for the coronavirus has deepened investor anxieties over the political and policy outlook. Financial markets are reflecting heightened risk aversion following the news overnight from Washington, as investors grapple with the potential ramifications of these developments. The key area of uncertainty is of course the election, with President Trump off the campaign trail for a few weeks at a minimum and only a month to go before Americans go to the polls. Joe Biden and his team will certainly need to release their Covid-19 testing status as soon as practicable, and the likelihood of one or more follow-up debates to this week’s first installment have clearly declined. Meanwhile, analysts are pondering whether the slim prospects of the fiscal stimulus package have been impacted in any way, as House Speaker Pelosi and Treasury Secretary Mnuchin had been making halting progress toward a compromise over the last few days (more below). Similarly, some commentators now expect that the process of confirming Amy Coney Barrett to the Supreme Court is more likely to be delayed until after the election. On the economics front, there is speculation that the President’s high-profile infection will underscore the high transmissibility and continued virulence of Covid-19 to the general public, a view that is congruent with the pre-market selloffs in airline, travel, and other equity sectors that are adversely impacted by coronavirus concerns. Lastly, analysts are bracing for a lack of transparency from the White House over President Trump’s ongoing condition, citing the example that the severity of UK Prime Minister Johnson’s illness with coronavirus was not disclosed until after his recovery.

US Nonfarm Payrolls Due

Amid heightened uncertainty over the prospects for the US economic recovery, today’s key September labor market data is expected to remain robust. Nonfarm payrolls are projected to show 850K new jobs after the US economy added 1.371 million jobs in August, down from 1.734 million in July, and only slightly below market forecasts of 1.4 million. That left payrolls 11.5 million below pre-pandemic levels as more than 22 million jobs were lost in March and April. This comes amid worrisome headlines on the employment front from Walt Disney, which has announced 28,000 layoffs due to diminished attendance at theme parks, depressed cruise demand, and struggles at retail outlets. Airlines are also poised to begin cutting headcount as government stimulus rolls off this week, with around 40,000 expected to be impacted. Other US economic data this week has been mixed, with August personal income surprising to the downside, while personal spending and inflation for that month was perkier than estimated, and the manufacturing purchasing managers’ index for September remained in robustly expansionary territory.

Additional Themes

Slim Fiscal Stimulus Hopes – Effort to forge a compromise stimulus package are expected to continue today despite the President’s diagnosis, as House Democrats and the White House remain at odds over remaining gaps, particularly the amount of state aid and degree of unemployment benefit augmentation. The House passed the Democrat-drafted $2.2 trillion version of the bill last night, which was expected to be the final step before a month-long recess, though Speaker Pelosi has indicated that talks will continue today.

Looking Ahead – With investor attention affixed on the US political and policy situation, the President’s health, and market volatility, next week’s relatively light economic calendar is likely to garner only modest notice. The minutes of the Fed’s September meeting have the greatest potential to move markets, to the extent they provide additional insight on the announced policy and forecast shifts. Global service sector purchasing managers’ indexes (PMIs) for September are due as well, alongside another week of US jobless claims data, a gauge of small business optimism, and a decision by the Reserve Bank of Australia.