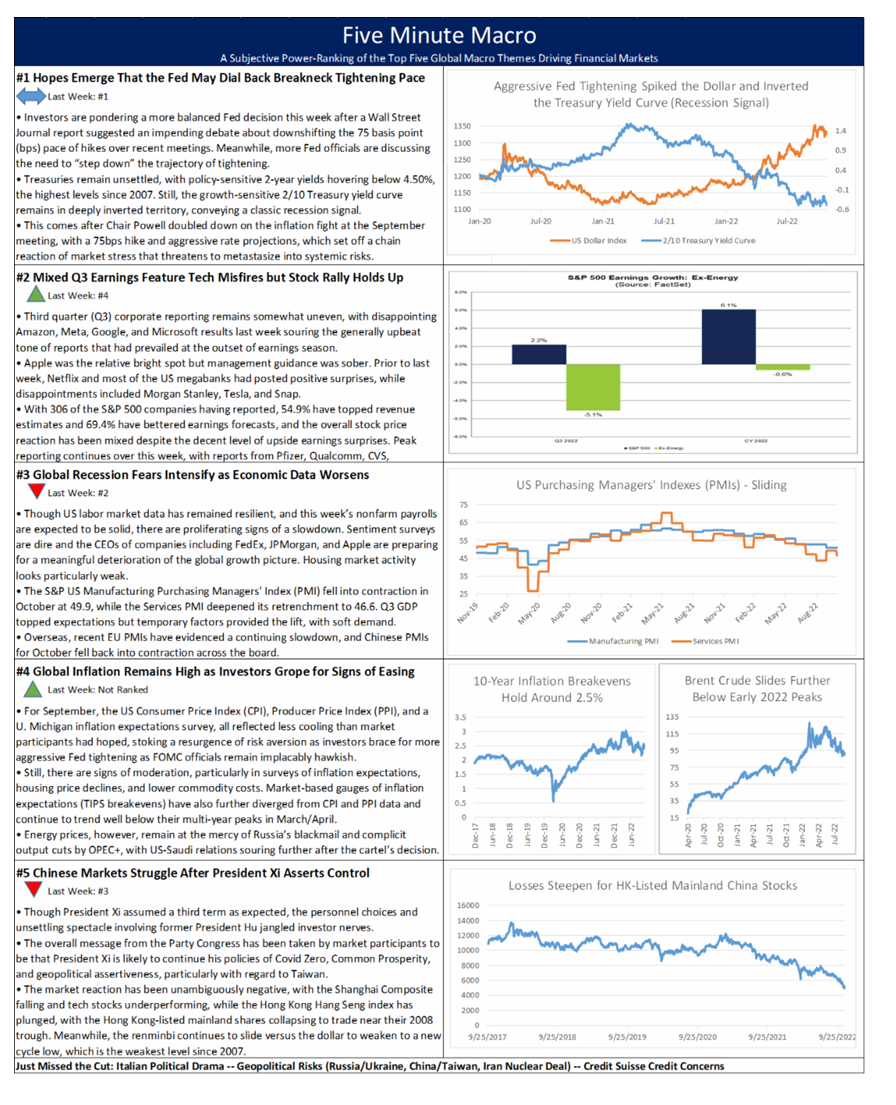

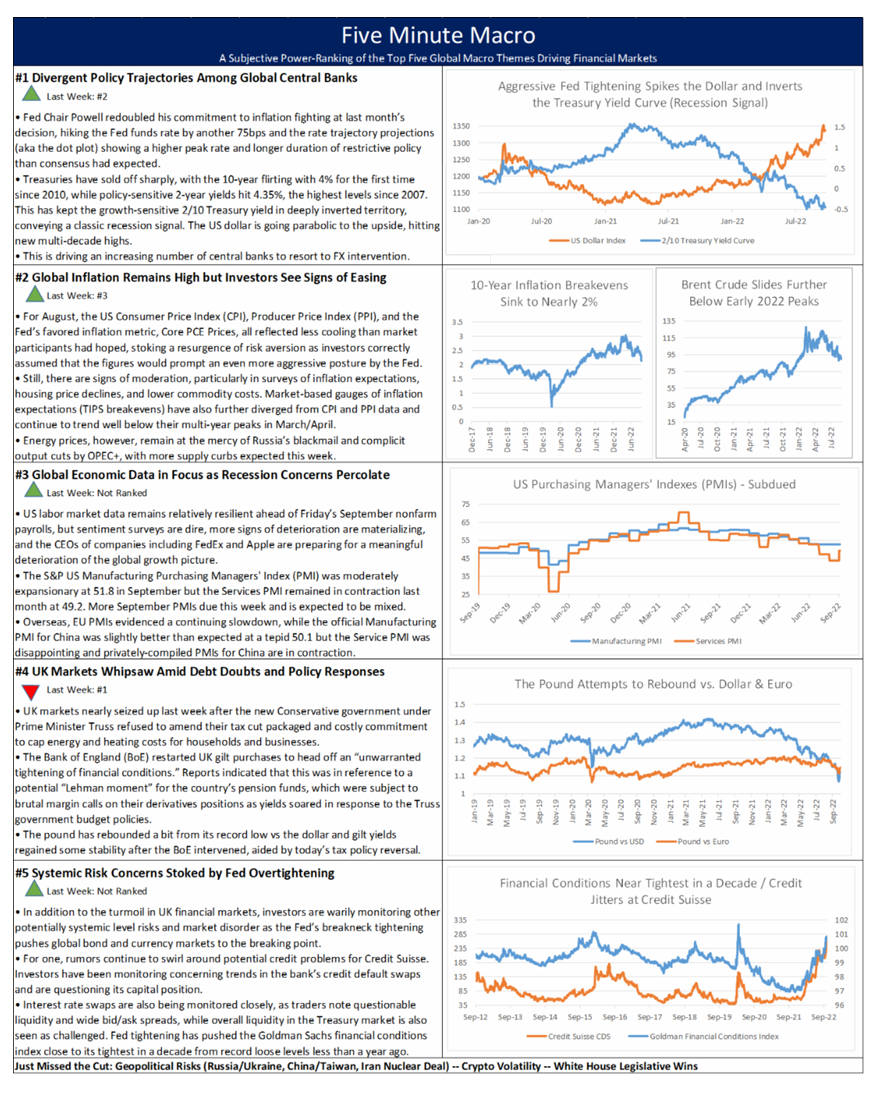

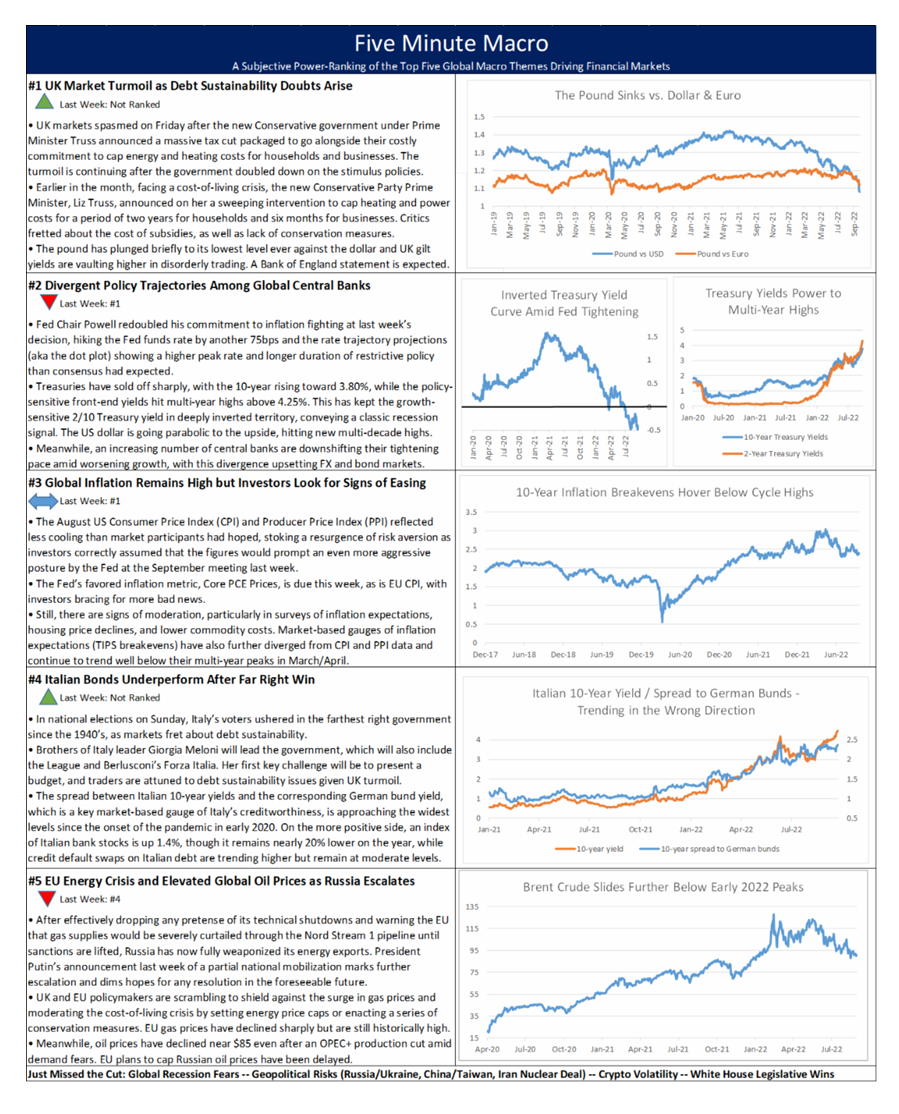

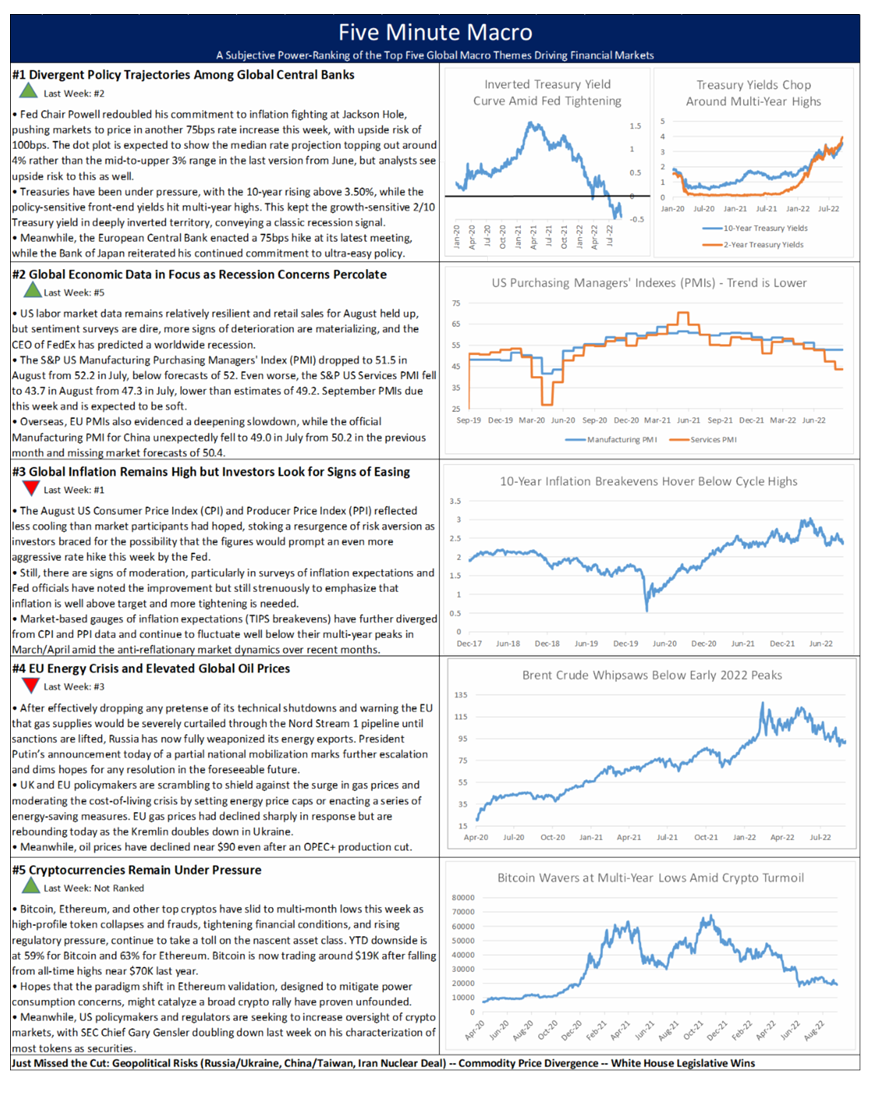

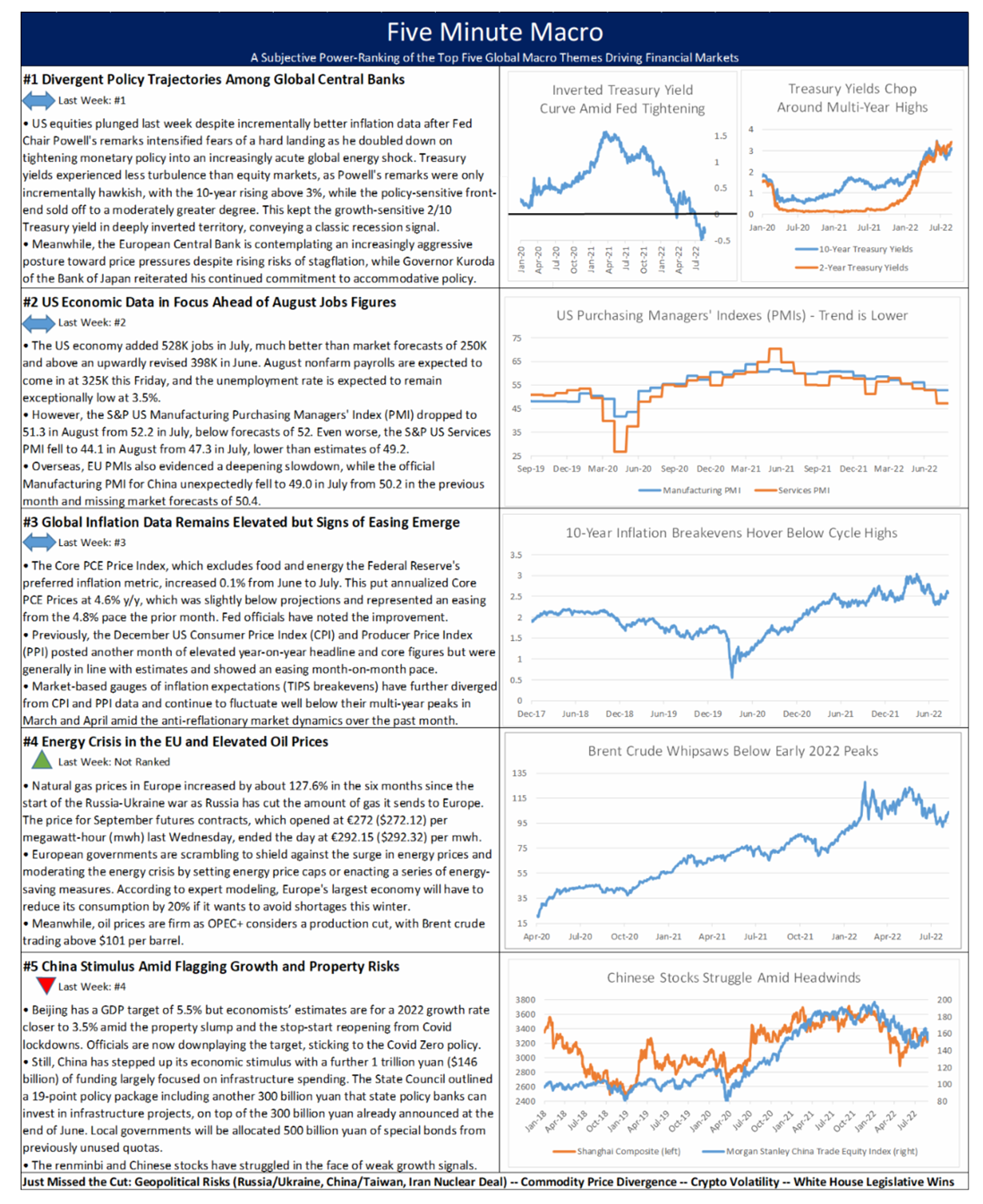

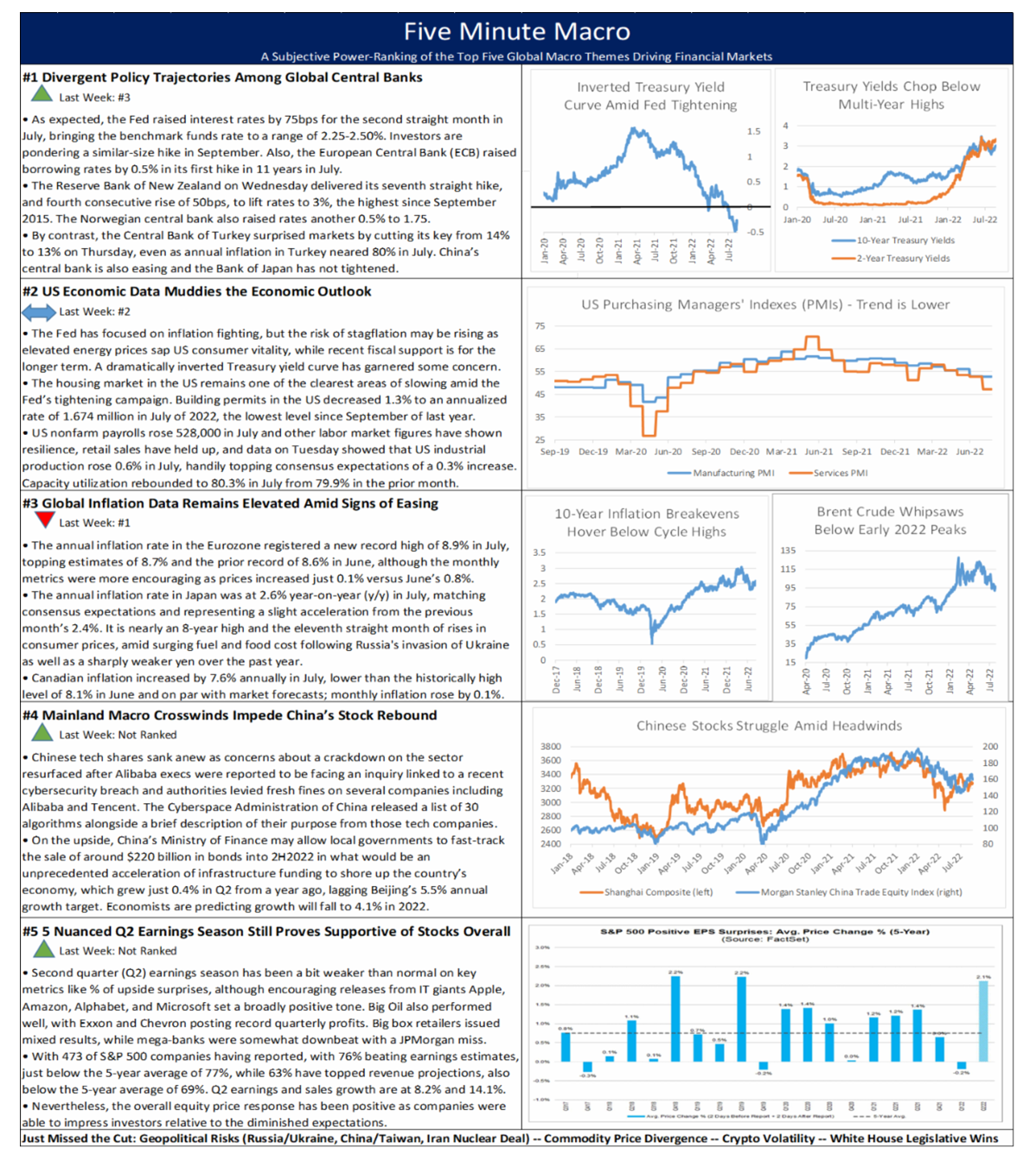

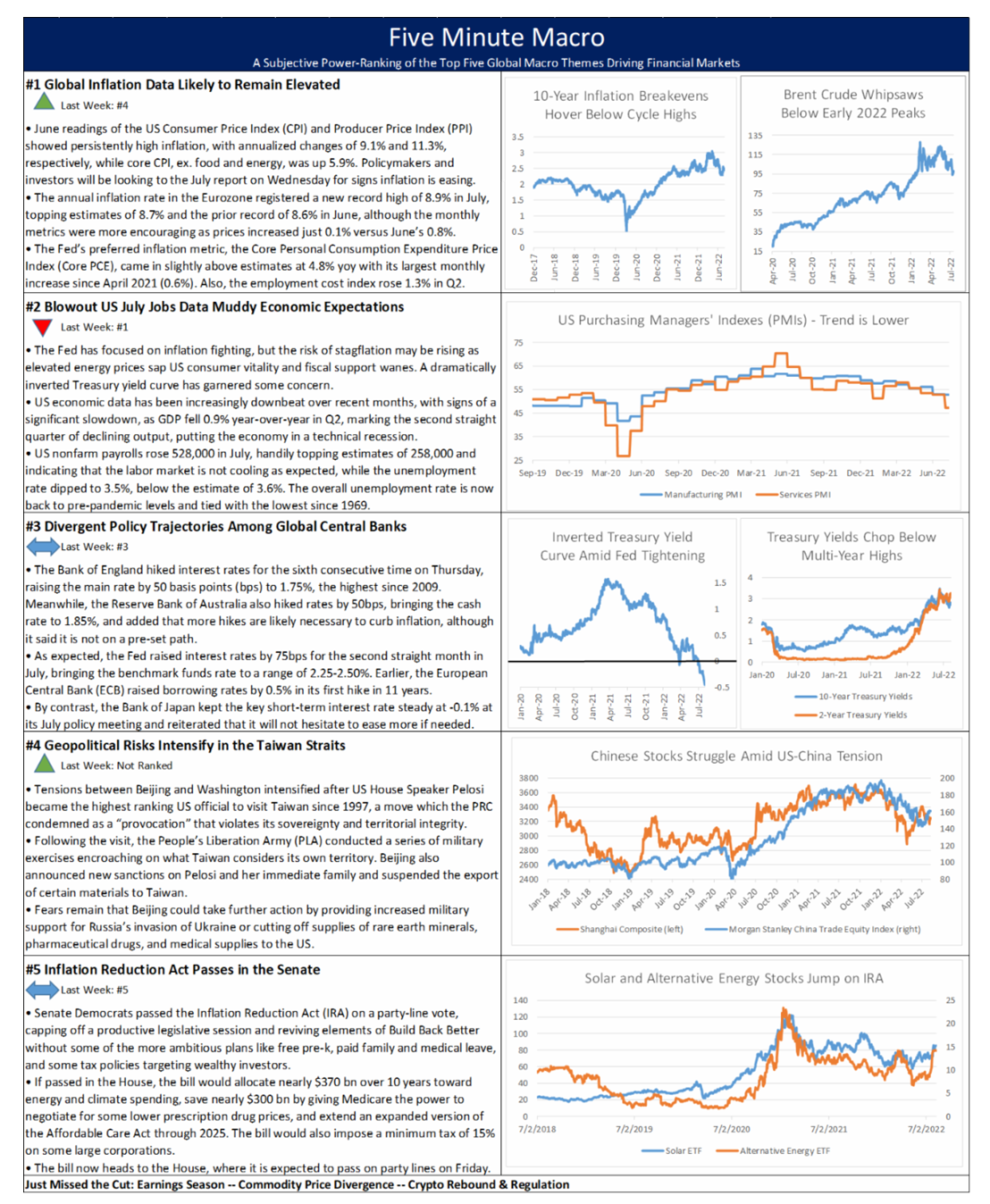

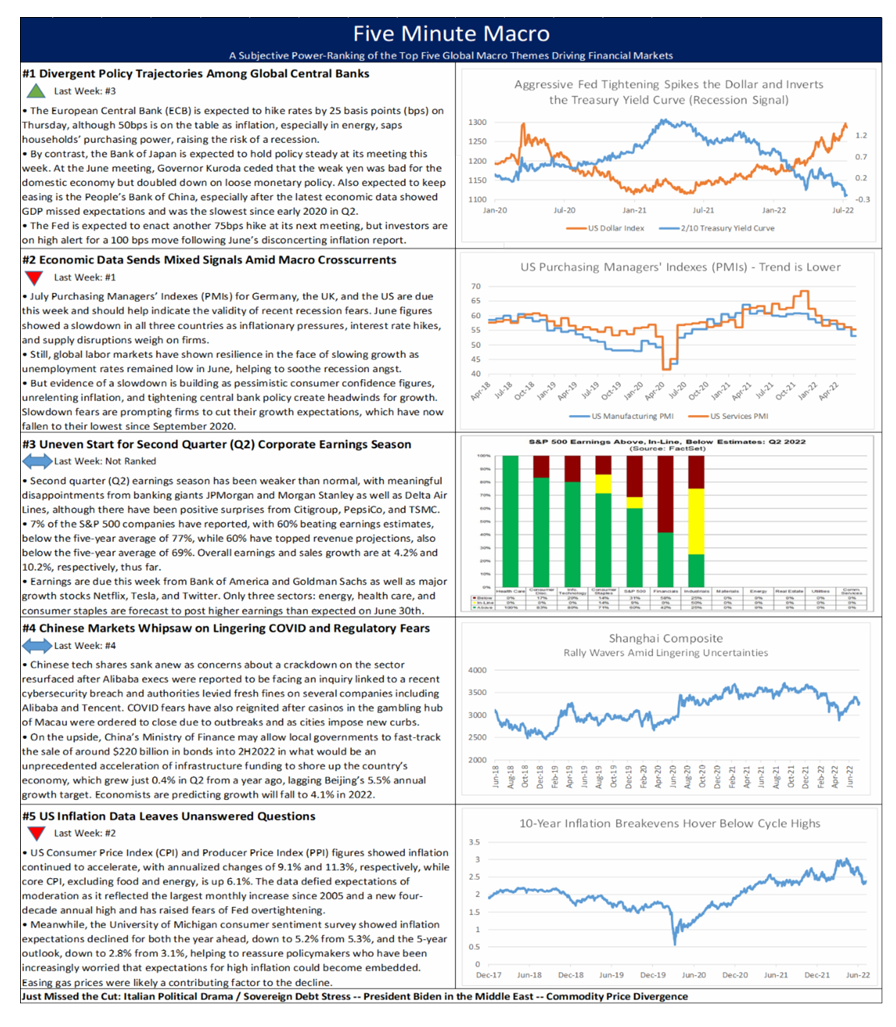

Hopes the Fed will dial down its tightening pace are driving market sentiment and weak tech earnings don’t stop overall markets from rallying. Global recession fears increase as data worsens and inflation shows signs of easing. Finally, Chinese assets struggle as Xi asserts control.