Summary and Price Action Rundown

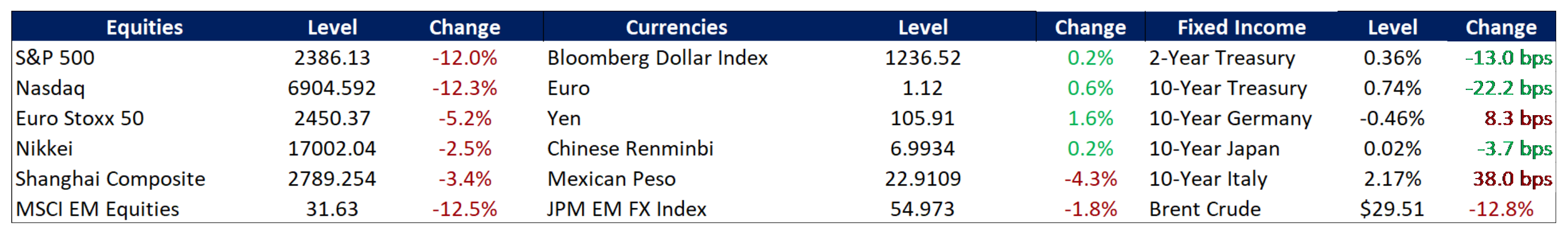

Major US equity benchmarks plunged today, erasing Friday’s outsized gains and extending losses deeper into “bear market” territory, defined as a 20% drop from recent highs, as investors assessed the mixed impact of forceful Fed liquidity operations and braced for a sweeping solvency crisis as the US and global economy grinds to a halt. The S&P 500 crashed 12.0% today, tripping another “circuit breaker” trading halt in the morning and posting its worst loss since “Black Monday” in 1987. This retraced Friday’s huge countertrend 9.3% rally that followed Thursday’s plunge of 9.5%. Amid these wild swings, the index is down 26.1% on the year, and 29.5% below its mid-February record high, as investors come to grips with the unprecedented ramifications of the pandemic and question the potential for government measures to counterbalance the multifaceted economic and financial fallout. Equities in Asia and the EU posted more moderate losses. Fed rate cuts over the weekend and acute risk aversion sent Treasury yields lower, with the 10-year yield closing at 0.74%, while the dollar edged back toward multi-year highs. Meanwhile, oil prices continued their swoon, with international benchmark Brent crude losing nearly 13% to sink below $30 per barrel.

Global Financial Markets Relapse Despite Powerful Fed Easing

Although the US public health and economic policy response to the pandemic has become increasingly energetic over the past week, the intensifying magnitude of the economic shock required to slow the contagion has forced investors to contemplate potentially severe economic and personal hardship over the coming months. More disorderly price action today has put the spotlight back on the Fed, the Trump administration, and Congress as investors ponder what measures beyond those already enacted might quell the panic. Some analysts cited President Trump’s indication that countermeasures against the virus could last into late summer months as adding to the pessimism, although others noted that policymakers need to level with the public about the outlook, no matter how dire. Travel restrictions and quarantines continued to tighten in the US and overseas, with increasing numbers of cities and states ordering restaurants, cafes, and bars to close. Meanwhile, the Senate is continuing to amend the emergency bill passed by the House last week, in cooperation with the Trump administration, as investors await details and the IMF announced that it would allocate up to $1 trillion to fight the impact of the outbreak. Though analysts continue to point to fiscal policy as the most appropriate form of stimulus to confront this crisis, monetary easing is becoming increasingly aggressive. Last evening, the Fed executed a surprise 100 basis point (bps) rate cut and announced a $700 billion quantitative easing program, alongside other measures to boost dollar liquidity in the US and overseas. But with this huge magnitude of monetary accommodation failing to steady market nerves, skeptical analysts are pointing to the inability of liquidity measures to address the economic reality that broad swaths of the US economy, businesses and workers alike, will need direct financial support from the government to make it through the coming weeks and months. – MPP view: We have suggested that the $8bn US fiscal package to fund the Covid-19 response is likely to be a down payment / first installment / foot in the door that would lead to more (possibly much more) fiscal spending to fight the virus, support industries, etc., and expected that the next tranche would top $150 billion, whatever form it takes. We also anticipated that reservations expressed by some administration officials and Congressional leaders over larger and broader fiscal stimulus would fade in the face of the worsening human and economic costs of the outbreak and rising systemic market stresses. We believe that the exceptionally adverse market reactions are helping spur necessary action, and Senator Schumer is upping the ante with calls for a $750 billion emergency spending bill.

Despite Strenuous Fed Accommodation, Signs of Heightened Systemic Stress Persist

Though the Federal Reserve has enacted major liquidity programs, significant fundamental strains remain evident in global financial markets, drawing comparisons with the global financial crisis. Analysts have monitoring significant and rising pressure in short-term funding markets (which first emerged in September), overseas dollar liquidity, credit market metrics, commercial paper markets, and interbank funding. For context, systemic risks, like those that manifested themselves in the global financial crisis in 2008, involve threats to the functionality of markets, availability of liquidity, and creditworthiness of companies and banks as opposed to standard market stress, which results in sometimes deeply adverse, but still orderly, price action. The Fed’s actions on Friday and over the weekend appear to have had a positive effect on US short-term funding markets, although repo rates remain choppy, though overseas dollar liquidity gauges have worsened further. Credit markets, however, remain consistent with a broad and worsening solvency crisis, particularly in some of the most impacted sectors, like energy, which is suffering further damage from the Saudi versus Russia oil price war. The commercial paper (CP) market is also experiencing continued stress, with some analysts suggesting that the Fed should begin to directly purchase CP in an effort to unfreeze this key source of corporate funding. EU financials, a perennial weak link in the global systemic risk chain, are also evidencing increasing credit pressure, as the cost to insure against default of European subordinated bank debt reaches levels last seen in 2012. – MPP view: The Fed continues to battle the acute liquidity strains on various fronts, and we do not doubt that it has the tools to address these shortages, both here and abroad. However, the continually worsening outlook for a severe economic impact from pandemic has forced market participants to confront the likelihood of a major, multi-sector corporate and household solvency crisis over the coming months. We had hoped that the market panic over the looming solvency risks could be temporarily stalled by Fed liquidity operations and promises for more coordinated fiscal and monetary action, but it appears that market participants are demanding more clarity, if not outright action, on direct government financial support to impacted industries and workers.

Additional Themes

Increasingly Severe Economic Impact of the Pandemic – Investors are now expecting a global recession or something even worse given the intensifying and unprecedented economic fallout from the epidemic. Over the weekend, China’s January-February economic releases were deeply negative. Industrial production fell 13.5% year-on-year while retail sales and fixed asset investment cratered 20.5% and 24.5%. And while US data has only evidenced a minor impact of the outbreak thus far, the New York region manufacturing activity gauge for March crashed from 12.9 to -21.5, its worst level since 2009, providing a grim harbinger of the economic damage to come. Tomorrow’s retail sales and industrial production numbers for February are expected to remain steady before almost certainly succumbing to steep contraction this month. Goldman Sachs has joined other economists in forecasting stagnant growth in the first quarter (1Q) and a steep contraction in 2Q.

US Airlines Request Government Support – With Trump administration officials already expressing an openness to supporting US airlines, the industry trade group has put forth a suggestion for up to $58 billion in aid of various kind, including tax rebates and grants. Airline stocks moderately outperformed the broader S&P 500 today but have suffered outsized year-to-date losses between 40% and 60% for the major US carriers.