Summary and Price Action Rundown

Global risk assets are retracing a portion of last week’s upside this morning as investors continue to monitor mixed corporate earnings and renewed downside for oil prices. S&P 500 futures point to a 1.8% lower open, which would pare last week’s 3.0% rally that put year-to-date downside for the index at 11.0% and the decline from February’s record high at 15.1%. Global equities had extended their rebound from mid-March lows last week as investors focused on the potential for economic recovery amid improving coronavirus containment data and hopes for an effective treatment, alongside massive fiscal and monetary stimulus. However, other asset classes, such as crude oil, failed to follow equities’ lead, and a more cautious tone is returning to markets this morning. EU stocks are more than 1% lower this morning and Asian were mixed overnight. Longer duration Treasury yields remain near historic lows, with the 10-year yield at 0.63%, while a broad dollar index is rising above one-month lows. Oil is conspicuously weak as international benchmark Brent crude is sliding and US benchmark WTI has crashed lower to $12 per barrel.

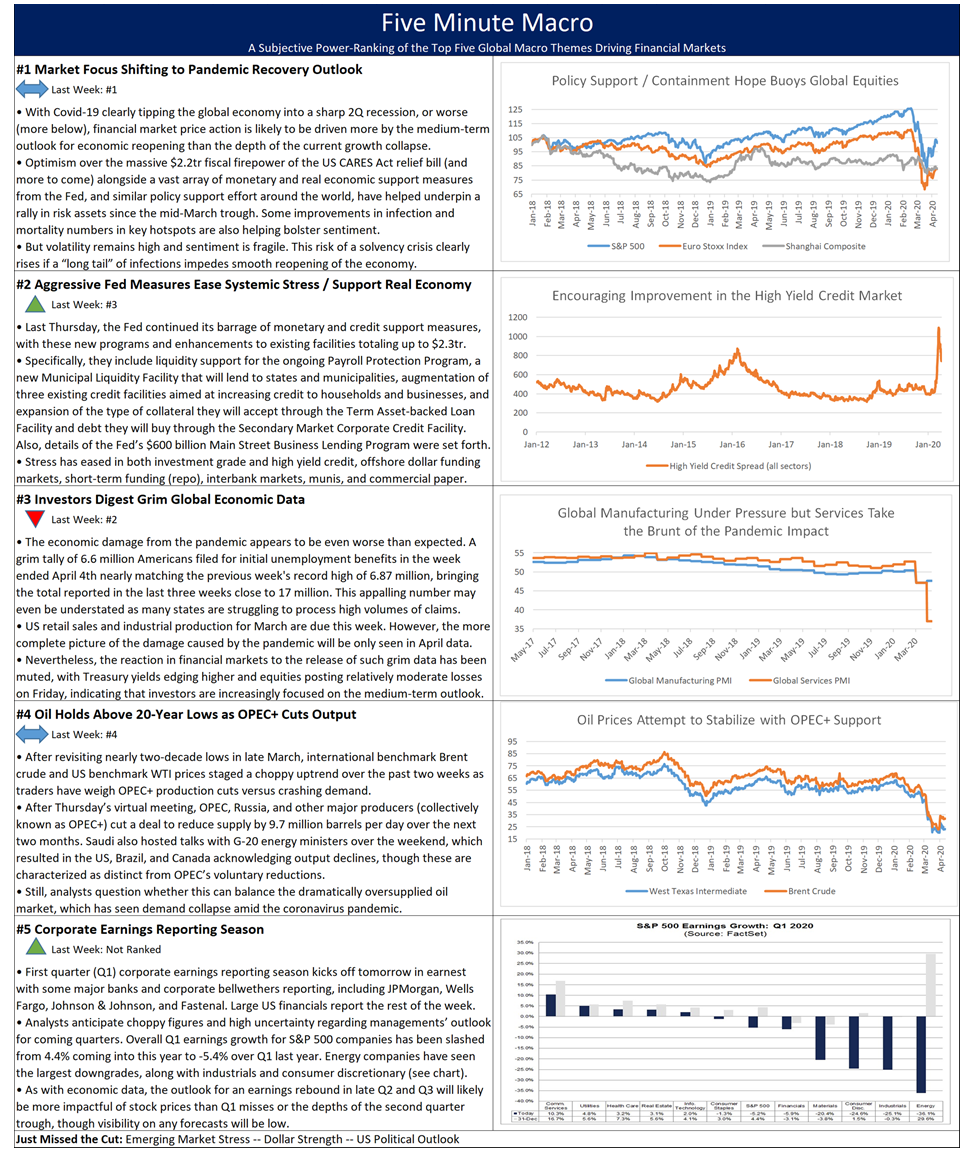

Oil Prices Extend Dispiriting Post-OPEC+ Agreement Declines

Détente between Russia and Saudi and a renewed OPEC+ output cut agreement appears to have provided modest support for international oil prices, but US benchmark WTI remains under significant pressure as traders focus on persistent oversupply and dwindling storage. After revisiting nearly two-decade lows in late March, international benchmark Brent crude and US benchmark WTI prices rebounded in early April as traders weighed production cuts versus crashing demand, but they have since relapsed to the downside, with WTI now at its lowest level since the late 1990’s. For context, OPEC, Russia, and other major producers (collectively known as OPEC+) cut a deal to reduce supply by 10 million barrels per day over the next two months (Mexico has held out), with Russia and Saudi agreeing to match each other’s reduced production levels. Various G-20 energy ministers’ have detailed their less expressly voluntary supply reductions. Analysts had questioned whether even these significant production cuts can balance the dramatically oversupplied oil market, which has seen demand collapse amid the coronavirus pandemic. The discouraging rollover in oil prices after the agreement validated the pessimistic view. Meanwhile, Texas regulators have not been able to find consensus on output curbs. The White House is exploring options for supporting the industry (paying producers not to pump oil, investing in additional storage solutions, filling the Strategic Petroleum Reserve) but Congress would have to approve the bulk of these appropriations.

Corporate Earnings Reporting Continues Amid High Uncertainty

This second week of first quarter (Q1) corporate earnings season is set to feature a more diverse group of companies than last week, which was dominated by financial giants, thus offering insight on the divergent impact of the pandemic among various sectors and companies. With 50 of the S&P 500 companies having reported, 69% have surprised to the upside on sales and 67% have topped earnings expectations. Major US banks dominated the earnings calendar last week, and reporting from the financial sector continues this week, featuring a heavy dose of regional bank including M&T Bank, Zions, Comerica, and Fifth Third. Credit card and Payments companies, including Discover, Capital One, American Express, PayPal and Synchrony, will provide a look into the state of the consumer. The insurance sector also begins reporting with Chubb, Travelers, and Aon. Asset managers on the calendar include T. Rowe Price and Franklin. Among the non-financial companies reporting are Haliburton, Coca-Cola, Netflix, Biogen, CSX, Quest Diagnostics, AT&T, Amazon, Intel, and T-Mobile. Finally, with billions approved by Congress for an airline bailout, there will be a heightened focus on earnings reporting from American Airlines, United Airlines, Southwest.

Additional Themes

Topping Up the PPP – Commentary over the weekend from the White House and Capitol Hill suggested that a deal may be imminent for additional funding for the Small Business Administration’s pandemic relief loan facility, the Paycheck Protection Program (PPP). For context, the PPP hit its $349 billion limit last week and is now out of money as Republican and Democrat leadership in Congress struggle to agree on how to top up its funds. Republicans have pushed for a stand-alone bill that would include $250 billion in additional money for the PPP while Democrats are seeking $100 billion for hospitals, $150 billion for states, and a boost in food assistance funding. Reports suggest that the deal is closer to the latter at $500 billion.

Reopening the Country – Last week, debate began to intensify in the US and EU about the roadmap for restarting certain activities and easing lockdown restrictions, and investors continue to ponder the outlook for this process. Some US governors took early initiative, while analysts warily note the experience of Singapore, where a secondary outbreak has occurred.