Congress passed a $2 Tril Spending Package, while Central Banks continue to aggressively provide liquidity, as the Global Economy plunges into contraction, driving Oil Prices to 20-Year Lows.

Congress passed a $2 Tril Spending Package, while Central Banks continue to aggressively provide liquidity, as the Global Economy plunges into contraction, driving Oil Prices to 20-Year Lows.

|

|

|

|

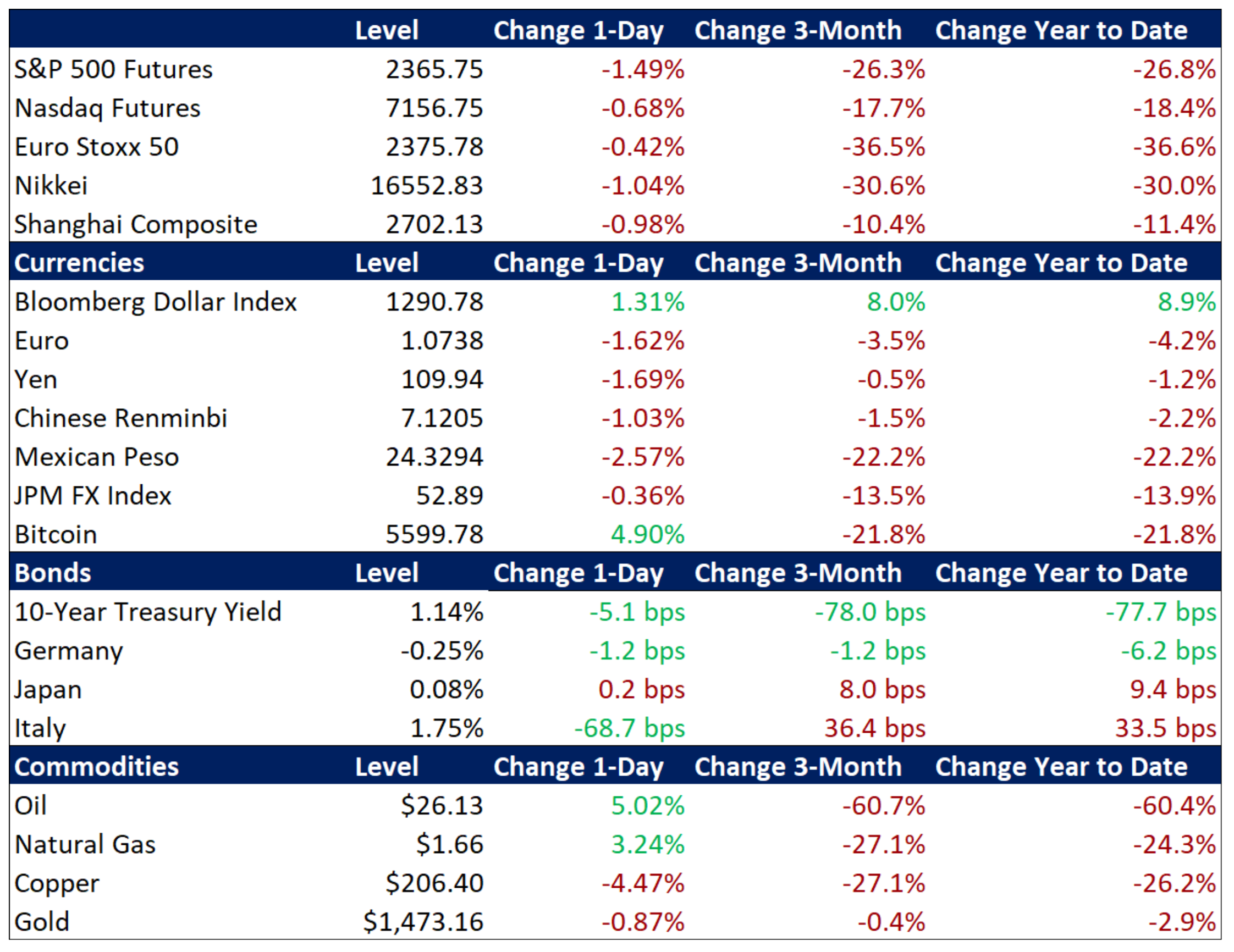

Summary and Price Action Rundown

Global financial markets are staging a recovery this morning as investors anticipate forceful fiscal measures aimed at cushioning the unprecedented economic impact from the pandemic and note easing signs of systemic stress following strong monetary policy action. S&P 500 futures are “limit up,” indicating a 5.1% rally at the open. Traders suggest that investor sentiment is finding support from more aggressive Fed accommodation, glimmers of hope from slightly decelerating Italian contagion figures, and expectations of a prompt resolution to the fiscal stimulus holdup on Capitol Hill. Coming off its worst week since 2008, the S&P 500’s year-to-date downside is now 30.8% and its decline from mid-February’s record high is 33.9%. EU and Asian equities also posted robust gains overnight. Amid the easing risk aversion, Treasury yields are ticking higher, with the 10-year yield at 0.80%, while EU sovereign bonds remain steady. Importantly, the dollar is falling back from multi-year highs. Lastly, oil prices are bouncing further above last week’s nearly multi-decade lows, with Brent crude up above $28.

Expectations of US Fiscal Support Help Steady Market Nerves

Investor sentiment remains fragile but tentatively more upbeat today as Congress and the White House work toward a third US spending bill aimed at providing government support to households and businesses during the pandemic, though analysts fret that even this massive package may prove to be too little, too late. Senate Democrats continue to hold out for amendments to the latest stimulus bill aimed at providing support to workers, companies, and the economy in general during the sharp contraction of activity amid the pandemic response. The latest reports indicate that House Speaker Pelosi would likely accept a version agreed between Senate Democrats and the White House, but that House Democrats have crafted their own version of the bill featuring $2.5 trillion in government support for workers and businesses. The House version features moratoriums for mortgage, car, and credit card payments, breaks for public housing rent, $10k in student loan forgiveness, and a freeze on foreclosures and evictions. This follows the rapid expansion of the size of the fiscal package last week from $1.3 trillion to roughly $2 trillion last week, as Congress and the Trump administration reacted to the soaring estimates of economic damage. Investors are struggling to comprehend how much fiscal firepower might be necessary to even partially cushion severe impact of the pandemic on the balance sheets of businesses and households, but more than $2 trillion represents a strong counterweight to this unfolding national solvency crisis. Meanwhile, President Trump’s latest remarks convey anxiousness to restart more normal economic activity, though most of the restrictions and lockdowns are mandated at the state level.

Signs of Easing Market Stress Amid Unprecedented Fed Support Measures

As the liquidity crisis that the Fed is attempting to quell remains intertwined with the slower-moving but intensifying solvency crisis brought on by the pandemic, the FOMC answered the call yesterday to more directly support credit markets and reinforce fiscal backstops to key sectors. Yesterday morning, the Fed announced extensive new measures to support the economy that will provide up to $300 billion in new financing for employers, consumers, and businesses. The Fed will also now be able to purchase Treasury securities and agency mortgage-backed securities in unlimited amounts in order to support smooth market functioning along with increasing buying of agency commercial mortgage-backed securities. They created two facilities to support credit to large employers and established a third facility to support the flow of funds to consumers and businesses, along with facilitating credit availability for municipalities. Investment grade credit rallied yesterday and traders noted some signs of better market functioning, although high yield debt remained under significant pressure. Meanwhile, analysts are citing diminished evidence of stress in offshore dollar funding markets (more below), while short-term funding (repo) and interbank markets similarly appear more orderly. Commercial paper and municipal bonds will be monitored for evidence of improvement.

Additional Themes

Data Shows Massive Economic Contraction – March purchasing managers’ indexes (PMIs) for the EU, Japan, and UK reflect unprecedented deterioration (readings below 50 denote contraction). The EU composite PMI plummeted to 31.4 after registering 51.6 in February, with the service sector showing the sharpest contraction at 28.4 versus 52.6 last month. Factory activity also saw a quickening decline, sinking from 49.2 in February to 44.8. Earlier, Japan’s March services PMI cratered to 32.7 from 46.8 and manufacturing slid to 44.8 from 47.8, putting the composite reading at 35.8. UK services slumped to 35.7, manufacturing was 48.0, and the composite crashed to 37.1 from 53.0 the prior month. US PMIs are due later today.

Dollar Depreciation Welcome – Analysts are crediting the Fed’s aggressive measures for taming the rampant dollar in overseas trading thus far today. The greenback is off its multi-year peak.

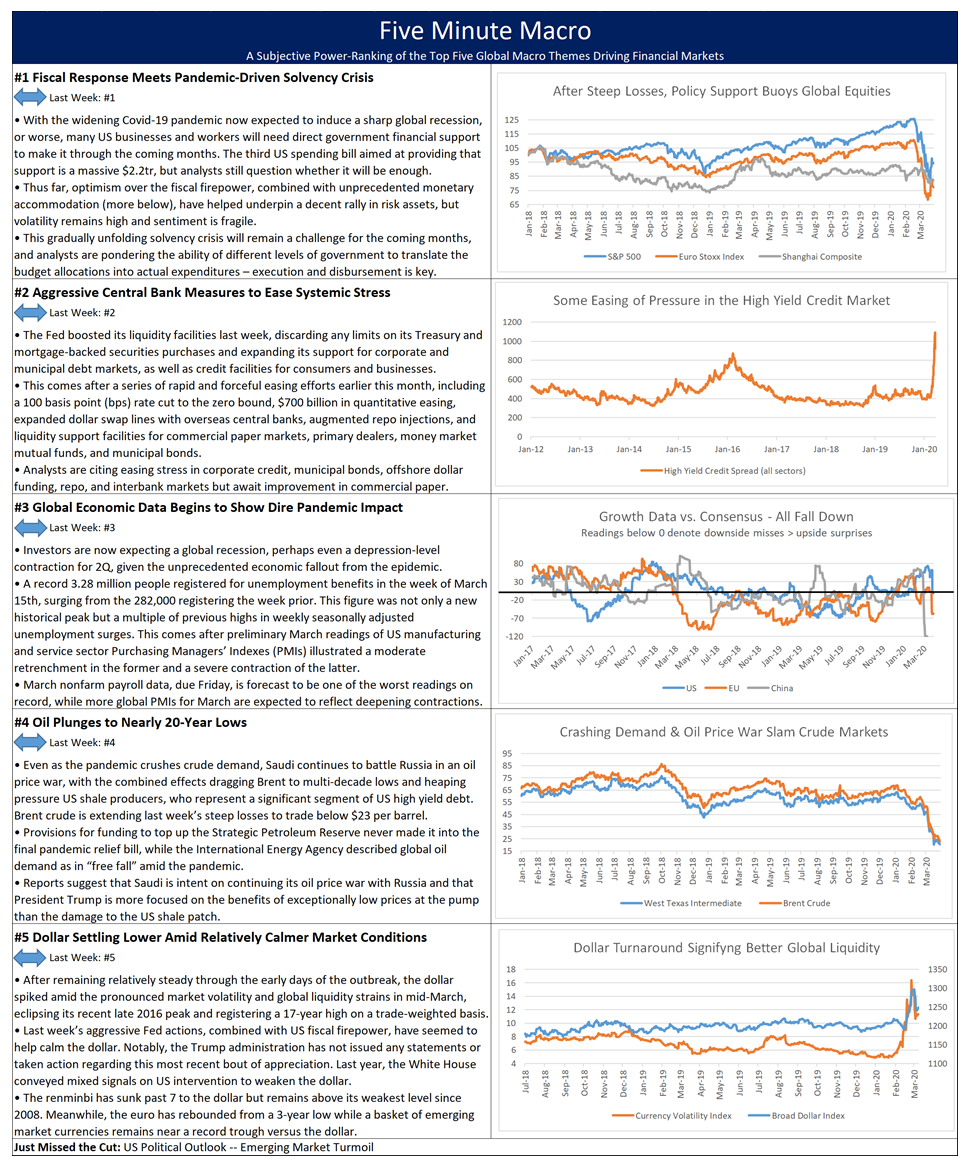

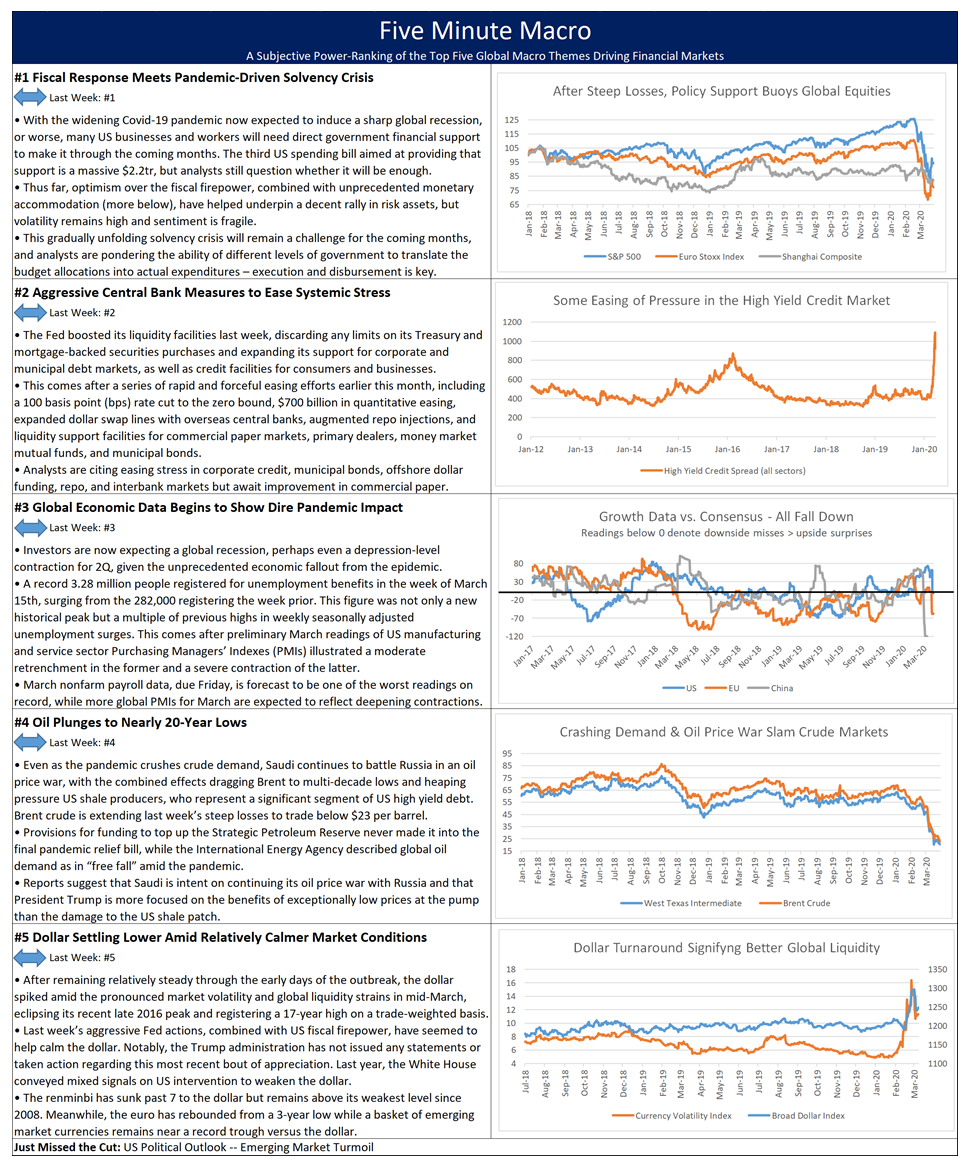

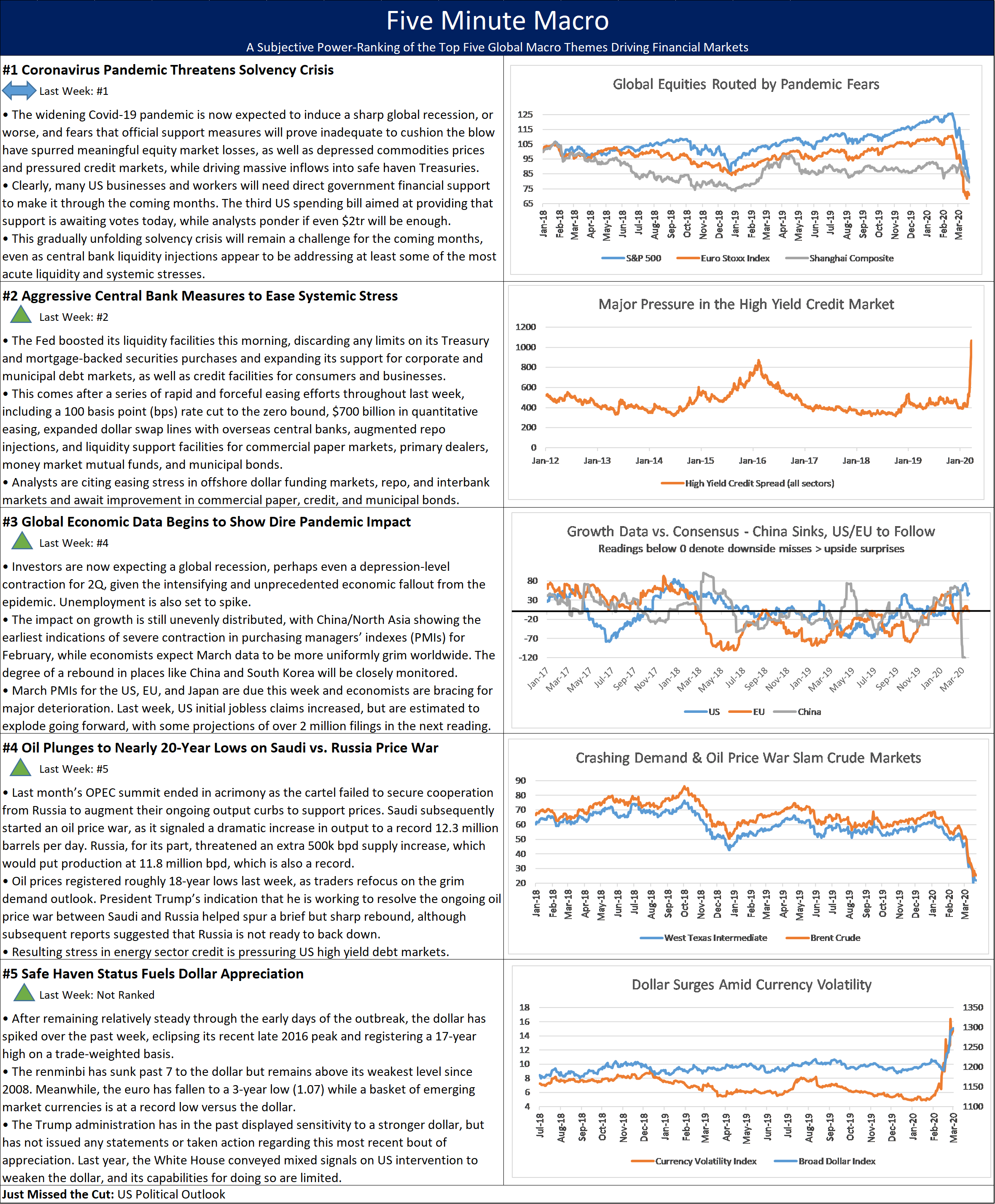

With the Coronavirus Pandemic now threatening a Solvency Crisis, Aggressive Central Bank Measures have been enacted to ease systemic stress, while Economic Data begins to show the stress. Meanwhile, Oil Continues to fall while the Dollar Strengthens.

|

|

Summary and Price Action Rundown

Global financial markets have fluctuated sharply overnight as US and EU central banks enacted even more forceful stimulus and support measures to quell the immediate market panic, though investors remain focused on the need for fiscal efforts to address the unprecedented economic fallout from the pandemic over the coming months. S&P 500 futures point to a 1.5% loss at the open, which represents only a moderate decline in the context of recent weeks but follows a swing of 8 percentage points overnight between solid gains to steep losses. Amid wild swings over the past week, the S&P 500 is down 25.8% on the year, and 29.2% below its mid-February record high. EU equities are only slightly lower this morning while Asian stocks registered another session of moderate downside overnight. Treasury yields are slightly lower, with the 10-year yield at 1.14%, while EU sovereign bond markets are rallying after the European Central Bank’s muscular actions last evening (more below). Meanwhile, the dollar continues to march to multi-year highs. Lastly, oil prices are retracing some of yesterday’s plunge, with Brent crude climbing above $26 per barrel.

Federal Reserve and European Central Bank Work to Calm Panicked Markets

Policymakers have been forced to take increasingly radical steps this week to confront the interlocking public health, economic, and financial crises brought on by the pandemic, with the European Central Bank (ECB) and Federal Reserve stepping in again last night to address rising systemic risks. After intervening in bond markets yesterday to stem the rout in Italian debt, the ECB announced overnight a €750 billion Pandemic Emergency Purchase Program (PEPP), with ECB President Lagarde stating that there are “no limits” to their commitment to steady EU financial markets, echoing her predecessor Mario Draghi’s “whatever it takes” stance that helped quell the EU debt crisis in 2012. The PEPP greatly ups the ECB’s firepower after last week’s €150 billion expansion and Lagarde’s seemingly reluctant tone underwhelmed market participants. The PEPP will not be bound by the same strictures as prior ECB quantitative easing programs, with Greek debt being eligible alongside other loosened restraints. Later in the evening, the Fed announced the Money Market Mutual Fund Liquidity Facility, to help ease the stress of spiking redemption demands in these vital segments of the financial market. This follows deployment of support programs for commercial paper markets and primary dealers.

Fiscal Firepower in Focus as Economies Freeze

While central banks work to counter the immediate systemic financial shocks, governments are scrambling to enact fiscal support measures that will keep their economies on life support through the coming weeks and months of pandemic lockdown. The Trump administration has stepped up its efforts on the fiscal front this week (“going big”), with Treasury Secretary Mnuchin outlining the basics of a massive follow-up package to the emergency spending bill that he hammered out with House Speaker Pelosi last week, which the Senate passed yesterday afternoon. This third stimulus bill is set feature up to $1.3 trillion in spending, encompassing direct payments for households, assistance for small and medium sized businesses, and liquidity for impacted industries, alongside $300 billion in tax payment deferrals as the April 15 deadline is pushed back for three months. Mnuchin dismissed concerns over the ballooning federal deficit though some analysts warned that Treasuries and other sovereign bond markets might react adversely to the coming flood of supply. Also, National Economic Council Director Kudlow indicated that the US government might eventually consider taking equity stakes in companies in need of support. Meanwhile, Berlin’s reluctance to deploy its fiscal headroom is now giving way, as the government readies a package of €550 billion to support Germany’s economy.

Additional Themes

Economists Brace for Spike in US Unemployment Claims – With economic data around the world beginning to show the intensifying impact of the pandemic, analysts are pointing to US initial jobless claims for last week as potentially an early indicator of mass layoffs that anecdotal evidence suggests may have already begun. Also, a survey of German business confidence sank to is worst level in a decade. This comes as major Wall Street banks continue to downgrade their economic outlooks, with a global recession now a “base case” for a number of them, while the second quarter is at risk of registering a “depression” level plunge in growth.

Oil Steadying Near Almost 20-year Lows – Oil prices plummeted to around 18-year lows yesterday, with the deepening sell-off being driven by fears that the coronavirus will result in a global recession and massively decrease demand for crude, compounded by the continuing price war between Saudi Arabia and Russia. The oil price slide is also being felt in the high-yield market, with an ETF of so-called “junk” bonds falling to its worst level since spring of 2009. Energy companies are among the biggest issuers of junk bonds, accounting for more than 11% of the market.