|

Market Reports

Morning Markets Brief 4-21-2020

Summary and Price Action Rundown

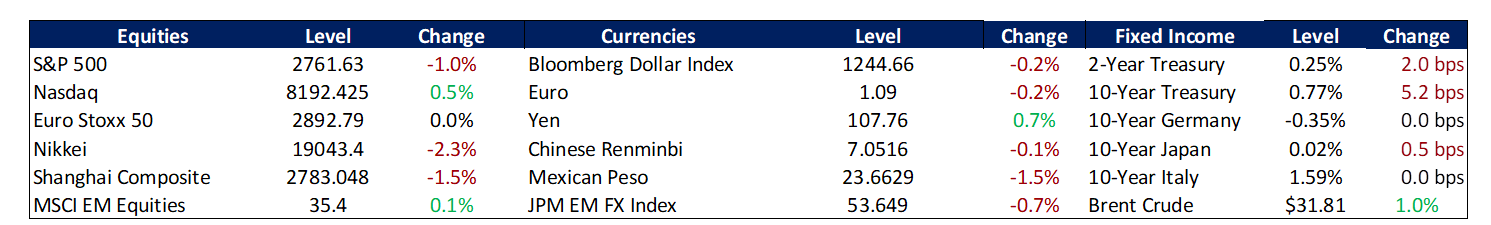

Global risk assets remain under pressure this morning as disorderly downside continues for oil prices, while mixed corporate earnings and heightened policy and geopolitical uncertainty also weigh on market sentiment. S&P 500 futures indicate a 1.5% lower open, which would extend yesterday’s 1.8% decline that put year-to-date downside at 12.6% and the decline from February’s record high at 16.6%. Global equities had extended their rebound from mid-March lows last week as investors focused on the potential for economic recovery amid improving coronavirus containment data and hopes for an effective treatment, alongside massive fiscal and monetary stimulus. But other asset classes, such as crude oil, failed to validate equities’ apparent optimism and this week’s stunning crude price declines have contributed to a renewed sense of risk aversion. Oil remains under severe pressure after the expiring May contract for US benchmark WTI crashed into unprecedented negative territory yesterday. EU stocks are down more than 2% this morning and Asian equities were uniformly lower overnight. Longer duration Treasury yields continued to edge down toward historic lows, with the 10-year yield at 0.58%, while a broad dollar index is extending yesterday’s rebound.

Crashing Oil Prices Exert Pressure on Global Markets

Accelerating downside in crude futures has reverberated across asset classes this week, highlighting the grim outlook for demand. International benchmark Brent crude and US benchmark WTI prices posted dramatic losses yesterday, with the changeover from the WTI contract from May to June exaggerating the slide and sending prices negative for the first time for the expiring WTI contract. Crude prices remain under pressure this morning. Currencies of oil dependent countries, like Russia and Mexico, have depreciated sharply versus the dollar and pressure has intensified on US energy sector credit spreads. For context, oil prices had rebounded from nearly 20-year lows in early April as OPEC, Russia, and other major producers (collectively known as OPEC+) ended the price war and agreed to reduce supply by 10 million barrels per day over the next two months. Still, traders clearly believe that even these significant production cuts cannot balance the dramatically oversupplied oil market, which has seen demand collapse amid the coronavirus pandemic. Meanwhile, Texas regulators continue to debate output curbs. The White House is exploring options for supporting the industry (paying producers not to pump oil, investing in additional storage solutions, filling the Strategic Petroleum Reserve) but Congress would have to approve the bulk of these appropriations.

Corporate Earnings Provide Little Optimism on the Outlook

This second week of first quarter (Q1) corporate earnings season features a more diverse group of companies than last week, offering insight on the divergent impact of the pandemic. United Airlines expects to report a $2.1 billion pretax Q1 loss, showing the impact that the pandemic had on airlines in March. United has applied to the Treasury Department to borrow as much as $4.5 billion, and if so, would issue warrants for the Treasury to buy 14.2 million shares at $31.50 per share, about 5.7% of shares outstanding. The loan would be in addition to the roughly $5 billion in grants and loans that United expects to receive under the Payroll Protection Program (PPP) to pay salaries and benefits this summer. Under that arrangement, United will issue warrants for the Treasury to buy up to 4.6 million shares. United shares fell 4.4% yesterday and are down 68.5% year-to-date. Meanwhile, oilfield services giant Halliburton reported a $1 billion Q1 loss and warned that bleak conditions in the shale patch would depress its results for the rest of the year. Shares of Halliburton posted a moderate gain but remain 68.8% lower this year. Lastly, subprime auto lender ALLY Financial reported a downside earnings surprise, driven by a major loan loss provision build related to a weakened customer credit outlook. Shares ended the day 2.2% lower. With 54 of the S&P 500 companies having reported, 70% have surprised to the upside on sales and 68% have topped earnings estimates.

Additional Themes

US Policy Action in Focus – The Senate is poised for a vote today, and the House may follow on tomorrow, on a bill for roughly $500 billion that will provide an additional $250 billion for the Small Business Administration’s pandemic relief loan facility, the PPP, as well as funding for hospitals and states. For context, the PPP hit its $349 billion limit last week and is now out of money. Meanwhile, analysts are pondering President Trump’s tweet last evening announcing an Executive Order to temporarily suspend all immigration to the US. This comes amid reports that the White House is preparing to slash federal regulation of business activities.

North Korea Headlines Noted – The South Korean won lagged regional peers overnight, but declines were still modest at 0.7% versus the dollar, amid reports claiming that North Korean leader Kim Jong Un is critically ill and incapacitated. If the reports prove true, the question of succession in the repressive regime greatly increases regional geostrategic uncertainty.

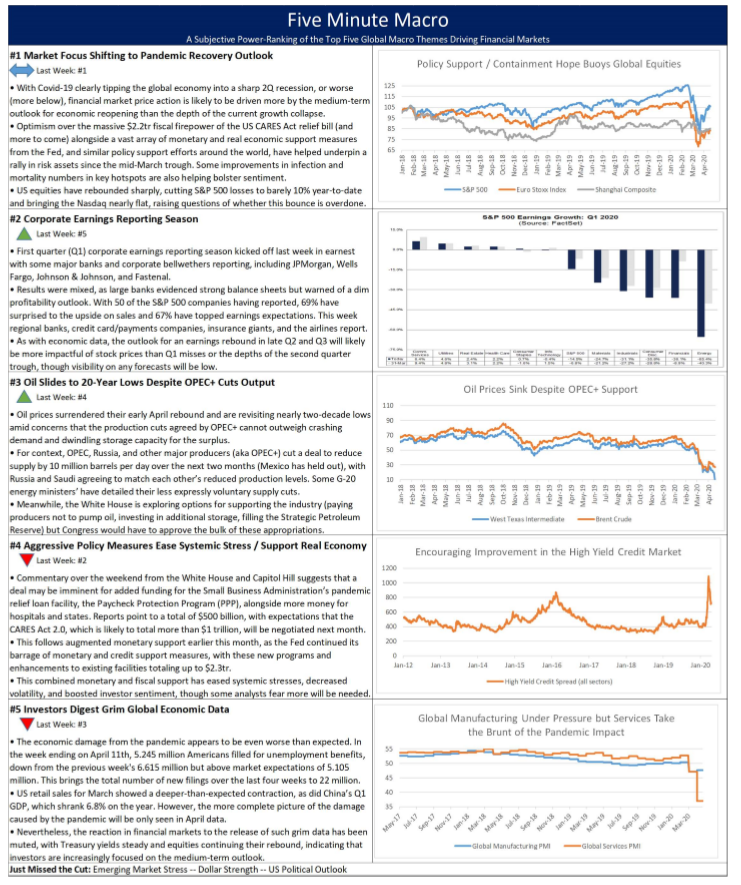

Five Minute Macro 4-20-2020

This week the market is shifting its focus to the Recovery Outlook as First Quarter Earnings provide insights from companies. Oil prices continue to Slide to 20-Year lows despite cuts from OPEC +. Aggressive Policy Measures continue to Ease Systemic Stress and Support the Real Economy but Global Data Continues to Look Grim.

Morning Markets Brief 4-20-2020

Summary and Price Action Rundown

Global risk assets are retracing a portion of last week’s upside this morning as investors continue to monitor mixed corporate earnings and renewed downside for oil prices. S&P 500 futures point to a 1.8% lower open, which would pare last week’s 3.0% rally that put year-to-date downside for the index at 11.0% and the decline from February’s record high at 15.1%. Global equities had extended their rebound from mid-March lows last week as investors focused on the potential for economic recovery amid improving coronavirus containment data and hopes for an effective treatment, alongside massive fiscal and monetary stimulus. However, other asset classes, such as crude oil, failed to follow equities’ lead, and a more cautious tone is returning to markets this morning. EU stocks are more than 1% lower this morning and Asian were mixed overnight. Longer duration Treasury yields remain near historic lows, with the 10-year yield at 0.63%, while a broad dollar index is rising above one-month lows. Oil is conspicuously weak as international benchmark Brent crude is sliding and US benchmark WTI has crashed lower to $12 per barrel.

Oil Prices Extend Dispiriting Post-OPEC+ Agreement Declines

Détente between Russia and Saudi and a renewed OPEC+ output cut agreement appears to have provided modest support for international oil prices, but US benchmark WTI remains under significant pressure as traders focus on persistent oversupply and dwindling storage. After revisiting nearly two-decade lows in late March, international benchmark Brent crude and US benchmark WTI prices rebounded in early April as traders weighed production cuts versus crashing demand, but they have since relapsed to the downside, with WTI now at its lowest level since the late 1990’s. For context, OPEC, Russia, and other major producers (collectively known as OPEC+) cut a deal to reduce supply by 10 million barrels per day over the next two months (Mexico has held out), with Russia and Saudi agreeing to match each other’s reduced production levels. Various G-20 energy ministers’ have detailed their less expressly voluntary supply reductions. Analysts had questioned whether even these significant production cuts can balance the dramatically oversupplied oil market, which has seen demand collapse amid the coronavirus pandemic. The discouraging rollover in oil prices after the agreement validated the pessimistic view. Meanwhile, Texas regulators have not been able to find consensus on output curbs. The White House is exploring options for supporting the industry (paying producers not to pump oil, investing in additional storage solutions, filling the Strategic Petroleum Reserve) but Congress would have to approve the bulk of these appropriations.

Corporate Earnings Reporting Continues Amid High Uncertainty

This second week of first quarter (Q1) corporate earnings season is set to feature a more diverse group of companies than last week, which was dominated by financial giants, thus offering insight on the divergent impact of the pandemic among various sectors and companies. With 50 of the S&P 500 companies having reported, 69% have surprised to the upside on sales and 67% have topped earnings expectations. Major US banks dominated the earnings calendar last week, and reporting from the financial sector continues this week, featuring a heavy dose of regional bank including M&T Bank, Zions, Comerica, and Fifth Third. Credit card and Payments companies, including Discover, Capital One, American Express, PayPal and Synchrony, will provide a look into the state of the consumer. The insurance sector also begins reporting with Chubb, Travelers, and Aon. Asset managers on the calendar include T. Rowe Price and Franklin. Among the non-financial companies reporting are Haliburton, Coca-Cola, Netflix, Biogen, CSX, Quest Diagnostics, AT&T, Amazon, Intel, and T-Mobile. Finally, with billions approved by Congress for an airline bailout, there will be a heightened focus on earnings reporting from American Airlines, United Airlines, Southwest.

Additional Themes

Topping Up the PPP – Commentary over the weekend from the White House and Capitol Hill suggested that a deal may be imminent for additional funding for the Small Business Administration’s pandemic relief loan facility, the Paycheck Protection Program (PPP). For context, the PPP hit its $349 billion limit last week and is now out of money as Republican and Democrat leadership in Congress struggle to agree on how to top up its funds. Republicans have pushed for a stand-alone bill that would include $250 billion in additional money for the PPP while Democrats are seeking $100 billion for hospitals, $150 billion for states, and a boost in food assistance funding. Reports suggest that the deal is closer to the latter at $500 billion.

Reopening the Country – Last week, debate began to intensify in the US and EU about the roadmap for restarting certain activities and easing lockdown restrictions, and investors continue to ponder the outlook for this process. Some US governors took early initiative, while analysts warily note the experience of Singapore, where a secondary outbreak has occurred.

Morning Markets Brief 4-17-2020

Summary and Price Action Rundown

Global risk assets are sharply higher this morning as encouraging news on a potential treatment for Covid-19 is underpinning hopes for a more rapid recovery, while investors continue to monitor mixed corporate earnings and deeply depressed economic data. S&P 500 futures indicate a 3.2% higher open, which would extend yesterday’s rally that put year-to-date downside at 13.4% and the decline from February’s record high at 17.3%. Risk assets surged higher last evening following reports that remdesivir, the anti-viral drug produced by Gilead, may be showing promising results in some patients, though the company stressed that trials have not been finalized. EU and Asian equities posted robust gains overnight. Longer duration Treasury yields, however, remain unmoved, with the 10-year yield at 0.64%, while a broad dollar index is hovering above one-month lows. Lastly, oil is mixed as international benchmark Brent crude rallies but US benchmark WTI sinks as traders parse divergent supply outlooks.

Investors Focus on Recovery Prospects Despite Dire Economic Data

US jobless data was worse than expected but still better than the prior week, while Chinese economic data revealed a steep first quarter (Q1) contraction. Overnight, China released its Q1 GDP figures, which showed a stunning degree of retrenchment, as the -6.8% y/y rate significantly undershot estimates of -6.0%. China’s March retail sales and industrial production contracted 15.8% y/y and 1.1% y/y, respectively, with the latter outpacing estimates but the former a notable disappointment. US data was similarly dismal. In the week ending on April 11th, 5.245 million Americans filled for unemployment benefits, down from the previous week’s 6.615 million and above market expectations of 5.105 million. The brings the total number of new filings over the last four weeks to 22 million. The four-week moving average jumped to an all-time high of 5.509 million, while continuing jobless claims hit a record 11.976 million in the week ended April 4th. US housing data also evidenced weakness, as housing starts plunged 22.3% month-over-month (m/m) to a seasonally adjusted annual rate (SAAR) of 1.216 million in March and below market expectations of 1.3 million. Meanwhile, building permits fell 6.8% (m/m) to a SAAR of 1.353 million, slightly above market expectations of 1.3 million.

Corporate Earnings Continue to Convey Mixed Signals

Results from this week’s start of first quarter (Q1) corporate earnings season highlight the starkly divergent impact of the pandemic on various sectors and companies. Yesterday, Morgan Stanley’s shares closed flat after reporting Q1 earnings per share (EPS) at $1.01, missing expectations of $1.14 and down 27% year-on-year (y/y). However, investors focused on strong trading revenues, up 30% on a yearly basis, with increased activity due to market volatility. In contrast to Morgan Stanley, shares of Keycorp fell 5.5% as earnings plunged 69% compared to a year ago. Q1 EPS was disappointingly low at $0.12, well below estimates of $0.28. Losses deepened during the earnings call, as management detailed the dim credit outlook, risk that the bank will have to significantly increase their reserves in coming quarters, and concern that its net interest margin will be hurt more than competitors. Contrasting the earnings of Keycorp and Morgan Stanley shows the difference between being a bank that makes its earnings on net interest margin and one that has investment banking. Meanwhile, Costco is raising its quarterly dividend by 7.7% to 70 cents per share, in contrast to much of the major global companies which have suspended cash returns to shareholders to shore up liquidity. In the face of stay-at-home orders, grocery retailers and some packaged-food companies have seen sales surge in recent weeks. Last week Costco reported a 9.6% jump in March comparable sales and joins Procter & Gamble and Johnson & Johnson which also raised their dividends earlier this week. Schlumberger and State Street report today, while next week features Netflix, Coca Cola, Intel, American Express, IBM, and some major US airlines.

Additional Themes

Reopening the Country – Yesterday, the White House released guidelines for restarting some activities around the country as infect rates level off, which feature a gradual three-phase and state-by-state approach. Public health officials continue to stress that wider testing and other data, like contact tracing and symptom tracking, are crucial for guiding policymakers’ efforts to restart portions of the economy and society but are currently lacking in much of the US.

PPP Out of Money – The Small Business Administration’s pandemic relief loan facility, the Paycheck Protection Program (PPP), hit its $349 billion limit yesterday and is now out of money as Republican and Democrat leadership struggle to agree on how to top up its funds. Republicans want to pass a stand-alone bill that would include $250 billion in additional money for the PPP while Democrats want to add in $100 billion for hospitals, $150 billion for states and a boost in food assistance funding. The impasse will last until at least Monday, when the Senate is next expected to convene for another “pro forma” session.

Looking Ahead – Twelfth of Never 4-9-2020

Looking Ahead – Twelfth of Never

This week featured some brightening glimmers of hope from the frontlines of the battle against the coronavirus pandemic – flattening infection curves and encouraging declines in mortality rates in a few key Covid-19 hotspots, as well as some (cautious) indications from respected public health officials that while the worst may not yet be behind us, the trends are showing the way to real improvement over the coming weeks and months. Some of the grimmest estimates for the human toll of the virus are being revised lower and the race for a vaccine is supplying a dose of hope that the world will be back to the status quo ex ante soon enough.

The narrative of a quick return to normal is understandably harder to believe for individuals that are over 50, are immunocompromised, or have family members under the same roof that fall into those vulnerable categories – for these many millions of Americans, the light at the end of the tunnel is far more distant. Even for the young and healthy, much care must still be taken in resuming normal activities lest secondary infection spikes occur. This dispiriting second wave of Covid-19 has hit Singapore, for instance, despite robust testing data, contact tracing, symptom tracking, etc. all of which is still a work in progress here in the US.

There is broad criticism that not enough was done in the US to prepare for a pandemic of this magnitude and policymakers cannot afford to compound the problem by failing to plan for the possibility of a “long tail” of the virus fighting effort, as we discussed in last week’s Looking Ahead. Fed liquidity provisions may be unlimited but they cannot solve a private sector and household solvency crisis. Muscular fiscal expenditures can provide an offset but, for example, with only a relatively small percentage of US small businesses able to access the PPP loans, and an average loan size of $150k, it is easy to see how more long-range planning will be needed if the economy is only able to recovery gradually and fitfully, as overseas evidence suggests.

The White House and Congressional leaders have already flagged infrastructure spending as a potential part of the pandemic relief packages, but more immediate needs, like topping up the small business lending facility, have pushed it down the list of priorities thus far. We believe infrastructure will not fall off the agenda this time and should be a feature in CARES 2.0 – but in what form?

“Infrastructure week” has been a laugh line in DC for the past few years, as anyone with an appreciation of the impaired political incentives, lengthy timelines, technical challenges, and myriad of other difficulties knows just how impossible a major federal infrastructure program has seemed, beyond another run-of-the-mill highway bill. We too believed that a major federal infrastructure push would not happen until the twelfth of never, but that is what time it is now.

Wrangling over allocation of trillions of dollars among specific projects is a bridge too far (pardon the pun) and giving money to the states directly for infrastructure outlays would understandably see that cash spent to fill short-term budgetary gaps. The Treasury should instead seek relatively more modest funding to establish a federal infrastructure bank as part of the CARES 2.0 package, find some office space for it at 1500 Pennsylvania and start staffing it up, doing planning, identifying projects, seeking approvals, etc. This is less splashy than a big dollar amount but more effective over the medium-term. Anyway, the projects themselves are too long-range to be part of any short-term relief but would come in very handy if the US economic restart needs some additional impetus six months to a year from now.

Critics say that it is impossible to start infrastructure projects in the middle of a pandemic, and they are right – the long timelines involved in these massive undertakings ensure that the infection peak will be behind us before anything really gets going on the ground (nothing is shovel-ready, as the Obama administration discovered). And what better time to fix public transportation when far fewer people are taking it or bridges and roads when there is less traffic? The same goes for our parks and recreation areas. Anyone who has tried to do a video conference for work while their children are engaged in remote-learning on their iPads knows connectivity is a big issue. The list of needs is long, as everyone knows.

In short, planning for adverse medium-term economic outcomes is not defeatist – it is prudent. There is an unacceptably high risk that the massive job losses we are experiencing will extend into a more chronic condition. Infrastructure can be part of the solution, but the groundwork needs to be started as quickly as possible. And if not now, then truly never.

Looking ahead to next week, US and China economic data is in focus. Stay safe and well!

- US Economic Data

- Bank of Canada

- China Economic Data

US Economic Data: Brace for impact

The Covid-19 shutdown has made certain datapoints more important than in the past, MBA Mortgage Applications, being a perfect example, which will be released on Wednesday. In the week ended April 3rd applications declined 17.9%, following a 15.3% rise in the previous week. Refinance applications dropped 19.4% and applications to purchase a home fell 12.2%, the lowest since 2015.

Later in the morning Retail Sales for March will be the focus of the market. February sales dropped 0.5% month-on-month (m/m), following an upwardly revised 0.6% increase in January and missing market expectations of 0.2%. This was the largest decline in trade since December 2018, as consumers cut back spending on a range of products, including motor vehicles & parts, furniture, electronics & appliances, building materials and clothing. Receipts also declined at gasoline stations and restaurants & bars. Excluding automobiles, gasoline, building materials and food services, retail sales were unchanged after increasing by 0.4% in January.

Industrial Production for March follows. IP in February increased by 0.6% m/m, recovering from a revised 0.5% in January. Manufacturing activity edged up 0.1%, boosted by a large gain for motor vehicles and parts, while production of civilian aircraft fell sharply. In addition, utilities output jumped 7.1%, as temperatures returned to more typical levels following an unseasonably warm January.

Wednesday also includes the NAHB Housing Market Index for April. March fell to 72 from 74 in February. The current single-family sub-index declined to 79 from 81; the sub-index for home sales for the next six months dropped to 75 from 79 and prospective buyers also went down to 56 from 57. It is important to note that half of the builder responses were collected prior to March 4, so the recent stock market declines and the rising economic impact of the coronavirus will be reflected more in this report.

Thursday brings the now all-important Initial Jobless Claims. In the week ended April 4th, the number of 6.6 mil Americans filed for unemployment benefits, compared to the previous week’s record high of 6.87 mil, well above expectations of 5.25 mil. The latest increase brought the total reported in the last three weeks to close to 17 mil, as the coronavirus crisis deepened. Continuing jobless claims hit 7.46 mil in the week ended March 28th, also the highest on record. The last week’s number may be underestimated as many states are struggling to process high volumes of claims.

Bank of Canada: Rates gone south in the great white north

Wednesday brings the Bank of Canada (BoC) Interest Rate Decision. On March 27th the BoC slashed its benchmark interest rate by 50bps to 0.25% in an emergency meeting. The move follows a similar margin cut on March 13th and brings borrowing costs to its effective lower bound aiming to support the economy and the financial system amid the coronavirus pandemic. The Committee also launched a Commercial Paper Purchase Program to help to restore a key source of short-term funding for businesses and said that will begin acquiring government securities in the secondary market until the economy recovers. Policymakers added that they are closely monitoring economic and financial conditions, in coordination with other G7 central banks and fiscal authorities and will take further action if necessary.

Chinese Economic Data: GDP = growth destroying pandemic

On Monday we will begin with China Balance of Trade and Foreign Direct Investment (FDI) data for March. February unexpectedly showed a trade deficit of $7.09 bil in January-February 2020, missing market expectations of a surplus of $24.6 bil. This was the first trade gap since March 2018, reflecting the severe impact of the rapid spread of COVID-19 outbreak to the country’s economy. Year-on-year, exports slumped 17.2% to $292.5 bil, while imports shrank 4% to $299.54 bil. China’s trade surplus with the US for the first two months of the year stood at $25.37 billion, much lower than a surplus of $42.16 billion in the corresponding period a year earlier. Meanwhile, FDI tumbled 8.6% y/y $19.26 bil, in the first two months of 2020 due to Covid-19 outbreak and the Lunar New Year holiday. For February, FDI plunged 25.6%.

Thursday’s focus will be on First Quarter 2020 Chinese GDP. In the fourth quarter 2019 the Chinese economy grew 6.0% y/y, the same as in the previous quarter. This remained the weakest growth rate since the first quarter of 1992, amid trade pressure from the US and sluggish demand from home and abroad. For the full year 2019, the economy grew by 6.1%, the slowest pace in 29 years, but still within the government’s target of 6 to 6.5%. Consensus expectations are for growth to remain at 6%.

Afternoon Markets Brief 4-13-2020

Summary and Price Action Rundown

US equities retraced a portion of their steep gains of last week, as investors digest the recent barrage of fiscal and monetary support, the OPEC+ deal, and mixed public health data while awaiting corporate earnings reports. The S&P 500 slipped 1.0% today, shaving its historic rebound of 12.1% last week, putting year-to-date downside for the index at 14.5% and the decline from February’s record high at 18.4%. Last month’s acute volatility has subsided somewhat amid supportive monetary and fiscal policy measures, with bouncing oil prices also lifting sentiment, although uncertainty over pandemic containment and economic recovery prospects persist. EU stock markets remain closed for a holiday and Asian equities were mixed overnight. Treasury yields edged higher, with the 10-year yield at 0.77%. Importantly, the dollar continued to slide below its mid-March multi-year peak. Meanwhile, oil prices remained supported as global leaders talked up the OPEC+ decision (more below).

Earnings Season Set to Begin with Investors Bracing for Downside and Uncertainty

Investors are understandably cautious about first quarter (Q1) corporate results as they await details from management on the depth of the current contraction and plans for navigating what is likely to be a tricky recovery. Earnings reporting season kicks off tomorrow in earnest with some major banks and corporate bellwethers reporting, including JPMorgan, Wells Fargo, Johnson & Johnson, and Fastenal. Most major US financials will report throughout the remainder of the week, including Bank of America, BlackRock, Goldman Sachs, and Citigroup. Analysts anticipate choppy figures and high uncertainty regarding managements’ outlook for coming quarters. Overall Q1 earnings growth for S&P 500 companies has been slashed from 4.4% coming into this year to -5.4% versus Q1 last year. Energy companies have seen the largest downgrades, along with industrials and consumer discretionary. As with economic data, the outlook for an earnings rebound in late Q2 and Q3 will likely be more impactful of stock prices than Q1 misses or the depths of the second quarter trough, though visibility on any forecasts will be low. – MPP view: Our view is that stock price reactions to Q1 earnings will probably be relatively more dependent on the background atmospherics of the market, which depend in large part on the public health data coming out over the coming week, as well as the state of the debate on reopening the economy (more below).

Oil Prices Continue Higher as the White House Talks Up the OPEC+ Deal

Brent crude fluctuated near its highest level in nearly a month after OPEC, Russia, and other major oil producers agreed to historic production curbs over the weekend, but some analysts still forecast continued oversupply. After revisiting nearly two-decade lows in late March, international benchmark Brent crude and US benchmark WTI prices have staged a choppy uptrend over the past week as traders have weighed production cuts versus crashing demand. After Thursday’s virtual meeting, OPEC, Russia, and other major producers (collectively known as OPEC+) cut a deal to reduce supply by 9.7 million barrels per day over the next two months, with Russia and Saudi agreeing to match each other’s reduced production levels. Mexico held out but eventually agreed to a more modest supply cut than their peers. Saudi also hosted talks with G-20 energy ministers over the weekend, which resulted in the US, Brazil, and Canada acknowledging output declines, though these are characterized as distinct from OPEC’s voluntary reductions. Today, President Trump and Saudi officials suggested that the cuts, combined with filling petroleum reserves, the total effective supply reductions/diversions will be nearly 20 million barrels per day. Still, analysts question whether even these large production cuts can balance the dramatically oversupplied oil market, which has seen demand collapse amid the coronavirus pandemic. – MPP view: Durable stabilization of oil prices would be a win (so far so good), and there is no reason not to jawbone crude prices higher. We’ll see what Texas comes up with in the next few days as they discuss curbs for the shale patch, which would be a welcome surprise, but isn’t likely.

Additional Themes

Debate Over Reopening the Economy Heats Up – President Trump asserted the right of the federal government to declare a reopening of businesses and schools across the US but state governors who responded tended to differ with this assessment. Governors of Washington, California, and Oregon announced that they would be teaming up to jointly strategize about restarting more normal levels of economic, educational, and social activities, as did the governors of New York, New Jersey, Pennsylvania, Delaware, Connecticut, and Rhode Island. Frameworks for reopening will be rolled out over the coming days. This comes amid speculation that Dr. Fauci, who has been a leader of the White House’s Covid-19 task force, may be facing dismissal. The White House denied this speculation and Dr. Fauci today noted that activities could resume “in some ways” in May. Meanwhile, in Europe, the EU Commission is said to be pushing for coordination across its member states on the timing and procedures for restarting the regional economy. – MPP view: Data needs to help inform the policy decisions about relaxing some of the lockdown measures currently in place. Experience overseas shows that a secondary spike in infections is a substantial risk, even where symptom tracking and contact tracing is far more unified and rigorous than it is in the US.

Airline Stocks Relapse Amid Bailout Wrangle – As Treasury Secretary Mnuchin and US airline heads debate the requirements of federal funding support, investors sold the stocks of the carriers today to the tune of 5-8% losses, reversing a modest rally in the sector. Mnuchin is pushing for 30% repayment of the grants within five years and has insisted that this is not a bailout.

Morning Markets Brief 4-16-2020

Summary and Price Action Rundown

Global risk assets are rallying this morning in a continuation of their back-and-forth price action this week, as investors weigh the prospects for economic recovery amid grim April growth figures, mixed corporate earnings reports, continued government support efforts, and modestly encouraging public health data. S&P 500 futures indicate a 0.4% higher open, which would put the index roughly flat for the week after yesterday’s 2.2% decline took year-to-date downside to 13.9% and the decline from February’s record high to 17.8%. Though a leveling off in Covid-19 infection curves, along with aggressive monetary and fiscal support measures, have calmed global financial markets, the outlook for an economic rebound remains shrouded in dismal data, uneven corporate earnings, and uncertainty over government plans to restart business activity. EU stocks are moderately higher, while Asian equities were mixed overnight. Longer duration Treasury yields have returned to nearly historic lows, with the 10-year yield at 0.63%, while a broad dollar index is extending gains above its lowest level in a month. Meanwhile, oil prices are rebounding from yesterday’s dispiriting decline.

Dismal Economic Data Continues but Investors Attempt to Focus on Recovery

Optimism for an impending rebound in growth was shaken after yesterday’s US economic figures proved even worse than the dismal projections, and more grim jobless data is expected this morning. This morning’s release of initial jobless claims for the week ending April 11 is forecast to show 5.5 million new filings after 6.6 million the prior week and roughly 17 million since mid-March. Meanwhile, efforts on Capitol Hill to top up the small business lending program, which is designed to alleviate layoffs, are continuing. Yesterday, the March reading of US retail sales plunged 8.7% month-over-month (m/m), undershooting expectations of an 8% drop. This is the largest decline on record, with purchases of clothing down 50.5%, food services and drinking places down 26.5%, motor vehicles down 25.6% and gasoline stations down 17.2%. However, sales of food and beverages increased 25.6% and health and personal care rose 4.3%. Year-on-year, retail sales fell 6.2%. Industrial production (IP) fell 5.4% m/m in March, the largest drop since January 1946 and below market expectations of a 4.0% drop. Year-over-year IP is down 5.5%, the largest decline since 2009. Pain in the factory sector was also seen in the New York Empire State Manufacturing Index, which tumbled 56.7 points to -78.2 in April, the lowest level on record and well below market expectations of -35.0. Lastly, the NAHB Housing Market Index plunged to 30 in April, the lowest since June 2012 and well below market forecasts of 55. The current single-family index sank to 36 from 79 in March, home sales for the next six months dropped to 36 from 75, and prospective buyers also fell to 13 from 56.

Corporate Earnings Remain Mixed

First quarter (Q1) corporate results continue to highlight the solidity of major US bank balance sheets but suggest a dim profitability outlook. Through the second day of Q1 earnings reporting season, major US banks remain in the spotlight and have provided insights into the economic damage inflicted by the coronavirus. Thus far, the leading US banks have all reported 40%-plus declines in earnings, and have generally seen resulting downside in their stock prices, as they have added billions in reserves to cover their projections for defaults on loans, credit cards and mortgages. Bank of America (BoA) reported Q1 earnings per share (EPS) of 40 cents, missing consensus estimates of 60 cents as the bank added $3.6 billion to its loan loss reserves. However, BoA noted that they ended the quarter with almost $700 billion in global liquidity sources. BoA shares closed 6.4% lower yesterday. Goldman Sachs (GS) stock, however, retraced early losses to end the day nearly flat after the bank reported EPS of $3.11 a share, missing estimates of $3.35, but losses in its debt and equity holdings were balanced by a surge in trading division revenue amid the extreme market volatility in the quarter. GS also set aside $937 in loan loss reserves. Citigroup also saw Q1 revenue fall 46%, with EPS of $1.05 versus $1.87 expected, as they added $4.9 billion in loan loss reserves and the consumer banking division posted a net loss of $754 million for the quarter. Citi shares fell 5.6% yesterday. Morgan Stanley and BlackRock are among the companies reporting today.

Additional Themes

Airlines Mostly Rally on Government Support – Secretary Mnuchin and US airline heads are said to have agreed over federal funding support of $25 billion, lifting industry share prices yesterday, though year-to-date losses remain around 60%. The terms stipulate that 30% of the money must be paid back to the Treasury over five years and give warrants for equity purchases by the government, which airline execs had argued against.

Economic Reopening Plans in Focus – Today, President Trump is expected to detail federal government plans for restarting certain activities as infection rates level off. State governors and consortia of state governors in various regions, are preparing to set their own parameters.

Morning Markets Brief 4-15-2020

Summary and Price Action Rundown

Global risk assets turned lower overnight, as investors monitor corporate earnings reports, government support efforts, and public health data for signals on the prospects for a global economic rebound. S&P 500 futures point to a 1.8% lower open, which would retrace a portion of yesterday’s sharp 3.1% rally that put year-to-date downside for the index at 11.9% and the decline from February’s record high at 16.0%. A leveling off in Covid-19 infection curves, along with aggressive monetary and fiscal support measures, have calmed global financial markets and allowed investors to focus on the tantalizing but uncertain prospects of an economic recovery. EU stocks are underperforming, while Asian equities declined moderately overnight. Treasury yields are turning ominously lower, with the 10-year yield at 0.69%, while a broad dollar index is bouncing from its lowest level in a month. Meanwhile, oil prices are failing to hold their recent gains amid concerns that new supply cuts cannot balance depressed demand.

Corporate Earnings Reporting Season Begins Amid High Uncertainty

First quarter (Q1) corporate results kicked off yesterday on a somewhat mixed note, as analysts lauded the solidity of major US bank balance sheets but registered disappointment on the profitability outlook. JPMorgan Chase reported first quarter earnings per share of 78 cents, compared with analysts’ expectations of $1.84. Profit of $2.87 billion plunged 69% from a year earlier, driven mostly by the provisions, while revenue proved to be more resilient, only declining 3% from a year earlier to $29.07 billion. The earnings drop was caused by a massive $6.8 billion addition to the bank’s credit reserves. The move signals that management expects a surge in defaults across the company’s lending businesses, from credit cards in its consumer division to energy, real estate and retail sector loans in its commercial operations, and that the coming quarters could see more significant reserve builds. JPMorgan shares fell 2.7% on the day. Wells Fargo reported a similar situation to JPMorgan, missing analyst expectations of 33 cents with a profit per share of just 1 cent with a $3.1 billion reserve build and a markdown of impaired securities, sending its shares 4.0% lower. Today, major US financial sector earnings will continue with Bank of America, Citigroup, Goldman Sachs, and PNC Bank. Also yesterday, Johnson & Johnson shares rose by 4.5% after the drugmaker raised its quarterly dividend, even as it cut full-year earnings guidance due to the coronavirus outbreak. Also, UnitedHealth Group shares are up over 1.0% in pre-market trading after solid results this morning.

Government Economic/Business Support Efforts Continue to Expand

The Paycheck Protection Program (PPP), which has been met with a rush of small businesses applying for loans, is set to be augmented and the Treasury Department has reportedly agreed with US airline companies on terms of government assistance. Treasury Secretary Mnuchin and Senate Democratic Leader Schumer are expected to reach a deal this week on an interim coronavirus relief bill that would add $250 billion to the PPP small business lending program. The PPP program is expected to run out of money as early as this week after making loans to a little over a million businesses. Mnuchin is working to focus this legislation on small-business programs, arguing that other issues such as funding for state governments and hospitals should be dealt with separately but has expressed a willingness to compromise. Meanwhile, Secretary Mnuchin and US airline heads are said to have agreed on requirements of federal funding support of $25 billion, lifting industry share prices in pre-market trading. The terms stipulate that 30% of the money must be paid back to the Treasury over five years and give warrants for equity purchases by the government, which airline execs had argued against.

Additional Themes

Oil Sinks Despite Support Efforts – International benchmark Brent crude prices are retracing a portion of their recent rally while US benchmark WTI prices have slumped back to nearly multi-decade lows under $20 per barrel as traders ponder the efficacy of supply cuts to offset the collapse of demand amid the pandemic. A report from the International Energy Agency (IEA) is estimating that the contraction in demand for this year will be over 9 million barrels per day (bpd), wiping out a decade of gains, with a -18% quarter-on-quarter plunge in Q2. It also forecasts that storage for the growing worldwide surplus might run out by mid-year. Yesterday, Texas regulators and industry leaders began a debate over potential output cuts in the state.

Grim Economic Data Continues – The Johnson Redbook Index, which represents over 80% of the Commerce Department’s official retail sales series but is released on a weekly basis, showed that sales dropped 8.3% month-on-month (m/m) and 2% year-on-year (y/y) in the week ending April 11. Sales had been up around 5.5% y/y in January and February and then surged to 9.1% y/y in early March as households stoked up for social distancing. Official March retail sales and industrial production are due today, with forecasts for contractions of 8.0% m/m and 4.0% m/m, respectively.

Morning Markets Brief 4-14-2020

Summary and Price Action Rundown

Global risk assets rose overnight, as investors continue to weigh the prospects for a global economic recovery amid unprecedented fiscal and monetary support, an OPEC+ deal, and hopeful public health data, while awaiting corporate earnings reports. S&P 500 futures point to a 1.1% higher open, which would retrace yesterday’s loss that put year-to-date downside for the index at 14.5% and the decline from February’s record high at 18.4%. A leveling off in Covid-19 infection curves, along with aggressive monetary and fiscal support measures, have calmed global financial markets and allowed investors to focus on the tantalizing but uncertain prospects of an economic recovery. EU stocks are moderately higher after reopening from the extended holiday weekend, while Asian equities mostly posted solid gains overnight. Treasury yields are fluctuating mildly, with the 10-year yield at 0.75%. The dollar is continuing to edge below its mid-March multi-year peak. Meanwhile, oil prices are attempting to hold their recent gains as traders continue to parse the impact of the OPEC+ decision (more below).

Highly Uncertain Corporate Earnings Reporting Season Kicks Off

Investors are understandably wary over first quarter (Q1) corporate results as they await details from management on the depth of the current contraction and plans for navigating what is likely to be a tricky recovery. Earnings reporting season kicks off today in earnest with some major banks and corporate bellwethers reporting, including JPMorgan, Wells Fargo, Johnson & Johnson, and Fastenal. Most major US financials will report throughout the remainder of the week, including Bank of America, BlackRock, Goldman Sachs, and Citigroup. Analysts anticipate choppy figures and high uncertainty regarding managements’ outlook for coming quarters. Overall Q1 earnings growth for S&P 500 companies has been slashed from 4.4% coming into this year to -5.4% versus Q1 last year. Estimates for Q2 are worse, projecting a contraction of 10% year-on-year. Energy companies have seen the largest downgrades, along with industrials and consumer discretionary. As with economic data, the outlook for a rebound in earnings in Q3 and Q4 will likely be more impactful of stock prices than Q1 misses or the depths of the Q2 trough, though visibility on any forecasts will be low.

Policymakers Grapple with Questions Over Restarting Segments of the Economy

Investors are increasingly focused on the outlook for the economic recovery, as significant unknowns and weighty policy decisions loom. Highlighting how contentious this delicate process may become, President Trump asserted the right of the federal government to declare a reopening of businesses and schools across the US but state governors who responded tended to differ with this assessment. Governors of Washington, California, and Oregon announced that they would be teaming up to jointly strategize about restarting more normal levels of economic, educational, and social activities, as did the governors of New York, New Jersey, Pennsylvania, Delaware, Connecticut, Massachusetts, and Rhode Island. Frameworks for reopening will be rolled out over the coming days, but analysts note that the levels of testing, symptom tracking, and contact tracing that other countries have employed in their recovery efforts are not yet similarly available in the US. Meanwhile, in Europe, the EU Commission is said to be pushing for coordination across its member states on the timing and procedures for restarting the regional economy. At this point, projections for growth in the second half of this year are little more than speculation, though economists are continuing to estimate the depth of the Q2 trough. Goldman Sachs is now forecasting a 35% contraction across developed economies for this quarter and the IMF will release their World Economic Outlook later today.

Additional Themes

Oil Prices Under Pressure Despite Support Efforts – International benchmark Brent crude and US benchmark WTI prices are struggling to hold their recent gains this morning as traders ponder the efficacy of supply cuts to offset the collapse of demand amid the pandemic. WTI is underperforming, trading barely above its nearly 20-year low from March, as state industry regulators in Texas meet today to discuss the potential for output curbs, which would mirror efforts by overseas oil producers to support prices. Specifically, OPEC, Russia, and other major producers (collectively known as OPEC+) cut a deal to reduce supply by 9.7 million barrels per day over the next two months, while other G-20 energy ministers also acknowledged output declines. Yesterday, President Trump and Saudi officials suggested that the cuts, combined with filling petroleum reserves, will effectively reduce supply by nearly 20 million barrels per day.

Airline Stocks Relapse Amid Bailout Wrangle – As Treasury Secretary Mnuchin and US airline heads debate the requirements of federal funding support, investors sold the stocks of the carriers yesterday, imposing losses of 5-8%, reversing a modest rally in the sector. The Treasury is pushing for 30% repayment of the funds within five years, and stock warrants worth a percentage of the total support package, and Mnuchin has insisted that this is not a bailout.