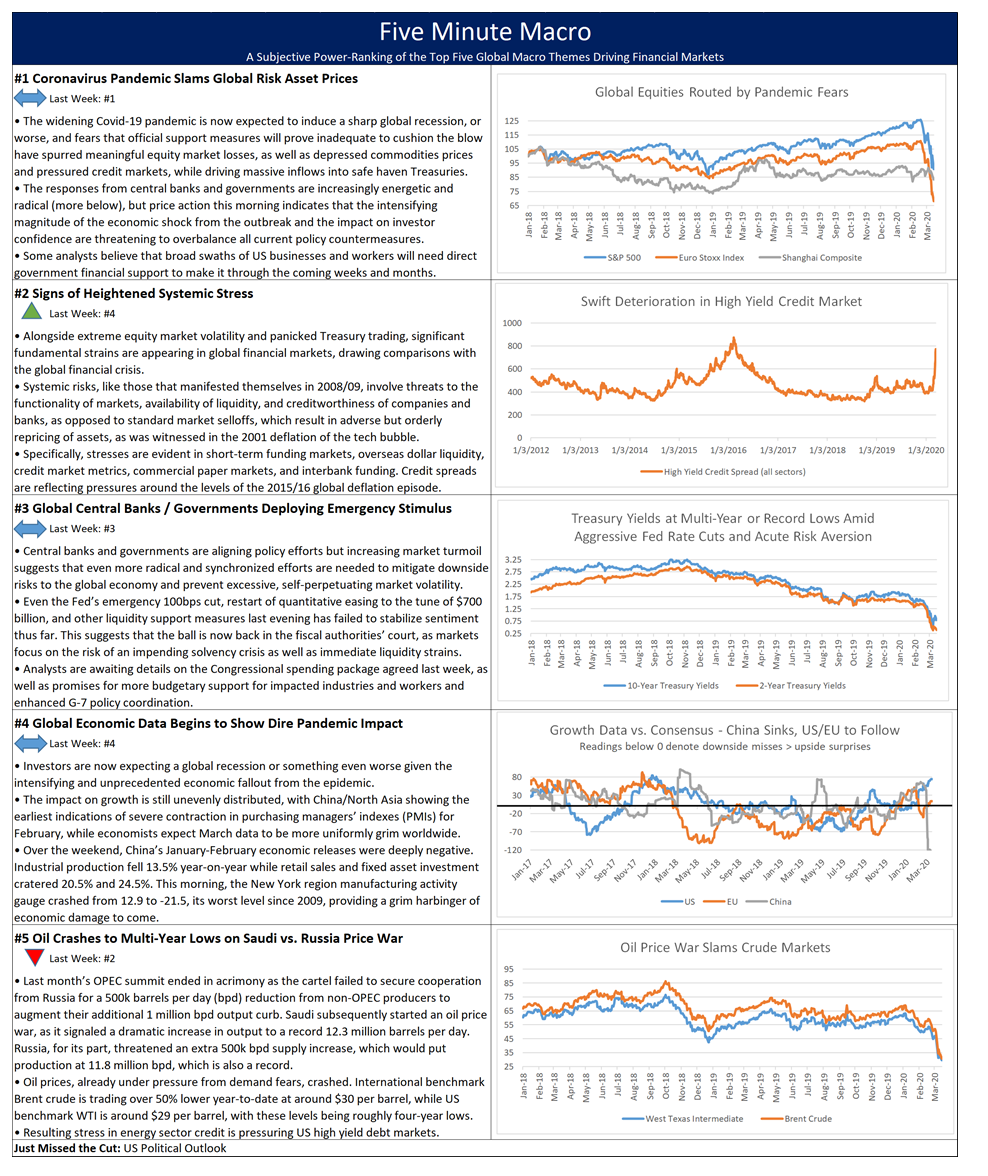

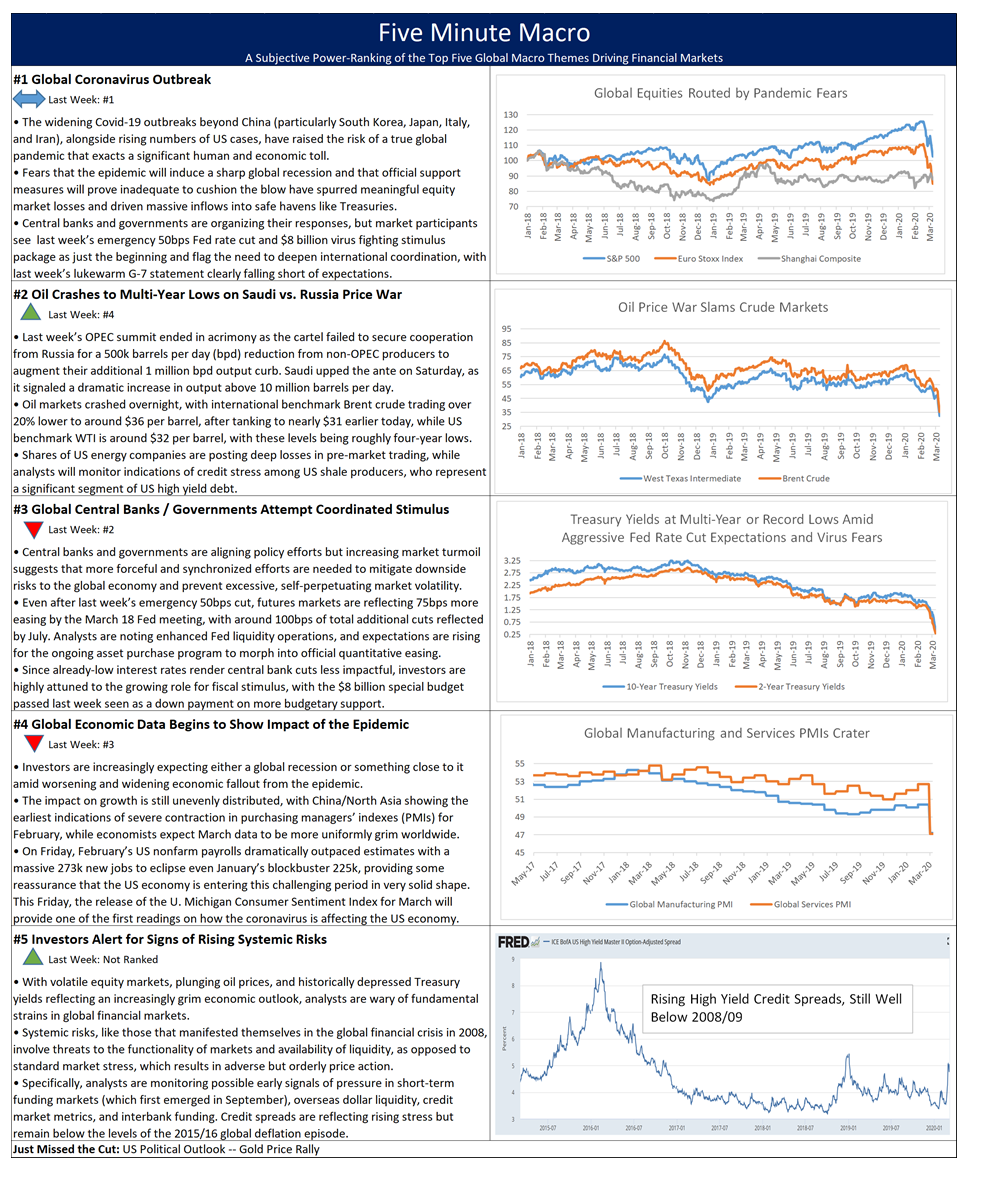

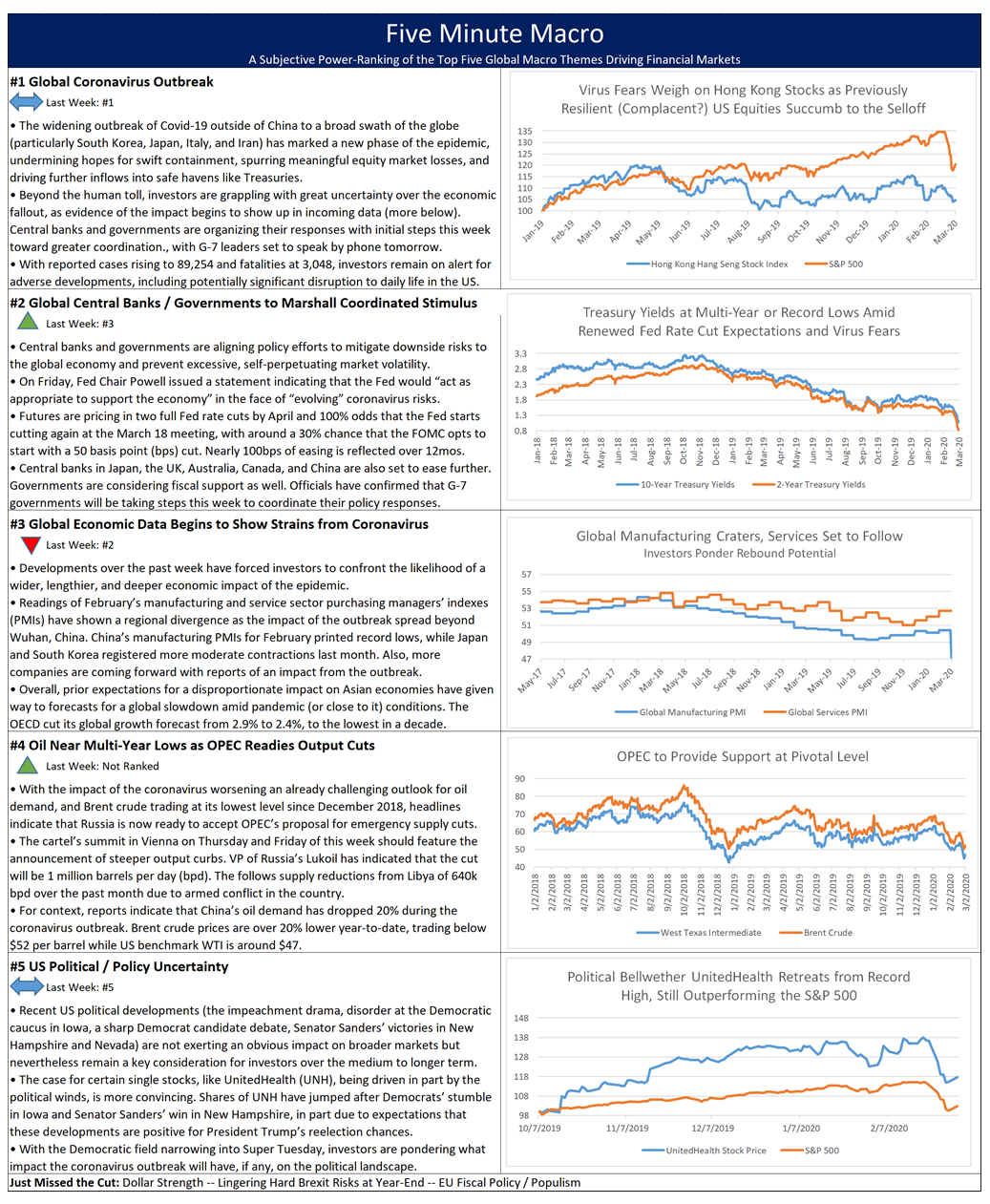

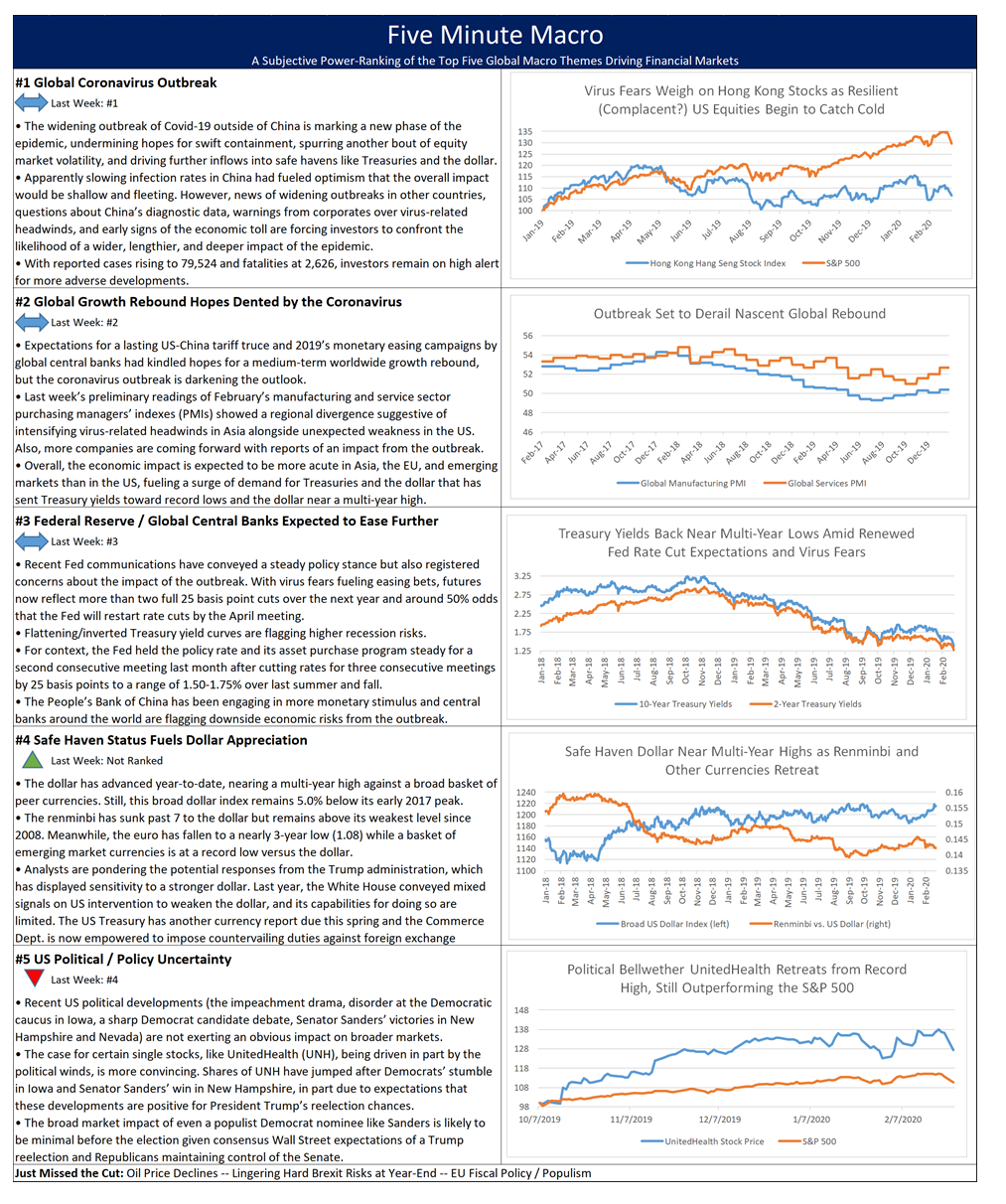

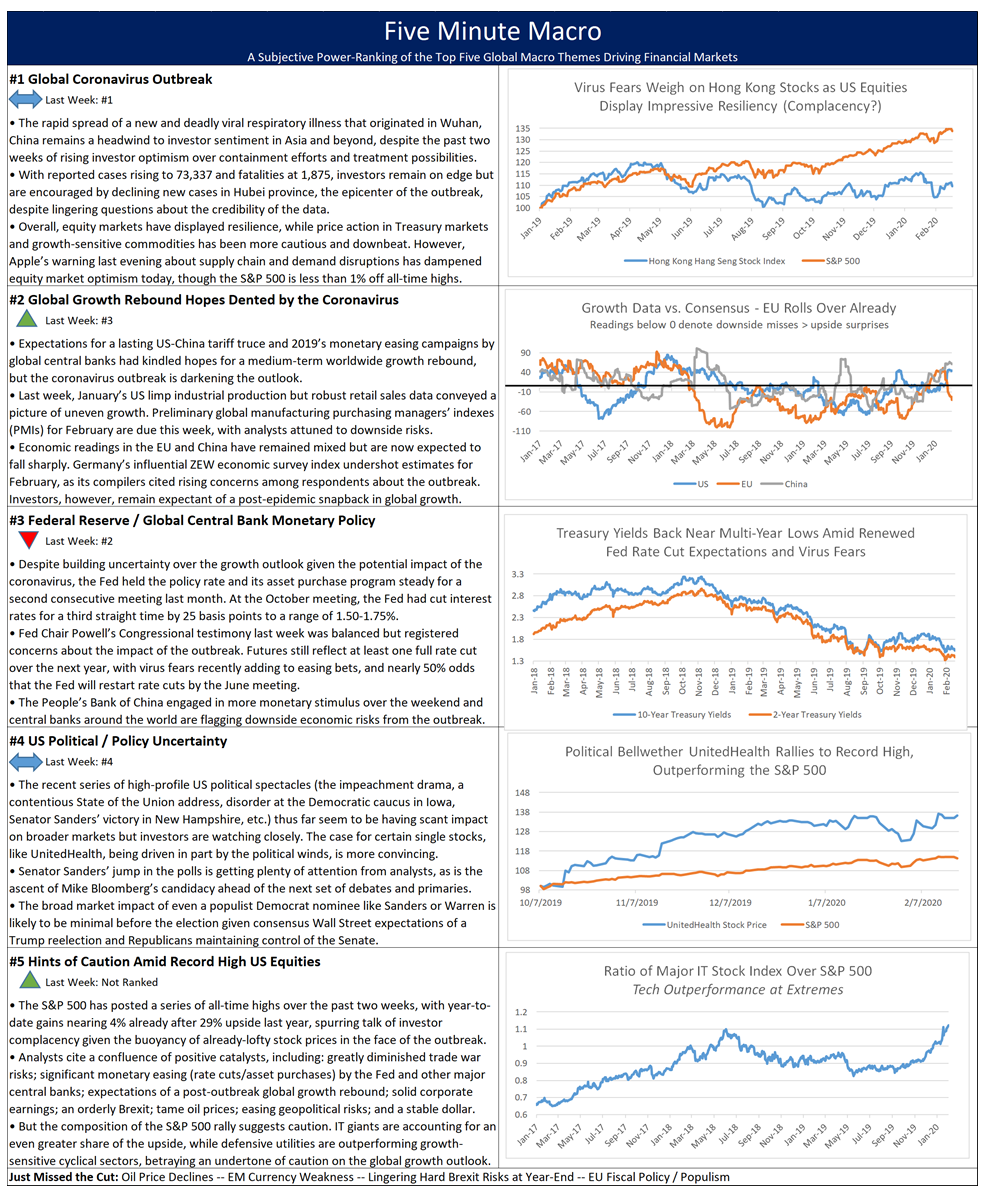

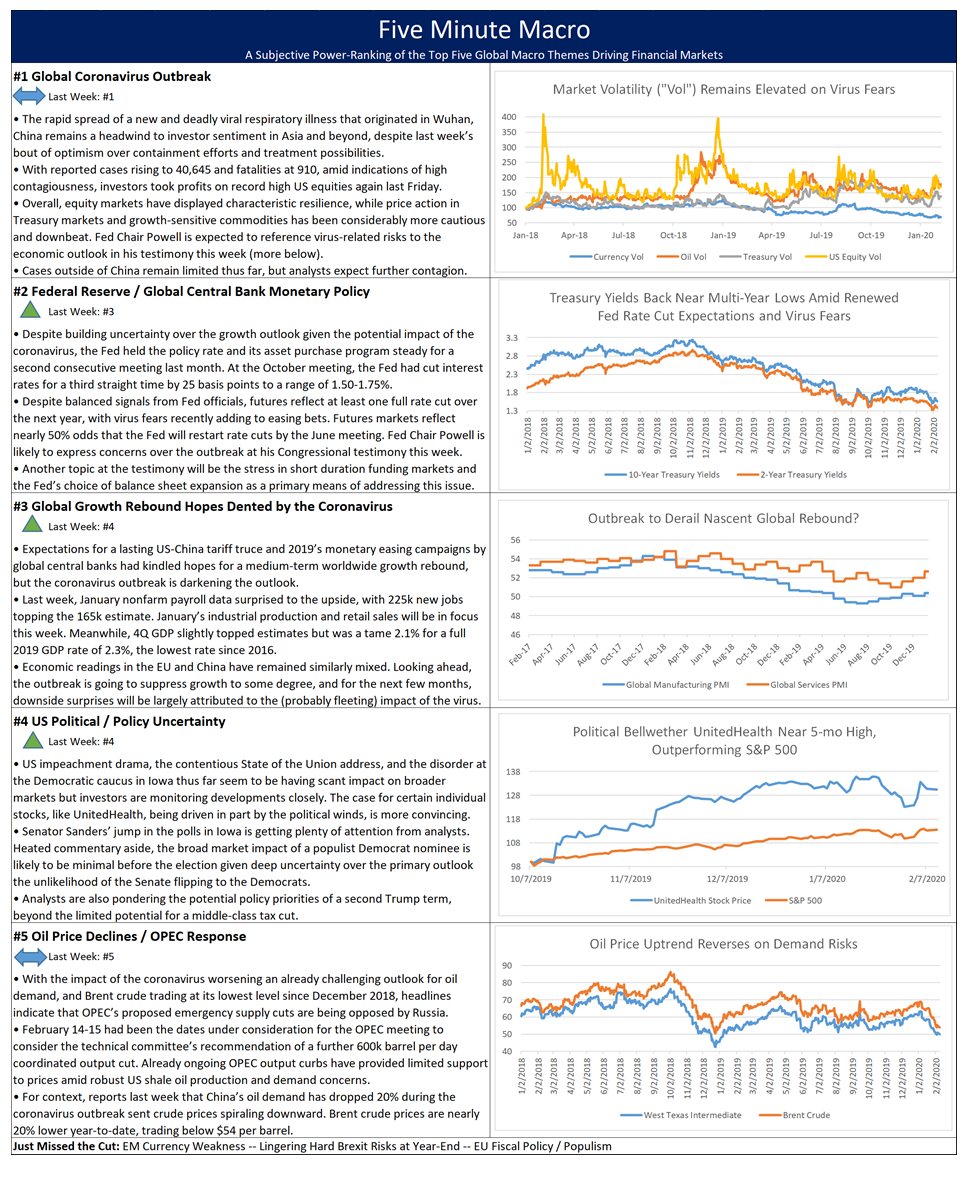

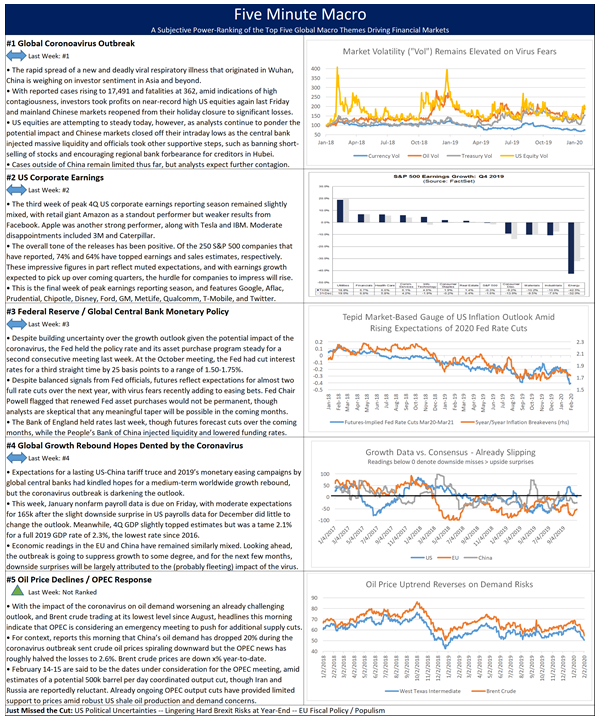

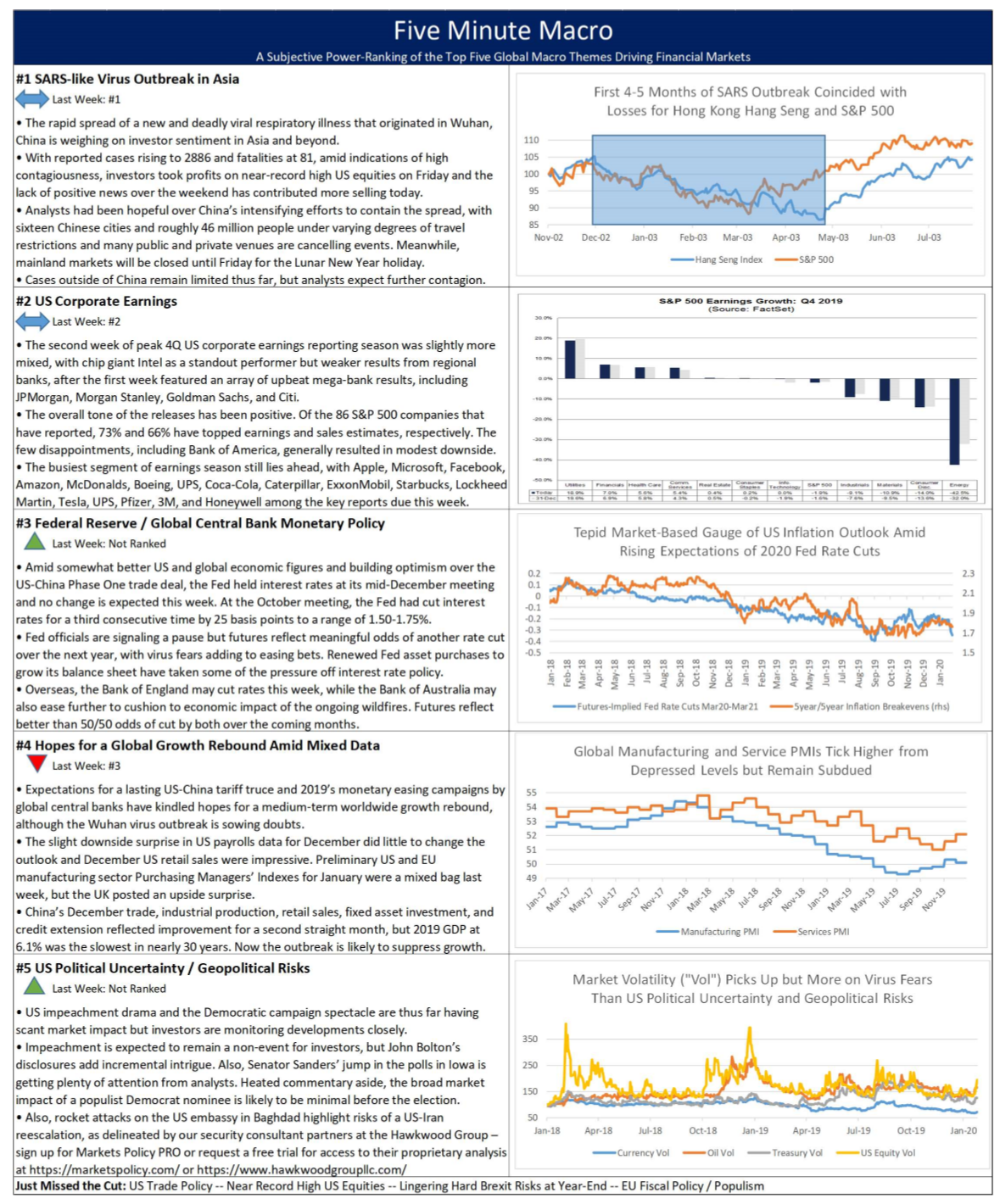

Coronavirus Fears continue to drive markets lower and now that fear is spreading into Heightened Systemic Risks. Global Central Banks and Governments continue to Deploy Emergency Stimulus as Global Data shows the Dire Impact of the Virus. Finally, Oil Crashed to Multi-year lows on the Saudi/Russia price war.