Summary and Price Action Rundown

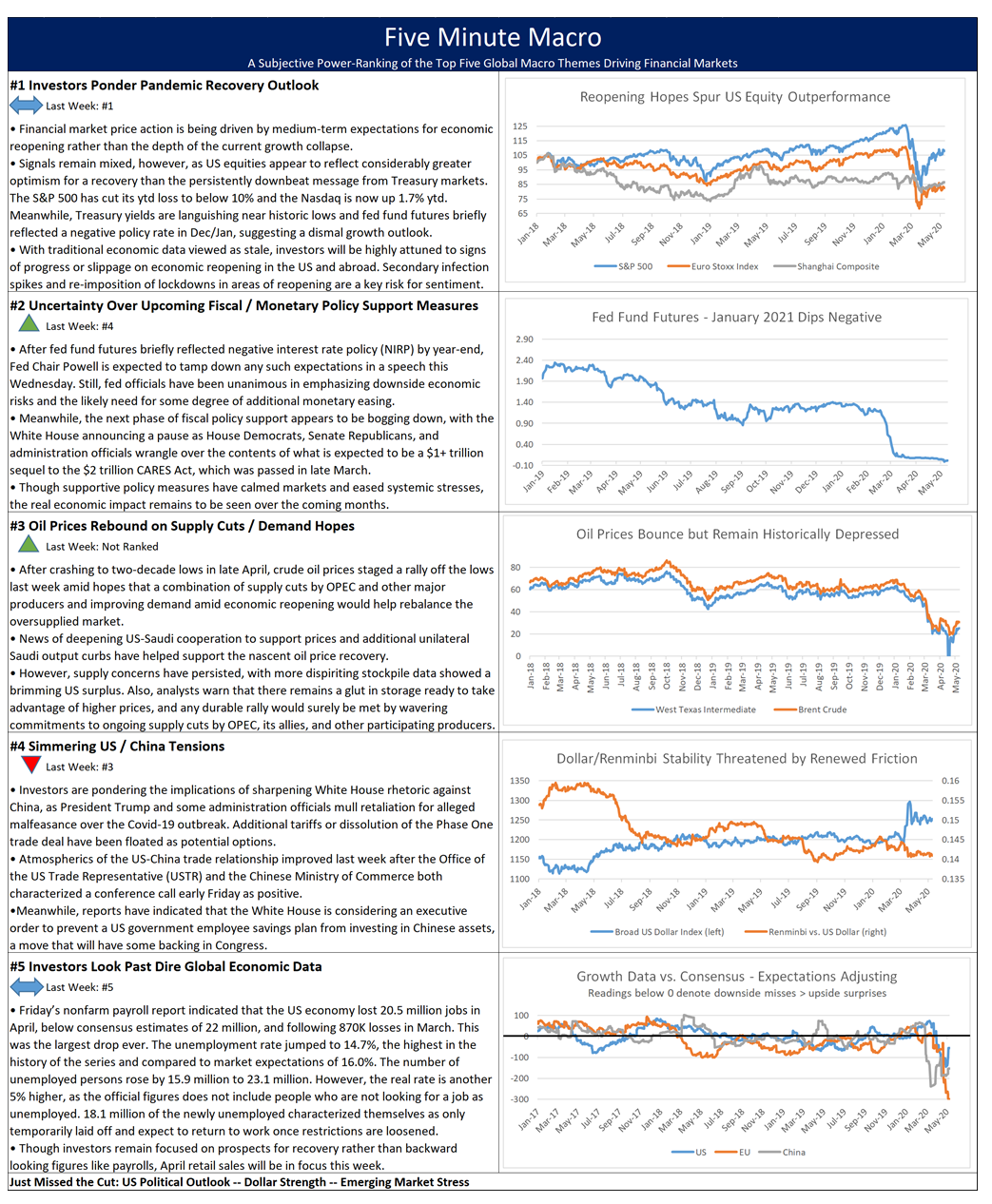

Global risk assets are moving higher this morning as investors remain focused on economic reopening and the prospects for additional fiscal and monetary support. S&P 500 futures indicate a 0.2% higher open after yesterday’s flat close left year-to-date downside at 9.3% and the decline from February’s record high at 13.5%. Equities in the EU and Asia were mixed and muted overnight. Longer-dated Treasury yields are hovering above recent lows as investors focus on Fed policy signals and impending debt auctions, with the 10-year yield at 0.71%. The dollar remains in the middle of its recent range as the renminbi holds up despite heighted US-China tensions. Crude oil is re-approaching one-month highs amid more Saudi supply cuts.

Markets Send Mixed Messages on Reopening as Congress Ponders Another Relief Bill

Financial markets continue to send mixed signals on the outlook for the recovery, as share price outperformance of sectoral “winners” from the pandemic like tech and healthcare becomes ever starker. Yesterday, in a familiar trend, the S&P 500 closed in positive territory as the health care and IT sectors, which gained 1.7% and 0.6%, respectively, again propped up the index while most other sectors posted losses on the day. Although the buoyancy of US equity indexes is consistent with a degree of investor optimism over the prospects for economic reopening, the growing disparity in performance among sectors that are less impacted by (or even benefit from) the pandemic and those that are adversely impacted suggests skepticism on a return to normalcy over the medium term. Treasury markets, meanwhile, remain consistent with a lengthy economic trough, though yields edged higher as Fed officials downplayed the odds of policy rates going negative (more below) and market participants prepare for upcoming Treasury auctions. As the feel-good factor of easing lockdowns is tempered by indications that reopening will be uneven and challenging, analysts are monitoring signals from Capitol Hill that the next round of fiscal relief may be back on track. Yesterday, New Jersey Senator Menendez indicated that a $500 billion support bill for states and municipalities was gaining traction, though White House officials have conveyed mixed messages on the administration’s stance.

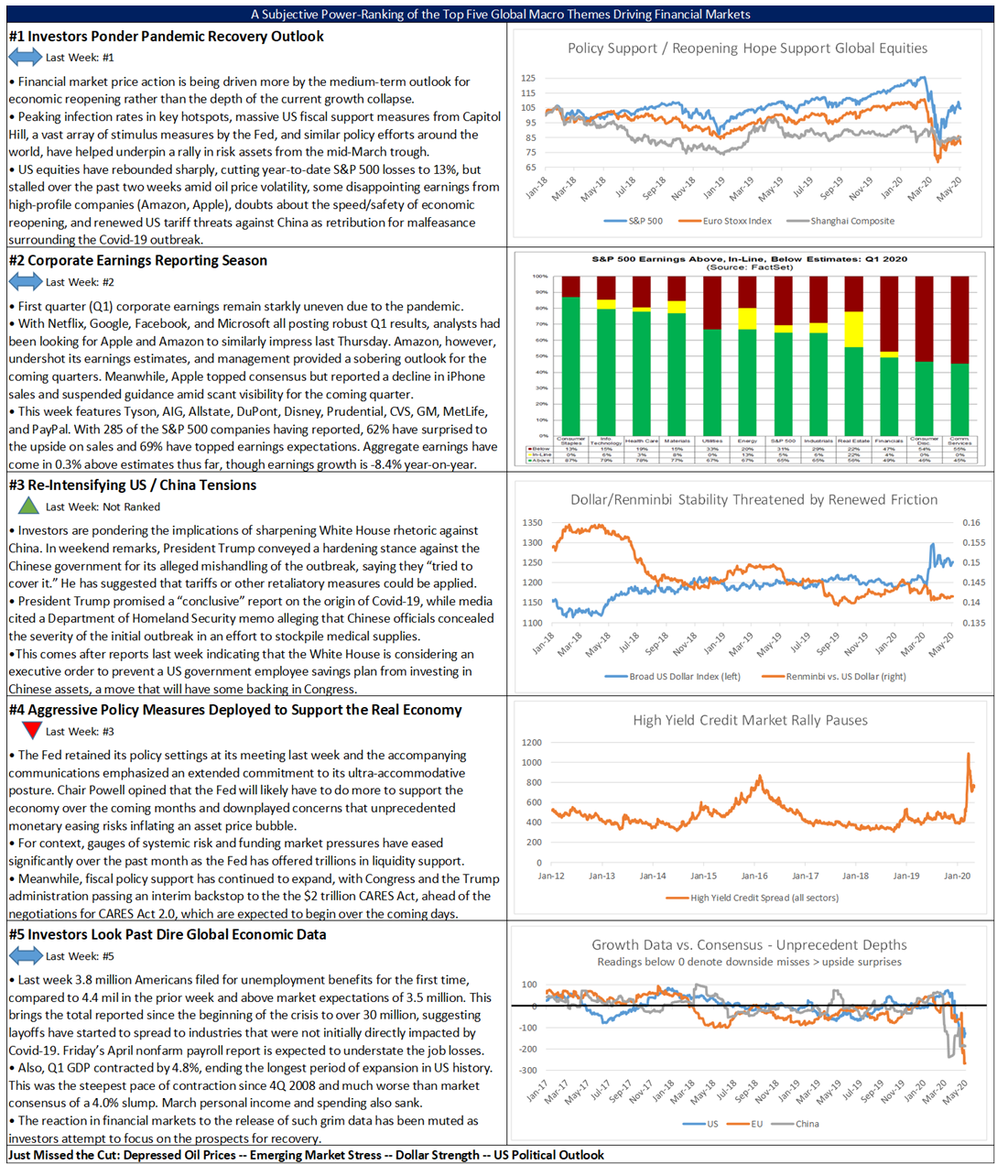

Fed Policy in Focus Over Negative Interest Rates and Credit ETF Purchases

Ahead of Fed Chair Powell’s remarks tomorrow, FOMC members yesterday talked down growing speculation over negative interest rate policy (NIRP) and the Fed will begin purchasing credit ETFs today. With an ex-Fed official and prominent Harvard economist both recently making the case for the Fed to follow the European Central Bank and Bank of Japan in imposing NIRP, and December 2020 and January 2021 fed fund futures both briefly reflecting negative interest rate expectations last week, FOMC members downplayed the likelihood of such a move. Chicago Fed President Evans indicated that he does not foresee the need for negative policy rates, though he expects them to remain at zero for “quite some time.” Meanwhile, Atlanta Fed President Bostic said he is “not a big fan” of NIRP, suggesting it is less effective than other policy tools. Correspondingly, fed fund futures have shifted out of negative territory on the late 2020/early 2021 contracts. Analysts expected Fed Chair Powell to echo his colleagues’ skepticism on NIRP in his remarks on Wednesday. Meanwhile, the New York Fed announced yesterday that it will begin to buy corporate credit, some of it below investment grade, though exchange-traded funds (ETFs). Reports suggest an initial amount of $250 billion among the Fed’s overall purchase programs will be allocated to corporate credit ETFs.

Additional Themes

Tensions with China Continue to Simmer – Despite last week’s improving atmospherics in the trade relationship, friction between China and the US, as well as some of its allies, continued overnight. In a move that had been floated by the White House previously and has some backing on Capitol Hill, President Trump is reportedly set to issue an executive order blocking the US government employee retirement savings plan from investing in Chinese equities. Still, the move is not being directly cast as retaliation for China’s handling of the Covid-19 outbreak nor is it as impactful as hiking tariffs, which President Trump had also threatened. Meanwhile, Australian stocks fell but the Aussie dollar recouped early losses after China suspended a significant portion of beef imports, a decision that may be tied to a spat over the pandemic.

Energy Earnings Slump – Last evening’s earnings reports highlighted the challenges to the energy sector. Sunoco and Energy Transfer both released downbeat reports missing earrings and revenue projections for the quarter, with their shares already -19.4% and -40.1% year-to-date, respectively. Meanwhile, Saudi oil giant Aramco also released dismal profit figures for last quarter but retained its dividend. Energy is the worst performing major US equity sector so far this year, though the week-long bounce in oil prices, which is continuing this morning, has provided some support. Oil prices have been fluctuating around one-month highs since Sunday after Saudi announced an additional unilateral output cut of 1 million barrels per day.