Looking Ahead – Fresh Squeezed

A week ago, when shares of GameStop and other heavily-shorted companies were still soaring and exacting a heavy toll on the hedge funds caught offside, analysts had their heads on a swivel looking around for the next target of the Reddit WallStreetBets short-squeeze mob. The crosshairs locked onto silver, spiking it nearly 15% last Friday morning but, after a half-session head fake, it settled back down, with the CME not waiting long to dial up margin requirements on transactions in the precious metal. Another reason a silver short-squeeze never caught on seemed to be that positioning was not heavily short in the first place, despite what a few posts on Reddit apparently claimed, spurring plenty of dissention in the ranks of fellow Redditors.

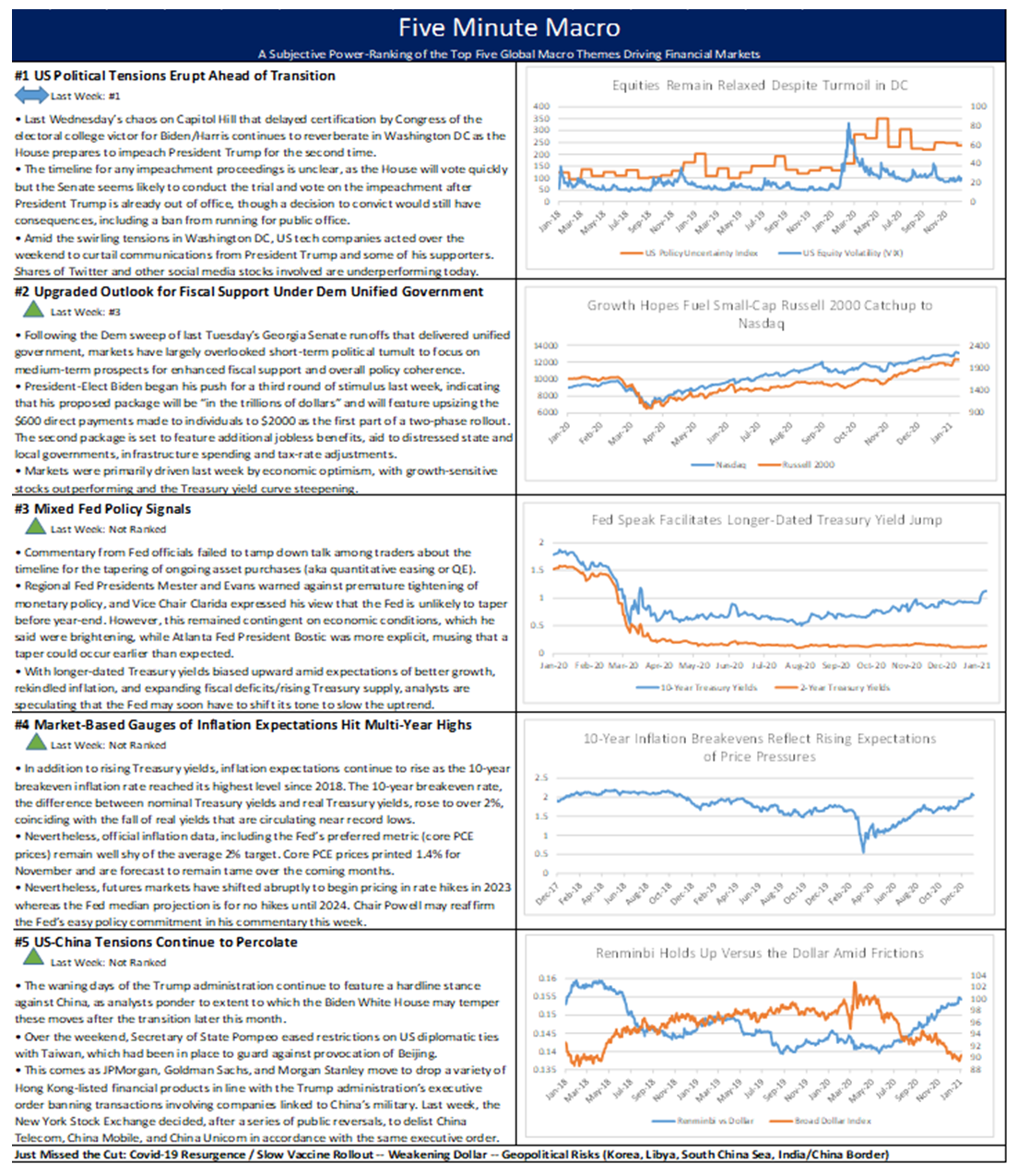

In scanning for other areas of heightened investor vulnerability to countertrend price action, plenty of analysts flagged another asset with heavily-concentrated downside positioning that had recently halted its precipitous slide and had been showing signs of incipient reversal. But this was no penny stock or nearly bankrupt retailer but rather an asset that would be particularly insusceptible to even the most concentrated retail speculative energies – the US dollar.

Currency markets are notorious for wrongfooting consensus trades and bearish positioning on the dollar has been as consensus as they come. A fiscal flood + determined Fed dovishness + risk on = dollar weakness, right?

Sentiment on the dollar was similarly dire at the beginning of 2018, but positioning was not even as extreme as it is now, and the dollar refused to break lower for a few choppy months and then surged higher, as US economic outperformance took hold. At the time, gold prices sank and oil prices climbed (a somewhat atypical divergence), while the dollar marched upward in an almost uninterrupted two-month, 7% ascent, while US equities ran higher in tandem.

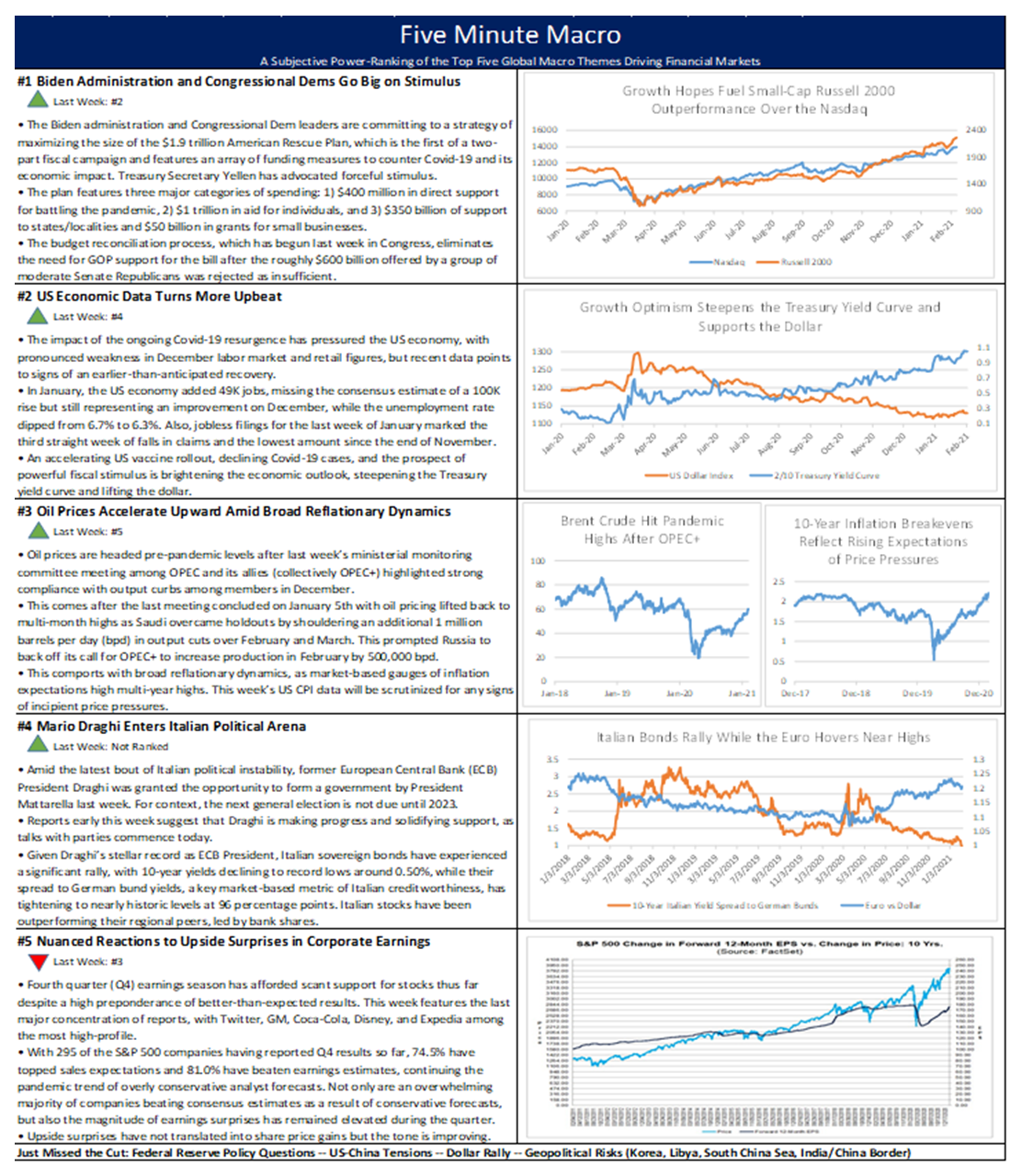

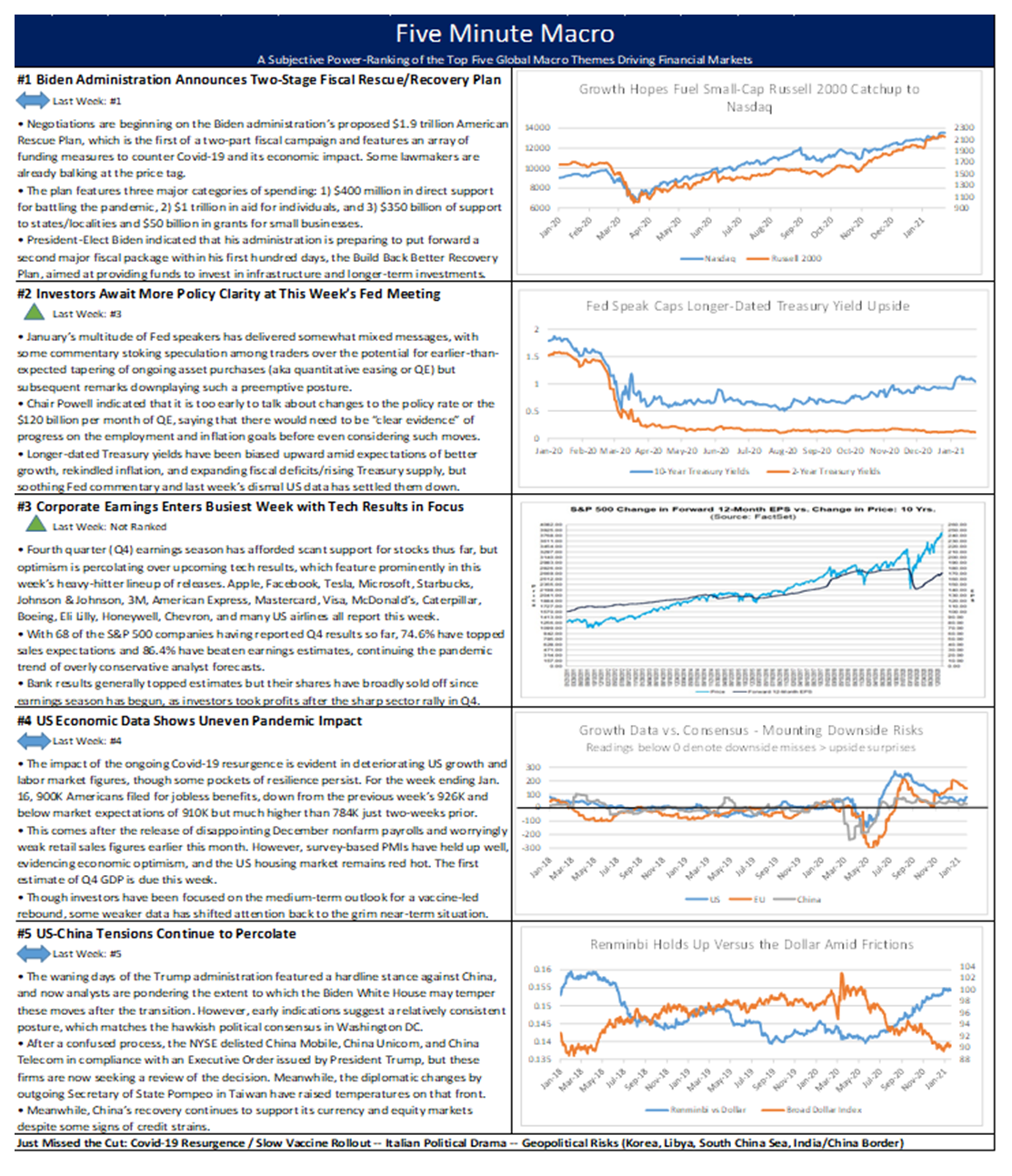

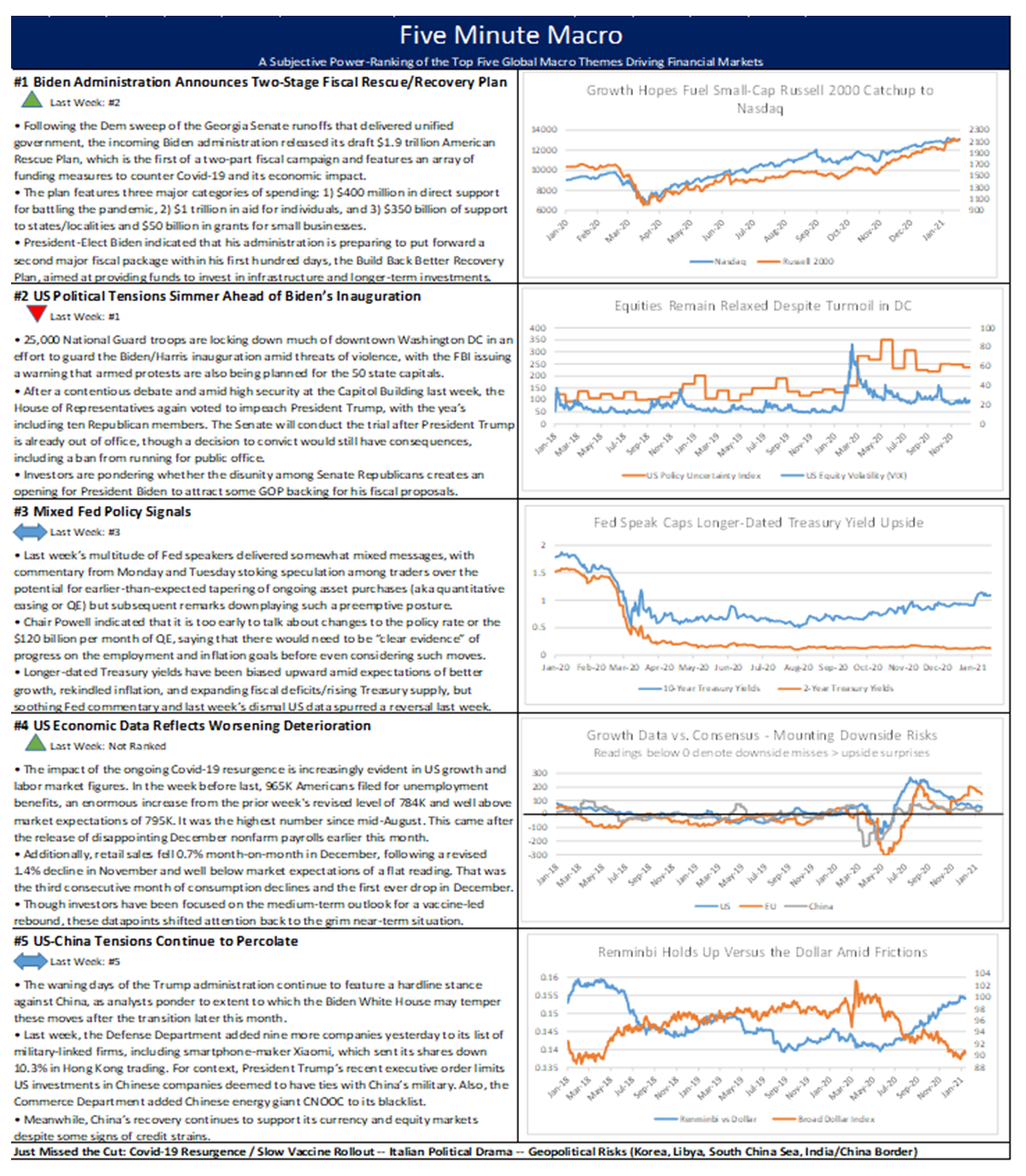

A similarly dollar- and risk-positive scenario, with US growth diverging to the upside from the G-10, may be emerging this year to upend consensus bearishness on the greenback. After a run of dismal December data amid the seasonal and mutated Covid-19 resurgence, further backsliding in early 2021 seemed like the clear base case, particularly given that that second pandemic relief bill in 2020 was delayed until late in the year. But recent US economic figures have been surprisingly resilient, despite a slight downside miss on January jobs numbers, and even outright strong in the case of housing market metrics and survey-based gauges like purchasing managers’ indexes (PMIs). Meanwhile, the Biden administration has decided that bipartisanship plays a distant second to their intent and urgency to deploy a super-sized pandemic relief package, while vaccine distribution appears to be picking up momentum after a slow start, with 35 million doses now administered and a trend that hits 100 million by mid-April – plus, the vaccines are deemed to be effective against the current set of mutations. And with the Reddit short-squeeze army regrouping in their barracks for now, the abatement of volatility has allowed investors to refocus on the brightening growth outlook.

One key distinguishing factor between the current setup and early 2018 is Fed policy. In 2018, Chair Powell was guiding the policy rate steadily upward, continuing the trajectory of 2017. Now, the FOMC is nearly unanimous in trying to tamp down speculation that they will taper their asset purchase program anytime soon, while “not even thinking about thinking about raising interest rates.” But it seems that the markets are skeptical, as futures continue to reflect expectations for incrementally earlier rate hikes than the Fed is projecting. Economic and market conditions later this year certainly seem aligned to test the Fed’s commitment to their current ultra-dovish formulation in the face of higher inflation and strong growth, which may be pivotal moment for any ongoing dollar rally.

Looking ahead to next week, the focus will be on efforts to pass the American Rescue Act through the narrow straits of the slim Democratic majorities in both houses of Congress. On the data front, US inflation figures will be in the spotlight as market-based gauges of inflation expectations advance to multi-year highs. The impeachment trial of former President Trump is also on the docket. Lastly, next week also features the last major concentration of fourth quarter earnings reports, with Twitter, GM, Coca-Cola, Disney, and Expedia among the most high-profile.

- US Consumer Price Data

- Global PMIs

- Bank of England

- Reserve Bank of Australia

- US Initial Jobless Claims

Global Economic Calendar: Price check

Monday

The week begins with German Industrial Production. In November, IP rose 0.9% m/m, following an upwardly revised 3.4% increase in October and above market forecasts of 0.7%. Output increased for intermediate and capital goods, while production of consumer goods decreased 1.7%. It is the 7th consecutive month of rising industrial production although it still was 3.8% lower than in February, the month before the pandemic began.

The evening brings the National Australia Bank’s Index of Business Confidence, which dropped sharply to 4 in December from an upwardly revised 13 in November, reflecting the impact of the Sydney COVID-19 outbreak. Sentiment deteriorated in all industries, except mining, construction, and transport & utilities. Meanwhile, business conditions rose to 14, the highest since September 2018, from 7 in November, with all three sub-indices were above average for the first time since early 2019. Capacity utilization saw further gains and is now around its long-run average and pre-virus levels, while forward orders pulled back but remain in positive territory. “The rise in the employment index is very encouraging and is consistent with the big gains we’ve seen in the official jobs data,” said Alan Oster, NAB Group Chief Economist.

Tuesday

German Balance of Trade kicks off the day. The trade surplus narrowed slightly once again to EUR 17.2 billion in November from EUR 18.5 billion a year earlier. Exports decreased 1.3% to EUR 111.7 billion, the 9th straight annual decline and imports edged down 0.1% to EUR 94.6 billion. Sales to the EU declined 1.7% and those to the Eurozone were down 2.2%. Shipments to China increased 14.3% while those to the US fell 3.1%. Imports from the EU went up 2.6% and those from China 5.4%, while purchases from the US fell 1.5%.

The NFIB Small Business Optimism Index fell to 95.6 in December, the lowest since May and compared to 101.4 in November. This month’s drop is one of the largest as the outlook of sales and business conditions in 2021 deteriorated sizably. Small businesses are concerned about new economic policy in the new administration and a further spread of COVID-19 that is causing renewed government-mandated business closures across the nation.

The Jobs and Labor Turnover Survey (JOLTS), showed the number of job openings in the US declined by 105 thousand to 6.527 million in November, remaining below its pre-pandemic level of 7 million. Job openings decreased in durable goods manufacturing by 48K, information by 45K, and educational services by 21K. The number of job openings was little changed in all four regions. Meanwhile, the number of hires rose by 67K to 6.0 million, while total separations including quits, layoffs and discharges, and other separations jumped by 271K to 5.4 million.

The Consumer Price Index in China closes out the day. In December the CPI rose by 0.2% y/y, after a 0.5% fall a month earlier and compared with market consensus of a 0.1% gain. Food prices increased 1.2%, reversing from a 2.0% fall in November, amid adverse weather and rising demand ahead of the Lunar New Year festival. Pork prices fell less after soaring last year due to the African Swine outbreak. Also, there were rises in cost of health, education, and other goods and services. At the same time, prices of household goods and services were flat for the second straight month, while cost fell for transport, rent, fuel, and utilities, and clothing. On a monthly basis, CPI increased by 0.7%, the most since February, after a 0.6% fall in November. For full 2020, consumer prices rose 2.5%.

Wednesday

Continuing the inflation data this week the day begins with the German consumer price index CPI. In January, the CPI increased 1% y/y, the first rise in seven months, preliminary estimates showed. The temporary reduction in the VAT rate aimed to revive the economy during the coronavirus crisis ended on December 31st. Higher CO2 prices and an increase in minimum wages from January also accounted for the CPI rise. On a monthly basis, inflation increased to 0.8% from 0.5%. The harmonized index went up 1.6% year-on-year and 1.4% month-over-month.

In the US, CPI increased 0.4% m/m in December, higher than 0.2% in November and in line with expectations, mainly driven by an 8.4% increase in the gasoline index, which accounted for more than 60% of the overall increase. The other components of the energy index were mixed, resulting in an increase of 4% for the month. The food index rose 0.4% in December, as both the food at home and the food away from home indexes increased 0.4%. Other increases were also seen for shelter, apparel, and new vehicles. Furthermore, Core CPI, which excludes volatile items such as food and energy, rose 0.1% m/m, following a 0.2% increase in November and matching market expectations.

Wholesale Inventories increased 0.1% m/m in December, following a flat reading in November. Nondurable goods inventories rebounded while durable ones stalled, following a 0.7% rise in October.

The day closes with the Westpac Consumer Confidence Index. Consumer Confidence in Australia decreased to 106.99 points in January from 112 points in December.

Thursday

The focus on a light data day will be US Initial and Continuing Jobless Claims. In the last week of January, 779K Americans filed for unemployment benefits, a significant decrease to from the previous week’s level of 812K, and also well below market expectations of 830K. It marks the third straight week of falls in claims and the lowest amount since the last week of November, however, still far above pre-pandemic levels of around 200K.

Friday

The UK Trade Deficit rose to GBP 5 billion in November from an upwardly revised GBP 2.3 billion in October. It was the largest monthly trade shortfall since April of 2019. Imports surged 8.9% to GBP 55.3 billion, as an 11.9% jump in purchases of goods more than offset a 1.1% decrease in acquisitions of services. Exports rose at a slower 3.9% to GBP 50.3 billion, as goods shipments increased 7.5% while services sales were down 0.3%.

UK Industrial Production edged down 0.1% m/m in November, compared to market forecasts of a 0.5% gain. It is the first decline in industrial output since a record 19.6% plunge in April, as the country was under another lockdown during the month of November to prevent the spread of the coronavirus. The decline was led by falls in mining and quarrying, electricity and gas and water and waste. In contrast, factory output rose 0.7%, led by transport equipment. Production output was 4.7% below February of 2020, the previous month of “normal” trading conditions, prior to the coronavirus pandemic. Year-on-year, industrial output sank 4.7%.

Eurozone Industrial Production rose 2.5% m/m in November 2020, a seventh consecutive month of growth and compared with market expectations of a 0.2% increase. Capital goods output jumped 7.0% and intermediate goods production advanced 1.5%. Meanwhile, output of durable consumer goods, such as televisions and washing machines, dropped 1.2%, after a 1.5% rise in the previous month. Production also fell for both energy and non-durable consumer goods.

The University of Michigan’s Preliminary Consumer Sentiment for February will close out the week. In January the index was revised lower to 79 from a preliminary of 79.2 and below 80.7 in December. There was a decrease in the assessment of current economic conditions, while the expectations component improved slightly. On the price front, both one-year inflation expectations and five-year were unchanged at 3% and 2.5%, respectively. “The overall level of the Sentiment Index has shown only relatively small variations since the pandemic started, averaging 81.5 in 2020, marginally above January’s 79.0. Needless to say, sentiment levels were well below the average of 97.0 from 2017 to 2019. Importantly, the level of key confidence indicators remained well above prior cyclical lows despite the sudden historic collapse in economic activity.”