Summary and Price Action Rundown

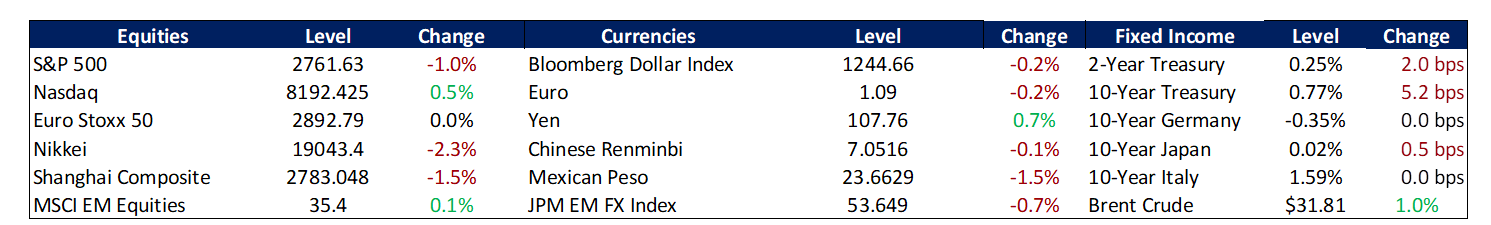

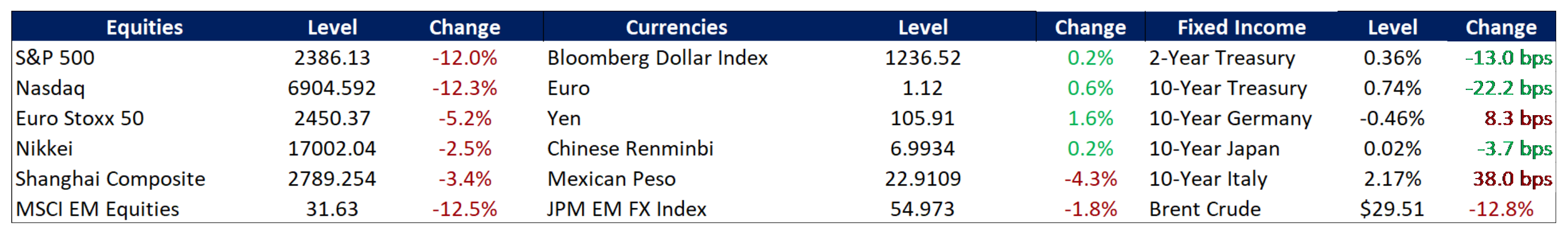

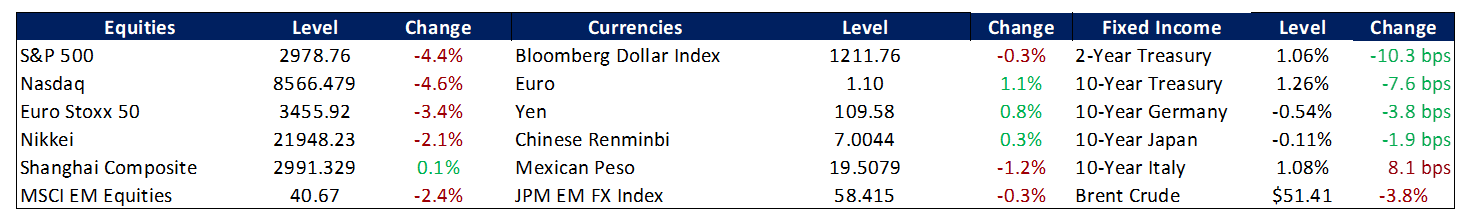

US equities gave up early gains today as the Fed decision provided no new upside impetus and tech underperformance reemerged, while investors monitored fiscal stimulus headlines and soft retail data. The S&P 500 lost 0.5% today, retracing yesterday’s upside and paring its year-to-date gain to 4.8%, which is around 5.5% below early September’s record high. The tech-heavy Nasdaq also erased yesterday’s 1.2% gain, taking its robust year-to-date gains to 23.2%. Equities in the EU closed slightly higher while Asian stocks were mixed overnight. The dollar bounced from intraday lows after the Fed declined to adopt the more dovish policy formulation that some analysts had expected, while longer-dated Treasury yields edged higher, with the 10-year yield closing at 0.70%. Brent crude prices rebounded above $42 per barrel as US inventories shrank.

Fed Decision Meets Expectations

Despite increasingly accommodating guidance from the Fed today, the FOMC declined to enact the most dovish potential formulation predicted by some analysts. In today’s decision, the FOMC unsurprisingly left interest rates unchanged at 0-0.25% and projected that it would maintain this ultra-low rate range through at least 2023 in order to facilitate the US economy recovery from the fallout of the coronavirus pandemic. Specifically, the accompanying statement stated that this accommodative rate would likely be maintained “until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time.” Dallas Fed President Kaplan dissented in favor of a more flexible formulation, allowing for more proactive monetary tightening, while Minneapolis Fed President Kashkari expressed his preference to steer policy toward 2% inflation “on a sustained basis.” The statement also reiterated a commitment to continue buying Treasuries and mortgage backed securities at least at the current pace of $80 billion and $40 billion, respectively, over “coming months.” The Fed also updated its Summary of Economic Projections, expecting the unemployment rate by year’s end to average 7.6%, compared to the June projection of 9.3% and the current 8.4% rate. Officials revised growth projections to -3.7% from the prior -6.5% estimate for 2020 but to 4% for 2021, a slower rate than the previous 5% outlook. In his press conference, Chair Powell declined to invoke “enhanced guidance,” an even more accommodative formulation that would more formally tie policy decisions to inflation and unemployment targets. He did mention that the Main Street Lending Program, which has now deployed $2 billion of its $600 billion total firepower, is being tweaked in an effort to improve uptake. – MPP view: The Fed met our expectation that it would shy away from fully embracing enhanced guidance today, meaning they would not directly link policy action on rates and asset purchases to specific inflation and employment benchmarks. But they indeed used the dot plot and strong messaging to hammer home their deep commitment to maintaining ultra-accommodative policy settings for the foreseeable future. Overall, we thought this decision would not amount to a hawkish surprise but will not be as wildly dovish as it could have been, which seems about right. Overall, the market reactions comported with this view, though Treasury yield curve slightly steepened, which we did not expect.

More Encouraging Atmospherics Around the Pandemic Relief Bill

Developments continue to suggest renewed momentum toward a deal on further fiscal support. Chief of Staff Meadows, who has been cited by Washington insiders as taking a hard line in negotiations on this stimulus bill, indicated that President Trump is favorably disposed toward the compromise $1.52 trillion proposal put forward yesterday by the House “Problem Solvers Caucus,” a group of 50 centrist Representatives. This package would include $120 billion for unemployment assistance at $450/week in mid-October and then $600/week from December through January 2021, a second round of stimulus checks, about $500 billion in state aid, and liability protections for employers. This follows Speaker Pelosi’s statement on CNBC yesterday vowing that the House will not go into recess for the November election until an additional round of stimulus is passed. On Monday, Treasury Secretary Mnuchin had urged action on economic stimulus during his appearance on CNBC and downplayed concerns over the size of the deficit. Still, House Democratic leadership, while citing progress, suggested that they might hold out for a higher number, calling the size of the compromise bill “insufficient,” while Senate Republicans expressed mixed sentiments and concern over the magnitude of spending. Meanwhile, late afternoon reports indicated that House Republicans are pushing to expedite a bill that would redeploy remaining money in the Paycheck Protection Program. – MPP view: We have been out of consensus in thinking the odds of an agreement on this relief bill before month-end are relatively high, and viewed this $1.5 trillion proposal is a formulation that enough lawmakers and the White House can get behind. The White House seems on board, and we continue to expect a deal around this basic framework to be agreed before the pre-election Congressional recess.

Additional Themes

US Retail Sales Undershoot – Retail sales for the month of August disappointed, rising 0.6% after the downward revision of July’s number to 0.9% and missing the consensus forecast of a 1.0% increase. The deceleration of retail sales over recent months has been blamed on the expiration of federal unemployment benefits, the drying up of support for small businesses, and the persistence of the pandemic. Meanwhile, core retail sales, which most closely track the consumer spending component of GDP, fell 0.1% in August. While sales continue to rise for areas such as food and drink (4.7%), clothing (2.9%), and furniture (2.1%), more areas are starting to see significant reversals such as department stores (-2.3%), grocery stores (-1.6%), and sporting goods and hobby (-5.7%). Most analysts point to August’s data as a forerunner to the economic damage likely to result absent a significant stimulus package from Congress. The dramatic rebounds in May and June that have since tapered off over previous months were attributed heavily to both pent-up demand upon phased reopening of the economy and the CARES Act, which bolstered US consumer spending. The backsliding in retail sales comports with the warnings of many economists and Fed officials and may rekindle greater urgency on Capitol Hill to pass the next stimulus bill.

Rate Sensitivity in Mortgage Markets – According to the Mortgage Bankers Association (MBA) Weekly Mortgage Applications Survey, last week’s applications fell 2.5% from the week ending on September 11th, after rising 2.9% the previous week. The Refinance Index decreased 4% since last week, though is still 30% higher from the same week a year ago. The seasonally adjusted Purchase Index also dropped 1% from and the unadjusted Purchase Index fell 12%, yet has remained 6% above last year’s figure. Even with elevated refinance activity reported over the past several months, Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting, blames slowing demand on “remaining borrowers in the market potentially [waiting] for another sizable drop in rates.” The average interest rate for fixed 30-year mortgages has remained unchanged at 3.07%, 1-basis point above the record low, and average loan size continued to inflate, hitting a new survey high of $370,200. While this week’s data showed falling applications, the underlying trends remain strong. Purchase activity has outpaced last year’s levels for 17 consecutive weeks. Record low rates and a limited housing supply continue to underpin a prosperous housing market. In a separate report released this morning, the NAHB housing market index jumped 5 points to 83 in September, beating market projections of 78. The climbing figure registered a new record high for the survey’s 35-year history, driven by the low rate environment and a flurry people leaving big cities amid the pandemic.