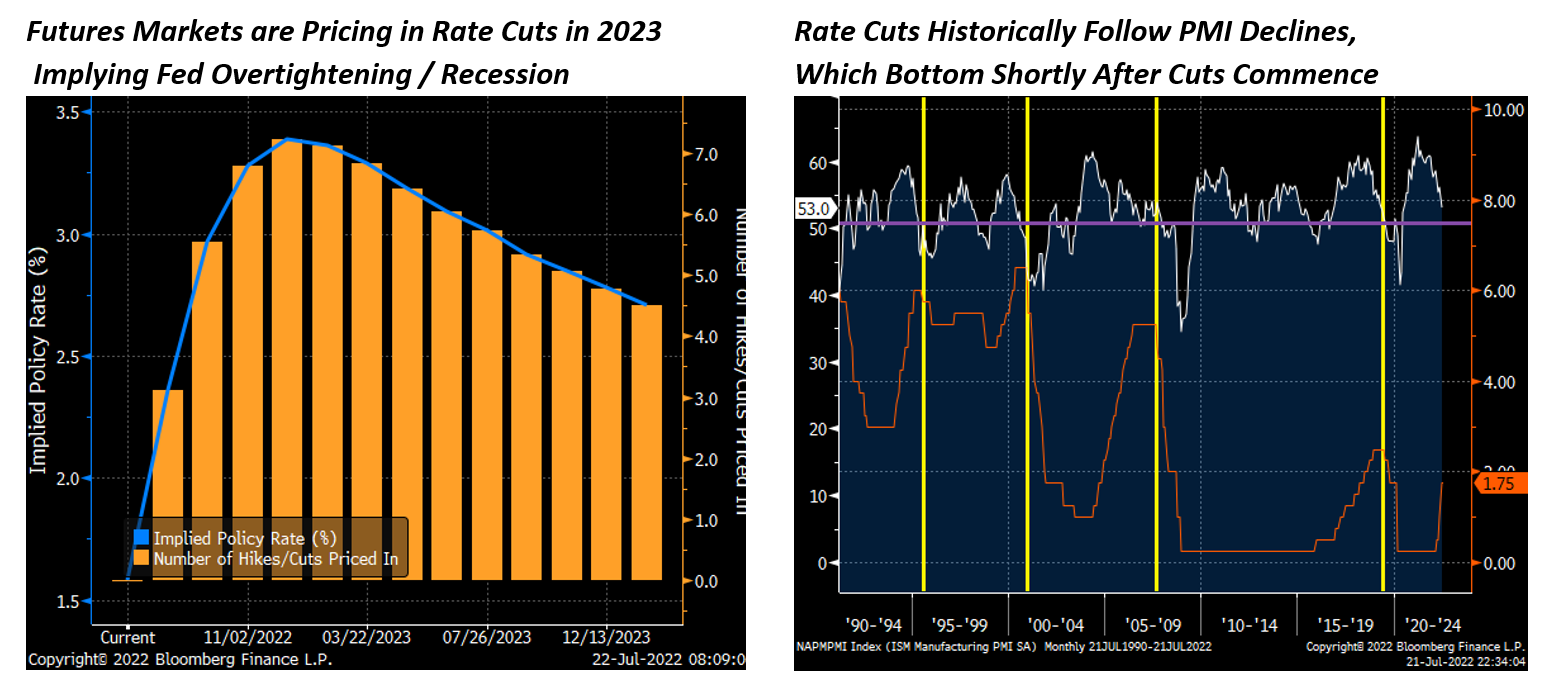

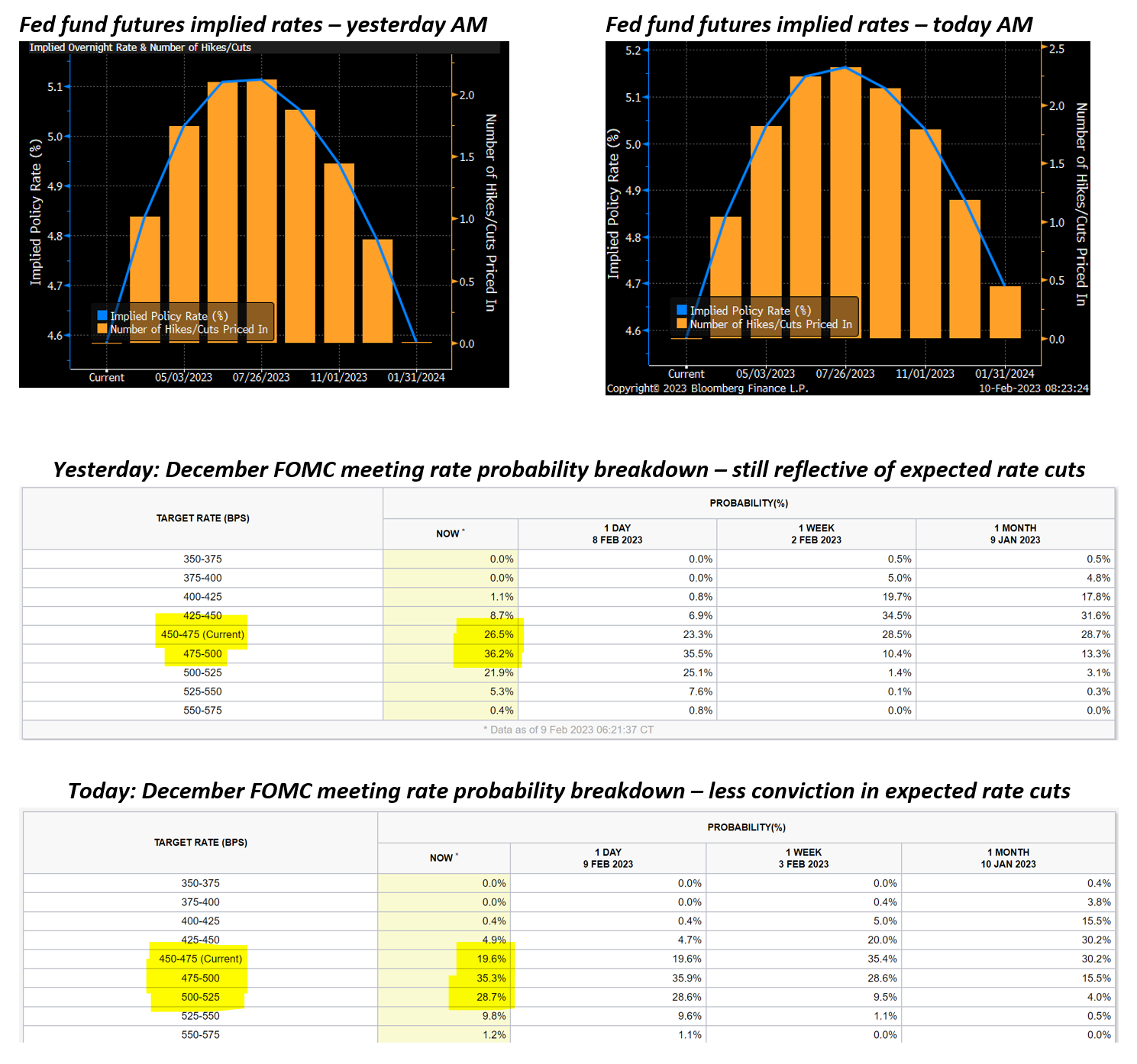

January’s blowout US nonfarm numbers roiled Treasury markets and halted the 2023 stock market rally in its tracks, and although markets steadied in the middle of this week, traders began to look to next week’s US Consumer Price and Produce Price Index prints with genuine concern. Last month’s jobs data might well be an anomaly, but upside surprises from those key inflation readings, alongside the possibility that retail sales and industrial production data also top estimates, could cause a paradigm shift in the expectations for Fed policy. Following the jobs report, investors marked up the terminal rate of the hiking cycle from roughly 5.00% at the March meeting to 5.25% at the May FOCM decision, but expectations for rate cuts in the back half of the year persisted through midweek. Yesterday, however, traders began to meaningfully reexamine that longstanding assumption of late 2023 Fed easing.

In short, the constant refrain from Fed officials about higher-for-longer interest rates, which is our base case, has not convinced investors, but recent data has begun to change their minds. For the near term, we expect next week’s data to be reassuring to investors, with inflation continuing to moderate and growth indicators muted, but our longstanding view is that the eventual repricing of markets to align with the higher-for-longer interest rate reality will be a challenging period for risk assets and will mark the second half of the bear market that began in early 2022.

A few notes on the observed dynamics in rates markets over the past day:

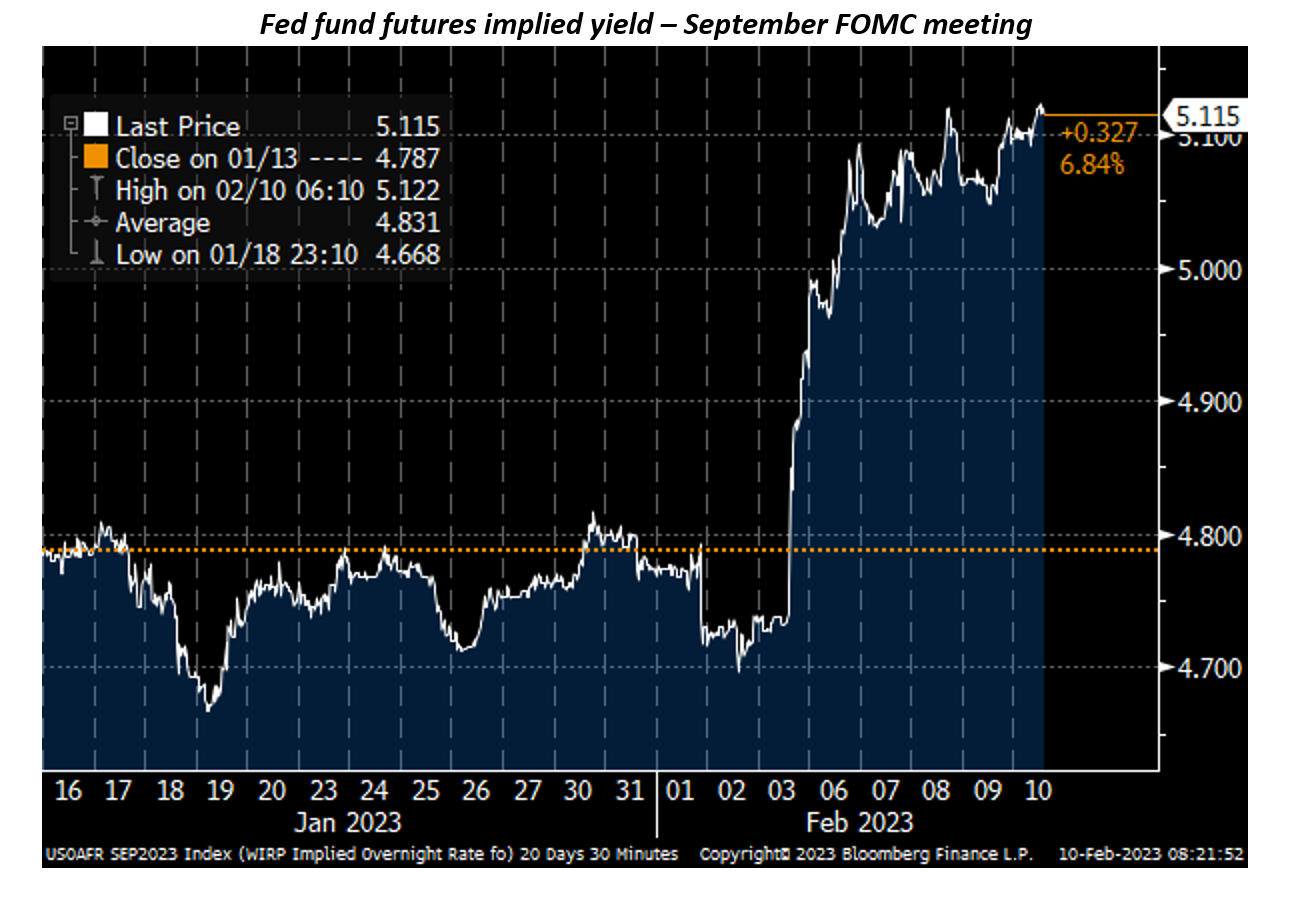

- The nonfarm payroll number accomplished what volumes of Fedspeak have failed to achieve – convincing markets that peak rates of this cycle are most likely to be above 5%. As the chart below of the fed fund futures September implied rates shows, Chair Powell’s commentary at the February 1st Fed decision actually put expected rates lower, and only the nonfarm payroll print on February 3rd elicited a meaningful reaction.

- Initially, price action suggested that the January jobs number told us more about the Fed’s near-term reaction function than about how the economy will play out and how policy will need to evolve later this year. As of yesterday morning, Fed fund futures showed the two more rate hikes that were being priced in before the summer being taken back by January next year, presumably in the face of deteriorating US growth or a recession. In short, January’s jobs numbers were being taken as a headfake that the Fed falls for, only to have to unwind the tightening within months.

But yesterday, fed fund futures began to pretty dramatically reprice the outlook for Fed easing, as next week’s inflation figures and retail sales data loom.

Looking ahead, next week’s macro calendar centers around the highly-anticipated US Consumer Price Index figures for January, with the Producer Price Index also due. US retail sales and industrial production data for last month will be scrutinized for any signs of additional slowing. UK inflation and retail sales are also on the calendar, along with EU industrial production, Australian business and consumer confidence, and Japan GDP. Peak earnings season is now considered over, but next week still features some reports from industry bellwethers including Coca-Cola, Deere, Shake Shack, Shopify, and Zillow.

- US Inflation Data (CPI & PPI)

- US Retail Sales

- US Industrial Production

- UK Inflation & Retail Sales

- EU Industrial Production

- Corporate Earnings

- Japan GDP

- Australian Confidence Gauges

Global Economic Calendar: Super Bowl of economic data

Monday

The Westpac-Melbourne Institute Index of Consumer Sentiment for Australia increased 5% to 84.3 in January, rising for the second straight month and posting the largest monthly gain since April 2021. January was the first month since April last year not to oversee a spike in the RBA cash rate. Still, Westpac expects the Reserve Bank Board to continue its interest rate policy tightening at the next meeting on February 7. The Index has lifted a cumulative of 8.1% over the last two months, from a 78 read in November which might prove to be the lowest point for Consumer Sentiment in this cycle, though sentiment remains depressingly low. The improvement in January was mainly driven by sub-indexes for “economic conditions next 12mths” (10.2%), “family finances next 12mths” (6.6%), and “time to buy a dwelling” (4.4%). Expectations about the labor market also brightened, while expectations for house prices dropped 10.3%.

Australia’s NAB business confidence index rose 3 points to -1 in December 2022 but stayed in the negative territory for the second month and remained below its long-run average. Sentiment strengthened across most industries, except transport & utilities. Meanwhile, business conditions weakened, dropping for the third month (12 vs 20 in November) amid falls in sales (18 vs 27), profitability (12 vs 19), and employment (8 vs 13). The decline was broad-based, with all sectors moderating. Leading indicators suggested conditions might ease further, with forward orders edging down (3 vs 5) and capacity utilization relaxing above average at 83.7%. Price and cost growth slowed but remained elevated. “Momentum is clearly slowing though activity remains solid,” said NAB chief economist Alan Oster. “We know the full impact of rates is yet to fully flow through so the survey should give us an indication of the accelerating impact from rates over coming months.”

The Japanese economy shrank 0.2% quarter-on-quarter in the three months to September 2022, compared with flash data of a 0.3% fall and after a 1.1% growth in the previous period. The latest figure came amid an upward revision of both government spending (0.1% vs flat reading in the first estimate and after a 0.7% rise in Q2) and net trade with exports growing faster than initially anticipated (2.1% vs 1.9% in the flash figure and after a 1.5% previously). Meantime, private consumption was sluggish (0.1% vs 0.3% in the initial print and after a 1.7% rise in Q2), hit by another COVID wave in August and despite efforts from the government to step up support for households. Business investment growth slowed notably (1.5%, matching the preliminary print and after a 2.4% gain in Q2).

Tuesday

The unemployment rate in the UK was unchanged at 3.7% in the three months to November of 2022, the same as in the previous period and in line with expectations. The number of people unemployed for up to six months increased, driven by those aged 16 to 24 years. Those unemployed for over six and up to 12 months increased, while those unemployed for over 12 months decreased. The employment rate was estimated at 75.6%, largely unchanged, with the number of employees and part-time self-employed workers increasing while full-time self-employed workers decreased. Meanwhile, the number of job vacancies fell by 75K to 1.161 million, as uncertainty across industries leads to holding back on recruitment.

Annual CPI inflation rate in the US slowed for a sixth straight month to 6.5% in December of 2022, the lowest since October of 2021, in line with market forecasts. It follows a 7.1% reading in November. Energy cost increased 7.3%, well below 13.1% in November, as gasoline cost dropped 1.5%, following a 10.1% surge in November. Also, fuel oil cost slowed (41.5% vs 65.7%) while electricity prices rose slightly faster (14.3% vs 13.7%). A slowdown was also seen in food prices (10.4% vs 10.6%) while cost of used cars and trucks continued to decline (-8.8% vs -3.3%). On the other hand, the cost of shelter increased faster (7.5% vs 7.1%). Compared to the previous month, the CPI edged 0.1% lower, the first decline since May of 2020, and beating forecasts of a flat reading. Inflation seems to have peaked at 9.1% in June of 2022 but it still remains more than three times above the Fed’s 2% target. Additionally, core CPI, which exclude volatile items such as food and energy, went up by 5.7 percent from a year earlier, compared to a 6.0 percent rise in the prior month and mostly in line with market expectations.

Building permits in the US fell 1.0 percent from a month earlier to a seasonally adjusted annual rate of 1.337 million in December 2022, the lowest level since May 2020, as high inflation and rising mortgage rates hit demand for new housing, revised data showed. Single-family authorizations declined 6.4 percent to a rate of 731 thousand, the lowest since April 2020, while the volatile multi-segment rose 6.3 percent to 606 thousand. Permits were down in the South (-1.7 percent to 740 thousand), Midwest (-12.1 percent to 175 thousand) and Northeast (-2.5 percent to 115 thousand), but were up in the West (9.3 percent to 307 thousand).

Wednesday

Annual inflation rate in the UK fell to 10.5% in December of 2022 from 10.7% in November, matching market forecasts. It marks a second consecutive month of slowing inflation and the lowest rate in three months, after a peak of 11.1% in October. The largest downward contribution came from transport prices (6.5% vs 7.2%), namely motor fuels. Average petrol prices fell by 8.3 pence per litre between November and December. Prices also eased for clothing and footwear (6.5% vs 7.5%) and recreation and culture (4.9% vs 5.3%), mainly games, toys and hobbies. On the other hand, prices rose faster for restaurants and hotels (11.3%, the largest since 1991 vs 10.2%), particularly accommodation, and food and non-alcoholic beverages (16.8%, which is the highest since 1977 according to modelled estimates vs 16.4%). Compared to the previous month, the CPI increased 0.4%, the same as in November and also in line with forecasts.

Retail sales in the US declined 1.1% month-over-month in December 2022, following an upwardly revised 1% drop in November and worse than forecasts of a 0.8% fall. Sales at gasoline stations recorded the biggest decrease (-4.6%), followed by furniture stores (-2.5%), motor vehicle dealers (-1.2%), electronics and appliances stores (-1.1%), miscellaneous (-1.1%) and nonstore retailers (-1.1%). In contrast, sales were up 0.3% in building materials and garden equipment stores (0.3%) and sporting goods, musical instruments and book sellers (0.1%). Sales at food and beverage stores were flat. Retail sales aren’t adjusted for inflation and part of the decrease in December can be explained by a fall in goods prices during the month and a holiday shopping that was pulled forward into October. However, excluding sales at gasoline stations, sales were down 0.8%, in another sign of a weaker-than-expected holiday shopping and a slowdown in consumer spending amid high inflation and interest rates.

Industrial production in the US fell by 0.7% mom in December of 2022, following an upwardly revised 0.6% decrease in November and more than market expectations of a 0.1% loss. It was the biggest drop in industrial activity since September 2021, as higher interest rates and prices weighed on demand. Manufacturing output dropped 1.3%, way more than expectations for a 0.3% decrease. The indexes for durable and nondurable manufacturing dropped 1.1% and 1.5%, respectively, while the index for other manufacturing (publishing and logging) stepped down 0.9%. Meanwhile, mining was down 0.9% while utilities rose 3.9%, driven by increases for both electric and natural gas utilities. Capacity utilization dropped 0.6 percentage point in December to 78.8%, a rate that is 0.8 percentage point below its long-run (1972–2021) average. Considering Q4, industrial production declined 1.7%.

Japan’s trade deficit widened to JPY 1,448.5 billion in December 2022 from JPY 603.1 billion in the same month a year earlier and compared with market consensus of a gap of JPY 1,652.8 billion. This was the 17th straight month of a trade shortfall, the longest stretch since 2015, raising concerns over the strength of the country’s economic recovery. Imports climbed 20.6% yoy to JPY 10,235.7 billion, the 20th straight month of double-digit rise; while exports grew at a softer 11.5%, the 22nd straight month of growth but the softest pace since the start of the year, to JPY 8,787.3 billion. Considering the whole year, Japan posted a trade deficit of JPY 19,971.3 billion, the second straight annual shortfall and the biggest since 1979, driven by a surge in imports amid high commodity prices and the slump in yen.

Thursday

The Producer Price Index in the US dropped 0.5 percent from a month earlier in December 2022, following a revised 0.2 percent gain in November and compared with market expectations of a 0.1 percent fall. It was the largest monthly decline since April 2020, adding to signs that inflationary pressure in the world’s largest economy is cooling. Goods prices were down 1.6 percent, led by a 7.9 percent slump in energy cost and, to a lesser extent, a 1.2 percent fall in food prices. On the other hand, service prices edged 0.1 percent higher, due to increased margins for final-demand trade services. On an unadjusted yearly basis, the PPI increased 6.2 percent in December, the least since March 2021.

Friday

Retail sales in the UK sank 1% month-over-month in December of 2022, following an upwardly revised 0.5% drop in November and compared to market forecasts of a 0.5% rise. Sales at non-food stores fell 2.1% as consumers are cutting back on spending because of increased prices and affordability concerns. Sales were mostly down for cosmetics, sports equipment, games and toys and watches and jeweller and at department and clothing stores. Also, food sales edged 0.3% lower as customers stocked up early for Christmas. Compared with December 2021, sales declined by 5.8%, the most for that month since records began. Retail sales are now 1.7% below their pre-covid levels. Between 2021 and 2022, retail sales volumes fell by 3.0%, as rising prices and the cost of living affected sales volumes.

Prices for US imports rose 0.4 percent from a month earlier in December 2022, following a revised 0.7 percent decrease in the previous month and compared with market consensus of a 0.9 percent fall. It was the first monthly increase in import prices since June on the back of higher nonfuel and fuel prices. Prices for nonfuel imports increased 0.4 percent, the first one-month advance since April, due to rising costs for nonfuel industrial supplies and materials; consumer goods; foods, feeds, and beverages; capital goods; and automotive vehicles. Import fuel prices moved up 0.6 percent, the first monthly increase since June, as higher natural gas prices more than offset lower prices for petroleum. On a yearly basis, US import prices advanced 3.5 percent in December, accelerating from November’s 2.7 percent increase.

US export prices fell by 2.6 percent from a month earlier in December of 2022, above expectations of a 0.5 percent drop and following an upwardly revised 0.4 percent retreat in the prior month. It was the sixth consecutive monthly decrease in export prices as nonagricultural export prices fell 2.7 percent, the most since in July 2022 and agricultural export prices decreased 2.4 percent . On a yearly basis, prices for US exports rose by 5 percent, the least since January of 2021 and slowing from the downwardly revised 6.1 percent in the previous month.