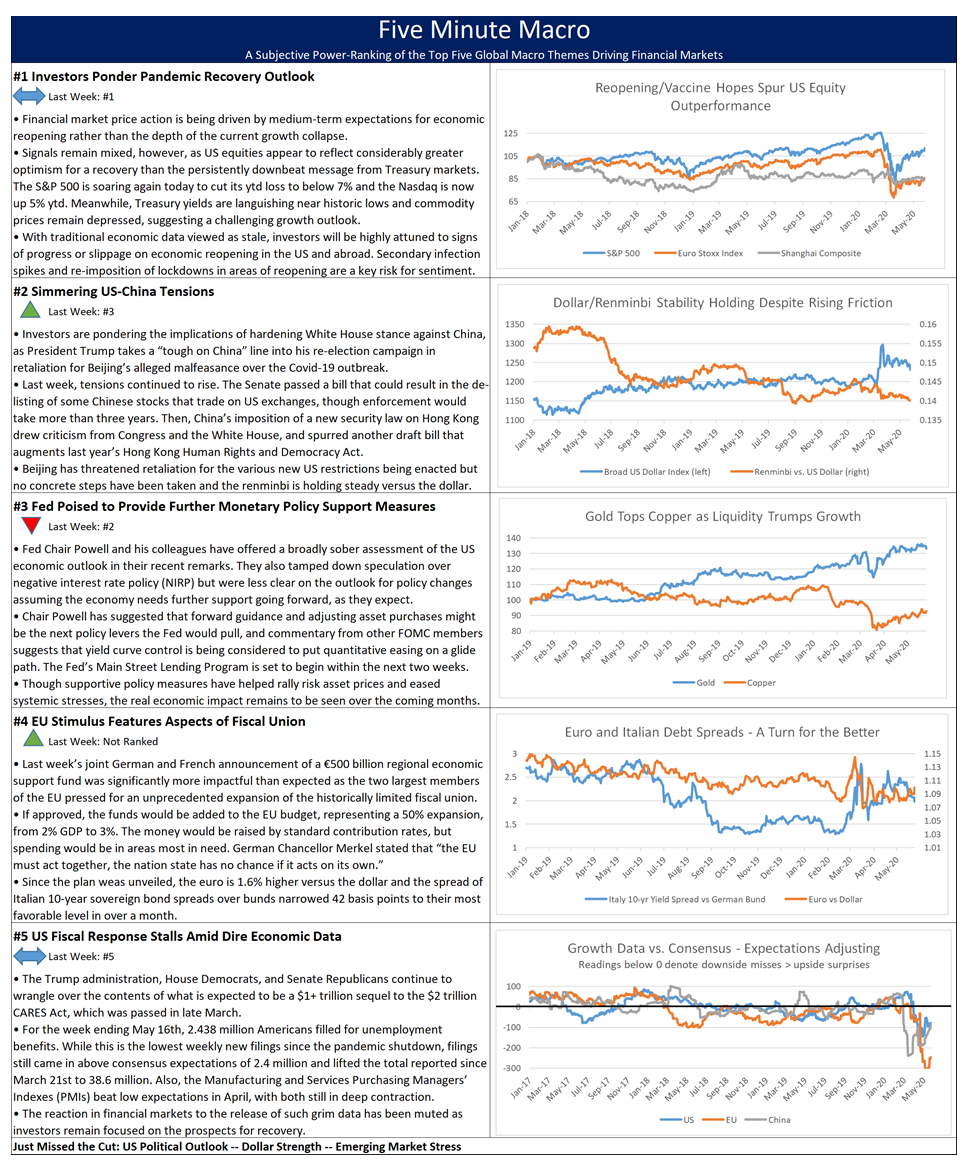

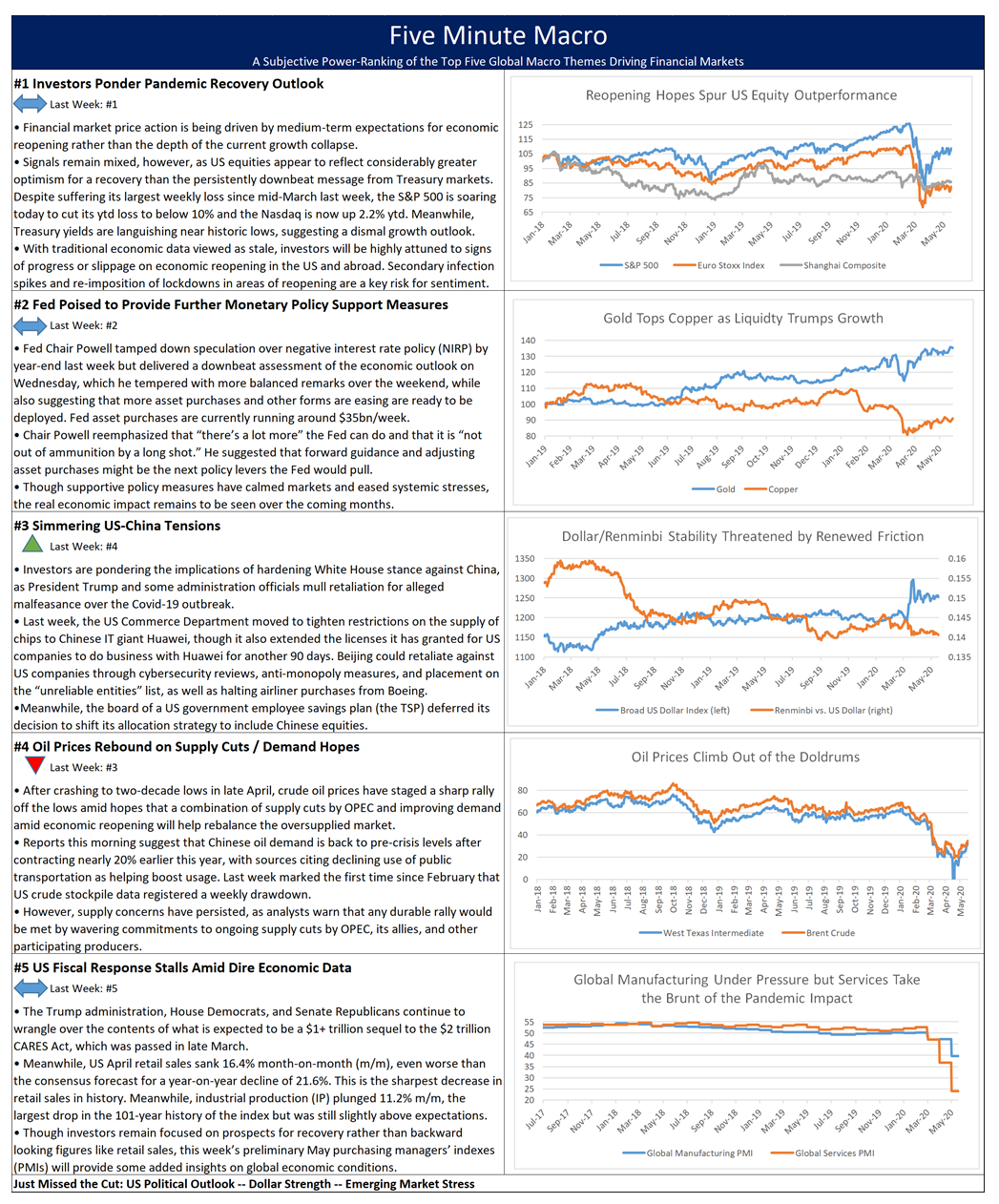

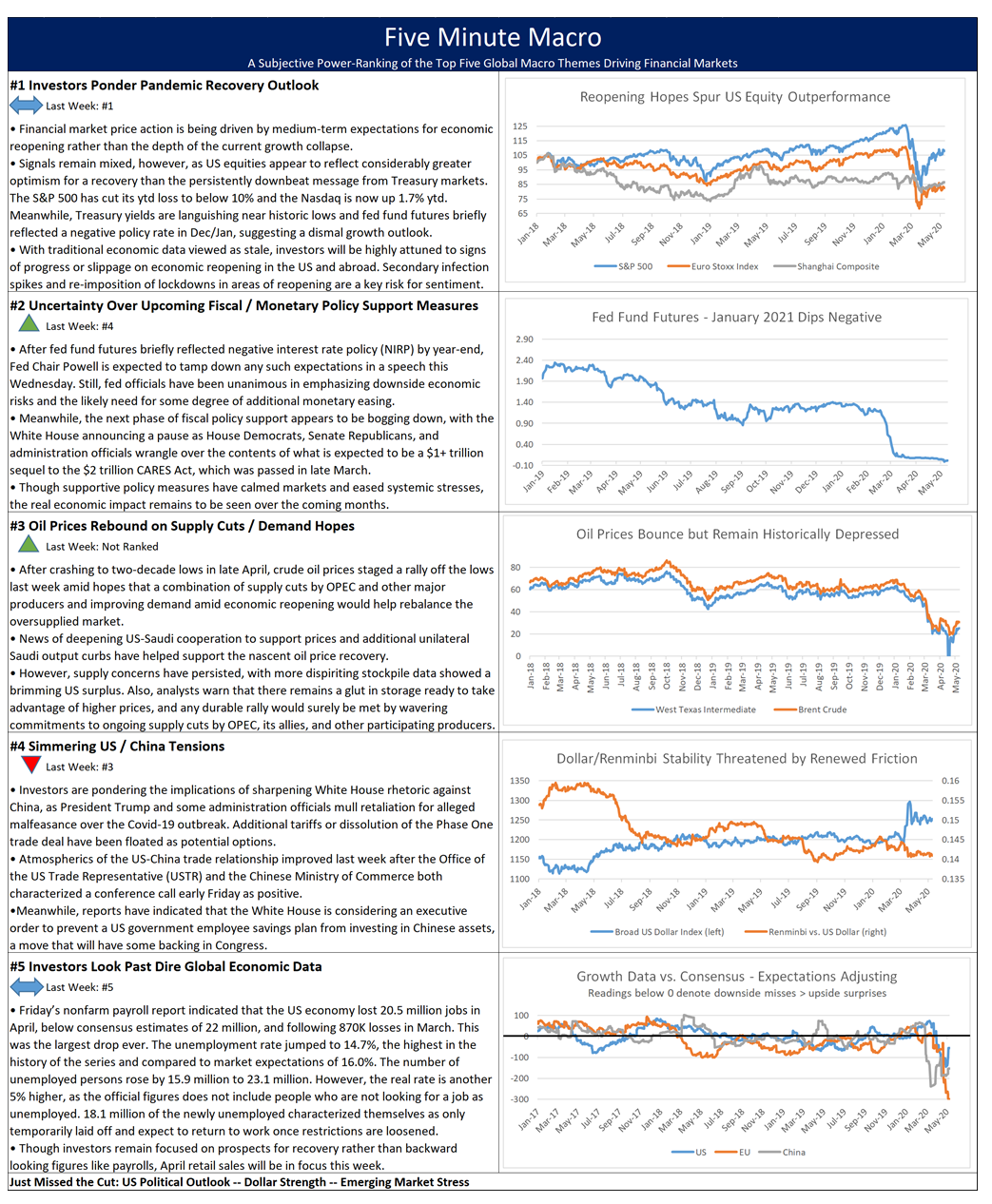

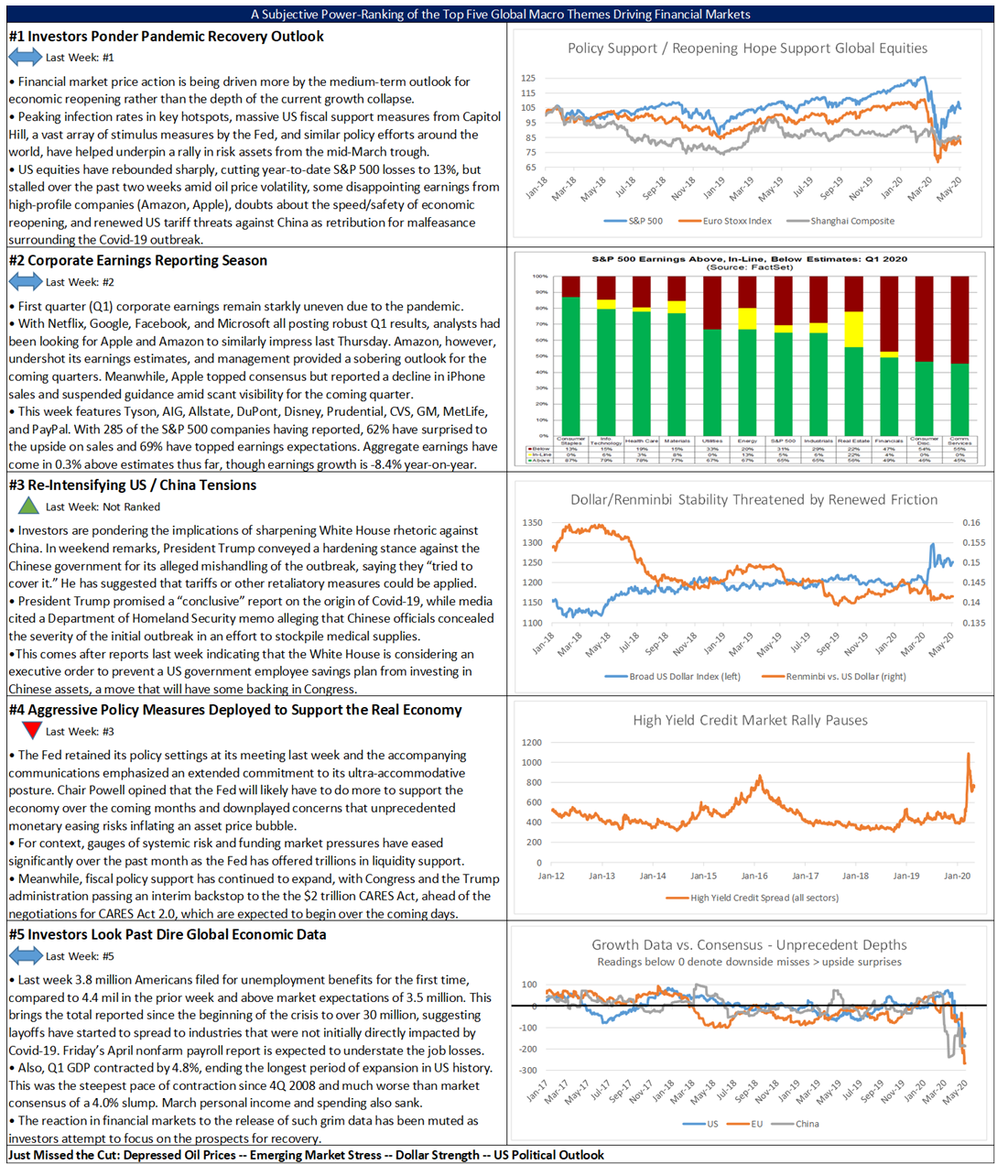

Economic recovery from the pandemic remains the main focus of investors for obvious reasons. However, simmering US-China relations moves up to second place, where it is likely to remain. Fed policy accommodation falls to third while EU Stimulus and possible Fiscal Union enters for the first time, followed by the US Fiscal Response negotiations.