Fed policy remains in focus as nonfarm payrolls disappoint but corporate earnings impress. Oil prices continue to drop while the yen hits multi-decade lows.

Category: Five Minute Macro

Five Minute Macro 3-20-2024

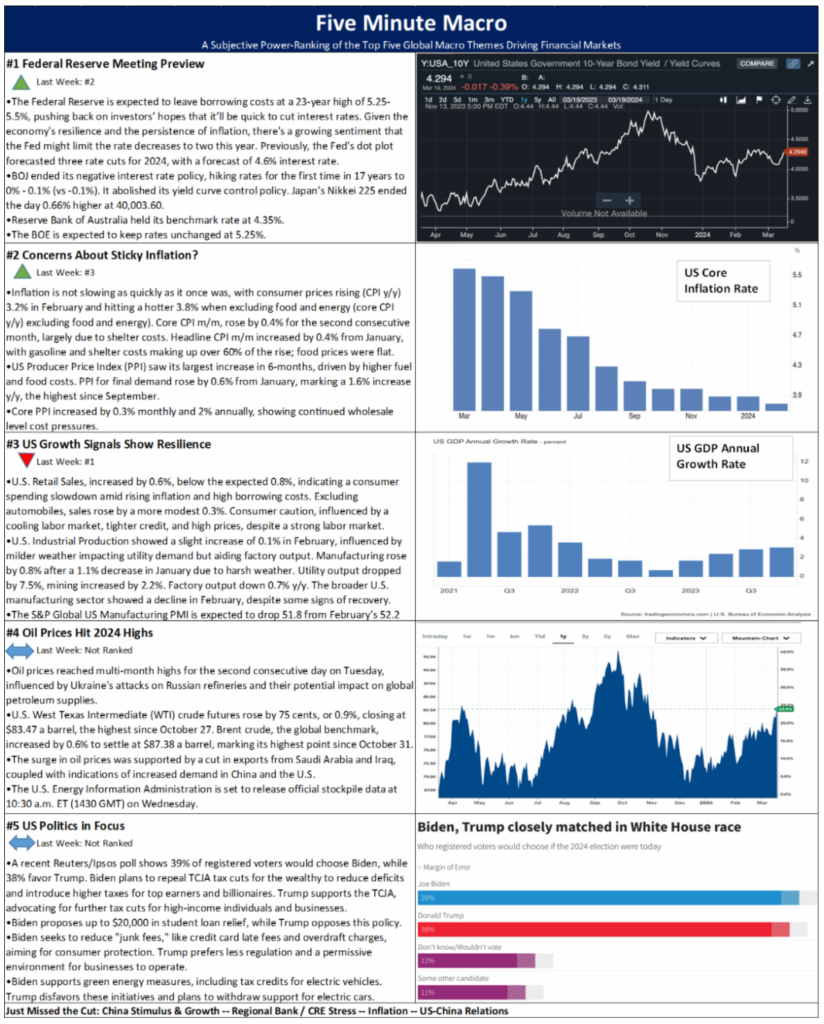

The Fed is front and center this week as concerns about sticky inflation remain and US growth shows resilience. Oil prices have rebounded to new 2024 highs and politics US remain in focus.

Five Minute Macro 3-11-2024

US and Global growth signals continue to remain garbled, but Fed communications add clarity to rate cut outlook in the face of concerns about sticky inflation. US politics remain in focus while Bitcoin continues to spike.

Five Minute Macro 3-4-2024

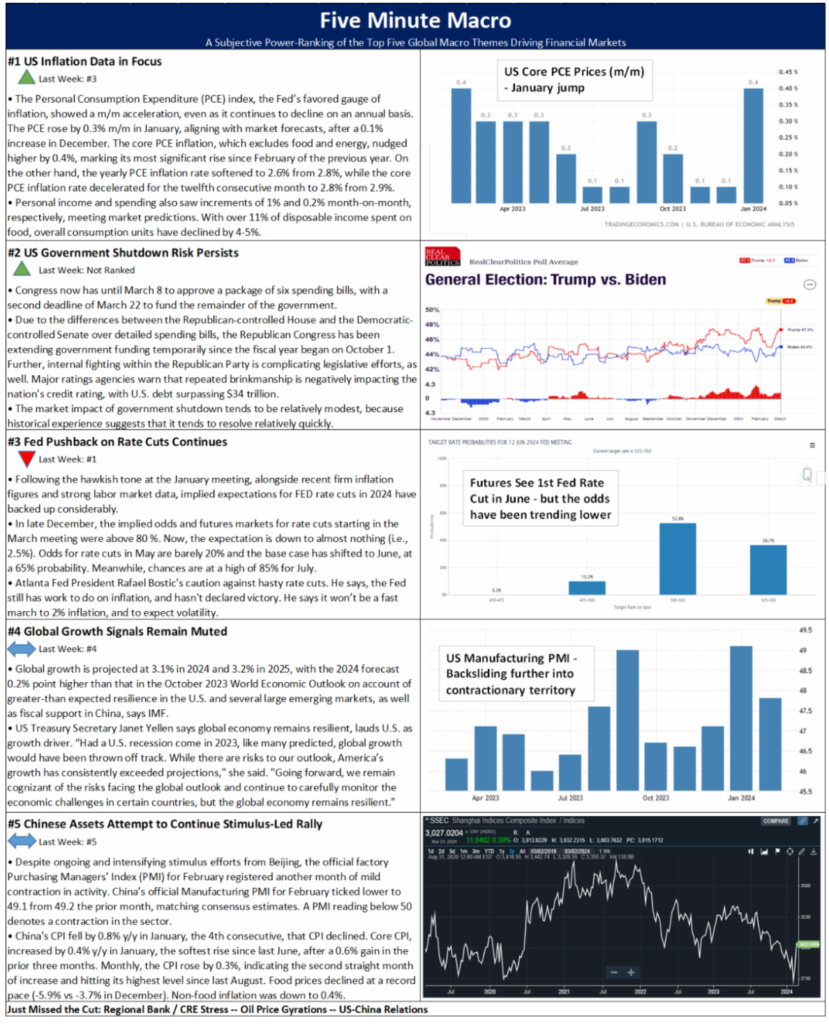

US inflation data in focus as we stare down another potential government shutdown and Fed officials continue to push back rate cut expectations, despite muted global growth signals, while Chinese assets attempt to continue stimulus-led rally.

Five Minute Macro 2-26-2024

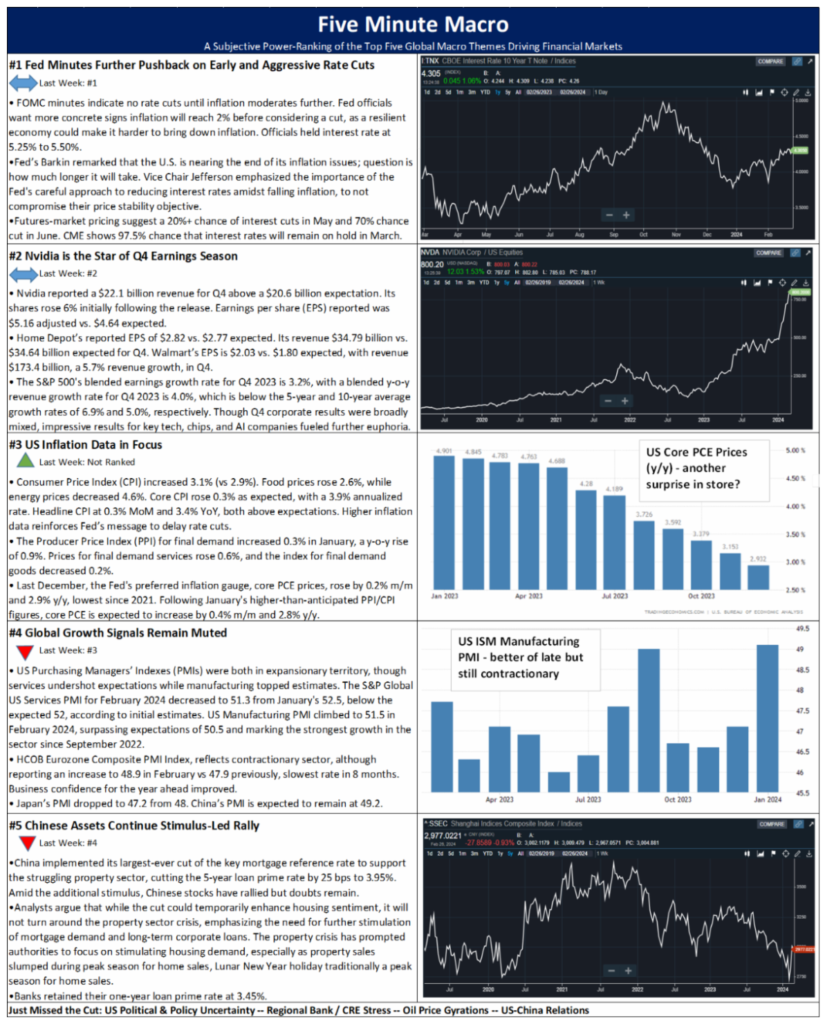

Fed Minutes further pushback rate cut expectations while Nvidia was the star of fourth quarter earnings season. Inflation data is in focus this week with the Fed’s preferred measurement and global growth signal remain muted. Finally, Chinese assets continue a stimulus-led rally.

Five Minute Macro 2-12-2024

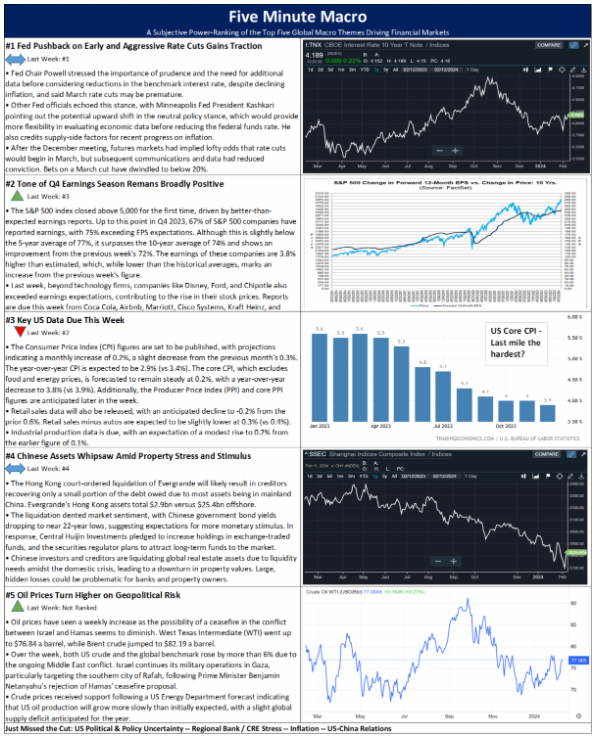

Fed pushback on early cuts begins to take traction as 4th quarter earnings remain broadly positive. Key US data is due this week while Chinese assets continue to whipsaw amid property stresses. Finally, oil prices continue to grind higher as geopolitical risks remain elevated.

Five Minute Macro 1-29-2024

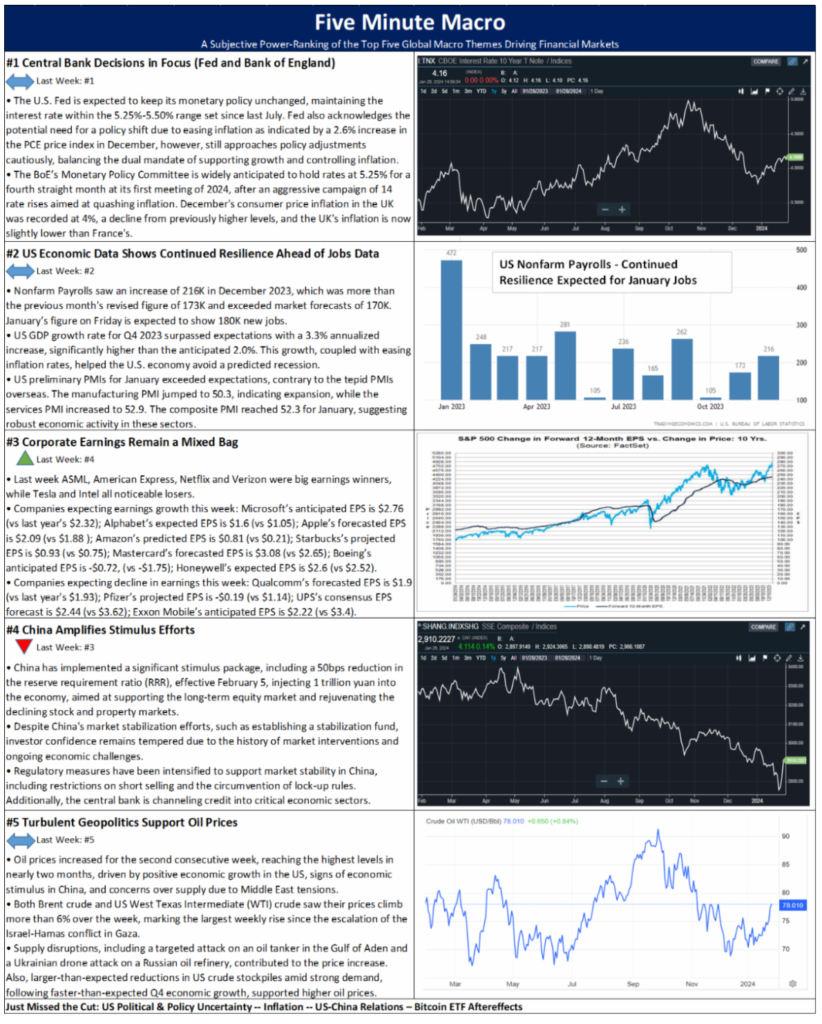

This week’s focus will be on the Fed and BoE as economic data remains resilient as inflation cools. Corporate earnings remain a mixed bag with the biggest tech companies up this week. China amplified their stimulus efforts and oil continues to push higher amid geopolitical turbulence.

Five Minute Macro 1-23-2024

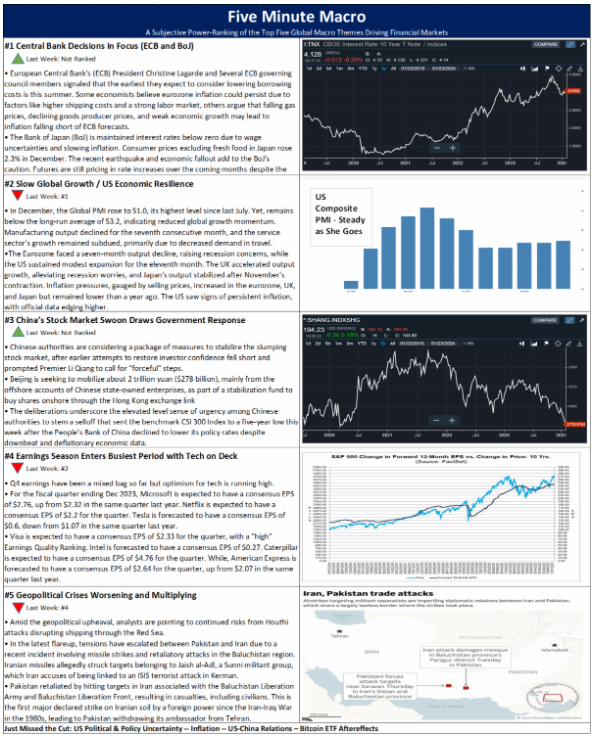

Central banks in focus this week as global growth continues to slow outside of the US. Chinese stocks swoon on government support hopes and earnings season continues with tech on deck. Finally, geopolitical worries intensify.

Five Minute Macro 1-18-2024

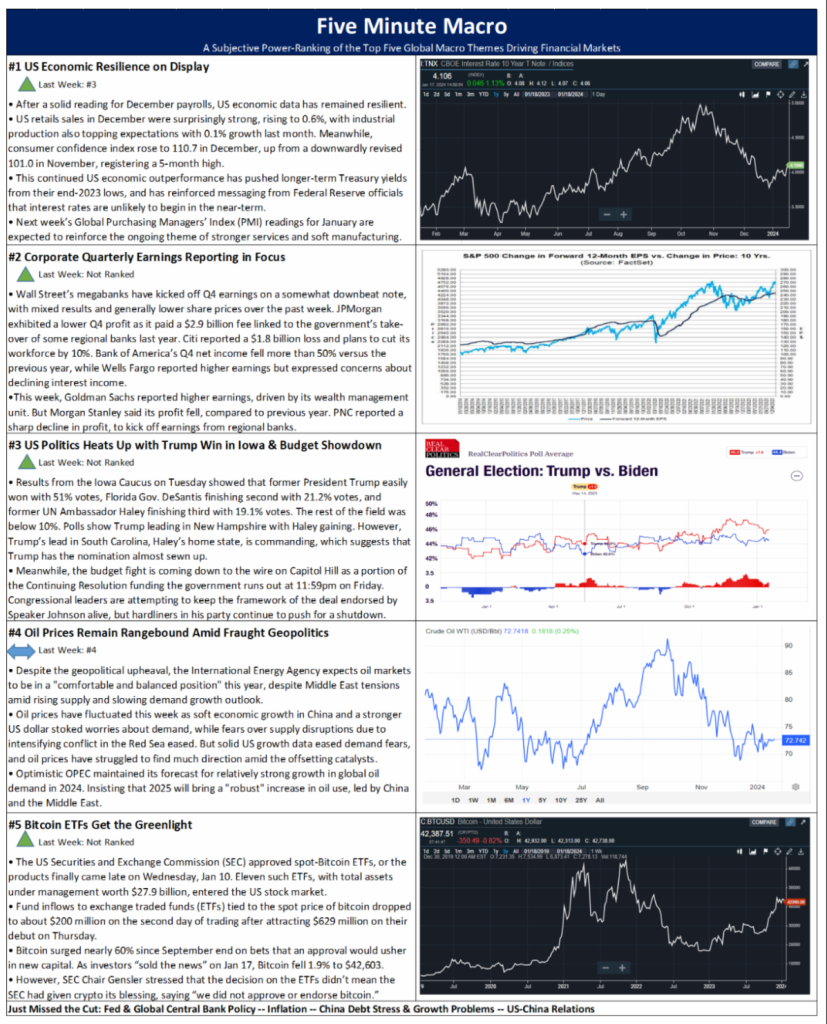

US economic data remains resilient while corporate earnings fail to swing sentiment one way or the other. Politics is heating up with primary elections and oil prices remain rangebound despite geopolitical tensions. Finally, Bitcoin gets ETF greenlight.

Five Minute Macro 12-18-2023

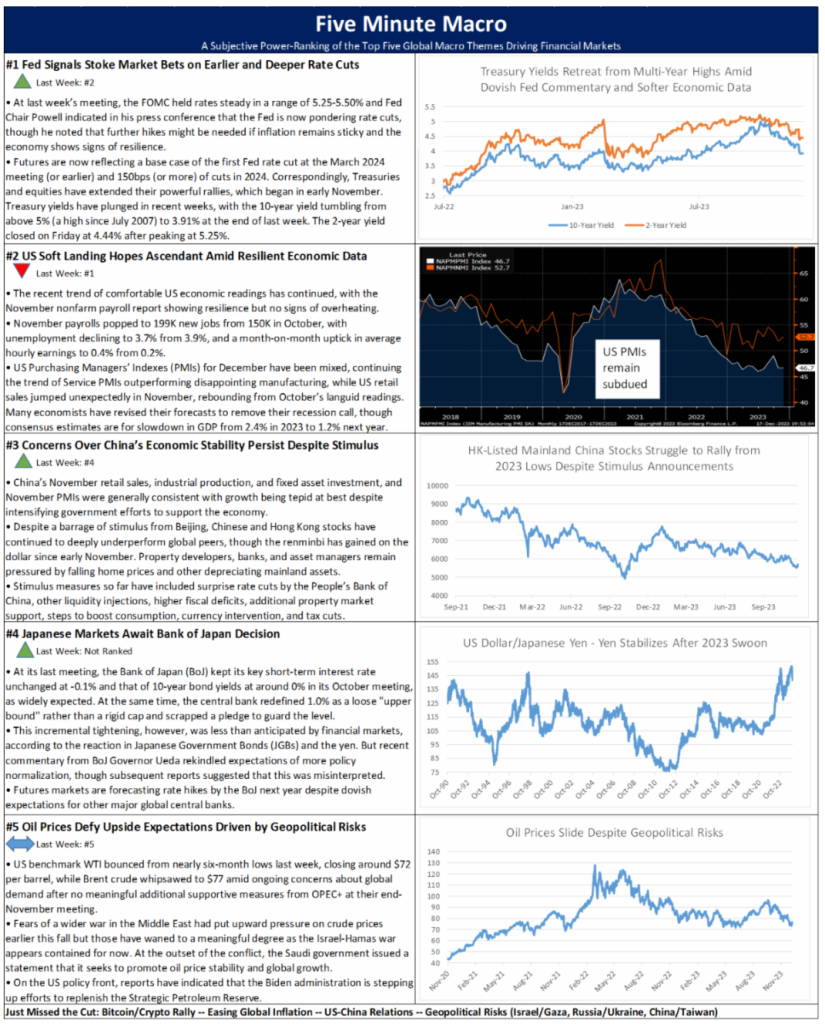

Fed dovish pivot drive risk assets globally as soft-landing hopes increase but Chinese economic stability worries persist. Japanese markets await key BOJ decision while oil prices find a bid due to geopolitical risks.