Summary and Price Action Rundown

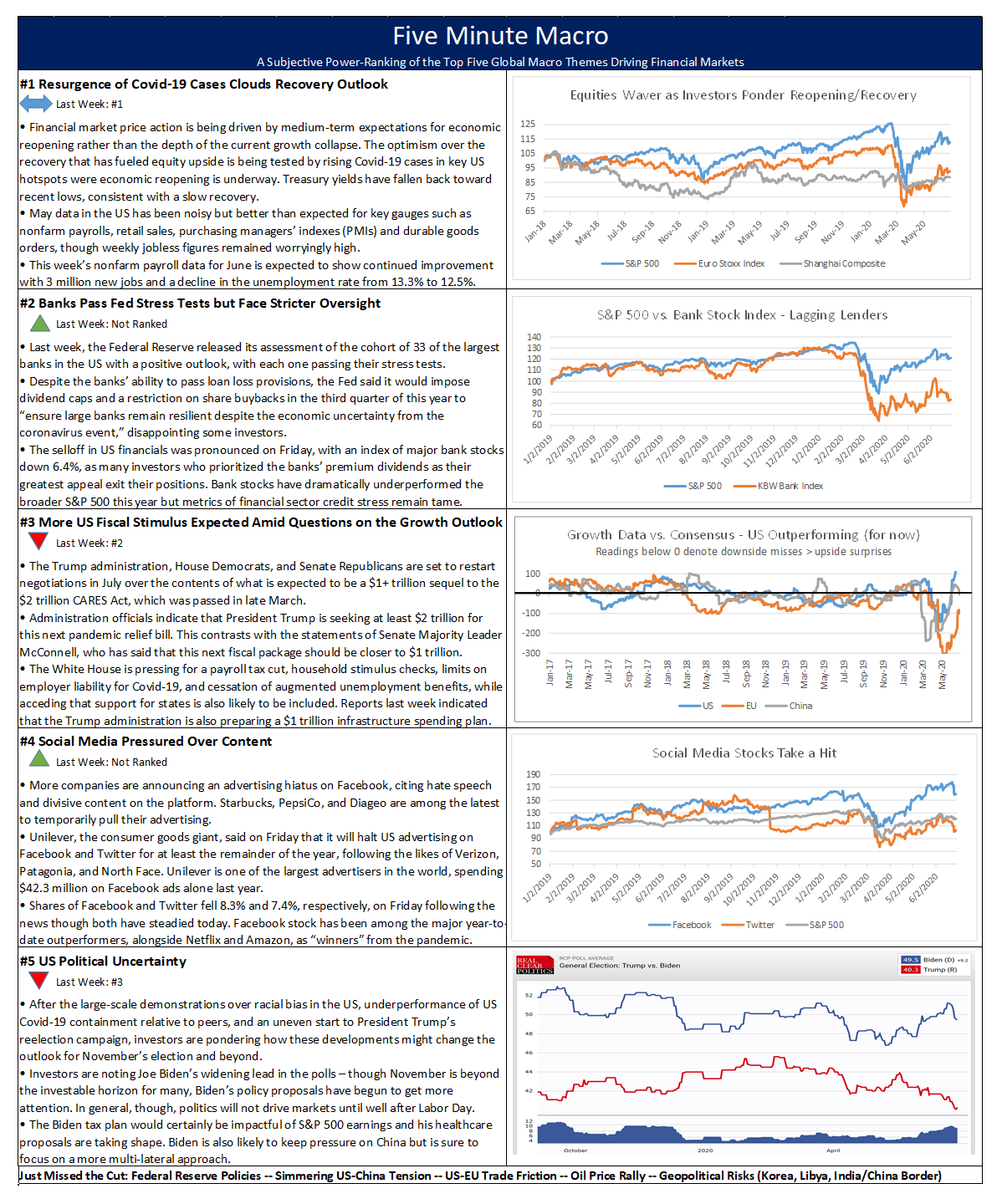

Global risk assets were mostly higher overnight after key Chinese economic data outpaced expectations while investors await today’s testimony from Fed Chair Powell and Treasury Secretary Mnuchin. S&P 500 futures indicate a 0.1% higher open after the index rallied 1.5% to start the week following Friday 2.4% loss, taking year-to-date downside to 5.5%. After their steep rally from the April trough, US stocks have struggled for direction over recent weeks as concerns over resurgent coronavirus cases in various hotspots in the US and overseas dampen recovery optimism. Equities in the EU are modestly higher while Asian stocks rallied overnight. The dollar is edging higher while longer-dated Treasury yields remain flat, with the 10-year yield at 0.63%. Brent crude prices are fluctuating above $41 per barrel.

Powell and Mnuchin Testimony in Focus

The prepared remarks from the two officials released in advance of today’s testimony before the House Financial Services Committee both convey optimism in the outlook while advocating further stimulus. The tone of Chair Powell’s statement is more upbeat than his most recent communications during his Humphrey-Hawkins testimony before Congress earlier this month and at his press conference following the June FOMC meeting, but re-emphasize the Fed’s commitment to use its “full range of tools” to support the recovery. The remarks cite a faster-than-anticipated pace of economic “bounceback,” calling it an “important new phase.” However, in keeping with previous communications, the outlook is described as “extraordinarily uncertain” with recovery dependent upon reasonably successful public health outcomes. Thus, Chair Powell will again stress the need for continued accommodation, including his thinly veiled advocacy of additional fiscal stimulus measures. This comes as Congress and the White House are set to restart negotiations over the next pandemic relief package later this month amid considerable disagreement over the size and composition of the spending. Meanwhile, Treasury Secretary Mnuchin’s prepared remarks emphasize the speed of the recovery, citing one private sector estimate of a V-shaped rebound, but indicate that more support may be needed, particularly for hard-hit industries.

China’s Growth Data Shows Steady Improvement

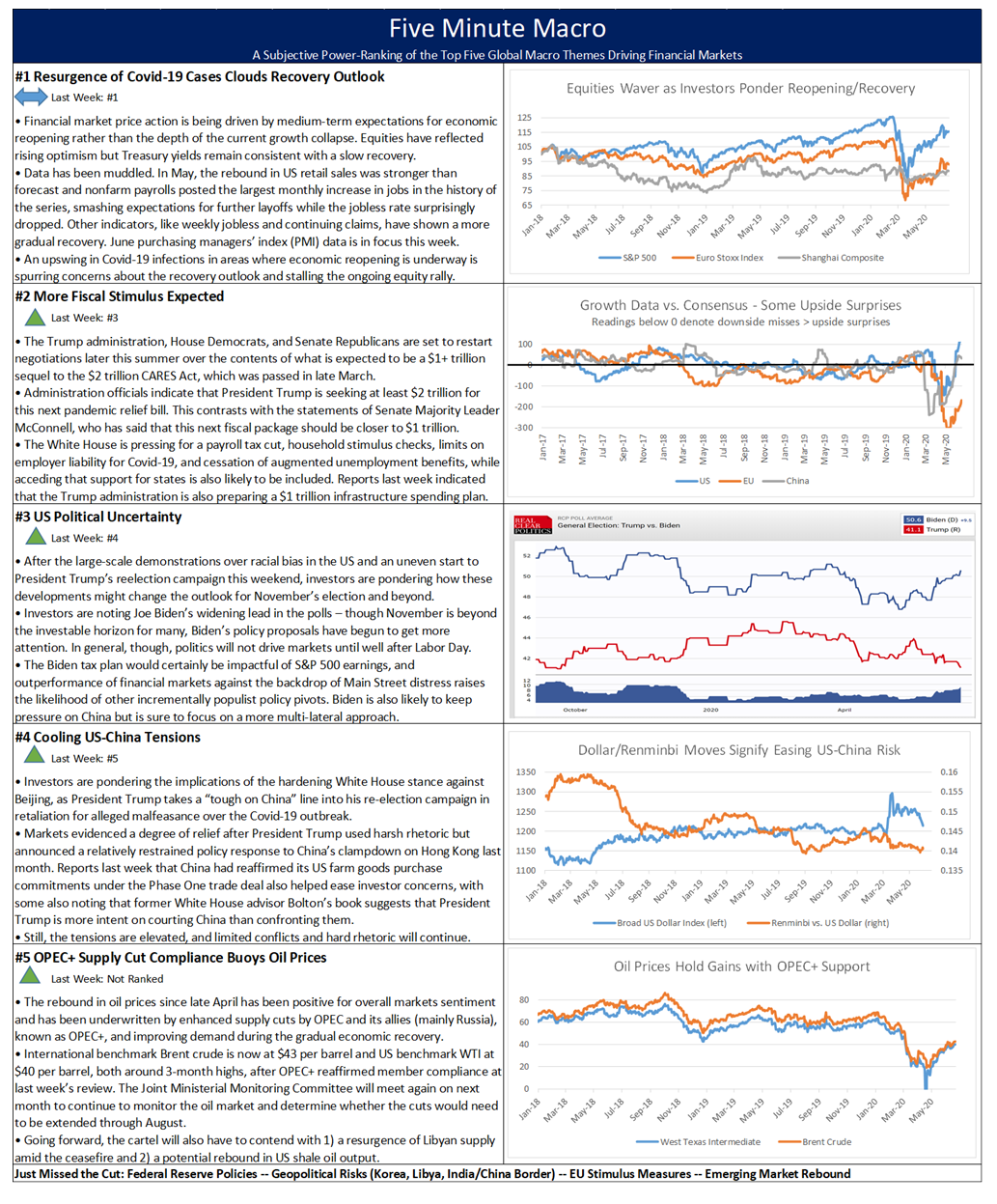

The official reading of China’s purchasing managers’ index (PMI) for June was better than expected and signaled continued recovery from the depths of February’s contraction. The official manufacturing PMI in China unexpectedly rose to 50.9 in June from 50.6 in the previous month, topping consensus estimates of 50.4. For context, PMI readings above 50 denote expansion in the sector. This was the fourth straight month of increase in factory activity and reflected the strongest pace of expansion since March. The state statistics bureau said in its announcement of the PMI reading that supply and demand are starting to pick up, with the index for new orders rising for two straight months. The new export order sub-index, however, remained in deeply contractionary territory at 42.6. The service sector also showed improvement, as the official non-manufacturing PMI increased to 54.4 in June from 53.6 in the prior month, which is the level it was forecast to maintain. This marked the fourth consecutive month of growth in the service sector and the strongest acceleration since January. Still, analysts are wary that a recent resurgence of new coronavirus cases in Beijing and some surrounding cities threatens to weigh anew on the domestic services sector.

Additional Themes

Well Fargo Cuts Its Dividend – Last Thursday, the Fed released its Stress Test results for the “Too Big to Fail” banks in the US, which issued all passing grades but called on banks to halt share buybacks and put dividends under review on a bank-by-bank basis, based on strength of capital in a severely adverse economic situation caused by the coronavirus. After markets closed yesterday, each bank released their planned dividend for the third quarter and all but Wells Fargo were allowed to maintain their current dividend levels. Wells Fargo said the Fed’s assessment of its business will warrant a reduction to its quarterly payout, which was widely expected by investors. Wells Fargo had a per share dividend of 51 cents and simply gave the guidance that it will be reduced as they reassess the future payout. CEO Charlie Scharf stated that the bank expects to have second quarter results that “will include an increase in the allowance for credit losses substantially higher than the increase in the first quarter.” Shares of Wells Fargo are -0.7% in pre-market trading and have fallen 6.0% over the past week

Hong Kong in Focus – News overnight indicated that China has passed its controversial security legislation for Hong Kong. This followed news that the US Commerce Department is removing preferential treatment for certain sensitive exports to the territory as part of the progressive rollback of Hong Kong’s special trading status due to China’s encroachment on its autonomy.