Summary and Price Action Rundown

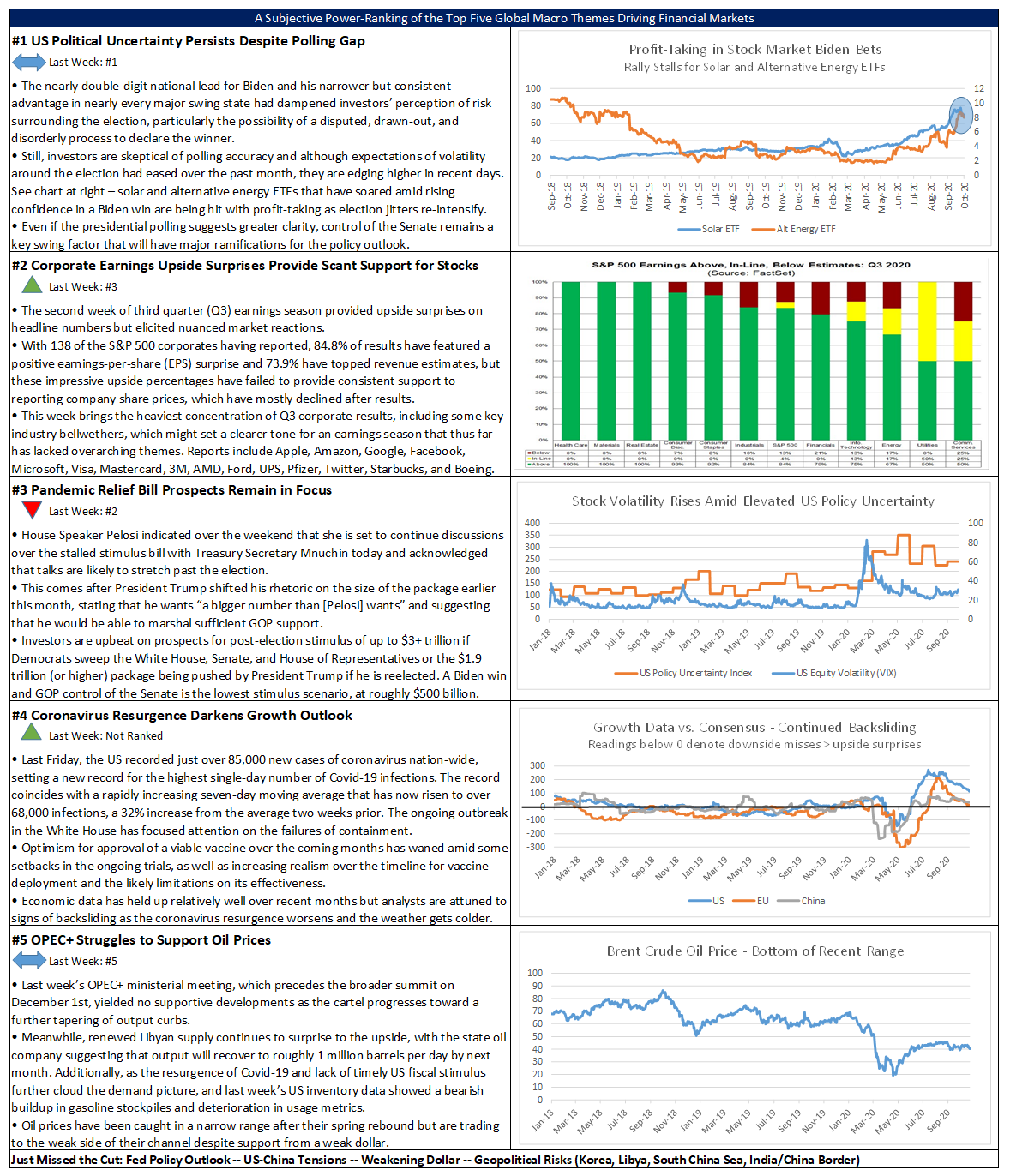

Global risk assets are pausing their recent rally this morning as investors continue to grapple with questions over the timeline and dynamics of a vaccine rollout while the near-term picture remains grim as the pandemic’s autumn wave continues to accelerate. S&P 500 futures indicate a 0.6% lower open after the index posted a fresh record high yesterday, gaining 1.2% today with growth-sensitive stocks remaining in the lead, to hoist its year-to-date upside to 12.3%. Equities in the EU are similarly retracing a portion of their recent upside, while Asian stocks were mixed overnight. A broad dollar index is sliding to a new multi-year low, while longer-dated Treasuries are rallying modestly, with the 10-year yield descending to 0.88%. Brent crude is fluctuating below $44 per barrel as traders look ahead to the month-end OPEC+ meeting.

Vaccine Optimism Contends with Near-Term Covid-19 Uncertainties

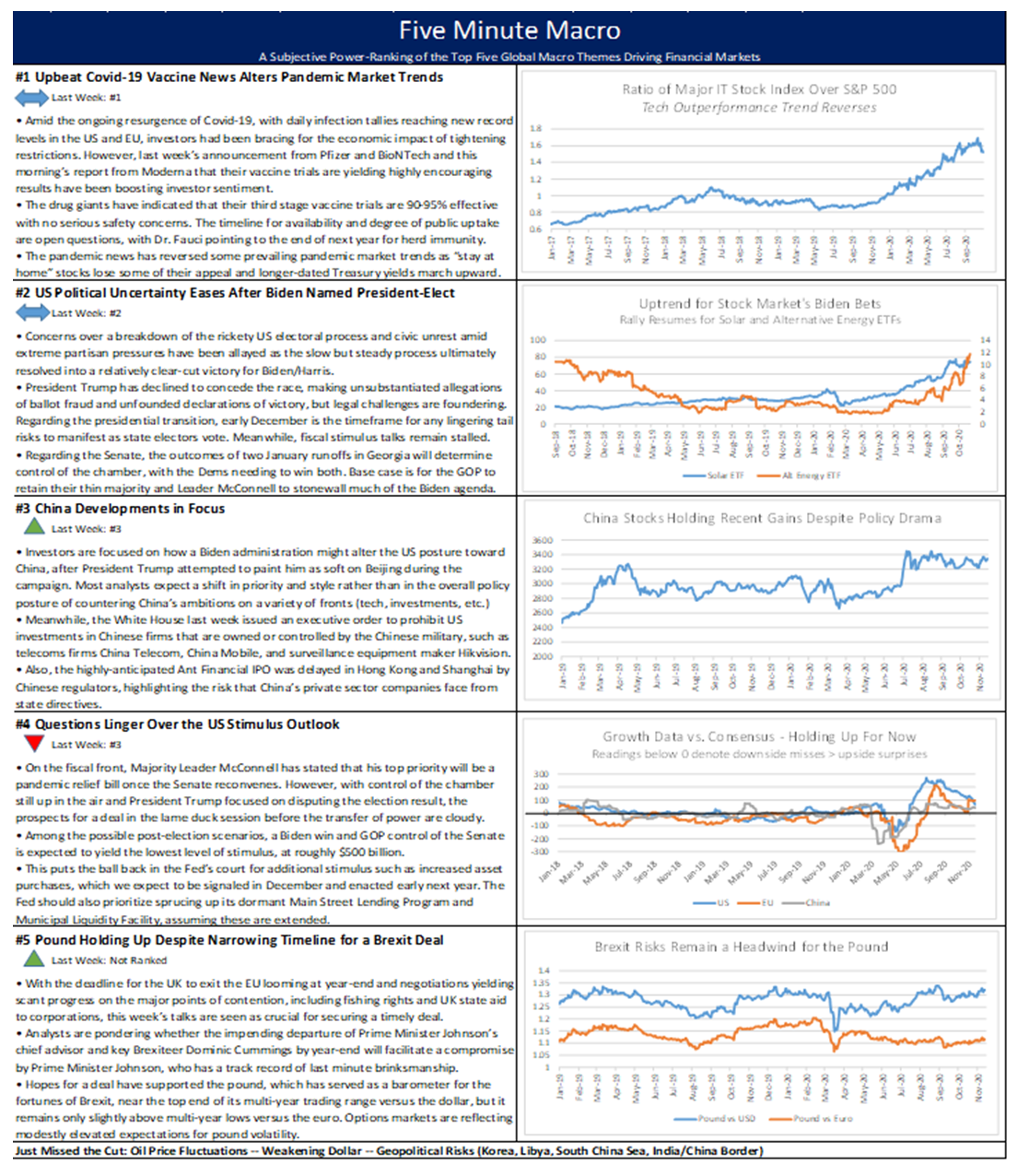

Markets are digesting yesterday’s latest announcement of highly encouraging vaccine data and pondering whether it is too early for the prevailing pandemic market trends to go fully into reverse. US stock indices soared to record highs yesterday after Moderna announced that its experimental coronavirus vaccine is 94.5% effective at preventing infection, according to recent results from its large-scale Phase 3 trial. Moderna is the second company to announce preliminary data on an apparently successful product, following Pfizer and BioNTech’s announcement last Monday that its experimental dose is 90% effective. Analysts also note that Moderna’s vaccine remains stable without the deep freeze required for Pfizer’s doses, easing the logistical burden of rollout. Meanwhile, Pfizer announced a four-state pilot program for distribution of its vaccine in New Mexico, Rhode Island, Tennessee, and Texas,

After yesterday’s announcement, “stay-at-home stocks” slipped, with shares of Zoom, Netflix, Logitech, and Teladoc down 1.1%, 0.8%, 0.3%, and 3.4%, respectively, while those stocks that have struggled during the pandemic rose, with AMC, Norwegian Cruise Lines, and Royal Caribbean climbing 4.7%, 6.3%, and 6.9%, respectively, and all major airline carriers posting robust gains as well. However, these price responses were considerably milder than after Pfizer’s announcement last Monday and there appears to be scant follow-through today, as tech-heavy Nasdaq futures are higher while S&P 500 and Dow Industrials futures are down. This speaks to the dilemma for equity investors, who are seeing the relative appeal of the pandemic winners lessened by the vaccine news but are concerned that it is still premature to aggressively rotate to those sectors more impacted by Covid-19 given the near term resurgence in infections and relatively lengthy timeline for vaccine rollout even under the most optimistic scenarios.

US Economic Data in Focus

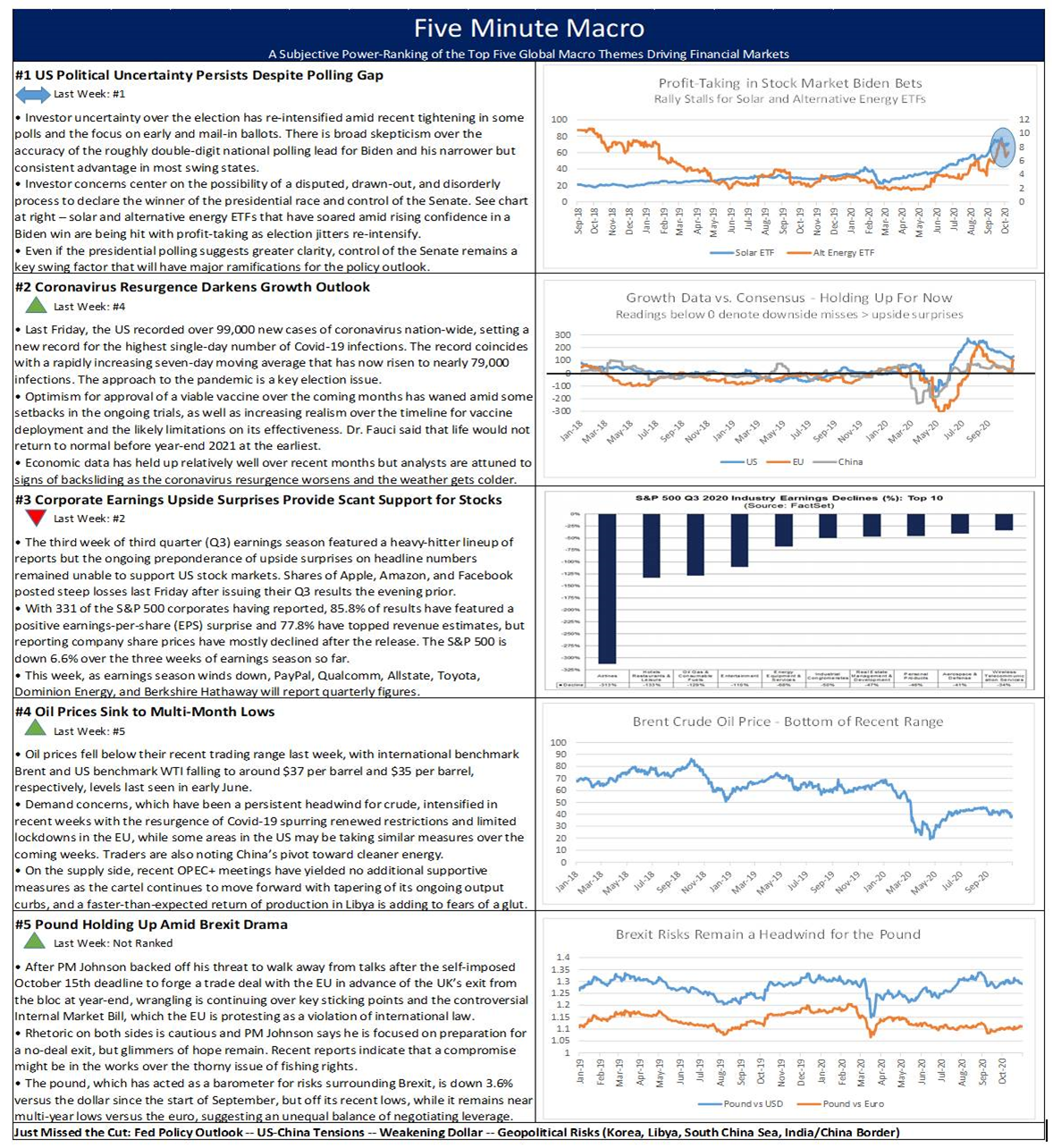

Although official data remains relatively resilient, this morning’s retail sales and industrial production data for October will be scrutinized for signs of backsliding. The pace of US retail sales growth in October is expected to decelerate to 0.5% month-on-month (m/m) from 1.9% in September, with the core reading that strips out autos and gasoline similarly forecast to register 0.6% versus 1.5% the prior month. These estimates for a more sober pace of consumer demand comes as high-frequency indicators, such as restaurant and travel bookings, are showing incipient signs of rolling over in recent weeks, corresponding with the nationwide surge in coronavirus cases. Analysts are pondering the degree to which the grim backdrop of the pandemic and lingering economic impact will affect holiday shopping season. Meanwhile, industrial production for October is estimated at 1.0 m/m%, which would be an improvement over September’s -0.6% reading. While manufacturing has generally held up better than service sectors during the pandemic, there have been some regional disparities. Yesterday’s release of the New York Fed’s factory gauge for November showed a slower-than-anticipated pace, printing 6.3 versus a consensus forecast of 13.5 and the previous month’s reading of 10.5. Overall, US economic indicators have evidenced resilience in recent months despite the resurgence of Covid-19 and the dwindling of fiscal support measures enacted by Congress in the spring.

Additional Themes

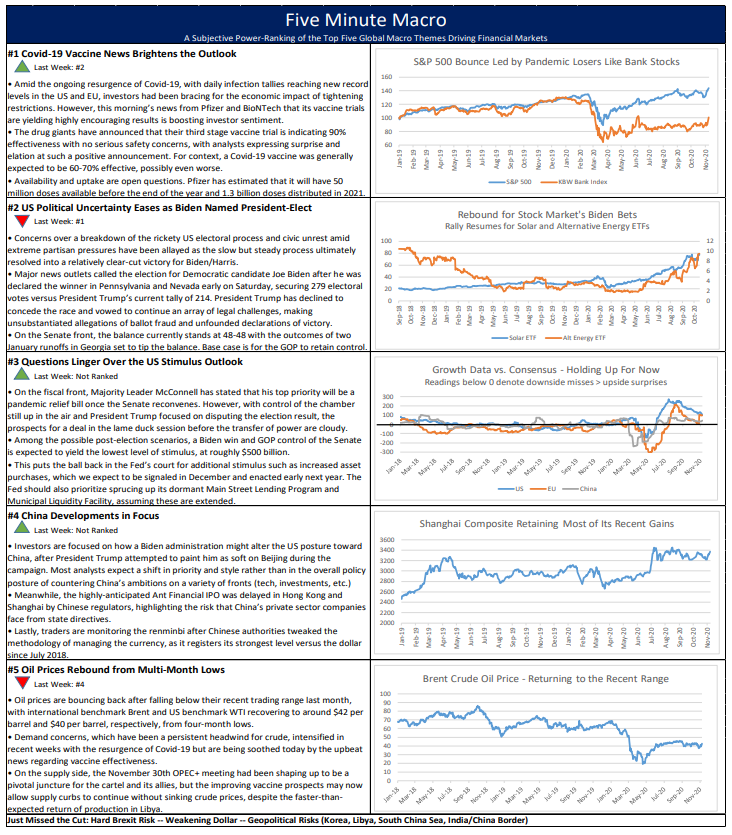

Pound Advances on Brexit Deal Hopes – The pound is up 0.5% versus the dollar this morning and 0.3% against the euro amid reports that negotiators from the UK and EU may be nearing a deal, with a prospective announcement possible as early as Monday. UK negotiators, however, cautioned that a breakdown in talks remains a risk, as the key points of contention over fishing rights and the “level playing field” businesses have yet to be fully resolved. Friday is seen to be a critical day as EU Chief Negotiator Barnier is set to present his progress report to EU leaders after which Prime Minister Johnson is potentially set to call European Commission President von der Leyen, pending confirmation.

Fed Nominee Shelton Faces Key Vote – After Senate Majority Leader McConnell initiated the process of confirming Judy Shelton to the Federal Reserve Board of Governors last week, she faces a procedural vote today. Shelton was one of President Trump’s nominations to the Fed’s Board, alongside Christopher Waller, though following her nomination 17 months ago, Shelton has not been able to garner enough support in the Senate to win confirmation. Senators on both sides of the aisle had criticized Shelton’s policy views for being well outside the mainstream, including her advocacy of the gold standard and questioning central bank independence. Other critics have pointed to her apparent willingness to abandon long-held views in order to conform to prevailing policy preferences of the Trump administration in an effort to secure her nomination, with Democrats flagging her supposed loyalty to President Trump after her work as an informal advisor to his campaign in 2016. Though upon Joe Biden’s victory, Senate Republicans appear to have reevaluated the nomination and are likely to vote next week. Senators Romney, Collins, and Alexander are the three Republicans in the chamber who have publicly opposed Shelton’s nomination, though with Alaska Senator Lisa Murkowski’s recent affirmation of support, Shelton may finally have enough support to move forward.