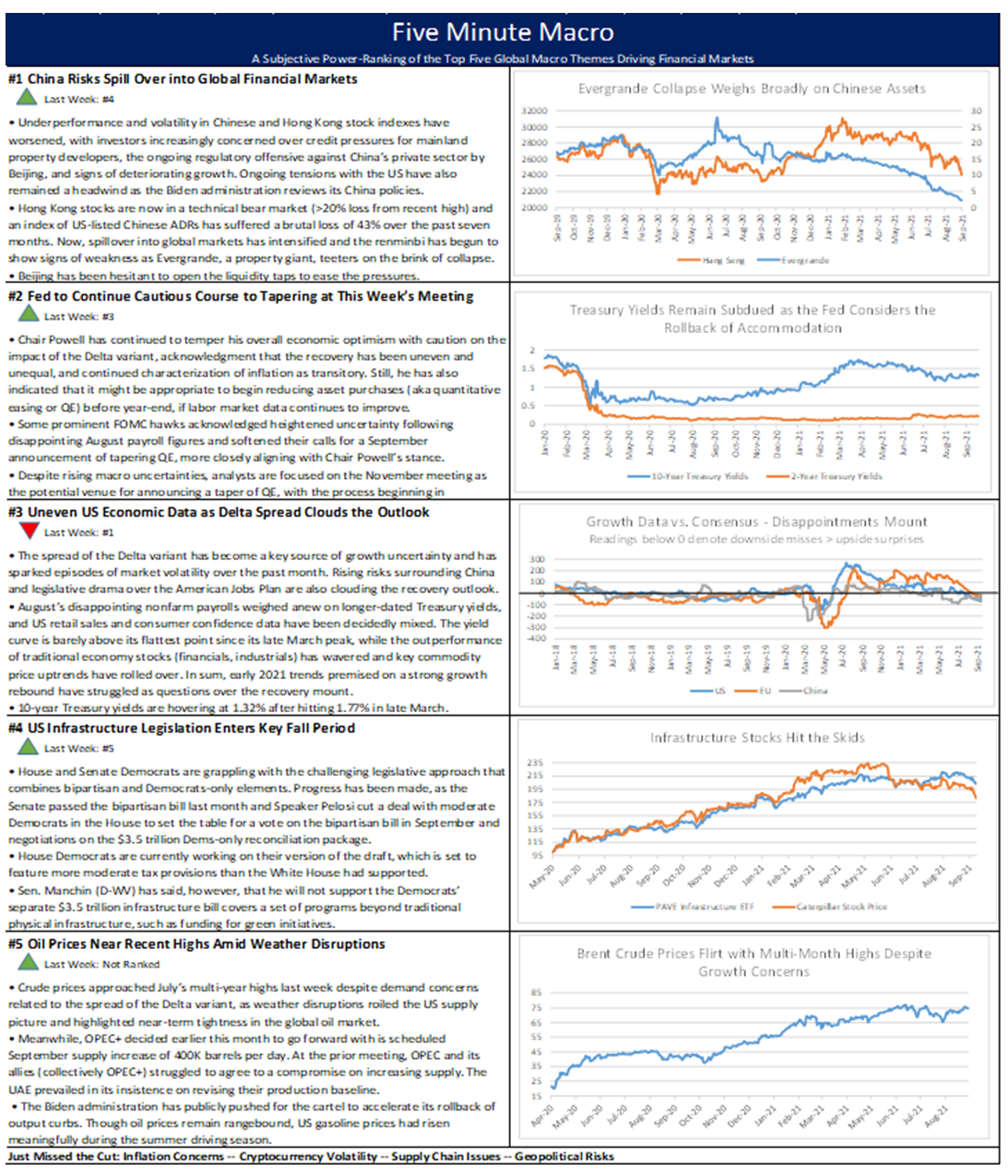

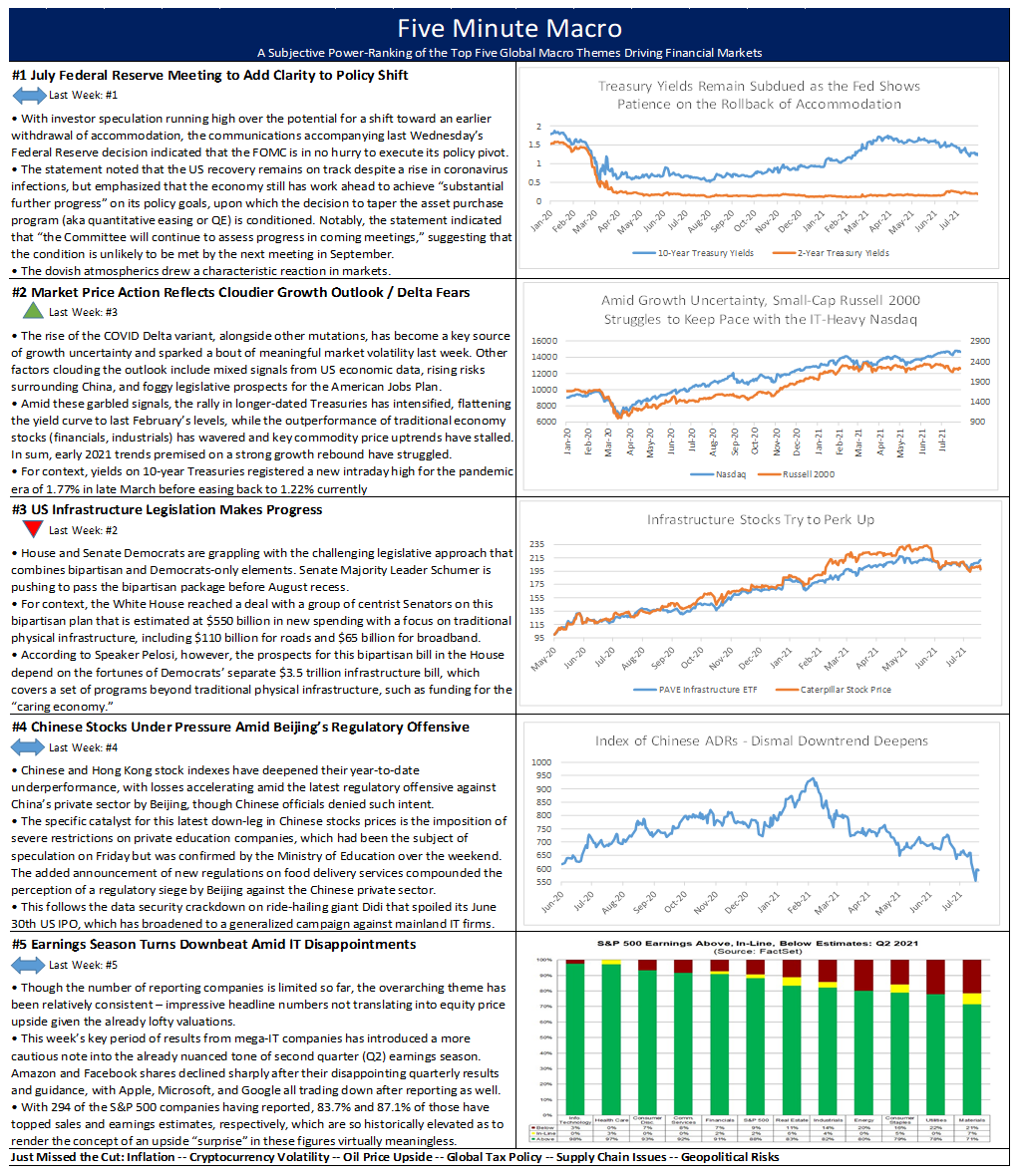

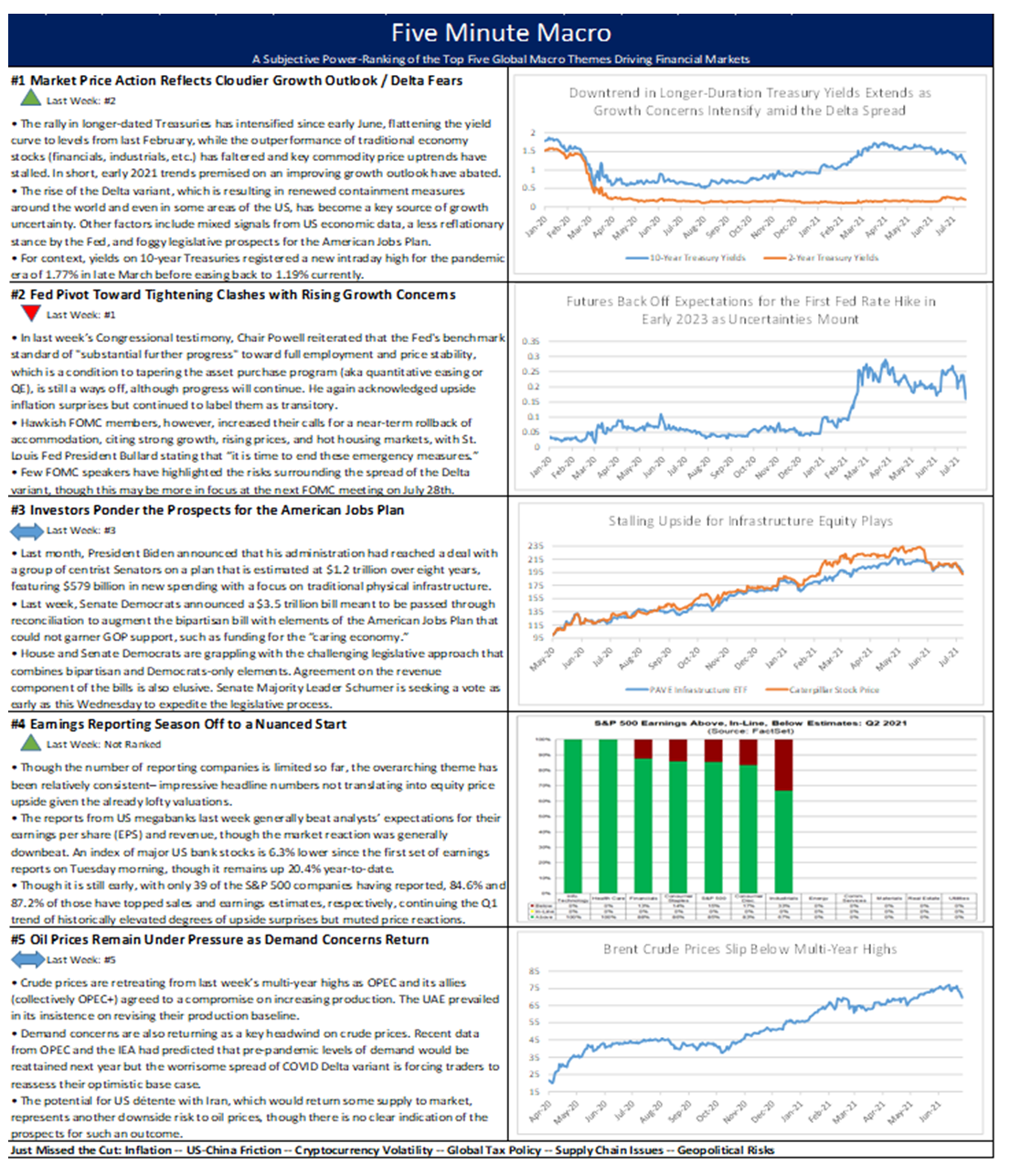

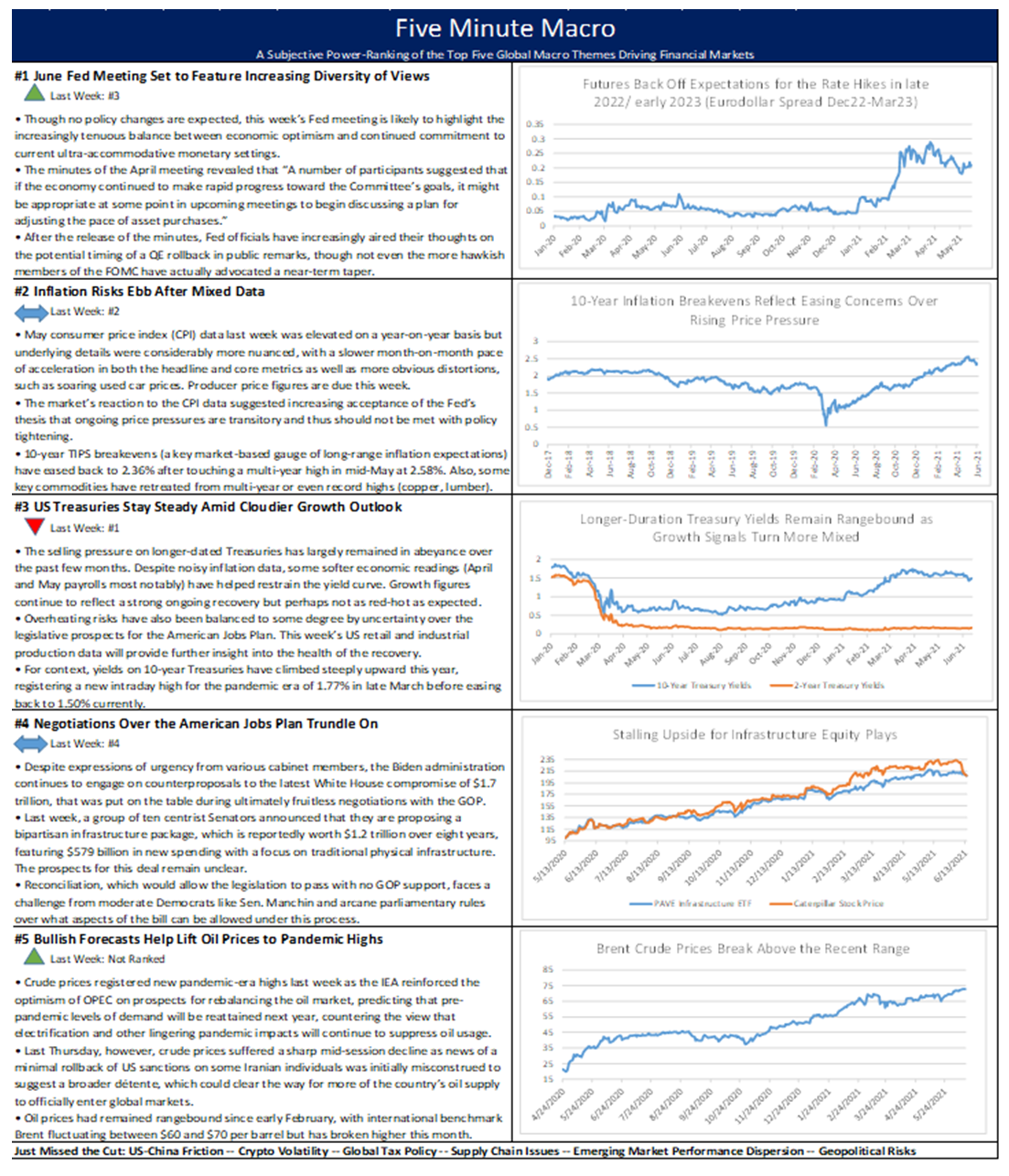

In this week’s Five Minute Macro, China’s real estate crisis is spilling over into global financial markets. The Fed meets on Wednesday where the focus will be on any guidance for the taper of their balance sheet. Delta keeps growth uneven, while infrastructure negotiations continue and finally, oil prices near highs.