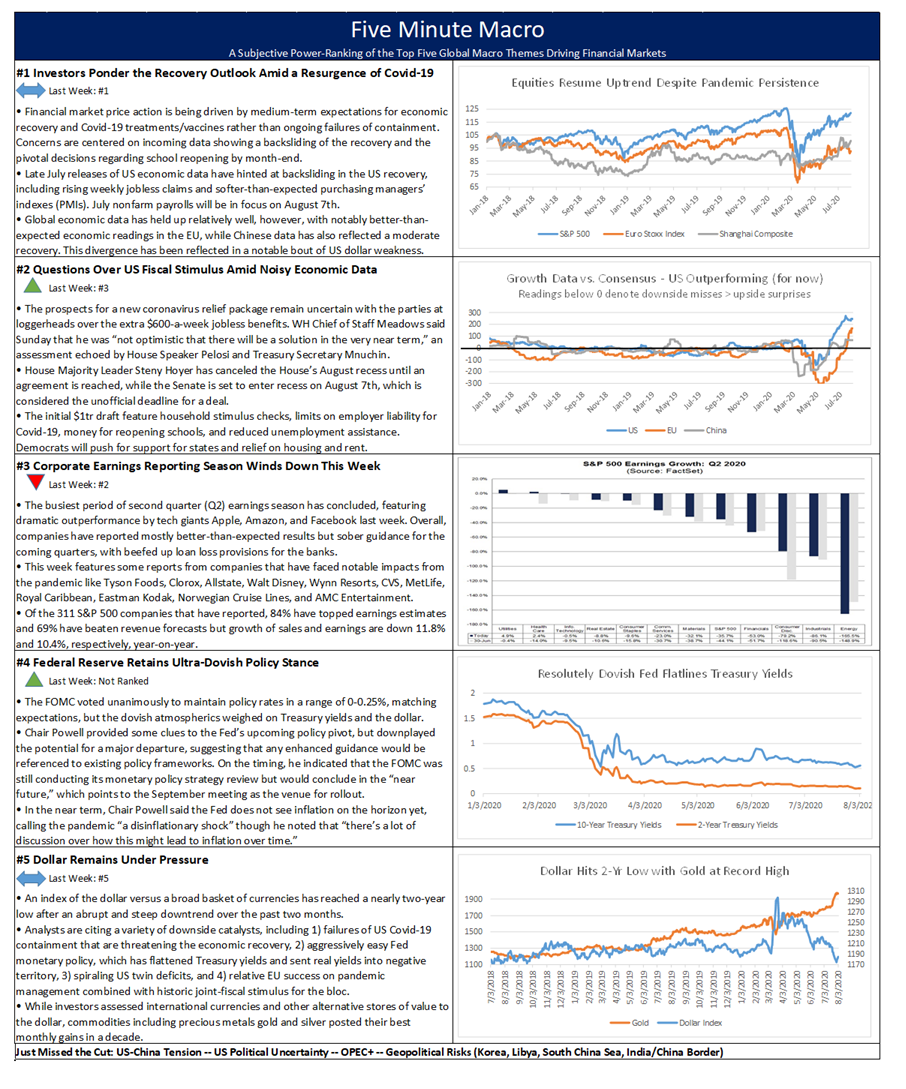

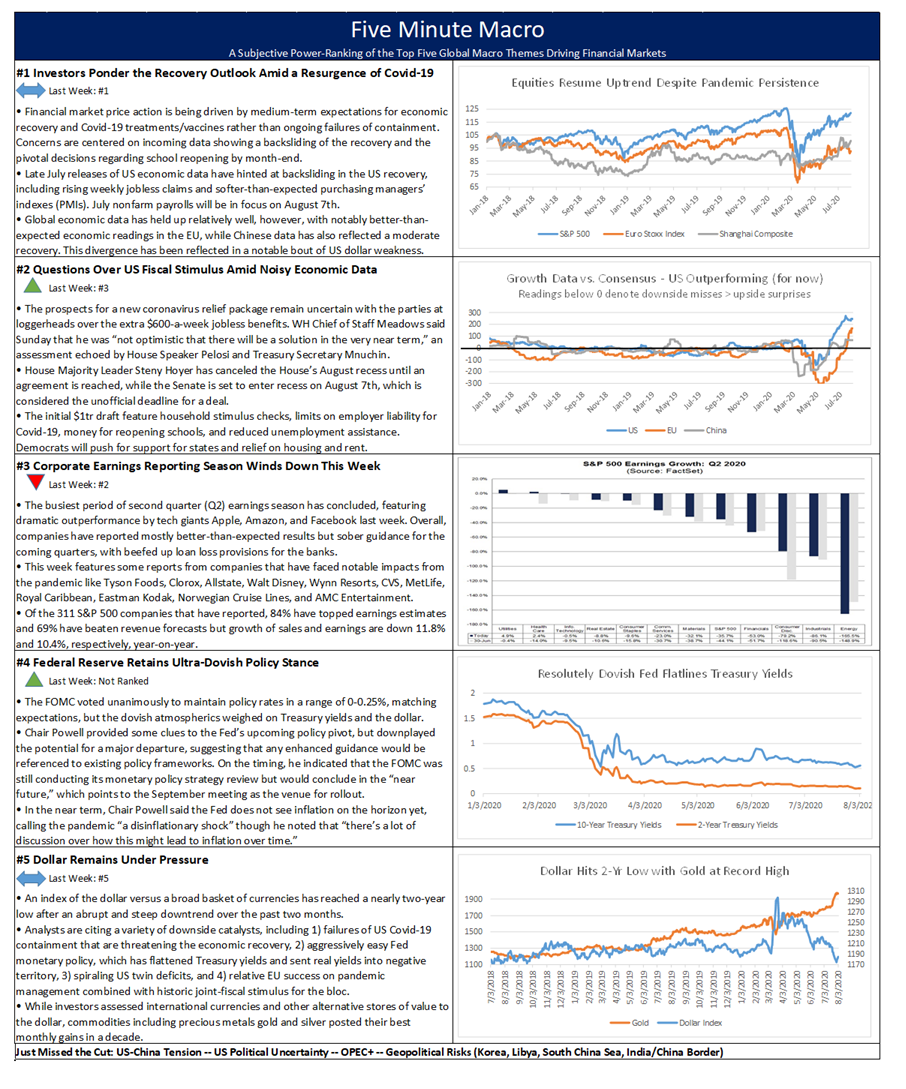

Pandemic recovery remains front and center but worries about CARES/HEROES 4 moves up to second. Corporate earnings drops to third while a dovish FOMC stance enters at 4 with dollar weakness remaining in the fifth spot.

Pandemic recovery remains front and center but worries about CARES/HEROES 4 moves up to second. Corporate earnings drops to third while a dovish FOMC stance enters at 4 with dollar weakness remaining in the fifth spot.

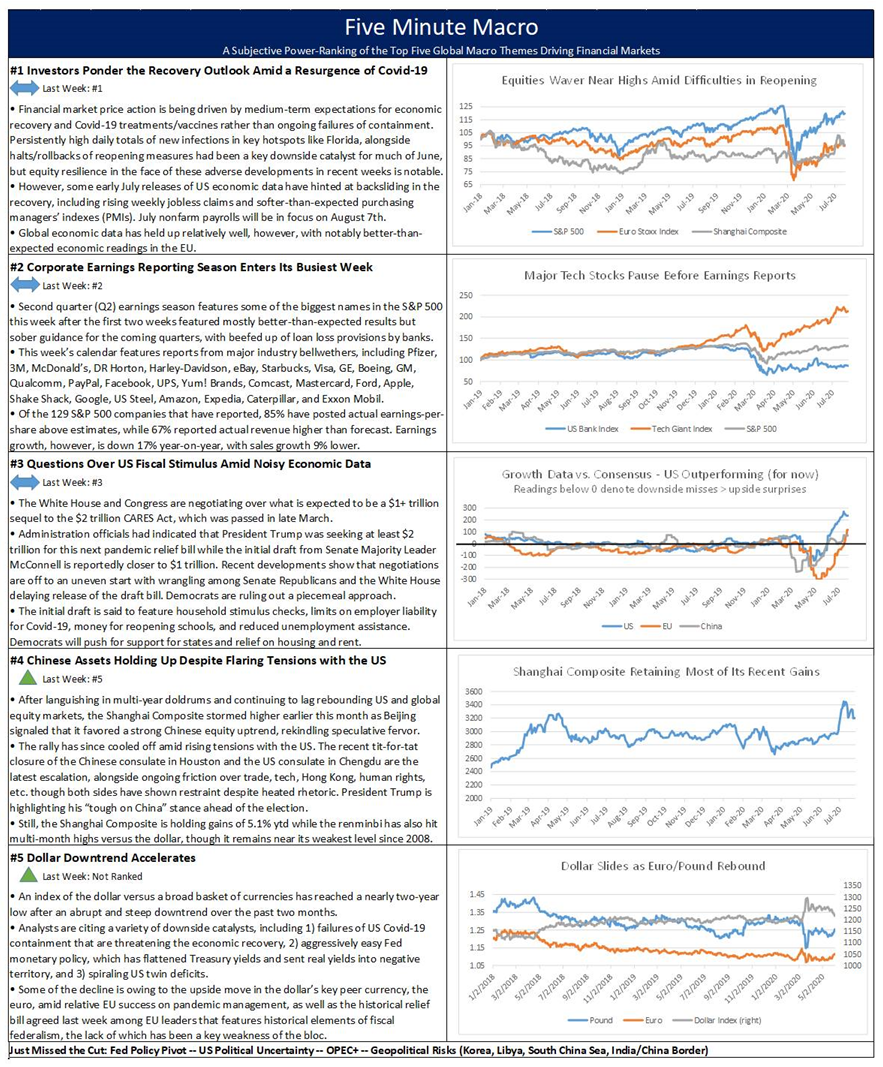

Covid-19 infection rates, corporate earnings and the state of CARES 4 remain the top three things driving markets this week. The Chinese asset rally moves up to fourth, while the quickly weakening Dollar enters in the final spot.

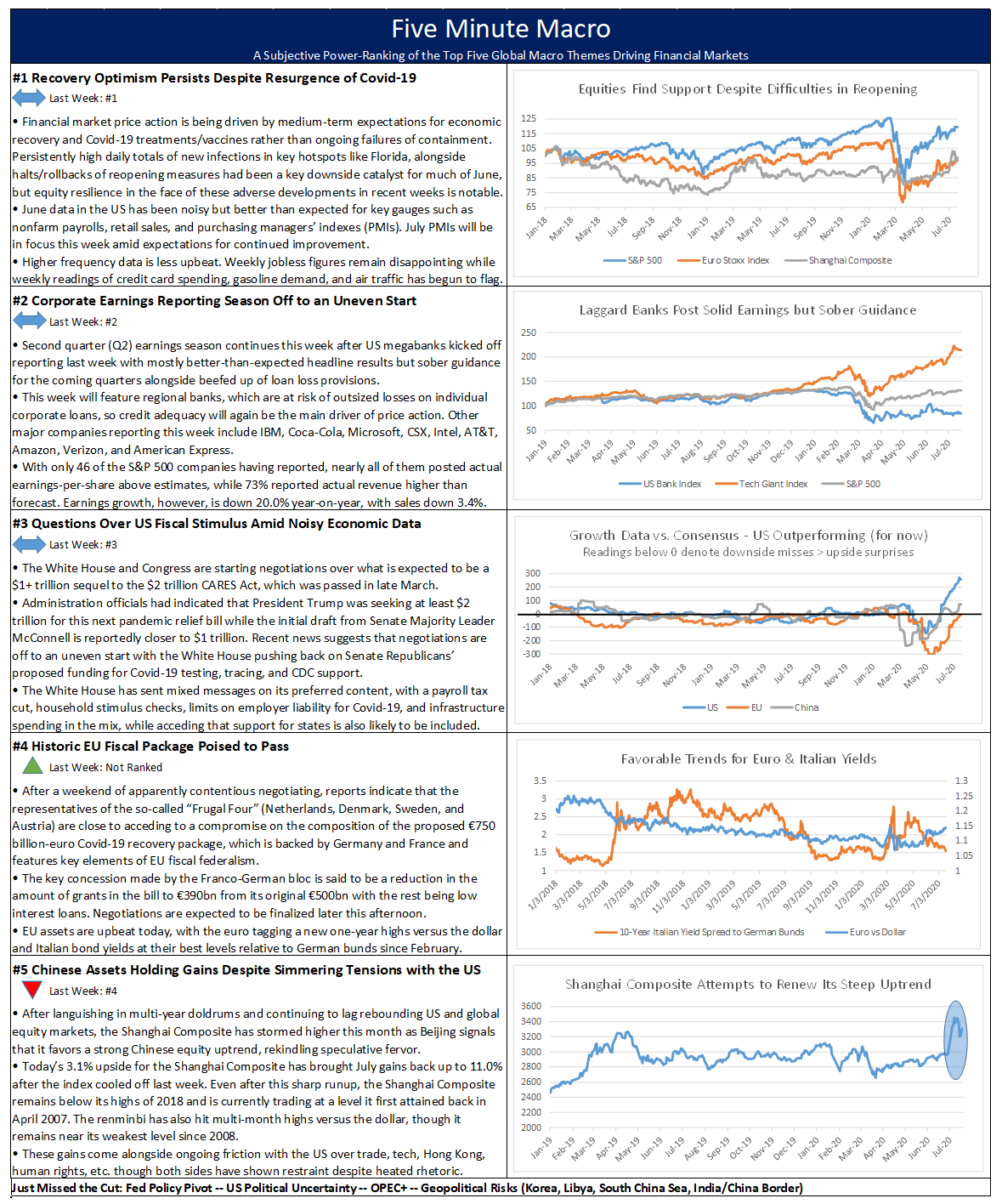

Recovery optimism continues to drive market sentiment, followed by week two of peak earnings season and continued negotiations over US and EU stimulus. Finally, the China asset rally rounds out the top five.

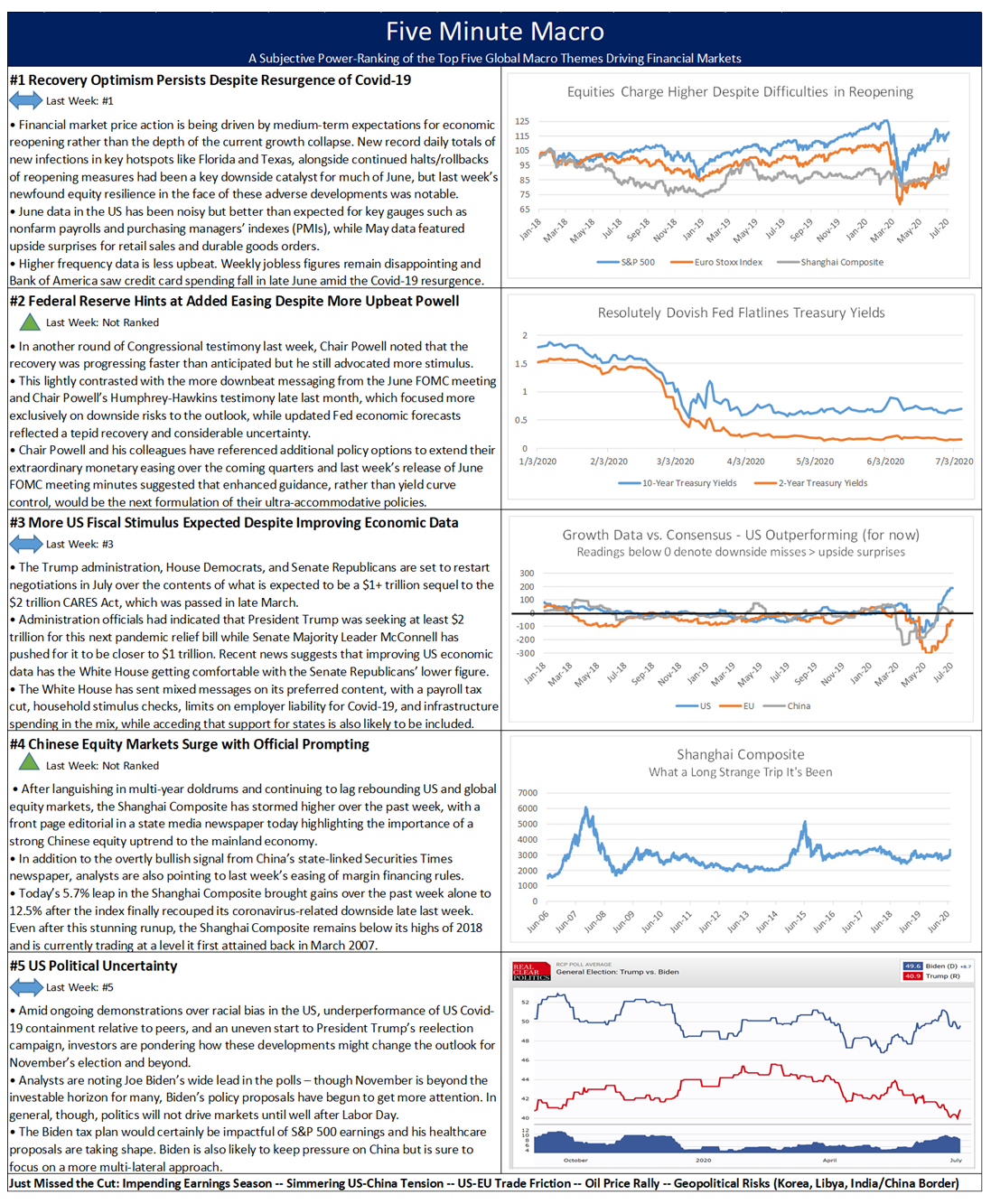

This week, Covid infection rates in the hot spot states remains the driving factor for risk. More Fed easing moves up to the second spot, while hopes for fiscal stimulus remains third. Chinese equity market’s surge due to official prompting enters at the fourth spot and US political uncertainty remains in the fifth spot.

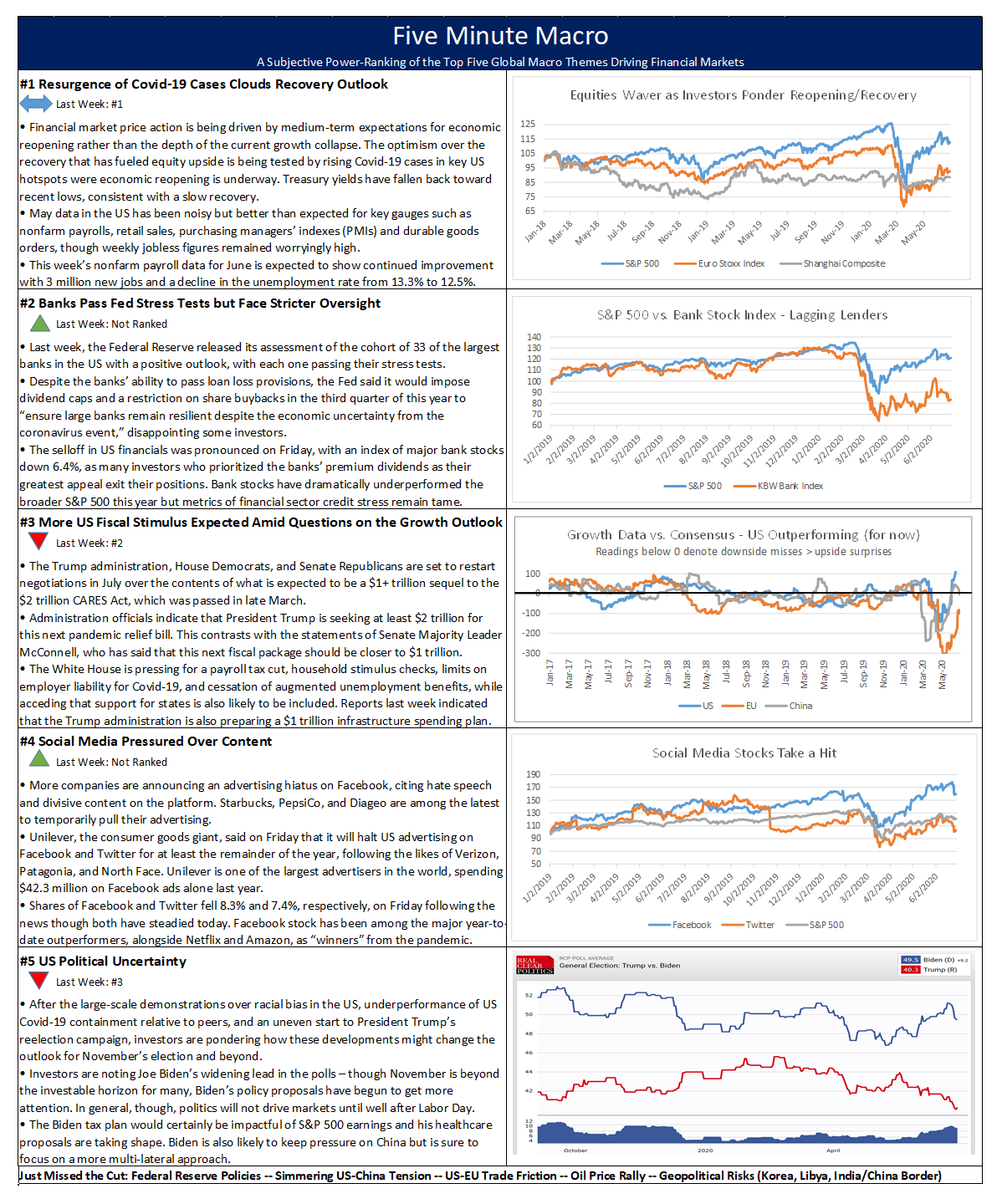

Covid infection rates remain the main driver of risk this week, while The Fed Bank Stress Test enters the mix for the first time. Fiscal stimulus moves down to the third spot and Pressure on social media content enters at the fourth spot. Finally, US political uncertainty rounds out the top five.

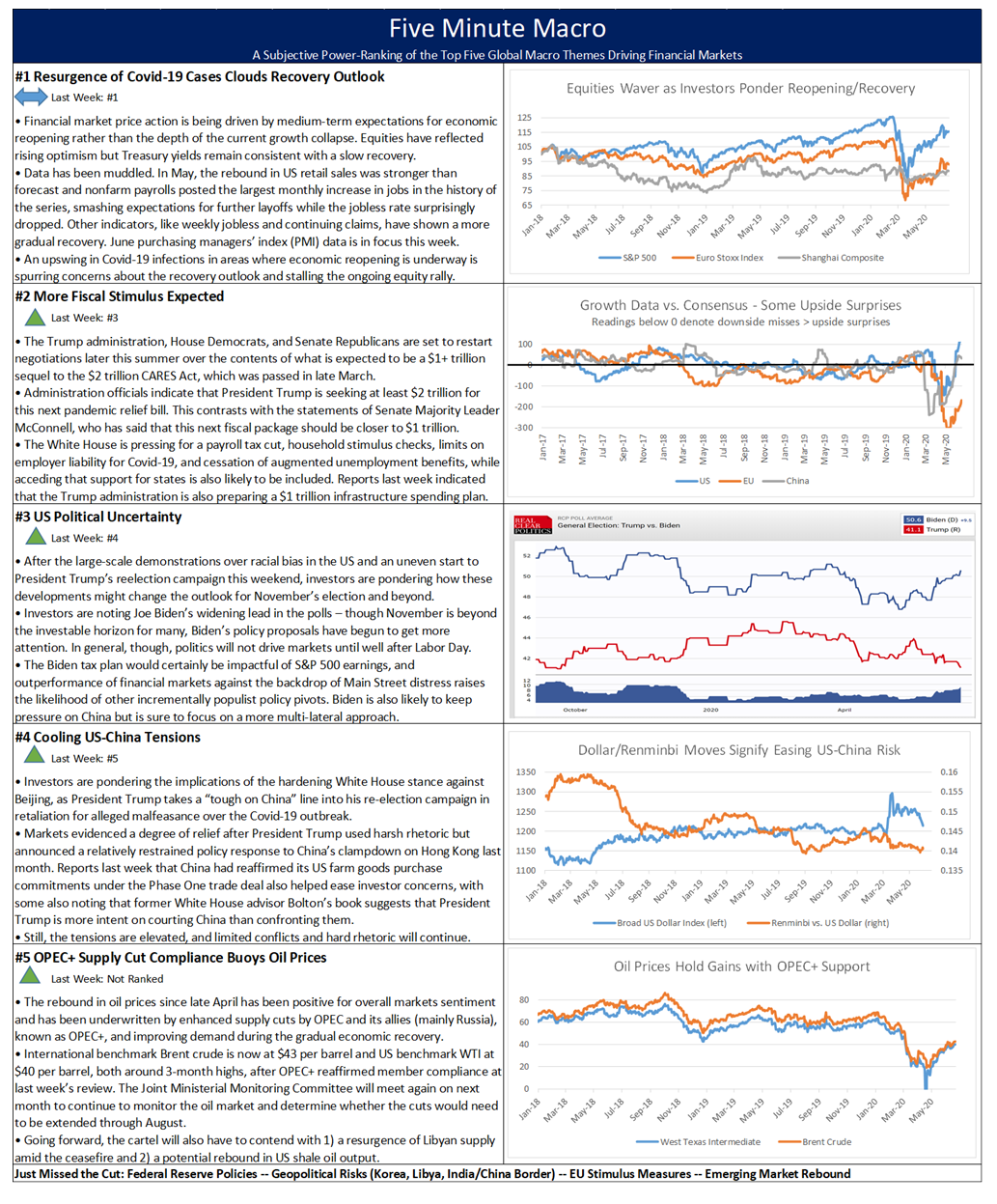

Covid resurgence remains the main concern of markets while Fiscal stimulus moves into the second spot. US Political uncertainty moves into the third spot and Cooling US-China relations takes the fourth spot. Finally OPEC supply cut compliance enters at the fifth spot.

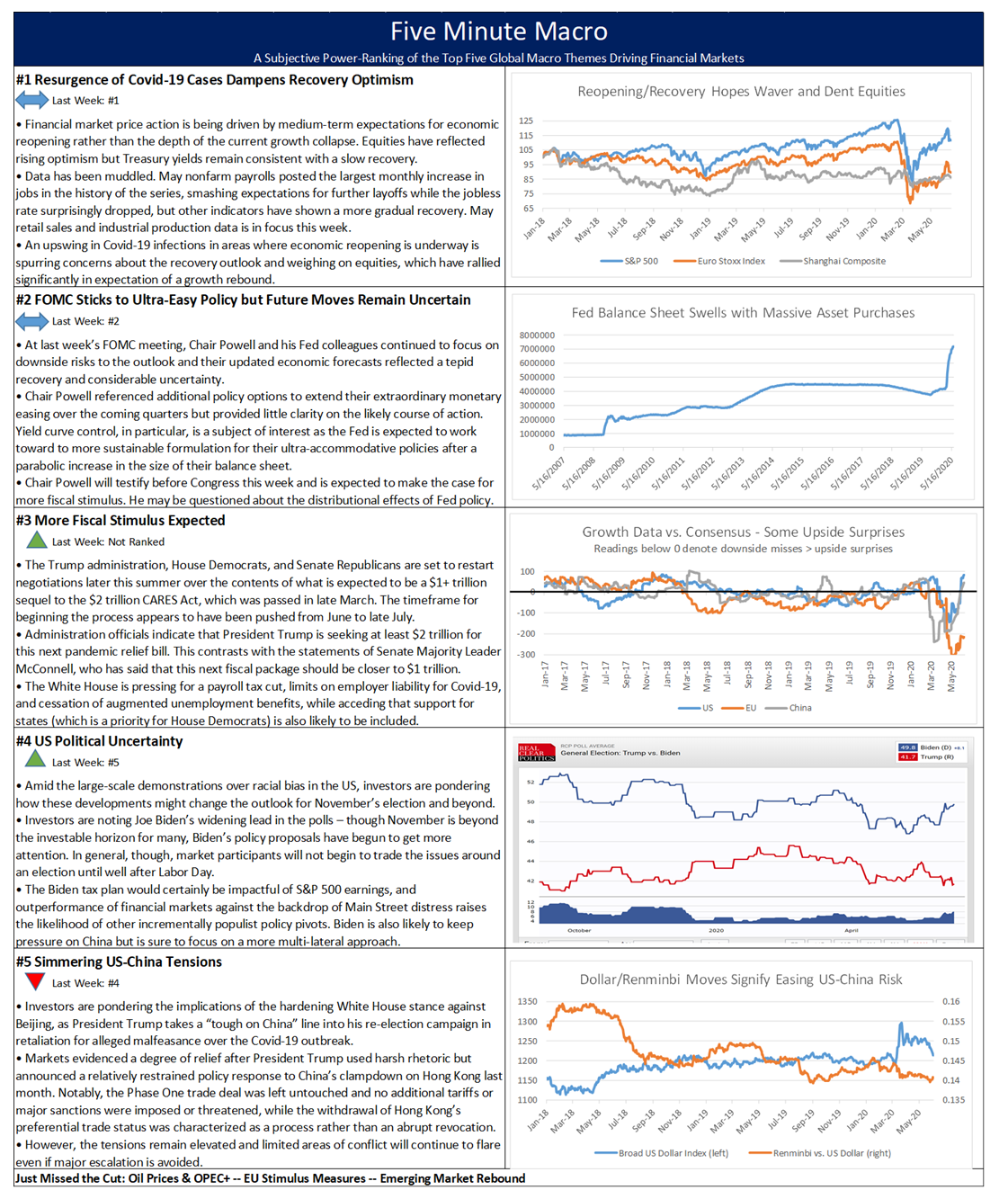

Covid-19 resurgence dampens recovery optimism remains front and center followed by Fed Policy and the size and timing of CARES Act 2. Finally, US Political Uncertainty and Simmering US-China Tensions round out the top five.

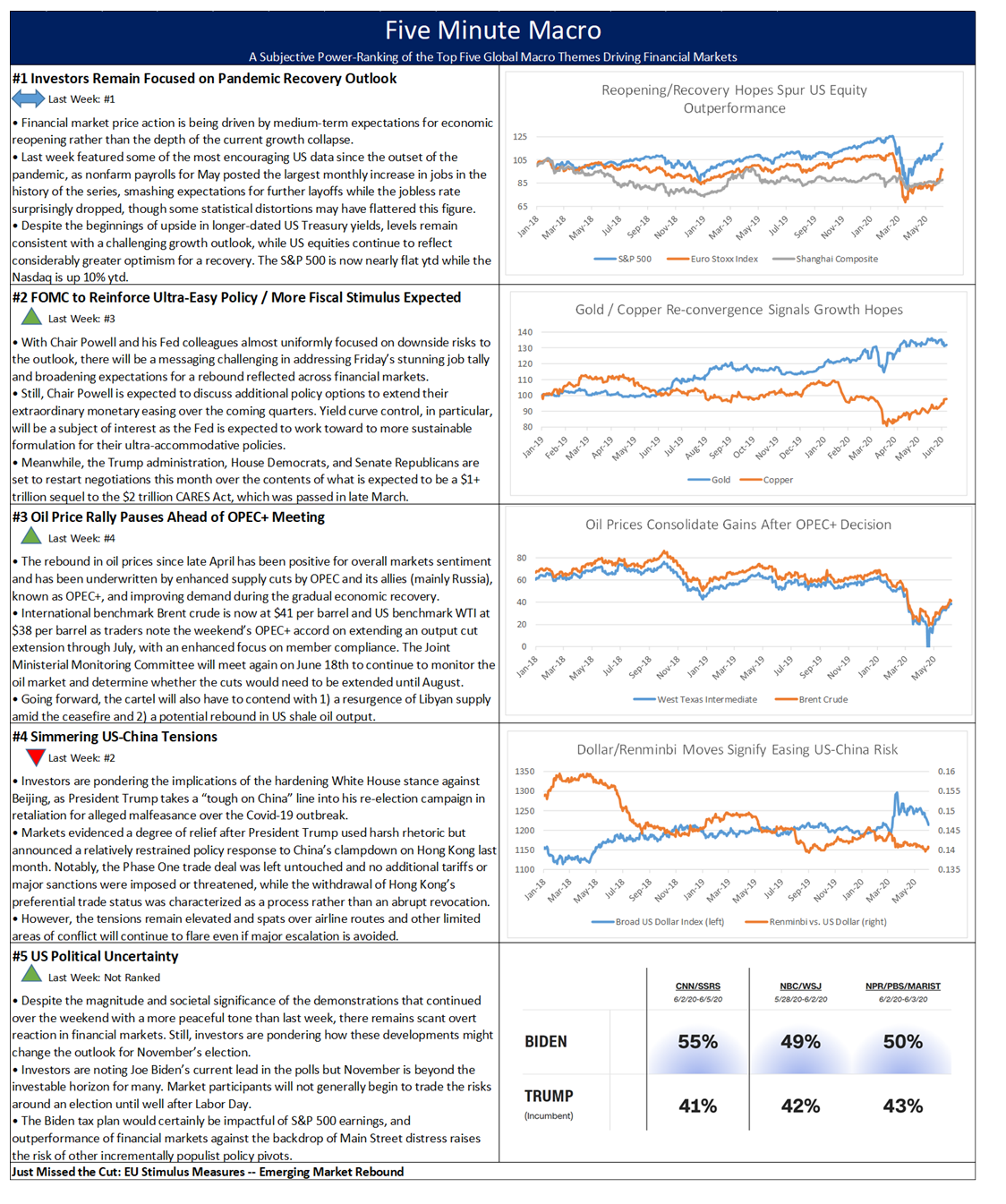

Pandemic recovery remains the main driver of markets, while aggressive Fed stimulus comes in second. The rally in oil moves into the third spot, with China/US tensions dropping down a few spots. Finally, US political uncertainty enters the top five.

Concerns around the Re-Opening of the Economy combined with nationwide protests remains the main driver of risk assets, followed by US-China tensions. As a Phase 4 deal takes shape, US Policy response moves up to the third spot. The Oil Price Rally followed by EU Stimulus and Fiscal Union round out the top five.

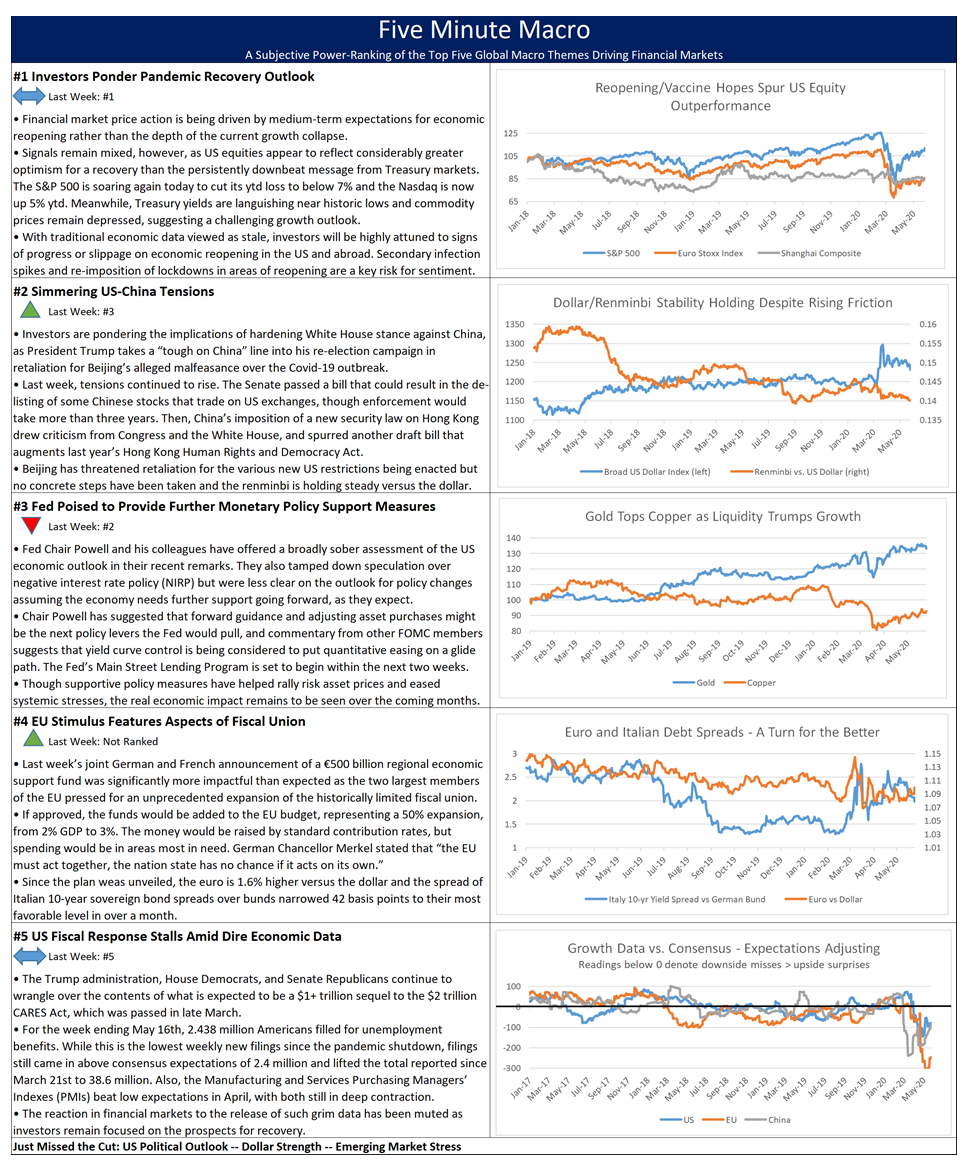

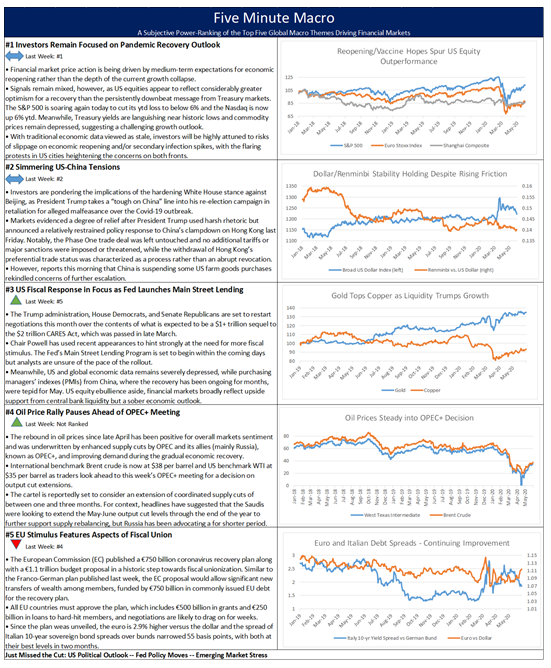

Economic recovery from the pandemic remains the main focus of investors for obvious reasons. However, simmering US-China relations moves up to second place, where it is likely to remain. Fed policy accommodation falls to third while EU Stimulus and possible Fiscal Union enters for the first time, followed by the US Fiscal Response negotiations.