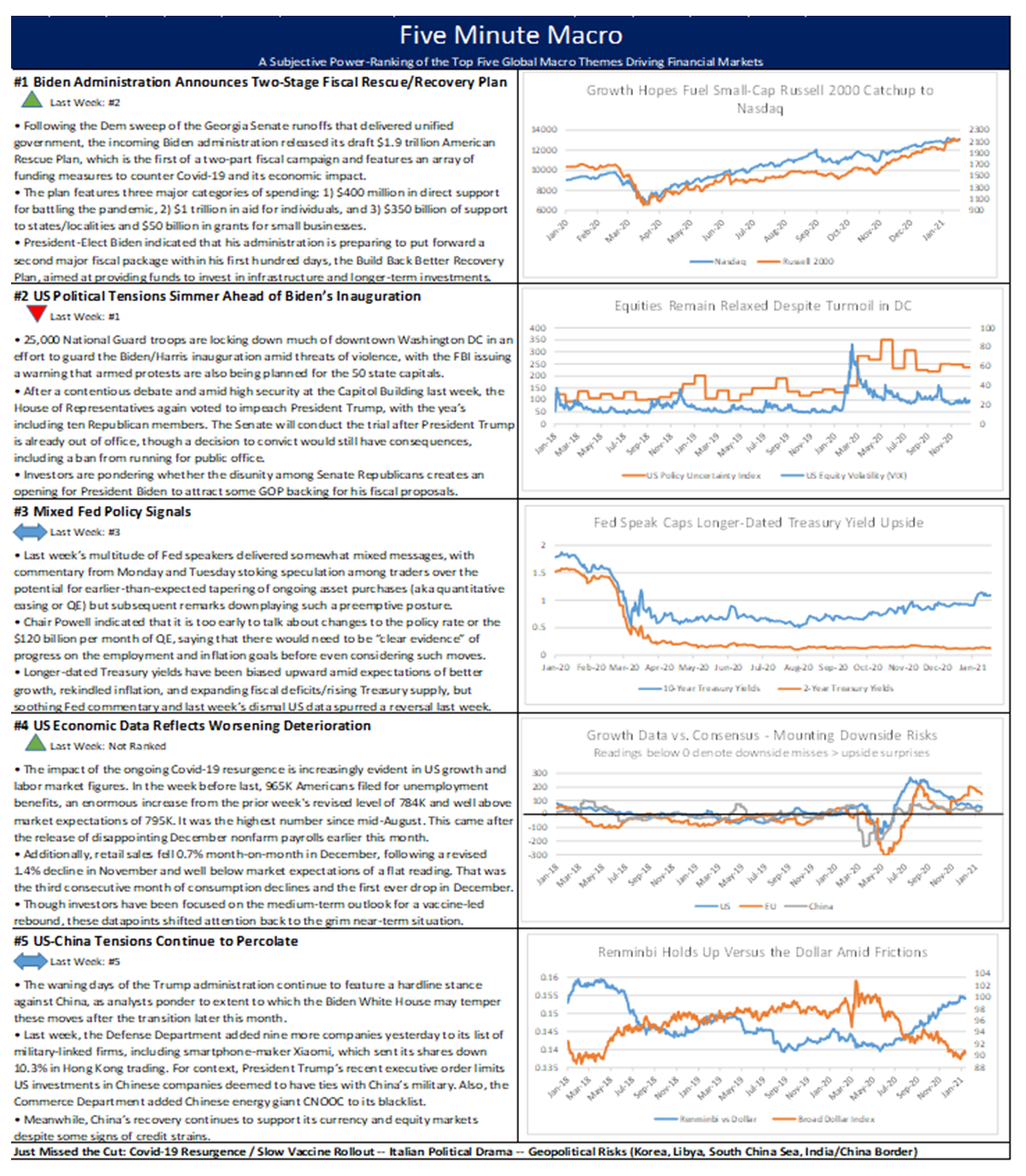

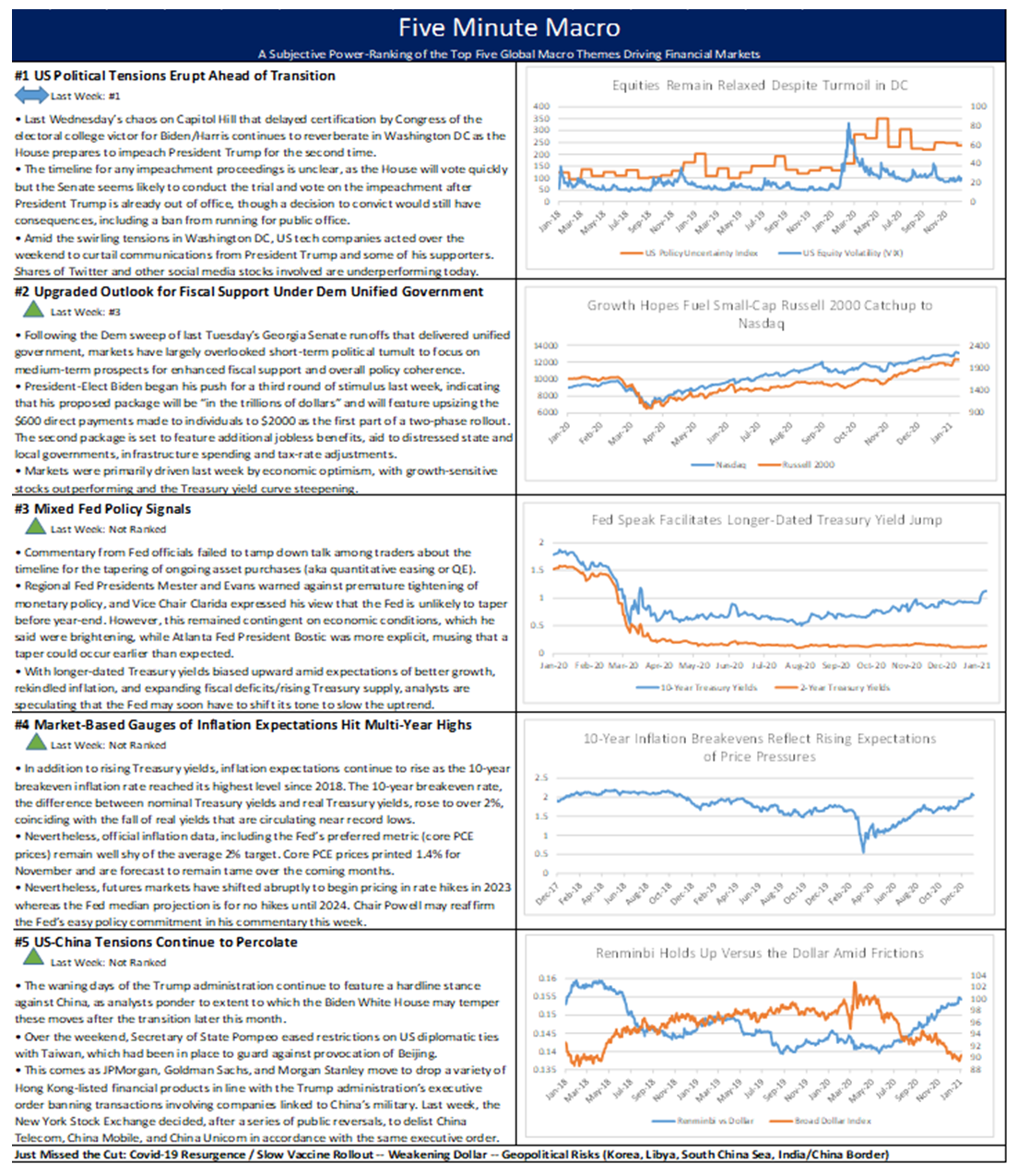

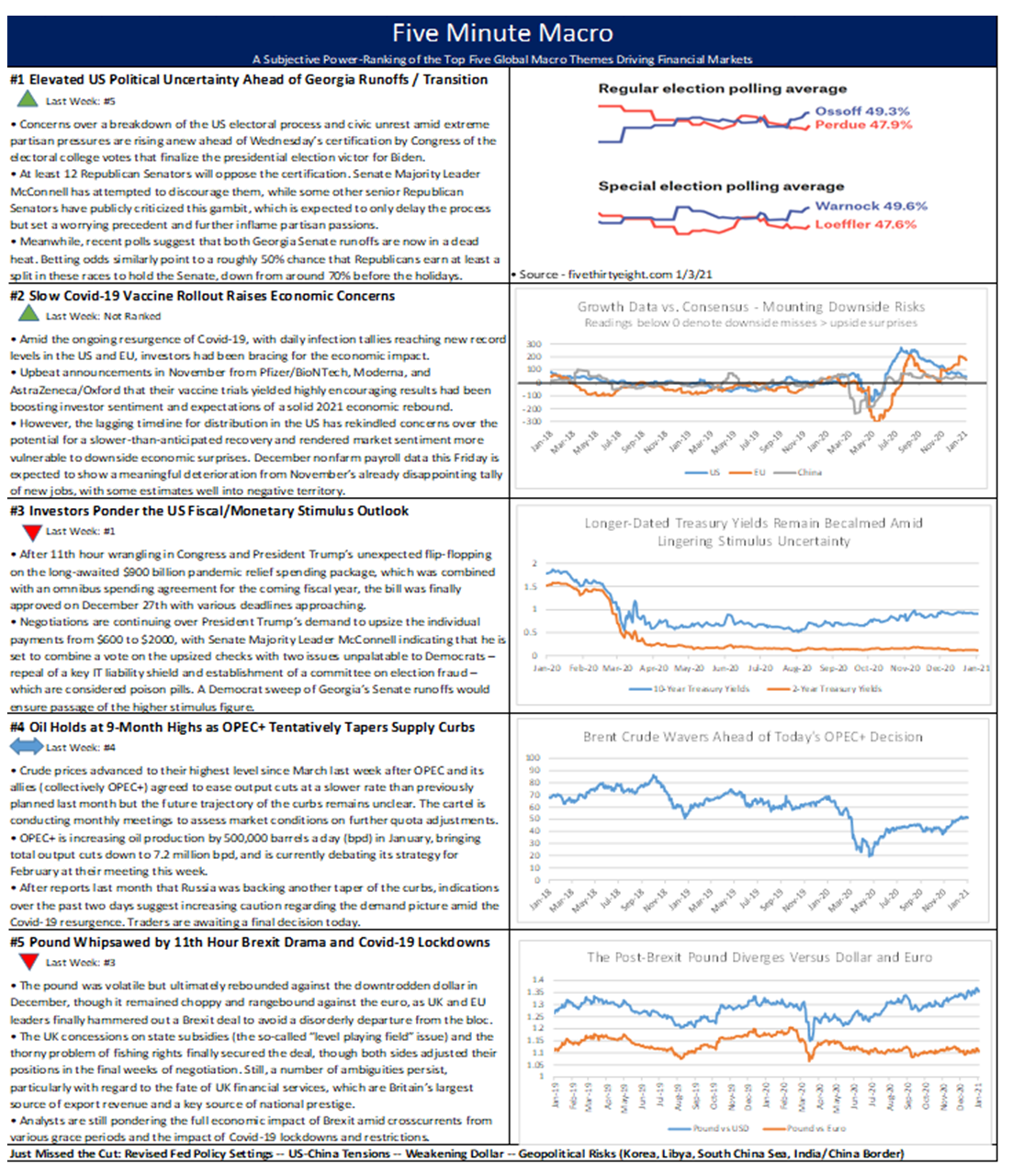

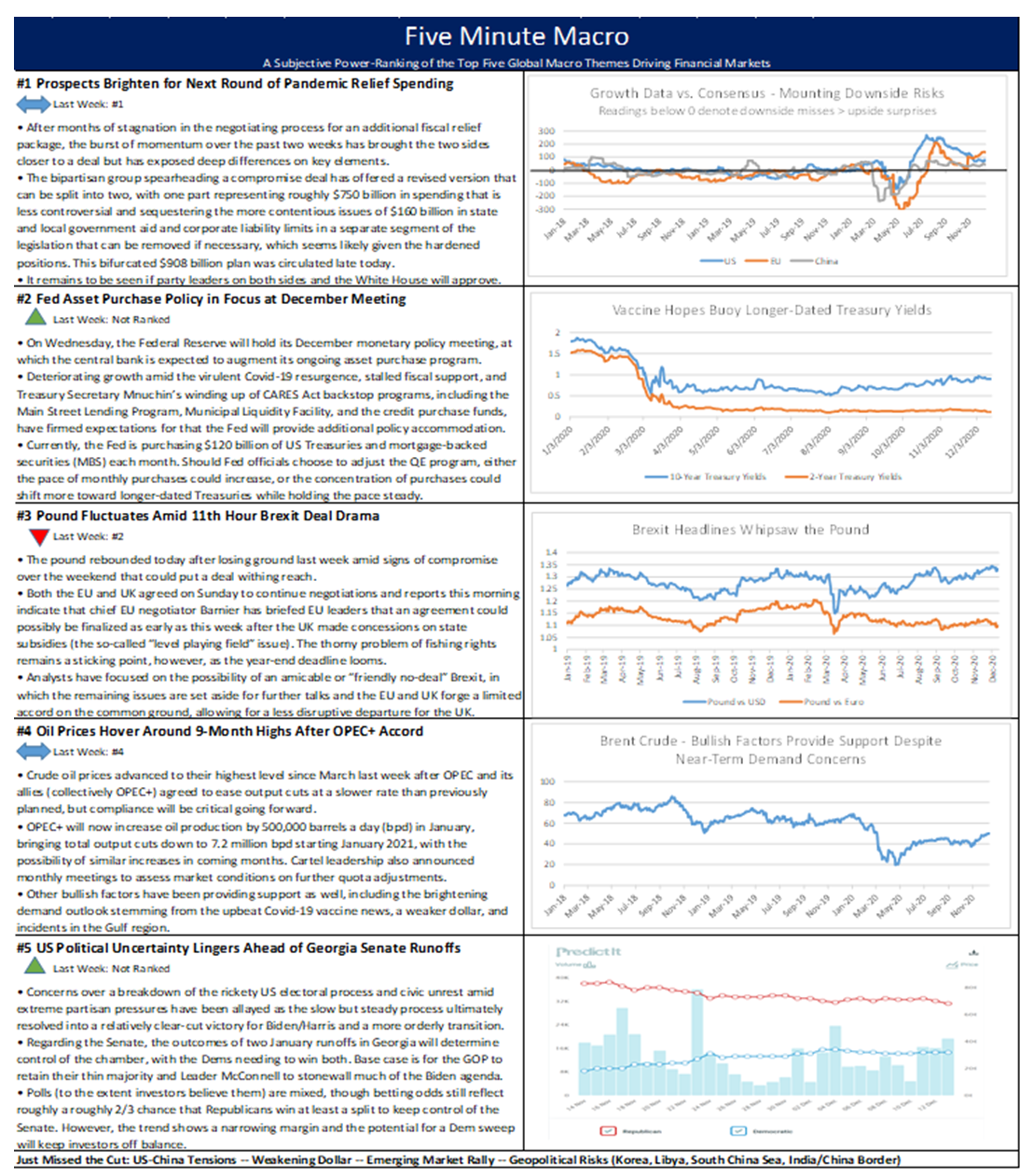

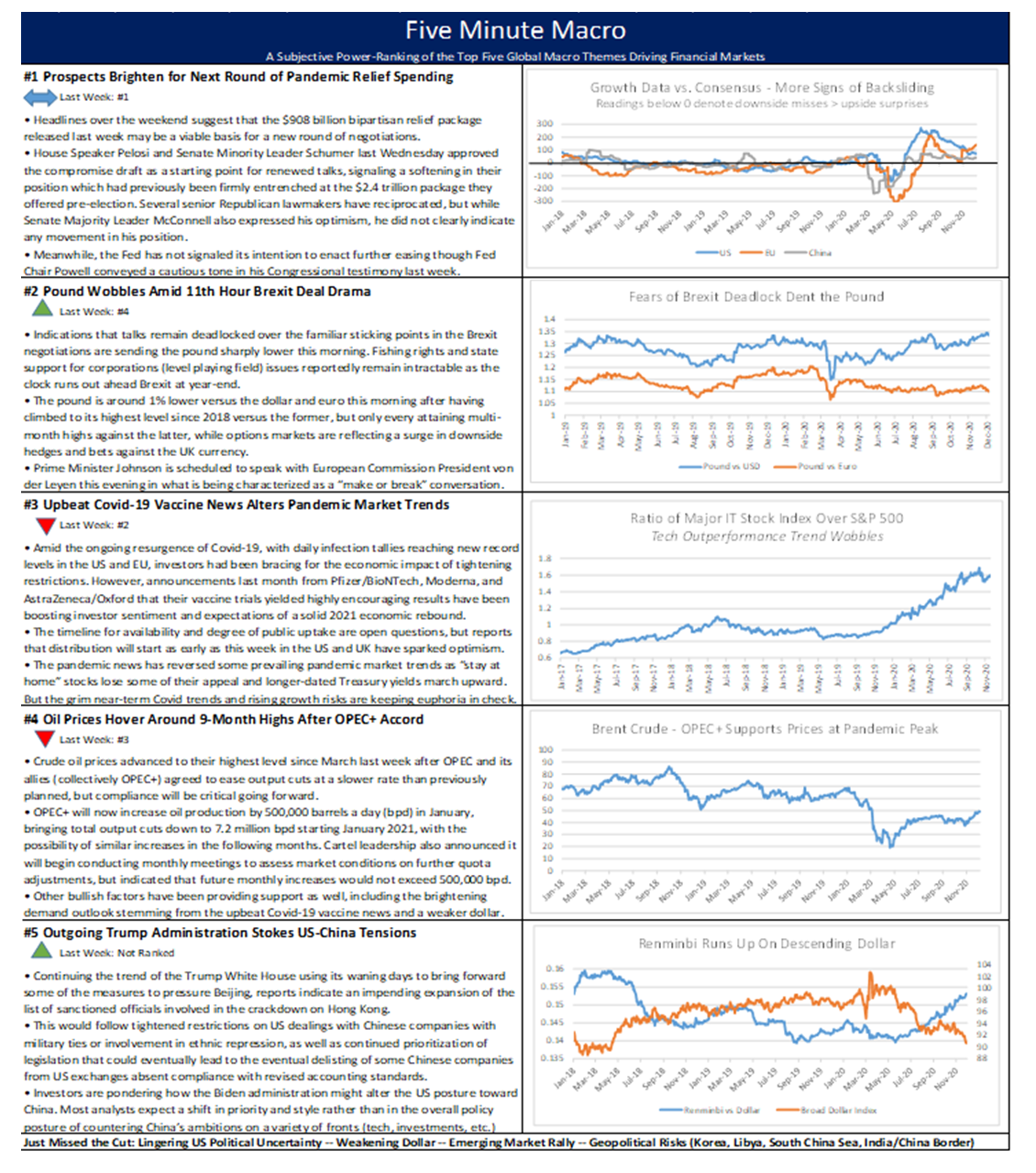

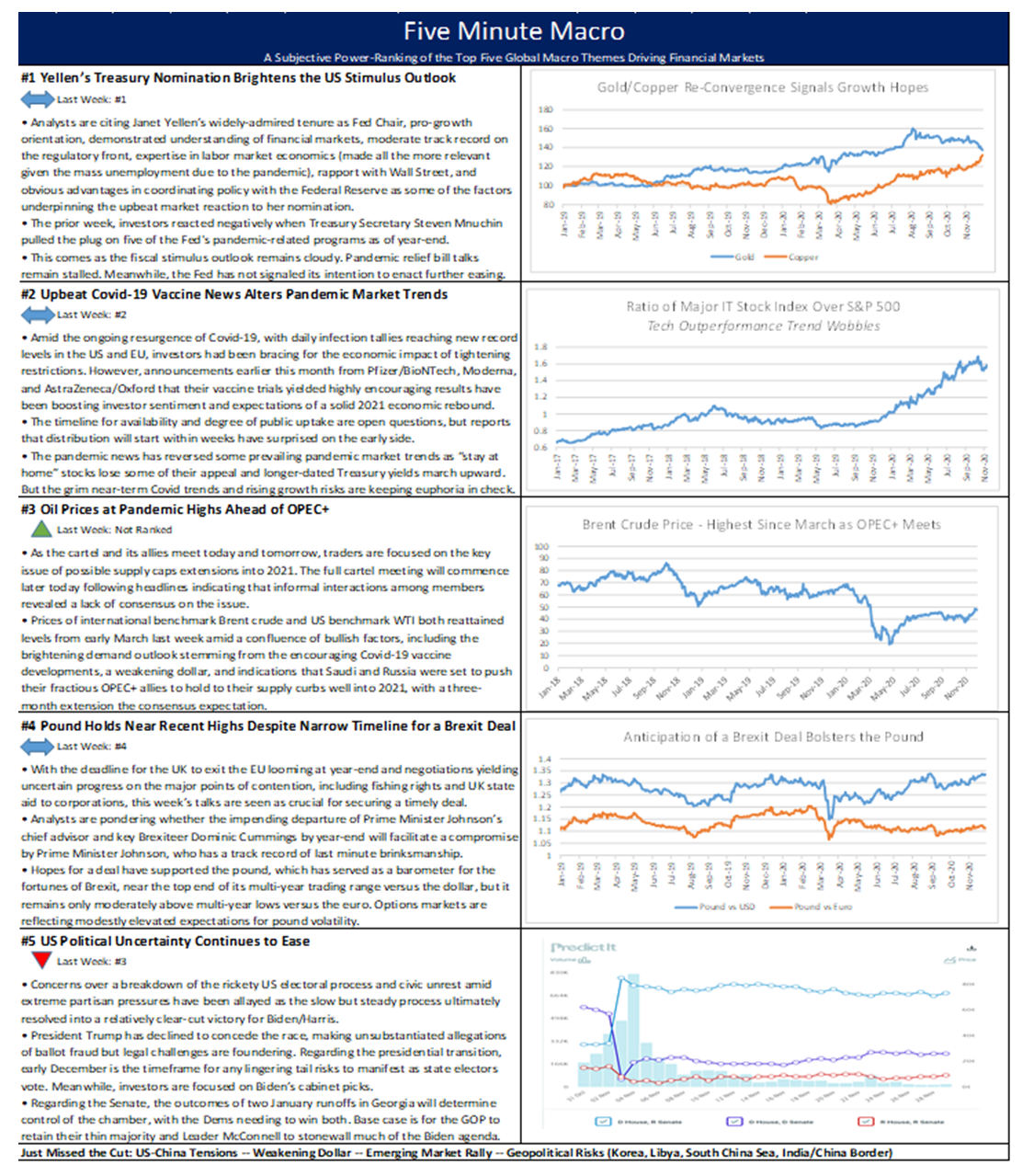

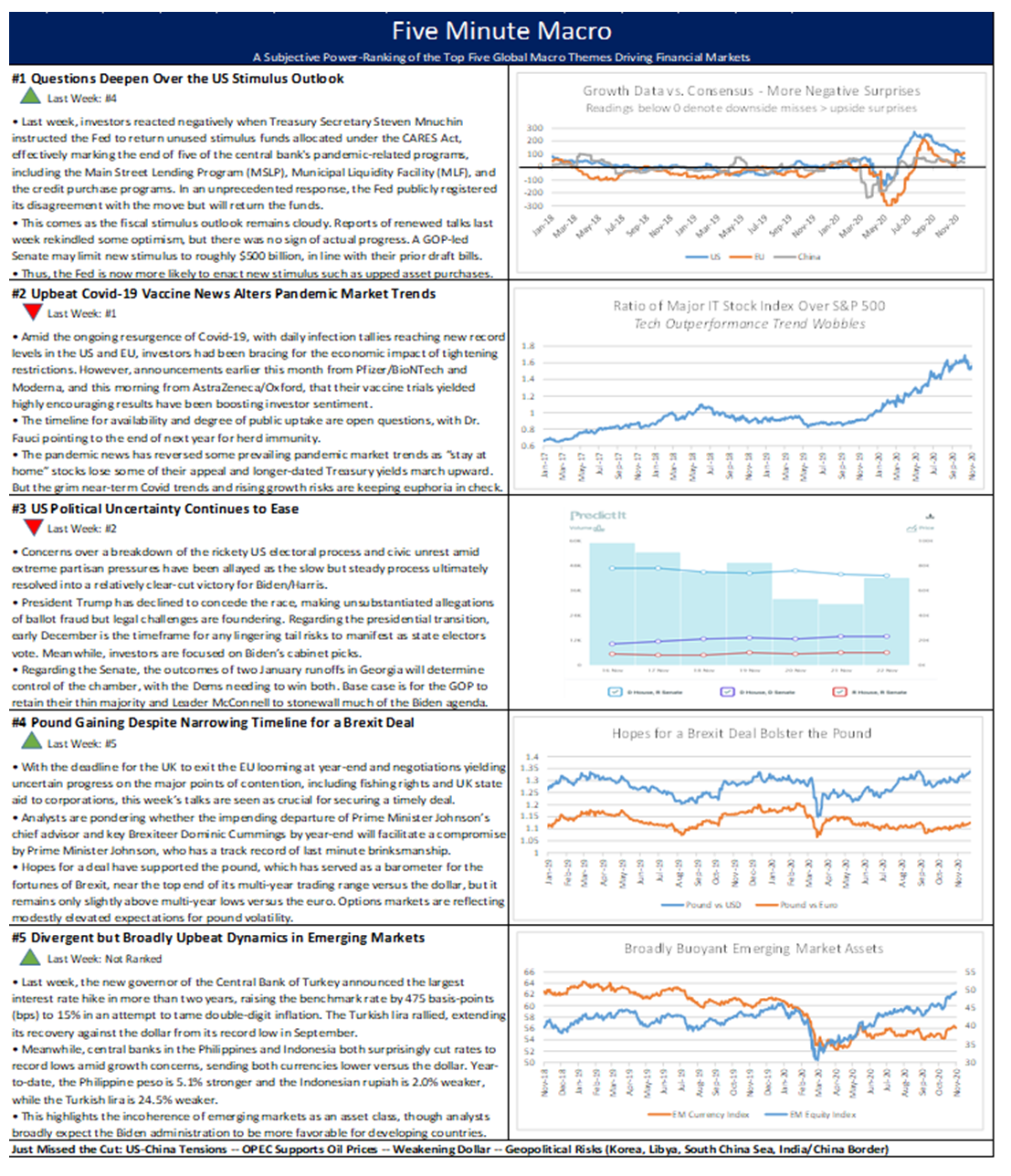

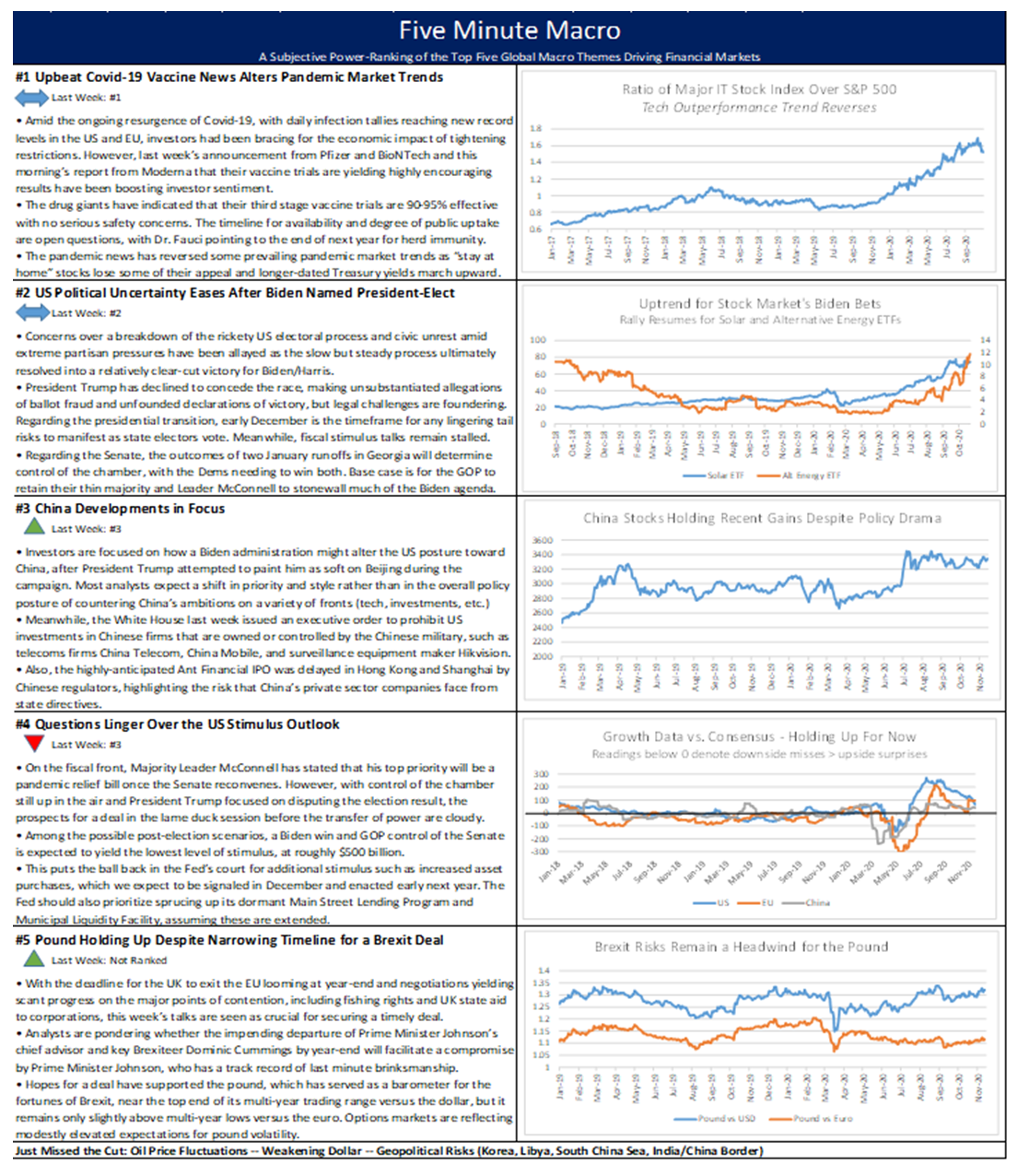

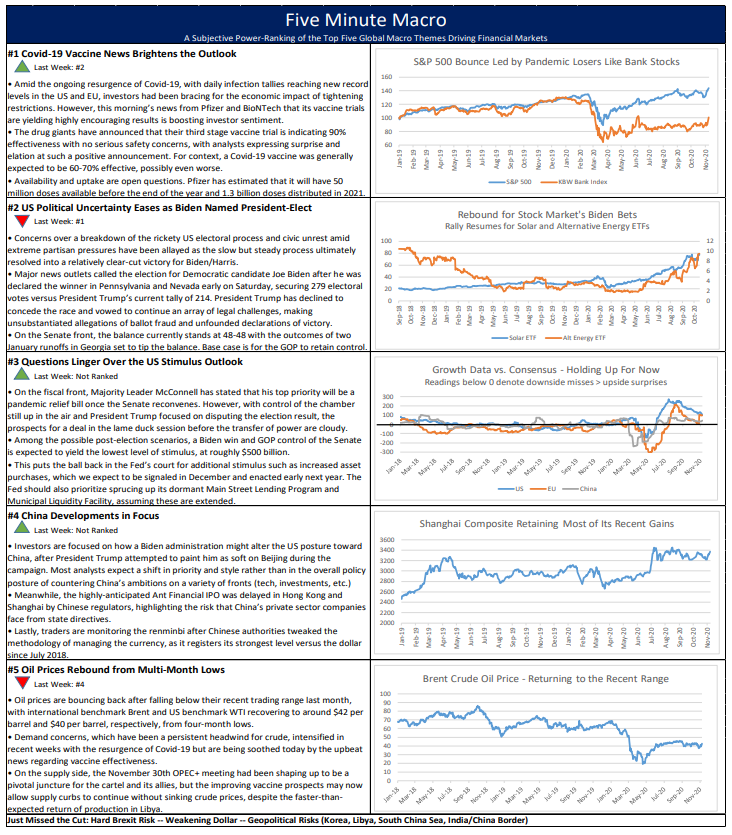

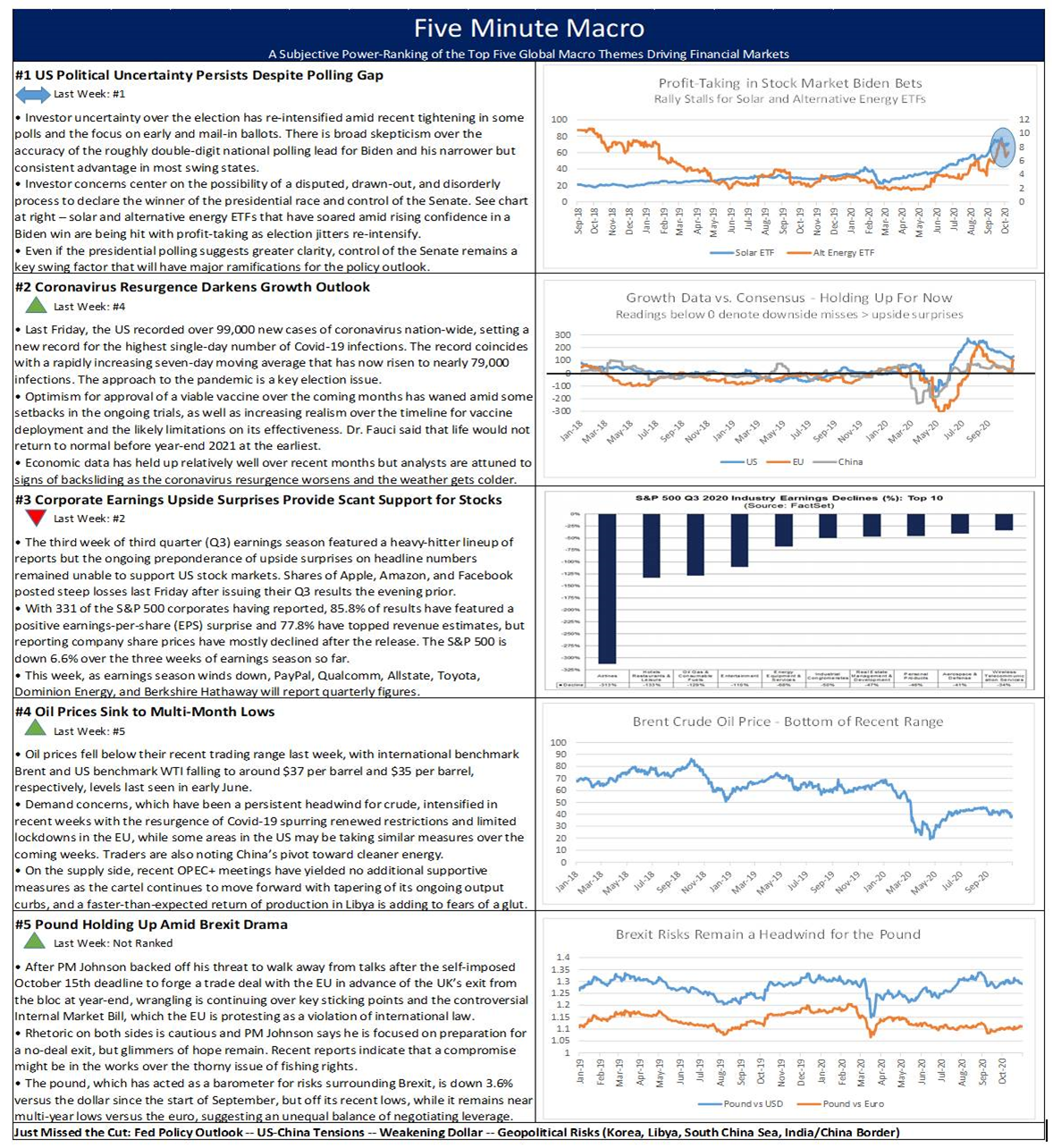

In this week’s Five Minute Macro, the Biden administration lays out a two-stage stimulus plan, while political tensions continue to simmer and Fed sends mixed policy signals. Meanwhile, US economic data continues to weaken and China tensions continue to percolate.