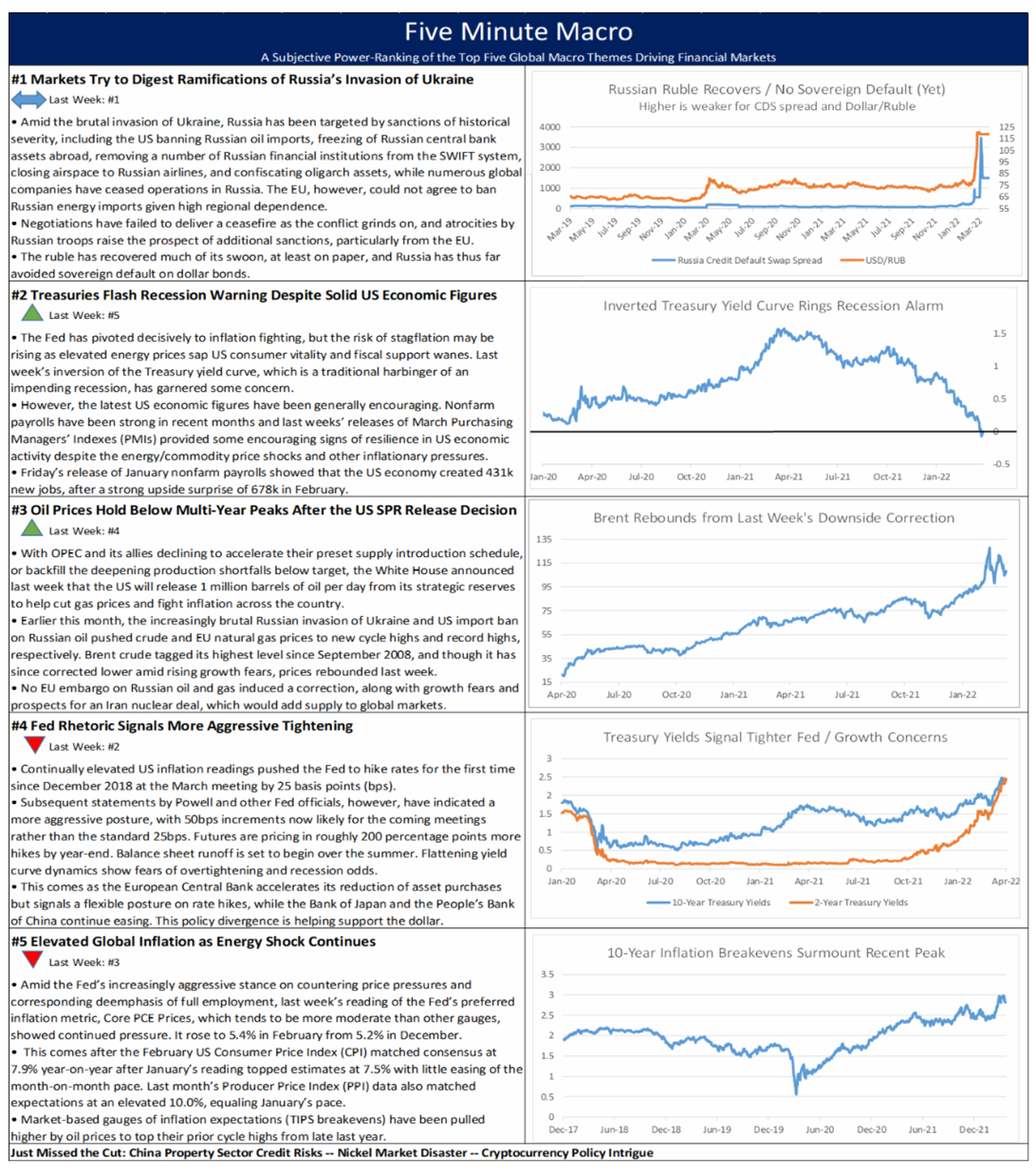

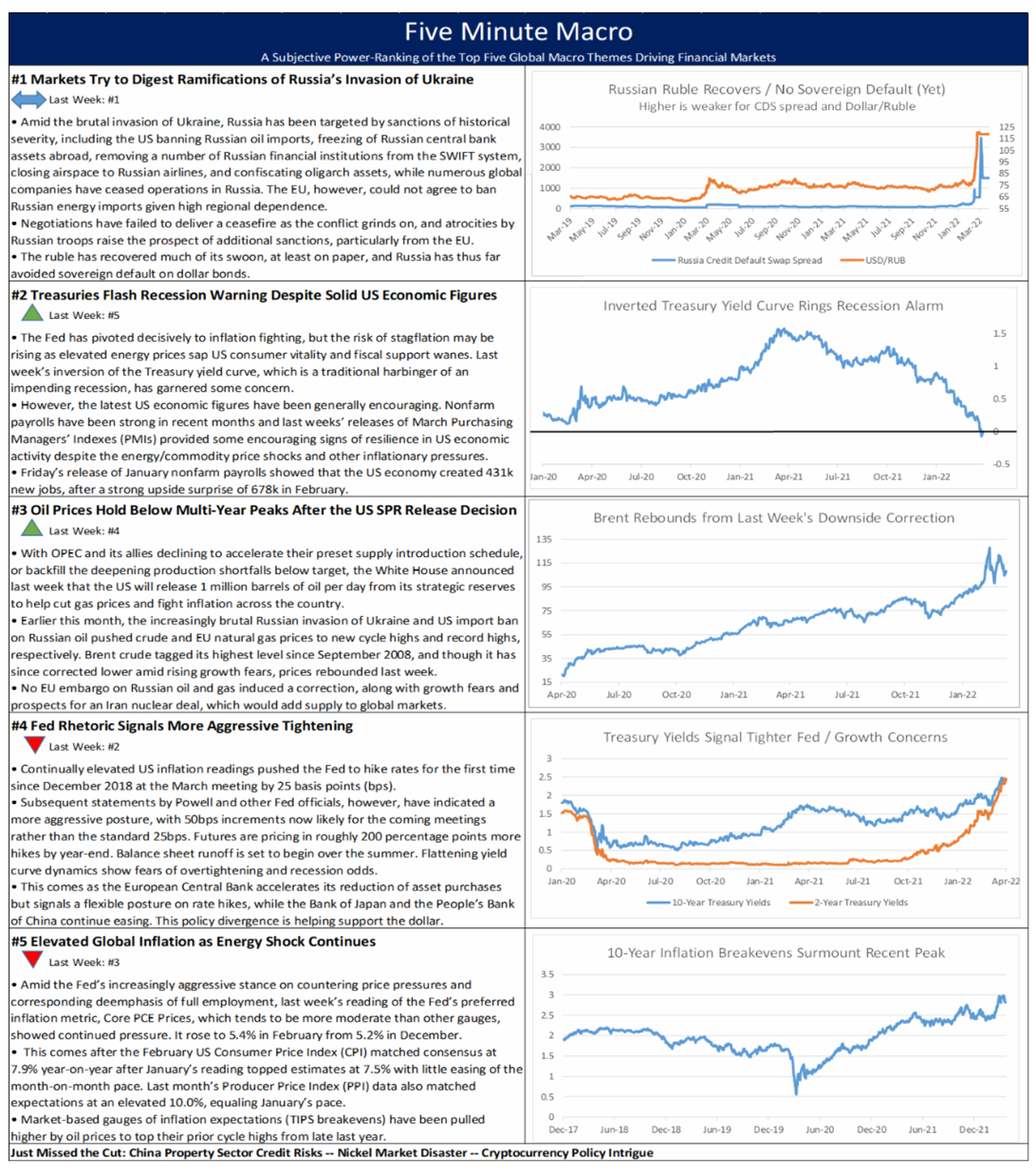

In this week’s Five Minute Macro, Russian invasion and sanctions remain on the forefront. Treasury curve inverts and flashes recession as oil prices remain at highs. Fed continues hawkish signaling as inflation remains high around the globe.

In this week’s Five Minute Macro, Russian invasion and sanctions remain on the forefront. Treasury curve inverts and flashes recession as oil prices remain at highs. Fed continues hawkish signaling as inflation remains high around the globe.

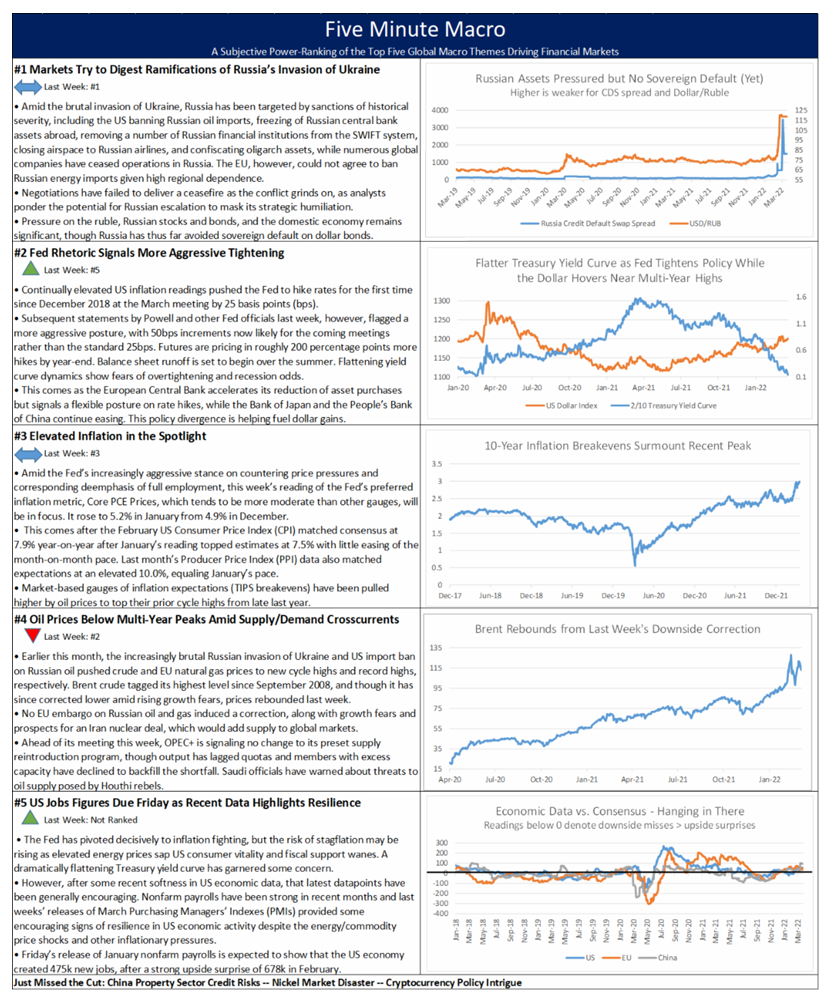

In this week’s Five Minute Macro, Russia’s invasion of Ukraine remains the main driving factor of markets. Fed signals more hawkish tightening as inflation remains elevated, however, oil prices are now below recent highs. Finally, the week closes with the all-important March Nonfarm Payroll Report.

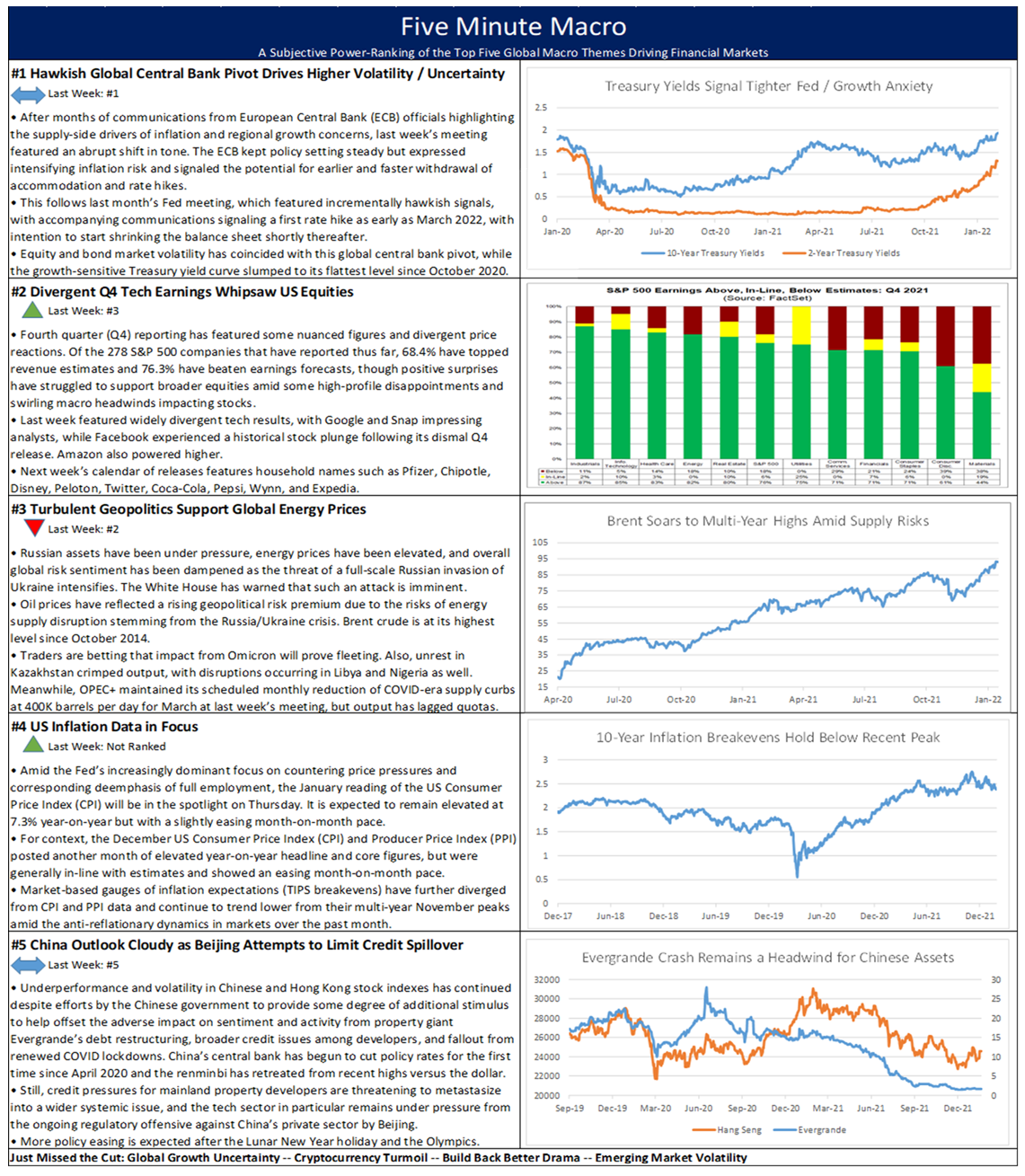

Central bank hawkishness continues to drive market moves, while divergent corporate earnings whiplash equities. Geopolitics keeps oil at recent highs, while US CPI will be in focus midweek. Finally, China’s outlook remains cloudy.

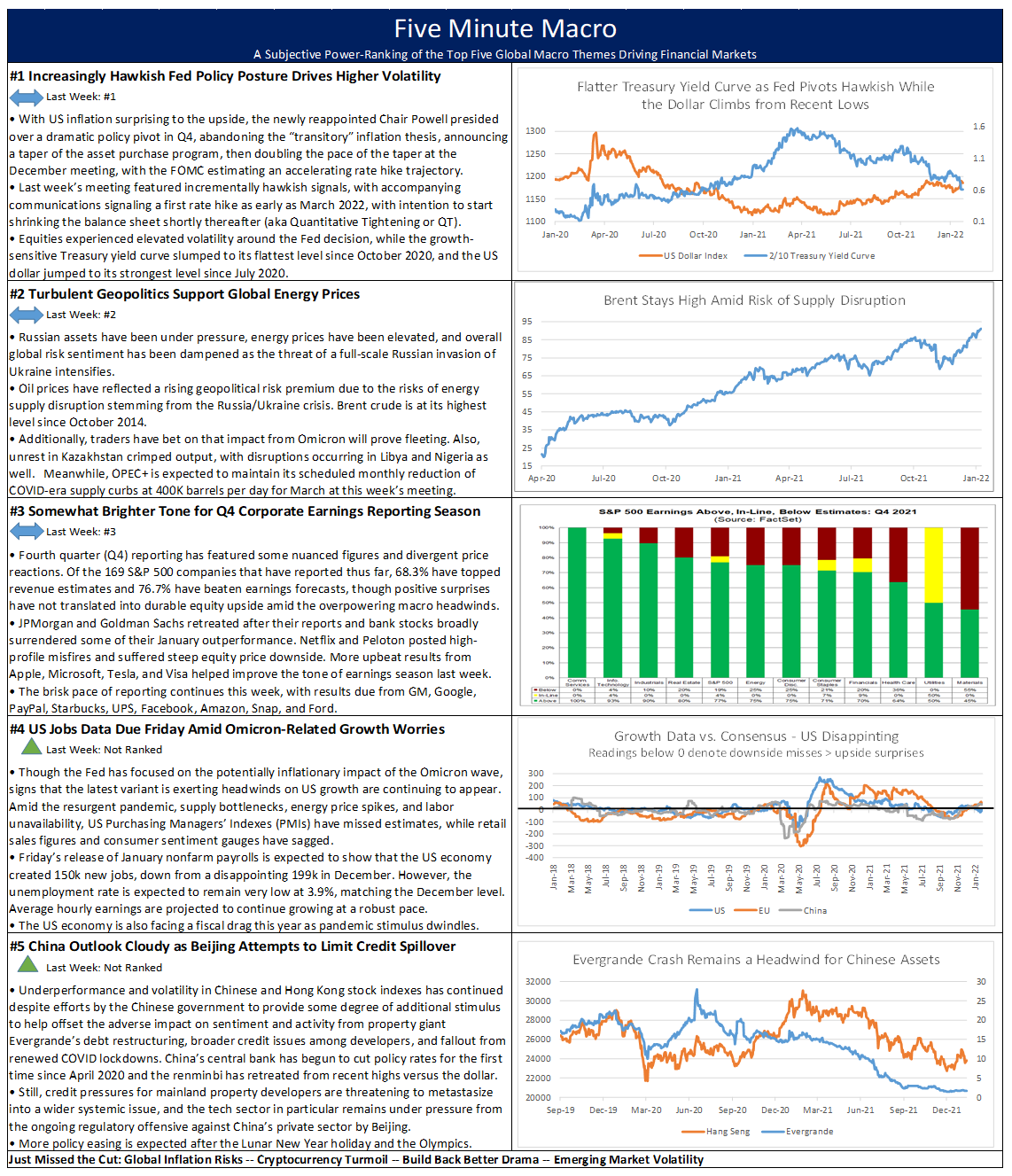

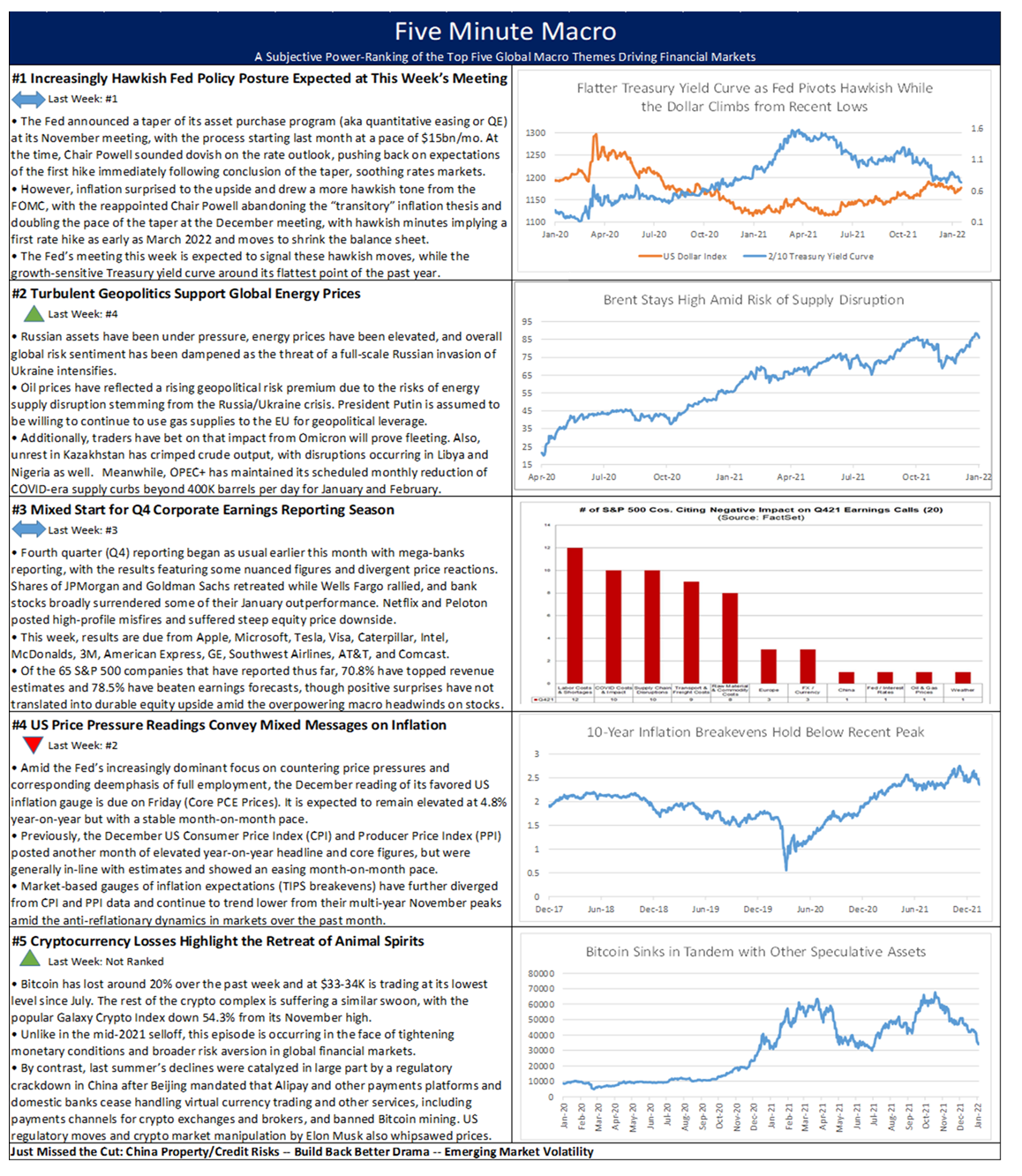

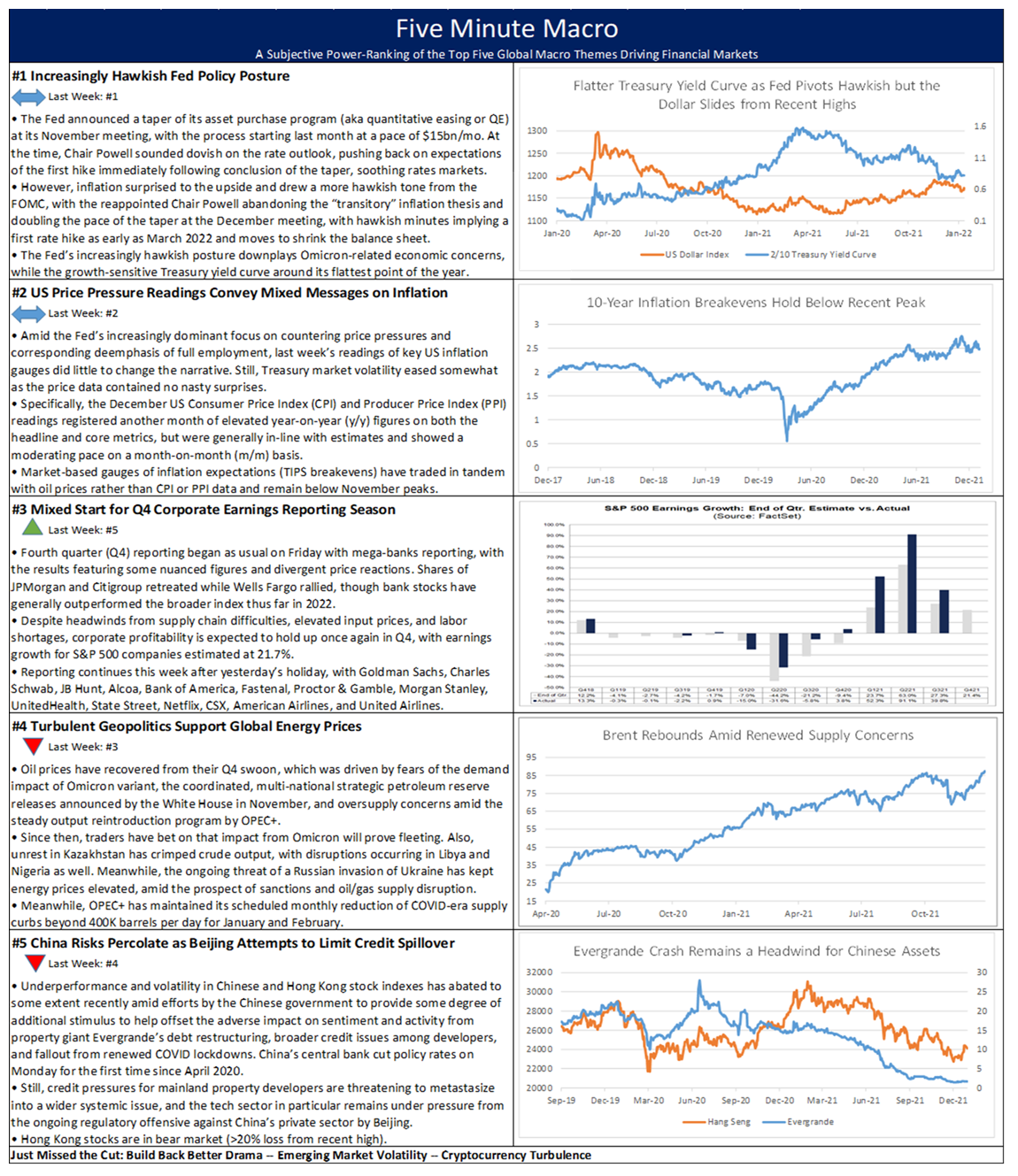

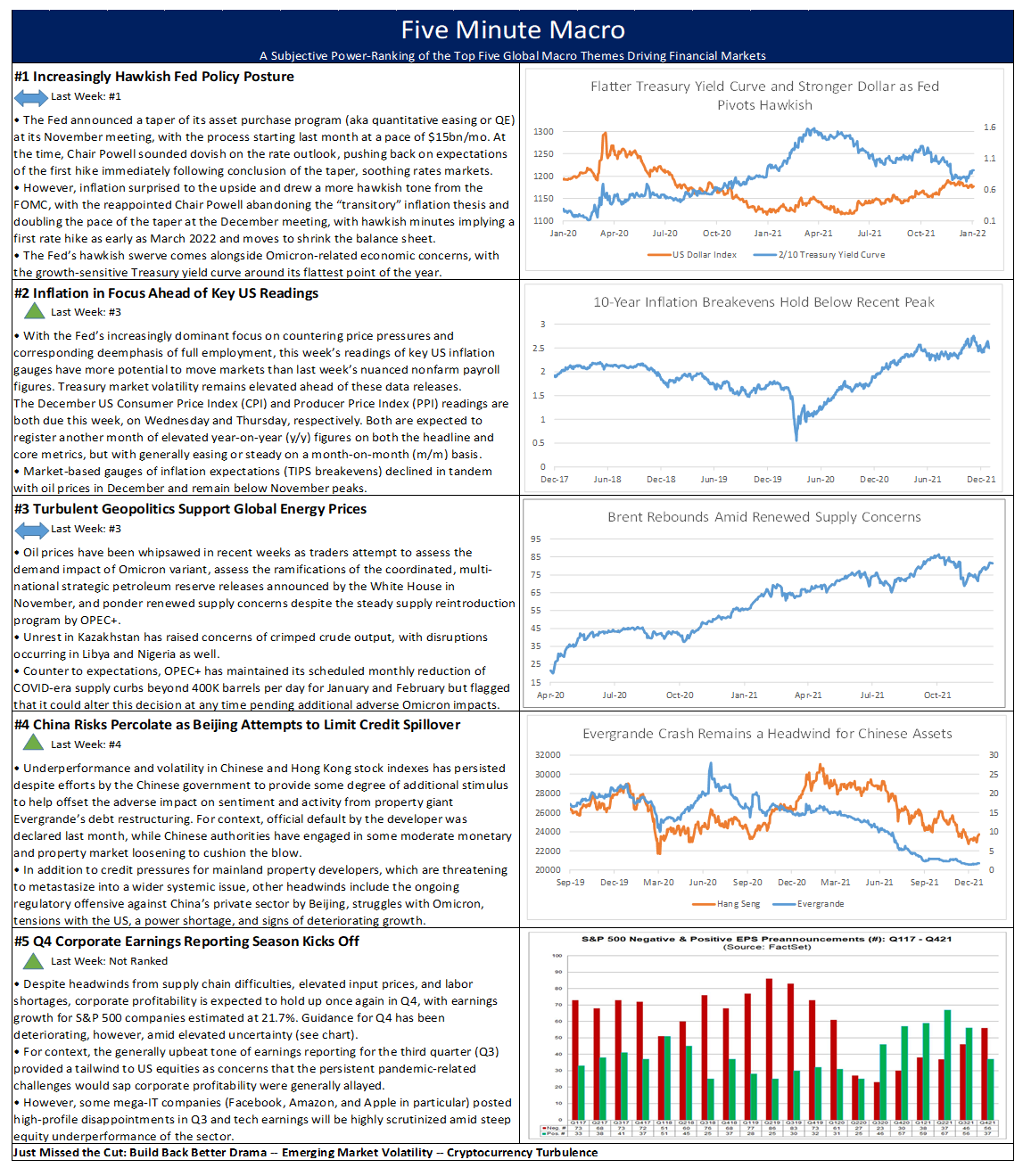

In this week’s Five Minute Macro, Fed hawkishness remains front and center and turbulent geopolitics keep energy prices on the rise. Corporate earnings season offers a brighter tone as traders wait for an uncertain jobs Friday. Finally, the outlook for China remains cloudy as it battles Covid and a credit spillover.

In this week’s Five Minute Macro, hawkish Fed expectations continue to roil markets as geopolitical risks push up oil prices. Corporate earnings season has been a mixed bag as inflations continues to hurt bottom lines. Finally, the crypto markets are in significant correction territory as they follow other risk markets lower.

In this week’s Five Minute Macro, a hawkish is still causing problems for risk markets as inflation remains elevated. Corporate earnings season is mixed so far, while geopolitics are providing a tailwind to oil markets. Finally, China ramps up its efforts to support the economy and limit a real estate corporate spillover.

An increasingly hawkish Fed continues to roil markets as they confront elevated inflation. Turbulent geopolitics supports energy prices, while China attempts to limit a credit spillover. Finally, corporate earnings season kicks off.

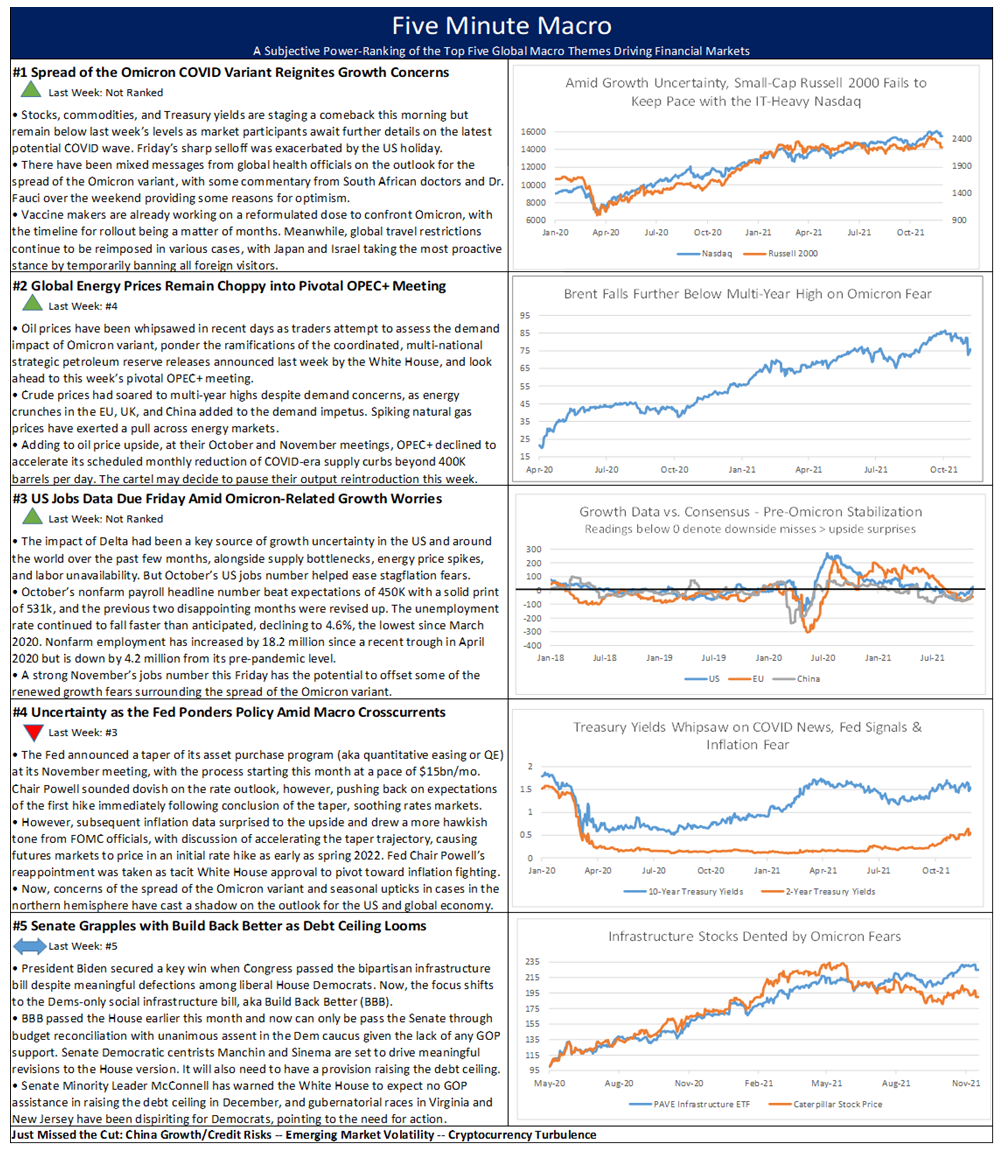

The spread of the Omicron variant has markets on edge as oil prices plunged ahead of the OPEC+ meeting this week. Friday brings the US jobs report and new worries put the path of Fed policy in question. Finally, the Senate continues to negotiate as Debt Ceiling looms.

Looking Ahead – At the Crossroads

This week’s early publication of Looking Ahead peers into a foggy crystal ball with the stakes on Capitol Hill at the highest of the Biden presidency, while the Federal Reserve is set to hold its most consequential policy meeting since the early of the pandemic next week. And to top it all off, we have highly-anticipated October nonfarm payrolls figures next Friday.

Our base case on the bipartisan infrastructure/reconciliation social infrastructure bill has remained virtually unchanged since the outset of the Biden presidency, though we pushed our estimated timeline for passage back from the late summer to the fall. To reiterate, we continue to expect a multi-trillion pair of infrastructure bills to pass over the coming weeks, perhaps as early as this week, with the total closer to $2.5-$3 trillion combined rather than the roughly $4.5 trillion original headline figure, and a massive debt ceiling increase accompanying the reconciliation bill. We had expected the pay-fors to be substantially watered down but it appears that it will be even a gentler and narrower tax package than we had anticipated.

With that said, time is not on the Dems’ side. All the incentives are stacked in favor of getting a reconciliation bill framework this week and a vote on the bipartisan package, with President Biden heading overseas to the G-20 in Italy and the climate summit in Scotland, while the Virginia governor’s election, which is now seen as a litmus test for Democrats’ support and is polling in a dead heat, looms on November 2nd. If they can’t get their act together this week, we will have to reassess our base case for the twin bills to be finalized this fall, if at all. This week’s extreme yield curve flattening and underperformance of growth-sensitive stocks is, in our opinion, due in no small part to the rising odds that the Democrats faceplant before the legislative finish line.

The house view on the Fed has shifted from an announcement of the taper of asset purchases (aka QE) in December with the process starting in early 2022 to that announcement coming next week, but with the start of the taper being held off until December. This delayed beginning would represent a dovish tilt to the taper relative to consensus expectations, which point to an immediate start to the process. It would serve to push market expectations of the first rate hike back from June and July given the projected timeline of the taper.

Additionally, we are very skeptical that rate hikes will immediately follow the end of the taper due to our anticipation that 1) much of the current inflation pressure will prove transitory as supply bottlenecks and labor shortages gradually abate, 2) Fed Chair Powell is replaced by the more dovish Governor Brainard, and 3) that the Fed will be extremely sensitive to the hyper-tense political environment ahead of the November midterm elections, making late summer/fall 2022 an inauspicious time to be tightening monetary conditions.

Thus far, equity markets have generally traded in alignment with our expectations of a broadly reflationary outlook, with solid growth and moderating inflation, while bond markets have lurched out of synch with our base case, which calls for a gradual steepening of the yield curve and a settling of TIPS breakevens into year end and early 2022. The yawning disparity in volatility between equity and bond markets is bound to turn back toward convergence, and we think that the latter settles down to meet the former and not the other way around. We know that this flies in the face of the assumption that bond markets are the more prescient of the two, but plenty of things have been turned on their head in 2021 so far. As we survey US fiscal and monetary policy at the crossroads, one thing we can say for sure is that the coming week will bring a significant degree of clarity, one way or the other.

Looking ahead, next week’s calendar features the biggest Fed meeting of the year and a pivotal nonfarm payroll reading. The Reserve Bank of Australia also has a crucial decision as markets lean into expectations of accelerated rate hikes. Global Purchasing Managers’ Indexes (PMIs) will provide an update on the state of the recovery amid the uneven fluctuations of the Delta wave. Corporate earnings reporting also continues, though major tech company results are mostly over.

Global Economic Calendar: Big week

Monday

The ISM Manufacturing PMI in the US increased to 61.1 in September, up for a second straight month and above market expectations of 59.6. The latest reading signaled one of the strongest rates of expansion since 1983, boosted by solid increases in production (59.4 vs 60.0 in August) and new orders (66.7, the same as in August), as well as a slight rebound in employment levels (50.2 vs 49.0). At the same time, factories experienced longer delays getting raw materials delivered and paid higher prices for inputs.

Construction spending in the US was virtually unchanged at a seasonally adjusted annual rate of $1.584 trillion in August, after increasing 0.3% in the previous month and defying market expectations of a 0.3% rise. Spending on private construction decreased 0.1 percent (vs 0.2 percent in July), mostly transportation (-2.4%) and lodging (-2.3%), while public construction outlays rose 0.5 percent (the same as in July).

The Reserve Bank of Australia will hold an interest rate meeting. At the October Meeting they kept the cash rate unchanged at a record low of 0.1%, as widely expected, while continuing its plans to trim the purchase of government bonds to A$4 billion a week until at least mid-February 2022. Policymakers noted that the timing and pace of the economic rebound in Australia were uncertain and that it will depend much on the easing of restrictions. ” In our central scenario, the economy will be growing again in the December quarter and is expected to be back around its pre-Delta path in the second half of next year.” The central bank reaffirmed its commitment to maintaining supportive monetary conditions and not increasing the cash rate until inflation is within the 2 to 3% target range, a condition that will not be met before 2024.

Tuesday

The IBD/TIPP Economic Optimism Index in the US slipped deeper into pessimistic territory, falling 1.7 points to 46.8 in October, its lowest since September of 2020. Americans have grown more pessimistic about the outlook for the U.S. economy with the lapse of unemployment benefits even as the latest Covid wave has slowed the jobs recovery. The six-month outlook for the U.S. economy held steady at a 13-month low of 41.3; and the federal policies subindex, which reflects views of how well government economic policies are working, fell 3.8 points to 45.3, the lowest since December, before the second round of stimulus checks. Also, the personal finances subindex, fell 2.1 points to 53.9, also the lowest since September 2020, weighed down by Dow Jones losses and inflation worries.

The Caixin China General Services PMI jumped to 53.4 in September from 46.7 in the prior month, moving away from the lowest level seen since the height of the pandemic last year. Both new orders and employment bounced back to the expansionary territory, as a major COVID-19 outbreak in the eastern province of Jiangsu eased. At the same time, outstanding business continued to increase, but at a slower pace. Meanwhile, new export sales shrank again, with the sub-index hitting its lowest in seven months due to the surging pandemic overseas. On the cost front, input prices rose for the 15th straight month and increased at a faster pace, on rising labor, freight, and raw material costs. Meantime, prices charged went up after falling in August. Looking forward, sentiment remained optimistic, with the gauge of business expectations rising further into positive territory, though remaining below its long-term average.

Wednesday

The Euro Area seasonally-adjusted unemployment rate edged down to 7.5% in August, the lowest level since May 2020 and in line with market expectations. The number of unemployed decreased by 261 thousand to 12.162 million, as the labor market continued to show signs of recovery. The youth unemployment rate, measuring job-seekers under 25 years old, edged down to 16.4 percent in August, from 16.7 percent in the previous month. Amongst the largest Euro Area economies, the highest jobless rates were recorded in Spain (14.0 percent), Italy (9.3 percent) and France (8.0 percent), while the lowest rates were recorded in the Netherlands (3.2 percent) and Germany (3.6 percent).

Payroll Provider ADP Employment Report estimated that private businesses in the US hired 568 thousand workers in September, the most in three months and compared with a downwardly revised 340 thousand in August and beating market expectations of a 428 thousand rise. Most jobs were created in the leisure and hospitality sector (266 thousand) followed by education and health (66 thousand); professional and business (61 thousand); trade, transportation and utilities (54 thousand); financial activities (22 thousand); and information (11 thousand). The goods-producing sector added 102 thousand jobs, led by manufacturing (49 thousand); construction (46 thousand); and natural resources and mining (7 thousand). Companies with 500 and more employees added the most jobs (390 thousand), followed by midsized (115 thousand) and small companies (63 thousand).

The ISM Services PMI edged up to 61.9 in September from 61.7 in August, beating forecasts of 60, and pointing to a robust growth in the services sector, although the ongoing challenges with labor resources, logistics, and materials are affecting the continuity of supply. Faster increases were seen for business activity (62.3 vs 60.1), new orders (63.5 vs 63.2) and backlog of orders (61.9 vs 61.3). On the other hand, employment (53 vs 53.7), supplier deliveries (68.8 vs 69.6) and new export orders (59.5 vs 60.6) slowed. Also, price pressures intensified (77.5 vs 75.4).

The Federal Reserve will hold an Interest Rate Meeting. Minutes from the September Meeting showed policymakers have agreed that the tapering emergency pandemic support should start either mid-November or mid-December. Officials stressed that if the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate. Participants also considered an illustrative path of tapering, including monthly reductions in the pace of asset purchases, by $10 billion in the case of Treasury securities and $5 billion in the case of agency mortgage-backed securities (MBS). The Fed left the fed funds rate steady at 0-0.25% and bond-buying at the $120 billion monthly pace during the September 2021 meeting.

Australia’s trade surplus increased to a fresh record high of AUD 15.08 billion in August from an upwardly revised AUD 12.65 billion in the previous month and exceeding market consensus of a surplus of AUD 10.3 billion. Exports jumped 4 percent month-over-month to a new top of AUD 48.52 billion, amid strengthening foreign demand in the aftermath of the coronavirus disruptions and rising commodity prices, while imports fell 1 percent to AUD 33.45 billion. Considering the first eight months of the year, the trade surplus soared to AUD 84.01 billion from AUD 47.20 billion in the same period of 2020.

Thursday

The Bank of England will hold an Interest Rate Meeting. At the September meeting the BOE left its benchmark interest rate at a record low of 0.1% and its bond-buying program unchanged at a total of GBP 895 billion by the end of this year. The central bank also said that the case for modest tightening strengthened from August, as inflation could persist above 4% well into 2022, although considerable uncertainties remain. Reflecting that view, two policymakers voted for an early end to government bond purchases, compared with only one in the August meeting. Meanwhile, expectations for the level of UK GDP in Q3 were lowered by near 1% to around 2.5% below its pre-Covid level.

The trade deficit in the US widened to a record high of $73.3 billion in August, higher than market forecasts of $70.5 billion. Exports edged up 0.5% to $213.7 billion, the highest since May of 2019, boosted by sales of nonmonetary gold and natural gas while shipments fell for autos and parts, civilian aircrafts, corn and travel. Imports were up 1.4% to a new all-time high of $287 billion, namely pharmaceutical preparations, toys, games, organic chemicals, transport and travel. The deficit with China increased $3.1 billion to $28.1 billion. The deficit with Canada increased $1.4 billion to $5.1 billion while the deficit with Mexico decreased $1.9 billion to $6.6 billion.

Last week the number of Americans filing new claims for unemployment benefits fell to a fresh 19-month low of 281 thousand, as the labor market slowly recovers to its pre-pandemic normal amid a surge in demand for labor, the expiration of enhanced jobless benefits, and record levels of job openings and quits by employees. However, the number of new filings remained well above the 212 thousand seen back in early March 2020, just before the COVID-19 crisis hit the US economy. Additionally, continuing jobless claims, which measure unemployed people who have been receiving unemployment benefits for an extended period, fell to a new pandemic low of 2.243 million in the week ending October 16th, from a revised 2.480 million a week before and below market expectations of 2.415 million.

Canada’s trade surplus rose to CAD 1.94 billion in August from a downwardly revised CAD 0.74 billion in the previous month and beating market estimates of a CAD 0.43 billion surplus. Total exports increased 0.8% in August to a new record high of CAD 54.4 billion, with gains observed in 6 of the 11 product sections, notably energy products (5.1%). Meanwhile, total imports were down 1.4% to CAD 52.5 billion, despite gains in a majority of product sections, led by lower purchases of motor vehicles and parts (-11.1%) and aircraft and other transportation equipment and parts (-28.8%).

Friday

Eurozone retail sales rose by 0.3% from a month earlier in August, trying to recover from a revised 2.6 percent slump in July but missing market expectations of a 0.8% growth. Sales of non-food products advanced 1.8%, with on-line trade jumping 9.0%. Meanwhile, purchases of food, drinks and tobacco fell for a fifth straight month, while fuel sales were down 0.1%. On a yearly basis, sales remained unchanged, easing from a 3.1% increase in July and missing forecasts of 0.4% growth.

The US economy added a meager 194K jobs in September, the lowest so far this year and well below forecasts of 500K. Job gains occurred in leisure and hospitality (74K), professional and business services (60K), retail trade (56K), and transportation and warehousing (47K). Meanwhile, employment declined sharply in public education (-161K) and in health care (-18K). Nonfarm employment has increased by 17.4 million since a recent trough in April 2020 but is down by 5.0 million, or 3.3 percent, from its pre-pandemic level in February 2020. “Recent employment changes are challenging to interpret, as pandemic-related staffing fluctuations in public and private education have distorted the normal seasonal hiring and layoff patterns,” the Bureau of Labor Statistics said in the release. Additionally, the unemployment rate dropped to 4.8% in September, from 5.2% in the previous month and below market expectations of 5.1%. It was the lowest rate since March 2020, as many people left the labor force and the negative effects of Hurricane Ida and the Delta variant’s summer spike started to fade. Still, the jobless rate remained well above the pre-crisis level of about 3.5 percent due to ongoing labor shortages but is seen declining further in the coming months as companies fill widespread vacancies and as more workers are expected to go back into the labor force.

The Canadian economy added a net 157 thousand jobs in September, significantly beating market expectations of a 65 thousand rise and pointing to the fourth consecutive month of expansion in the workforce, enough to see employment return to its pre-pandemic level from February of 2020. Job creation was concentrated in full-time work (+194,000), split between the public sector (+78,000) and private sector (+98,000), while part-time jobs saw little change in September. Employment significantly rose in the service sector (+142,000), driven by public administration (+37,000), information, culture, and administration (+33,000), and professional, scientific, and technical services (+33,000), while accommodation and food services jobs fell for the first time in 5 months (-27,000). Little change was noted in the goods-producing sector, while self-employment also remained unchanged to mark the sixth consecutive month without growth.

The Ivey Purchasing Managers Index in Canada increased to 70.4 in September from 66 in the prior month, signaling a continued improvement in business conditions in Canada. It was the highest reading since June, supported by rising prices (79.1 vs 69.7 in August) and an increase in supplier deliveries (36.5 vs 34.2). Meanwhile, the pace of job creation eased further (63.7 vs 66.9) and inventories also fell (57.7 vs 60.3).

Saturday

China’s trade surplus widened to $66.76 billion in September, from $35.34 billion in the same month a year earlier and far above market consensus of $46.8 billion. It was the largest trade surplus since last December, as exports extended their double-digit growth to a fresh all-time high while imports rose at a softer pace, but also hit a new record. The trade surplus with the United States rose to $42 billion, up from $37.68 billion in August. Considering the first nine months of the year, the trade surplus widened to $429.2 billion from $316.6 billion in the same period of 2020.

Summary and Price Action Rundown

US equities extended their streak of new record highs as upbeat corporate earnings provide further support alongside more positive atmospherics around President Biden’s infrastructure bills. The S&P 500 added 0.4%, registering another all-time high and upping year-to-date returns to 23.3%, while the Nasdaq kept pace despite a drag from Tesla (more below). The Euro Stoxx Index also gained while Asian stocks mostly retreated overnight. Longer-dated Treasury yields held steady while the short end rallied ahead of tomorrow’s consequential Fed decision, with the 10-year Treasury yield closing at 1.55%, which is still on the high side of its 2021 trading range. Meanwhile, a broad dollar index continued its rebound but remained below recent multi-month highs. Oil prices slipped slightly ahead of this week’s OPEC+ meeting, with Brent crude still holding above $84 per barrel.

Latest Headlines Suggest More Progress on Biden Bills

Congressional Democrats continue to make progress on the intricately coordinated two-track infrastructure legislation, with ongoing uncertainty over the prospects for a near-term House vote on both bills. An ETF of US infrastructure-related stocks climbed 0.9% to hit a record high today and extend its gains on the year to 32.3% as optimism over the prospects for the Biden administration’s physical and social infrastructure bills continues to build among equity investors. In a press conference at the climate summit in Glasgow Scotland, President Biden expressed his confidence that centrist Senator Manchin will support the Dems-only reconciliation bill after verifying certain specifics. This comes after Senator Machin asserted yesterday that more time is needed to review the $1.75 trillion social infrastructure package. He again called for the House to vote on the bipartisan infrastructure package, which the liberal wing of the caucus has held up in an effort to get consensus and unequivocal Senate support on the reconciliation bill. Also today, Senate Majority Leader Schumer indicated that Congressional Democrats have worked out a compromise on prescription drug pricing terms that cap out-of-pocket spending at $2,000 per year and outline industry reforms, noting that centrist Senator Sinema is on board. Meanwhile, political commentators are awaiting results in the Virginia governor’s election, which is being cast as something of a litmus test for Democrats’ political fortunes against a Trump-linked candidate. – MPP view: Still no clarity on the timing of the vote, and today’s latest deadline may give way again, but there is a sense of momentum and we think the odds of near-term passage remain relatively high – however, if timeline for a vote slips into mid-November or later, the odds worsen markedly.

Solid Earnings Continue to Buoy Stocks

Third quarter (Q3) results remain broadly upbeat, with the bulk of the reporting concluding this week. Pfizer shares jumped 4.2% today after reporting better than expected profit and revenue for the third quarter. The pharma giant earned $1.42 per share topping estimates and issued an improved full-year forecast on strong demand for both the covid vaccine and other non-covid related treatments. Management reported revenues of $24.1 billion, reflecting 130% operation growth excluding Comirnaty (vaccine) revenue. Pfizer raised full-year guidance for revenues to a range of $81 to $82 billion and adjusted diluted EPS to a range of $4.13 to $4.18, reflecting 94% and 84% year over year growth at the midpoints, respectively. It anticipates Comirnaty revenue of approximately $36 billion, reflecting 2.3 billion doses expected to be delivered in 2021.

Dr. Albert Bourla, Chairman and CEO stated, ““While we are proud of our third quarter financial performance, we are even more proud of what these financial results represent in terms of the positive impact we are having on human lives around the world. For example, more than 75% of the revenues we have recorded up through third-quarter 2021 for Comirnaty have come from supplying countries outside the U.S., and we remain on track to achieve our goal of delivering at least two billion doses to low- and middle-income countries by the end of 2022 — at least one billion to be delivered this year and one billion next year, with the possibility to increase those deliveries if more orders are placed by these countries for 2022.”

Pfizer’s earnings reflect strong growth with and without the Comirnaty revenue. The short-term outlook for vaccine revenue is high as 58% of the US are fully vaccinated and many from the rest of the world, especially in low- and middle-income countries awaiting their doses. Pfizer CFO Frank D’Amelio stated that the company is increasing guidance excluding Comirnaty for the second consecutive quarter, demonstrating the ability to execute on other segments beyond the vaccine.

“We continue to make progress on advancing our internal pipeline across all therapeutic areas while also prudently deploying our capital through partnerships and bolt-on acquisitions to gain access to cutting-edge platforms, science and technologies that could potentially bolster our growth in the latter half of this decade. I am proud of what we have accomplished so far in 2021 and look forward to finishing the year strong.”

Car rental stock Avis Budget surged 108.3% after the company reported a stronger-than-expected third quarter that sparked massive trading volume. The company reported $10.74 in per-share earnings for the third quarter, which was more than $4 above expectations. Avis Budget’s board also authorized an additional $1 billion in share buybacks. Vague comments on the conference call by executives about increasing purchases of electric cars for its fleet appeared to add juice to the rally, as chief executive officer Joseph Ferraro said the company would play a “big role” in the growth of electric cars in the US. Ahead of the earnings report, 20.5% of the float of Avis Budget’s stock was sold short, which is extremely high. When a stock rises, short-sellers are forced to cover their positions by buying shares, creating more upward pressure on the stock price. This is called a “short squeeze.”

With 346 of the S&P 500 companies having issued Q3 results, the figures have been impressive, with reporting companies beating sales and earnings estimates at rates of 67.5% and 81.8%, respectively. – MPP view: With Q3 earnings season pretty much in the books, the margin squeeze/bottleneck/input costs/labor shortage dogs didn’t do as much barking as feared and we expect increasing signs of easing some of the snags and shortages over the coming months.

Additional Themes

Sobering Signs from an Economic Sentiment Gauge – The IBD/TIPP Economic Optimism Index in the US fell for the 5th straight month to 43.9 in November, the lowest since September of 2015, and just undercut the prior pandemic low of 44 in July 2020, as the second Covid wave was hitting. With the Delta variant slowing the jobs recovery and inflation fears mounting, household financial stress is spiking and faith in federal economic policies is sinking. The six-month economic outlook index sank 2.7 points to 38.6, the lowest since July 2020. Inflation worries weighed on the personal finances subindex, which fell 2 points to a 14-month low of 51.9, despite the S&P 500 closing the month at a record high. Dimming faith in federal economic policies was the biggest drag, as the federal policies subindex fell 4.2 points to 41.1. That was the lowest since January 2016.

Tesla Shares Dented by Hertz News – In contrast to today’s continued upswing in US equity markets, Tesla shares slid 3.0% today after CEO Elon Musk disclosed on Twitter that no contract had been signed with rental car company Hertz after reports of its intent to buy 100,000 electric vehicles from the carmaker. Musk also downplayed the potential impact of the deal due to demand for Tesla EVs consistently outstripping supply prior to the Hertz news.