Summary and Price Action Rundown

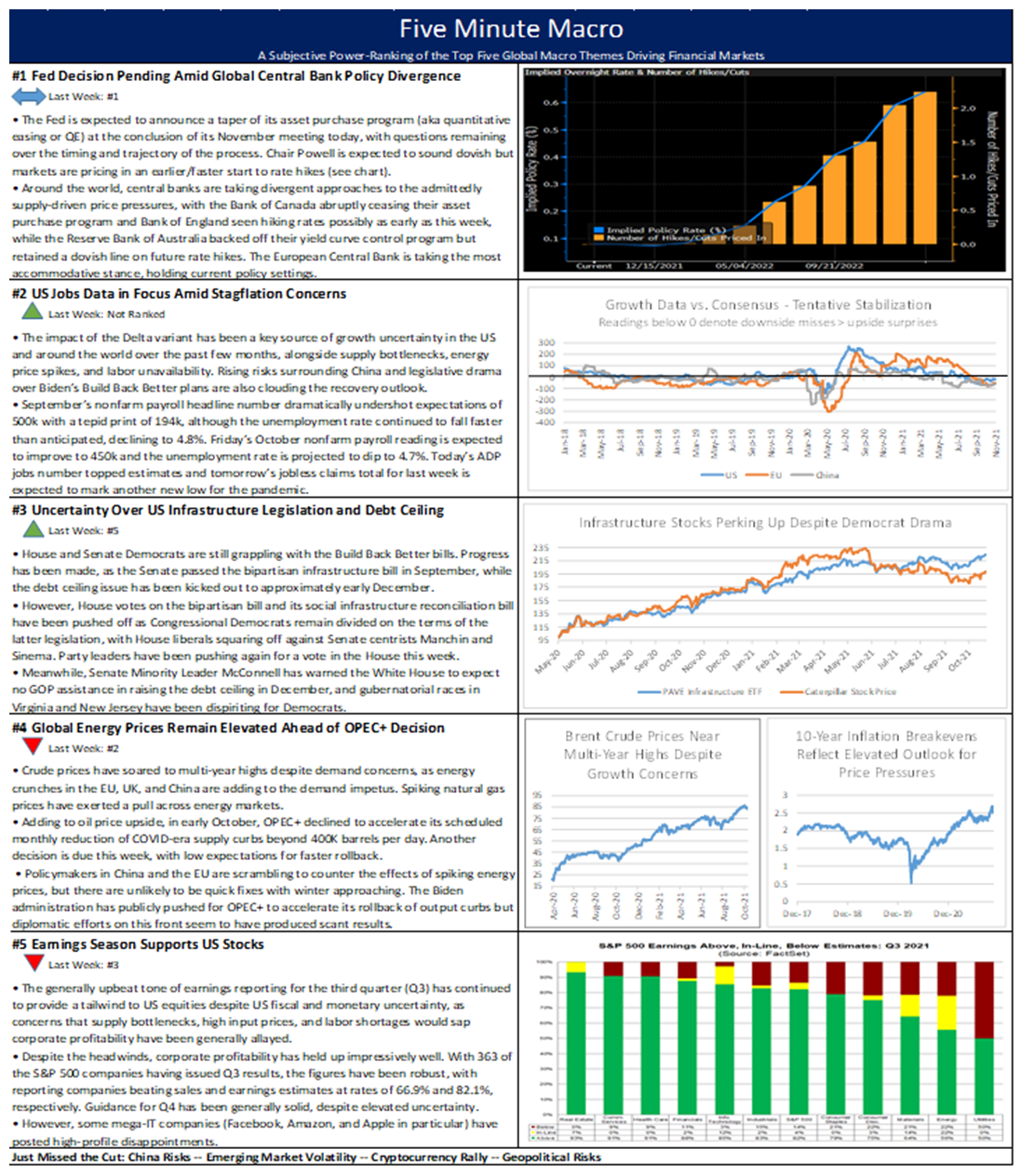

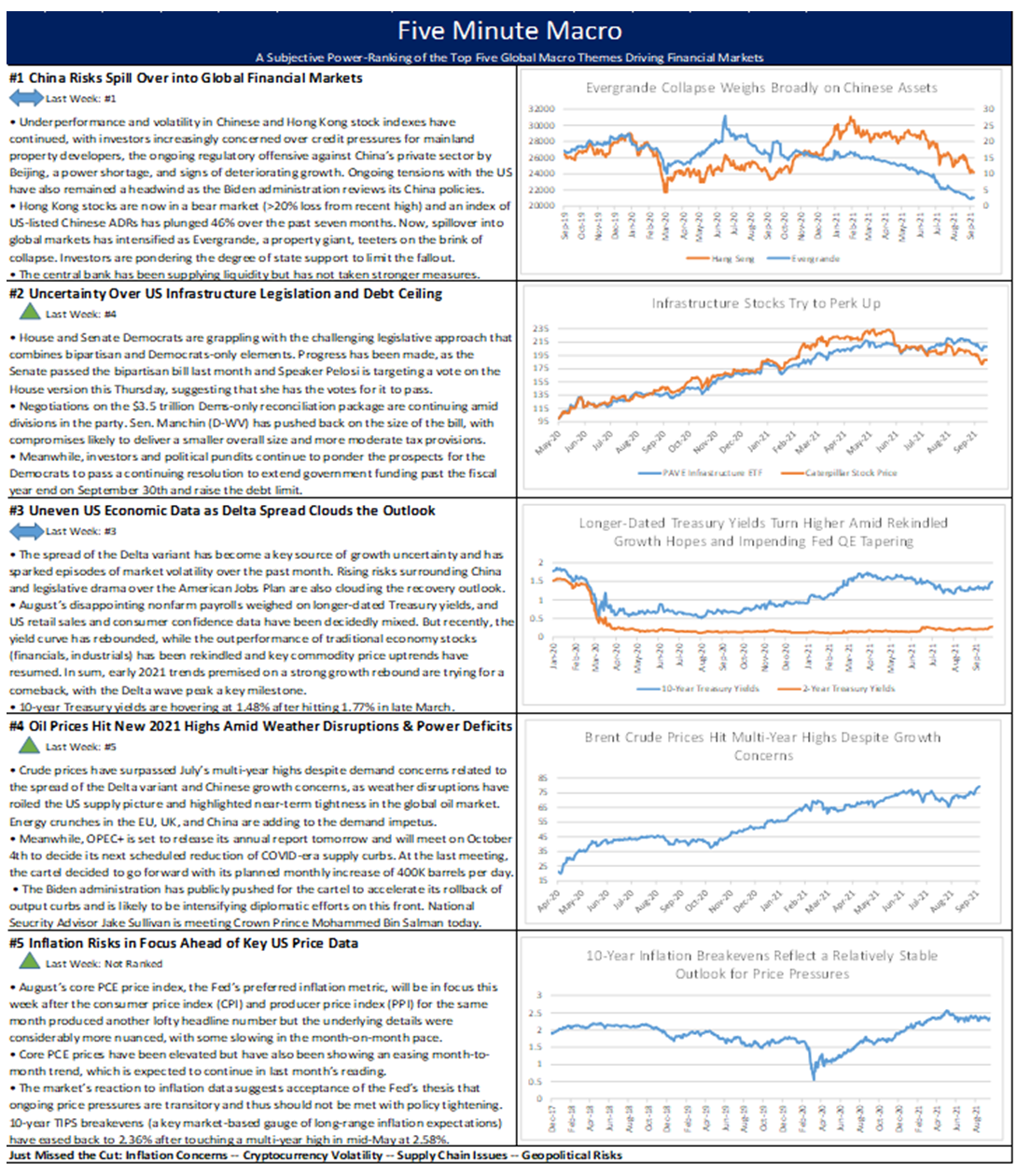

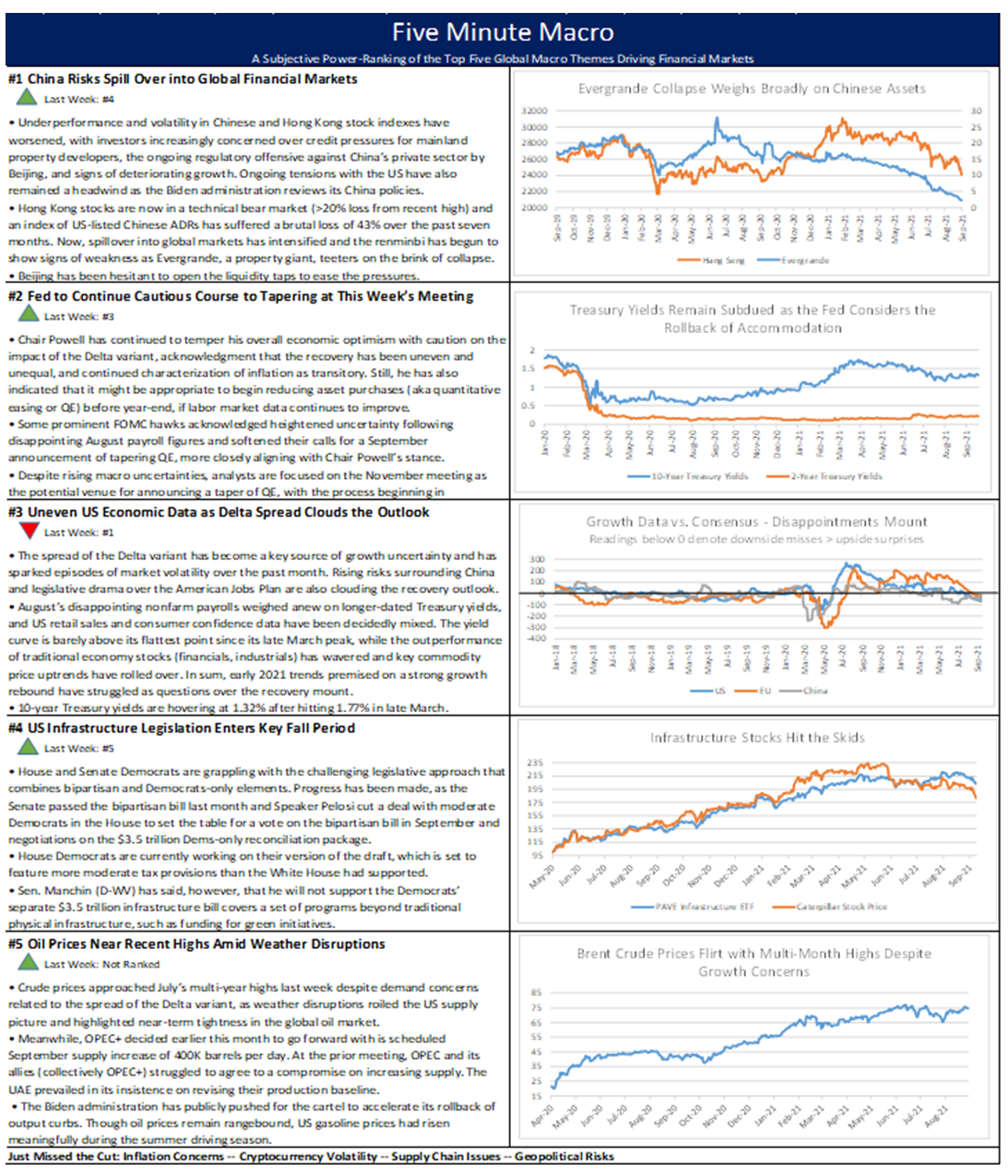

US equities extended their streak of new record highs as upbeat corporate earnings provide further support alongside more positive atmospherics around President Biden’s infrastructure bills. The S&P 500 added 0.4%, registering another all-time high and upping year-to-date returns to 23.3%, while the Nasdaq kept pace despite a drag from Tesla (more below). The Euro Stoxx Index also gained while Asian stocks mostly retreated overnight. Longer-dated Treasury yields held steady while the short end rallied ahead of tomorrow’s consequential Fed decision, with the 10-year Treasury yield closing at 1.55%, which is still on the high side of its 2021 trading range. Meanwhile, a broad dollar index continued its rebound but remained below recent multi-month highs. Oil prices slipped slightly ahead of this week’s OPEC+ meeting, with Brent crude still holding above $84 per barrel.

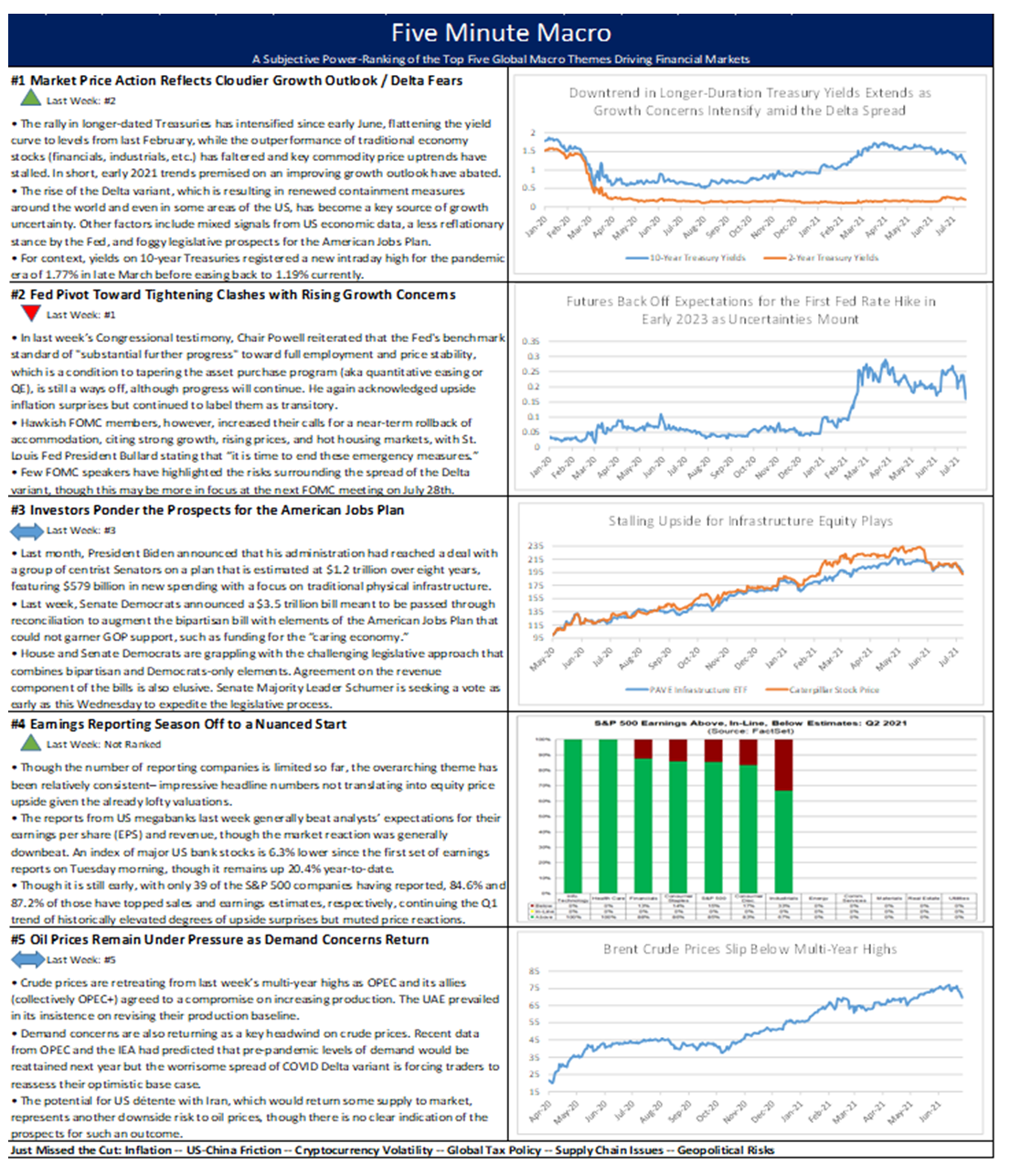

Latest Headlines Suggest More Progress on Biden Bills

Congressional Democrats continue to make progress on the intricately coordinated two-track infrastructure legislation, with ongoing uncertainty over the prospects for a near-term House vote on both bills. An ETF of US infrastructure-related stocks climbed 0.9% to hit a record high today and extend its gains on the year to 32.3% as optimism over the prospects for the Biden administration’s physical and social infrastructure bills continues to build among equity investors. In a press conference at the climate summit in Glasgow Scotland, President Biden expressed his confidence that centrist Senator Manchin will support the Dems-only reconciliation bill after verifying certain specifics. This comes after Senator Machin asserted yesterday that more time is needed to review the $1.75 trillion social infrastructure package. He again called for the House to vote on the bipartisan infrastructure package, which the liberal wing of the caucus has held up in an effort to get consensus and unequivocal Senate support on the reconciliation bill. Also today, Senate Majority Leader Schumer indicated that Congressional Democrats have worked out a compromise on prescription drug pricing terms that cap out-of-pocket spending at $2,000 per year and outline industry reforms, noting that centrist Senator Sinema is on board. Meanwhile, political commentators are awaiting results in the Virginia governor’s election, which is being cast as something of a litmus test for Democrats’ political fortunes against a Trump-linked candidate. – MPP view: Still no clarity on the timing of the vote, and today’s latest deadline may give way again, but there is a sense of momentum and we think the odds of near-term passage remain relatively high – however, if timeline for a vote slips into mid-November or later, the odds worsen markedly.

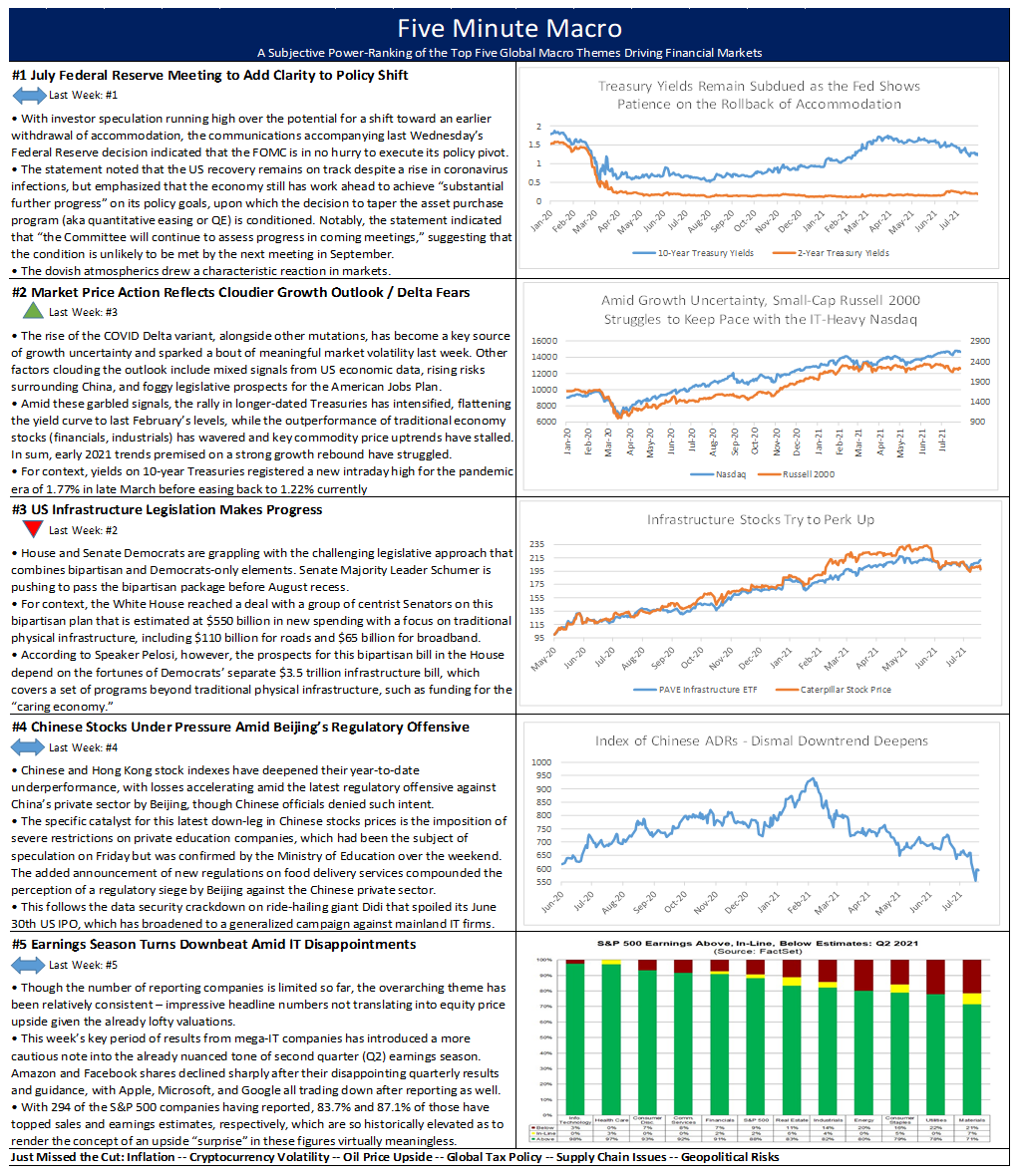

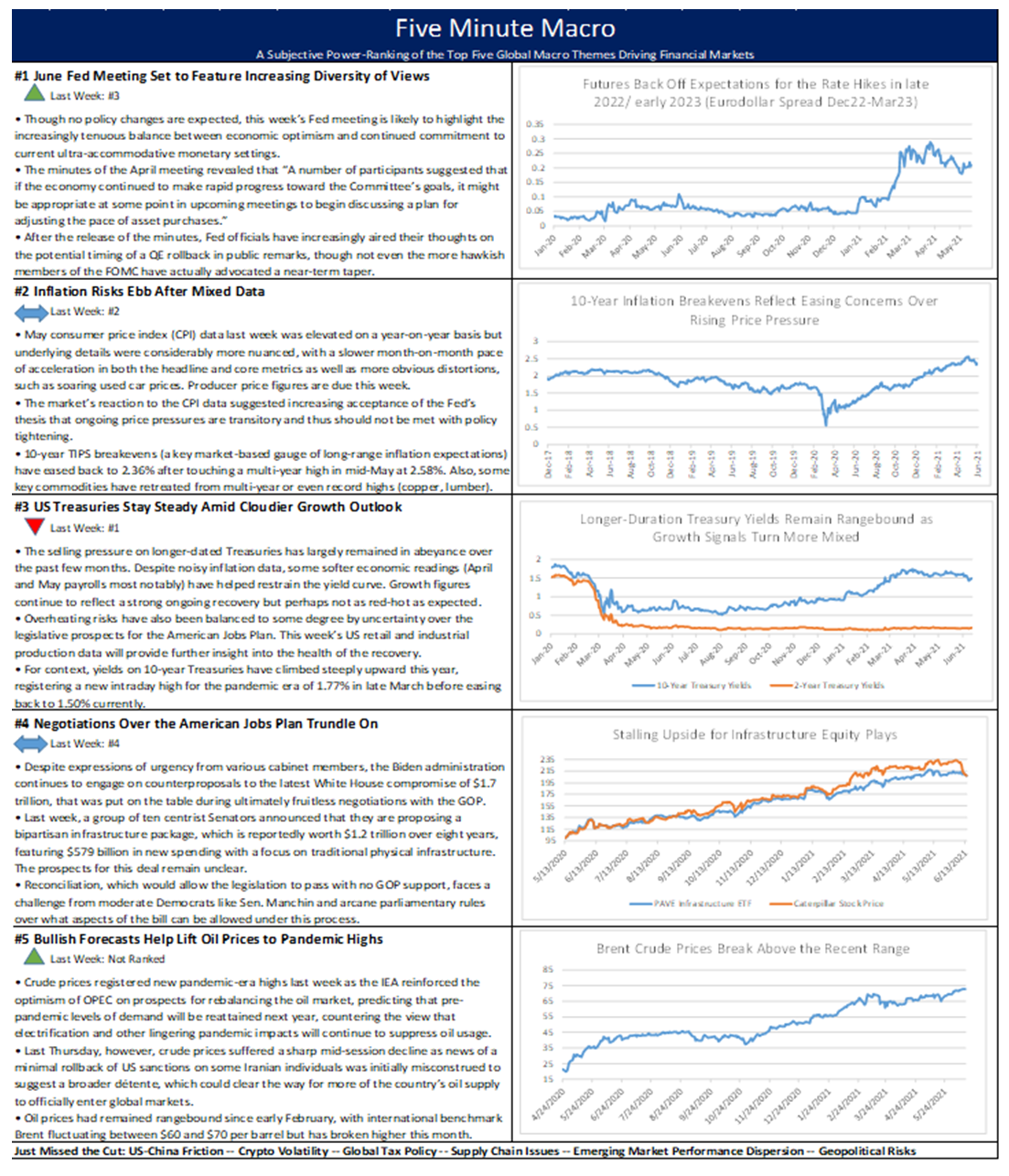

Solid Earnings Continue to Buoy Stocks

Third quarter (Q3) results remain broadly upbeat, with the bulk of the reporting concluding this week. Pfizer shares jumped 4.2% today after reporting better than expected profit and revenue for the third quarter. The pharma giant earned $1.42 per share topping estimates and issued an improved full-year forecast on strong demand for both the covid vaccine and other non-covid related treatments. Management reported revenues of $24.1 billion, reflecting 130% operation growth excluding Comirnaty (vaccine) revenue. Pfizer raised full-year guidance for revenues to a range of $81 to $82 billion and adjusted diluted EPS to a range of $4.13 to $4.18, reflecting 94% and 84% year over year growth at the midpoints, respectively. It anticipates Comirnaty revenue of approximately $36 billion, reflecting 2.3 billion doses expected to be delivered in 2021.

Dr. Albert Bourla, Chairman and CEO stated, ““While we are proud of our third quarter financial performance, we are even more proud of what these financial results represent in terms of the positive impact we are having on human lives around the world. For example, more than 75% of the revenues we have recorded up through third-quarter 2021 for Comirnaty have come from supplying countries outside the U.S., and we remain on track to achieve our goal of delivering at least two billion doses to low- and middle-income countries by the end of 2022 — at least one billion to be delivered this year and one billion next year, with the possibility to increase those deliveries if more orders are placed by these countries for 2022.”

Pfizer’s earnings reflect strong growth with and without the Comirnaty revenue. The short-term outlook for vaccine revenue is high as 58% of the US are fully vaccinated and many from the rest of the world, especially in low- and middle-income countries awaiting their doses. Pfizer CFO Frank D’Amelio stated that the company is increasing guidance excluding Comirnaty for the second consecutive quarter, demonstrating the ability to execute on other segments beyond the vaccine.

“We continue to make progress on advancing our internal pipeline across all therapeutic areas while also prudently deploying our capital through partnerships and bolt-on acquisitions to gain access to cutting-edge platforms, science and technologies that could potentially bolster our growth in the latter half of this decade. I am proud of what we have accomplished so far in 2021 and look forward to finishing the year strong.”

Car rental stock Avis Budget surged 108.3% after the company reported a stronger-than-expected third quarter that sparked massive trading volume. The company reported $10.74 in per-share earnings for the third quarter, which was more than $4 above expectations. Avis Budget’s board also authorized an additional $1 billion in share buybacks. Vague comments on the conference call by executives about increasing purchases of electric cars for its fleet appeared to add juice to the rally, as chief executive officer Joseph Ferraro said the company would play a “big role” in the growth of electric cars in the US. Ahead of the earnings report, 20.5% of the float of Avis Budget’s stock was sold short, which is extremely high. When a stock rises, short-sellers are forced to cover their positions by buying shares, creating more upward pressure on the stock price. This is called a “short squeeze.”

With 346 of the S&P 500 companies having issued Q3 results, the figures have been impressive, with reporting companies beating sales and earnings estimates at rates of 67.5% and 81.8%, respectively. – MPP view: With Q3 earnings season pretty much in the books, the margin squeeze/bottleneck/input costs/labor shortage dogs didn’t do as much barking as feared and we expect increasing signs of easing some of the snags and shortages over the coming months.

Additional Themes

Sobering Signs from an Economic Sentiment Gauge – The IBD/TIPP Economic Optimism Index in the US fell for the 5th straight month to 43.9 in November, the lowest since September of 2015, and just undercut the prior pandemic low of 44 in July 2020, as the second Covid wave was hitting. With the Delta variant slowing the jobs recovery and inflation fears mounting, household financial stress is spiking and faith in federal economic policies is sinking. The six-month economic outlook index sank 2.7 points to 38.6, the lowest since July 2020. Inflation worries weighed on the personal finances subindex, which fell 2 points to a 14-month low of 51.9, despite the S&P 500 closing the month at a record high. Dimming faith in federal economic policies was the biggest drag, as the federal policies subindex fell 4.2 points to 41.1. That was the lowest since January 2016.

Tesla Shares Dented by Hertz News – In contrast to today’s continued upswing in US equity markets, Tesla shares slid 3.0% today after CEO Elon Musk disclosed on Twitter that no contract had been signed with rental car company Hertz after reports of its intent to buy 100,000 electric vehicles from the carmaker. Musk also downplayed the potential impact of the deal due to demand for Tesla EVs consistently outstripping supply prior to the Hertz news.