Summary and Price Action Rundown

Global risk assets are extending their recent downtrend this morning as muddled earnings, lingering US political and policy uncertainty, and the Covid-19 resurgence continue to dampen investor spirits. S&P 500 futures indicate a 1.0% decline at the open after the index shed 0.7% yesterday, paring its year-to-date gain to 8.0%, which is 2.6% below early September’s record high. Equities in the EU are underperforming as Covid-19 containment measures are reinstated in major regional cities, while Asian shares posted more moderate losses overnight. Boosted by safe haven demand, the dollar is rallying from multi-year lows while longer-dated Treasury yields continue to descend below recent highs, with the 10-year yield at 0.70%. Brent crude prices are also retreating but remain within their recent range, trading above $42 per barrel.

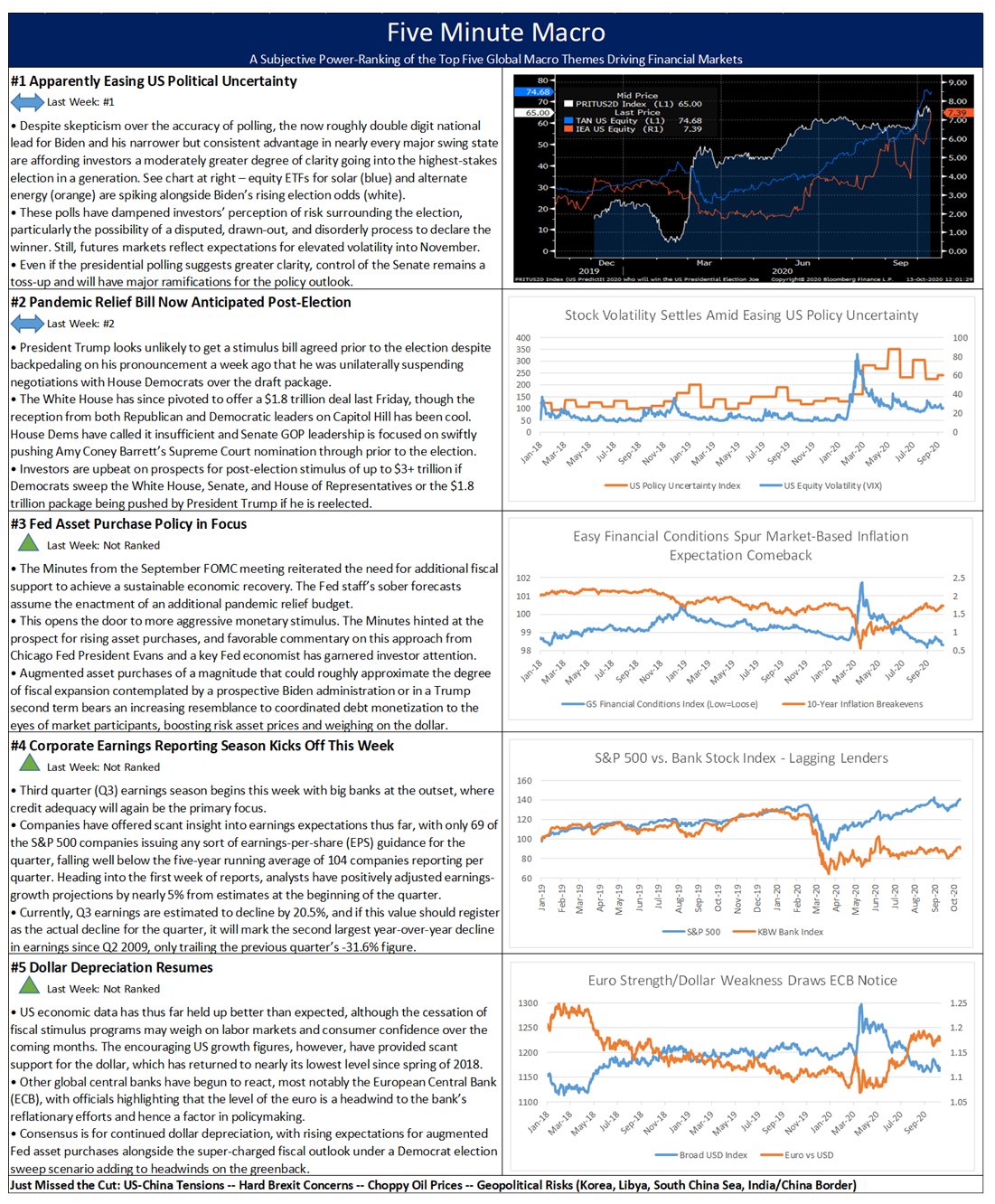

Early Earnings Reporting Season Drawing a Mixed Market Reception

Third quarters (Q3) corporate earnings reporting season continues today, as Morgan Stanley closes out the results from US megabanks, which have been broadly uneven. Yesterday, Bank of America, Goldman Sachs, and Wells Fargo reported their third quarter earnings results with Goldman Sachs outperforming. The megabank reported an earnings-per-share (EPS) of $9.68, trouncing estimates by $4.24, and revenue climbed to $10.78 billion, a nearly 30% increase from one year ago. As with the prior quarter, the upside was driven by trading revenues, with fixed income, currencies and commodities (FICC) revenue climbing 49% and equities trading grew by 10%. Additionally, asset management increased 77%, wealth management by 13%, and investment banking grew 7%. With Goldman primarily focusing on trading, asset management, and investment banking, the need for credit loss provisions is typically smaller, relative to its peers. Goldman increased provisions by $278 million, less than expected, though falling in the same range as other reporters thus far. However, despite the strong performance, shares of Goldman closed mostly flat on the day. Meanwhile, shares of Bank of America fell 5.3% after the bank narrowly beat earnings estimates but fell short of revenue projections. Performance was particularly impacted by shortfalls in net interest income (NII), which declined 16.9% from last year. After yet another disappointing quarter for the bank, executives remain upbeat, as CFO Paul Donofrio stated “Q3 likely will be the bottom for NII and we are optimistic it will move higher in 2021.” Wells Fargo stock fell 6.0% after it too reported a notable decline in NII by nearly 19%. On the positive side, fee income was stronger, mortgage banking grew just over 400% from last quarter, and credit loss provisions of $769 million were well below estimates. So far, megabank results are echoing themes from last quarter, with trading-intensive banks reaping significant returns, and consumer-facing banks falling short as the low rate environment poses a major headwind for NII. Yesterday, the KBW Bank Index closed down 1.8% on the day to deepen its year-to-date loss to 32.2%. This morning, Morgan Stanley will release its Q3 earnings, closing out the US megabank reports.

Significant US Growth and Labor Figures in Focus

Today’s initial jobless claims data kicks off a series of notable US economic releases before the weekend. Initial jobless claims are expected to settle to 825K in the week ending October 10th after posting 840K in the week ending October 3rd, which topped market forecasts by 20K and represented only a slight downtick from the prior week’s upwardly revised 849K figure. This week’s reading is projected to mark the seventh consecutive week that claims remained in the 800K’s territory, roughly four-times the pre-pandemic level, suggesting the labor market has made limited overall improvement amid waning fiscal support. Continuing claims last week fell to 10.98 million in the week ending September 26th, a nearly 1 million drop from the prior week’s report, and registered below market consensus of 11.40 million. The reading marked the lowest level since early April when the effects of the coronavirus pandemic had just started to coalesce. Outside of state programs, Pandemic Unemployment Assistance (PUA) data totaled to 464K in the week ending October 3rd, a 44K decline from the prior report’s figure which underwent a significant downward revision. Total persons claiming unemployment benefits under all programs fell by 1 million to 25.5 million in the week ending September 19th. Also due today are October’s regional manufacturing indexes for New York and Philadelphia, followed by tomorrow’s US September industrial production number, which is expected to show a modest acceleration. Perhaps most importantly, the health of the US consumer will be in focus with tomorrow’s release of September retail sales data and the U. Michigan consumer sentiment gauge for October, with both expected to reflect broad stability at solid levels.

Additional Themes

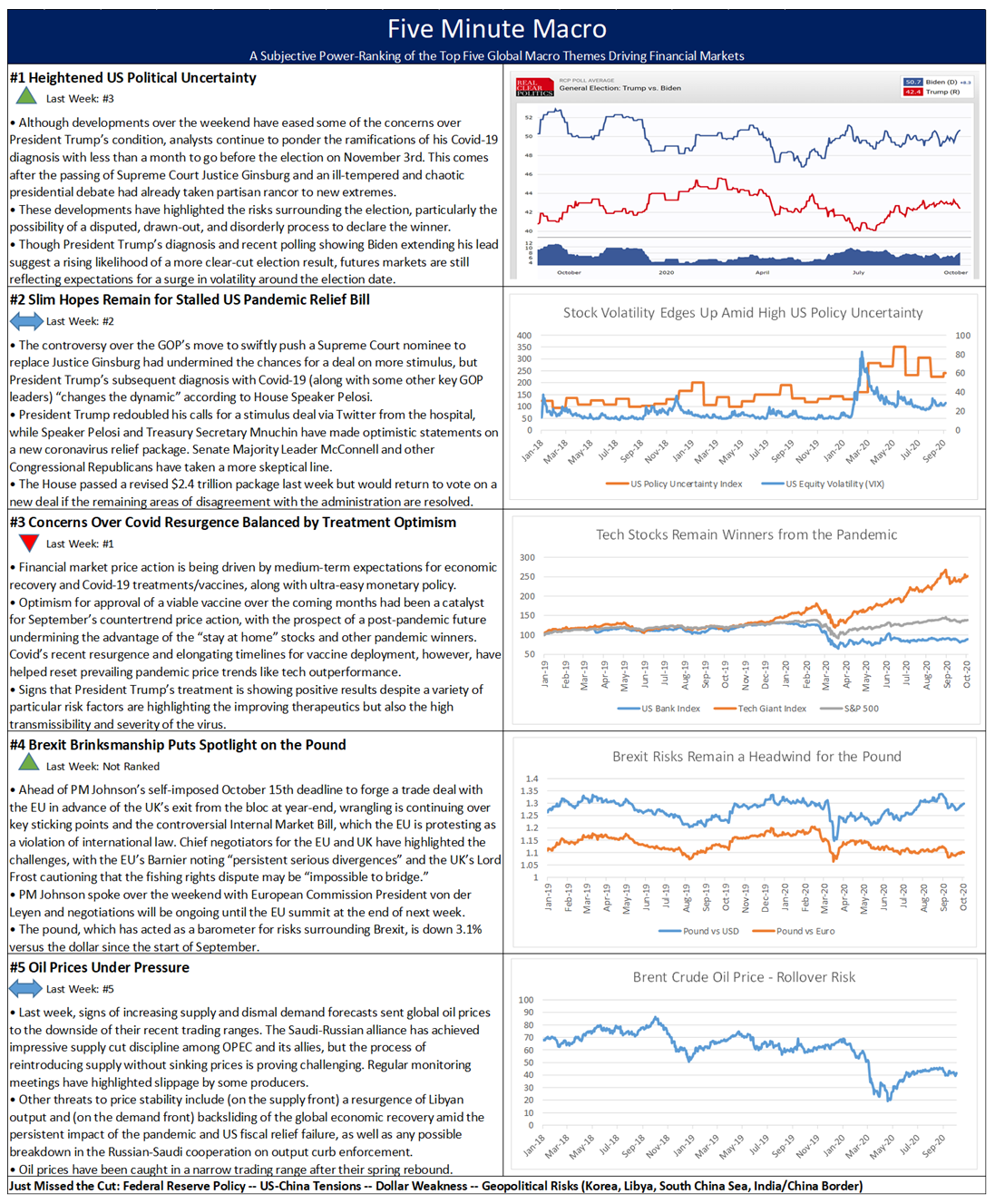

Covid-19 Resurgence – EU and UK equity indexes are down 2-3% this morning amid rising investor concerns that the second wave of the coronavirus outbreak will reverse the ongoing economic recovery in the region. Both London and Paris are implementing more severe restrictions, though these fall short of the full-scale lockdowns that were prevalent last spring at the outset of the pandemic.

US Political Uncertainty Remains Elevated – With the second presidential debate cancelled following President Trump’s refusal to take part in a virtual version of the event, both candidates will appear in competing “town hall” discussion formats this evening, with Biden on ABC and President Trump on NBC. Some commentators are critical of NBC’s airing of the Trump town all at the same time as the previously scheduled Biden event, denying some viewers the opportunity to view both. Polls remain steadily in favor of Biden, though investors maintain broad skepticism of their accuracy. Equity volatility futures, while moderating over the past week, still reflect expectations of heightened stock market turbulence around the election and for the months that follow.