This week the Market has Shifted to Pandemic Recovery Outlook, along with the Aggressive Fed Measures to Support the Real Economy in the Face of Grim Global Data. Oil Holds Above $20 as OPEC + Cuts Output and Corporate Earnings Season Begins.

This week the Market has Shifted to Pandemic Recovery Outlook, along with the Aggressive Fed Measures to Support the Real Economy in the Face of Grim Global Data. Oil Holds Above $20 as OPEC + Cuts Output and Corporate Earnings Season Begins.

Summary and Price Action Rundown

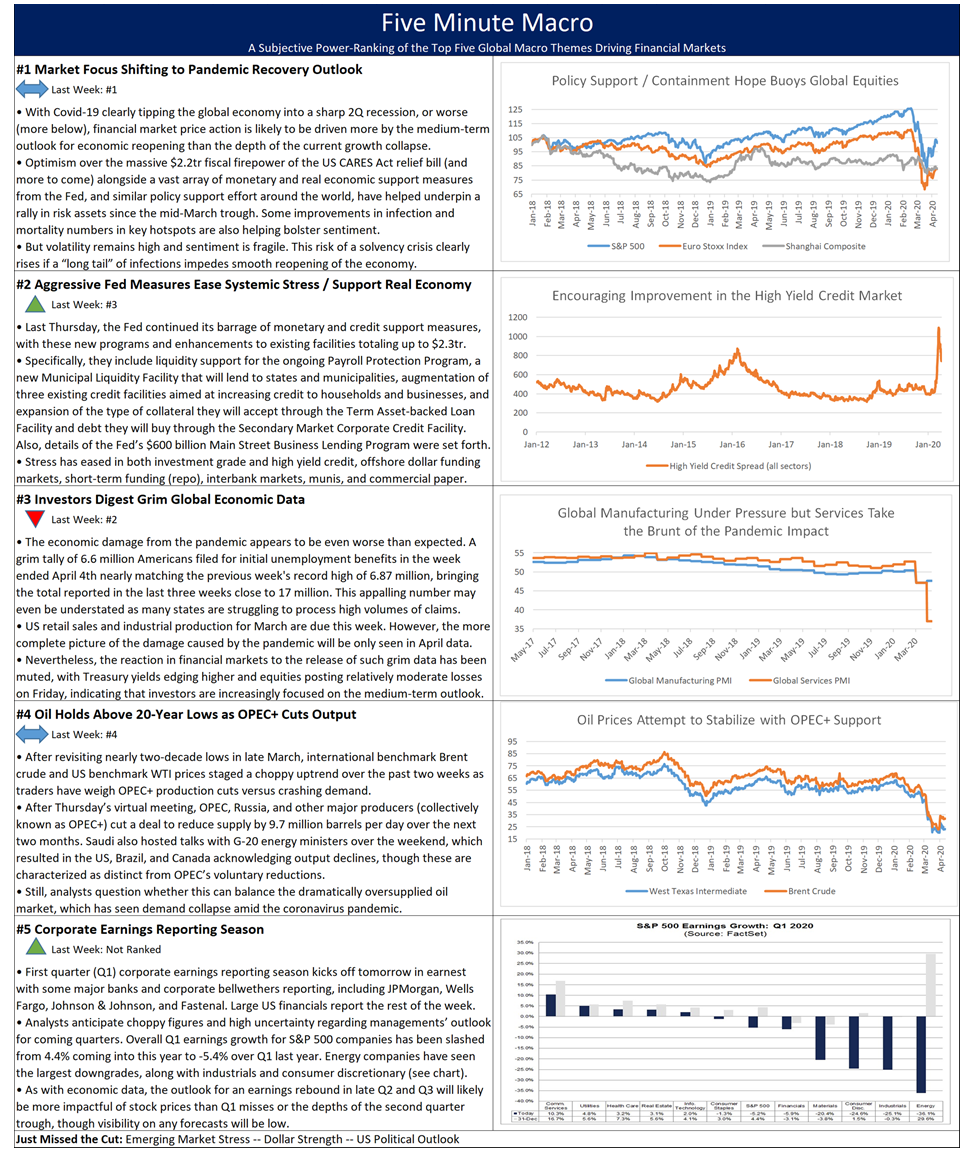

Global risk assets are moderately lower this morning following last week’s steep rally, as investors pause to digest the most recent Fed action and the OPEC deal, while awaiting corporate earnings reports. S&P 500 futures indicate a 0.7% lower open after rebounding 12.1% last week, which put year-to-date downside for the index at 13.7% and the decline from February’s record high at 17.6%. Last month’s acute volatility has subsided somewhat amid supportive monetary and fiscal policy measures, with stabilizing oil prices also lifting sentiment, although uncertainty over pandemic containment and economic recovery prospects persist. EU stock markets remain closed for a holiday and Asian equities were mixed overnight. Treasury yields are flat, with the 10-year yield at 0.72%. The dollar is continuing to slide below its mid-March multi-year peak. Meanwhile, oil prices are fluctuating moderately after their steep rally as traders parse the impact of the OPEC+ decision (more below).

Dramatic Fed Action Keeps Investors Focused on Support Measures

Last week, the Federal Reserve announced muscular new aid programs and augmentations to other facilities to support the US economy during the depression-level contraction of business activity mandated by pandemic containment. Ahead of a scheduled online webinar by Chair Powell last Thursday, the Fed unveiled a large array of new programs, which total up to $2.3 trillion. Specifically, they include liquidity support for the ongoing Payroll Protection Program, a new Municipal Liquidity Facility that will offer up to $500 billion in lending to states and municipalities, augmentation of three existing credit facilities aimed at increasing credit to households and businesses, and expansion of the type of collateral they will accept through the Term Asset-backed Loan Facility. Furthermore, the Secondary Market Corporate Credit Facility will lend, on a recourse basis, to a special purpose vehicle (SPV) that will purchase corporate debt issued by eligible issuers, including individual corporate bonds as well as High Yield ETFs. Also, the details of the Fed’s $600 billion Main Street Business Lending Program show that the loans will be targeted toward businesses with up to 10K employees and less than $2.5 billion in revenues for 2019, while principal and interest payments will be deferred for a year. The Main Street loans will be a minimum of $1 mil and a maximum of either $25 million or an amount that “when added to the Eligible Borrower’s existing outstanding and committed but undrawn debt, does not exceed four times the Eligible Borrower’s 2019 earnings before interest, taxes, depreciation, and amortization,” whichever is less. Rates will be equal to the Fed’s Secure Overnight Financing Rate, currently 0.01%, plus 250-400 basis points with a four-year maturity. A special-purpose vehicle that Fed created jointly with the Treasury Department will purchase 95% of the loan while the financing institution would hold the other 5%.

Oil Steadies as Price War Ends and Further Output Cuts Begin

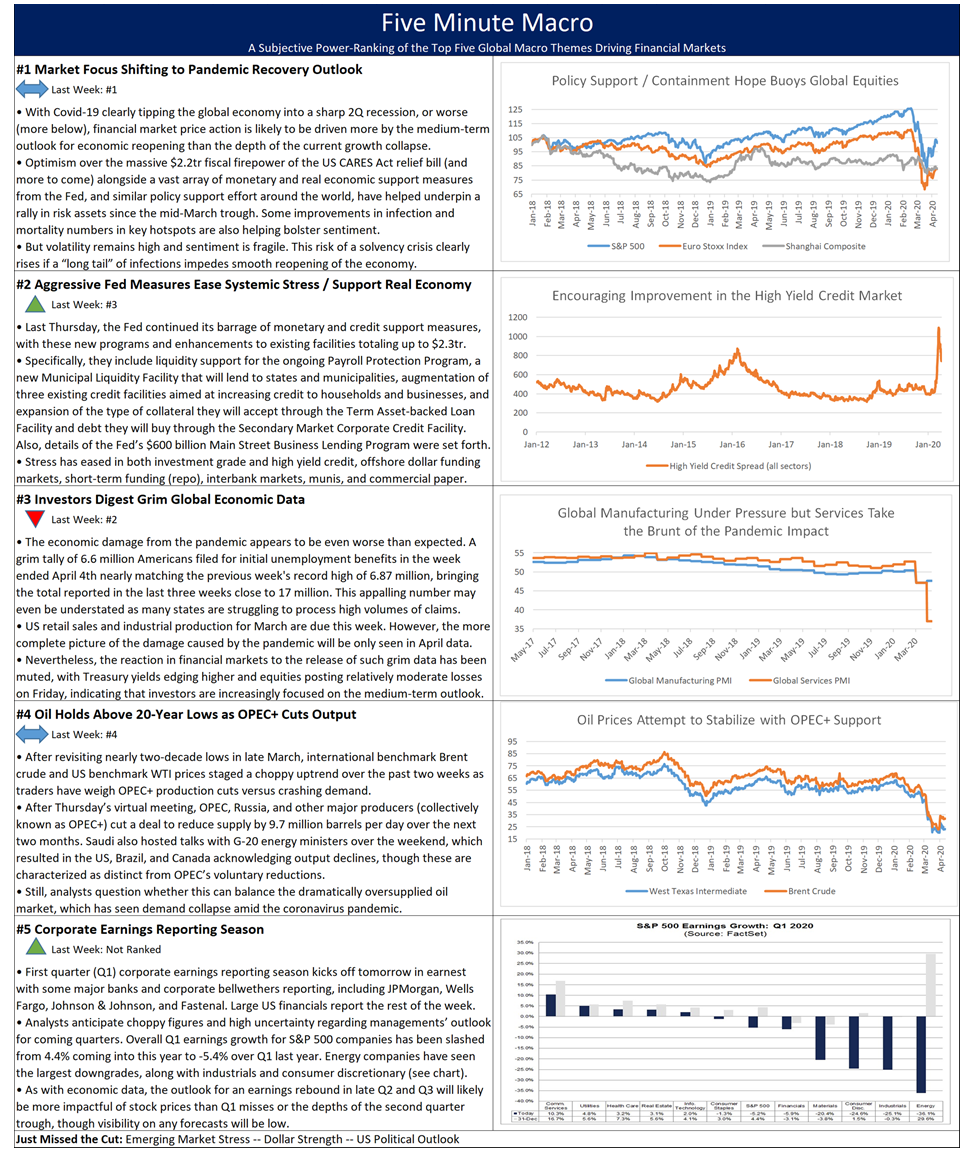

Brent crude is hovering at its highest level in nearly a month after OPEC, Russia, and other major oil producers agreed to historic production curbs over the weekend, but some analysts still forecast continued oversupply. After revisiting nearly two-decade lows in late March, international benchmark Brent crude and US benchmark WTI prices have climbed $9 per barrel and $3 per barrel, respectively, to $31.48 and $22.76, in a choppy uptrend over the past week as traders have weighed production cuts versus crashing demand. After Thursday’s virtual meeting, OPEC, Russia, and other major producers (collectively known as OPEC+) cut a deal to reduce supply by 9.7 million barrels per day over the next two months, with Russia and Saudi agreeing to match each other’s reduced production levels. Mexico held out but eventually agreed to a more modest supply cut than their peers. Saudi also hosted talks with G-20 energy ministers over the weekend, which resulted in the US, Brazil, and Canada acknowledging output declines, though these are characterized as distinct from OPEC’s voluntary reductions. Still, analysts question whether even these large production cuts can balance the dramatically oversupplied oil market, which has seen demand collapse amid the coronavirus pandemic.

Additional Themes

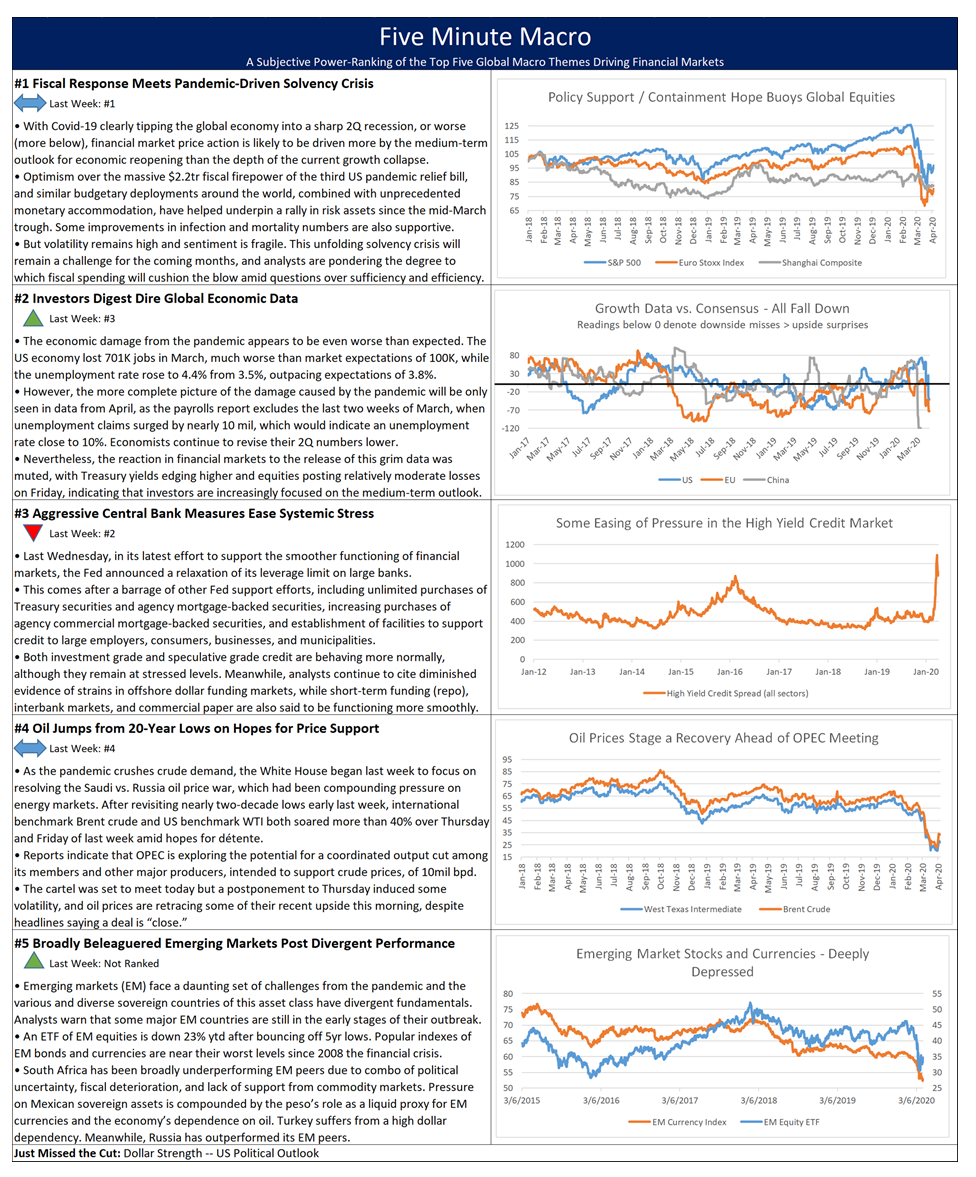

Investors Brace for Earnings Reports – First quarter corporate earnings reporting season kicks off tomorrow in earnest with some major banks and corporate bellwethers reporting, including JPMorgan, Wells Fargo, Johnson & Johnson, and Fastenal. Analysts anticipate choppy figures and high uncertainty regarding managements’ outlook for coming quarters. As with economic data, the outlook for a rebound will likely be more impactful of stock prices than the depths of the second quarter trough.

Week Ahead – Initial jobless claims data for the week ending April 11 will be in the spotlight on Thursday after the prior week registered another grim tally of 6.6 million more filings, bringing the total reported in the last three weeks close to 17 million. US industrial production and retail sales data for March will also be in focus, along with first quarter Chinese GDP.

Summary and Price Action Rundown

Global risk assets are mixed this morning ahead of tomorrow’s US holiday, as investors await additional fiscal support from Congress, key jobs data, an OPEC decision, and statements from Fed Chair Powell. S&P 500 futures point to a slightly lower open after the index reaccelerated to the upside yesterday, putting week-to-date gains at 10.5%, which reduced year-to-date downside for the index to 14.9% and the decline from February’s record high to 18.8%. Last month’s acute volatility has subsided somewhat amid supportive monetary and fiscal policy measures, with bouncing oil prices also lifting sentiment, although uncertainty over pandemic containment and economic recovery prospects persist. Yesterday, traders also seized upon Dr. Fauci’s statement that the coming week could mark “the beginning of a turnaround” in the US outbreak, though he added that suppression measures should not be relaxed, while some analysts attributed a degree of yesterday’s market upside to Senator Sanders’ suspension of his presidential campaign. EU and Asian equities were mixed overnight. Treasury yields are edging lower, with the 10-year yield at 0.73%, while EU sovereign bond yields similarly dip. The dollar is continuing to fluctuate mildly below its mid-March multi-year peak. Meanwhile, oil prices are extending their steep rally ahead of today’s pivotal OPEC+ decision.

Economic Support Efforts Help Underpin Optimism on Recovery

Investors continue to pin hopes on the significant and swift deployment of US fiscal firepower to offset the economic impact of the pandemic. Only days after last Friday’s official launch of the $349 billion small business support facility, the Paycheck Protection Plan (PPP), which was established as part of the $2.2 trillion CARES Act, the Trump administration is working to augment the program with additional funds amid a flood of applications. Specifically, the Treasury Department is asking Congress to commit another $250 billion to replenish the PPP. Senate Majority Leader McConnell stated that he would work to “approve further funding for the Paycheck Protection Program by unanimous consent or voice vote” today given that most lawmakers are in home districts. However, Senate Minority Leader Schumer and House Speaker Pelosi are proposing inclusion of funds to provide additional relief to hospitals and state & local governments, potentially complicating an expedited top-up of the small business loan program.

Expectations of Deep and Coordinated Supply Curbs Extend Oil Rebound

Brent crude is at its highest level in nearly a month on signs that consensus on measures to support oil prices will be reached between OPEC, Russia, and other major oil producers at today’s virtual meeting. Reports yesterday eased concerns that the cartel may fail to secure cooperation from Russia and other key producers in a unified attempt to restrict oil production and rebalance the oversupplied market. Oil ministers from Kuwait and Algeria both cited the potential for output curbs of 10 million barrels per day or more, and Russia conveyed favorable signals as well. Saudi is also hosting a G-20 energy ministers’ conference call tomorrow. Although the US will not directly cooperate with OPEC production cuts, the US Energy Information Administration estimated that US shale oil production would fall by 1 million barrels per day as a consequence of pressures on the industry, which some analysts view as signaling de facto US participation. For context, Brent crude prices have rebounded more than 50% since last week, after revisiting a nearly two-decade low, amid signs that Saudi and Russia may be stepping back from their oil price war, with President Trump encouraging détente. Still, analysts question whether even significant production cuts can balance the dramatically oversupplied oil market, which has seen demand collapse amid the coronavirus pandemic.

Additional Themes

Fed Minutes Set the Table for Chair Powell – Yesterday, the Minutes of the Federal Reserve’s March 15th meeting showed that the Fed expects the economic activity to decline in the coming quarter due to the coronavirus outbreak. They noted that the timing of the recovery will depend on the containment measures put in place, the success of those measures, and on the responses of fiscal policy. Policymakers also see an extremely large degree of uncertainty regarding how long and severe such a decline in activity would be. Fed Chair Powell will give an update on the economy today at 10am in a webcast sponsored by the Brookings Institution. He is also expected to detail Fed support programs, including the Main Street lending facility.

Jobless Claims in Focus – Initial jobless claims data for the week ending April 4 is due this morning and analysts are expecting another grim tally, with consensus at 5.5 million, though many estimates are closer to 7 million. Even if this morning’s reading registers a modest decline from the 6.6 million filings the prior week, it would put the total of new jobless claims since mid-March over 15 million and send the unemployment rate toward 15%. Markets, however, appear priced to receive this dire data, with only modest responses to the prior releases.

Summary and Price Action Rundown

Global risk assets are mixed and price action is moderate this morning as investors remain focused on the prospective transition from pandemic containment to economic recovery, while monitoring the ongoing impact of key stimulus programs. S&P 500 futures indicate a 0.5% gain at the open after the index struggled yesterday to maintain Monday’s upward momentum, surrendering gains of around 3.5% to close slightly lower. This put year-to-date downside for the index at 17.7% and the decline from February’s record high at 21.5%. Though last month’s acute volatility has subsided somewhat amid supportive monetary and fiscal policy measures, persistent uncertainty over pandemic containment and doubts over economic recovery prospects continue to hold back investor sentiment. EU and Asian equities posted divergent performance overnight. Treasury yields are edging higher, with the 10-year yield at 0.74%, while EU sovereign bond yields are mixed. The dollar is fluctuating mildly below its mid-March multi-year peak. Meanwhile, oil prices are steadying after yesterday’s sharp downside reversal as traders position ahead of tomorrow’s pivotal OPEC meeting.

Policymakers Rush to Re-Up Small Business Loan Program

Small business owners are seeking support in droves as conditions worsen, while questions reverberate over the size of the program and issues regarding access. Only days after last Friday’s official launch of the $349 billion small business support program, the Paycheck Protection Plan (PPP), which was established as part of the $2.2 trillion CARES Act, the Trump administration is working to augment the program with additional funds amid a flood of applications. Specifically, the Treasury Department is preparing to ask Congress to commit another $250 billion to replenish the PPP, with reports suggesting that the request could come as soon as today, not even a week into the program. Banks and the Small Business Administration have been overwhelmed by applications, which some analysts are estimating could need as much as $1 trillion to fulfil the demand. Senate Majority Leader McConnell stated that he would work with Treasury Secretary Mnuchin and Senate Minority Leader Schumer to “approve further funding for the Paycheck Protection Program by unanimous consent or voice vote during the next scheduled Senate session on Thursday.” Meanwhile, financial sector participation in the program is widening, as Secretary Mnuchin indicated that 3,000 banks and other lenders are accepting applications, up from 2,400 on Monday.

Economic Distress Intensifies as Containment Efforts Continue

The urgent need for support at the small business level and for workers suddenly out of a job could hardly be more obvious and is validated by incoming data. Yesterday’s reading of the NFIB Small Business Optimism gauge plummeted by an unprecedented degree in March. It is now at 96.4, almost a five-year low, while its collapse from 104.5 in February to 96.4 constituted the largest net change (8.1) on record. The small business outlook for six months from now fell 17 points from 22 to 5, the worst since November 2012. Sales expectations had the largest ever decrease, while uncertainty increased to three-year highs. In February, US job openings (JOLTS) fell 130k from 7.012m (4.4%) in January to 6.882m (4.3%). Expectations for job openings were as low as 6.50m, likely a forward projection as some participants over-anticipated early effects of the virus. Job openings contractions were focused in real estate and health services. Professional and business services constituted the largest contraction in hiring, followed by construction. Analysts agree that US job openings were elevated before the virus spurred layoffs. Given the rebound in January and general resiliency in February, the labor market was solid at the beginning of the year – before the coronavirus began to drag on the economy. President Trump and White House officials continue to reference ongoing plans to restart portions of the economy, although the data used to inform such decisions in various countries overseas, like symptom tracking and contact tracing, is not yet available in the US.

Additional Themes

EU Lacks Consensus on Broader Virus Response – A meeting of EU finance chiefs failed to settle on a unified €500 billion regional economic support package to offset the depression-like contraction induced by mass isolation and social distancing. The key sticking points were said to be aspects of the program that would force the various countries to accept a degree of fiscal burden sharing, including the potential issuance of pan-EU debt. Talks are continuing.

Fed Minutes Precede Chair Powell Tomorrow – Analysts are awaiting this afternoon’s release of the minutes from the emergency March 15 Fed meeting, at which the FOMC cut interest rates by 100 basis points to effectively zero and announced a $700 billion asset purchase program (quantitative easing), which was later upped to unlimited purchases, alongside an array of other facilities to support liquidity in domestic markets and dollar availability overseas. This will set the stage for Chair Powell’s webcast economic update at 10am tomorrow.

Summary and Price Action Rundown

Global risk assets are extending yesterday’s rally this morning as investors continue to focus on the prospective transition from pandemic containment to economic recovery, while monitoring the ongoing impact of key stimulus programs. S&P 500 futures point to a 3.3% gain at the open, which would build on yesterday’s 7.0% surge that brought year-to-date downside for the index to 17.6% and the decline from February’s record high to 21.3%. With the extreme market stress of the past few weeks easing amid a confluence of supportive monetary and fiscal policy measures, and the bounce in oil prices also helping improve the mood, market participants are shifting their focus to hopes of pandemic containment and gradual economic recovery. EU and Asian equities also advanced overnight. Treasury yields are moving upward amid the improved risk appetite, with the 10-year yield at 0.75%, while EU sovereign bond yields are also edging higher. The dollar is retreating further from its mid-March multi-year peak. Meanwhile, oil prices are resuming their sharp rally ahead of Thursday’s OPEC meeting.

Upbeat Tone Continues as Investors Pin Their Hopes on Containment and Stimulus

The ongoing rally in equities is being underpinned by optimism that pandemic containment efforts will facilitate a progressive reopening of the economy amid ever more muscular fiscal support. House Speaker Pelosi reportedly told fellow Democrats yesterday that another pandemic relief spending bill is in the works, worth at least $1 trillion, to top up existing programs from the $2.2 trillion CARES Act. Specifically, Speaker Pelosi said the funds would go to more direct payments to individuals and households, augmented unemployment benefits, and the small business loan program (more below). Speaker Pelosi’s priorities for this next round of spending represent a pivot from a prior blueprint, which featured infrastructure spending components rather than fully concentrating on direct pandemic relief. President Trump reiterated his support for additional fiscal spending to cushion the blow of the pandemic yesterday, though he continues to want “real infrastructure” spending to be featured. This comes as investors increasingly focus on the prospects for economic recovery following the seemingly impending peak of the infection curve, as the recent decline in fatality rates of Covid-19 in key hotspots, including Italy, Spain, France, New York, and New Jersey, spur hopes for a gradual resumption of more normal economic and societal activity by later April or early May.

Small Business Loan Program in Demand

Small business owners seek support as conditions worsen but questions reverberate over the size of the program and issues regarding access. Friday’s official launch of the $349 billion small business support program, the Paycheck Protection Plan (PPP), which was established as part of the $2.2 trillion CARES Act, has been met with a rush of applicants. National Economic Council Director Kudlow yesterday morning stated that $38 billion in loans had been made to 130,000 small businesses already. For context, banks are acting as intermediaries for the loans and existing lending clients are being given priority, which is being highlighted as a flaw in this system. Bank of America stated that it has received applications from 177K of its small business clients, totaling $33 billion in financing, pending approval by the Small Business Administration. Meanwhile, Wells Fargo announced that they are not accepting any new loan applications, as they have already reached their $10 billion target. Many banks have yet to begin taking applications due to uncertainty around the Treasury Department’s rules, though reports note that 2,400 lenders are currently involved. Also, the Federal Reserve announced yesterday that it will create a facility to purchase loans offered under the PPP with the intention to help banks continue lending to cash-strapped firms from their own balance sheets. Meanwhile, a gauge of US small business confidence registered the largest drop on record in March.

Additional Themes

Oil Prices Rise Ahead of OPEC – After revisiting nearly two-decade lows early last week, international benchmark Brent crude and US benchmark WTI are extending their rally amid favorable indications for a supportive deal at Thursdays meeting between OPEC, Russia, and other major producing nations. For context, oil prices have rebounded nearly 50% over the past week following signs that Saudi and Russia may be stepping back from their oil price war, with President Trump encouraging détente. The cartel is exploring the potential for a coordinated output cut of 10 million barrels per day among its members and other major producers.

Emerging Markets (EM) Rebound Amid IMF Action – Reports indicate that the IMF is set to launch a short-term dollar lending program to further address the issue of dollar liquidity scarcity that is particularly acute in some EM countries. This would be similar to the repo facility opened by the Federal Reserve last week through which a broad swath of foreign central banks can post their Treasury holdings as collateral against short-term dollar loans. A broad index of EM currencies is up 0.7% today after hitting a cycle low on Friday.

Fiscal responses are meeting Pandemic-Driven Crisis, while Investors Digest Dire Data that has led to Aggressive Central Bank Measures. Oil Jumped from 20-Year Lows and Emerging Markets feel the Pain across the board.

|

|

|

|