Looking Ahead – ‘23 and Me

As we noted last week, our base case for topping inflation and slowing (but not crashing) growth with a downshifting Fed is the recipe for the second half 2022 rally. This week’s tantalizing bounce has us temped to upgrade stocks earlier than we feel comfortable doing – financial markets have a way of forcing investors into uncomfortable decisions, of course. Still, we are holding our neutral posture for now on US stocks, especially with some banana peels possible amid next week’s gauntlet of mega IT earnings, plus a pivotal Fed decision, but upcoming dips will look increasingly buyable for the more extended second half rally we anticipate.

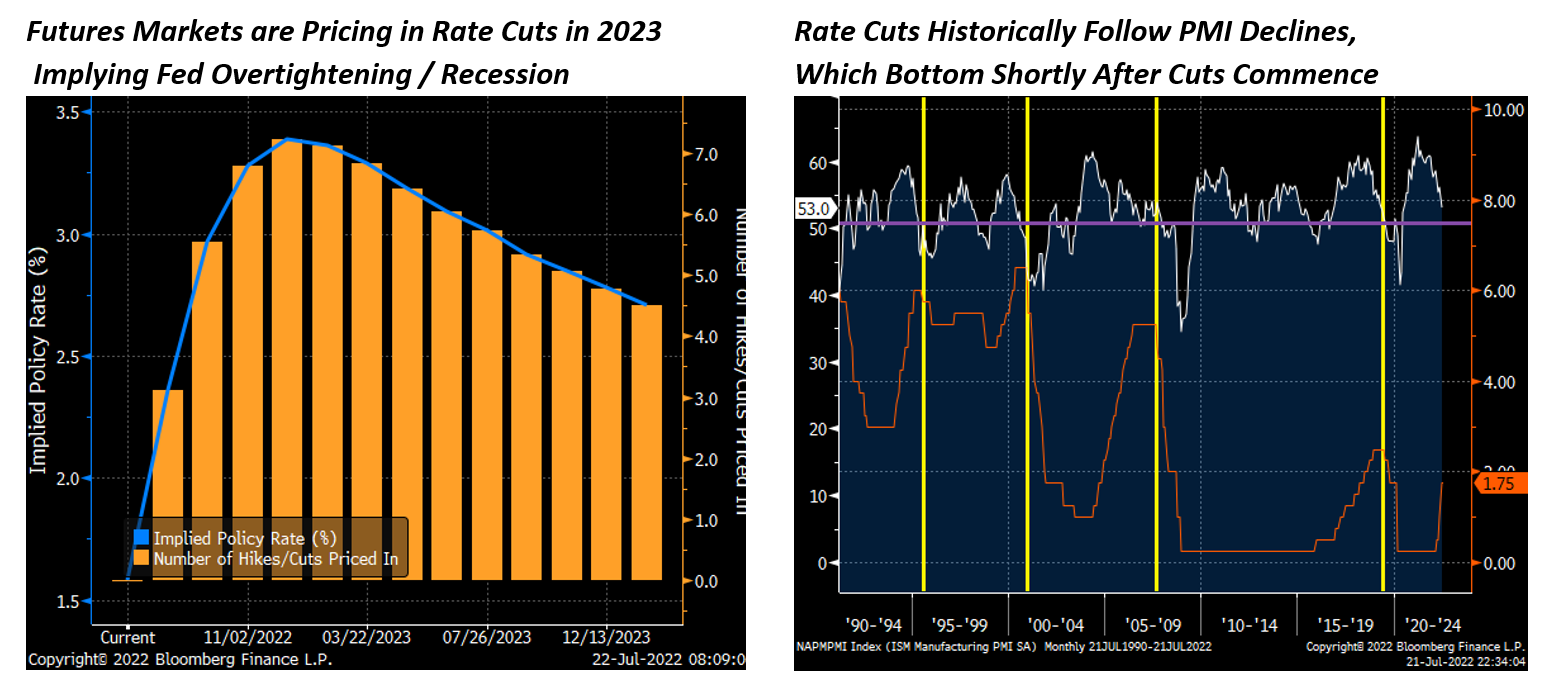

If this is an ordinary market cycle, then we would probably further assume that the bottom of this bear market is nearly in place after a few more months of pain. And this is essentially what futures markets are suggesting, with the hiking cycle seen topping at year end 2022 and interest rate cuts commencing gradually in spring/summer of 2023 (see the chart on the left below). This would follow the historical pattern of sliding growth (with manufacturing PMI as the growth proxy in the chart at right below) eliciting rate cuts which, shortly thereafter, help lift growth from its lows. Stocks anticipate this and would start to rally later this year as the Fed puts its last rate hike on the board.

However, our view is that inflation will come down but stay sticky, with the housing component remaining elevated and persistently lofty energy prices keeping the Fed on alert for a rebound in price pressures lest they ease prematurely. With economists and commentators like Larry Summers breathing down their necks, and the narrative about the high costs of the “stop/start” 70’s monetary policy approach shaping their reaction function, plus the standard “once bitten, twice shy” dynamic, we expect that the bar for rate cuts in 2023 will be very high. Also, on the political front, the Democrats will also be blaming midterm outcomes on inflation and will be favorably inclined to the Fed prioritizing inflation suppression over growth support, which is not a negligible factor in our view.

We think this formulation will make for a challenging 2023 for risk assets, as the assumption of rate cuts and easing evaporate despite continued or worsening weakness in growth. It is worth noting that Fed tightening does hit the economy with a lag and we expect the headwinds from persistently high energy prices to exert durable and non-linear pressure on consumers. In short, the consensus view is things get worse before they get better, while we expect things to get better in the second half of 2022 and relapse.

Looking ahead, the main event on next week’s macro calendar is the July Fed meeting, with analysts expecting a 75bps hike after speculators toyed with the idea of 100bps after the hotter than expected June Consumer Price Index reading earlier this month. On the data front, the initial reading of Q2 US GDP will be in focus as economists project a modest expansion. EU GDP readings are also due, along with inflation figures for the bloc, while Japan also releases its CPI data along with retail sales and industrial production. Earnings reporting season heats up with a heavy concentration of mega-cap IT companies reporting figures, including Google, Microsoft, Apple, Amazon, and Facebook. Also reporting are 3M, Visa, UPS, Chipotle, Coca-Cola, Ford, GE, GM, Hilton, Mastercard, Pfizer, and Procter & Gamble.

- Fed Meeting

- US GDP

- EU GDP

- Corporate Earnings

- EU CPI

- Japan CPI, Retail & Industrial Production

Global Economic Calendar: Fed Dead Ahead

Monday

The Ifo Business Climate indicator for Germany fell to 92.3 in June from a 3-month high of 93 in May, falling short of market expectations of 92.9 as concerns over the threat of gas shortages caused the subindexes for both current conditions (99.3 vs 99.6 in May) and expectations (85.8 vs 86.9) to deteriorate. By sector, sentiment weakened in manufacturing, chemicals, and especially trade, which saw its expectations index fall to its lowest level since April 2020. Wholesalers and retailers also expressed pessimism about the second half of the year. On the upside, the service and construction sectors notched improvements in both their assessments of the current business situation as well as their expectations for the coming months, although many companies remain tangibly pessimistic.

The Chicago Fed National Activity Index dropped to an eight-month low of +0.01 in May from +0.40 in April, with production-related indicators contributing -0.01 (down from 0.29 in April) and the personal consumption and housing category falling to -0.11 from +0.10 in the previous month. By contrast, employment-related indicators contributed +0.08, up slightly from +0.07, and the contribution of the sales, orders, and inventories category jumped to +0.05 in May from -0.07. The index’s three-month moving average, CFNAI-MA3, decreased to +0.27 from +0.39, suggesting that the economy is still expanding, albeit at a slower rate compared to previous months.

Tuesday

The S&P CoreLogic Case-Shiller 20-city home price index in the US increased 21.2% year-over-year in April, a new record high, above market forecasts of 21% and following a downwardly revised 21.1% increase in March. Figures showed once again that the housing market remained strong heading into Q2, with Tampa (35.8%), Miami (33.3%), and Phoenix (31.3%) remaining the cities with the strongest price gains in the last year. However, the national index eased to 20.4% from 20.6% in March. “April 2022 showed initial (although inconsistent) signs of a deceleration in the growth rate of U.S. home prices. We continue to observe very broad strength in the housing market and a more-challenging macroeconomic environment may not support extraordinary home price growth for much longer,” said Craig J. Lazzara, Managing Director at S&P DJI.

New home sales in the US rose 10.7% from a month earlier to a seasonally adjusted annual rate of 696,000 in May, beating market expectations of 588,000. Increases were seen in home sales in the West (39.3% to 202,000) and South (12.8% to 413,000), while sales continued to decline in the Northeast (-51.1% to 23,000) and Midwest (-18.3% to 58,000). Meanwhile, the median sales price of new houses sold was $449,000, down slightly from the previous month but still much higher than $390,400 a year earlier, while the average sales price was $511,400, down from $569,500 in April.

The annual inflation rate in Australia surged to 5.1% in Q1 2022 from 3.5% in Q4, topping market estimates of 4.6% and marking the strongest quarterly inflation since the introduction of the Goods and Services Tax in July 2000 as soaring fuel prices and building costs boosted the overall rate. Main upward pressure came from transport prices, which rose the most since the Iraqi invasion of Kuwait in 1990 (13.7% vs 12.% in Q4); while price increases in food and non-alcoholic beverages (4.3% vs 1.9%), alcohol and tobacco (1.8% vs 1.1%), housing (6.7% vs 4%), recreation (3% vs 2.1%), health (3.5% vs 3.3%), and insurance and financial services (2.7% vs 2.2%) also accelerated. On a quarterly basis, consumer prices went up 2.1%, the most since Q3 2000 and following a 1.3% gain in Q4, mainly due to a jump in the cost of new dwellings and fuel. The RBA Trimmed Mean CPI went up 3.7% y/y, the most in 12 years, exceeding the midpoint of the central bank’s 2-3% target for the second consecutive quarter. Quarter-on-quarter, the index increased 1.4% following a 1% rise in Q4.

Wednesday

The GfK Consumer Climate Indicator in Germany sank to a record low of -27.4 heading into July from an upwardly revised -26.2 in June, slightly above market forecasts of -27.7. All of the main subindexes weakened as high inflation and recession fears weighed heavily on consumers, with economic expectations falling to -11.7 from -9.3, income expectations dropping to a near-20-year low of -33.5 from -23.7, and the propensity to buy sinking to -13.7 from -11.1. “The ongoing war in Ukraine and disrupted supply chains are causing energy and food prices in particular to explode and making the consumer climate more gloomy than ever,” said Rolf Bürkl, GfK consumer expert.

US Durable Goods Orders increased 0.7% month-over-month to $267.2 billion in May, following a 0.4% rise in April and beating forecasts of a 0.1% rise, in a sign that business spending plans remained strong despite higher interest rates and elevated inflation. Orders increased for transportation equipment (0.8%), capital goods (0.8%), machinery (1.1%), and computers and electronics (0.5%), while orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, edged up 0.5%, up from 0.3% in April.

Pending home sales in the US unexpectedly rose 0.7% month-over-month in May, the first rise in seven months and following a 4% decline in April. Figures came well above market forecasts of a 3.7% fall. By region, signings increased in the Northeast (15.4%) and South (0.2%), while the Midwest (-1.7%) and West (-5%) experienced declines. However, despite the gain in May, soaring mortgage rates and low supply were expected to continue to weigh on the housing market, with the NAR estimating that at the median single-family home price and with a 10% down payment, monthly mortgage payments have increased by about $800 since the start of the year as mortgage rates have climbed 2.5% since January. “Despite the small gain in pending sales from the prior month, the housing market is clearly undergoing a transition. Contract signings are down sizably from a year ago because of much higher mortgage rates,” said Lawrence Yun, Chief Economist at the National Association of Realtors. Year-on-year, pending home sales plunged 13.6%.

The Federal Reserve’s Open Market Committee will convene next Tuesday, where it is expected to once again raise interest rates by 75 bps as inflation continues to rage, although some are forecasting an even more aggressive 100 bps hike after June CPI data showed prices increased 9.1% year-on-year, the highest reading since November 1981. At its last meeting in June, the Committee raised the target for the federal funds rate by 75 bps to 1.5%-1.75%, marking the third consecutive rate increase and the largest hike since 1994. Fed Chair Jerome Powell has stated that the Fed remains committed to doing whatever it takes to restore price stability, although other Fed policymakers including Atlanta Fed President Raphael Bostic and St. Louis Fed President James Bullard have downplayed or, in the case of Bostic, outright cautioned against a dramatic 100 bps hike. The Fed is currently projected to bring the federal funds rate to around 3.5% by year’s end.

Thursday

The annual inflation rate in Germany was confirmed at 7.6% in June, slowing from 7.9% in the previous month, which was the highest reading since the German reunification in 1990, as a controversial fuel price rebate designed to cushion the impact of the conflict in Ukraine on consumers had a slight downward effect on overall inflation. Energy prices rose at a softer 38% year-over-year, compared to 38.3% in May, while food price inflation accelerated to 12.7%, the highest rate since at least 1992 and up from 11.1% in May. The price of energy products increased sharply, especially for heating oil (108.5%), motor fuels (33.2%), and natural gas (60.7%), reflecting the impact of Russia’s invasion of Ukraine. Meanwhile, inflation in the cost of services eased to 2.1% from 2.9%, with rent prices up 1.7%. On a monthly basis, consumer prices rose 0.1%, the least in seven months and down from 0.9% growth in May. The CPI, harmonized to compare with other European countries, was up 8.2% on the year but edged down 0.1% month-on-month, which was the first decline since November 2020.

The US economy (GDP) contracted an annualized 1.6% on quarter in the first three months of 2022, slightly worse than the previous estimate of a 1.5% decline and marking the first quarterly contraction since the onset of the pandemic in 2020 as record trade deficits, supply constraints, worker shortages, and high inflation weighed on growth. Imports surged more than anticipated (18.9% vs 18.3% in the second estimate), led by nonfood and nonautomotive consumer goods, while exports dropped less than previously estimated (-4.8% vs -5.4%). Also, consumer spending growth was revised lower (1.8% vs 3.1%) as increased spending on services, especially housing and utilities, was partially offset by decreased spending on goods, namely groceries and gasoline. In addition, private inventories subtracted 0.35 percentage points from growth, much less than the 1.09 percentage point drag reported in the second estimate. Fixed investment growth remained robust (7.4%), although housing investment was subdued (0.4%).

Japan’s unemployment rate rose to 2.6% in May from 2.5% in April, slightly above market expectations of 2.5%. The number of unemployed increased by 40,000 to 1.8 million, while employment decreased by 140,000 to 69.04 million and those detached from the labor force fell by 40,000 to 41.13 million. The non-seasonally adjusted labor force participation rate edged up to 62.7% from 62.5% in May 2021. Meanwhile, the jobs-to-applications ratio reached a 25-month high of 1.24 in May from 1.23 in April, in line with forecasts.

Friday

The consumer confidence index in Japan fell to an 18-month low of 32.1 in June from 34.1 in the previous month amid ongoing global uncertainty. All subindexes weakened, with employment perceptions down 1.6 points from a month earlier to 37.4, overall livelihood down 2.6 points to 29.8, views toward income growth down 1.4 points to 35.8), and willingness to buy durable goods down 2.6 points to 25.3.

The German economy (GDP) expanded by 0.2% on quarter in the first three months of 2022, recovering from a 0.3% fall in Q4 2021 and in line with preliminary estimates. Growth was mainly supported by a rebound in capital formation (2.7% vs 0% in Q4) as construction investment bounced back and machinery and equipment investment increased, while government spending rose 0.1% (vs 0.2% in Q4). Household expenditure was down 0.1%, an improvement from the 1.3% contraction in Q4, while net exports also had a downward effect on the economy as exports fell 2.1% (vs a 3.8% rise) and imports continued to rise, albeit at a slower pace than in the previous quarter (0.9% vs 4.1%). On a yearly basis, the economy grew 3.8%, which was the fastest yearly growth in three quarters.

The Eurozone economy (GDP) expanded 0.6% on quarter in the first three months of 2022, up from previous estimates of 0.3% and above a downwardly revised 0.2% gain in Q4 2021 as net trade and inventories helped boost overall output. Exports rose 0.4% compared to a 0.6% decline in imports, while gross fixed capital formation rose just 0.1%. Meanwhile, household consumption sank 0.7% and public expenditure contracted 0.3%. Compared with the same period last year, the Eurozone economy advanced 5.4%. Still, the economy was expected to face headwinds from the war in Ukraine and related supply disruptions and uncertainty. The European Central Bank (ECB) also ended an eight-year period of negative interest rates yesterday, which is likely to drag consumer spending and investment in the coming months.

The annual inflation rate in the Eurozone was confirmed at a record high of 8.6% in June, compared to 8.1% in May and 1.9% a year earlier. Prices increased across the board, with energy once again making the largest contribution (42% vs 39.1% in May) and food, alcohol & tobacco (8.9% vs 7.5%), services (3.4% vs 3.5%), and non-energy industrial goods (4.3% vs 4.2%) also showing sustained inflation. Excluding energy, the inflation rate increased to 4.9% from 4.6% in the previous month, well above the ECB’s target of 2%. Month-over-month, prices increased 0.8%.

Personal spending in the US increased 0.2% month-over-month in May, the weakest gain so far this year and following a downwardly revised 0.6% rise in April. Figures fell short of market forecasts of 0.4%. Still, spending rose for international travel and hospital services, gasoline, and services, namely housing, although spending on motor vehicles and parts, especially new autos, declined. Adjusted for changes in prices, purchases of goods and services fell 0.4%, marking the first drop this year as high inflation weighs on affordability.

Personal income in the US went up 0.5% from a month earlier in May, the same as in the previous month and matching market expectations as an increase in compensation and proprietors’ income offset a decrease in government social benefits. Within compensation, the increase reflected increases in both private and government wages and salaries. The increase in proprietors’ income was led by nonfarm income, while the fall in government social benefits reflected a decrease in transfers to nonprofit healthcare providers through the Provider Relief Fund, although the decrease was partially offset by increases in Medicaid and Medicare payments.

The personal consumption expenditure price index increased 0.6% month-over-month in May, up from a 0.2% rise in April. Still, the annual rate remained at 6.3% after reaching a record high of 6.6% in March. Energy prices increased 35.8%, up from 30.4% in April, although food inflation quickened once again to 11% from 10%. Core PCE, which excludes food and energy, rose 4.7% from one year ago, easing from 4.9% in April and below forecasts of 4.8%.