Summary and Price Action Rundown

Global risk assets remain under pressure this morning as disappointing earnings reports and intensifying White House rhetoric against China dampen investor sentiment. S&P 500 futures indicate a 0.9% lower open, which would extend Friday’s 2.8% loss that put year-to-date downside at 12.4% and the decline from February’s record high at 16.4%. With Amazon and Apple earnings reports highlighting the challenging outlook, Warren Buffett abandoning his airline holdings, and intensifying White House rhetoric on Chinese culpability for the pandemic, the market mood is cautious. Many overseas equity markets remain closed for holidays but EU stocks reopened to a sharp selloff. Longer duration Treasury yields continue to fluctuate near their lows, with the 10-year yield at 0.60%, while a broad dollar index is turning higher. Crude oil is continuing to retrace a portion of its recent recovery from nearly 20-year lows.

Earnings Releases Closed Last Week on a Downbeat Note

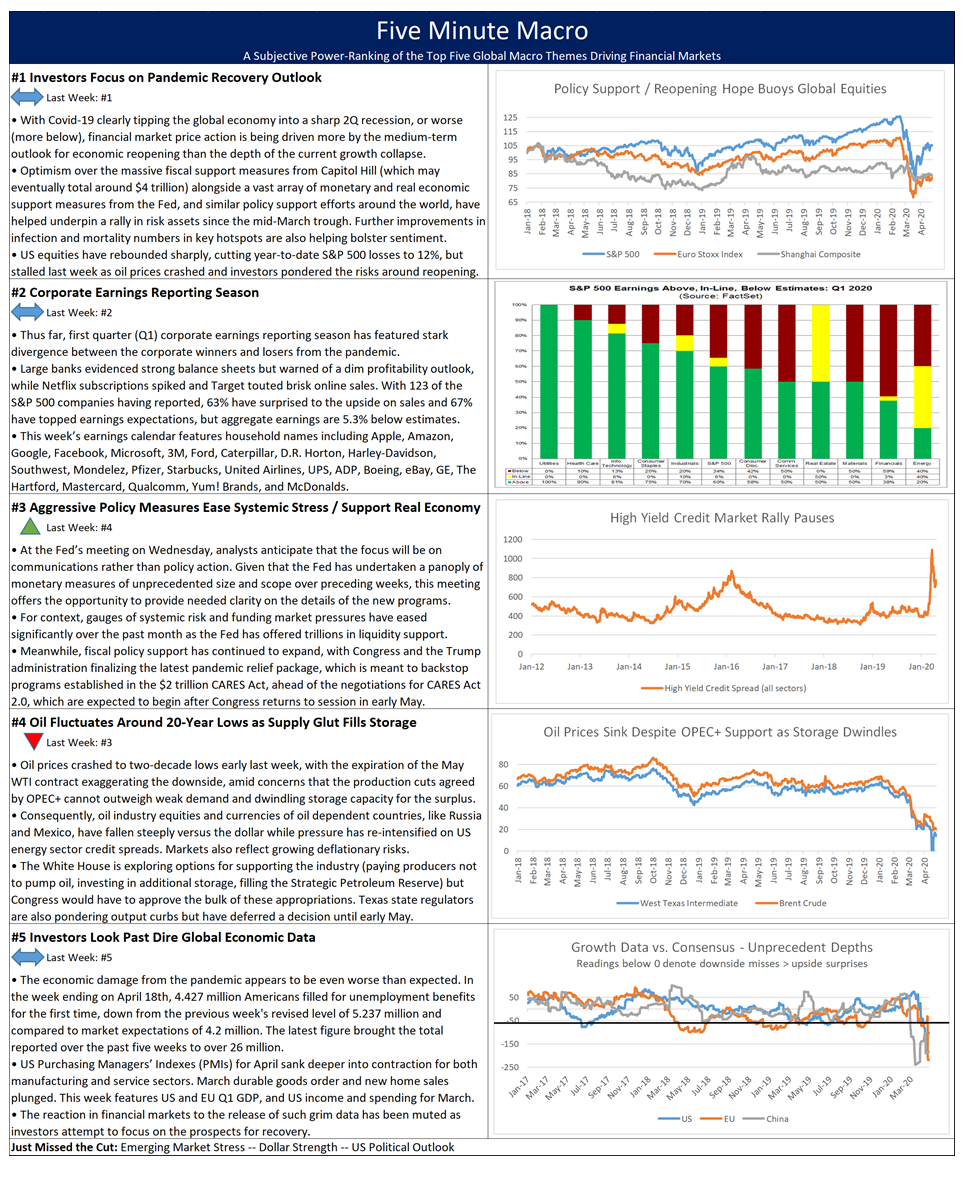

Investors await more first quarter (Q1) earnings results after some underwhelming reports on Thursday and Friday, alongside warnings from Amazon and Apple over the outlook, have rekindled a degree of caution. With Netflix, Google, Facebook, and Microsoft all posting robust Q1 results, analysts had been looking for Apple and Amazon to similarly impress after Thursday’s closing bell. Amazon, however, undershot its earnings estimates, and management provided a sobering outlook for the coming quarters. Meanwhile, Apple topped consensus but reported a decline in iPhone sales and suspended guidance amid scant visibility for the coming quarter. Shares of Amazon and Apple fell 7.6% and 1.6%, respectively, on Friday putting year-to-date performance at 23.7% and -1.6%. Tesla was another high-flier that when into reverse, with shares swooning 10.3% on Friday after CEO Elon Musk tweeted that its valuations were too high, though shares remains up 67.7% on the year. Meanwhile, ExxonMobil fell short on revenues and froze its dividends, sending its shares 7.2% lower on the day to trade -37.5% year-to-date. Colgate-Palmolive topped quarterly projections but withdrew its full 2020 forward guidance amidst the uncertainty from the pandemic. Its shares fell 2.5% on Friday to turn slightly negative for the year. Lastly, Honeywell beat earnings estimates but missed revenue projections while also suspending forward guidance plans for 2020. Honeywell stock sank 3.3% for the day for year-to-date downside of 22.5%. In other corporate news, retailer J. Crew filed for bankruptcy overnight. With 280 of the S&P 500 companies having reported, 63% have surprised to the upside on sales and 69% have topped earnings expectations. Aggregate earnings have come in 0.3% above estimates thus far, though earnings growth is -8.6% year-on-year (y/y). This week features Tyson, AIG, and Shake Shack today, with Allstate, DuPont, Disney, Prudential, Western Union, AvalonBay, CVS, GM, MetLife, and PayPal later this week.

White House Sharpens Rhetoric Against China

In remarks over the weekend, President Trump conveyed a hardening stance against China for its alleged mishandling of the outbreak. Investors are pondering yet another source of uncertainty as President Trump continues to press his case that the Chinese government is culpable for the pandemic, saying “they made a mistake” and “tried to cover it.” He has suggested that tariffs or other retaliatory measures could be applied. Meanwhile, Secretary of State Pompeo over the weekend continued to espouse the theory that the virus emanated from a Wuhan virus lab. President Trump promised a “conclusive” report on the origin of Covid-19, while reports cited a Department of Homeland Security memo alleging that Chinese officials concealed the severity of the initial outbreak in an effort to stockpile medical supplies. This comes after reports last week indicating that the White House is considering an executive order to prevent a US government employee savings plan from investing in Chinese assets.

Additional Themes

Dismal Global Growth Data – Global manufacturing purchasing managers’ indexes (PMIs) for April were broadly depressed, with the final EU reading at 33.4 after registering 44.5 in March. For context, PMI readings above 50 denote expansion in the sector. Asian factory PMIs were similarly depressed. South Korea, despite generally being cited as the most successful example of Covid-19 containment, printed a dire 41.6 for last month. In the US today, investors are bracing for a depressed March readings of factory orders and durable goods orders.

Warren Buffett Dumps Airlines – During the Berkshire Hathaway quarterly earnings call over the weekend, CEO Warren Buffett disclosed that his company had unloaded its stakes in US airlines, citing major changes for the industry. Share prices for the major US carriers are 8-10% lower in pre-market trading despite already being down significantly on the year, with Delta, United, American, and Southwest suffering year-to-date losses of 58.8%, 69.8%, 62.9%, and 45.9%, respectively, as of Friday’s close. Buffett also disclosed that Berkshire Hathaway has not made significant purchases of stocks over the past two months.