Summary and Price Action Rundown

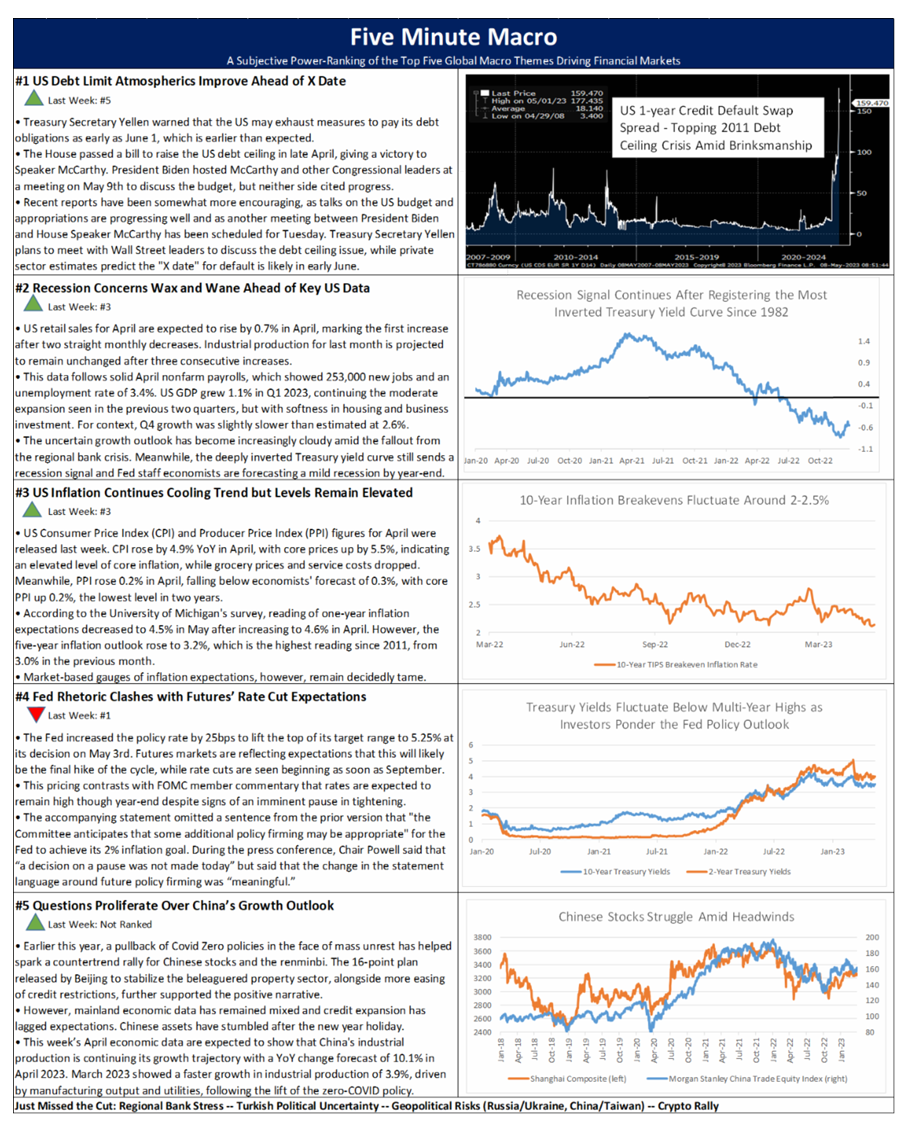

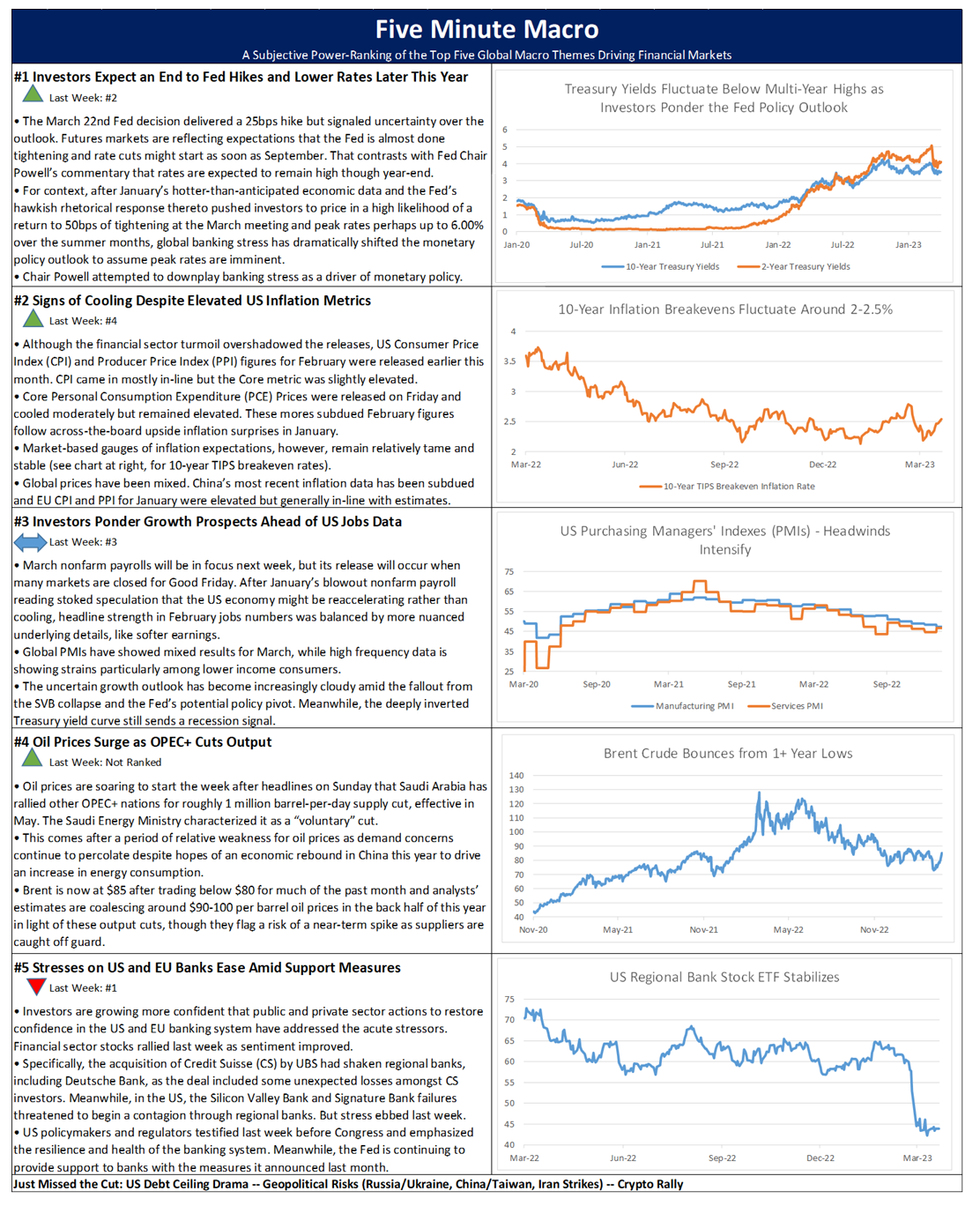

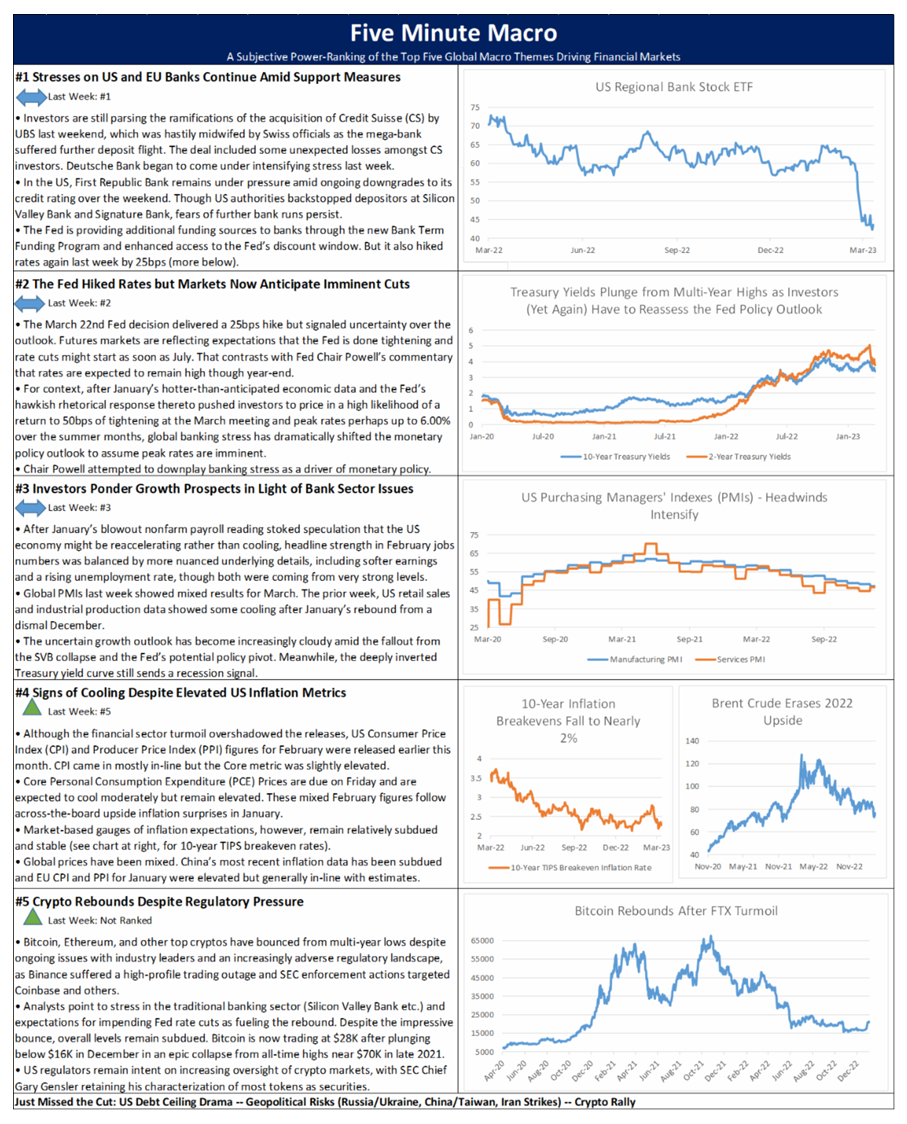

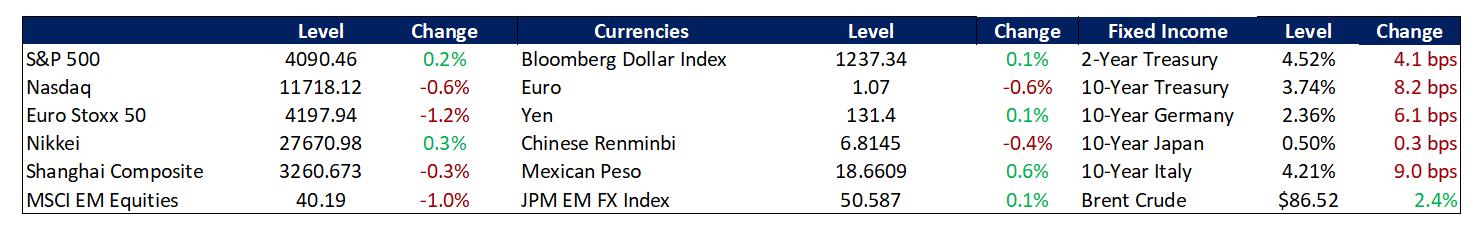

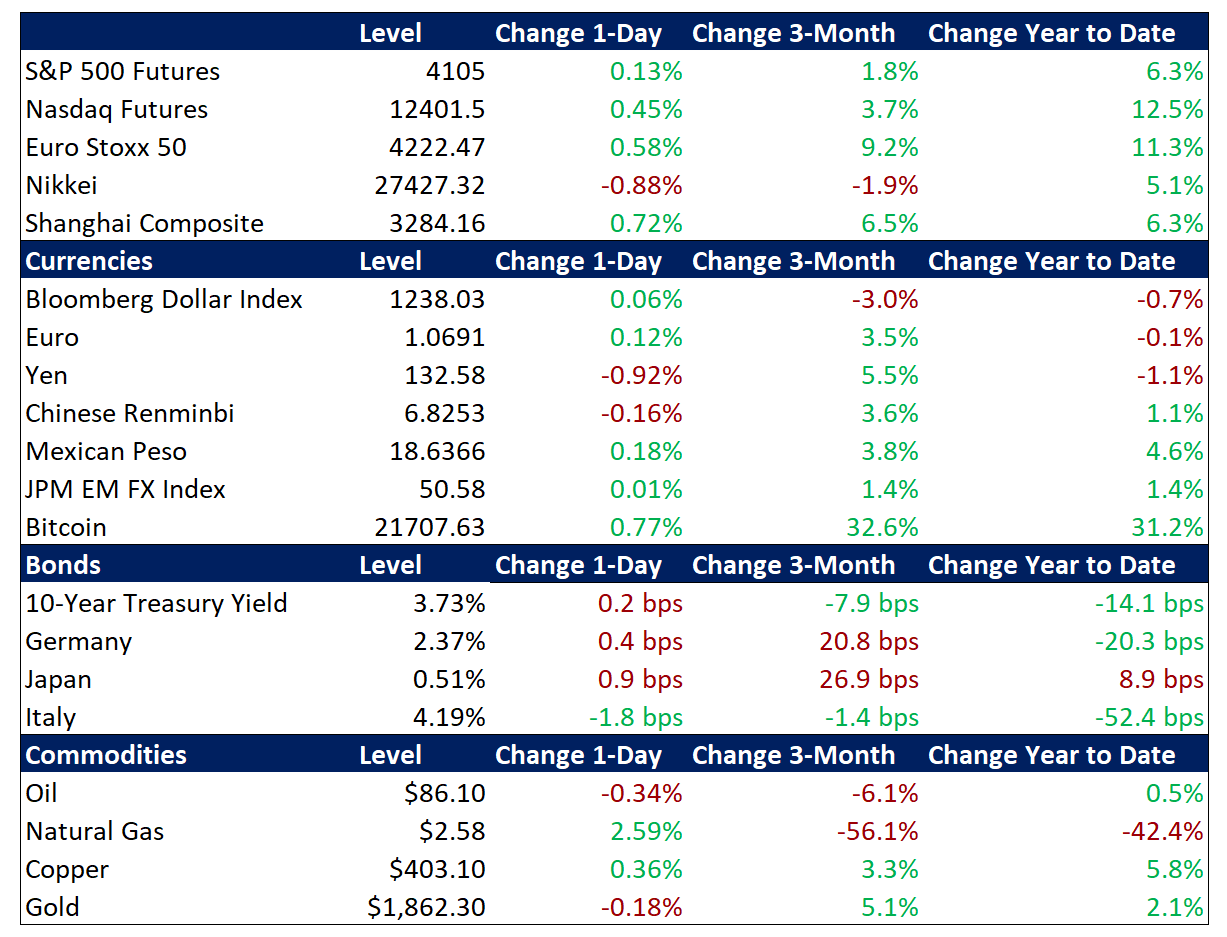

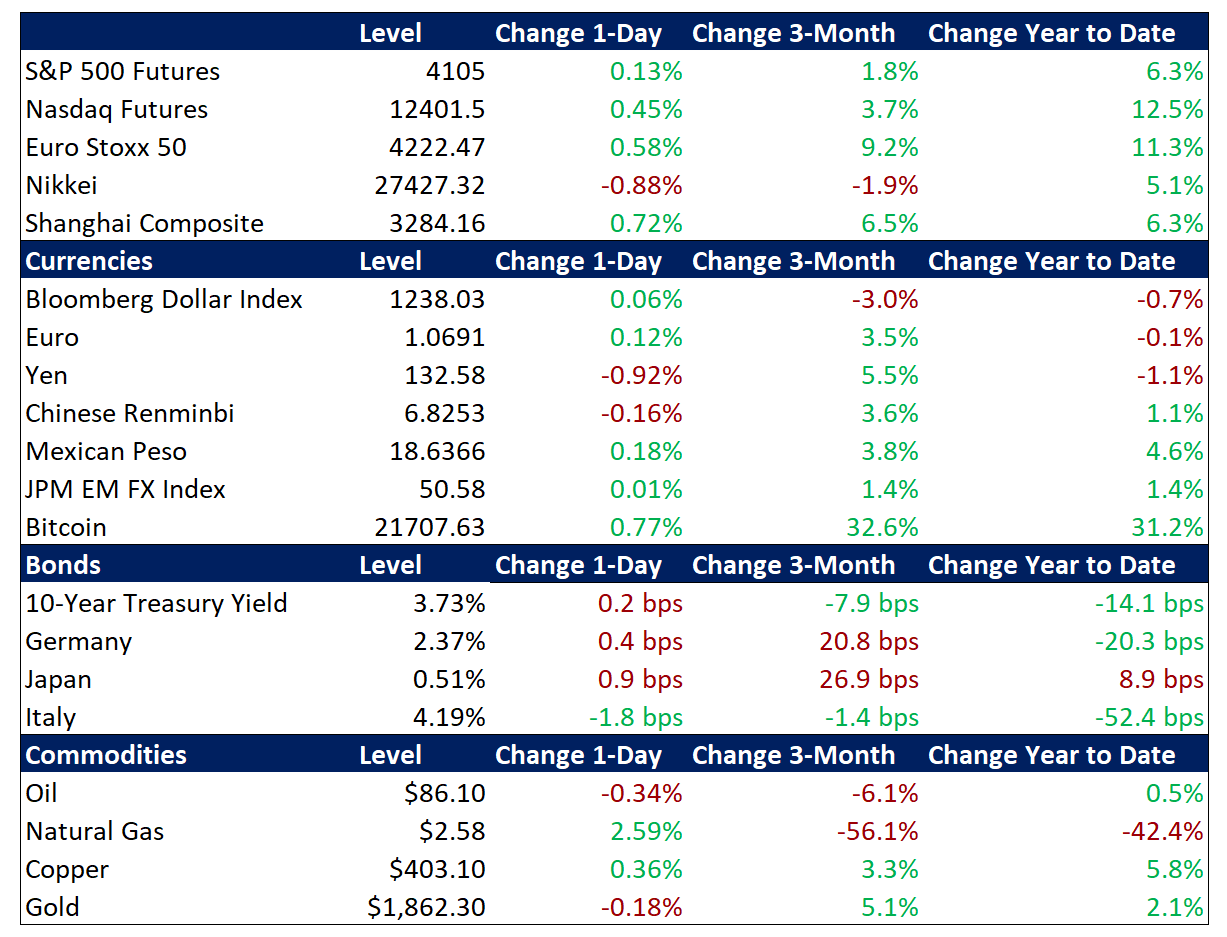

Global risk assets were mixed overnight as sentiment steadies ahead of tomorrow’s potentially pivotal US inflation figures. S&P 500 futures are pointing to a slightly higher open after the index recouped early losses on Friday to gain 0.2% and pare the week’s losses to 1.1%, taking its gain on the year to 6.5%, though the Nasdaq lost 0.6% for weekly downside of 2.4% to cut its early 2023 rally to 12.0%. EU equities are registering a moderate advance, while Asian stocks were mostly lower overnight. Longer-dated Treasuries are attempting to stabilize, with the 10-year yield holding at 3.73%, while the growth-sensitive Treasury yield curve remains deeply inverted, conveying a grim recession warning. The broad dollar is slightly stronger as it continues to fluctuate well below the two-decade highs of late September. Oil prices are reversing a portion of last week’s rebound, which was extended by Russia’s production cut, with Brent crude slipping back to $86 per barrel.

US Inflation in Focus

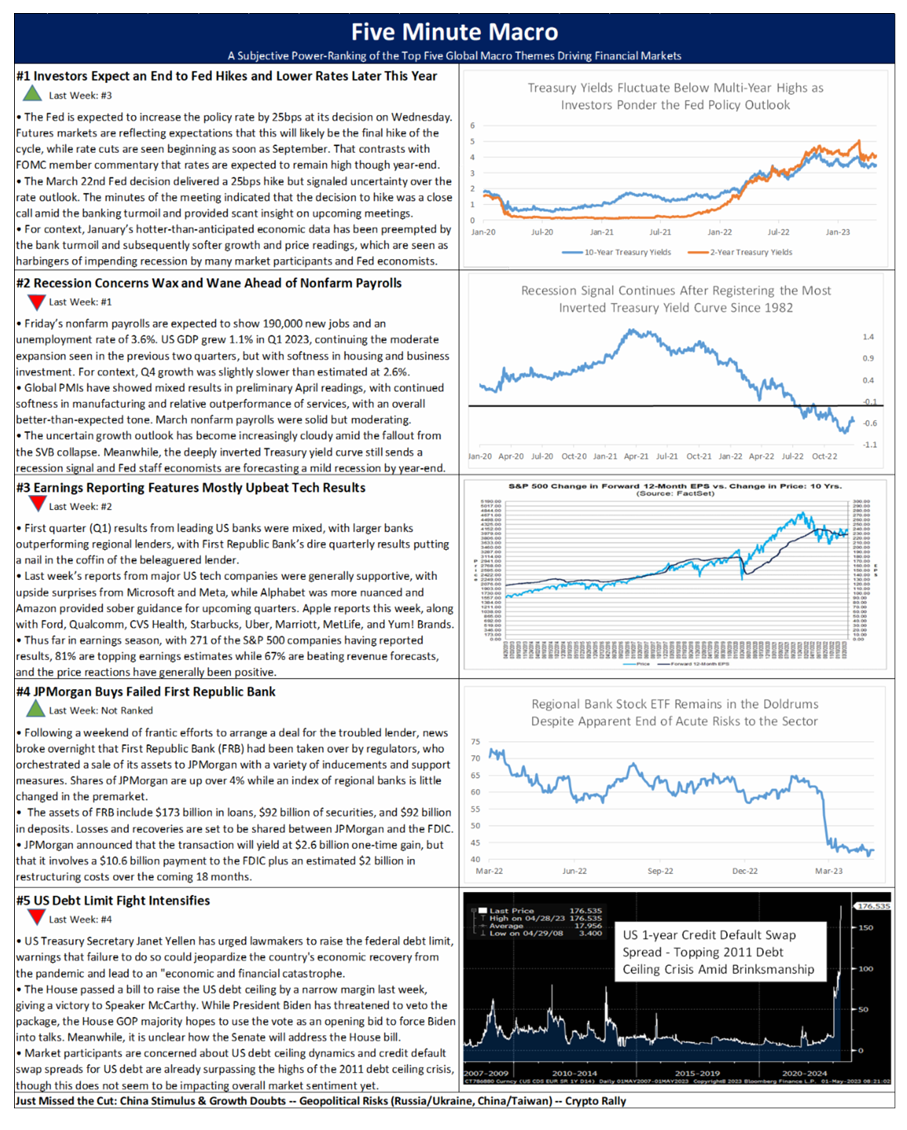

Traders are tentative ahead of tomorrow’s US Consumer Price Index (CPI) reading for January amid concerns of a disproportionate market reaction to an upside surprise. Treasuries are steady this morning but suffered meaningful selling last week as market participants fretted about the upcoming CPI data in light of the stunning blowout in January jobs figures. Investors are concerned that if CPI similarly tops estimates, the Fed will make good on its threats to raise rates higher than fed fund futures currently are pricing and hold them there for longer than market expectations reflect.

CPI is expected to reaccelerate to a 0.5% month-on-month (m/m) pace from 0.1% m/m in December, while Core CPI is forecast to remain steady at 0.4% m/m, equaling the prior month’s cadence. These readings would translate into annualized CPI and Core CPI readings of 6.2% and 5.5%, respectively, versus 6.5% and 5.7% in December. The Producer Price Index (PPI) for last month is due on Thursday of this week and is similarly expected to pick up on a monthly basis but cool further on an annualized basis.

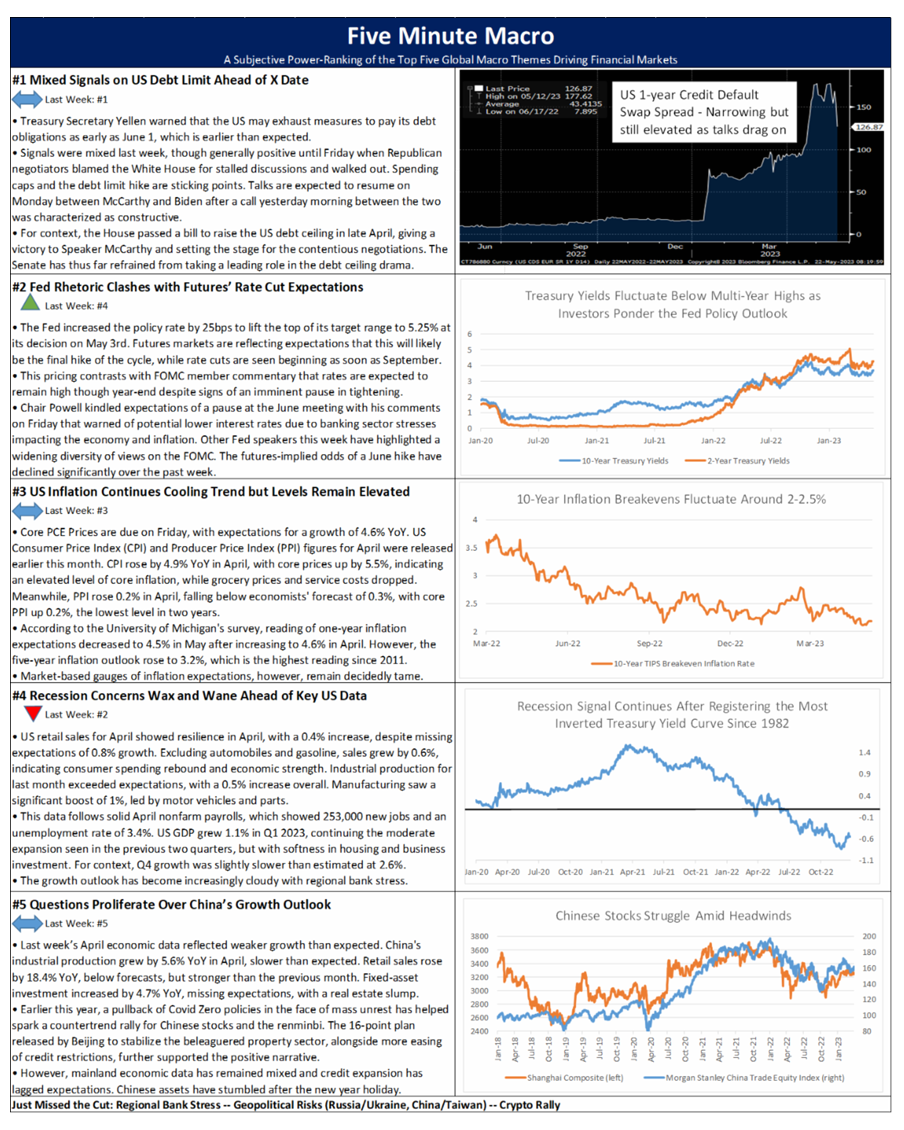

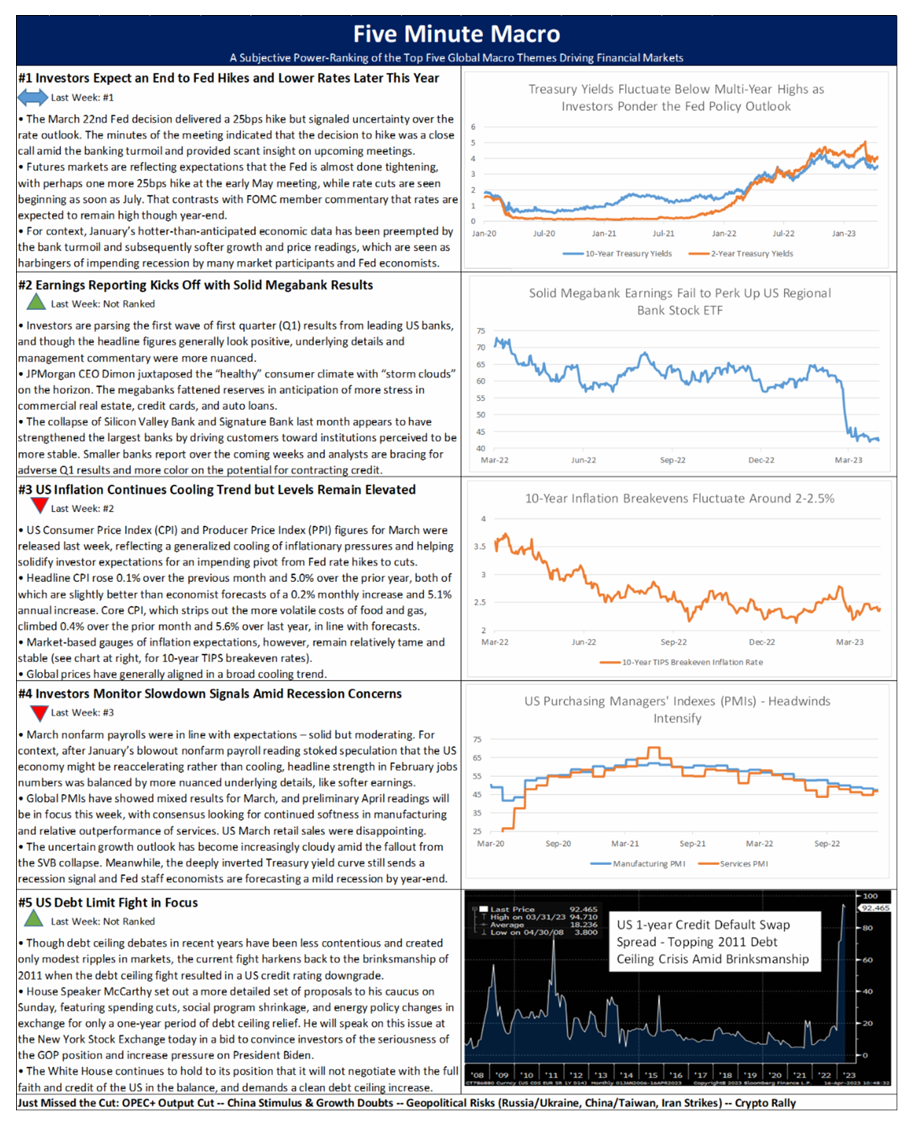

Meanwhile, TIPS breakevens, the key market-based gauges of inflation expectations, moved higher last week but remain at generally subdued levels. Specifically, breakevens on 5- and 10-year TIPS are now trading at 2.51% and 2.34%, respectively, significantly lower than their cycle tops of 3.73% and 3.03% last March and April. – MPP view: Our anticipation is that easing inflation, hopes for a soft landing, and the conclusion of the Fed’s tightening cycle leads to an “eye of the hurricane” period of market calm though roughly Q1. We doubt that this tentative optimism will be the start of a new bull market, as we see improvement in inflation stalling and price pressures remaining sticky at above-target levels while the global economy continues to slow into broadly recessionary conditions by midyear, with scant prospect of either monetary or fiscal stimulus sufficient to jumpstart the engines of growth.

As we noted in Looking Ahead – More Than Words (https://conta.cc/3YCGuLI), recent major macro events, data, and earnings, posed a potential challenge to the continuation of our “eye of the hurricane” thesis for Q1, particularly as investors begin to reduce their bets on Fed easing later this year. But on balance, we think that the broadly positive market tone can continue until crystalizing recession risks later this year, alongside the Fed’s stubborn unwillingness to ease policy, bring stormy conditions back to risk assets.

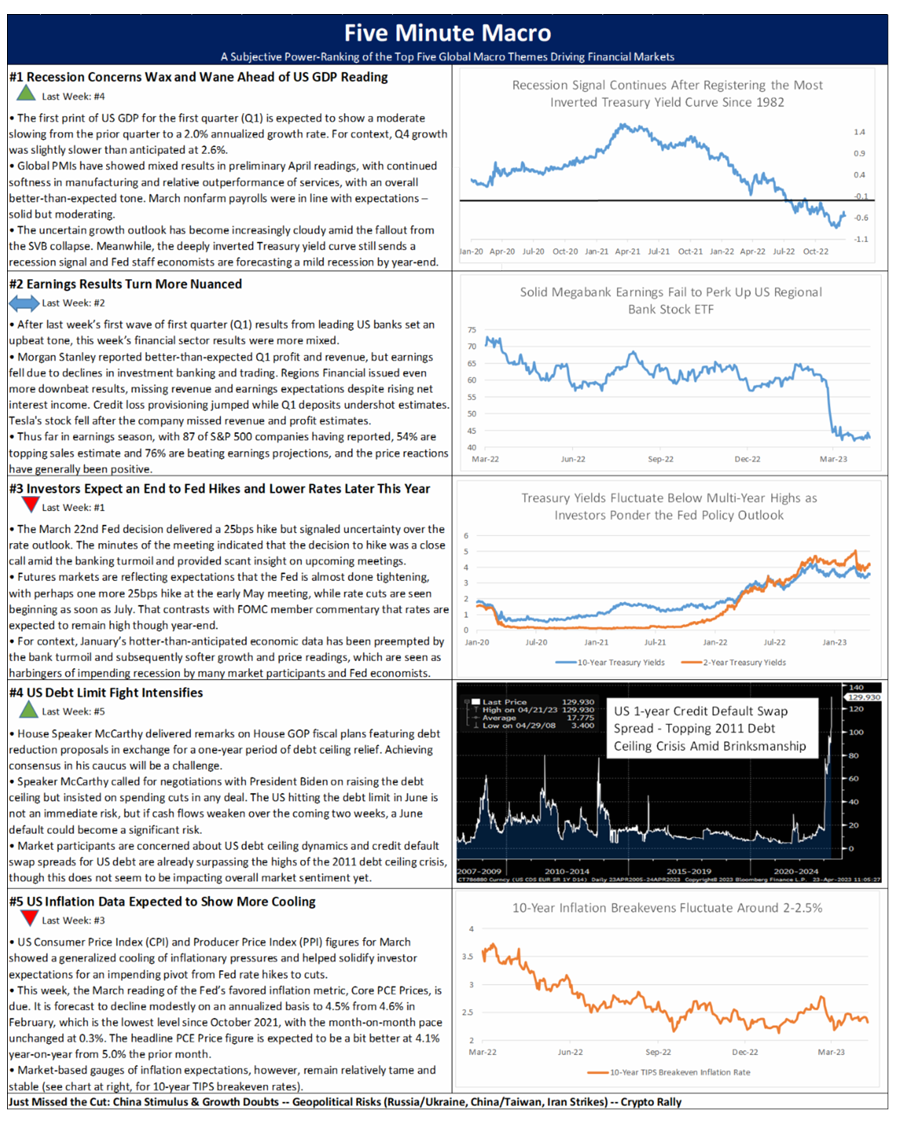

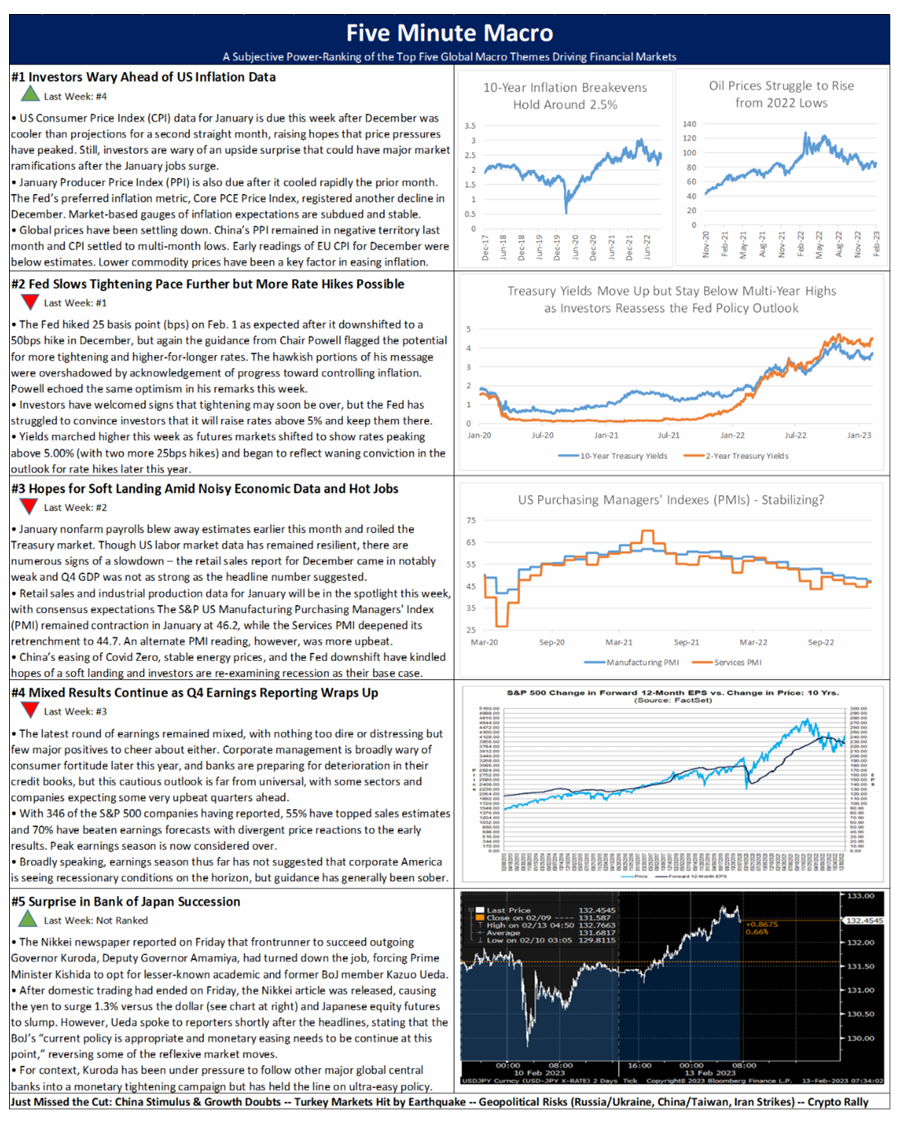

Mixed Earnings Season Wraps Up This Week

Fourth quarter (Q4) earnings season has offered little direction to overall indexes and has done little to clarify the outlook. With 346 of the S&P 500 companies having reported, 55% have topped sales estimates and 70% have beaten earnings forecasts with divergent price reactions to the early results. Peak earnings season is now considered over, but this week still features some reports from industry bellwethers including Coca-Cola, Deere, Shake Shack, Shopify, and Zillow. Palantir is the most prominent company reporting today, with its results due after the closing bell.

Broadly speaking, Q4 earnings season as brought nothing too dire or distressing but few major positives to cheer about either, and has reassuringly indicated that corporate America is not seeing recessionary conditions on the horizon. Corporate management is broadly wary of consumer fortitude later this year, and banks are preparing for deterioration in their credit books, but this cautious outlook is far from universal, with some sectors and companies expecting some very upbeat quarters ahead. – MPP view: Nothing in the results so far is a smoking gun for a recession or a wholesale downgrade of broader earnings expectations (though we believe that is impending later this year), so macro factors have remained the main driver of stocks at the index level. So with Q4 earnings season providing little overarching direction and raising as many questions it answered, we maintain our baseline view that Q1 will feature a broadly reflationary and optimistic dynamic that will prove supportive of a risk asset rebound that probably goes on longer than it should given the gathering recessionary winds that will blow through the economy later this year.

Additional Themes

Geopolitics Remain Tense Amid Reports of Downed Objects Over North America – Following the matter of the Chinese spy balloon, headlines over the weekend indicated that more objects have been detected and shot down by the US Air Force. Fewer details have been provided about the latest series of objects that were downed. Meanwhile, this morning, Chinese official media has alleged that multiple US spy balloons have been detected over China in recent years, keeping the heat under simmering US-China tensions.

Looking Ahead – This week’s macro calendar centers around the highly-anticipated US Consumer Price Index figures for January, with the Producer Price Index also due. US retail sales and industrial production data for last month will be scrutinized for any signs of additional slowing. UK inflation and retail sales are also on the calendar, along with EU industrial production, Australian business and consumer confidence, and Japan GDP.

Latest Macrocast: America runs on trucking – On today’s Macrocast, hosts Meghan Pennington and John Fagan are joined by Loren Smith of Skyline Policy Risk Group to discuss the latest on the IRA and infrastructure spending, permitting reform and its impact on energy production, the debt ceiling, and more. Tune in here! https://marketspolicy.com/podcast-2/

MPP 2023 Outlook Video – In our first video of the new year, Brendan, John, and Bob discuss the MPP financial market and policy outlook for 2023, which calls for a return to stormy conditions after the more placid conditions of Q1 deteriorate as the Fed withholds rate cuts despite a deepening recession. Markets Policy YouTube Channel Watch Here

Russell Napier: 2023 – 2038 Forecast for Financial Repression / New Rules for Investors – We hosted a very revealing, compelling, and entertaining macro strategy session with macro legend Russell Napier on Friday, January 29, 2023. Russell is predicting an era of financial repression that reverses many of the characteristics of successful investing – we think this will be very worth your time. The full interview is on the Markets Policy YouTube Channel Watch Here