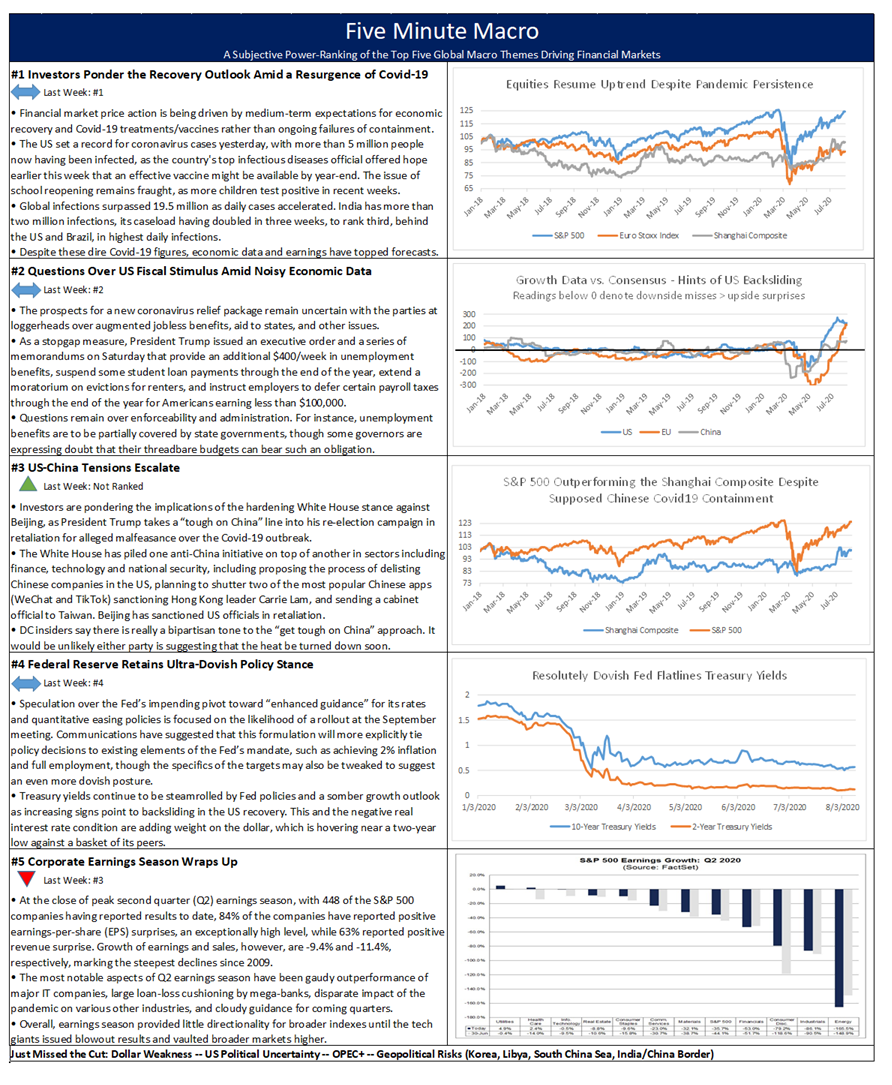

Summary and Price Action Rundown

Global risk assets are mostly higher this morning as monetary easing in China overnight set a positive tone to start the week, while investors continue to ponder the prospects for the US pandemic relief package amid deepening rancor in Washington. S&P 500 futures indicate a 0.3% higher open after the index closed flat on Friday, holding its year-to-date gain at 4.4% and hovering just short of February’s all-time high. Equities in the EU are little changed, while Asian stocks were mixed overnight amid outperformance by mainland Chinese markets. The dollar remains subdued near two-year lows while longer-dated Treasury yields are retracing a portion of their recent upside, with the 10-year yield at 0.69%. Brent crude is edging below $45.

US Postal Service Controversy Clouds Pandemic Relief Outlook

Speaker Pelosi called the House back to Washington over the weekend, cutting short summer recess in an effort to address concerns surrounding the Trump administration’s actions impacting the US Postal Service. With President Trump continuing to denigrate mail-in ballots and his administration pursuing changes at the Postal Service that could impede voting by mail, House Democrats are reconvening to push forward efforts to support the USPS and are calling Postmaster General DeJoy to testify on August 24th. White House Chief of Staff Meadows indicated that President Trump would support and sign a bill offering additional $10 billion in funding for the USPS, and though Speaker Pelosi has previously rejected any piecemeal approach to passing elements of the broader pandemic relief bill, analysts note that this could be treated as a standalone given its highly-charged political nature. Analysts broadly note that the controversy over the USPS may remain compartmentalized from the broader negotiations of the pandemic relief package, as the gaps between the two sides persist over state aid and augmented jobless benefits. Meanwhile, financial markets continue to display scant reaction to the DC dramatics, with equity indexes poised to register new record highs this week.

Global Economic Data Remains Mixed with August PMIs in Focus

July’s reading of US retail sales reflected continued but moderating improvement, as investors shift their focus to income August data to gauge the health of the recovery. US retail sales rose 1.2% from a month earlier in July, missing market expectations of 2.1% advance and slowing from an 8.4% month-on-month (m/m) surge in June. In all, it still marked the third straight monthly gain for retail, which plunged 14.7% m/m in April then rebounded to 18.3% m/m in May as the strict lockdowns were eased. July purchases lifted retail sales 2.7% higher than the same month in the previous year, their highest level since the government started tracking the series in 1992. Excluding automobiles, gasoline, building materials and food services, retail sales increased 1.4% m/m in July, topping estimates of a 0.8% gain, after soaring 6.0% in June. Overnight, Japanese GDP data provided another reminder of the pain of the second quarter, with GDP contracting at a 27.8% annualized rate, the steepest drop on record and worse than the 26.9% forecast. The Nikkei underperformed overnight but the yen was stable within its recent trading range versus the dollar. Later this week, analysts will be focused on the first glimpses of global economic activity in August, with preliminary readings of purchasing managers indexes (PMIs) for the US, EU, UK, and Japan, which are expected to show an incrementally accelerating rate of expansion despite the stubborn persistence of the virus.

Additional Themes

People’s Bank of China (PBoC) Injects Liquidity – The Shanghai Composite bounced 2.3% overnight, re-approaching its multi-year high from early July, while the renminbi posted modest gains and local bonds rallied after the PBoC supplied the market with an unexpectedly generous 700 billion renminbi through its medium-term lending facility. This comes after last week’s net injection of funds through open market operations. The PBoC has been notably less aggressive with accommodation than other major global central banks during the ongoing pandemic and key Chinese economic data for July showed a slackening in the pace of recovery, particularly among consumers.

US-China Tensions Continue to Percolate – Reports this morning indicate that the Commerce Department is poised to tighten restrictions on controversial Chinese tech giant Huawei’s access to US technology. This comes after Friday’s news that the planned US-China Phase One trade deal review has been postponed indefinitely, with scheduling problems being cited for the delay. Vice Premier Liu had been set to engage in a video conference with US Trade Representative Lighthizer and Treasury Secretary Mnuchin. President Trump and National Economic Council Director Kudlow both spoke favorably of the Phase One deal last week despite Chinese agricultural goods and energy purchases meaningfully lagging their targets.