Summary and Price Action Rundown

Global risk assets are mostly higher this morning ahead of a week of major corporate earnings, key economic releases, and a Federal Reserve meeting. S&P 500 futures indicate a 0.4% higher open, which would retrace last week’s choppy 0.3% decline that took the index back into negative territory year-to-date after it registered a new high for the pandemic on Wednesday. The Nasdaq posted rare underperformance last week, falling 1.3% as high-flying IT shares reversed from lofty levels, but is set to rebound today ahead of major tech earnings this week. Equities in the EU and Asia were mixed overnight. The dollar continues to sink lower versus its peers, while longer-dated Treasury yields are declining, with the 10-year yield at 0.58%. Brent crude prices are holding above $43 per barrel.

Pivotal Week for Corporate Earnings

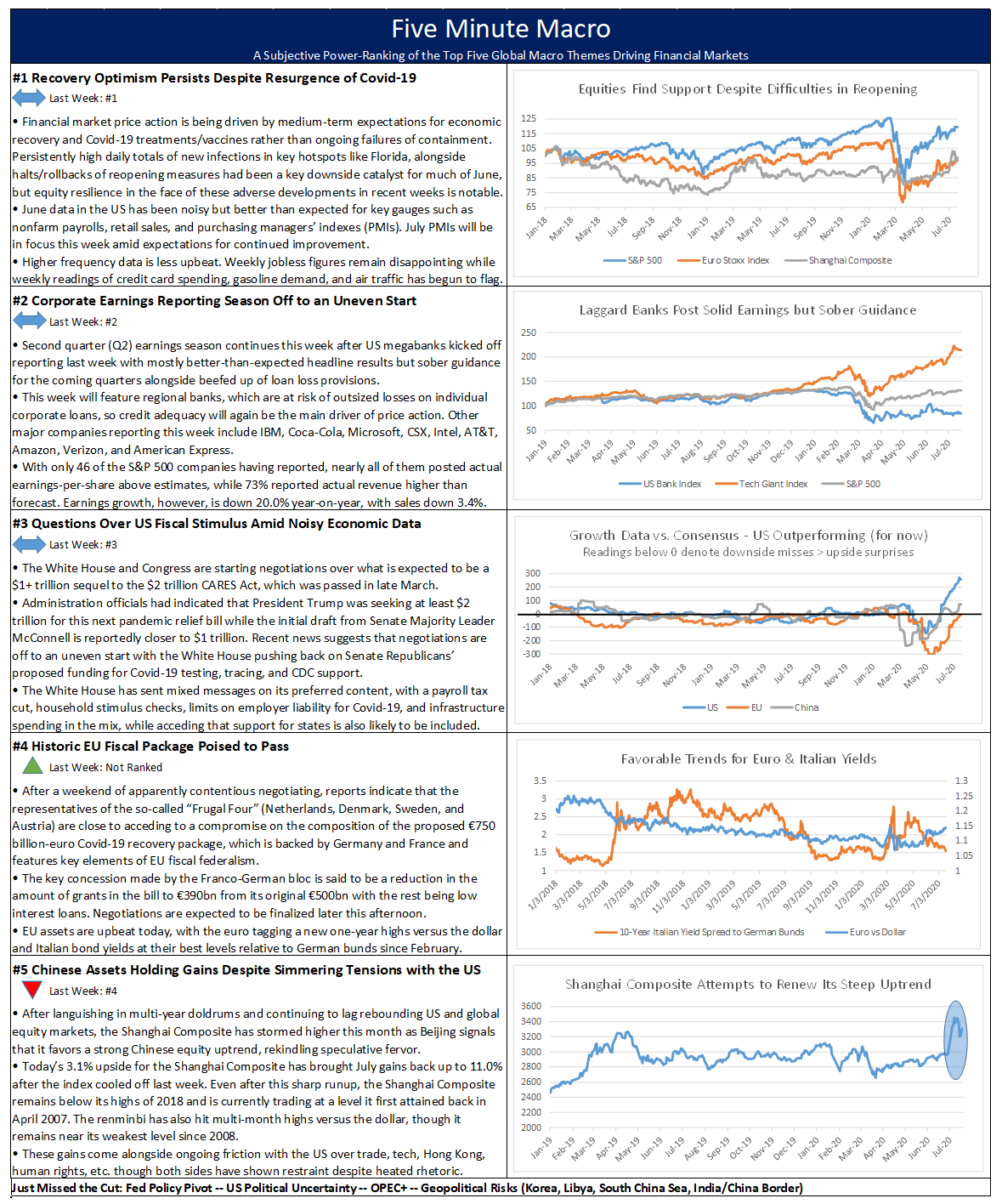

The second week of second quarter (Q2) earnings reporting again provided scant direction for stocks as analysts brace for this week’s busy calendar of results, featuring major tech giants and other US corporate bellwethers. Friday marked the close of the second week of Q2 earnings season with 181 of the S&P 500 companies reporting results to date. Thus far, 85.5% of results have featured a positive earnings-per-share (EPS) surprise and 67.7% have beaten revenue estimates, with both percentages being higher than their respective five-year averages. While this usually indicates positive trends, earnings and revenue estimates prior to the start of the quarter had been significantly lowered, with Q2 estimated earnings languishing in the doldrums at -44.7% year-on-year (y/y) two weeks ago. The current blended earnings decline, which combines actual results from companies that have reported and estimates of those that have not yet done so, has improved slightly to -42.4% from last week’s -44.1%. The blended revenue decline for the second quarter sits at -10.1%, rising from the revenue decline of -10.4% last week, and forming a trend of improvement from -10.8% two weeks ago. This week’s calendar features reports from major industry bellwethers, including Pfizer, 3M, McDonald’s, DR Horton, Harley-Davidson, eBay, Starbucks, Visa, GE, Boeing, GM, Qualcomm, PayPal, Facebook, UPS, Yum! Brands, Comcast, Proctor & Gamble, Mastercard, Ford, Apple, Shake Shack, Google, US Steel, Amazon, Expedia, Caterpillar, and Exxon Mobil.

US-China Tensions Remain Elevated but Restraint is Evident

China has closed the US consulate in Chengdu in retaliation for the US closure of the Chinese consulate in Houston, but Chinese assets were steady overnight and the lack of further escalation has eased concerns of a potentially major rupture in relations. Analysts had expected China to respond in kind after the US ordered China’s Houston consulate to be shuttered, though initial speculation had been that Beijing would shutter the US consulate in Wuhan. The US diplomatic presence in Chengdu is considered the more strategic of the two, as it is where the State Department monitors Tibet and the Western China region in general, which is a hotbed of human rights issues. However, no further measures were announced and Chinese assets steadied overnight. After sinking 3.9% on Friday amid the rising tensions, the Shanghai Composite eked out a 0.3% gain overnight, while the Hong Kong Hang Seng lost a modest 0.4% after closing 2.2% lower the prior session. The renminbi also advanced versus the dollar and is near its strongest level since March.

Additional Themes

GOP Draft of US Pandemic Relief Bill Expected Today – Though portions of the Republican’s draft $1 trillion stimulus plan have trickled out, the full text of the version crafted by Senate Majority Leader McConnell’s office is set to be released later today. Among the available details, the most notable is the new unemployment insurance scheme to replace the current $600/week benefits that are set to expire in a few days. The GOP unemployment insurance plan will focus instead on a 70% wage replacement benchmark. Additionally, the plan is said to include direct payments of $1,200 and $2,400 to individuals and families, $105 billion for reopening schools, targeted additional funds for the Payroll Protection Plan (PPP), $16 billion in additional funding for coronavirus testing, tax breaks for businesses to retain workers and retool for new safety protocols, and provisions for flexibility on state use of previous funding. The Trump administration has also backed off its demands for payroll tax cuts. Democrats will contest the absence of additional funding for state and local governments, as well as the lack of support measures for housing and rent. House Speaker Pelosi dismissed talk of a piecemeal approach to passing the bill but administration officials continue to advocate such an approach.

Dollar Downtrend Continues – An index of the dollar versus a broad basket of currencies has reached a nearly two-year low after an abrupt and steep downtrend over the past two months. Analysts are citing a variety of downside catalysts, including failures of US Covid-19 containment and aggressively easy Fed monetary policy.