#1 US-Iran Tensions / Geopolitical Risk / US Political Uncertainty

![]() Last Week: Not Ranked

Last Week: Not Ranked

• Investors are grappling with the risks and ramifications of last week’s US airstrike, which killed a key Iranian military leader and a number of his deputies near the Baghdad airport following a series of assaults on US personnel and installations in the country.

• Iran’s leaders have indicated that they will abandon the restrictions on their nuclear program and vowed to strike back while the White House has indicated that any such retaliation will be met with further US airstrikes. Iraq’s Parliament has approved a nonbinding resolution to expel US troops from the country.

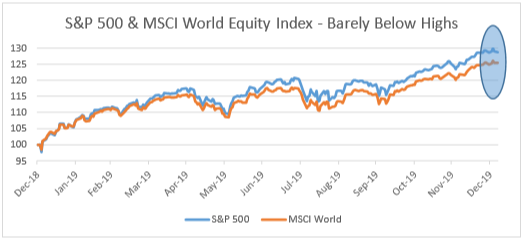

• The enflamed geopolitical tensions have dented investor risk appetite, weighing on global equities over the last two sessions, although losses remain modest and many indexes, such as the S&P 500 are less than 1% below record highs.

#2 Higher Oil Prices

![]() Last Week: Not Ranked

Last Week: Not Ranked

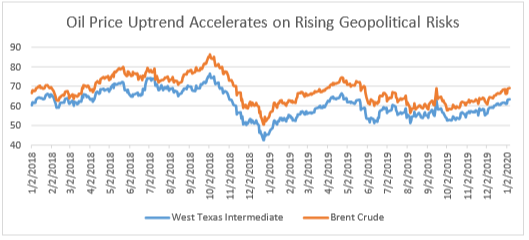

• Brent crude prices are unsurprisingly higher amid the rising Middle East turmoil, rising 4.7% to hover around $69 per barrel, reflecting an increasing geopolitical risk premium, but remain below 12-month highs of $75 from last April.

• Investors are pondering the risk that Iran chokes off shipping through the Straits of Hormuz or again attacks Saudi or other regional oil facilities, in a repeat of September’s surprising attacks. However, for context, this jump in prices remains shy of the surge in September after Saudi Aramco’s facilities were hit by Iranian missiles and drones.

• With OPEC (particularly Iran’s regional rival Saudi Arabia) restraining its production over the past year in an effort to support prices, analysts note that any significant rallies in oil would likely be met with a swift supply response, thereby limiting upside potential.

#3 Hopes for a Global Growth Rebound Amid Mixed Data

![]() Last Week: #2

Last Week: #2

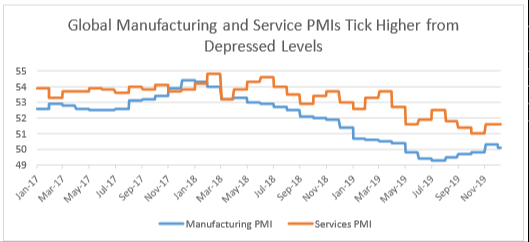

• Expectations for a lasting US-China tariff truce and 2019’s monetary easing campaigns by global central banks have kindled hopes for a medium-term worldwide growth rebound. Recent indicators have been mixed but suggest modest improvement.

• The major upside surprise in US payrolls data for November further boosted optimism, although last month’s US retail sales were disappointing and the US manufacturing gauge for December undershot estimates. Analysts await readings of service sector activity and nonfarm payrolls for last month.

• China’s November trade figures remained depressed but industrial production, retail sales, and fixed asset investment figures reflected improvement. Recent credit extension figures also rebounded after poor October totals.

#4 Fed / Global Central Bank Monetary Policy

![]() Last Week: #4

Last Week: #4

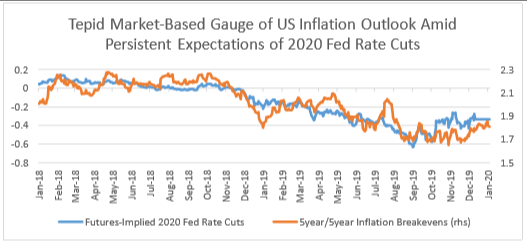

• Amid somewhat better US and global economic figures and building optimism over the progress toward a US-China Phase One trade deal, the Fed held interest rates at its midDecember meeting, as expected. At the October meeting, the Fed had cut interest rates for a third consecutive time by 25 basis points to a range of 1.50-1.75%.

• Fed communications signal a pause in the easing cycle but aside from persistently strong jobs numbers, US growth data has been mixed and futures reflect meaningful odds of another rate cut over the next year. The restart of Fed asset purchases to grow its balance sheet has taken some of the pressure off interest rate policy.

• The European Central Bank also remained on hold last month and analysts noted balanced accompanying communications by newly-minted President Lagarde.

#5 US-China Trade Détente

![]() Last Week: #1

Last Week: #1

• Global risk assets rallied throughout 4Q19 in anticipation of a US-China Phase One trade deal, which both sides confirmed was complete in mid-December.

• The US has agreed to partial removal of existing tariffs on Chinese imports in addition to cancellation of the scheduled duty increases consumer-facing products in mid-December. The White House will retain some tariffs as leverage in Phase Two talks, but investors expect no real progress on that front before the November elections. China agreed to some degree of increased US farm imports. Enforcement procedures are also said to be included, alongside intellectual property, structural reforms, and currency policy terms.

• A Chinese delegation led by Vice Premier Liu is scheduled to arrive in Washington for a signing ceremony of the Phase One US-China trade deal on January 15.

Just Missed the Cut: Reemergent Hard Brexit Risks — EU Fiscal Policy / Populism