In this week’s Five Minute Macro, Russian invasion and sanctions remain on the forefront. Treasury curve inverts and flashes recession as oil prices remain at highs. Fed continues hawkish signaling as inflation remains high around the globe.

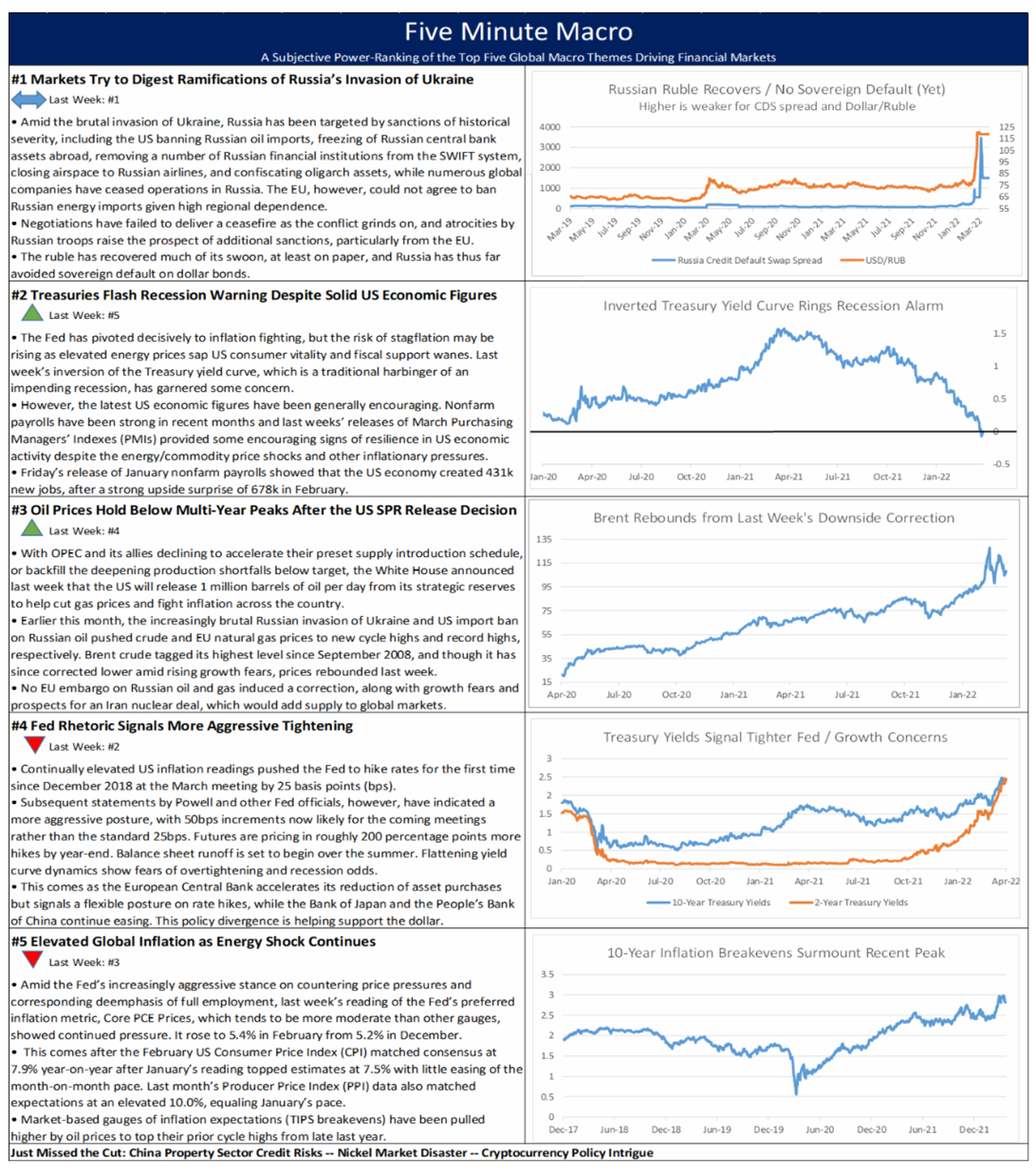

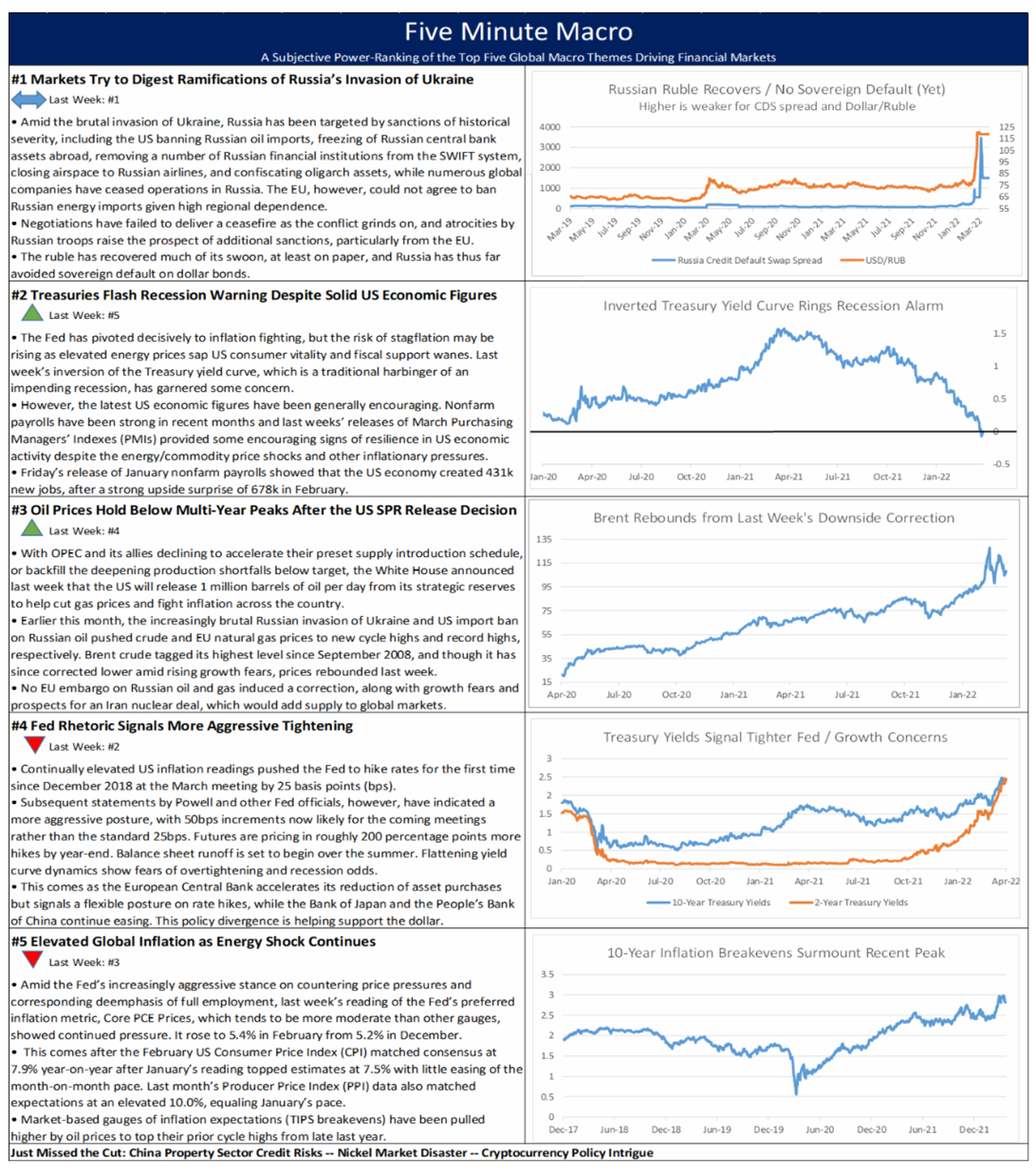

In this week’s Five Minute Macro, Russian invasion and sanctions remain on the forefront. Treasury curve inverts and flashes recession as oil prices remain at highs. Fed continues hawkish signaling as inflation remains high around the globe.

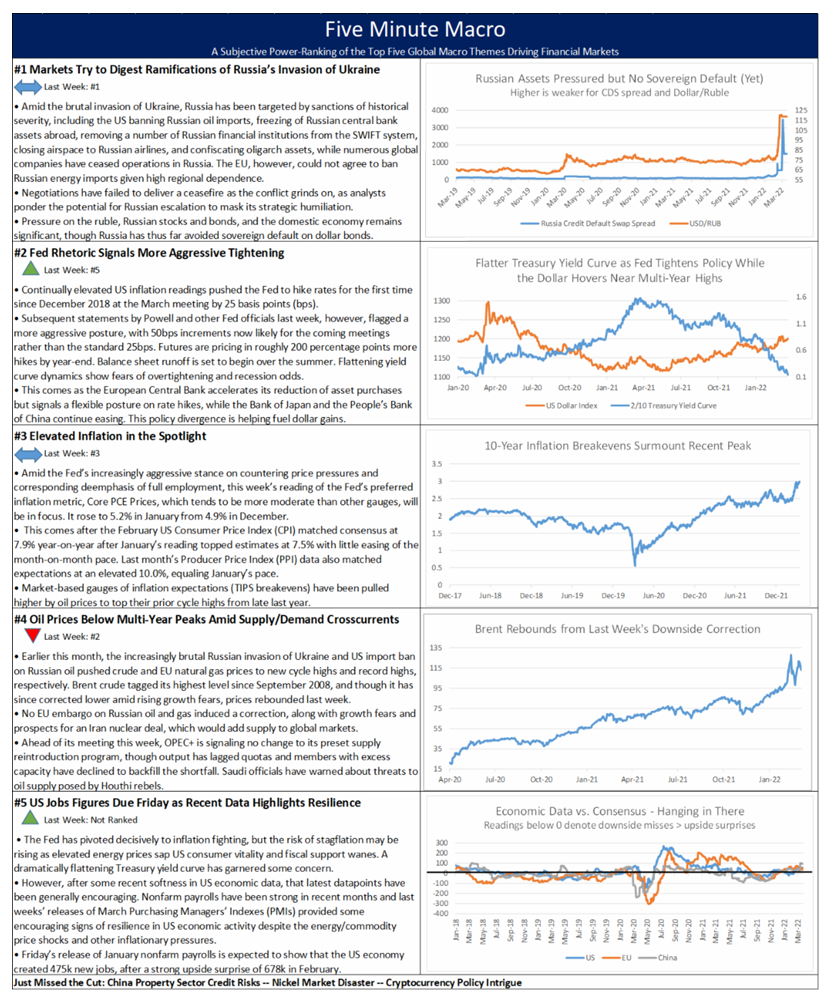

In this week’s Five Minute Macro, Russia’s invasion of Ukraine remains the main driving factor of markets. Fed signals more hawkish tightening as inflation remains elevated, however, oil prices are now below recent highs. Finally, the week closes with the all-important March Nonfarm Payroll Report.

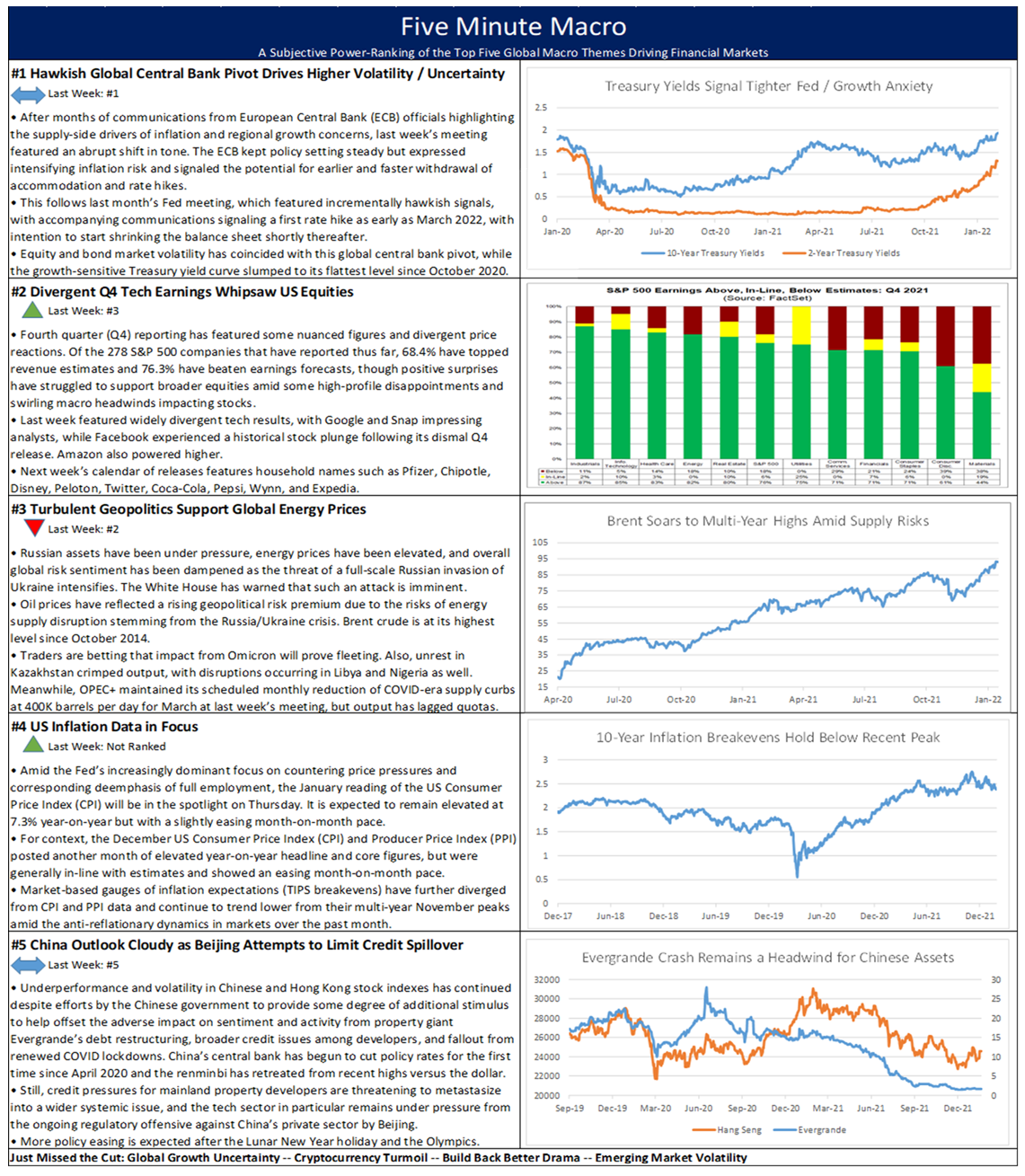

Central bank hawkishness continues to drive market moves, while divergent corporate earnings whiplash equities. Geopolitics keeps oil at recent highs, while US CPI will be in focus midweek. Finally, China’s outlook remains cloudy.

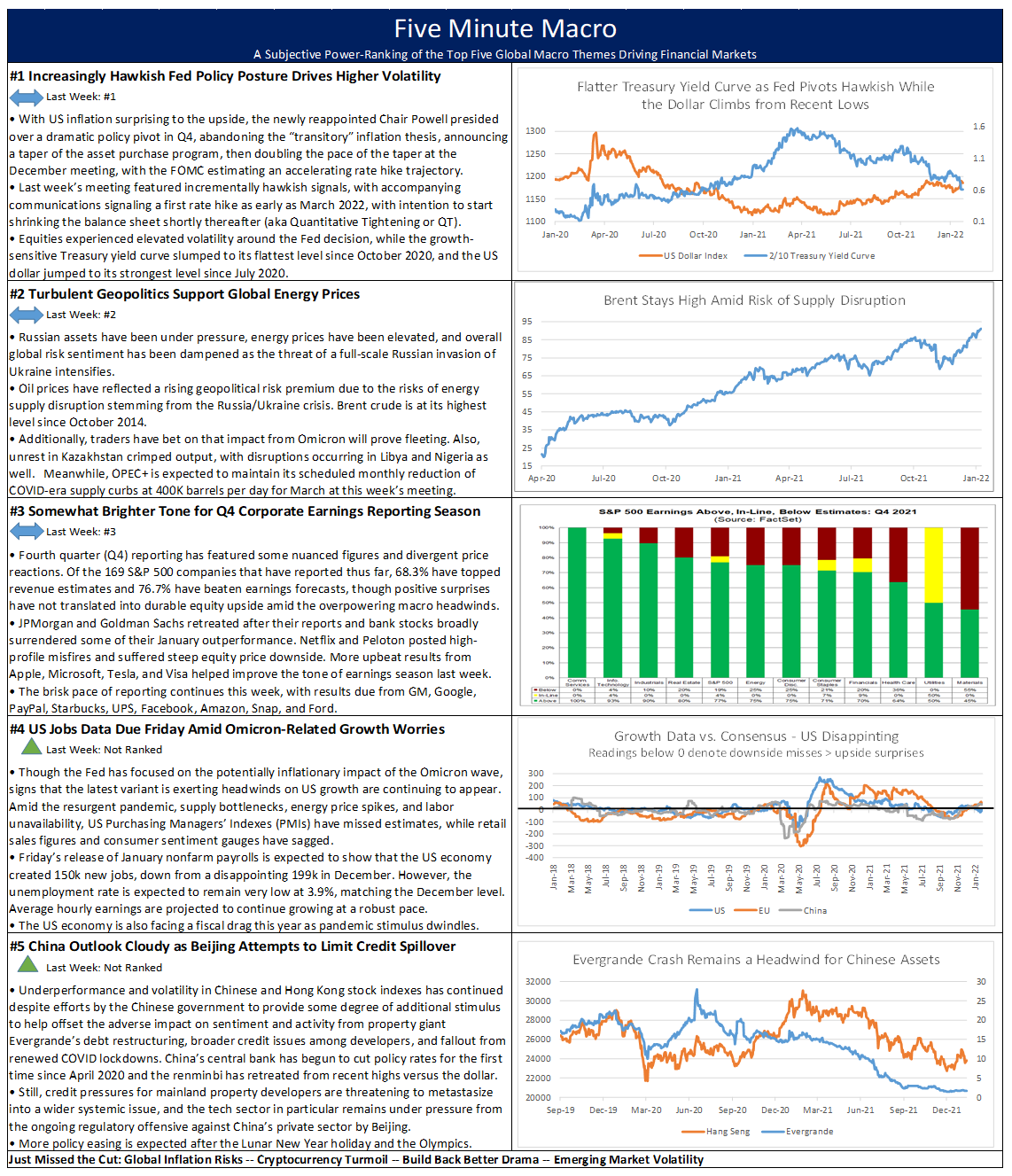

In this week’s Five Minute Macro, Fed hawkishness remains front and center and turbulent geopolitics keep energy prices on the rise. Corporate earnings season offers a brighter tone as traders wait for an uncertain jobs Friday. Finally, the outlook for China remains cloudy as it battles Covid and a credit spillover.

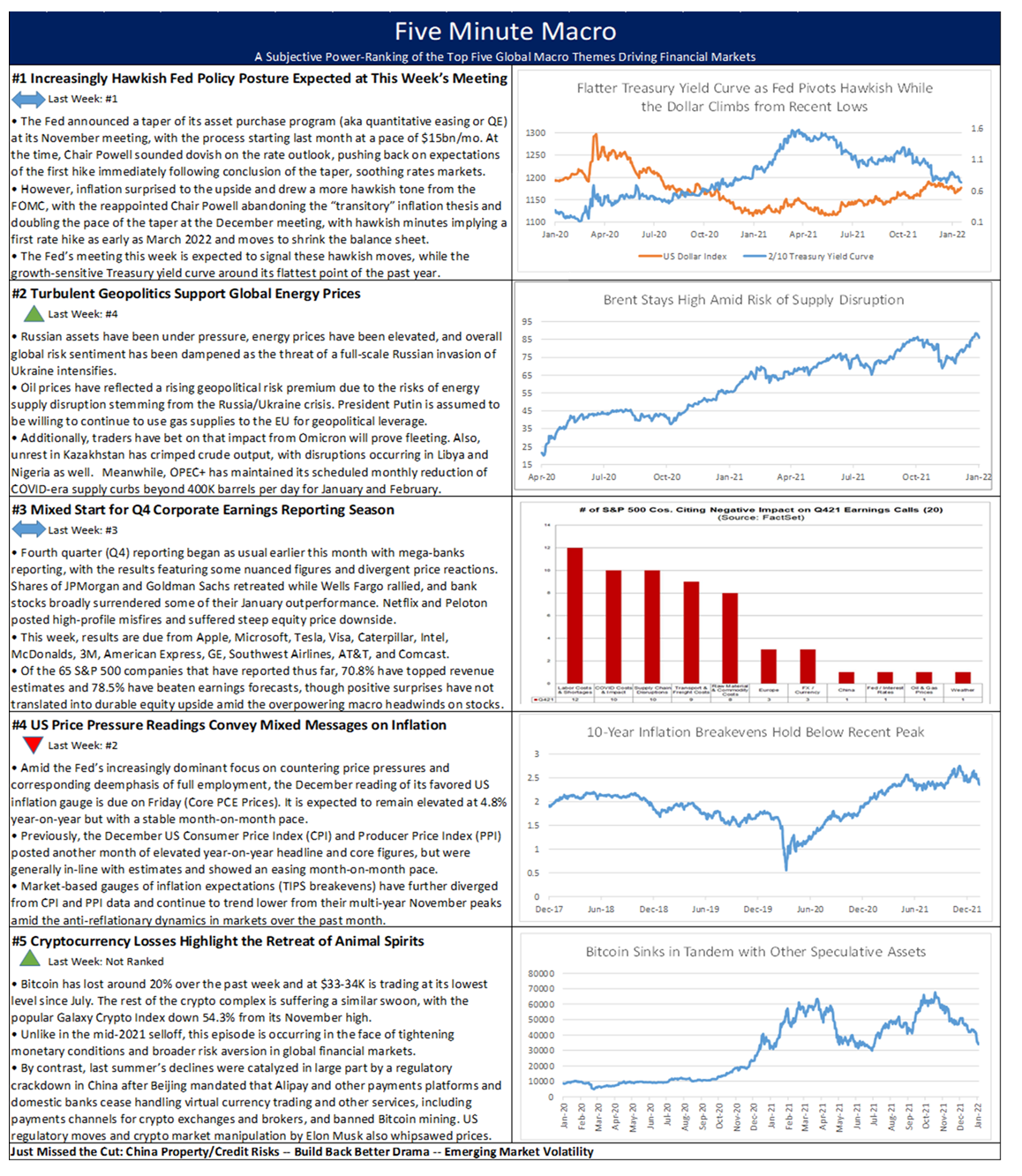

In this week’s Five Minute Macro, hawkish Fed expectations continue to roil markets as geopolitical risks push up oil prices. Corporate earnings season has been a mixed bag as inflations continues to hurt bottom lines. Finally, the crypto markets are in significant correction territory as they follow other risk markets lower.

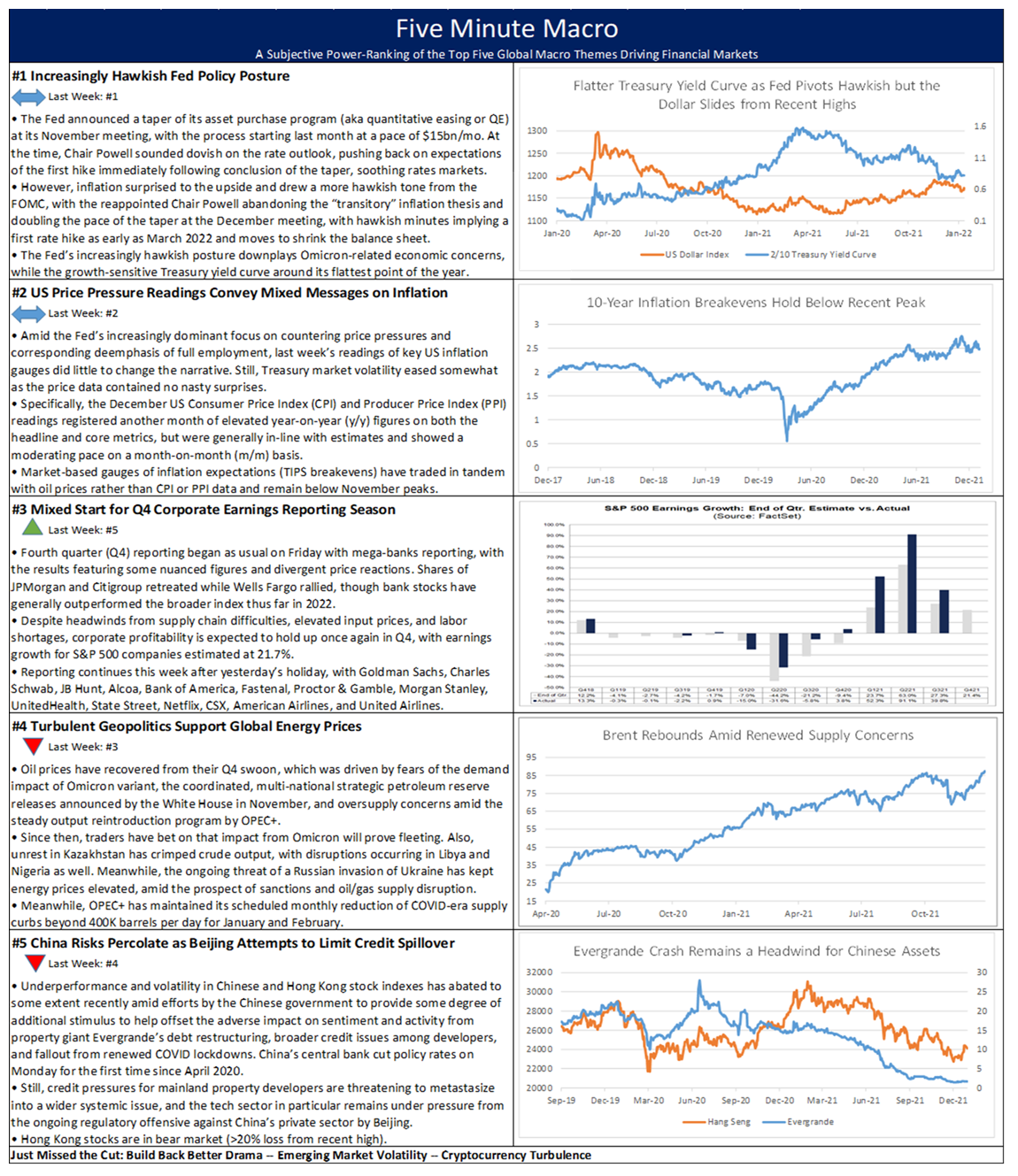

In this week’s Five Minute Macro, a hawkish is still causing problems for risk markets as inflation remains elevated. Corporate earnings season is mixed so far, while geopolitics are providing a tailwind to oil markets. Finally, China ramps up its efforts to support the economy and limit a real estate corporate spillover.

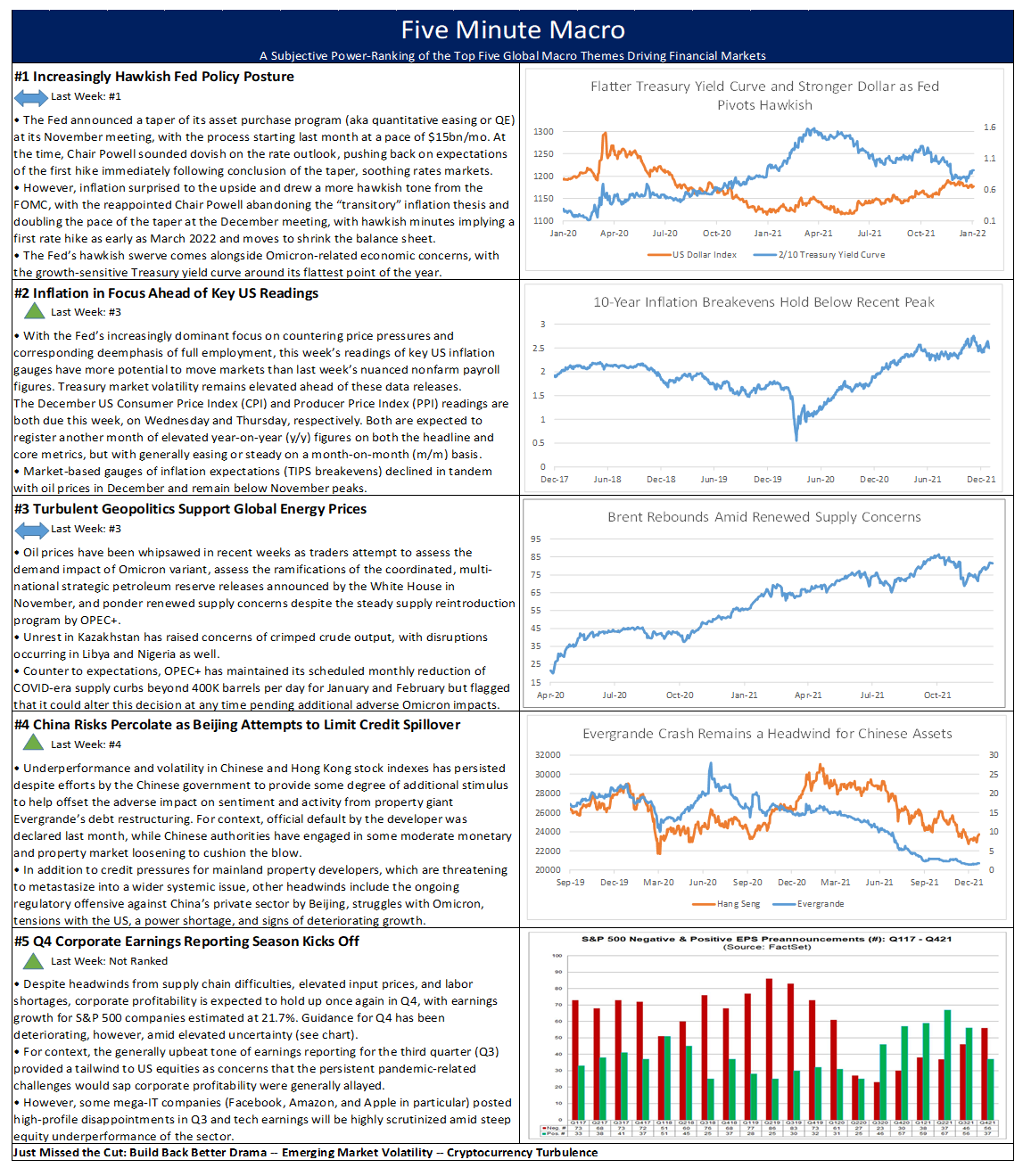

An increasingly hawkish Fed continues to roil markets as they confront elevated inflation. Turbulent geopolitics supports energy prices, while China attempts to limit a credit spillover. Finally, corporate earnings season kicks off.

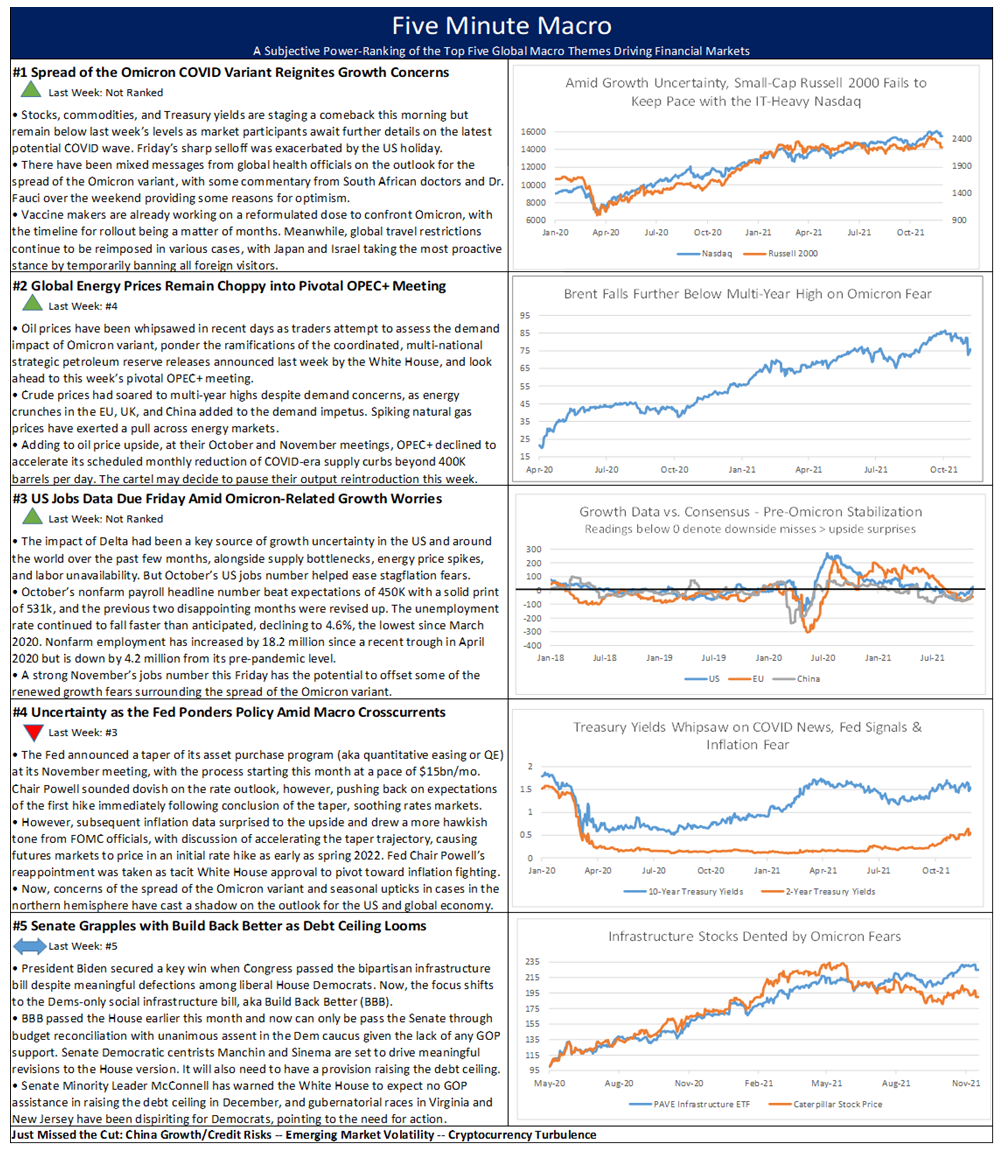

The spread of the Omicron variant has markets on edge as oil prices plunged ahead of the OPEC+ meeting this week. Friday brings the US jobs report and new worries put the path of Fed policy in question. Finally, the Senate continues to negotiate as Debt Ceiling looms.

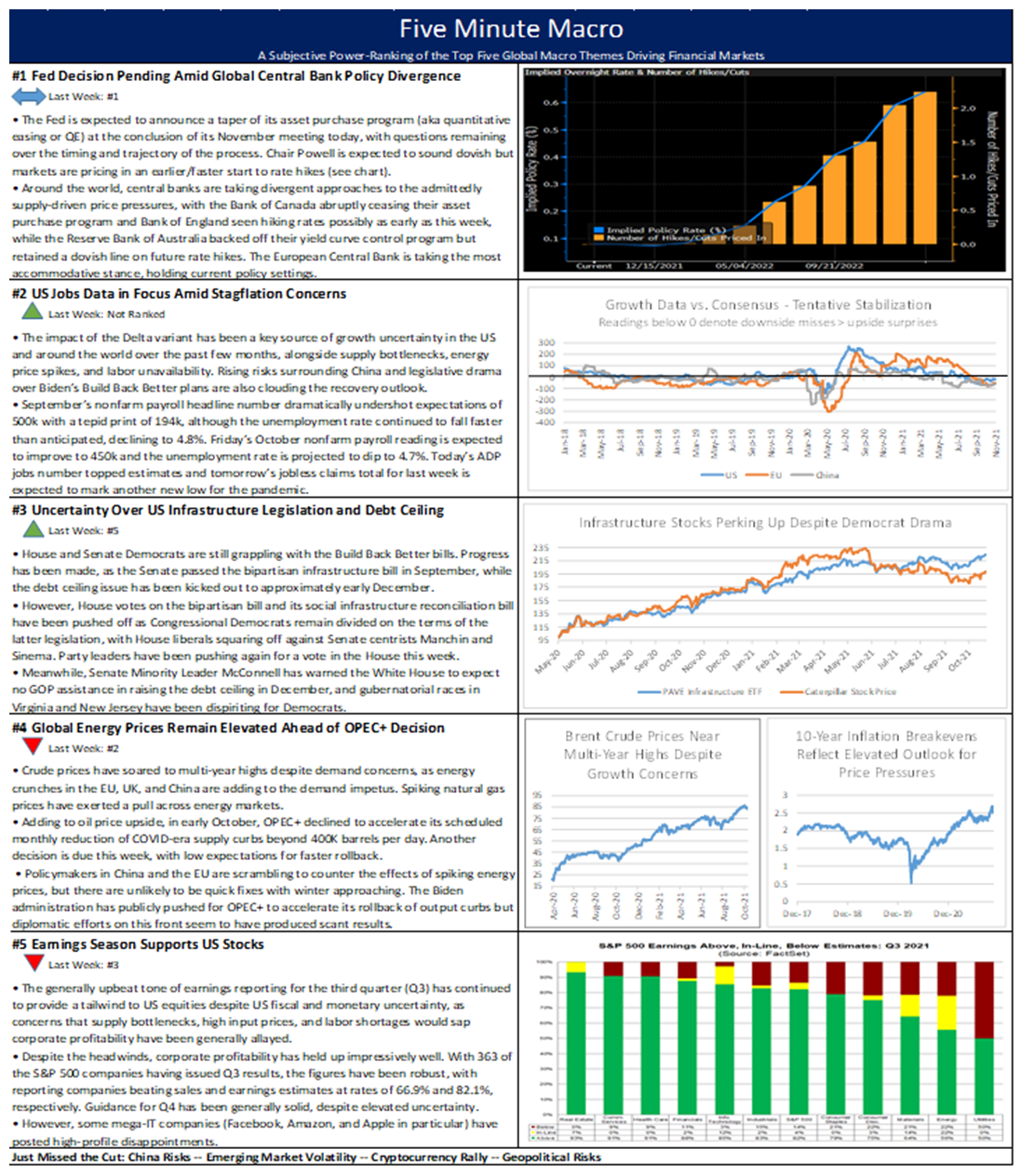

The Fed’s decision this week is by far the focus of the market as we wait for Friday’s Nonfarm Payroll report. Democrats continue to negotiate over infrastructure and energy prices remain high ahead of the OPEC+ meeting. Finally, earnings season continues to support stocks.

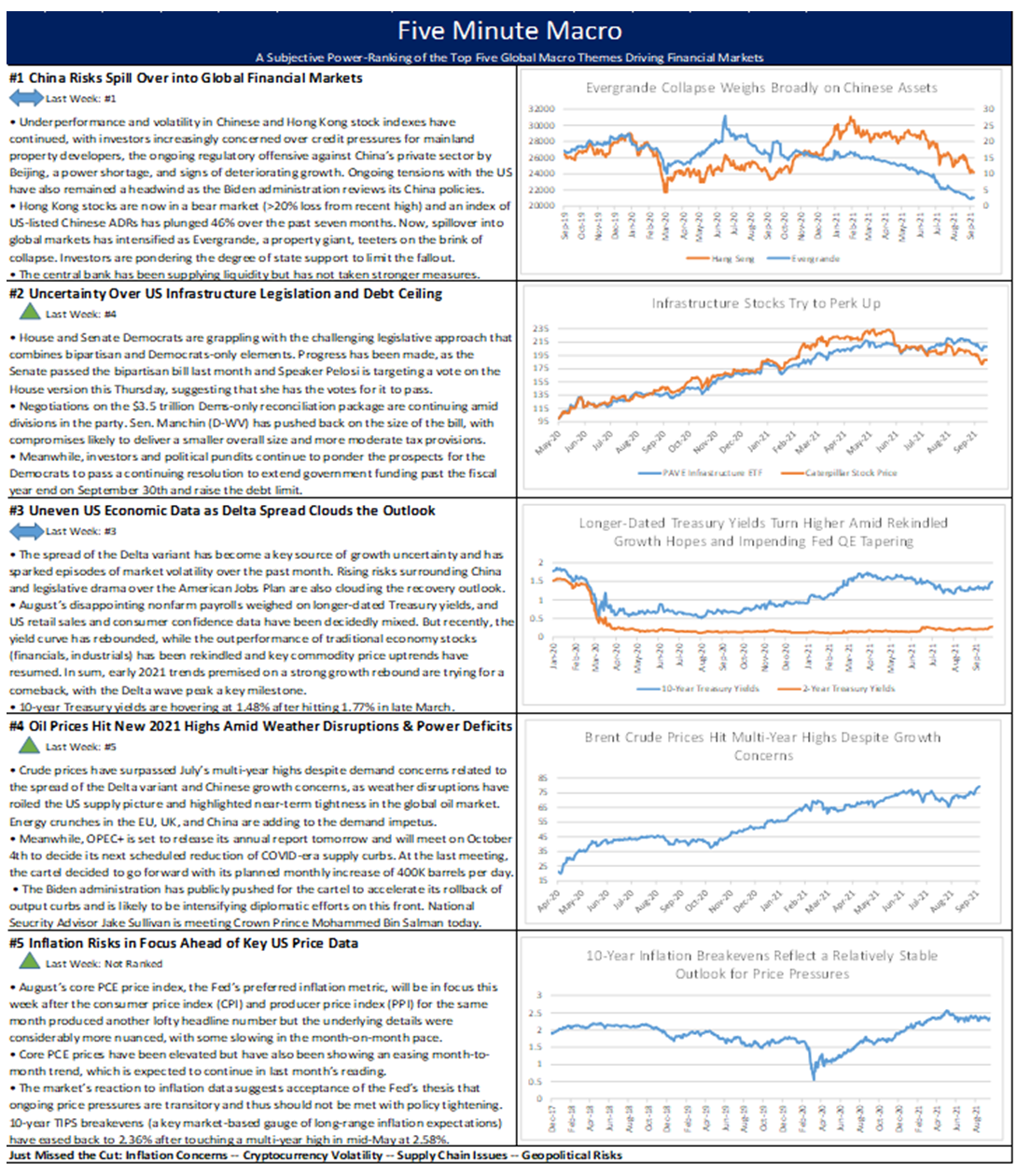

China risks remain front and center while uncertainty around US infrastructure and debt ceiling move up to the second spot. Uneven economic data and rising oil prices along with inflation risks round out the top five spots.