Summary and Price Action Rundown

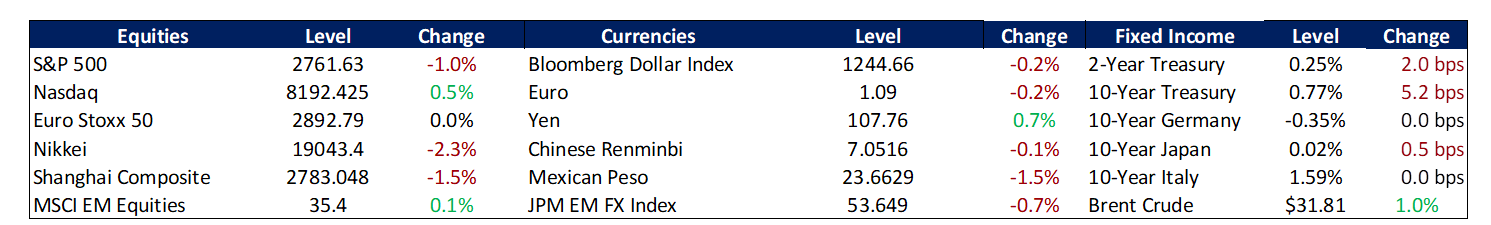

US equities retraced a portion of their steep gains of last week, as investors digest the recent barrage of fiscal and monetary support, the OPEC+ deal, and mixed public health data while awaiting corporate earnings reports. The S&P 500 slipped 1.0% today, shaving its historic rebound of 12.1% last week, putting year-to-date downside for the index at 14.5% and the decline from February’s record high at 18.4%. Last month’s acute volatility has subsided somewhat amid supportive monetary and fiscal policy measures, with bouncing oil prices also lifting sentiment, although uncertainty over pandemic containment and economic recovery prospects persist. EU stock markets remain closed for a holiday and Asian equities were mixed overnight. Treasury yields edged higher, with the 10-year yield at 0.77%. Importantly, the dollar continued to slide below its mid-March multi-year peak. Meanwhile, oil prices remained supported as global leaders talked up the OPEC+ decision (more below).

Earnings Season Set to Begin with Investors Bracing for Downside and Uncertainty

Investors are understandably cautious about first quarter (Q1) corporate results as they await details from management on the depth of the current contraction and plans for navigating what is likely to be a tricky recovery. Earnings reporting season kicks off tomorrow in earnest with some major banks and corporate bellwethers reporting, including JPMorgan, Wells Fargo, Johnson & Johnson, and Fastenal. Most major US financials will report throughout the remainder of the week, including Bank of America, BlackRock, Goldman Sachs, and Citigroup. Analysts anticipate choppy figures and high uncertainty regarding managements’ outlook for coming quarters. Overall Q1 earnings growth for S&P 500 companies has been slashed from 4.4% coming into this year to -5.4% versus Q1 last year. Energy companies have seen the largest downgrades, along with industrials and consumer discretionary. As with economic data, the outlook for an earnings rebound in late Q2 and Q3 will likely be more impactful of stock prices than Q1 misses or the depths of the second quarter trough, though visibility on any forecasts will be low. – MPP view: Our view is that stock price reactions to Q1 earnings will probably be relatively more dependent on the background atmospherics of the market, which depend in large part on the public health data coming out over the coming week, as well as the state of the debate on reopening the economy (more below).

Oil Prices Continue Higher as the White House Talks Up the OPEC+ Deal

Brent crude fluctuated near its highest level in nearly a month after OPEC, Russia, and other major oil producers agreed to historic production curbs over the weekend, but some analysts still forecast continued oversupply. After revisiting nearly two-decade lows in late March, international benchmark Brent crude and US benchmark WTI prices have staged a choppy uptrend over the past week as traders have weighed production cuts versus crashing demand. After Thursday’s virtual meeting, OPEC, Russia, and other major producers (collectively known as OPEC+) cut a deal to reduce supply by 9.7 million barrels per day over the next two months, with Russia and Saudi agreeing to match each other’s reduced production levels. Mexico held out but eventually agreed to a more modest supply cut than their peers. Saudi also hosted talks with G-20 energy ministers over the weekend, which resulted in the US, Brazil, and Canada acknowledging output declines, though these are characterized as distinct from OPEC’s voluntary reductions. Today, President Trump and Saudi officials suggested that the cuts, combined with filling petroleum reserves, the total effective supply reductions/diversions will be nearly 20 million barrels per day. Still, analysts question whether even these large production cuts can balance the dramatically oversupplied oil market, which has seen demand collapse amid the coronavirus pandemic. – MPP view: Durable stabilization of oil prices would be a win (so far so good), and there is no reason not to jawbone crude prices higher. We’ll see what Texas comes up with in the next few days as they discuss curbs for the shale patch, which would be a welcome surprise, but isn’t likely.

Additional Themes

Debate Over Reopening the Economy Heats Up – President Trump asserted the right of the federal government to declare a reopening of businesses and schools across the US but state governors who responded tended to differ with this assessment. Governors of Washington, California, and Oregon announced that they would be teaming up to jointly strategize about restarting more normal levels of economic, educational, and social activities, as did the governors of New York, New Jersey, Pennsylvania, Delaware, Connecticut, and Rhode Island. Frameworks for reopening will be rolled out over the coming days. This comes amid speculation that Dr. Fauci, who has been a leader of the White House’s Covid-19 task force, may be facing dismissal. The White House denied this speculation and Dr. Fauci today noted that activities could resume “in some ways” in May. Meanwhile, in Europe, the EU Commission is said to be pushing for coordination across its member states on the timing and procedures for restarting the regional economy. – MPP view: Data needs to help inform the policy decisions about relaxing some of the lockdown measures currently in place. Experience overseas shows that a secondary spike in infections is a substantial risk, even where symptom tracking and contact tracing is far more unified and rigorous than it is in the US.

Airline Stocks Relapse Amid Bailout Wrangle – As Treasury Secretary Mnuchin and US airline heads debate the requirements of federal funding support, investors sold the stocks of the carriers today to the tune of 5-8% losses, reversing a modest rally in the sector. Mnuchin is pushing for 30% repayment of the grants within five years and has insisted that this is not a bailout.