Summary and Price Action Rundown

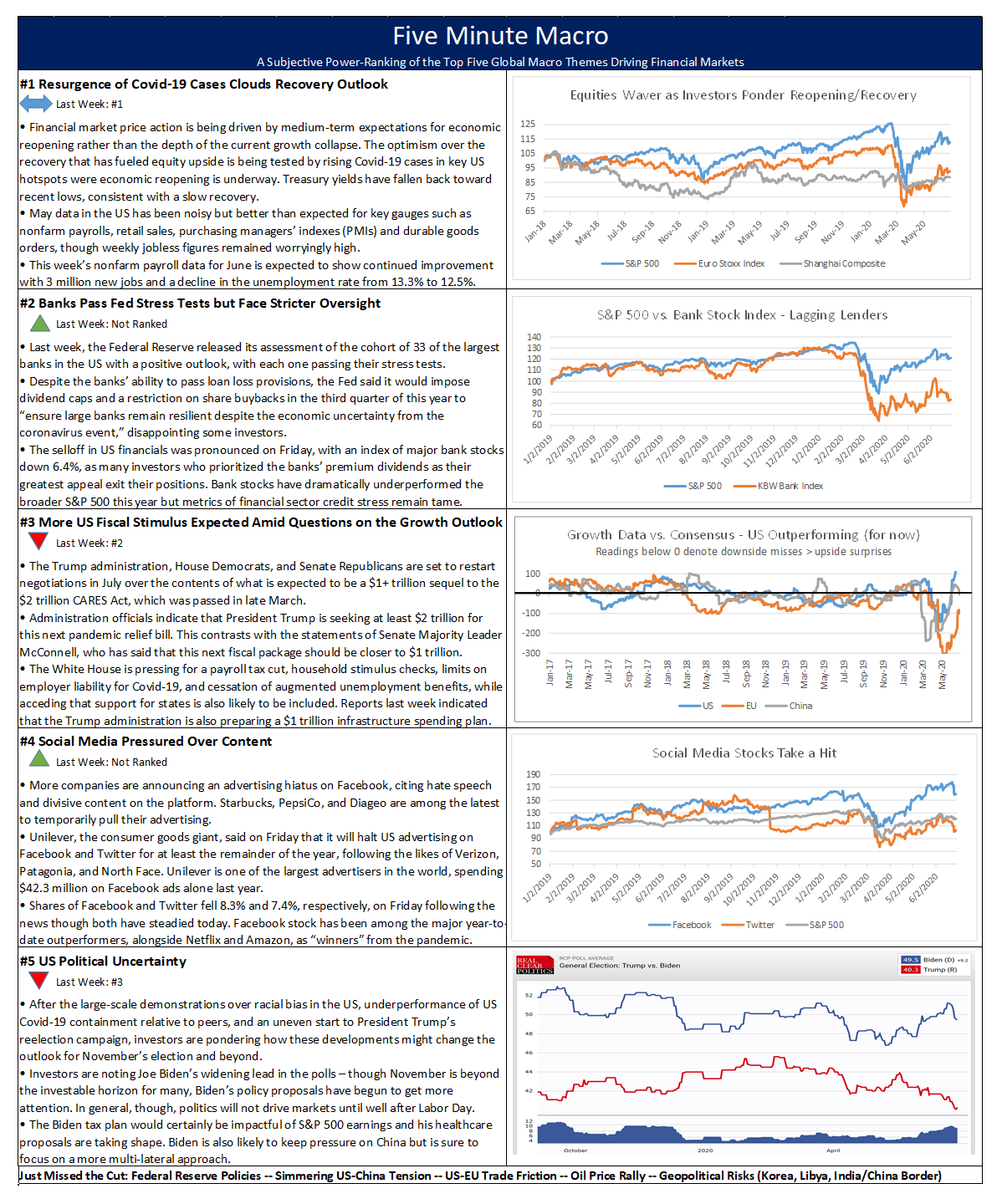

Global risk assets were mixed overnight as the continued rise in coronavirus cases in various hotspots in the US and overseas undermines hopes for the economic rebound, with more key US labor market data due today. S&P 500 futures have been choppy overnight and indicate a 0.3% lower open after falling 2.6% yesterday, which erased most of last week’s rebound and deepened the index’s year-to-date loss to 5.6%. Equities in the EU are rebounding from yesterday’s underperformance while Asian stocks were mixed overnight, with a number of bourses closed for holidays. Amid the cautious market mood, the dollar is edging upward and longer-dated Treasury yields are lower, with the 10-year yield at 0.67%. Brent crude prices are back below $40 per barrel as estimates of US inventory data showed a bearish buildup.

Optimism for the Economic Recovery Wavers Amid Rising Coronavirus Cases

Investors are confronting the rising likelihood that progress toward reopening will be impeded or in some cases rolled back in order to contain the widening spread of Covid-19 infections in key hotspots in the US and overseas. Market sentiment deteriorated yesterday as the US posted its largest single-day increase in coronavirus cases since the outset of the pandemic, alongside other discouraging news on the public health front. Two weeks ago, US cases were rising at 20,000 per day but that tally has risen to 36,880 currently, topping the previous high on April 24, and 33 states are registering a higher seven-day average of new infections than they were two weeks prior. Meanwhile, state leaders in New York, New Jersey, and Connecticut announced that they will require a 14-day quarantine for anyone arriving from a coronavirus hotspot, while new record numbers of daily infections were reported in California (7,149), Florida (5,508), and Texas (5,551) and available ICU beds are dwindling in Houston, where Apple announced they are re-closing more stores. Disneyland in California has now delayed its scheduled reopening beyond July 17 with no new data given and New York is delaying its reopening of malls, movie theaters, and gyms. Governors and mayors remain generally resistant to reversing reopening efforts or imposing other more stringent restrictions, though Nevada and Miami are the latest locales to require use of masks in public. Overseas, reports are noting clusters of infections in Germany and Tokyo leading to re-imposed restrictions, while the UK prepares to forge ahead with its reopening plans slated for early July.

IMF Sounds a Cautious Note on the Global Economy

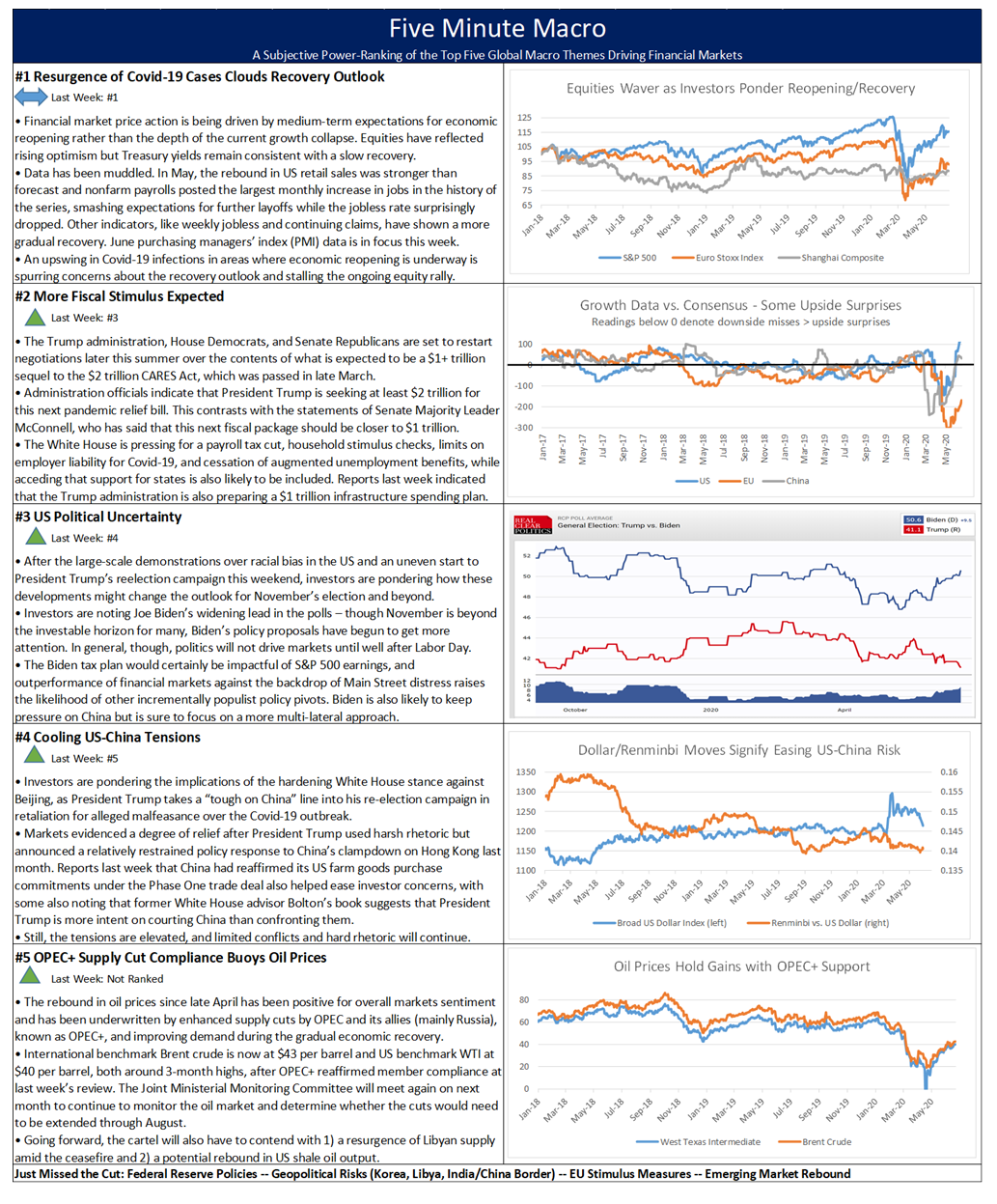

The IMF turned more negative on the global grows outlook while investors await more key US labor market data this morning. Following similarly downbeat projections from the World Bank and OECD in recent weeks, the IMF issued downgraded economic forecasts for 2020 yesterday, with global GDP moving from its estimate of -3.0% in April to -4.9% currently. The report also warned of the potential for “long-lasting negative consequences” for the global economy. The OECD issued its revised outlook earlier this month, calling for a 6% contraction in global growth this year, with its estimate for US GDP at -7% and the EU at -9%, and only a 5% rebound in 2021 for the worldwide economy. Similarly, the World Bank sees the global economy shrinking 5.2% for the year and warned of a more adverse scenario in which the global GDP contraction could be as high as 8%, with emerging market economies shrinking around 5% and an estimated sluggish 1% global recovery in 2021. Speaking earlier this week, World Bank Chief Economist Reinhart cautioned that a rebound should not be confused with a recovery and that returning to pre-pandemic income levels could take years. As investors continue to ponder the uncertain economic outlook, they will parse releases of US weekly initial and continuing jobless claims later this morning, as well as May durable goods orders.

Additional Themes

Fed’s Bank Stress Test Results Due – Investors will be highly attuned to these results for any ramifications for bank capital management, particularly share buybacks and dividends. For context, last year’s stress test included as its most severe hypothetical scenario a global recession resulting in $410 billion in total losses for the 18 participating institutions, the US unemployment rate rising by more than 6 percentage points to 10%, a major decline in real estate prices, and elevated stress in corporate loan markets. “The results confirm that our financial system remains resilient,” Vice Chairman Randal K. Quarles said at the time. The Fed has already said that this year’s stress test results will “include additional analyses that explore how plausible risks to the economy stemming from the coronavirus response could affect bank capital.” There remains a lack of consensus how severe the Fed makes their “additional analyses” of the coronavirus risks to the economy.

Oil Prices Battered by Rising US Inventories and Demand Fears – US crude stockpiles rose to a record high 540 million barrels last week according to the Energy Information Administration, while the resurgence in Covid-19 cases dampens the demand outlook.