Summary and Price Action Rundown

Global risk assets are mostly higher this morning amid continued optimism over economic reopening, rising oil prices following the OPEC+ agreement, and expectations for more exceptionally accommodative messaging from the Federal Reserve at this week’s meeting. S&P 500 futures indicate a 0.4% higher open, which would add to last week’s torrid 4.9% gain that cut year-to-date downside to a mere 1.4% and the decline from February’s record high to 5.7%. Equities in the EU are retracing a portion of their ongoing rally this morning, while Asian stocks also posted gains overnight. Longer-dated Treasury yields are extending their breakout from their two-month trading range, with the 10-year yield rising to 0.91%, while the dollar is continuing its downtrend. Crude oil is climbing to a new multi-month high after OPEC and its allies agreed over the weekend to extend supply cuts (more below).

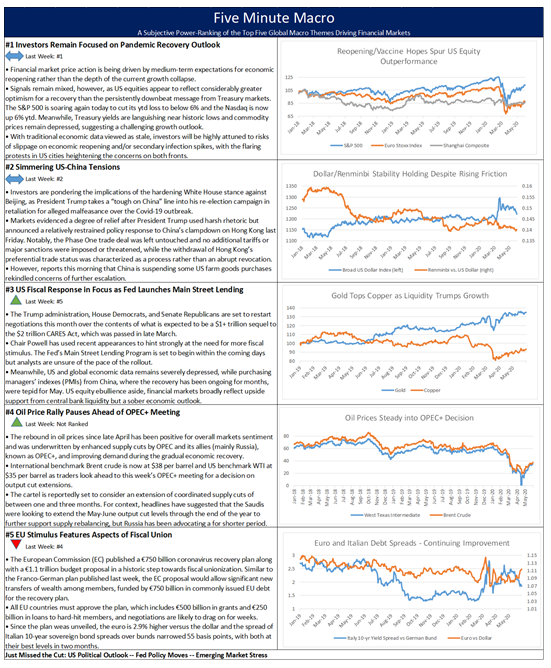

OPEC+ Unites Over Further Supply Cuts

Crude oil is continuing its steep multi-month rally after OPEC and its allies (collectively known as OPEC+) agreed on Saturday to extend output curbs through July with a focus on stricter compliance. Key aspects of the deal include an agreed-upon 9.6 million barrels per day (bpd) cut through July (slightly lower than previous 9.7 million bpd due to Mexico’s withdrawal from supply cuts) and previously non-compliant countries from May and June making extra supply reductions to compensate, a point that was non-negotiable to both Saudi and Russian officials. These compensatory measures will turn investor attention towards the compliance of Iraq and Nigeria over the next few months as the primary indicator of the cohesiveness of the cartel’s agreement. The Joint Ministerial Monitoring Committee will meet again on June 18th to continue to monitor the oil market and determine whether the cuts would need to be extended until August. Going forward, the cartel will also have to contend with two key factors that may work to counter their efforts to support prices. First is the resurgence of Libyan oil, as the ceasefire agreement has already seen the resumption of production at the war-torn country’s largest oil facilities. Second is the potential rebound in US shale oil output, with reports noting that producers are starting to undo the shut-ins that have occurred over the past few months.

Economic Data Sends Mixed Signals Over Global Recovery

As analysts continue to ponder the dramatic upside surprise in last Friday’s US nonfarm payroll figures for May, data from overseas suggests that the recovery remains fitful. Although April data may be considered somewhat stale and backward-looking, German industrial product for the month was worse than anticipated, contracting 17.9% month-on-month and 25.3% year-on-year (y/y). Automobile sales in Germany were down 50% y/y in May, though China’s car buying rebounded for a gain of 1.9% y/y. Not all the data from China was positive, however, with May exports down -3.3% y/y and imports -16.7% y/y, with the former moderately better than expected but the latter considerably weaker. However, analysts noted that the import data showed large increases in crude oil and soybean purchases, which are suggestive of compliance with Phase One trade deal commitments. Meanwhile, Japan’s revised first quarter GDP figure showed an improvement from the initial reading of -3.4% quarter-on-quarter annualized contraction to 2.2%, though economists are pointing to possible distortions in the figure based on challenging reporting conditions during the onset of the pandemic. Similarly, market participants are trying to parse the significance of the “misclassification error” disclosed by the Bureau of Labor Statistics, which led to a significant understatement of the unemployment rate in Friday’s stunning release. For context, the unemployment rate fell to 13.3% after record highs in April, well below market expectations of 19.8%. The number of unemployed persons fell by 2.1 million to 21 million. However, the real unemployment rate is another 3% higher at 16.1% due to continued misclassifications in BLS household surveys regarding temporary layoffs due to the pandemic. The challenge is the treatment of furloughed workers, who reported that they remain employed but absent at the direction of management.

Additional Themes

US Protests Remain a Backburner Issue for Markets – Despite the magnitude and societal significance of the demonstrations that continued over the weekend with a more peaceful tone than last week, there remains scant overt reaction in financial markets. Still, investors are pondering how these developments might change the outlook for November’s election.

This Week – Analysts will be highly attuned to how Chair Powell and the FOMC frame the surge in May nonfarm payrolls on Wednesday at the conclusion of the two-day Fed meeting. Aside from the FOMC, this week’s calendar is somewhat light. Initial jobless claims and continuing jobless claims will be in focus on Thursday. Consumer and producer price indexes will be noted, but are unlikely to move the market, while the consumer sentiment gauge on Friday will be salient to the assessment of the ongoing economic rebound.