Summary and Price Action Rundown

Global risk assets are struggling for direction again this morning as the recent rally pauses amid key corporate earnings reports and lingering political and policy uncertainty. S&P 500 futures point to a flat open after the index declined 0.6% yesterday, paring its year-to-date gain to 8.7%, which is 1.9% below early September’s record high. Equities in the EU and Asia were mixed overnight. The dollar is stabilizing near multi-year lows while longer-dated Treasury yields continue to slip below multi-month highs, with the 10-year yield at 0.72%. Brent crude prices remain choppy above $42 per barrel as demand concerns remain a headwind.

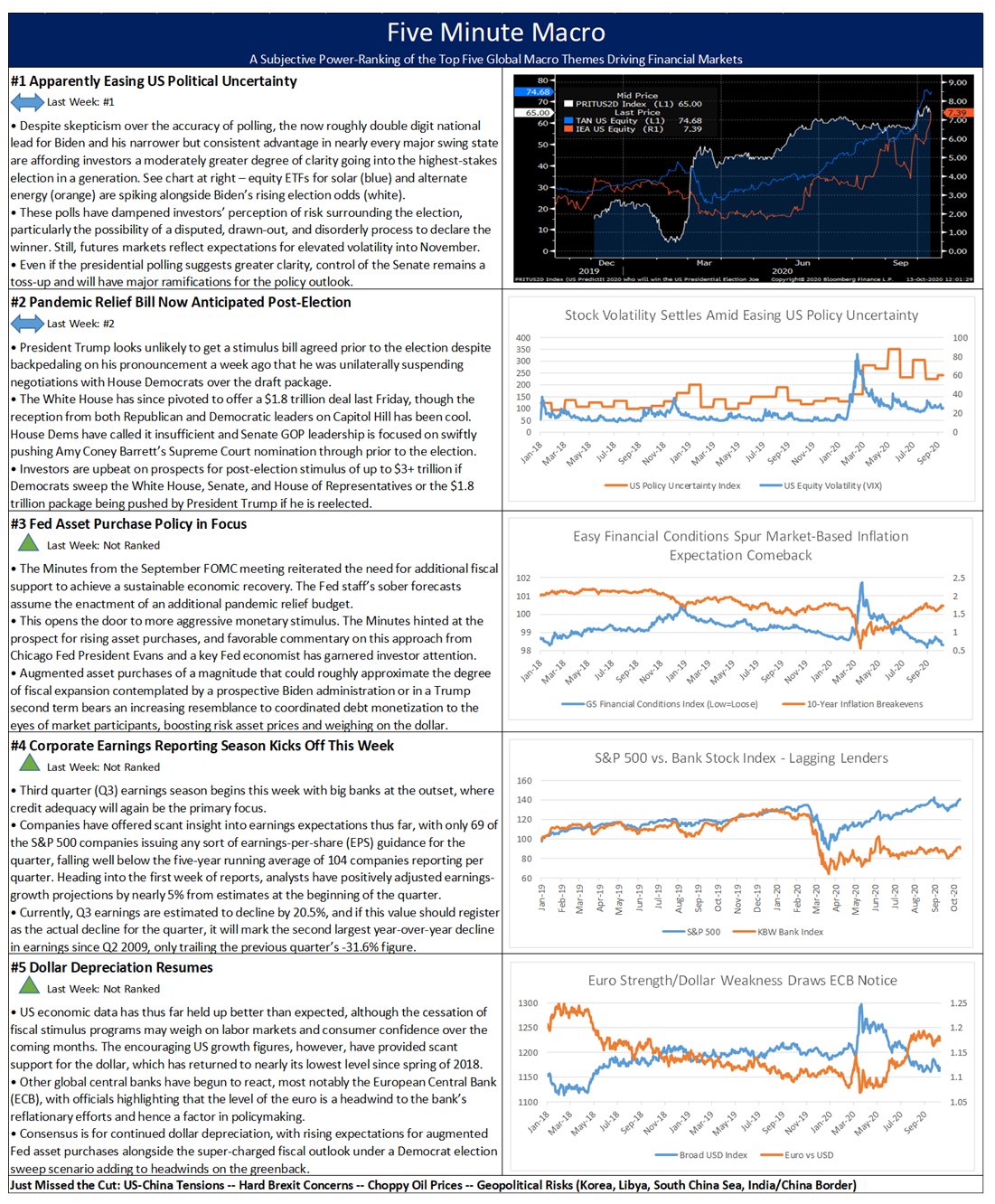

Earnings Reporting Season Continues with Reports from US Megabanks

Corporate earnings reporting season kicked off in earnest yesterday, as upside surprises from key US megabanks failed to impress investors. Yesterday, JPMorgan and Citigroup kicked off the third quarter earnings season as both US megabanks topped earnings and revenue expectations, but their stocks closed lower amid lack of upside catalysts for the coming quarters. JPMorgan reported an earnings-per-share (EPS) value of $2.92, topping consensus projections by $0.73 and recording a 9% increase from Q3 2019. Revenues totaled to $29.15 billion, a 3% decline from one year ago. JPMorgan saw significant total trading growth of 30% as investment banking revenue rose 12% to $2.1 billion, the fixed income division’s revenues surged 29%, and equities were up by 32%. Importantly, credit loss provisions rose by only $611 million, falling well short of the $2.88 billion forecast and a trivial comparison to the $10.47 billion injection during the second quarter. The move suggests that the bank may be projecting less-than-expected loan defaults moving forward. The increased trading revenues, lower provisions, and healthy deposit growth all offset lower-than-expected revenues from net interest income (NII), which has struggled to yield healthy revenues in the low interest rate environment. Citigroup reported earnings of $1.40 and revenue of $17.3 billion, and also saw its growth driven by higher trading volume and lower credit loss provisions. Fixed income trading activity increased 18% from last year, and equity trading grew by 15%. Citigroup added just $314 million to credit loss reserves, compared to $5.6 billion last quarter. The bank’s initiative to expand branches in the US proved fruitful last quarter, with North America-based deposits climbing 19%. In other reports yesterday, Delta Airlines reported a quarterly net loss of nearly $5.4 billion and reiterated the continued presence of industry shortfalls. Travel demand remains about 70% below the same time last year, and the carrier said it would delay the purchase of aircraft to better suit its outlook. Today, Bank of America, US Bancorp, Wells Fargo, and Goldman Sachs report earnings, with Morgan Stanley issuing its results tomorrow.

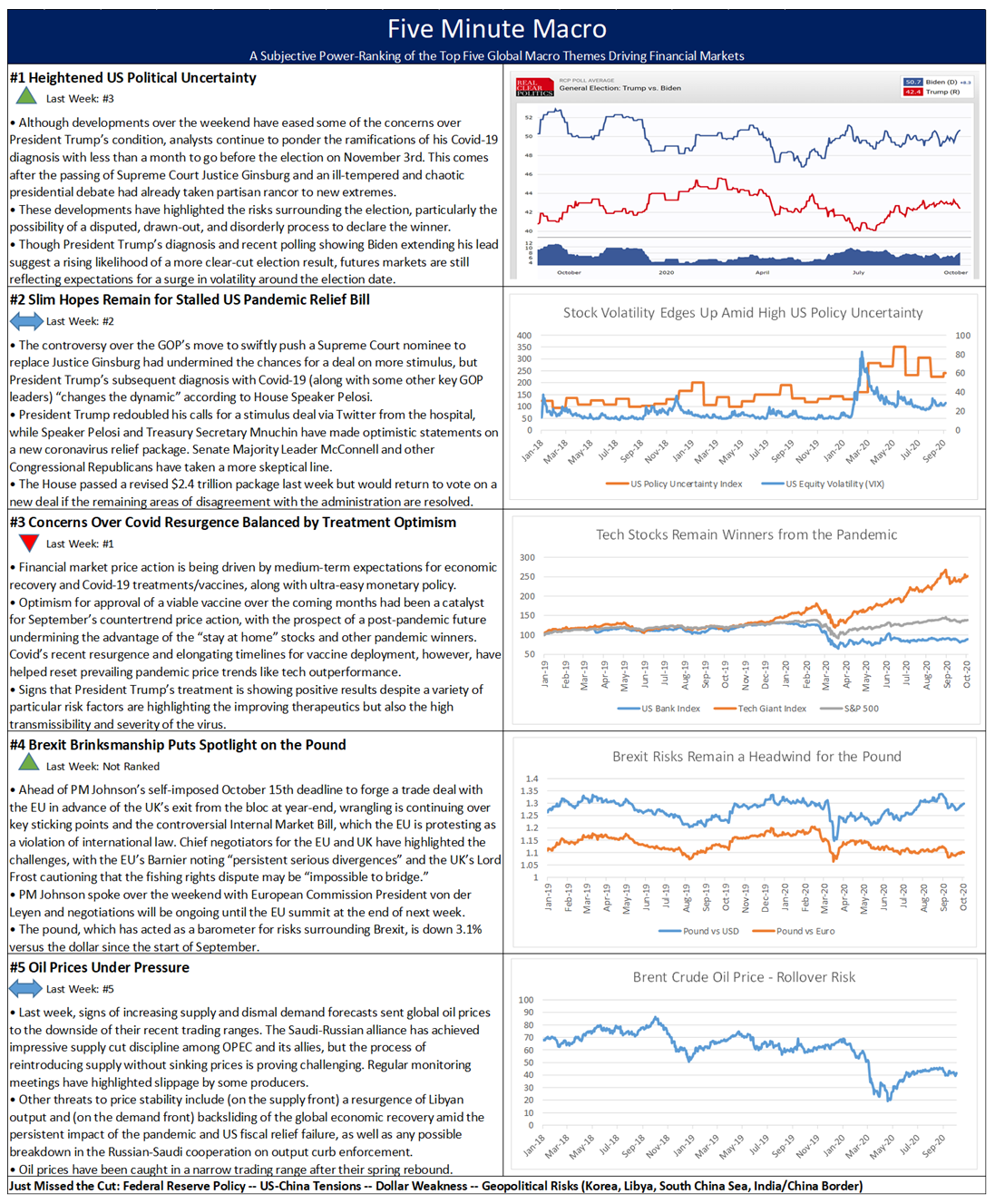

UK Backs Away from Brexit Bluff

The pound is stabilizing this morning after reports have indicated that Prime Minister Johnson will not abruptly pull out from Brexit negotiations with the EU at his self-imposed deadline of tomorrow to secure a deal. Citing an unnamed source, the articles suggest that the UK government will continue to negotiate over the coming days and will likely reassess their progress after the EU leaders’ summit. PM Johnson and European Commission President von der Leyen are scheduled to speak today, though no breakthroughs are expected. EU negotiators and leaders, including German Chancellor Merkel, emphasize that key hurdles remain and consensus is insufficient for terms to be considered at the upcoming EU leaders’ summit, which begins tomorrow. PM Johnson has employed brinksmanship in his Brexit negotiations to decent effect and has signaled that he is prepared to take the UK into a no-deal Brexit at year-end. The UK pound, which has served as a barometer for the fortunes of Brexit, is rangebound against the weakening dollar but is hovering barely above five-year lows versus the euro, suggesting a disparity of leverage in these negotiations. Fishing rights remain a key sticking point, along with treatment of Northern Ireland and UK business subsidies.

Additional Themes

Fate of Fiscal Stimulus Hinges on US Election – Yesterday, Majority Leader McConnell indicated that he is preparing a Senate vote next week on another “skinny” stimulus package, this time focused on replenishment of the Payroll Protection Program (PPP), which disburses funds to small businesses. House Speaker Pelosi predictably rejected this approach, while President Trump tweeted “Go big or go home!!!” in response. For context, President Trump announced last Tuesday that he was pulling out of stimulus talks after weeks of prevarication, and then abruptly pivoted to offer a $1.8 trillion deal last Friday, to which the reception has been cool.

Snags in Covid Treatment Trials – Markets were rattled yesterday by a surprise announcement from Johnson & Johnson indicating that a patient in its vaccine trial had become unexpectedly sick, causing a halt to the testing program for the time being. Shares of the pharma giant fell 2.3%. This came ahead of today’s announcement that Eli Lilly’s vaccine trial is also on hold now over health concerns, which sent its shares 0.8% lower in pre-market trading. Such pauses are considered typical in drug trials, and AstraZeneca’s trial was delayed in early September after a subject fell ill. Analysts continue to ponder the outlook for a vaccine, with the base case roughly approximating a partially effective vaccine by next spring.