|

Summary and Price Action Rundown

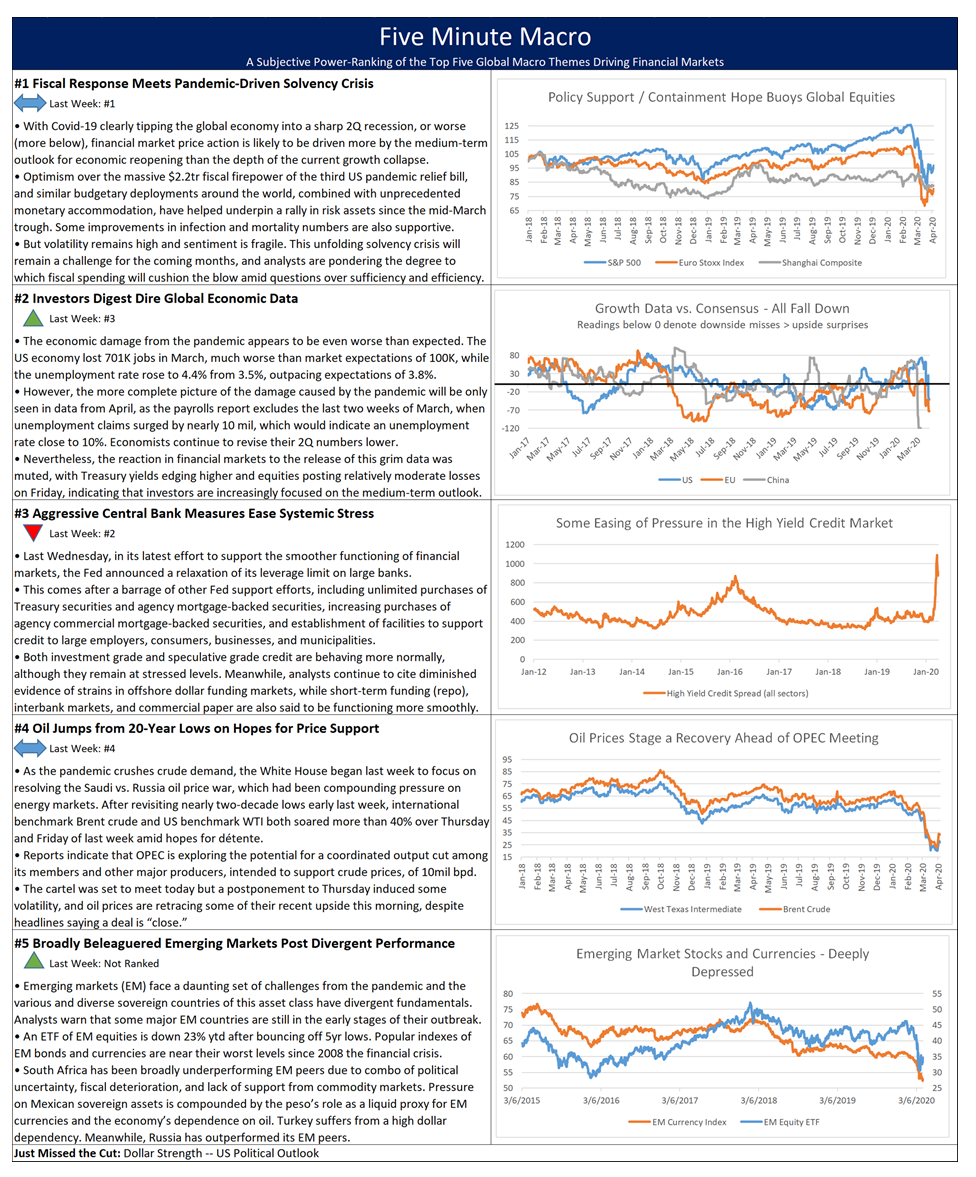

Global risk assets are trading with an upbeat tone this morning as investors focus on incrementally more positive news on pandemic containment efforts while monitoring the ongoing impact of key stimulus programs. S&P 500 futures indicate a 3.7% gain at the open, which would more than recover last week’s 2.1% loss that brought year-to-date downside for the index to 23.0% and the decline from February’s record high to 26.5%. With the extreme market stress of the past few weeks easing amid a confluence of supportive monetary and fiscal policy measures, and the bounce in oil prices also helping improve the mood, market participants are shifting their focus to hopes for better pandemic containment and gradual economic recovery. EU and Asian equities also advanced overnight. Treasury yields are moving higher amid the improved risk appetite, with the 10-year yield at 0.65%, while EU sovereign bond yields are also edging higher. The dollar is steadying below its mid-March multi-year peak. Meanwhile, oil prices are fluctuating widely amid shifting signals on Saudi/Russia détente.

Some Encouraging Headlines Kindle Hopes for a Rebound

Optimistic market participants focus on peaking infections in some regions as pointing to an potential economic recovery, though significant uncertainty remains over the timeline. A decline in the fatality rate of Covid-19 in key hotspots of the pandemic, including Italy, Spain, France, New York, and New Jersey, are spurring efforts to plan for a gradual reopening of economy and society, all of which is supporting a rebound in risk appetite this morning. In accord with the more encouraging data, President Trump conveyed a more upbeat assessment of the situation in his briefing on Sunday, although on Saturday he had cautioned that the US was entering a “very deadly period” over the coming weeks, a warning echoed by the US Surgeon General. The President also tweeted his approval of a proposal for a new Coronavirus panel focused on economic recovery, which would mirror the committees established in France, Spain, and other EU countries to advise on restarting more normal business, educational, and social activities. There were other notable voices, including Bill Gates, who sounded a more positive note over the weekend regarding the infection and mortality data, and Morgan Stanley’s chief US equity strategist opined that the “worst is behind us” for stock market downside, calling current levels a “good entry point.” Meanwhile, St. Louis Fed President Bullard suggested that the $2.2 trillion pandemic relief bill could be sufficient to cushion the blow to the economy if executed properly.

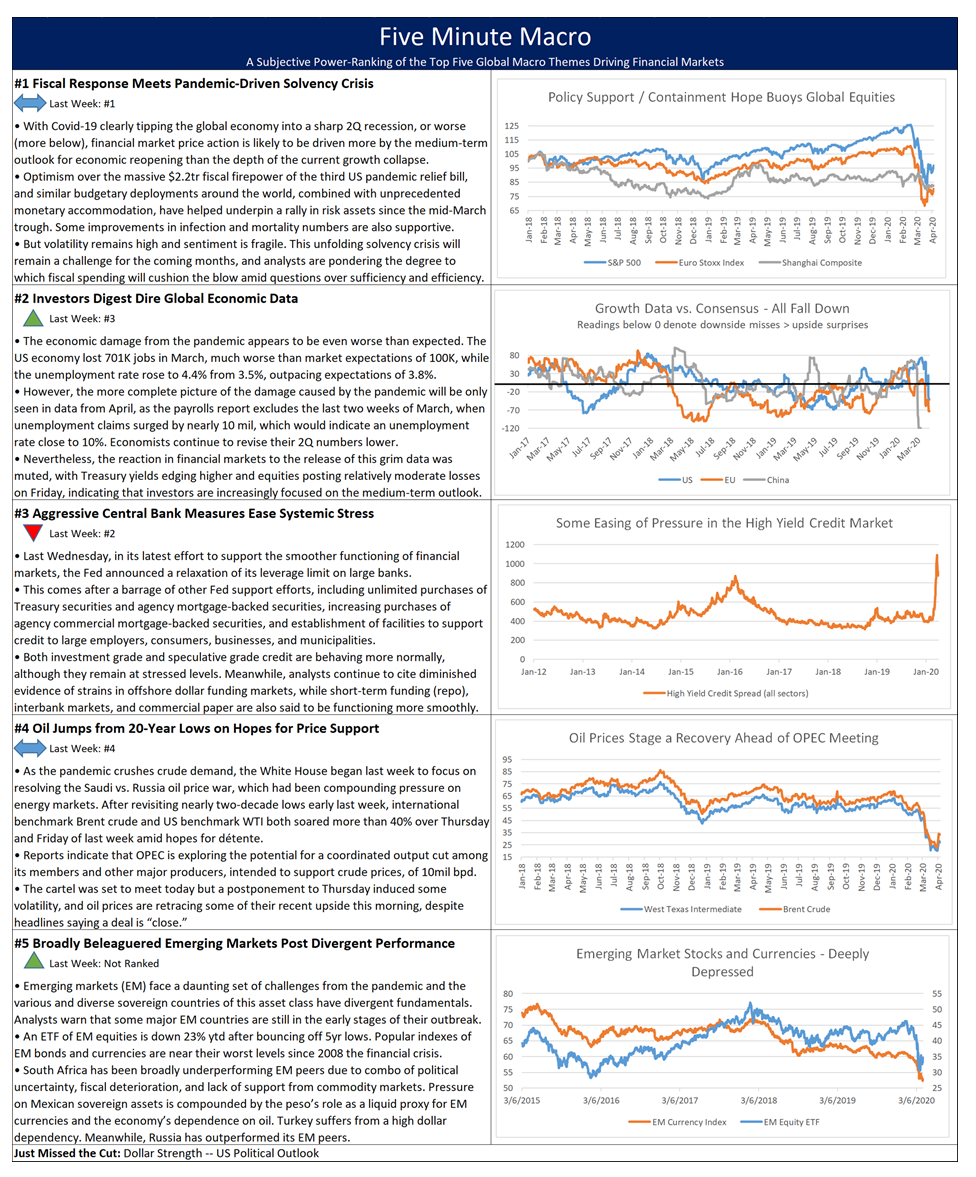

Investors Attempt to Look Past Unprecedented Economic Damage

Friday’s jobs report surprised significantly to the downside but the relatively muted reaction in financial markets suggests that analysts are now focused primarily on the medium-term outlook rather than the depth of the current economic trough. The US economy lost 701K jobs in March, much worse than market expectations of 100K, while the unemployment rate rose to 4.4% from 3.5%, outpacing expectations of 3.8%. The rise was a direct result of the effects of the coronavirus and efforts to contain it. This is the first decline in payrolls since September of 2010 and about two-thirds of the drop occurred in leisure and hospitality, mainly in food services and drinking places. However, the fuller extent of the damage caused by the pandemic will be only seen in data from April, as the payrolls report excludes the last two weeks of March, when unemployment claims surged by nearly 10 million, which would indicate a jobless rate close to 10%. Nevertheless, the reaction in financial markets to the release of this grim data was muted, with Treasury yields edging higher and equities posting relatively moderate losses on Friday, indicating that investors are increasingly focused on the medium term outlook.

Additional Themes

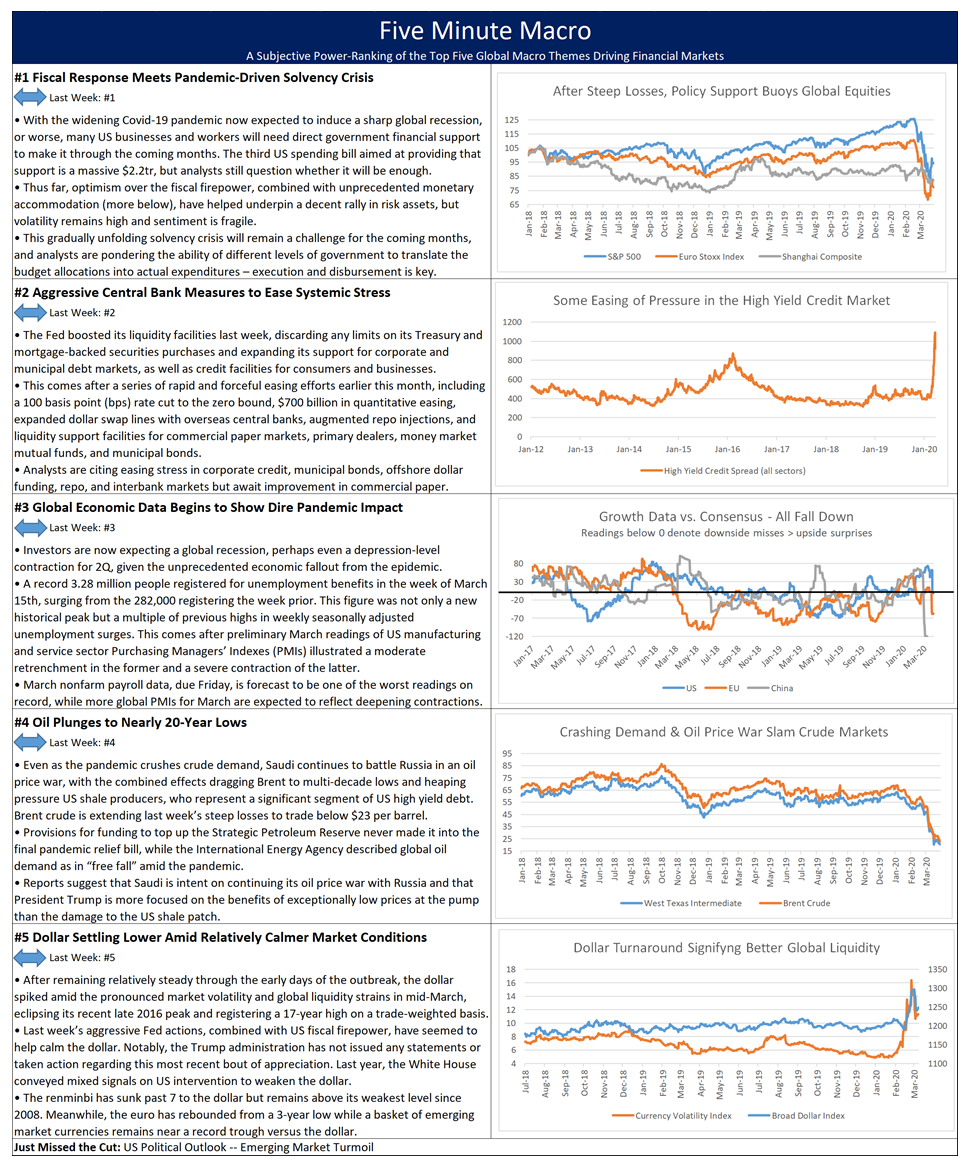

Oil Prices Fluctuate After Sharp Rebound – After revisiting nearly two-decade lows early last week, international benchmark Brent crude and US benchmark WTI both soared more than 40% over Thursday and Friday of last week amid news that Saudi and Russia may be stepping back from their oil price war, with President Trump encouraging détente. Reports also indicated that OPEC is exploring the potential for a coordinated output cut among its members and other major producers, intended to support crude prices, of 10 million barrels per day. The cartel was set to meet today but a postponement to Thursday induced some volatility, and oil prices are retracing some of their recent upside this morning, despite headlines saying a deal is “close.”

Big Demand for Small Business Loan Program – Friday’s official launch of the $350 billion small business support program, which was established as part of the $2.2 trillion CARES Act, was met with a rush of applicants. With banks acting as intermediaries for the loans, only existing lending clients are being deemed eligible, which is being highlighted as a flaw in this system. Friday’s episode of our podcast (the HPS Macrocast) features insights on this vital program from our friend Adrian Stewart, an attorney at Dentons. https://marketspolicy.com/podcast-2/. |