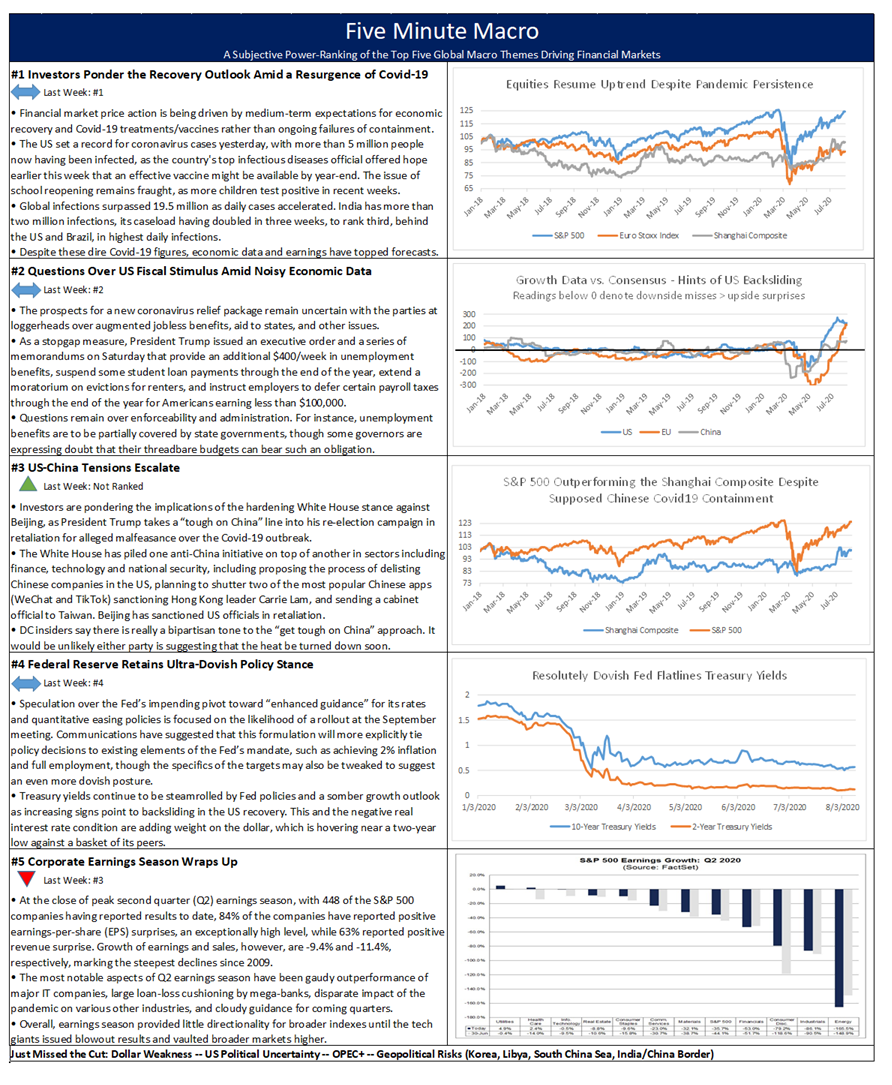

Summary and Price Action Rundown

Global risk assets are mixed this morning ahead of key US economic data after China’s growth readings for July broadly met expectations overnight. S&P 500 futures point to a 0.2% lower open after the index wavered yesterday, again falling a few points short of February’s all-time high. Equities in the EU are underperforming as the UK expands its quarantine requirements to more EU countries, while Asian stocks were mixed overnight. The dollar is hovering just above two-year lows while longer-dated Treasury yields are dipping ahead of US retail sales data but still near their highest level since late June, with the 10-year yield at 0.70%. Brent crude prices are edging below $45 per barrel.

Chinese Economic Data Tracks Expected Recovery Trajectory

July economic data out of China overnight reflected continued improvement mostly in-line with forecasts, though retail sales undershot expectations. China’s economy has returned to growth after a deep slump at the start of the year, but some unexpected weakness in domestic consumption weighed on momentum. China’s fixed-asset investment improved to -1.6% year-to-date (ytd) compared to a 3.1% ytd decline registered in June, matching consensus, as the economy continues to re-open and authorities loosen coronavirus-related restriction measures. Private investment, which accounts for 60% of total investment in China, decreased 5.7%, while public investments rose at a faster 3.8%. Investment was driven by acceleration of activity in the property sector, with analysts also expecting the rebound in infrastructure spending to continue over the coming months on the back of government support. Meanwhile, China’s industrial production rose by 4.8% year-on-year (y/y), matching June’s growth rate but below forecasts for a 5.2% expansion. This remained the steepest rise in industrial output in six months, amid ongoing recovery from the pandemic. While investment and industrial production were roughly in line with projections, retail sales registered a disappointing -1.1% y/y, missing expectations of a 0.1% rise but still improving from June’s -1.8% y/y pace. This was the seventh straight month of contraction in retail trade, suggesting a hesitance to return to crowded places like shops, restaurants, and cinemas amid the lingering impact of Covid-19. The decline in retail sales was broad based, with auto sales a key exception, surging 12.3%.

US Retail Sales in Focus

With high-frequency data suggesting a backsliding in US consumption, market participants will be attuned to today’s release of retail sales data for July. Consensus forecasts are for a more modest monthly gain of 2.1% after a 7.5% month-on-month (m/m) snapback in June that brought the gauge into positive year-on-year territory. This would mark the third straight month of upside in retail sales following a record 14.7% slide in April. For context, May’s record 18.2% m/m jump was cited by White House officials as indicative of a brisk economic recovery as states began reopening following lockdowns. The past two months have brought retail sales up to just 0.6% below February’s levels from before the coronavirus pandemic and control group sales, which exclude more volatile autos, gas and building materials, jumped 5% above February’s levels as of last month, underscoring a recovery in consumer spending as lockdown measures eased. Still, rising Covid-19 cases and stalled state re-openings could have deterred shoppers from visiting brick-and-mortar stores, as well as bars and restaurants. The figures may help confirm high-frequency credit card data showing that the consumer recovery has cooled. Other economic data set for release today includes industrial production for July, which is forecast to ease to a 3.0% m/m from 5.4% in June, and University of Michigan consumer sentiment gauge, with estimates for a slight softening to 72.0 from 72.5.

Additional Themes

US Stimulus Talks Remain Deadlocked – Congress has left town for August recess with no deal on the latest pandemic relief package, suggesting that any agreement might slide into September. House Speaker Pelosi stated earlier this week that the sides remain “miles apart” and National Economic Council Director Kudlow reiterated White House concerns that the Democrats’ compromise figure of $2 trillion, which includes a greater measure of state aid than the Republican version, was too high. Meanwhile, President Trump indicated that he would not veto the bill if it contains additional funding for the US Postal Service.

Looking Ahead – Next week features some of the first glimpses of global economic activity in August, with preliminary readings of purchasing managers indexes (PMIs) for the US, EU, UK, and Japan, which are expected to show an incrementally accelerating rate of expansion. Also, analysts will parse the minutes from the Fed’s July meeting, which may include additional insights on their anticipated policy pivot to “enhanced guidance” in September. Also, the US-China Phase One trade deal review is expected to make headlines.