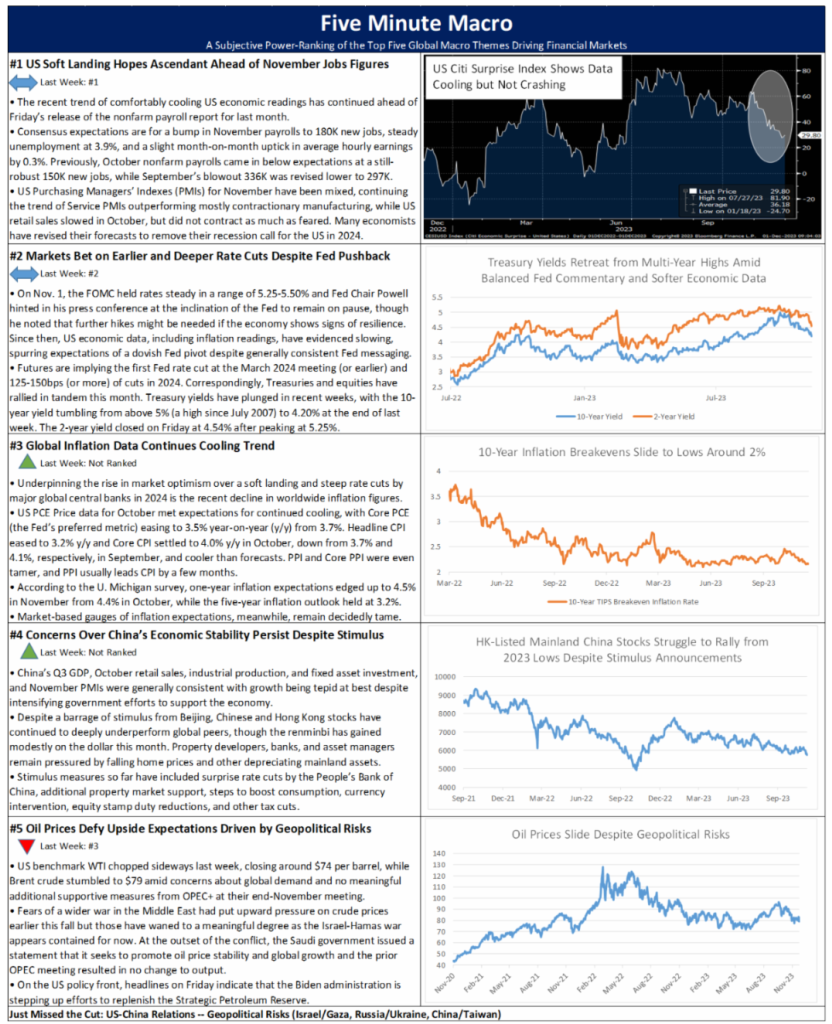

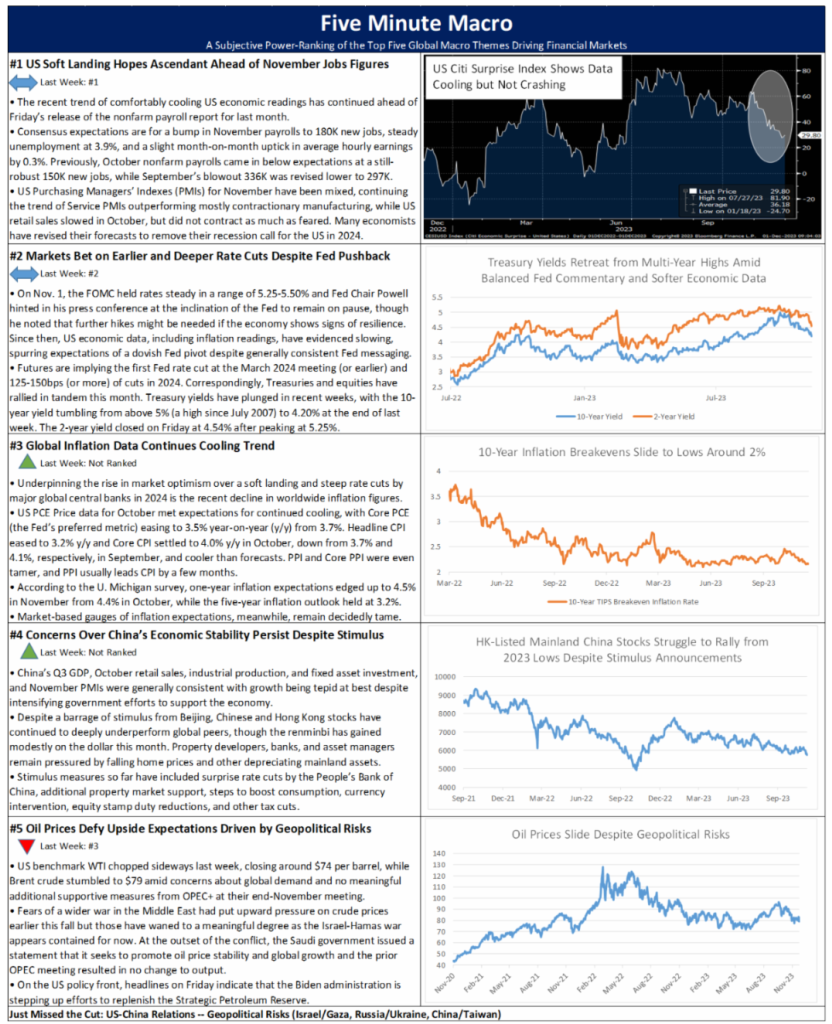

Hopes for a soft landing in the US increase ahead of key jobs report as markets bet on earlier Fed cuts with global inflation continuing to cool. China growth remains a concern and oil continues to shrug off geopolitical risks.

Hopes for a soft landing in the US increase ahead of key jobs report as markets bet on earlier Fed cuts with global inflation continuing to cool. China growth remains a concern and oil continues to shrug off geopolitical risks.

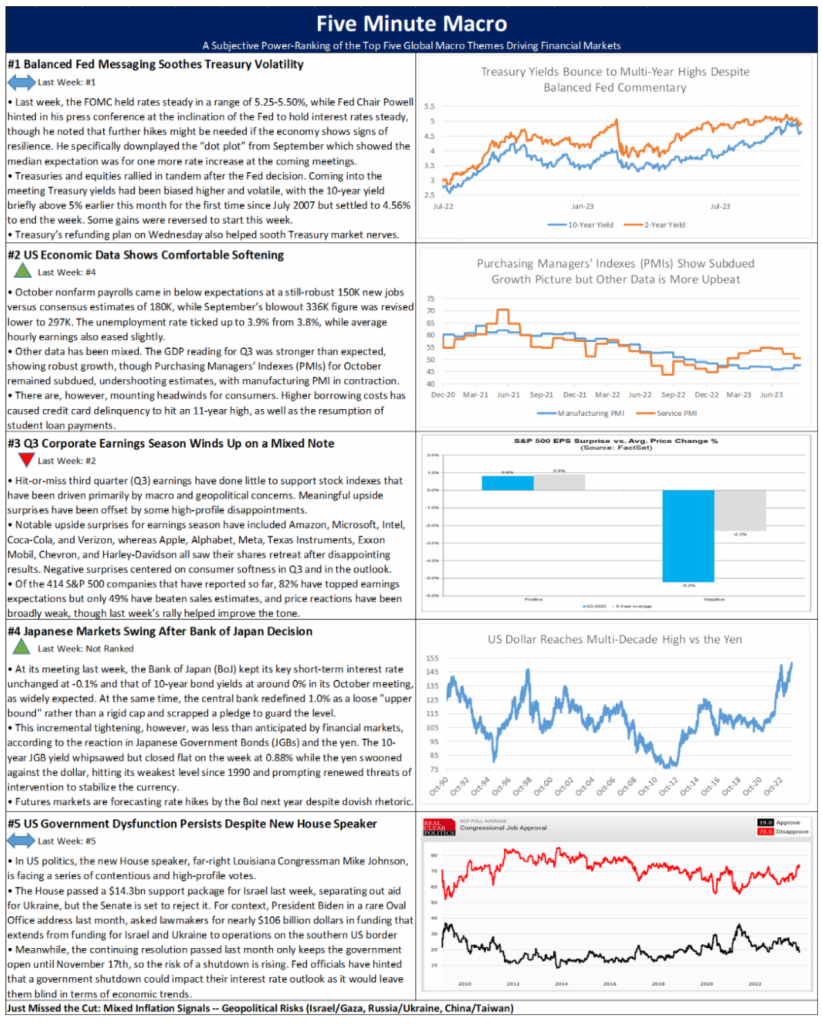

Fed messaging remains the driver of global risk markets while US data continues to cool. Q3 earnings season wraps up on a mixed note, while Japanese markets swing after BOJ decision and US government dysfunction persists.

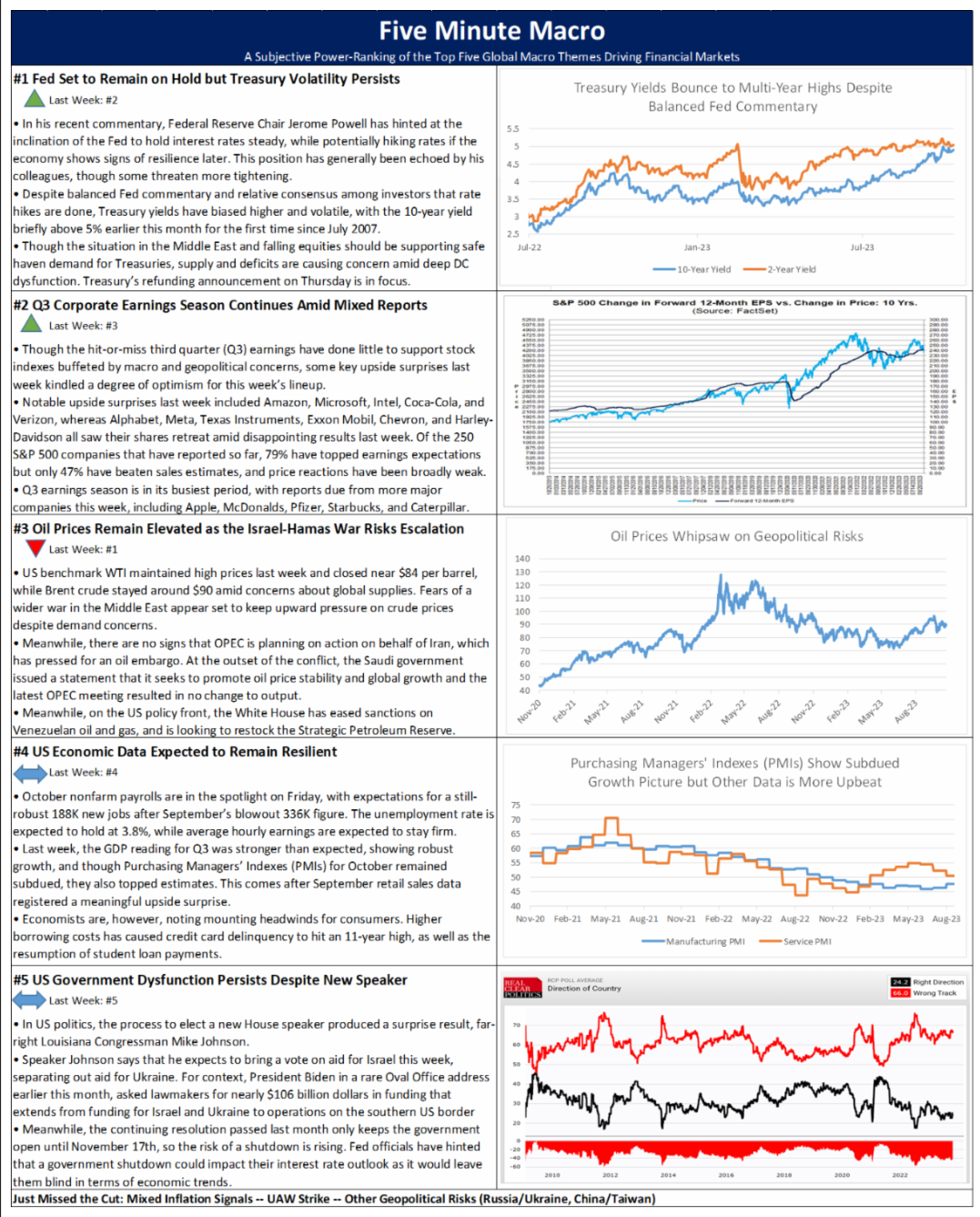

This week’s Fed Meeting is front and center for global markets, while this will be a key week of corporate earnings. Oil prices continue to fluctuate around the Middle East and US economic data remains resilient and the US finally elects a Speaker.

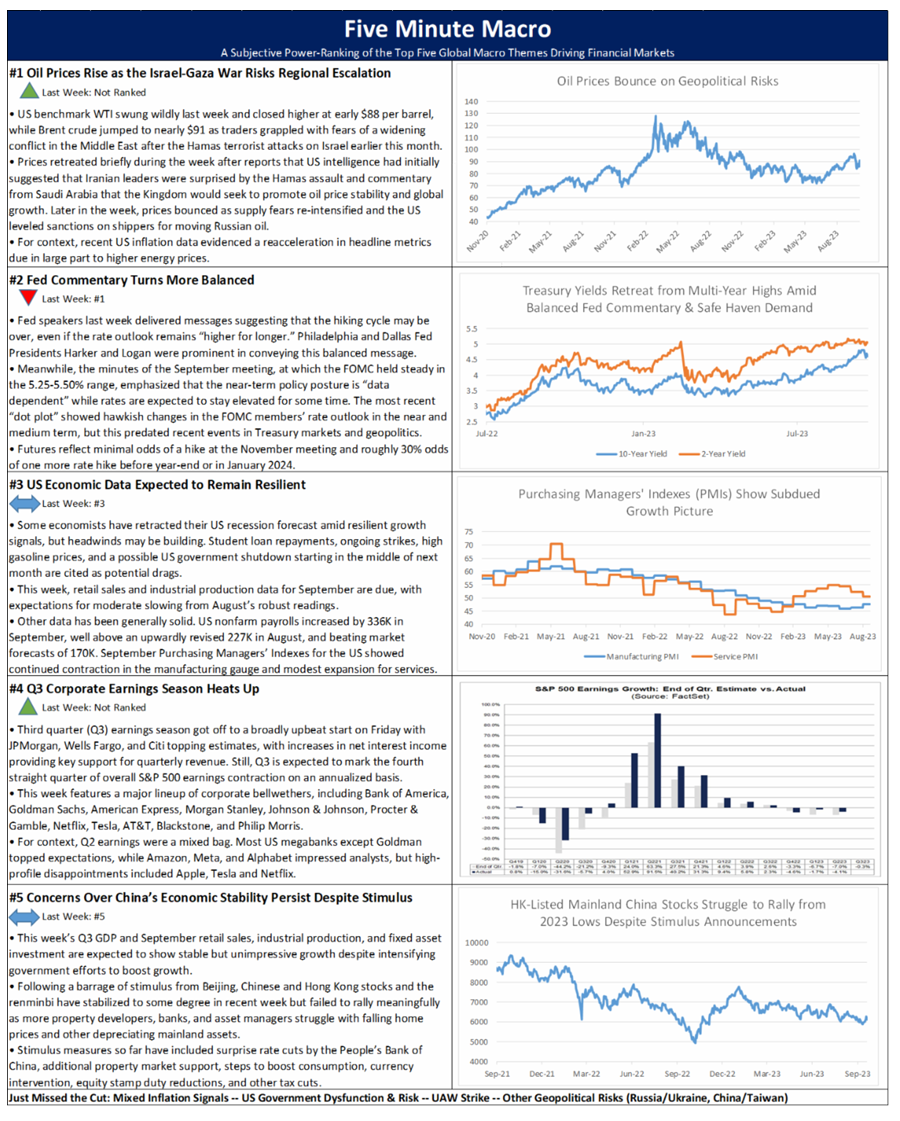

Oil prices are the top concern as the Israel-Gaza war escalates. This week will be heavy with Fed speeches, which turned more dovish last week. Economic data is expected to remain resilient as corporate earnings season heats up. Finally, concerns over China’s economic stability persist.

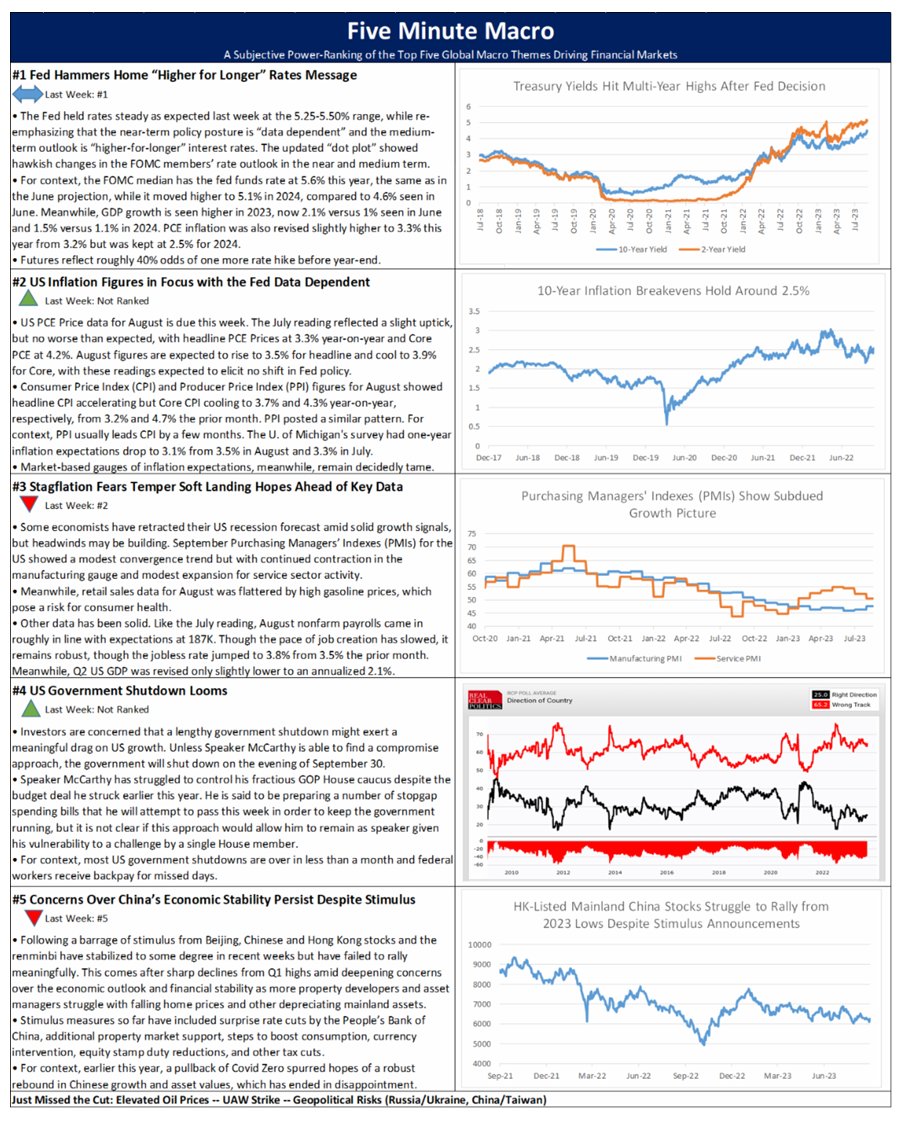

The Fed hammers home higher for longer as markets await key inflation figures and stagflation fears grow and a government shutdown looks inevitable. Finally, concerns over China’s economic stability persist.

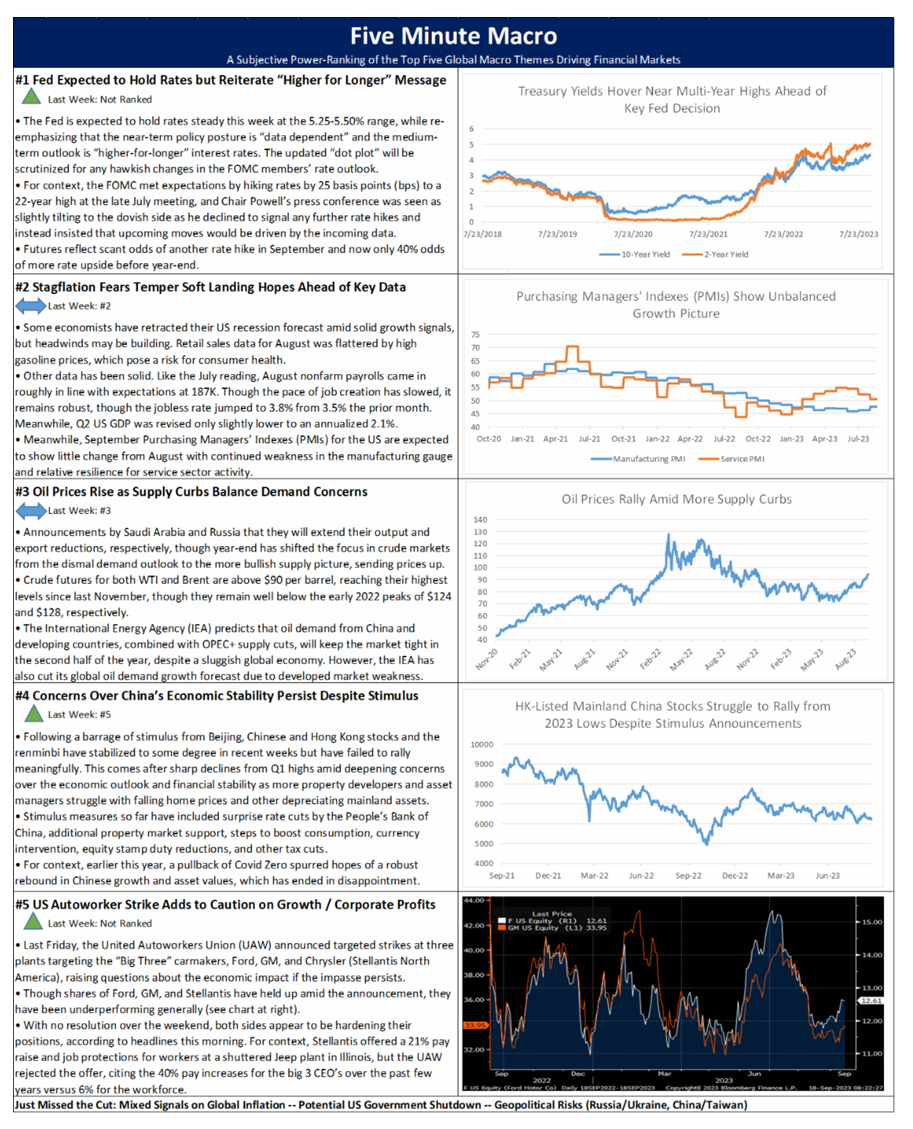

The Fed is expected to hold rates this week as stagflation fears grow as oil continues to climb higher. Additionally, concerns over Chinese growth continue and UAW goes on strike.

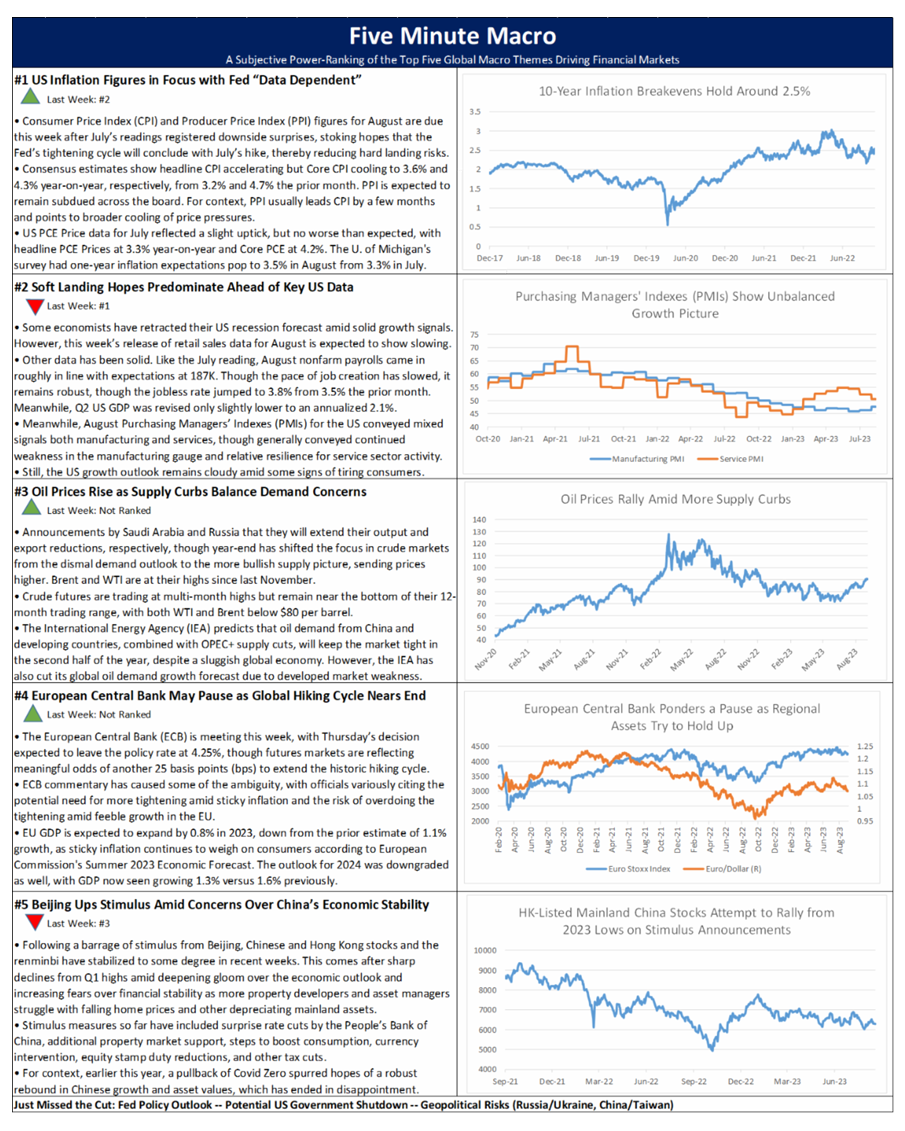

Inflation figures this week will help drive Fed policy as soft-landing hopes continue but high oil prices are hurting consumer sentiment. ECB meets this week with hopes for one final hike and China continues to step up stimulus efforts.

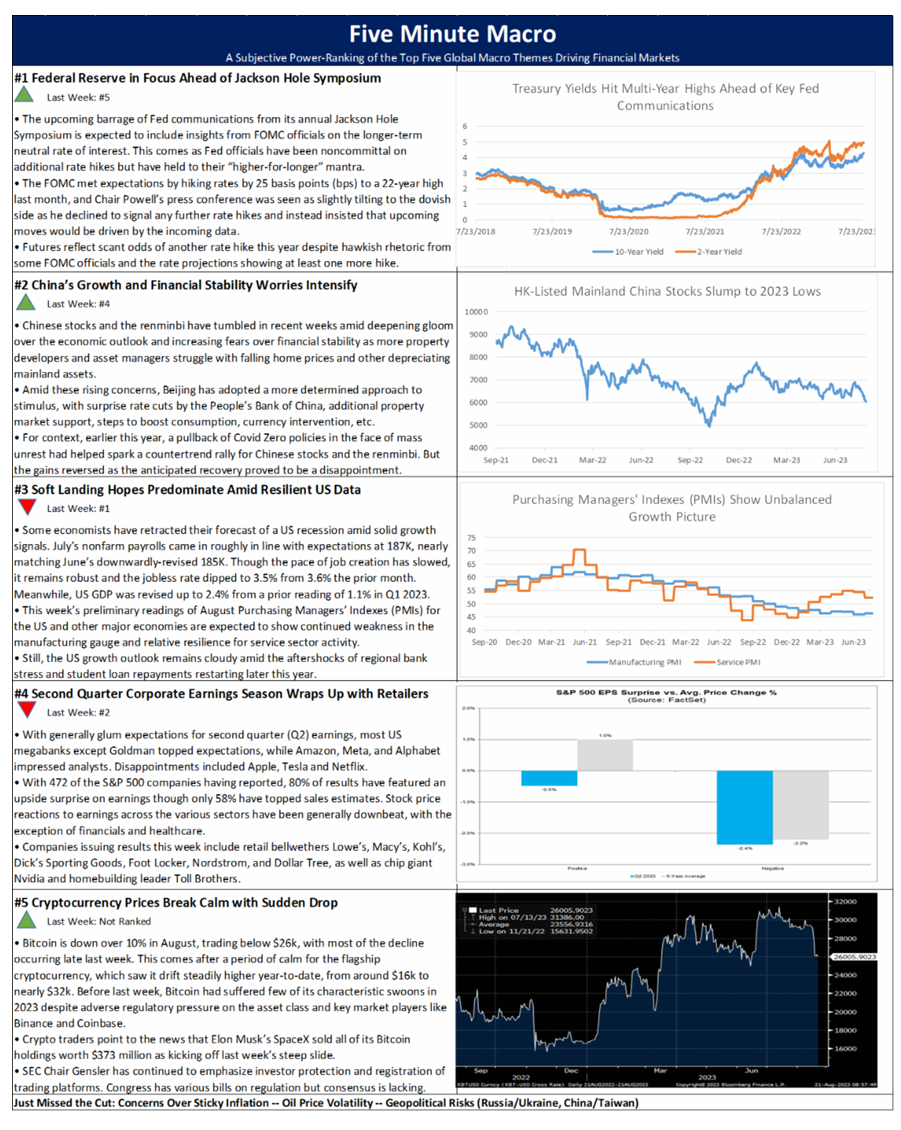

Policymakers head to Jackson Hole while Chinese growth concerns intensify. Soft landing hopes persist as 2nd quarter earnings season wraps up. Finally, crypto prices drop.

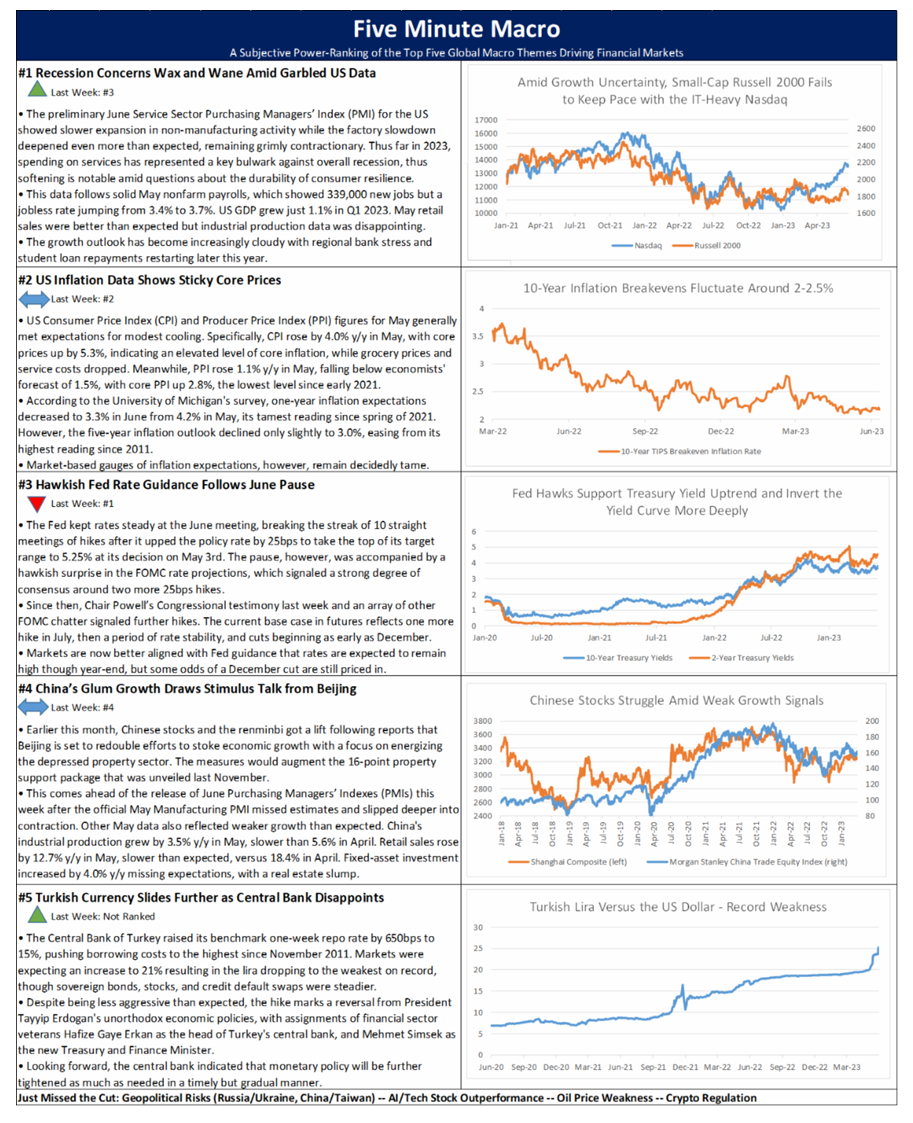

Recession concerns continue to wax and wane as US inflation remains sticky and the Fed continues to provide hawkish guidance following the June pause. China’s glum growth draws stimulus and the Turkish lira slides further as central bank disappoints.

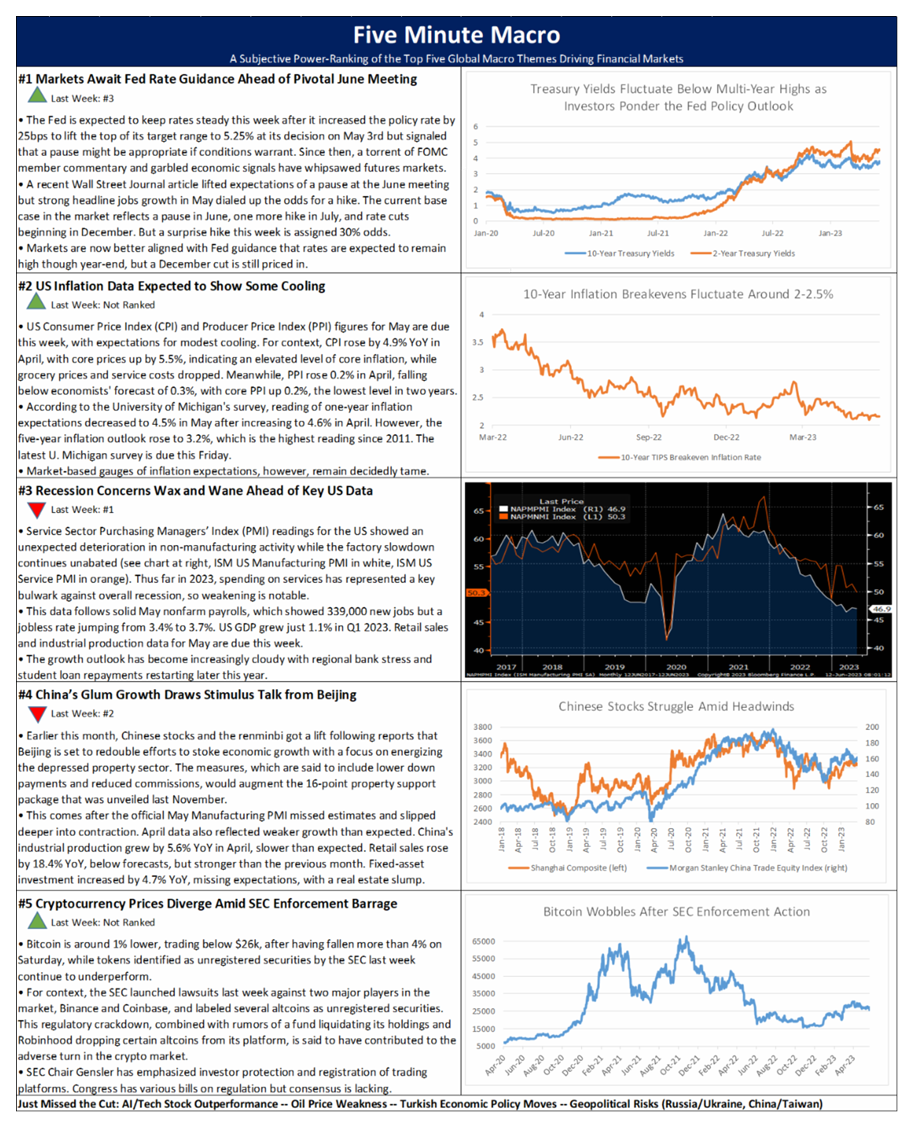

A key Fed decision and inflation data are the main focus of markets this week as recession fears wax and wane. China’s weak growth sparks calls for stimulus while the SEC has crypto exchanges in its crosshairs.