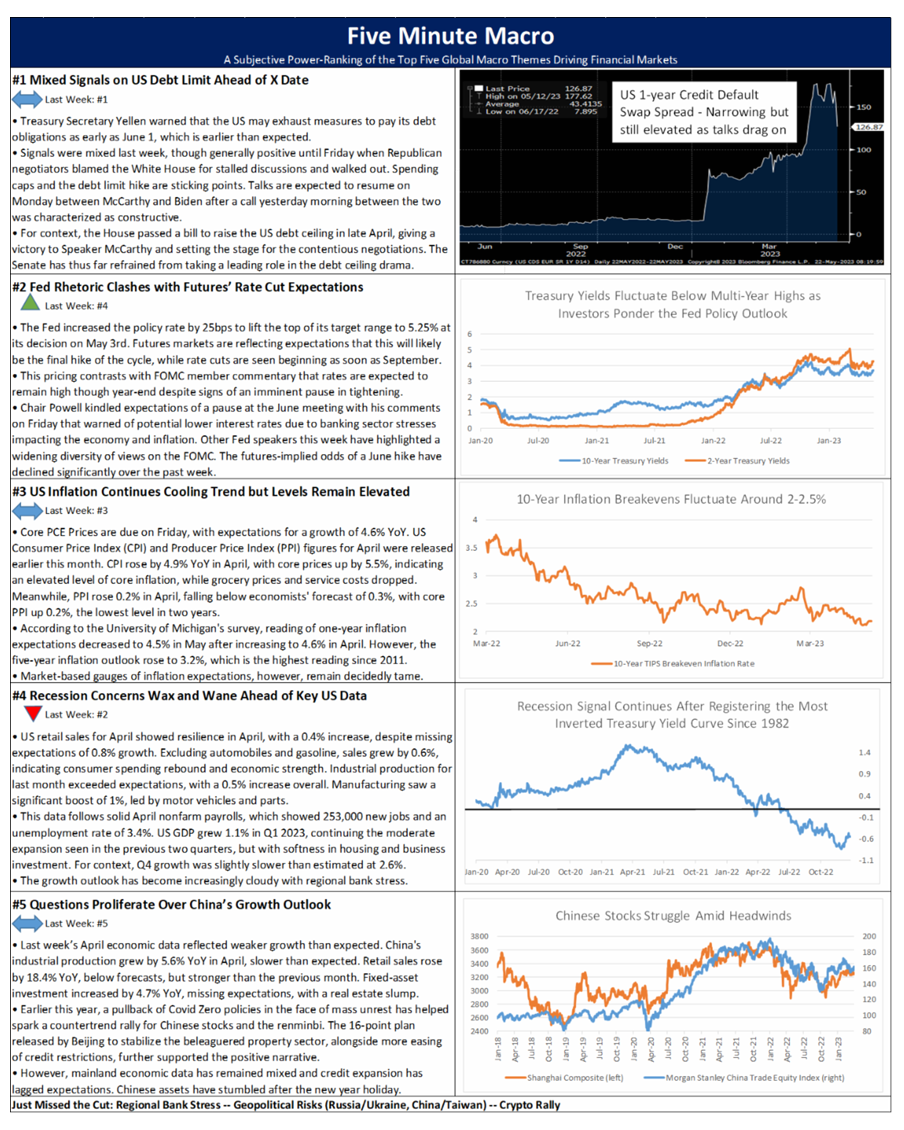

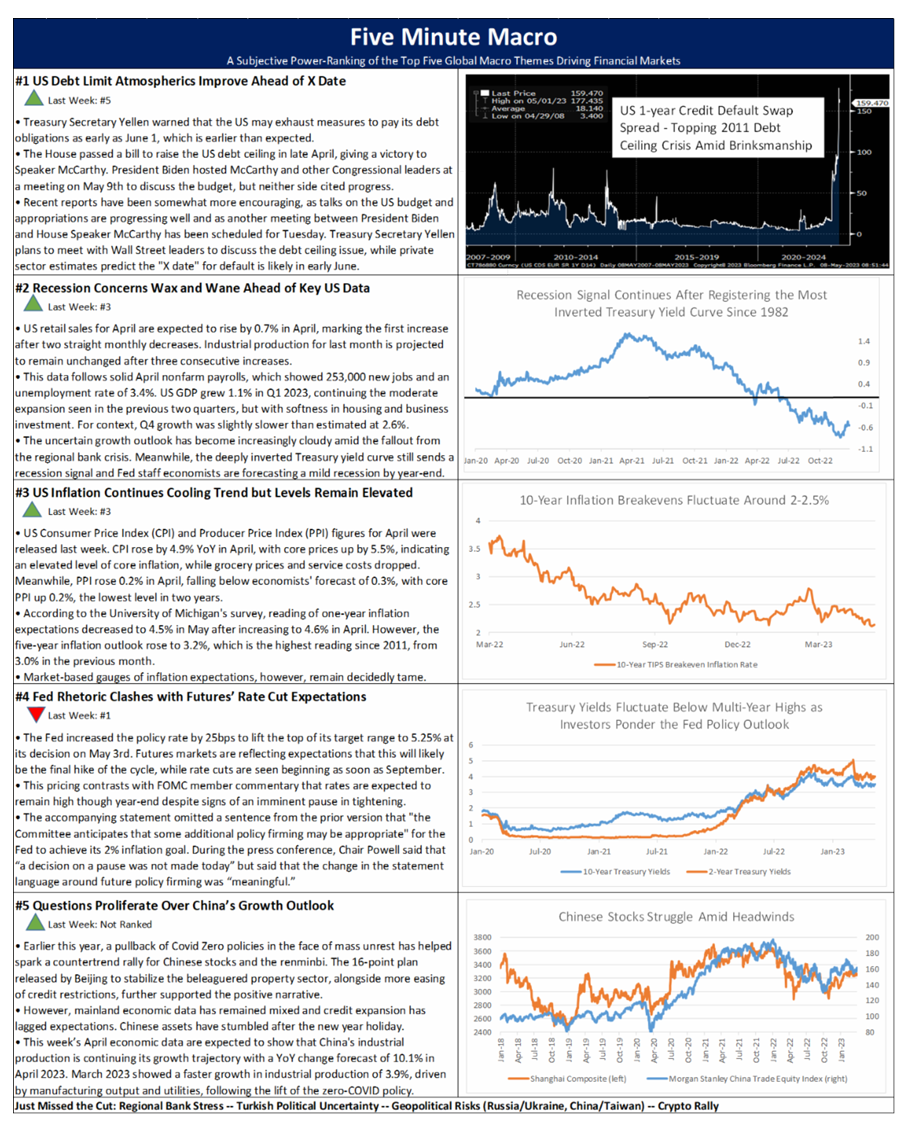

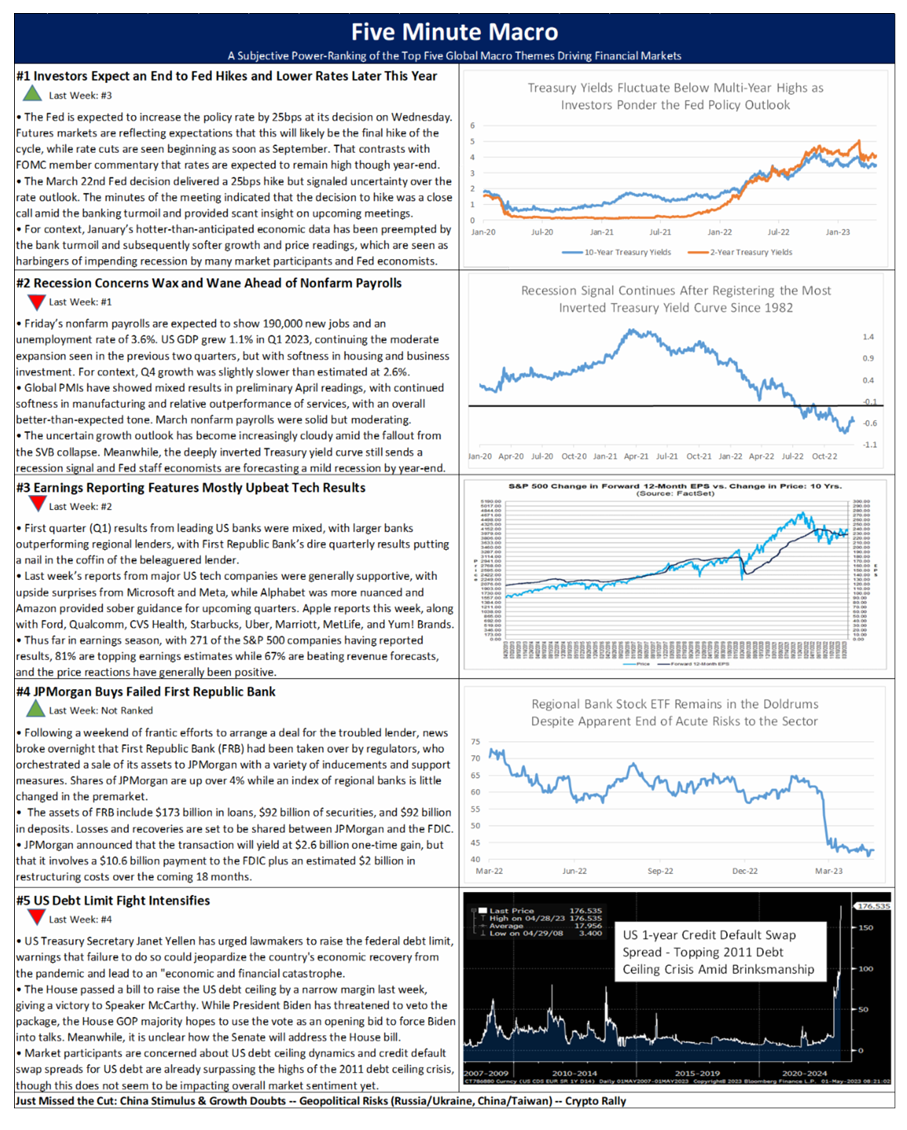

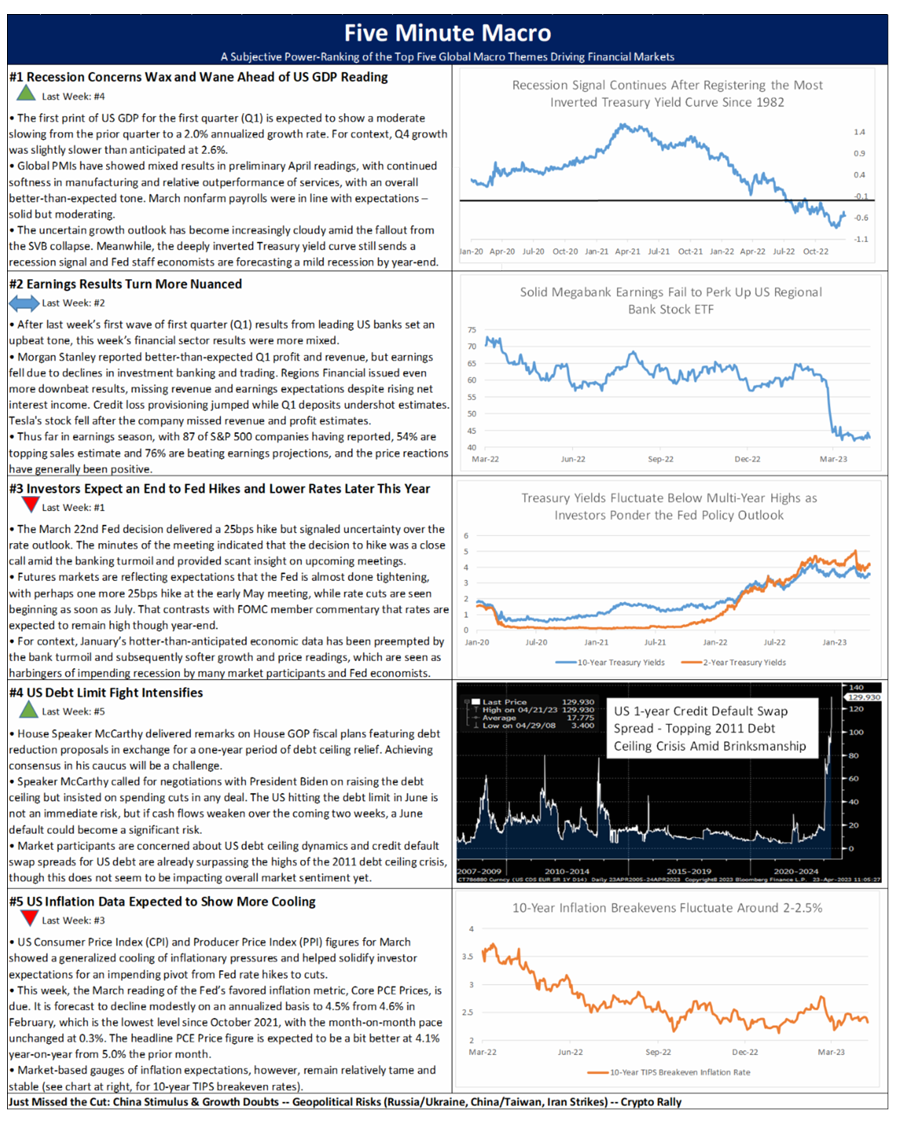

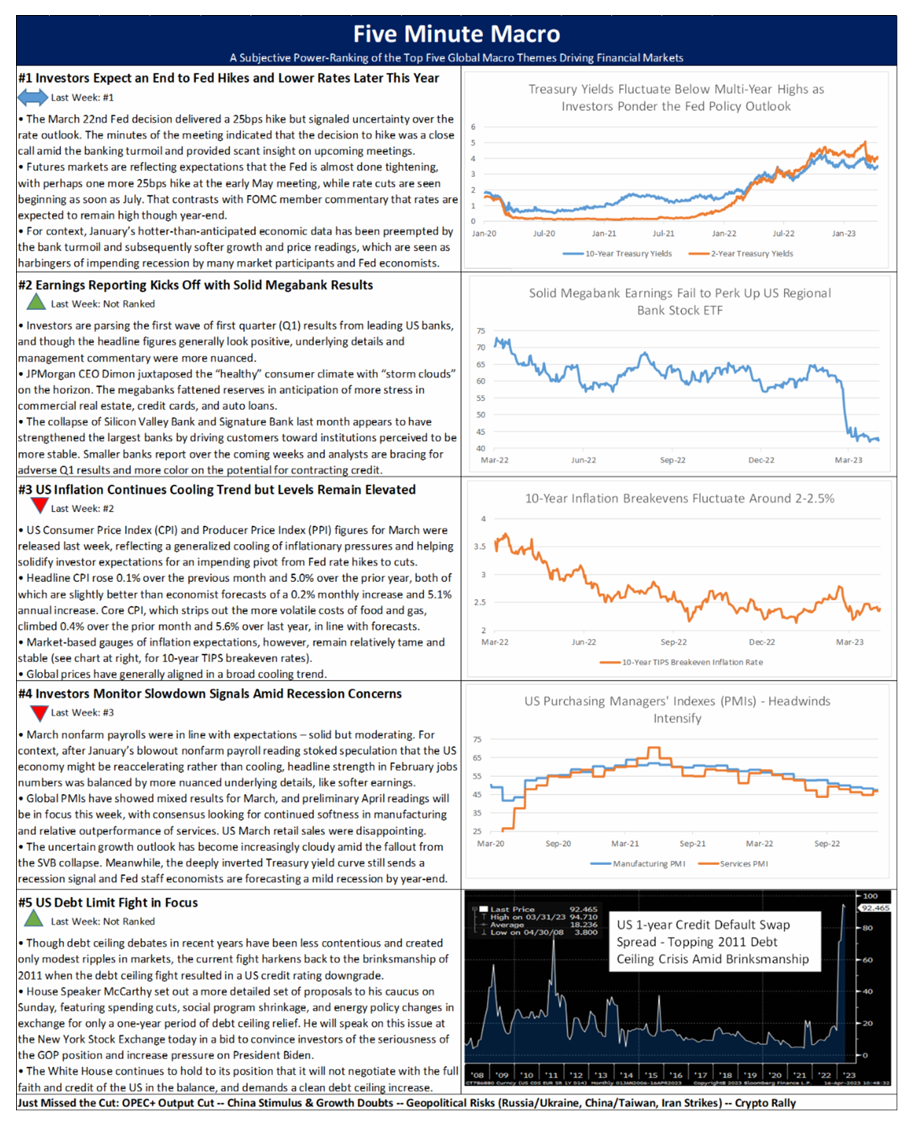

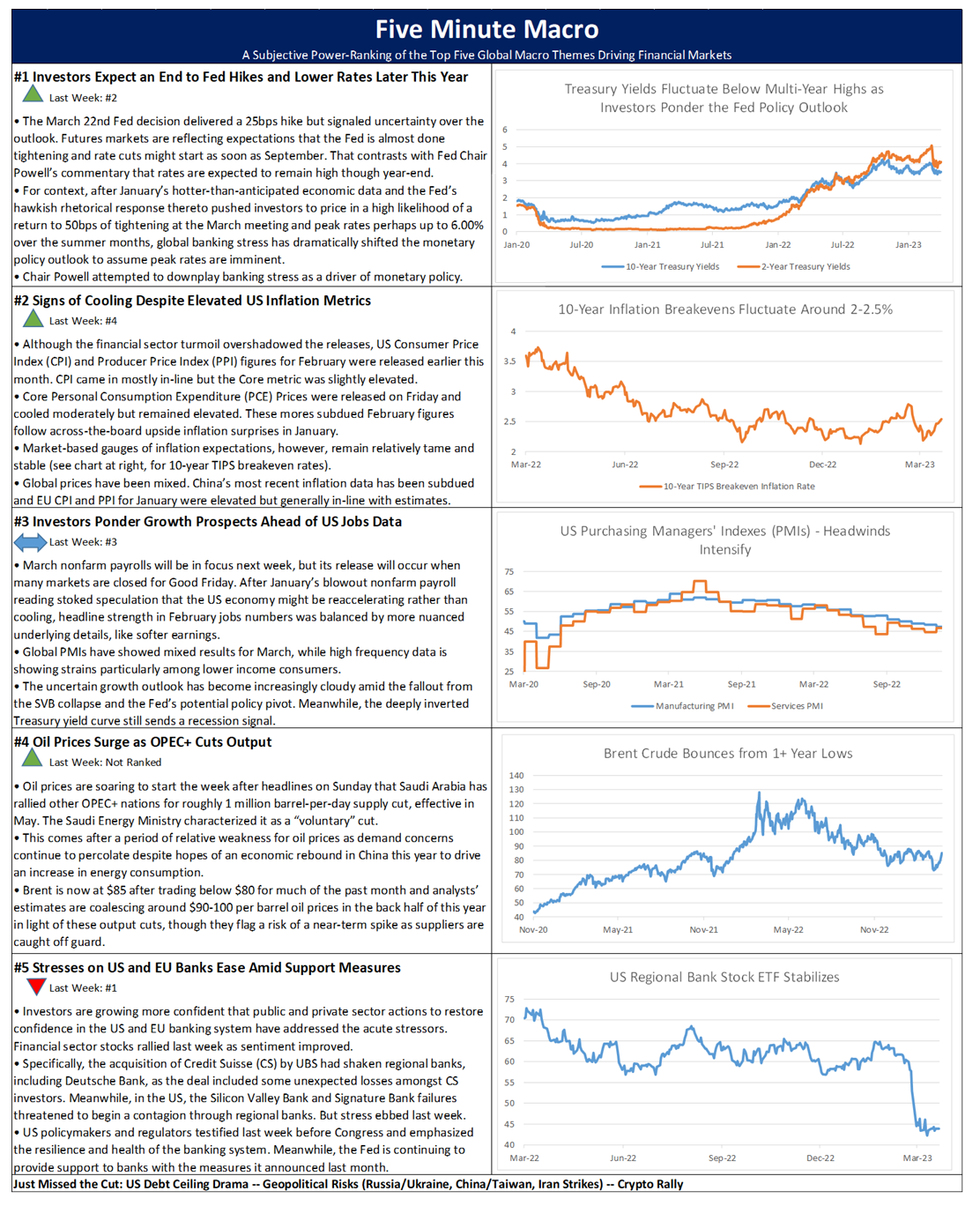

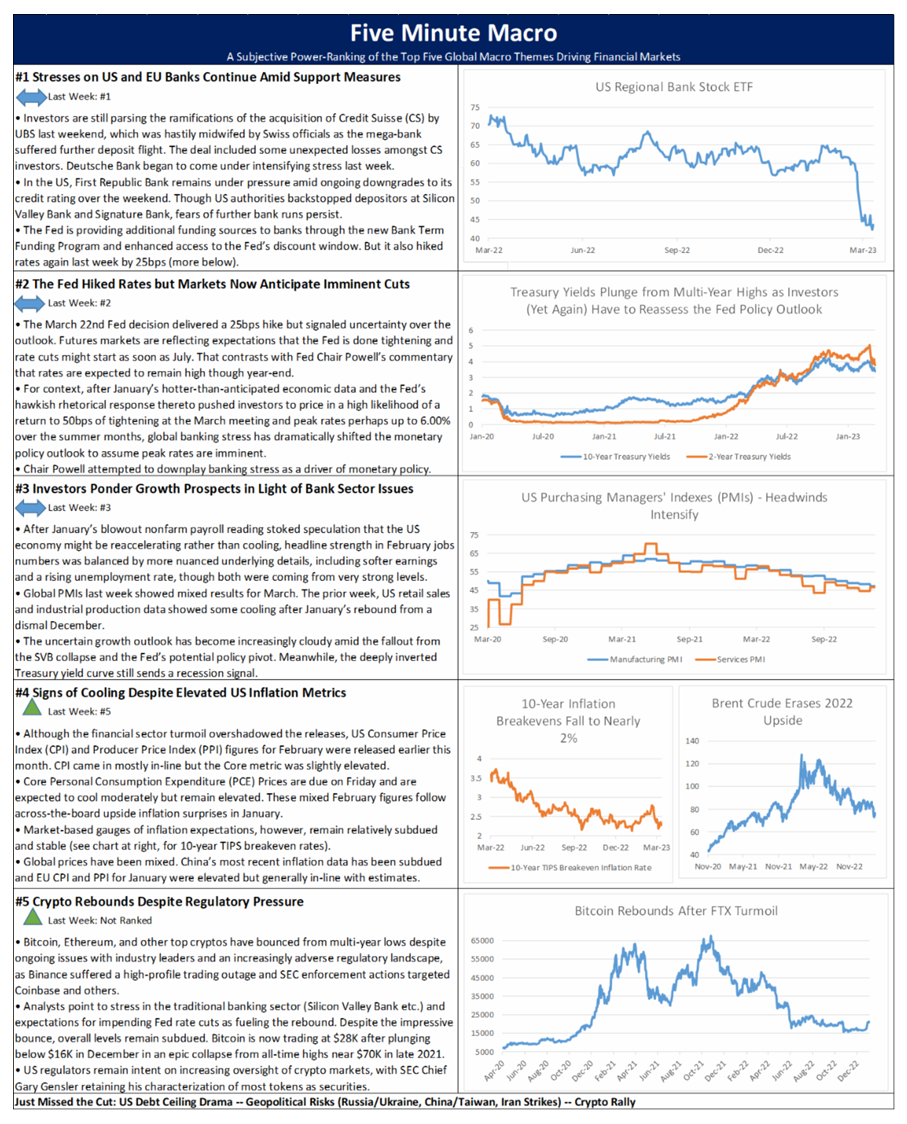

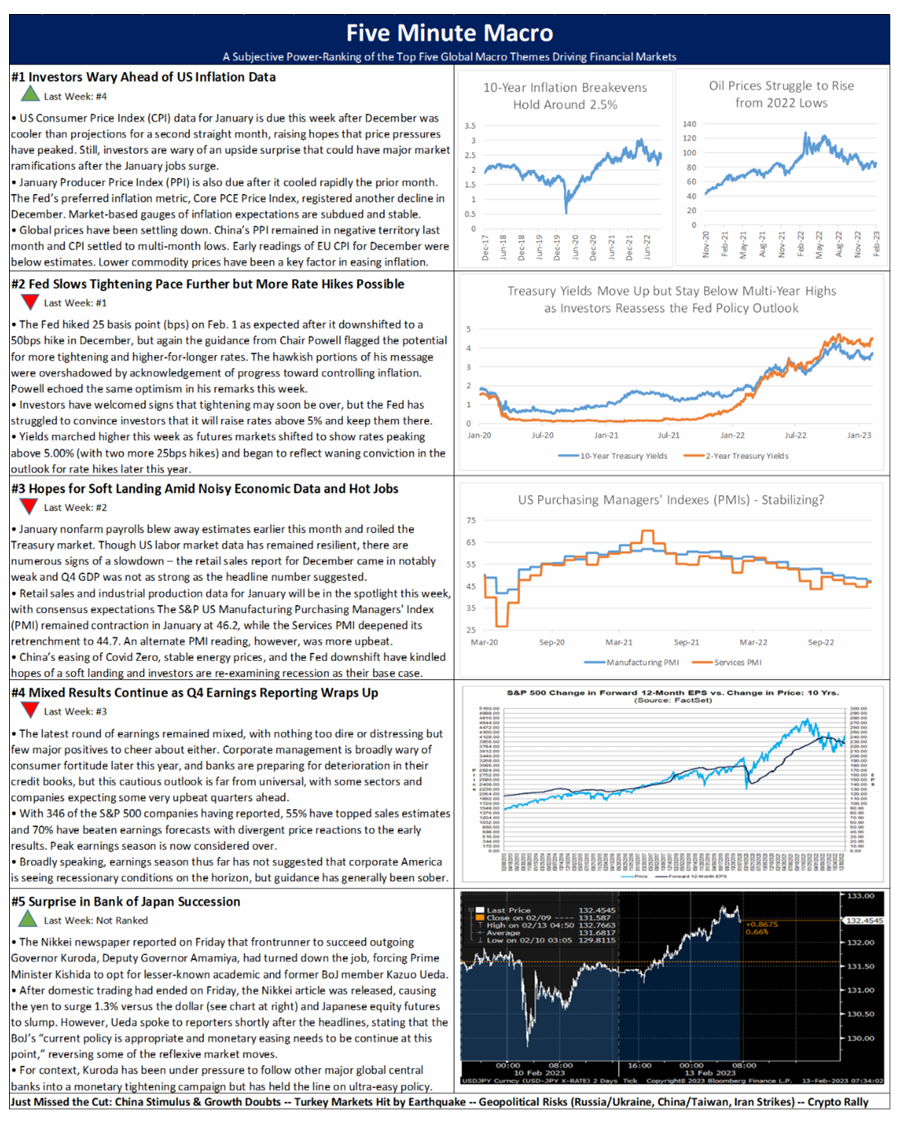

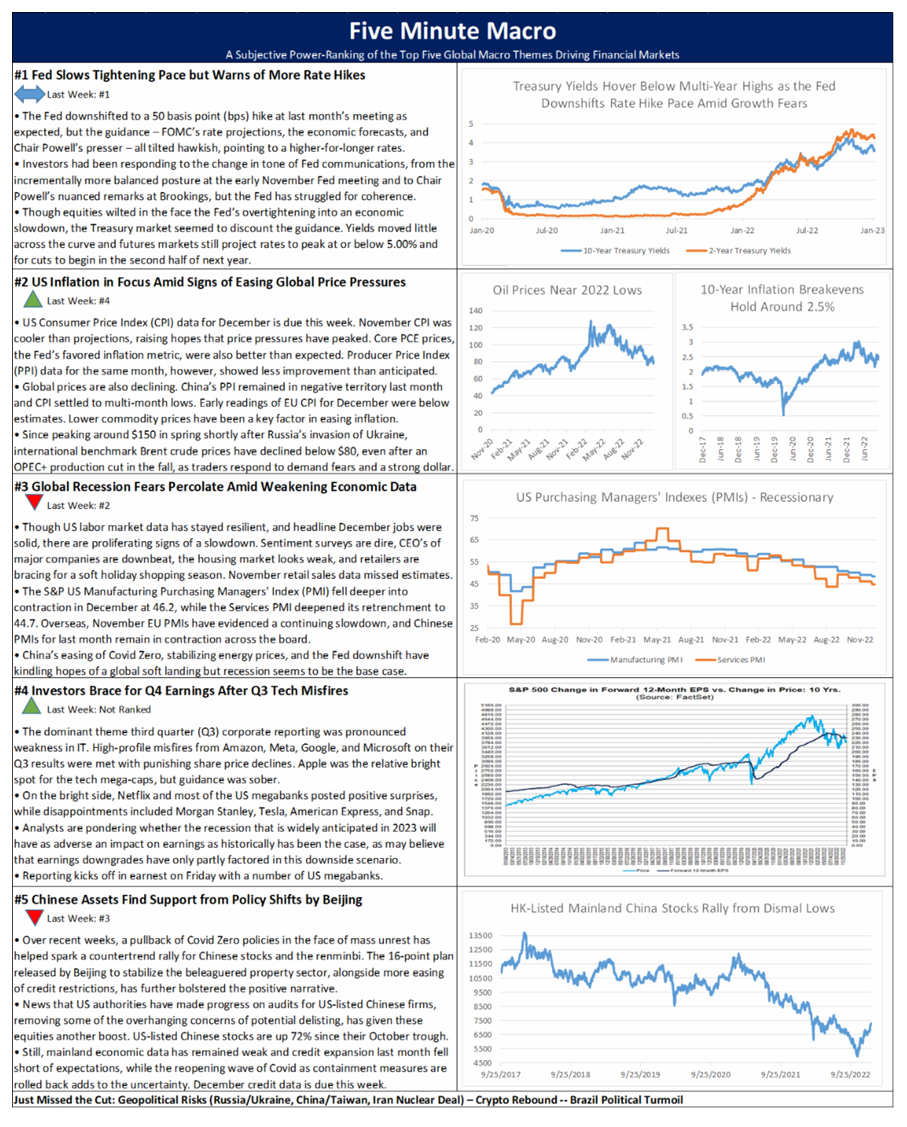

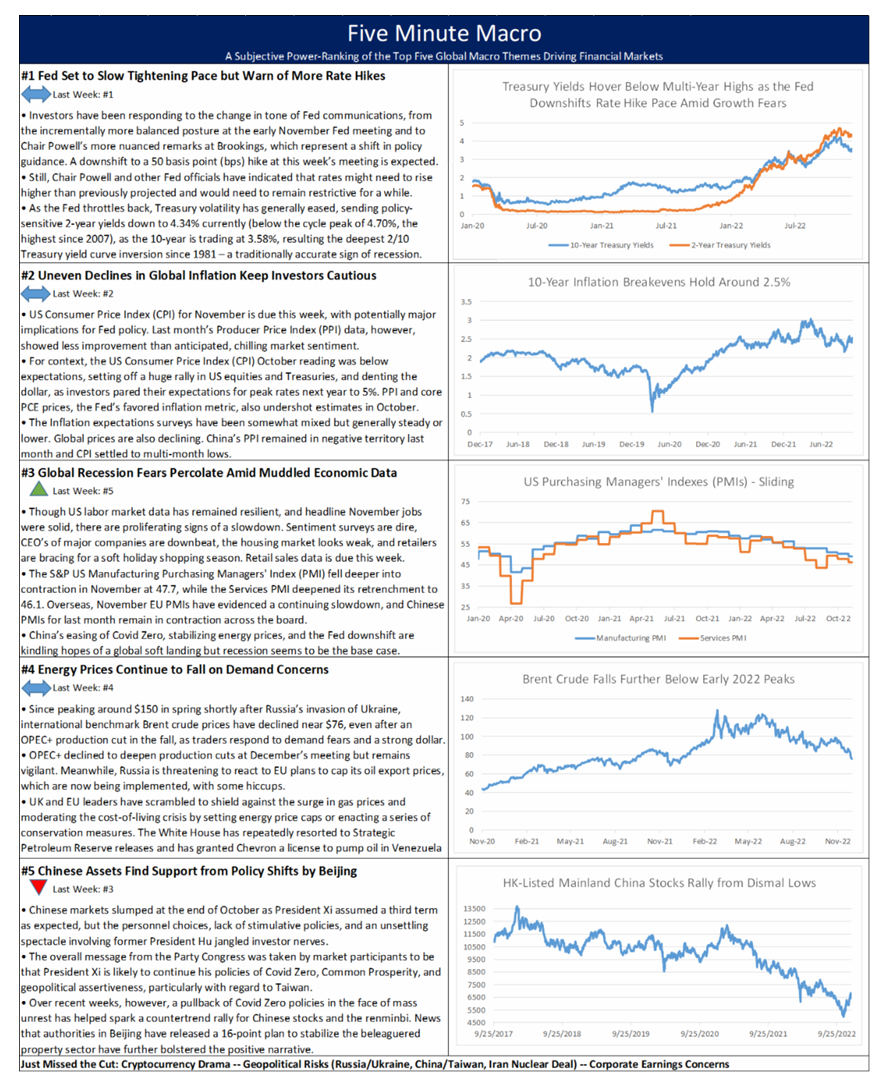

Debt ceiling negotiations remains the focus of capital markets, while the Fed continues to push back on rate cut expectations. Inflation continues to cool but remains elevated while recession fears remain. Finally, concerns remain over China’s growth prospects.