Summary and Price Action Rundown

Global risk assets are mixed this morning after yesterday’s solid rally as investors digest upbeat news on the Covid-19 treatment front, some positive earnings reports, and a consistently accommodative posture from the Federal Reserve amid grim economic data. S&P 500 futures indicate a 0.3% lower open, which would pare yesterday’s 2.7% surge that put year-to-date downside at 9.0% and the decline from February’s record high at 13.2%. Equities in the EU are lagging this morning, though Asian stocks were strong overnight. Longer duration Treasury yields continued to hover near their lows, with the 10-year yield at 0.61%, while a broad dollar index is retracing more of last week’s upside. Crude oil is extending its ongoing recovery from nearly 20-year lows amid reports of US pressure on Saudi to cut output.

Key Earnings Releases Turning Supportive of Stocks

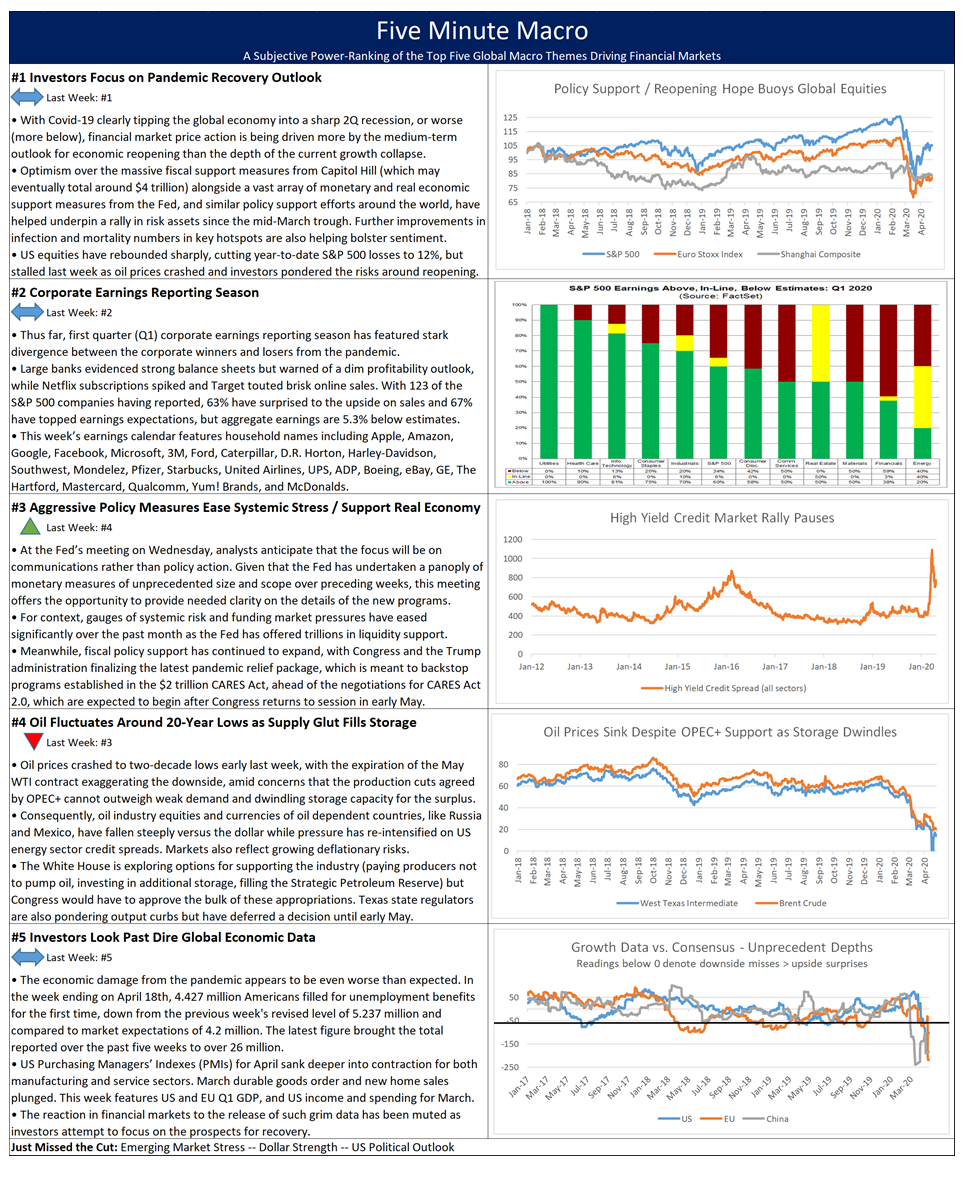

Though first quarter (Q1) earnings reports remain mixed, reports from IT giants have added further upside momentum to the ongoing stock market rebound this week. After the market closed yesterday, Facebook released its earnings report stating an earnings-per-share (EPS) value of $1.71 for the quarter, beating consensus by $0.01. Revenues came in at $17.74 billion, up 17.6% year-on-year (y/y), beating expectations by $520 million. Shares of the social media giant are up 8.5% in pre-market trading, a gain that would put them in positive territory year-to-date (ytd). Facebook attributed much of the recent trend to increased consumer engagement: “people around the world sheltered in place and used our products to connect with the people and organizations they care about.” Microsoft also beat both EPS and revenue expectations, as management emphasized that Covid-19 had hardly any net impact on revenue. Shares prices are up 1.7% in early trading to add to the 12.5% gain ytd. Qualcomm also topped expectations for Q1. Looking forward, guidance for Q3 assumes an “approximate 30% reduction in handset shipments,” though preparations for the global implementation of 5G network capabilities were a source of optimism. Qualcomm stock is trading up 0.6% ahead of the opening bell and is -10.5% ytd. Lastly, Tesla handily surpassed expectations, marking “its best Q1 ever” sending its shares 8.4% higher pre-market. Tesla is up 91.4% ytd. The remainder of the week features Apple, Amazon, Visa, McDonalds, and Comcast today, and ExxonMobil, Honeywell, and Clorox tomorrow. Amazon will be of particular interest, with its stock at a record high and its delivery services taking on an even greater importance during the widespread lockdowns. With 211 of the S&P 500 companies having reported, 65% have surprised to the upside on sales and 67% have topped earnings expectations. However, aggregate earnings have come in 1.9% below estimates thus far.

Global Growth Figures Reveal Economic Pain but Draw Scant Market Reaction

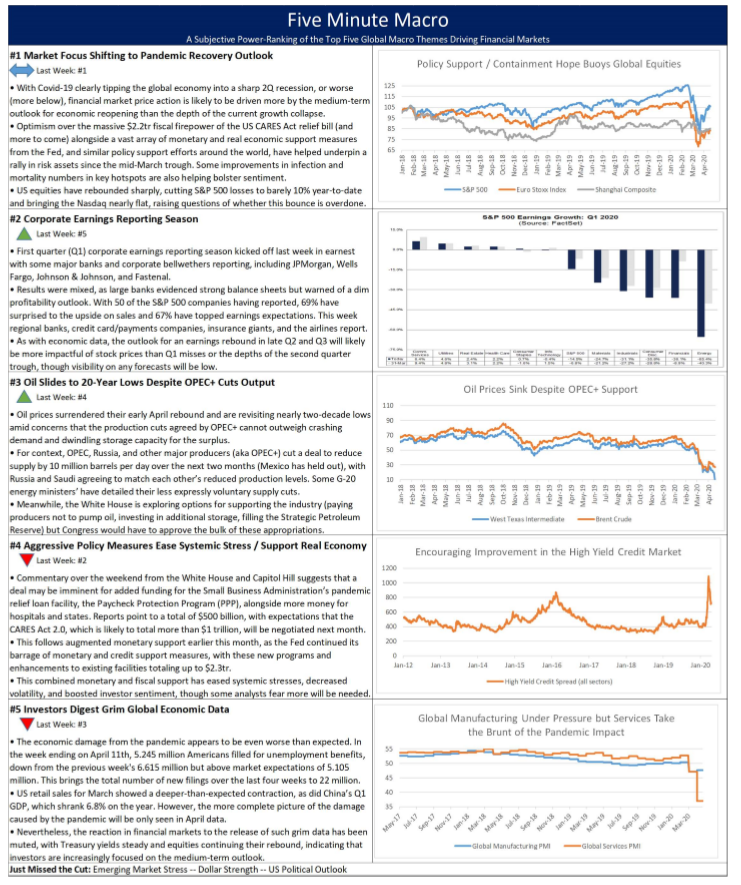

With more dismal jobless data due this morning, investors continue to focus on the prospects for recovery rather than the depths of the current trough. Initial jobless claims for the week ending April 25th are forecast to total 3.5 million, down from 4.4 million the prior week, which brough the total over the past five weeks to over 26 million. Estimates for the unemployment rate are in the mid-teens to 20%. Meanwhile, March readings of personal income, spending, and inflation are expected to be downbeat. This follows yesterday’s release of US Q1 GDP, which posted a contraction of 4.8%, ending the longest period of expansion in US history. This was the steepest pace of retrenchment since 4Q 2008 and much worse than market consensus of a 4.0% slump. Household consumption tumbled, business investment contracted for a fourth consecutive period and healthcare spending shrank as elective surgeries were delayed. In addition, exports and imports were down sharply, while residential fixed investment rose as well as government spending. EU Q1 GDP, released this morning, was similarly dire, shrinking 3.8% quarter-on-quarter, with France, Spain, and Italy underperforming with quarterly contractions of 5.8%, 5.2%, and 4.7%, respectively. China’s data reflects a moderate degree of recovery, but the April manufacturing purchasing managers’ index (PMI) slid to 50.8 from 52.0 the prior month on weak export orders. For context, PMI readings above 50 denote expansion.

Additional Themes

Fed Steady, Dovish – Yesterday, the FOMC voted unanimously to maintain the target range for the federal funds rate between 0 to 0.25%, held the interest on required and excess reserve balances at 0.10%, and maintained its massive liquidity operations. Despite no shifts in policy, the accompanying communications conveyed an ultra-accommodative posture and Fed Chair Powell opined that the Fed will likely have to do more to support the economy.

Drug Hopes – Risk sentiment surged yesterday on an announcement from Gilead Sciences that preliminary results of a coronavirus drug trial showed positive results for treating severe cases of Covid-19 with remdesivir. Meanwhile, President Trump announced a government-led push for a vaccine, dubbed “Operation Warp Speed” targeting wide availability by year-end.