Covid-19 infection rates, corporate earnings and the state of CARES 4 remain the top three things driving markets this week. The Chinese asset rally moves up to fourth, while the quickly weakening Dollar enters in the final spot.

Covid-19 infection rates, corporate earnings and the state of CARES 4 remain the top three things driving markets this week. The Chinese asset rally moves up to fourth, while the quickly weakening Dollar enters in the final spot.

Summary and Price Action Rundown

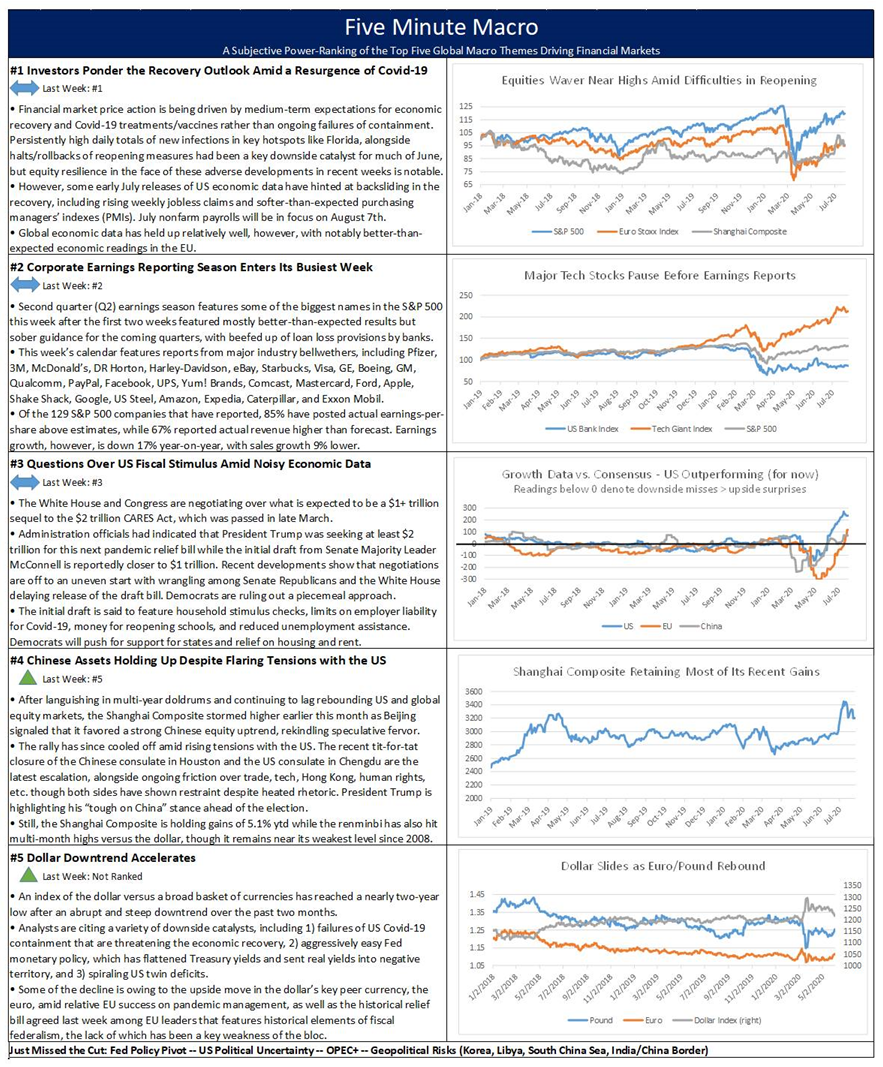

Global risk assets are mostly higher this morning ahead of a week of major corporate earnings, key economic releases, and a Federal Reserve meeting. S&P 500 futures indicate a 0.4% higher open, which would retrace last week’s choppy 0.3% decline that took the index back into negative territory year-to-date after it registered a new high for the pandemic on Wednesday. The Nasdaq posted rare underperformance last week, falling 1.3% as high-flying IT shares reversed from lofty levels, but is set to rebound today ahead of major tech earnings this week. Equities in the EU and Asia were mixed overnight. The dollar continues to sink lower versus its peers, while longer-dated Treasury yields are declining, with the 10-year yield at 0.58%. Brent crude prices are holding above $43 per barrel.

Pivotal Week for Corporate Earnings

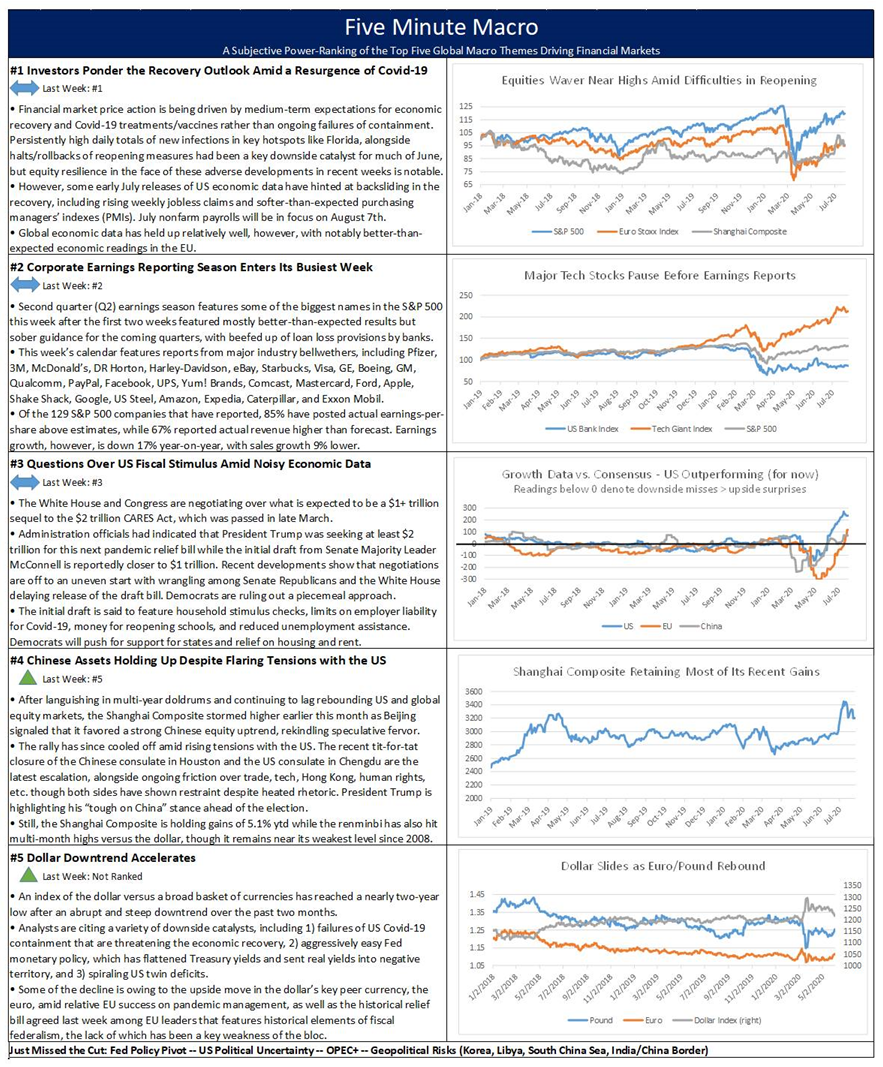

The second week of second quarter (Q2) earnings reporting again provided scant direction for stocks as analysts brace for this week’s busy calendar of results, featuring major tech giants and other US corporate bellwethers. Friday marked the close of the second week of Q2 earnings season with 181 of the S&P 500 companies reporting results to date. Thus far, 85.5% of results have featured a positive earnings-per-share (EPS) surprise and 67.7% have beaten revenue estimates, with both percentages being higher than their respective five-year averages. While this usually indicates positive trends, earnings and revenue estimates prior to the start of the quarter had been significantly lowered, with Q2 estimated earnings languishing in the doldrums at -44.7% year-on-year (y/y) two weeks ago. The current blended earnings decline, which combines actual results from companies that have reported and estimates of those that have not yet done so, has improved slightly to -42.4% from last week’s -44.1%. The blended revenue decline for the second quarter sits at -10.1%, rising from the revenue decline of -10.4% last week, and forming a trend of improvement from -10.8% two weeks ago. This week’s calendar features reports from major industry bellwethers, including Pfizer, 3M, McDonald’s, DR Horton, Harley-Davidson, eBay, Starbucks, Visa, GE, Boeing, GM, Qualcomm, PayPal, Facebook, UPS, Yum! Brands, Comcast, Proctor & Gamble, Mastercard, Ford, Apple, Shake Shack, Google, US Steel, Amazon, Expedia, Caterpillar, and Exxon Mobil.

US-China Tensions Remain Elevated but Restraint is Evident

China has closed the US consulate in Chengdu in retaliation for the US closure of the Chinese consulate in Houston, but Chinese assets were steady overnight and the lack of further escalation has eased concerns of a potentially major rupture in relations. Analysts had expected China to respond in kind after the US ordered China’s Houston consulate to be shuttered, though initial speculation had been that Beijing would shutter the US consulate in Wuhan. The US diplomatic presence in Chengdu is considered the more strategic of the two, as it is where the State Department monitors Tibet and the Western China region in general, which is a hotbed of human rights issues. However, no further measures were announced and Chinese assets steadied overnight. After sinking 3.9% on Friday amid the rising tensions, the Shanghai Composite eked out a 0.3% gain overnight, while the Hong Kong Hang Seng lost a modest 0.4% after closing 2.2% lower the prior session. The renminbi also advanced versus the dollar and is near its strongest level since March.

Additional Themes

GOP Draft of US Pandemic Relief Bill Expected Today – Though portions of the Republican’s draft $1 trillion stimulus plan have trickled out, the full text of the version crafted by Senate Majority Leader McConnell’s office is set to be released later today. Among the available details, the most notable is the new unemployment insurance scheme to replace the current $600/week benefits that are set to expire in a few days. The GOP unemployment insurance plan will focus instead on a 70% wage replacement benchmark. Additionally, the plan is said to include direct payments of $1,200 and $2,400 to individuals and families, $105 billion for reopening schools, targeted additional funds for the Payroll Protection Plan (PPP), $16 billion in additional funding for coronavirus testing, tax breaks for businesses to retain workers and retool for new safety protocols, and provisions for flexibility on state use of previous funding. The Trump administration has also backed off its demands for payroll tax cuts. Democrats will contest the absence of additional funding for state and local governments, as well as the lack of support measures for housing and rent. House Speaker Pelosi dismissed talk of a piecemeal approach to passing the bill but administration officials continue to advocate such an approach.

Dollar Downtrend Continues – An index of the dollar versus a broad basket of currencies has reached a nearly two-year low after an abrupt and steep downtrend over the past two months. Analysts are citing a variety of downside catalysts, including failures of US Covid-19 containment and aggressively easy Fed monetary policy.

Summary and Price Action Rundown

Global risk assets retreated overnight as US-China friction remained in the headlines, while investors await more key US economic data and corporate earnings. S&P 500 futures point to a 0.2% lower open after the index retreated 1.2% yesterday to erase nearly all the year-to-date upside it had accumulated earlier this week, which had marked a new high for the pandemic. The tech-heavy Nasdaq posted rare underperformance as high-flying IT shares reversed from lofty levels. Equities in the EU and Asia are lower, with Chinese stocks falling sharply (more below). The dollar is down despite the cautious tone in markets, while longer-dated Treasury yields are steady, with the 10-year yield at 0.58%. Brent crude prices are holding above $43.

US-China Tensions Weigh on Sentiment

In the latest cycle of escalation in the ongoing and multi-faceted confrontation between Washington and Beijing, China announced that it had ordered the US consulate in Chengdu to cease operations in retaliation for the US closure of the Chinese consulate in Houston. Analysts had expected China to respond in kind, though initial speculation had been that Beijing would shutter the US consulate in Wuhan. The US diplomatic presence in Chengdu is considered the more strategic of the two, as it is where the State Department monitors Tibet and the Western China region in general, which is a hotbed of human rights issues. Therefore, by choosing Chengdu, analysts suggest that Beijing is taking a more aggressive retaliatory approach, while President Trump has hinted that more Chinese consulates could be closed. Reports earlier this week noted that federal prosecutors are accusing the Chinese consulate in San Francisco of sheltering a Chinese scientist accused of visa fraud for concealing her ties to the Chinese military. Meanwhile, Secretary of State Pompeo delivered hawkish remarks yesterday on the Chinese Communist Party (CCP). Though he did not go so far as to advocate regime change, Pompeo’s rhetoric toward the CCP was harsh and he appealed to the Chinese people to seek change and called upon the international community to aid in that process. The Shanghai Composite fell 3.9% overnight, while the Hong Kong Hang Seng lost 2.2%, as market participants cited the further deterioration in US-China relations as weighing on sentiment.

US Labor Market Data Raises Questions on the Recovery

After yesterday’s disappointing weekly jobless claims data suggested a degree of economic backsliding, analysts await today’s preliminary purchasing managers’ index (PMI) figures for July. The flash readings of July PMI are expected to reflect a transition from contraction to expansion for both US manufacturing and service sectors, with consensus forecasts of 52.0 and 51.0, respectively, after June’s readings of 49.8 and 47.9. For context, PMI readings over 50 denote expansion in the sector. Analysts are wary of setbacks to the US growth recovery amid the resurgence of Covid-19 cases in key regional hotspots, with yesterday’s upside surprise in new jobless claims for the week ending July 18th adding to the concerns. Notably, this reading was the first weekly increase in unemployment claims since late March. Meanwhile, the EU posted better-than-expected preliminary July PMIs, which registered 51.1 for manufacturing and 55.1 for services versus forecasts of 50.1 and 51.0, respectively, representing marked improvement from the prior month’s 47.4 and 48.3 prints. The first readings of UK PMIs for July also meaningfully surprised to the upside and reflected expansion across the board. Nevertheless, the euro and pound are slightly weaker versus the dollar this morning, though the former is close to a two-year peak while the latter is at multi-month highs.

Additional Themes

Slow Progress Toward US Pandemic Relief Bill – Though portions of the Republican’s draft $1 trillion stimulus plan have trickled out, reports indicate that the official release will be delayed until next week. Among the available details, the most notable is the new unemployment insurance scheme to replace the current $600/week benefits that are set to expire in a few days. The GOP unemployment insurance plan will focus instead on a 70% wage replacement benchmark. Additionally, the plan is said to include direct payments of $1,200 and $2,400 to individuals and families, $105 billion for reopening schools, targeted additional funds for the Payroll Protection Plan (PPP), $16 billion in additional funding for coronavirus testing, tax breaks for businesses to retain workers and retool for new safety protocols, and provisions for flexibility on state use of previous funding. The Trump administration has also backed off its demands for payroll tax cuts. Democrats will contest the absence of additional funding for state and local governments, as well as the lack of support measures for housing and rent, and have rejected suggestions of a piecemeal approach to passing the bill.

Earnings Fail to Stem Tech Stock Selloff – Microsoft and Tesla, which have posted dramatic stock price outperformance this year, topped earnings and revenue projections, but shares of both companies fell yesterday as high-flying IT stocks suffered broad losses.

Summary and Price Action Rundown

Global risk assets are moving higher morning as investors focus on relatively upbeat corporate earnings reports while awaiting key US labor market data. S&P 500 futures indicate a 0.4% higher open after the index climbed yesterday to a 1.4% year-to-date gain, marking a new high for the pandemic, though the tech-heavy Nasdaq lagged below Monday’s fresh record high. Equities in the EU are also rising amid positive news in the region (more below), while Asian stocks were mixed overnight. The dollar is continuing lower, while longer-dated Treasury yields are steady, with the 10-year yield at 0.60%. Brent crude prices are hovering above $44.

Earnings Remain Mixed but Broadly Supportive

Although second quarter (Q2) earnings season remains in its early stages, the emerging themes are better-than-expected headline results but cloudy guidance, with investors seemingly keen to accentuate the positive. Telsa reported another solid quarter after yesterday’s closing bell, sending its shares 5.0% higher in pre-market trading, which would add to the carmaker’s already eye-watering 280.6% year-to-date (ytd) stock price gain, which many analysts point to as evidence of a burgeoning bubble in US equities. Meanwhile, Microsoft, which has been another significant outperformer during the pandemic, also beat earnings and sales estimates with its report late yesterday afternoon, but analysts point to the softening in it key cloud business segment as weighing on its share price, which is down 2.1% before the market open. Nevertheless, Microsoft is still dramatically outperforming the wider index, closing yesterday with ytd gains of 34.3%. Today, AT&T, Blackstone, American Airlines, and Twitter are among the companies reporting before the opening bell, while Intel and E*Trade will release their figures after the close. Of the 99 S&P 500 companies that have issued results, a lofty 81.5% have topped earnings-per-share (EPS) estimates while 68.7% have beaten revenue projections. Still, the growth of sales and earnings remains down year-on-year, with declines of 7.0% and 17.0%, respectively, thus far.

US Labor Markets Data in Focus

As analysts ponder the economic ramifications of the ongoing Covid-19 resurgence in the US and the resulting rollback of reopening measures in key virus hotspots, today’s weekly jobless claims data will provide a hint as to the degree of backsliding. This morning’s release of initial jobless claims for the week ending July 18th are expected to show continued stagnation in the prior trend of improvement, with filings projected to remain steady at 1.30 million. For context, the 1.30 million new claims in the week ended July 11th was little-changed from a revised 1.31 million claims in the prior week and above expectations of 1.25 million. Last week’s tally lifted the total claims since March 21st to 51.3 million. Some economists expect labor market deterioration to be significant enough to send July nonfarm payrolls back to negative territory.

Additional Themes

Markets Take US-China Friction in Stride – After briefly weighing on sentiment yesterday, markets have steadied as the latest flare-up in tensions between Washington and Beijing looks set to remain in the diplomatic realm for now. The surprise announcement that the US had demanded closure of the Chinese consulate in Beijing and vows of retaliation from China was the latest escalation in the re-intensifying feud, which has taken on an added significance due to its prominence as a campaign issue for the upcoming US presidential election. Reports suggest that China will close the US consulate in Wuhan and perhaps seek to scale back US diplomatic activities in Hong Kong in retaliation.

Italian Debt Continues to Rally Amid Spending Plans – Yields on 10-year Italian debt have fallen below 1% for the first time since the onset of the pandemic in early March, while the 10-year yield spread to German bunds, a key metric of Italian creditworthiness, are at their most favorable level since late February. This key milestone in the ongoing rally in Italy’s sovereign bonds occurred despite news overnight that the Italian government is preparing a €25 billion special relief budget to cushion the economic blow from the pandemic, which follows two prior stimulus packages totaling €75 billion. However, among EU members, Italy stands to receive the most funds from the EU’s €750 billion pandemic relief package that was agreed earlier this week, with Italian Prime Minister Conte suggesting that the combination of grants and loans to Italy from this historic fiscal stimulus could total more than €200 billion.

Summary and Price Action Rundown

Global risk assets are mixed this morning as investors monitor the latest US-China friction and incoming corporate earnings reports while awaiting signals on progress toward the next US pandemic relief package. S&P 500 futures indicate a 0.2% lower open after the index edged further into positive for the year yesterday despite giving up most of its intraday gains as the tech-heavy Nasdaq retreated from yesterday’s fresh record high. Equities in the EU are lower while Asian stocks were varied overnight. The dollar is continuing its downtrend, which accelerated yesterday, while longer-dated Treasury yields are also lower, with the 10-year yield at 0.59%. Brent crude prices are falling back below $44 ahead of US oil stockpile data.

US-China Tensions Back in the Headlines

In the latest flare-up in this fraught relationship, Beijing is vowing retaliation against the abrupt US order to close the Chinese consulate in Houston. Reports of fires in the courtyard of the Chinese consulate in Houston, to which local police and firefighters responded, were followed by a US State Department announcement that it had ordered the closure of the Chinese consulate in Houston citing the need to “protect American intellectual property… and private information.” This comes after the US Justice Department yesterday named two hackers it claims are sponsored by Beijing who stole sensitive data and attempted to access coronavirus research. As has been the motif in recent US actions against China, Beijing has decried the move, calling it “unprecedented” and “political provocation,” while vowing unspecified retaliation. Analysts expect that a US consulate in China will be closed in response, with speculation centering on Wuhan. The offshore renminbi weakened abruptly on the news but the downside is moderate at 0.3% and it remains near its strongest levels versus the dollar since mid-March, while an ETF of Chinese stocks is down 1.0% in pre-market trading.

Earnings Season Features More Upside Surprises

Alongside a series of positive second quarter (Q2) results for some traditional US corporate bellwethers yesterday, midsized banks also issued generally better-than-expected figures. The second week of Q2 earnings season took an increasingly positive tone yesterday as releases from Coca-Cola, Lockheed Martin, IBM, and Philip Morris proved broadly supportive of their stock prices, though management guidance for the coming quarters remained highly uncertain. Meanwhile, midsized financial companies also posted encouraging headline numbers yesterday, mirroring the trend from the megabank reports last week. Comercia and Synchrony Financial beat earnings-per-share (EPS) estimates and revenue projections by considerable margins, though revenue plunged 15.8% and 17.9%, respectively, year-over-year (y/y). Though both suffered a reduction in net interest income and added $88 million and $475 million, respectively, to loan loss reserves, offsetting growth in areas such as loans and deposits helped cushion the blow. However, results turned more mixed after yesterday’s closing bell, with Capital One, United Airlines, Snap, and Texas Instruments among the companies reporting. Among these, Snap is the biggest laggard in pre-market trading, with losses of 8.3%. Today, KeyCorp and Northern Trust report before the opening bell, while results from Microsoft, Tesla, Chipotle, CSX, and Discover Financial are due after markets close. Of the 62 S&P 500 companies that have issued results, a lofty 80.7% have topped earnings-per-share (EPS) estimates while 71.0% have beaten revenue projections. Still, the growth of sales and earnings remains down year-on-year, with declines of 6.3% and 20.7%, respectively, thus far.

Additional Themes

Japan’s July PMI Shows Continued Contraction – The preliminary July reading of the Jibun Bank Japan Composite purchasing managers’ index (PMI) rose to 43.9 from a final 40.8 a month earlier, as activity in both the manufacturing and services sectors continued to retrench, though at a more moderate pace. For context, PMI readings below 50 denote contraction in the sector. The manufacturing PMI increased to 42.6 in July from a final 40.1 in June, while the services PMI edged up to 45.2 in July from a final 45.0 in the prior month, with the relaxed of emergency measures providing some relief. The latest readings marked the 15th and 6th straight months of contraction in manufacturing and services, respectively. The rates of contraction for output, new orders, and new export orders all declined. On the inflation front, input prices were broadly unchanged while selling prices declined less than in June. Looking ahead, sentiment deteriorated in manufacturing but remained positive in services. Preliminary July PMIs for the US and EU are due on Friday.

Oil Prices Whipsaw Near Multi-Month Highs – After hitting a nearly $45 peak for the pandemic yesterday, spurred by hopes of improving demand amid another burst of fiscal stimulus by the EU, with a weakening dollar providing another boost, Brent crude prices are turning lower again after the American Petroleum Institute forecast a sizeable build in US oil inventories last week.

Summary and Price Action Rundown

Global risk assets are advancing this morning after EU leaders cemented agreement on a historic pandemic relief bill, while investors continue to anticipate more impending US fiscal stimulus and monitor corporate earnings reports. S&P 500 futures point to a 0.7% higher open after the index turned positive for the year yesterday, registering a new high for the pandemic, while the Nasdaq jumped to a new all-time record high. Equities in the EU are outperforming following news of the budget deal while Asian stocks also moved higher overnight. The dollar is retreating further, while longer-dated Treasury yields are flat, with the 10-year yield at 0.62%. Brent crude prices are vaulting above $44 on the improving demand picture.

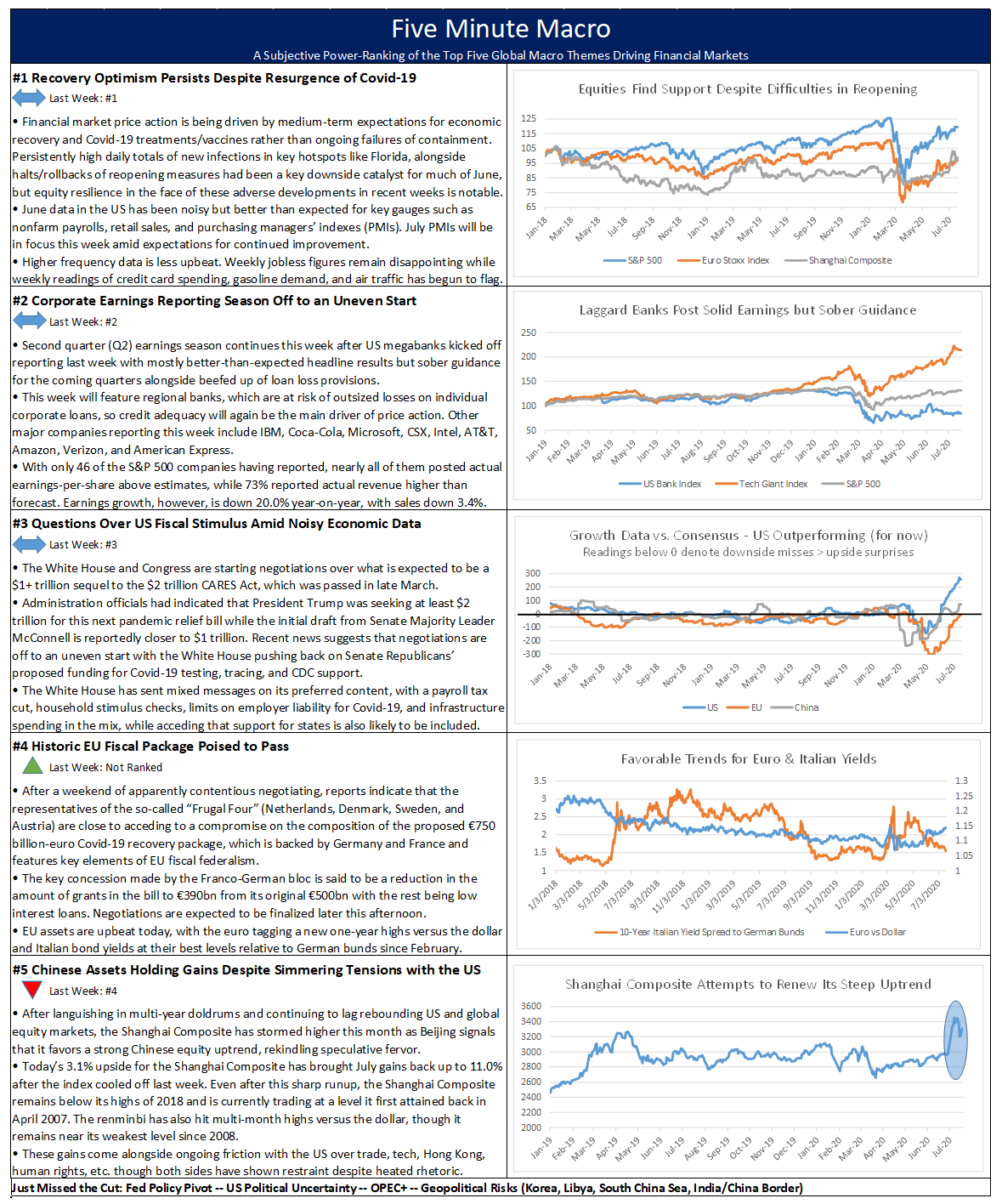

EU Leaders Strike Historic Fiscal Deal

EU assets are rallying on the completion of an unprecedented pandemic relief package that features key elements of fiscal federalism, alongside a broader multi-year regional budget deal. EU leaders agreed on a landmark stimulus package that will see the bloc issue €750 billion ($860 billion) of joint debt to help member states mitigate the ongoing economic downturn. The emergency fund will give out €390 billion of grants, which was reduced over the course of negotiations from the €500 billion figure originally proposed by in May, and €360 billion in low-interest loans. The deal was announced in a tweet from European Council President Michel, while French President Macron called it a “historic day for Europe” and German Chancellor Merkel expressed relief, saying “We have come up with a response to the biggest crisis the EU has faced.” Dutch Prime Minister Rutte, who took the hardest line among the so-called “Frugal Four” countries (Sweden, Denmark, Austria, and the Netherlands) secured an emergency brake that would allow any country to raise concerns that another was not honoring promises to reform its economy, and temporarily halt transfers of EU recovery money by Brussels.

Leaders also signed off on the EU’s next seven-year budget, which totals €1.074 trillion. The final compromise included budget rebates for the Frugal Four, reducing their annual net contributions. Denmark, Germany, the Netherlands, Austria, and Sweden will get more than €50 billion in rebates over the next budget cycle.

Of the emergency funding, Italy, the original EU epicenter of the pandemic, will likely be the biggest beneficiary from the plan and expects to receive about €82 billion in grants and about €127 billion in loans, according to initial estimates. Italy’s 10-year government bond yields are continuing to trend lower, along with borrowing costs in other southern European countries. Italy’s yield spread over German bunds, a key metric of Italian creditworthiness, is trading at 1.53 percentage points, its best level since February after trading nearly twice that level in March. Meanwhile, the euro is holding its recent gains versus the dollar and nearing its strongest level since January 2019. The Euro Stoxx index is 1.5% higher today, stretching its rally since mid-May to 24.1% and cutting losses for the year to 8.1%. EU bank stocks are leading to the upside this morning with a gain of 3.4%, though sector performance remains at a depressed -28.6% year-to-date.

Earnings Season Continues After Mixed Start

Analysts are gearing up for another busy week of second quarter (Q2) earnings reporting after last week’s first set of reports provided scant direction for stocks. The second week of Q2 earnings season began slowly yesterday with Halliburton and IBM the only notable results. The oil services giant impressed analysts with its cost control and pivot to international opportunities amid struggles in the US shale patch, lifting its shares 2.5% yesterday, while the tech stalwart topped earnings expectations with growth of its key cloud-computing business line, boosting its equity price 5.2% in pre-market trading. This morning, the calendar features results from Coca-Cola, Lockheed Martin, Synchrony Financial, and Philip Morris, while Capital One, United Airlines, Snap, and Texas Instruments report after the closing bell. Of the 52 S&P 500 companies that have issued results, a lofty 83.0% have topped earnings-per-share (EPS) estimates while 73.1% have beaten revenue projections. Still, the growth of sales and earnings remains down year-on-year, with declines of 3.7% and 21.5%, respectively, thus far.

Additional Themes

US Pandemic Relief Bill Negotiations Heat Up – House Speaker Pelosi and Treasury Secretary Mnuchin are scheduled to meet today as Senator McConnell and his Republican colleagues prepare to put forth their proposed stimulus package, estimated at $1.3 trillion. Negotiations are likely to be centered on enhanced unemployment benefits, which are set to expire at the end of this week, and provisions for state and local governments.

Biden Proposes “Caring Economy” – Former Vice President Biden unveiled the latest plank in his economic platform, which proposes $775 billion to support child and elderly care.

Recovery optimism continues to drive market sentiment, followed by week two of peak earnings season and continued negotiations over US and EU stimulus. Finally, the China asset rally rounds out the top five.

Summary and Price Action Rundown

Global risk assets are mixed and muted this morning as investors await more US corporate earnings while monitoring ongoing progress toward additional fiscal stimulus in the US and EU. S&P 500 futures point to a slightly lower open after the indexstopped just short of turning positive for the year last week, while the Nasdaq continues to hover near record highs. Equities in the EU and Asia were mostly higher overnight, with Chinese mainland stocks returning to outperformance. The dollar is softer amid continued euro strength, while longer-dated Treasury yields are fluctuating near recent lows, with the 10-year yield at 0.62%. Brent crude prices are falling below $43 as traders shift their focus to demand after last week’s OPEC+ decision.

Corporate Earnings Season Continues After Uneven First Week

With the first week of second quarter (Q2) earnings season featuring mostly better-than-expected headline results but sober guidance from US megabanks, investors are awaiting this week’s releases, which feature regional banks and various industry bellwethers. With only 45 of the S&P 500 companies having reported, nearly all of them reported actual earnings-per-share (EPS) above estimates, while 73% reported actual revenue higher than forecast. While this is positive, earnings estimates had been significantly lowered prior to the start of the quarter, with Q2 estimated earnings residing at -44.7% last week, revised from -13.6% at the beginning of the quarter. This past week the biggest US banks and other financial sector constituents were the primary focus and though most beat EPS and revenue consensus estimates for the quarter, investors were concerned by the greater-than-expected credit-loss provisioning and cautious guidance from management amid the deep pandemic-related uncertainty. An index of major bank stocks ended the week 0.3% lower, and year-to-date performance is languishing at -35.5%. This week will feature regional banks, which are at risk of outsized losses on individual corporate loans, so credit adequacy will again be the main driver of price action. Other major companies reporting this week include IBM, Coca-Cola, Microsoft, CSX, Intel, AT&T, Amazon, Verizon, and American Express. Among these, Amazon and Microsoft have been substantial year-to-date outperformers, with gains of 60.3% and 28.7%, respectively.

EU and US Fiscal Firepower in Focus

The euro is continuing to advance against the dollar as EU leaders are reportedly nearing agreement on a historic stimulus bill that features key elements of fiscal federalism, while US negotiations for the next round of pandemic relief begin to heat up. After a weekend of apparently contentious negotiating, reports indicate that the representatives of the so-called “Frugal Four” (Netherlands, Denmark, Sweden, and Austria) are close to acceding to a compromise on the composition of the proposed €750 billion-euro Covid-19 recovery package, which is backed by Germany and France. For context, the agreement on this spending plan must be unanimous among the 27 member nations. The key concession made by the Franco-German bloc is said to be a reduction in the amount of grants in the bill to €390 billion from its original €500 billion with the rest being low interest loans. Negotiations are expected to be finalized at another meeting later this afternoon. EU assets are broadly upbeat today, with the euro tagging a new one-year highs against the dollar and peripheral sovereign bond yields moving toward their best levels relative to German bunds since February. The Euro Stoxx Index, which has outperformed the S&P 500 over the past two months, with respective gains of 21.9% versus 9.2% over that span, is also steady this morning though banks are underperforming. Meanwhile, in the US, reports over the weekend indicated that the Senate Republicans’ $1 trillion proposal for the next round of fiscal stimulus, which is set to be negotiated this month, is meeting some unanticipated resistance at the White House. Specifically, the Trump administration is said to be opposed to the $25 billion in additional funds in the bill for Covid-19 testing and tracing, as well as the $10 billion for the CDC. House Democrats, meanwhile, had set forth a $3.5 trillion plan and the White House has sent mixed signals on its preference for the size, scope, and substance of this bill.

Additional Themes

US Covid-19 Outbreaks Impede Reopening – Though investor sentiment has been buoyed in recent weeks by encouraging news on progress toward developing a vaccine, the failures of coronavirus containment in the US continue to result in rising infections in key hotspots. Daily new cases in California, Texas, and Florida remained around 10,000 on average over the past week and Los Angeles Mayor Garcetti warned of another potential shutdown order. Overseas, resurgences in Hong Kong and Tokyo further highlight the uneven recovery timeline even in regions that achieve relative success in containment.

Global Data Consistent with Rebound – Taiwan’s June exports jumped 6.5% year-on-year as shipments of IT equipment rose and declines for non-tech products lessened. This is consistent with June data around the world, which has broadly surprised to the upside, though expectations for July are darkening amid the resurgence of Covid-19 in key global regions.

Summary and Price Action Rundown

Global risk assets are mostly higher this morning as investors continue to parse mixed US corporate earnings while monitoring ongoing progress toward additional fiscal stimulus in the US and EU. S&P 500 futures indicate a 0.4% higher open after yesterday’s 0.3% decline held the index back from turning positive for the year. Equities in the EU and Asia were gently adrift overnight, with Chinese mainland stocks steadying after wild swings this week. The dollar is turning lower again, while longer-dated Treasury yields are back near recent lows, with the 10-year yield at 0.60%. Brent crude prices are holding above $43 despite a cloudy demand picture.

Corporate Earnings Remain Uneven

As the first week of second quarter (Q2) earnings season draws to a close, investors are weighing positive results from US megabanks against cautious management guidance for the coming months, while disappointing Netflix figures may deepen this week’s tech sector underperformance. Yesterday, Bank of America (BoA) and Morgan Stanley (MS) issued their Q2 earnings, reporting better-than-expected results but cautioning over the outlook, in keeping with the broad trends for the sector. BoA and MS topped consensus estimates on both earnings-per-share (EPS) and revenue for the quarter, with BoA’s revenue totaling to $22.3 billion, down 3.5% year-on-year (y/y). MS far surpassed revenue estimates by $3 billion, totaling to $13.4 billion for an impressive 31% gain y/y. Like its peers, BoA exhibited strong trading growth lead by a fixed income, currency and commodity (FICC) and investment-banking performance set a record quarter, but this stellar performance was also partially offset by a $4 billion addition to credit-loss reserves, exceeding expectations of $3.8 billion, attributable to an increasingly downbeat economic outlook. Amid these cloudy future expectations, BoA shares fell 2.7% yesterday. MS shares outperformed, rising 2.5%, on its gargantuan trading and investment banking figures for Q2, though some analysts question the bank’s ability to sustain such performance when volatility settles in the future quarters. Meanwhile, Netflix issued disappointing figures after yesterday’s closing bell, with subscriber projections falling short of estimates. Shares of the streaming giant are 8.0% lower in pre-market trading.

EU Leaders Continue to Wrangle Over Historic Stimulus Bill

European assets are holding their ground this morning despite German Chancellor Merkel downplaying prospects for a deal at the July EU leaders summit which begins today and runs through Saturday. Commenting on the negotiations, Chancellor Merkel characterized the remaining differences among EU members as “very, very great” and advocated a “readiness to compromise.” Dutch Prime Minister Rutte put the odds of a deal this weekend below 50%, though Austrian Chancellor Kurz is expressing optimism. For context, representatives of the so-called “Frugal Four” (Netherlands, Denmark, Sweden, and Austria) continue to push back against the size and composition of the proposed €750 billion-euro Covid-19 recovery package, which is backed by Germany and France. Where the draft plan calls for €500 billion in grants, Frugal Four countries continue to insist the package consist primarily of loans. Negotiations began a month ago at the June EU leaders summit, at which Austrian Chancellor Kurz stated the conservative North’s position on calling for clear time limits and linkages to pandemic recovery to avoid “an entry into a permanent debt union.” German Chancellor Merkel and European Central Bank (ECB) President Lagarde have warned EU leaders that the failure to come to an agreement on stimulus would result in additional market shocks. EU assets are broadly stable today as negotiations were expected to be challenging, with the euro climbing toward one-year highs against the dollar and peripheral sovereign bond yields stable. The Euro Stoxx Index, which has outperformed the S&P 500 over the past two months, with respective gains of 21.9% versus 9.2% over that span, is also steady this morning though banks are underperforming.

Additional Themes

US Pandemic Relief Bill Negotiations Heat Up – Headlines yesterday suggested that President Trump will hold firm to his demand for a payroll tax cut to be featured in this upcoming pandemic relief package, which is being drafted primarily by Senate Majority Leader McConnell. A similar demand was not met in the $2.2 trillion CARES Act, which was passed in late March. One report also indicated that National Economic Council Director Kudlow is backing the payroll tax cut while Treasury Secretary Mnuchin is advocating stimulus checks and extended unemployment benefits. The first draft is set to be released next week.

Looking Ahead – Next week is dominated by ongoing US corporate earnings reporting, with the calendar featuring results from IBM, Halliburton, Coca-Cola, Lockheed Martin, Snap, Capital One, KeyCorp, Northern Trust, CSX, Tesla, Microsoft, Southwest Airlines, AT&T, Twitter, American Airlines, Honeywell, Verizon, Schlumberger, Royal Caribbean, and Intel. On the economic data front, preliminary global purchasing managers’ indexes (PMIs) for July will be scrutinized for signals on the health of the ongoing economic recovery.

Summary and Price Action Rundown

Global risk assets are moving lower this morning as investors ponder mixed US corporate earnings and Chinese growth figures ahead of key US economic data this morning. S&P 500 futures point to a 0.6% lower open after yesterday’s 0.9% rally brought the index just shy of turning positive for the year. Equities in the EU and Asia also declined overnight, with Chinese mainland stocks leading to the downside as Beijing cools the recent red-hot rally. The dollar is edging higher, while longer-dated Treasury yields are back near recent lows, with the 10-year yield at 0.62%. Brent crude prices are holding above $43 after yesterday’s OPEC+ decision.

Banks Issue Mostly Positive Results but Sober Guidance

After yesterday’s second day of second quarter (Q2) earnings season took on a somewhat more upbeat tone on strong results from Goldman Sachs, results remained broadly uneven and highlight a deeply uncertain outlook. Goldman Sachs, Bank of New York, PNC, and US Bancorp reported mostly better-than-expected results for Q2 but caution over the outlook and preparation for credit deterioration remained key themes, continuing yesterday’s trends for the sector. Leading the pack, Goldman Sachs trounced earnings and revenue expectations, fueled by impressive growth in total trading revenues, which registered its best quarterly performance in nine years. Its investment banking unit also reported record quarterly revenue on strength in equity and debt underwriting. The results are even more impressive considering the company set aside an additional $1.5 billion towards credit-loss reserves, beating expectations as well. Still, Goldman shares retreated from early gains of nearly 5% to close 1.4% higher. Meanwhile, US Bancorp topped estimates but the steep year-on-year earnings decline reflected the difficulties of this quarter. Management struck an optimistic note, however, highlighting healthy fee revenue growth and strong capital and liquidity positions moving forward, and its share rose 3.7%. PNC shares also rallied, rising 2.8%, although the bank missed earnings estimates as analysts cited solid capital positioning. Like PNC’s peers, management noted that the drop in profits was largely attributable to a higher provision for credit losses. On a more downbeat note, Bank of New York (BoNY) beat Q2 earnings and revenue expectations but stressed the risk of credit losses and “significant pressure” from low interest rates in its outlook for the coming quarters, sending its shares 5.4% lower on the day. In other major reports yesterday, UnitedHealth Group had a positive earnings surprise but missed on revenue, denting its share price by 1.8%. Today, analysts will be attuned to reports from Bank of America and Morgan Stanley, as well as Johnson & Johnson before the opening bell, with Netflix and JB Hunt Transport after markets close.

US-China Tensions Temper Chinese Growth Optimism

China’s GDP surprised to the upside and June economic data was broadly in-line with expectations, but ongoing frictions between Washington and Beijing raise risks of escalation. China’s Q2 GDP rose 3.2% year-on-year (y/y), topping estimates of 2.4% and representing a sharp rebound from the pandemic-induced 6.8% contraction in Q1. Meanwhile, June data was also consistent with broad improvement in economic activity, though retail sales lagged estimates, remaining in negative territory at -1.8% y/y versus expectations of a 0.5% increase after May’s -2.8% reading. Industrial production for last month expanded as expected at 4.8% y/y, accelerating from the prior month’s 4.4% pace, while year-to-date fixed asset investment improved slightly more than expected to -3.1% from -6.3% in May. Nevertheless, the renminbi declined moderately from its strongest level versus the dollar since early March. This mixed market reaction to broadly upbeat data comes amid additional headlines highlighting ongoing tensions between the US and China as analysts suggest that President Trump remains intent on pushing a more prominent “tough on China” policy line before the election. Recent reports are indicating that the Trump administration is mulling a travel ban on Chinese Communist Party officials, while analysts continue to speculate over the impact of the Hong Kong sanctions bill. Last night’s outsized 4.5% loss for the Shanghai Composite, however, is generally being attributed to signs that Beijing is trying to rein in the speculative equity fervor stoked by state media barely two weeks ago, during which the index flew 16% higher over eight trading days.

Additional Themes

European Central Bank (ECB) Decision Due – Later this morning, the ECB will conclude its July meeting, with analysts expecting no major policy announcements. The June meeting featured a greater-than-expected expansion of the Pandemic Emergency Purchase Program.

Key US Economic Data – This morning, analysts will parse June retail sales figures, which are expected to extend their recovery by 5.0% month-on-month (m/m) after leaping 17.7% m/m in May following a record 14.7% drop in April. Initial jobless claims for the week ending July 11th are also due, with estimates of 1.25 million new filings, down from 1.31 million the prior week.