Summary and Price Action Rundown

Global risk assets are trading with a hopeful tone amid signs of progress toward a US fiscal stimulus deal, while investors await key US economic data. S&P 500 futures point to a 0.9% higher open after the index closed 0.8% higher yesterday, upping its year-to-date gain to 4.1%, which is about 6% below early September’s record high. Equities in the EU are slightly higher while Asian markets were mixed amid widespread holiday closures and a technical outage at the Tokyo Stock Exchange. As fiscal stimulus hopes rise, the dollar is extending this week’s downtrend, while longer-dated Treasury yields are edging higher, with the 10-year yield at 0.70%. Brent crude prices remain choppy, falling below $42 per barrel.

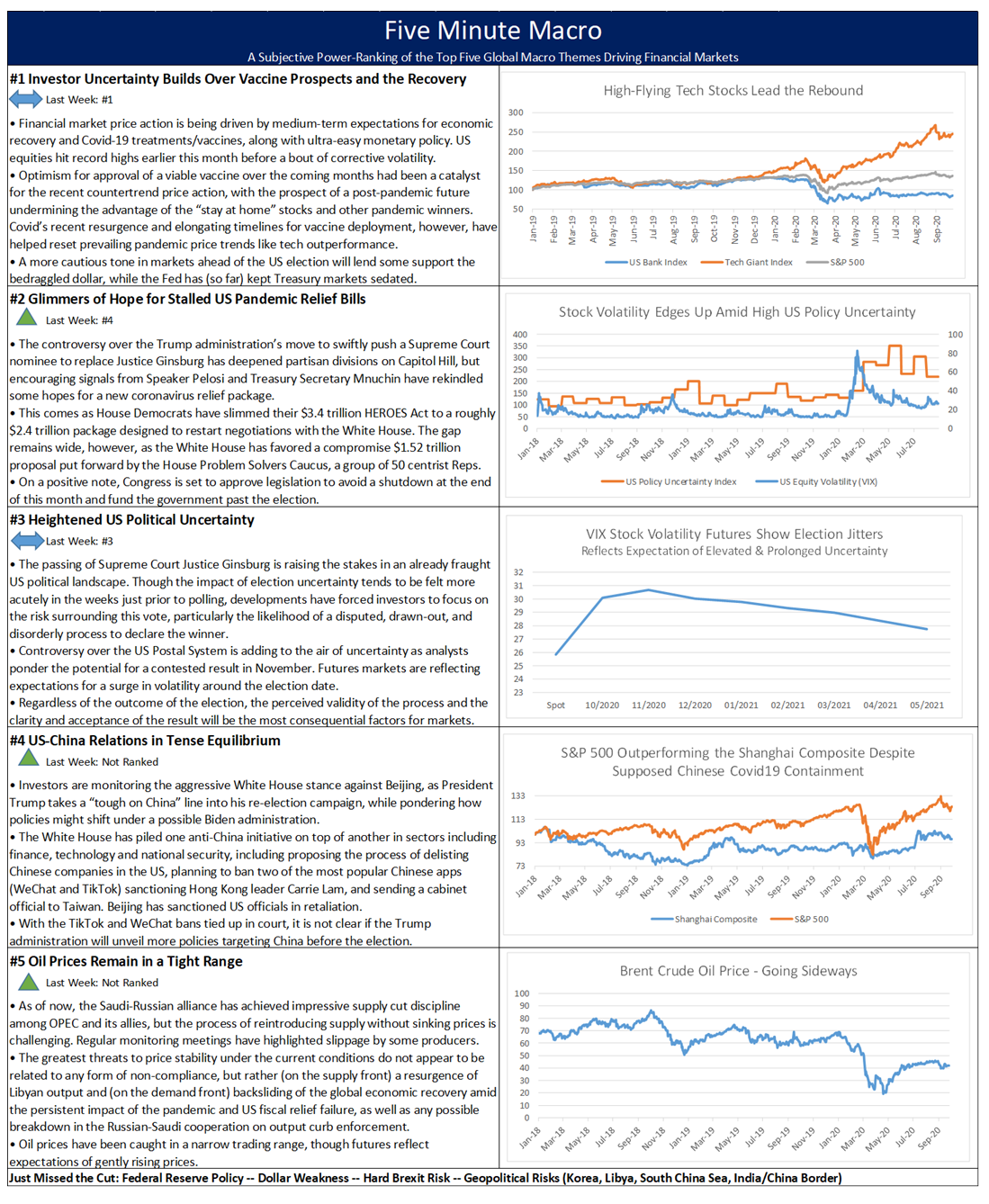

Hopes for a US Pandemic Relief Bill Reverberate in Markets

Effort to forge a compromise stimulus package are coming down to the wire today as price movements in stocks, the dollar, and Treasuries reflect rising degrees of optimism. Equities continue to ride the hopes of more fiscal stimulus as Speaker Pelosi and Secretary Mnuchin continued talks in an attempt to strike a deal on necessary economic relief, though skeptical commentary from Senate Majority Leader McConnell dampened spirits in later trading yesterday. The two met today on Capitol Hill, where Secretary Mnuchin presented a counteroffer to the Democratic proposal announced on Monday that allocates $2.2 trillion towards needed economic stimulus in the form of direct payments, PPP funding, unemployment benefits through January 2021, and funding for local and state governments among other initiatives. Secretary Mnuchin’s reportedly $1.62 trillion counteroffer is comparable to the size and scope of a proposal crafted by the House “Problem Solvers’ Caucus,” and is said to include $250 billion for state/local governments, $400/week in unemployment enhancement, which are both below the Democrats’ figures, and increased funding for testing from the prior White House offer. Early reports suggested that the plan also contains an escalator clause in the case the virus’s persistence, in which case roughly $2 trillion could become available, but subsequent reports have not featured this element. An agreement between Secretary Mnuchin and Speaker Pelosi would like garner enough support to pass the Senate. Meanwhile, House Majority Leader Steny Hoyer has delayed a vote on the new Democratic legislation until later today, allowing time for final negotiations before House members go on recess until after November’s election results.

US Labor Market Data in Focus

Investors are awaiting this morning’s release of last week’s jobless claims figures and tomorrow’s September nonfarm payrolls after a private sector jobs reading topped consensus estimates yesterday. This morning, markets participants will parse another US labor market release in advance of nonfarm payrolls, as initial jobless claims data for last week is due. For context, unemployment filings rose by 870K in the week ending September 19th, topping estimates by 30K, and a 4K increase from last week’s upwardly revised 866K figure. While monthly nonfarm payrolls figures have generally remained solid, these weekly jobless claims tallies have remained in the 800K’s territory for four consecutive weeks, suggesting the labor market recovery may be stalling as government support continues to wane. For context, September nonfarm payrolls report is expected to show new 868K new jobs, which is a strong level but would be below the 1.37 million in August. This comes after yesterday’s estimates from ADP that private businesses hired 749K workers in September, handily beating market expectations a 650K rise. While this was the largest ADP jobs number in the last three months, it still means only half of the near 20 million jobs lost since March have been recovered.

Additional Themes

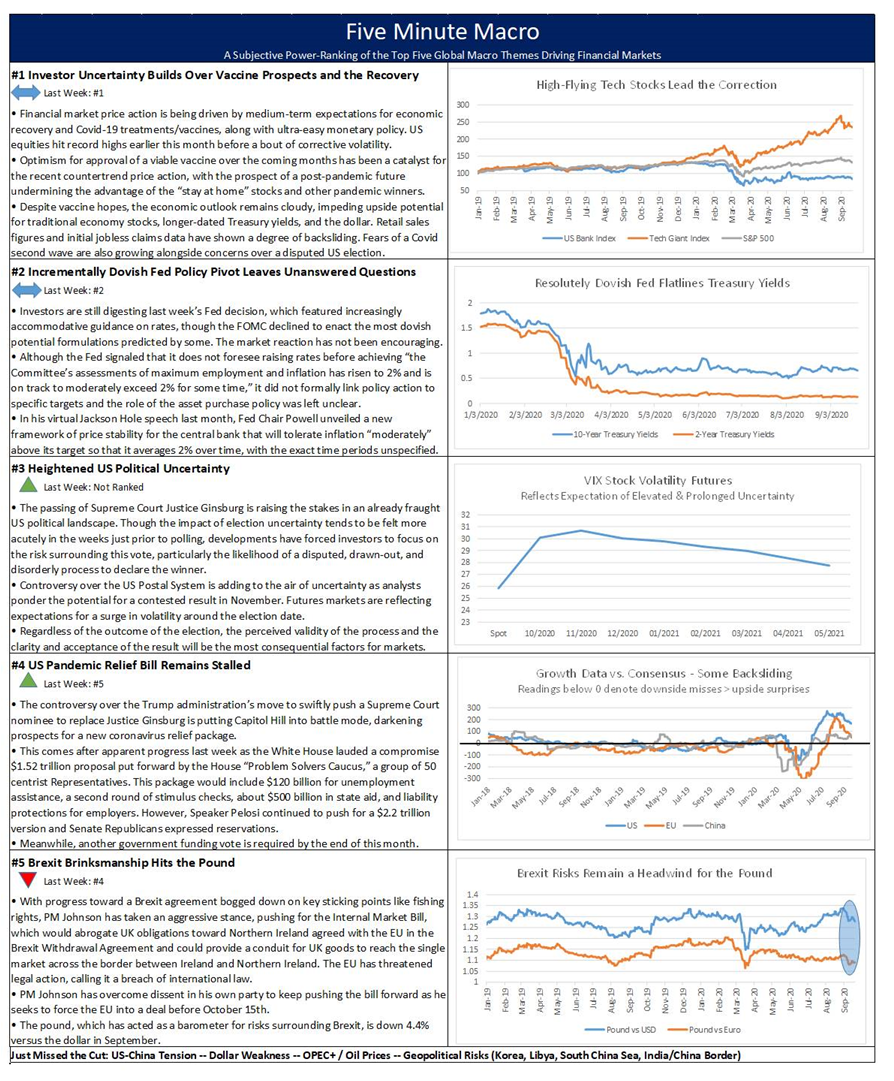

More Brexit Drama Roils the Pound – The pound, which has acted as a market-based barometer for the fortunes of Brexit, has been choppy this morning after the EU took steps to initiate legal action regarding the UK’s Internal Market Bill, which passed the Lower House of Parliament and awaits a verdict in the House of Lords. For context, the Internal Market Bill is deemed by Brussels to be a clear breach of the Withdrawal Agreement between the UK and EU, undermining that accord’s treatment of Northern Ireland post-Brexit. Amid concerns that his brinksmanship will backfire, Prime Minister Johnson has set an unofficial deadline of October 15th for a Brexit deal with the EU as the final departure date looms at year-end.

Inflation Headlines Today’s US Data Lineup – Following the Fed’s pivot toward a more permissive policy stance on inflation over the past month, analysts will parse today’s release of the central bank’s favored metric for price pressures, core personal consumption expenditure prices (core PCE). With the Fed’s revised inflation target of an average 2% core PCE over some unspecified period of time, today’s estimated reading of 1.4% for August would remain well shy of any key threshold for a policy response, though representing improvement from 1.3% in July. This datapoint comes alongside August person spending and income figures, which are forecast to deteriorate from the prior month, as well as the ISM manufacturing purchasing managers’ index (PMI) for September, which is expected to remain in robustly expansionary territory