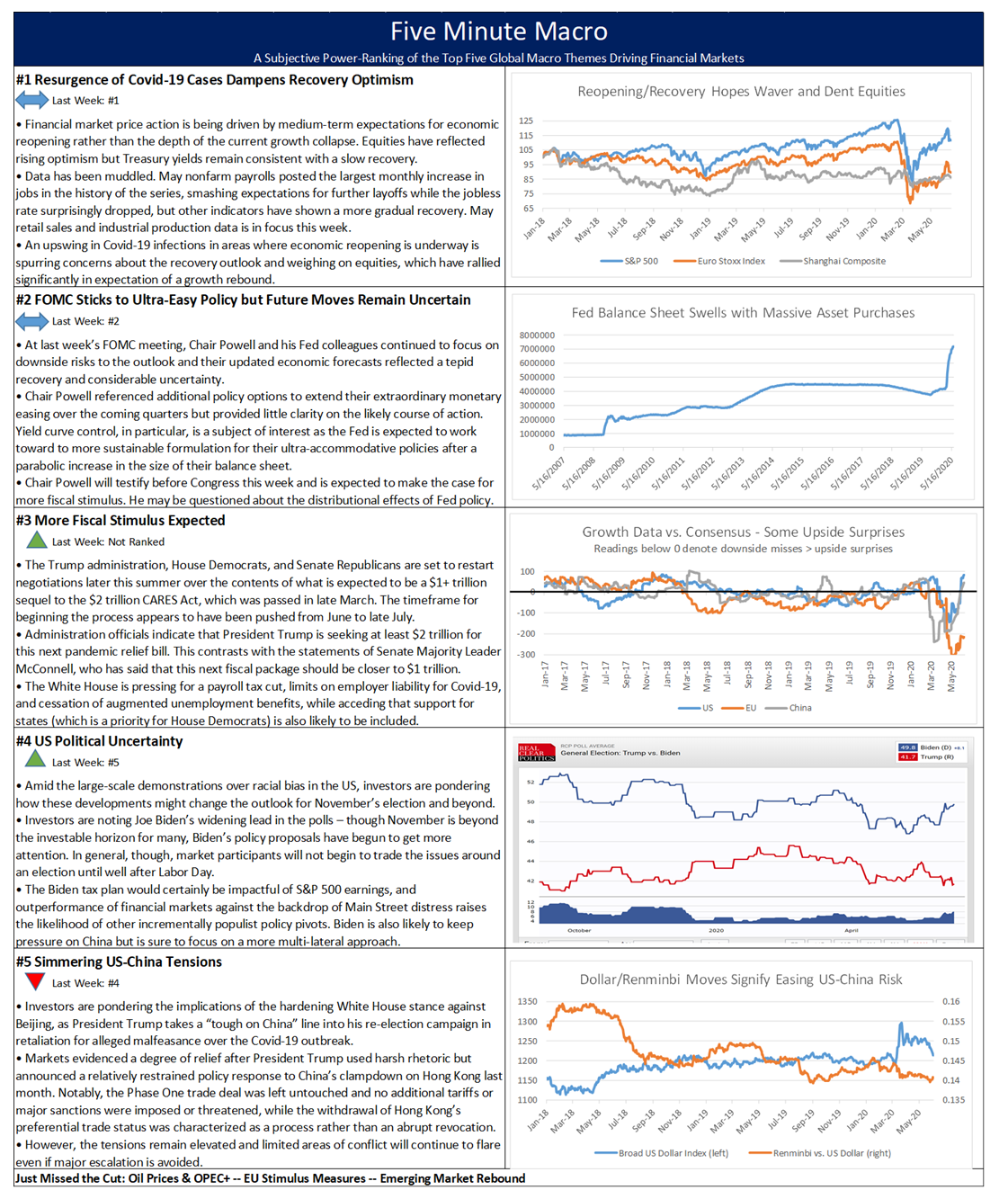

Summary and Price Action Rundown

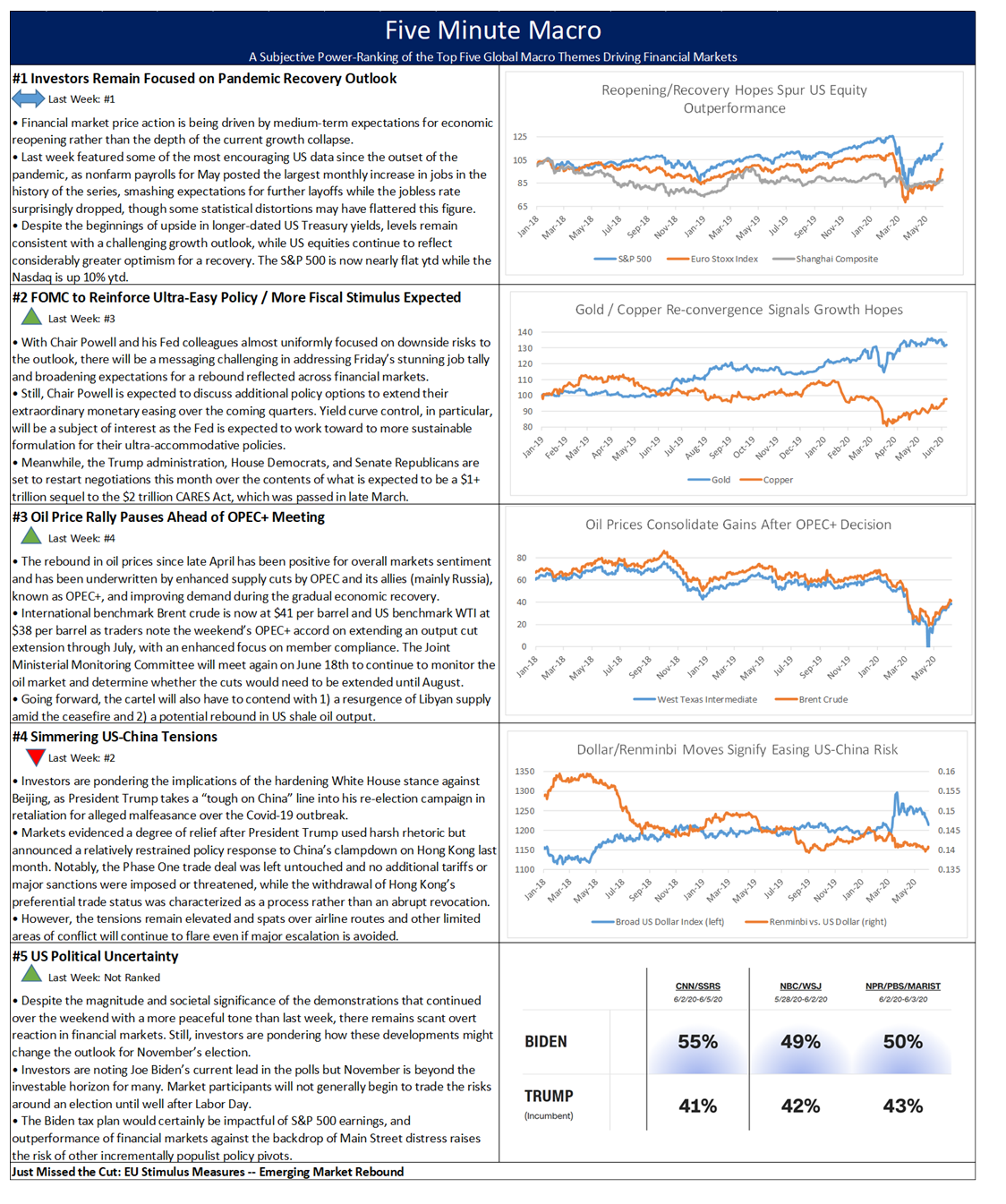

Global risk assets are mostly lower this morning as investors continue to weigh the prospects for economic recovery, aided by ongoing fiscal and monetary stimulus, against the risks that areas of Covid-19 resurgence will impede reopening plans. S&P 500 futures point to a 0.4% lower open after the index broke a three-day streak of gains yesterday, taking its year-to-date downside to 3.6%. Equities in the EU are also slipping this morning and Asian stocks were mixed overnight. The dollar is flat, while longer-dated Treasury yields are edging lower amid the cautious tone in markets, with the 10-year yield at 0.72%. Crude oil, however, is finding support ahead of today’s OPEC supply cut compliance review, with Brent at $41 per barrel.

Central Banks Remain in the Spotlight

After two days of dovish testimony from Fed Chair Powell and augmented accommodation measures from both the Federal Reserve and the Bank of Japan earlier this week, today has featured more easing by the Bank of England (BoE) and an announcement of €1.3 trillion in concessionary funding by the European Central Bank (ECB). This morning, the BoE announced its latest monetary policy maneuvers, meeting consensus expectations for an increase in quantitative easing (QE) measures by £100 billion to a total of £745 billion while holding interest rates steady at 0.10%. Some analysts had expected the BoE to be more aggressive and increase QE by £200 billion and/or cut the policy rate to zero today, with a view toward negative rates later this year. A more proactive approach to easing would not have been particularly surprising given statements from the BoE that “the economy may be heading for the worst downturn in three centuries” after UK GDP shrank by more than 20% in April alone, while the nation is grappling with the worst Covid-19 outbreak in Europe, protests over racial inequality, and the risk of a hard Brexit at year-end. Also, the consumer price index (CPI) for May was up just 0.5% from a year earlier, dramatically undershooting the BoE’s 2% target rate. UK assets are broadly stable thus far following the decision. Meanwhile, the ECB announced that today’s offer of cheap loans with three-year terms to regional banks (TLTRO’s) was tapped by 742 institutions for a total of €1.3 trillion, which was in the middle of the range of estimates for uptake. EU markets are broadly steady this morning, having rallied significantly over recent weeks, with the euro close to 12-month highs versus the dollar and the spread between 10-year Italian and German debt yields (a key market-based indicator of Italian creditworthiness) near its most favorable level since early March, though equities are down from early June highs.

Covid-19 Data Suggests Resurgence Risk

After last week’s selloff was spurred in part by an acceleration of the outbreak in US states that were forging ahead with economic reopening, investors remain wary this week of the continuing rise in cases and are monitoring reports from Beijing’s surge in infections. One of China’s top virologists stated that the secondary spike in Beijing is under control, helping bolster risk sentiment overnight. However, reports indicate that the re-imposed restrictions have taken traffic in the Chinese capital to 29% of normal levels during today’s morning rush hour. Meanwhile, single-day coronavirus case increases hit new highs in Florida yesterday, with Texas, Arizona, and other southern states that had been spared the worst of the outbreak to this point also showing an accelerating spread. Earlier this week, White House public health advisor Dr. Fauci indicated that the rising cases could not be explained by increased testing, adding that this is still the “first wave” and not a secondary spike in infections in these states. Oklahoma is among those worsening hotspots, which has raised concerns about President Trump’s upcoming campaign rally in Tulsa that is scheduled for Saturday in a 20,000 seat indoor arena. Thus far, no mass lockdowns have been re-imposed in the US.

Additional Themes

Investors Note US-China Headlines – Some analysts are pondering whether yesterday’s late-day selloff in US stocks was spurred by headlines relating to the forthcoming book by former White House national security advisor John Bolton. The reports detail Bolton’s claims in the book that President Trump asked Chinese President Xi to help him win reelection, among other untoward overtures to Xi and other global leaders. Meanwhile, Secretary of State Pompeo met with his Chinese counterpart in Hawaii yesterday amid simmering tensions between the two superpowers. Both sides issued positive statements after the meeting but were short on specifics. Also, President Trump signed into law a bill that would target Chinese entities and officials involved in the suppression of Muslim minorities in western China with sanctions, drawing threats of retaliation from Beijing.

US Jobless Claims Data Due – Later this morning, initial jobless claims for the week ending June 13th are expected to decline to 1.3 million from 1.5 million the prior week. Continuing claims for the week ending June 6th are forecast to fall to 19.9 million from 20.9 million.