Summary and Price Action Rundown

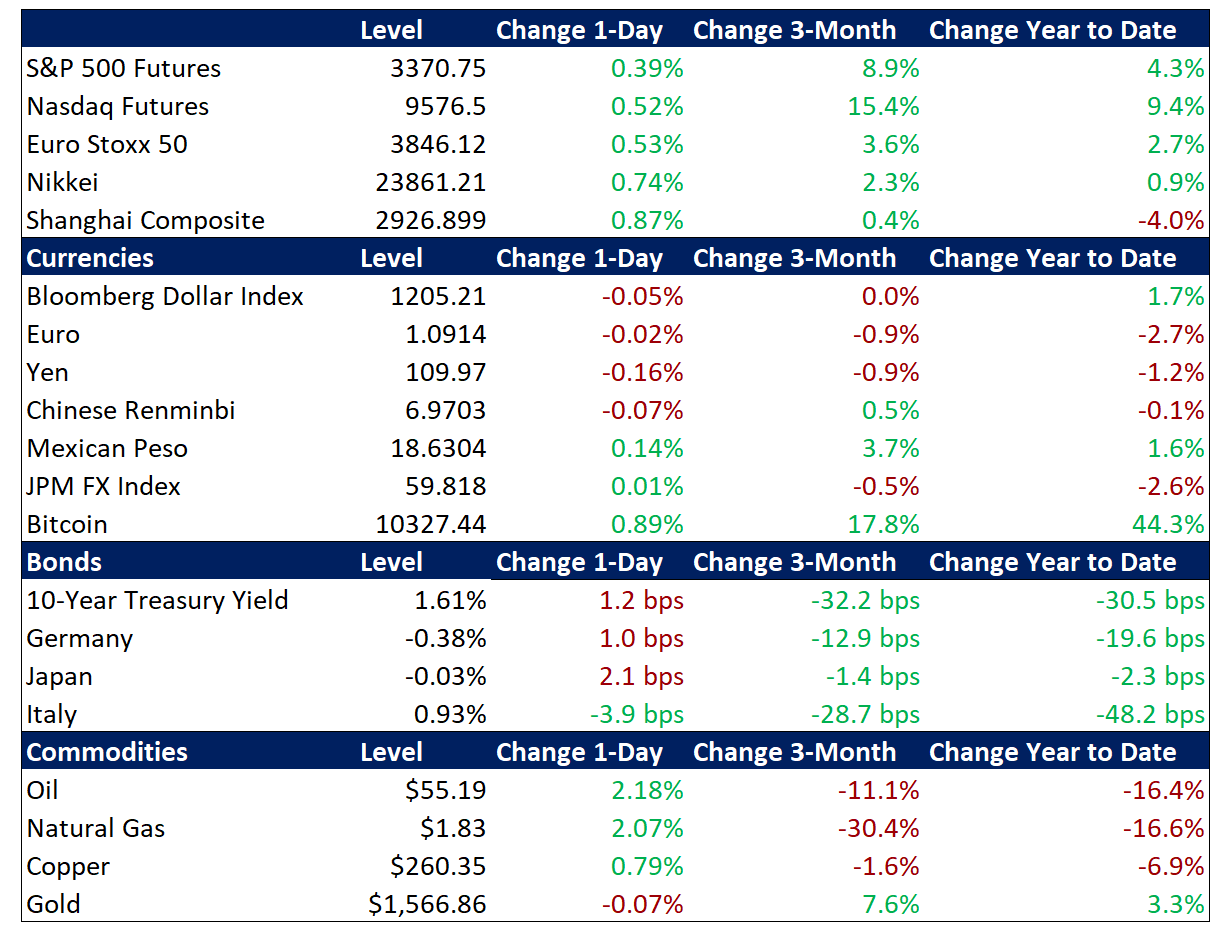

Global risk asset prices continued to run higher overnight as investors further downplay the potential impact of the coronavirus outbreak and monitor testimony by Fed Chair Powell. S&P 500 futures indicate a 0.4% gain at the open, which would send the index to another record high. Last Friday’s moderate selloff has proven to be a temporary lull in the rally, which is being fueled by optimism on apparently slowing infection rates and renewed production and other economic activity in China. Overnight, equities in Asia and the EU also extended their uptrend. Treasury yields are edging higher from recent lows as risk appetite rises, with the 10-year yield at 1.61%, while Fed Chair Powell’s ongoing Congressional testimony is having little impact on the policy outlook. The dollar remains in a holding pattern. Crude oil prices are extending their rebound as virus-related growth fears ebb, with Brent crude back above $55.

Fed Chair Powell to Continue Balanced Testimony Today

In yesterday’s first half of the semiannual Humphrey-Hawkins testimony in front of Congress, Chair Powell maintained an optimistic outlook on the US economy but acknowledged the potential for a global slowdown emanating from the outbreak in China. The Fed’s written statement preceding the testimony had identified the coronavirus outbreak as a “new risk” and Chair Powell highlighted the potential for a global spillover from Chinese economic disruption related to the outbreak. Still, he struck a generally positive note on the domestic front, stating that he sees no reason why the US expansion cannot continue. For context, futures markets reflect over 50% odds that the Fed will restart rate cuts by the July meeting, and one full 25 basis point rate cut, and a meaningful likelihood of a second, are being priced in before March 2021. Those speculative bets on further easing have ebbed slightly over the past few days amid broadening optimism over coronavirus containment (more below). Regarding short-term funding market stress, Chair Powell claimed success in the Fed’s efforts to ease liquidity pressures, which emerged suddenly last fall, and gave no further details on how long the Fed would continue to grow its balance sheet at a pace of $60 billion per month. Following yesterday’s testimony, two of the most dovish FOMC members, Minneapolis Fed President Kashkari and St. Louis Fed President Bullard, both highlighted that the Fed will remain ready to respond to virus-related economic disruptions. Meanwhile, President Trump continued his criticism of the Fed on Twitter, calling for easier monetary policy.

Heightened Optimism for Coronavirus Containment

Investors continue to discount the risks and economic fallout from the contagion amid declining numbers of recorded infections in China and President Xi’s pledge to meet growth targets. Although investors are continuing to monitor news on the ongoing outbreak of the Wuhan coronavirus (now named Covid-19), positive developments are in focus and optimism is running high. Specifically, analysts are attuned to the declining numbers of new reported cases in Hubei Province, the epicenter of the outbreak. Overall daily increases in infections have declined over the past week, according to official figures, with the total rising to 45,204 while fatalities have reached 1,116. News overnight that IT component maker Foxconn, which is incrementally restarting a number of its previously closed mainland facilities, expects to reach 50% of production capacity by month-end is also being taken as a positive sign. With over one million employees in China, Foxconn has been viewed as a bellwether for the private sector response to the outbreak. Meanwhile, Chinese President Xi stated overnight that the China would “defeat the epidemic” and also meet its economic and social goals, supporting investor assumptions that further stimulus measures will soon be forthcoming from Beijing. The Shanghai Composite rallied for a seventh straight session, advancing 0.9% to further reduce post-Lunar New Year losses to 1.7%. Official and unofficial state support is being credited with helping the index rebound. The renminbi remained steady versus the dollar overnight near its strongest level of the month. Equities in Hong Kong also rallied for a second straight session, gaining 0.9%, as did copper futures, suggesting broadening investor optimism.

Additional Themes

EU Industrial Weakness – December’s industrial production in the EU was even weaker than the downbeat forecasts, registering -4.1% year-on-year (y/y) versus an expectation of -2.5%, following a downwardly revised -1.7% y/y the prior month. Reports earlier this week suggested that the European Central Bank may be mulling additional easing if growth remains poor, but with the policy rate at -0.5%, futures reflect less than 50% odds of another cut over the coming year. EU growth doubts have pressured the euro, which is hovering near a multi-year low.

OPEC Cuts Oil Demand Estimate – The cartel has published figures reflecting a 440k barrels per day decline in oil demand this quarter due to the impact of the coronavirus. Crude prices are stabilizing above their lowest level in over a year.