Summary and Price Action Rundown

Global risk assets were mostly positive overnight at the outset of a week of key earnings reports and global central bank meetings, while investors keenly monitor plans to reopen some segments of the economy. S&P 500 futures indicate a 0.8% higher open, which would extend the index’s 1.4% gain on Friday that put year-to-date downside at 12.2% and the decline from February’s record high at 16.2%. Equities in the EU and Asia posted gains overnight, with the Nikkei outperforming after the Bank of Japan upped its monetary stimulus (more below). Longer duration Treasury yields are edging upward from recent lows, with the 10-year yield at 0.62%, while a broad dollar index is retracing a portion of last week’s upside. Oil prices are giving back some of their recent rebound, which took crude above its 20-year lows from early last week, as analysts remain focused on dwindling storage capacity for the supply glut.

Equities Rise into Key Earnings Reports This Week

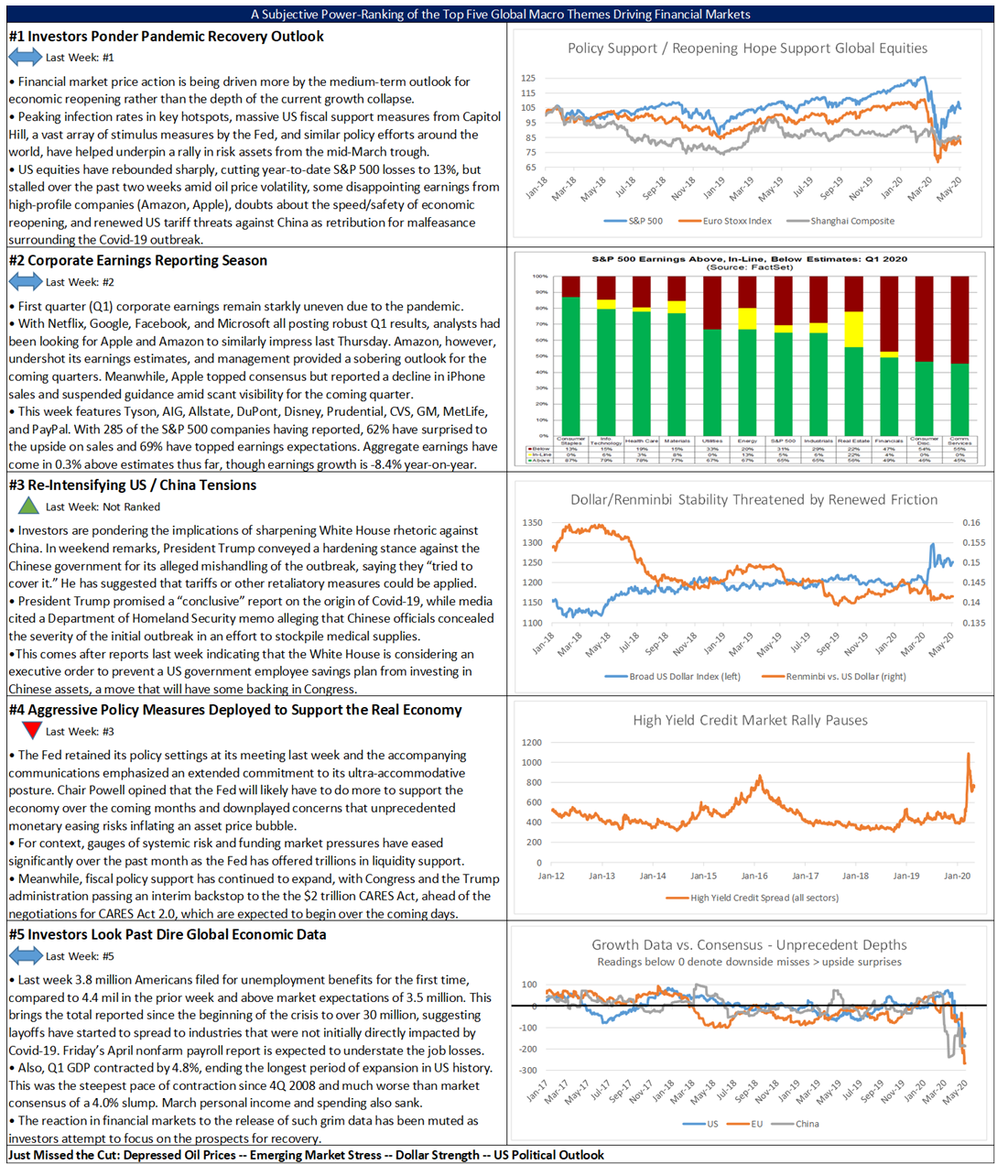

Though first quarter (Q1) earnings reporting has been uneven thus far, this week’s calendar is set to feature many of the companies that investors expect to be successfully weathering the pandemic. Thus far, earnings season has featured stark divergence between the corporate winners and losers from the pandemic. While companies like Netflix and Target have benefitted from increased subscribers and robust online sales, respectively, banks and credit card companies have had to aggressively prepare for credit deterioration. Brick and mortar retailers like JC Penney, which is in advanced bankruptcy talks with lenders, and travel sector companies have suffered an exceptionally adverse impact. This week’s earnings calendar features household names including Apple, Amazon, Google, Facebook, Microsoft, 3M, Ford, Caterpillar, D.R. Horton, Harley-Davidson, Southwest, Mondelez, Pfizer, Starbucks, United Airlines, UPS, Archer-Daniels-Midland, ADP, Boeing, eBay, GE, The Hartford, Mastercard, Qualcomm, Yum! Brands, and McDonalds. Amazon will be of particular interest, with its stock at a record high and its delivery services taking on an even greater importance in people’s lives during the widespread lockdowns. With 123 of the S&P 500 companies having reported, 63% have surprised to the upside on sales and 67% have topped earnings expectations.

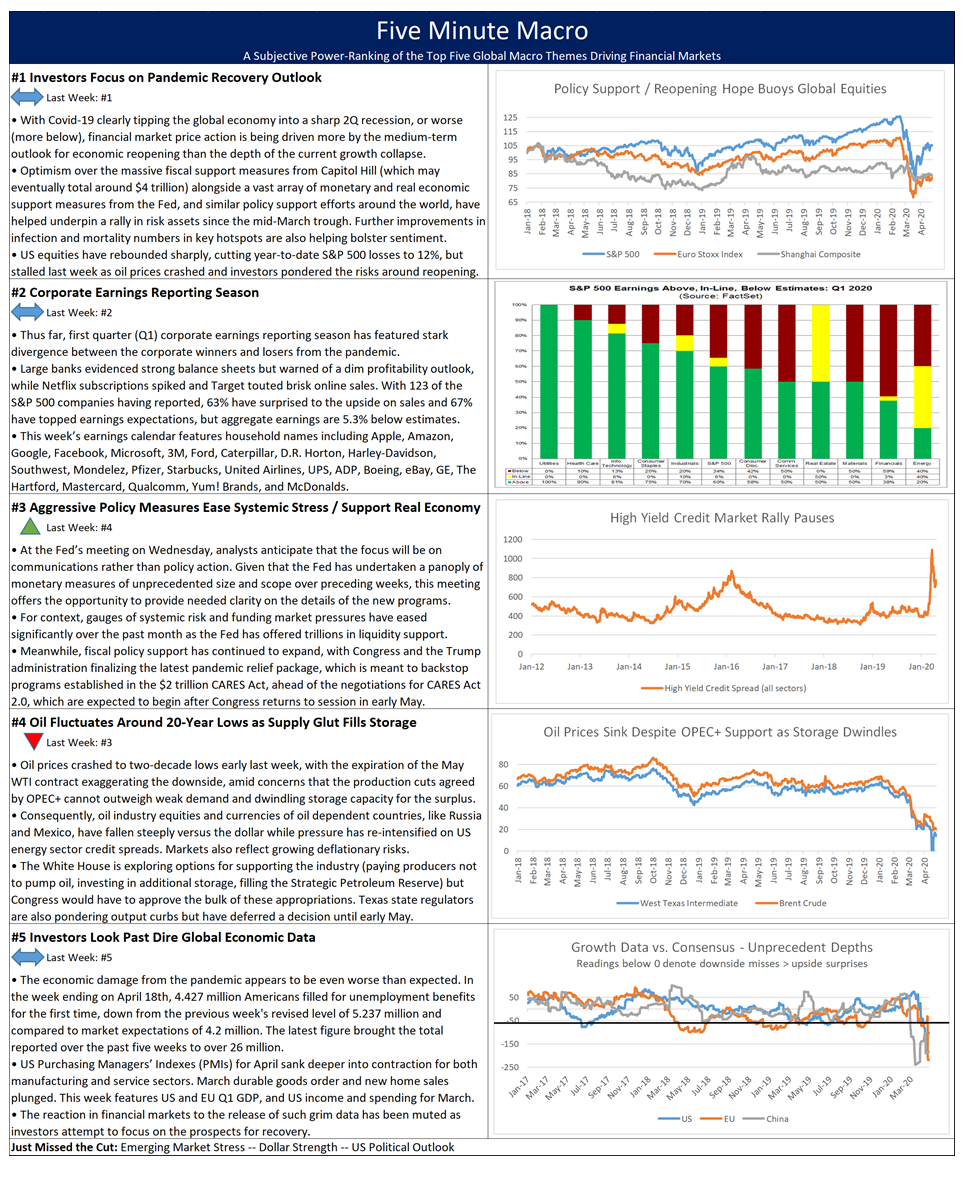

Policy Support in Focus Ahead of the Fed Meeting

With market participants citing aggressive monetary and fiscal policy actions as key factors underpinning the improvement in sentiment and market function over the past few weeks, Fed communications at its meeting this week are set to convey details of enacted programs. The FOMC will convene on Wednesday at a regularly scheduled meeting, and analysts anticipate that the focus will be on communications rather than actual policy action. Given that the Fed has undertaken a panoply of monetary measures of unprecedented size and scope over preceding weeks, this meeting offers the opportunity to provide needed clarity on the progress of the newly enacted programs. For context, gauges of systemic risk and funding market pressures have eased significantly over the past month as the Fed has offered trillions in liquidity support. Meanwhile, fiscal policy support has continued to expand, with Congress and the Trump administration finalizing the latest pandemic relief package, which is meant to backstop programs established in the $2 trillion CARES Act, ahead of the negotiations for CARES Act 2.0, which are expected to begin after Congress returns to session in early May. This latest bill provides an additional $320 billion for the Small Business Administration’s pandemic relief loan facility, the Payroll Protection Program (PPP), of which $30 billion is set aside for smaller banks and credit unions and another $30 billion will be funneled through even smaller lenders. Additionally, $60 billion will go to additional Economic Injury payouts, $75 billion to hospitals, and $25 billion to fund testing efforts, $18 billion of which is directly to states’ testing efforts.

Additional Themes

Reopening Plans in Focus – With Covid-19 hotspots showing a flattening of infection rates, government planning for restarting some segments of the economy, social life, etc. are helping boost sentiment. With lags in economic data, however, analysts’ ability to measure the progress of recovery will be uneven. Over the coming months, the most important metric will remain the infection rates in areas that have begun to reopen. Any significant re-intensification of Covid-19 transmission in places like New York and Italy, or even worse a return to lockdown as experienced in Singapore, would dent investor confidence. A NABE survey showed estimates for business to return to normal ranging from 5-8 weeks all the way out to 3-6 months.

Bank of Japan (BoJ) Augments Policy Support – The yen posted moderate gains versus the dollar, Japanese government bonds (JGBs) were steady, and the Nikkei outperformed overnight after the BoJ pledged to buy unlimited JGBs to achieve its policy goals, upped its cap on corporate bond buying to ¥20 trillion, and increased an emergency liquidity program for banks. For context, Japan has suffered an acceleration in Covid-19 infections recently.