|

Category: Morning Markets Brief

Morning Market Brief 3-27-2020

|

Morning Markets Brief 3-26-2020

|

Morning Markets Brief 3-25-2020

|

Morning Markets Brief 3-24-2020

Summary and Price Action Rundown

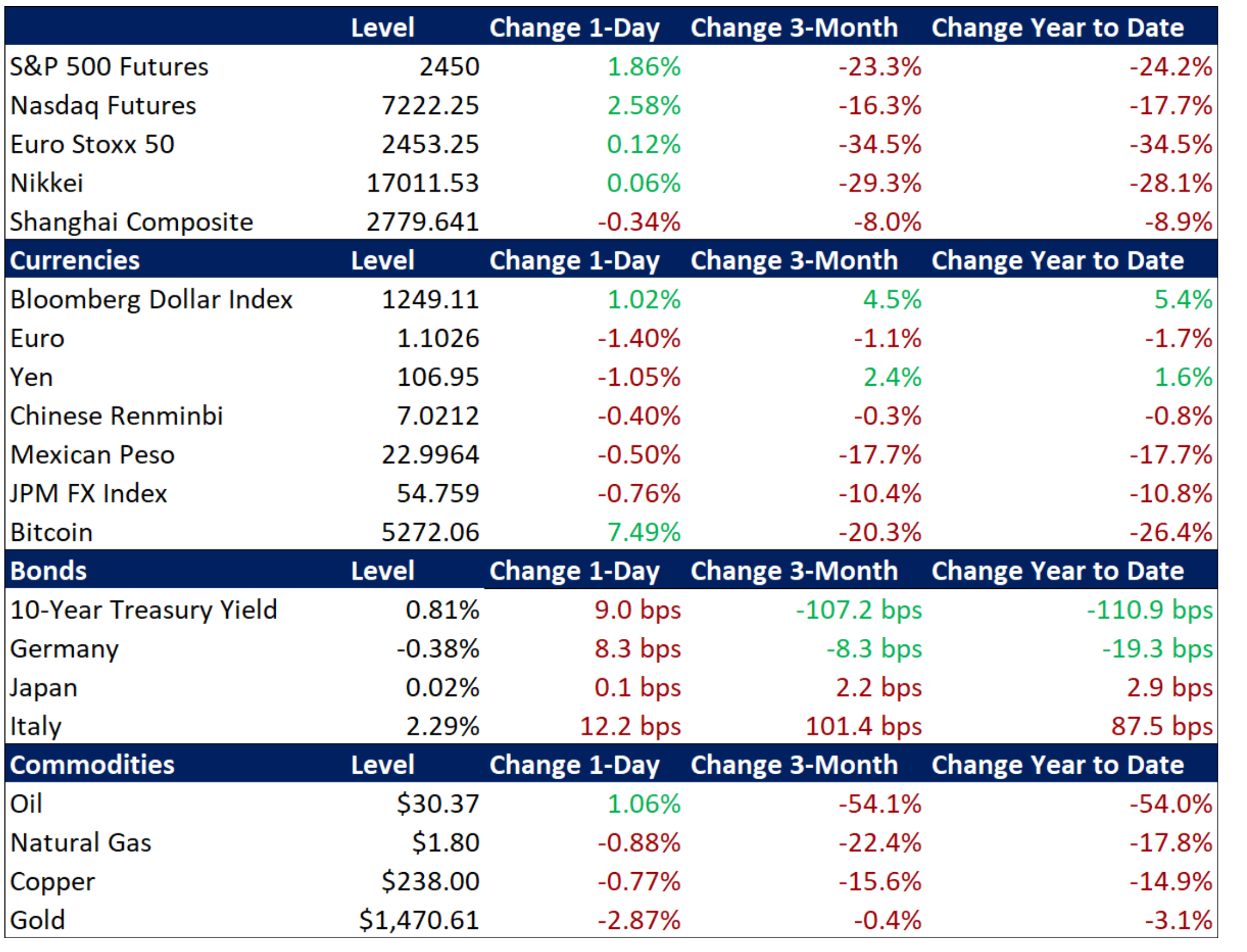

Global financial markets are staging a recovery this morning as investors anticipate forceful fiscal measures aimed at cushioning the unprecedented economic impact from the pandemic and note easing signs of systemic stress following strong monetary policy action. S&P 500 futures are “limit up,” indicating a 5.1% rally at the open. Traders suggest that investor sentiment is finding support from more aggressive Fed accommodation, glimmers of hope from slightly decelerating Italian contagion figures, and expectations of a prompt resolution to the fiscal stimulus holdup on Capitol Hill. Coming off its worst week since 2008, the S&P 500’s year-to-date downside is now 30.8% and its decline from mid-February’s record high is 33.9%. EU and Asian equities also posted robust gains overnight. Amid the easing risk aversion, Treasury yields are ticking higher, with the 10-year yield at 0.80%, while EU sovereign bonds remain steady. Importantly, the dollar is falling back from multi-year highs. Lastly, oil prices are bouncing further above last week’s nearly multi-decade lows, with Brent crude up above $28.

Expectations of US Fiscal Support Help Steady Market Nerves

Investor sentiment remains fragile but tentatively more upbeat today as Congress and the White House work toward a third US spending bill aimed at providing government support to households and businesses during the pandemic, though analysts fret that even this massive package may prove to be too little, too late. Senate Democrats continue to hold out for amendments to the latest stimulus bill aimed at providing support to workers, companies, and the economy in general during the sharp contraction of activity amid the pandemic response. The latest reports indicate that House Speaker Pelosi would likely accept a version agreed between Senate Democrats and the White House, but that House Democrats have crafted their own version of the bill featuring $2.5 trillion in government support for workers and businesses. The House version features moratoriums for mortgage, car, and credit card payments, breaks for public housing rent, $10k in student loan forgiveness, and a freeze on foreclosures and evictions. This follows the rapid expansion of the size of the fiscal package last week from $1.3 trillion to roughly $2 trillion last week, as Congress and the Trump administration reacted to the soaring estimates of economic damage. Investors are struggling to comprehend how much fiscal firepower might be necessary to even partially cushion severe impact of the pandemic on the balance sheets of businesses and households, but more than $2 trillion represents a strong counterweight to this unfolding national solvency crisis. Meanwhile, President Trump’s latest remarks convey anxiousness to restart more normal economic activity, though most of the restrictions and lockdowns are mandated at the state level.

Signs of Easing Market Stress Amid Unprecedented Fed Support Measures

As the liquidity crisis that the Fed is attempting to quell remains intertwined with the slower-moving but intensifying solvency crisis brought on by the pandemic, the FOMC answered the call yesterday to more directly support credit markets and reinforce fiscal backstops to key sectors. Yesterday morning, the Fed announced extensive new measures to support the economy that will provide up to $300 billion in new financing for employers, consumers, and businesses. The Fed will also now be able to purchase Treasury securities and agency mortgage-backed securities in unlimited amounts in order to support smooth market functioning along with increasing buying of agency commercial mortgage-backed securities. They created two facilities to support credit to large employers and established a third facility to support the flow of funds to consumers and businesses, along with facilitating credit availability for municipalities. Investment grade credit rallied yesterday and traders noted some signs of better market functioning, although high yield debt remained under significant pressure. Meanwhile, analysts are citing diminished evidence of stress in offshore dollar funding markets (more below), while short-term funding (repo) and interbank markets similarly appear more orderly. Commercial paper and municipal bonds will be monitored for evidence of improvement.

Additional Themes

Data Shows Massive Economic Contraction – March purchasing managers’ indexes (PMIs) for the EU, Japan, and UK reflect unprecedented deterioration (readings below 50 denote contraction). The EU composite PMI plummeted to 31.4 after registering 51.6 in February, with the service sector showing the sharpest contraction at 28.4 versus 52.6 last month. Factory activity also saw a quickening decline, sinking from 49.2 in February to 44.8. Earlier, Japan’s March services PMI cratered to 32.7 from 46.8 and manufacturing slid to 44.8 from 47.8, putting the composite reading at 35.8. UK services slumped to 35.7, manufacturing was 48.0, and the composite crashed to 37.1 from 53.0 the prior month. US PMIs are due later today.

Dollar Depreciation Welcome – Analysts are crediting the Fed’s aggressive measures for taming the rampant dollar in overseas trading thus far today. The greenback is off its multi-year peak.

Morning Markets Brief 3-23-2020

|

Morning Markets Brief 3-20-2020

|

Morning Markets Brief 3-19-2020

Summary and Price Action Rundown

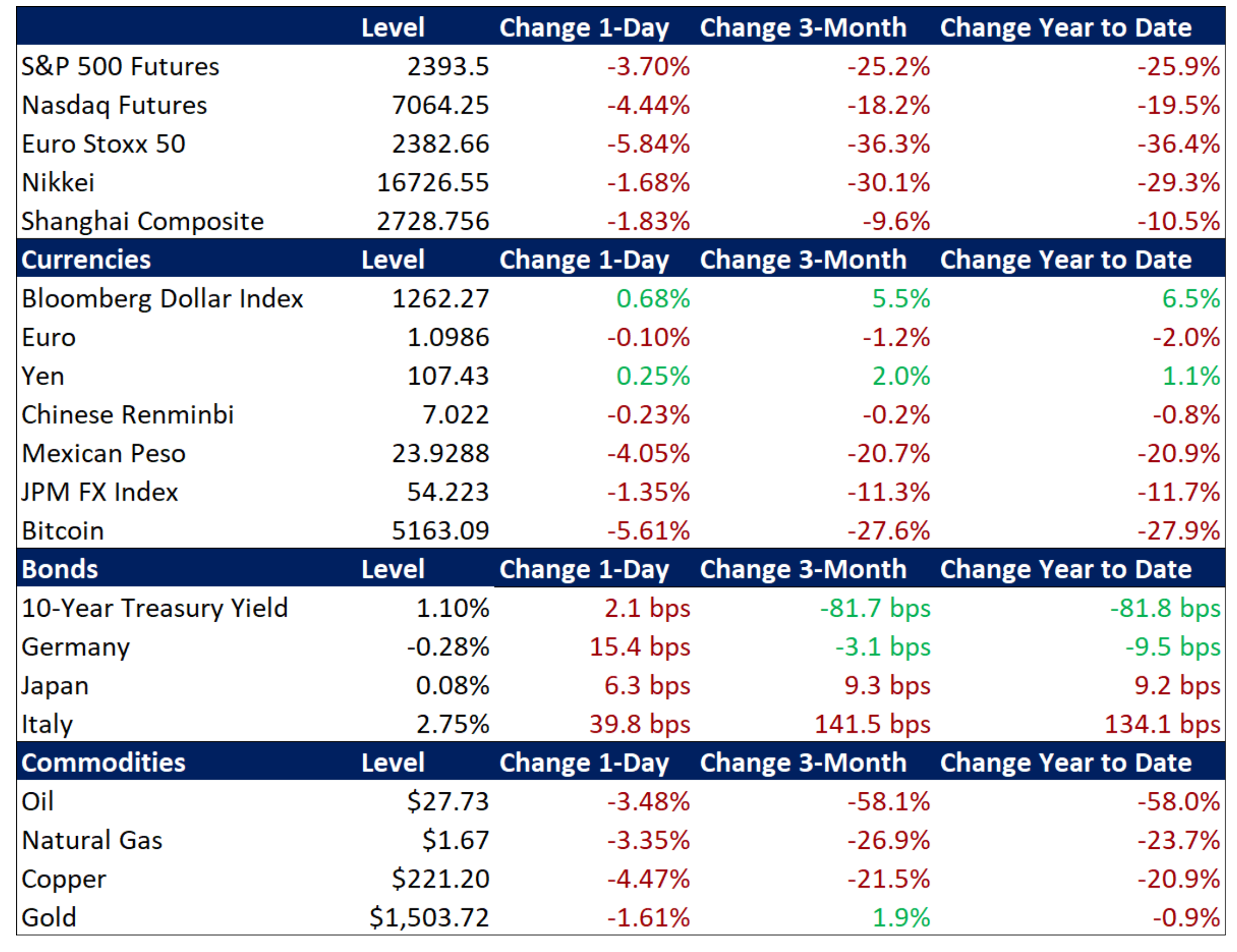

Global financial markets have fluctuated sharply overnight as US and EU central banks enacted even more forceful stimulus and support measures to quell the immediate market panic, though investors remain focused on the need for fiscal efforts to address the unprecedented economic fallout from the pandemic over the coming months. S&P 500 futures point to a 1.5% loss at the open, which represents only a moderate decline in the context of recent weeks but follows a swing of 8 percentage points overnight between solid gains to steep losses. Amid wild swings over the past week, the S&P 500 is down 25.8% on the year, and 29.2% below its mid-February record high. EU equities are only slightly lower this morning while Asian stocks registered another session of moderate downside overnight. Treasury yields are slightly lower, with the 10-year yield at 1.14%, while EU sovereign bond markets are rallying after the European Central Bank’s muscular actions last evening (more below). Meanwhile, the dollar continues to march to multi-year highs. Lastly, oil prices are retracing some of yesterday’s plunge, with Brent crude climbing above $26 per barrel.

Federal Reserve and European Central Bank Work to Calm Panicked Markets

Policymakers have been forced to take increasingly radical steps this week to confront the interlocking public health, economic, and financial crises brought on by the pandemic, with the European Central Bank (ECB) and Federal Reserve stepping in again last night to address rising systemic risks. After intervening in bond markets yesterday to stem the rout in Italian debt, the ECB announced overnight a €750 billion Pandemic Emergency Purchase Program (PEPP), with ECB President Lagarde stating that there are “no limits” to their commitment to steady EU financial markets, echoing her predecessor Mario Draghi’s “whatever it takes” stance that helped quell the EU debt crisis in 2012. The PEPP greatly ups the ECB’s firepower after last week’s €150 billion expansion and Lagarde’s seemingly reluctant tone underwhelmed market participants. The PEPP will not be bound by the same strictures as prior ECB quantitative easing programs, with Greek debt being eligible alongside other loosened restraints. Later in the evening, the Fed announced the Money Market Mutual Fund Liquidity Facility, to help ease the stress of spiking redemption demands in these vital segments of the financial market. This follows deployment of support programs for commercial paper markets and primary dealers.

Fiscal Firepower in Focus as Economies Freeze

While central banks work to counter the immediate systemic financial shocks, governments are scrambling to enact fiscal support measures that will keep their economies on life support through the coming weeks and months of pandemic lockdown. The Trump administration has stepped up its efforts on the fiscal front this week (“going big”), with Treasury Secretary Mnuchin outlining the basics of a massive follow-up package to the emergency spending bill that he hammered out with House Speaker Pelosi last week, which the Senate passed yesterday afternoon. This third stimulus bill is set feature up to $1.3 trillion in spending, encompassing direct payments for households, assistance for small and medium sized businesses, and liquidity for impacted industries, alongside $300 billion in tax payment deferrals as the April 15 deadline is pushed back for three months. Mnuchin dismissed concerns over the ballooning federal deficit though some analysts warned that Treasuries and other sovereign bond markets might react adversely to the coming flood of supply. Also, National Economic Council Director Kudlow indicated that the US government might eventually consider taking equity stakes in companies in need of support. Meanwhile, Berlin’s reluctance to deploy its fiscal headroom is now giving way, as the government readies a package of €550 billion to support Germany’s economy.

Additional Themes

Economists Brace for Spike in US Unemployment Claims – With economic data around the world beginning to show the intensifying impact of the pandemic, analysts are pointing to US initial jobless claims for last week as potentially an early indicator of mass layoffs that anecdotal evidence suggests may have already begun. Also, a survey of German business confidence sank to is worst level in a decade. This comes as major Wall Street banks continue to downgrade their economic outlooks, with a global recession now a “base case” for a number of them, while the second quarter is at risk of registering a “depression” level plunge in growth.

Oil Steadying Near Almost 20-year Lows – Oil prices plummeted to around 18-year lows yesterday, with the deepening sell-off being driven by fears that the coronavirus will result in a global recession and massively decrease demand for crude, compounded by the continuing price war between Saudi Arabia and Russia. The oil price slide is also being felt in the high-yield market, with an ETF of so-called “junk” bonds falling to its worst level since spring of 2009. Energy companies are among the biggest issuers of junk bonds, accounting for more than 11% of the market.

Morning Markets Brief 3-18-2020

Summary and Price Action Rundown

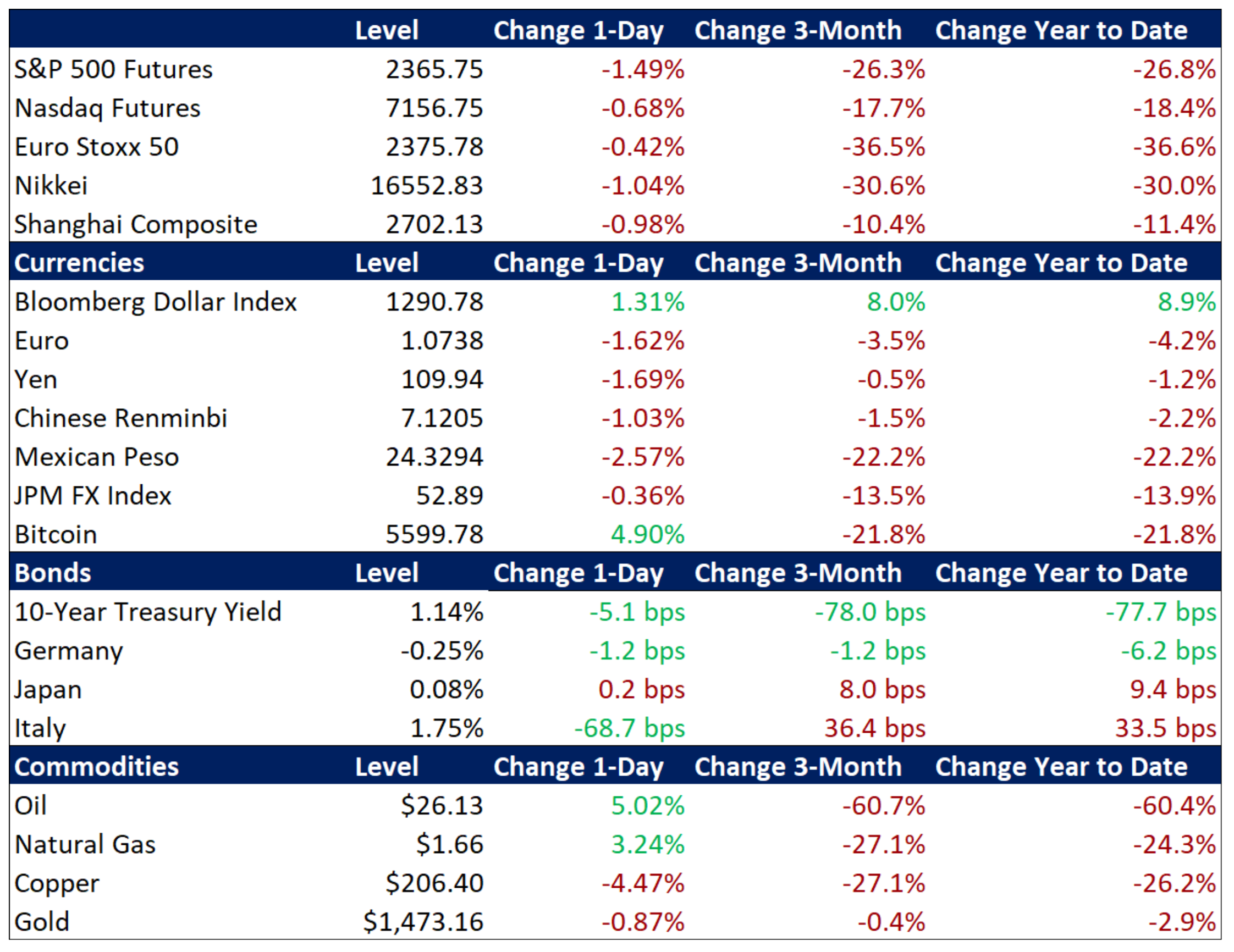

Global financial markets are relapsing to the downside this morning as investors ponder whether even the radical stimulus and support measures being enacted by central banks and governments will be sufficient to counteract the unprecedented economic fallout from the pandemic. S&P 500 futures are under pressure and point to a retracement of yesterday’s 6.0% rally, triggering another “circuit breaker” trading halt. The index is struggling to rebound even after shedding 12.0% on Monday, the worst percentage point loss since “Black Monday” in 1987. Amid wild swings over the past week, the S&P 500 is down 21.7% on the year, and 25.3% below its mid-February record high, as investors come to grips with the unprecedented ramifications of the pandemic and question the potential for government measures to counterbalance the multifaceted economic and financial impact. EU equities are down nearly 6% while Asian stocks posted more moderate downside overnight. Prospects for muscular fiscal stimulus are pushing Treasury yields higher, with the 10-year yield above the key 1.00% level, but EU sovereign bond markets are selling off in a less orderly manner (more below). Meanwhile, the dollar continues to march to multi-year highs. Lastly, oil prices are continuing their swoon, with international benchmark Brent crude sinking below $28 per barrel.

Heightened Uncertainty Persists Despite Bold Policy Efforts to Cushion the Economic Shock

With policymakers enacting ever more radical measures to confront the interlocking public health, economic, and financial crises brought on by the pandemic, investors are grappling with questions over the sufficiency, as well as the potential side-effects, of such policies. Monday’s panicky price action, even after powerful easing on Sunday evening by the Federal Reserve, shifted the onus back to the Trump administration and Congress, as investors confront the fact that broad swaths of the US economy, businesses and workers alike, will need direct and significant financial support from the government to make it through the coming weeks and months. In response, the Trump administration stepped up its efforts on the fiscal front yesterday (“going big”), with Treasury Secretary Mnuchin urging the Senate to quickly pass the emergency spending bill that he hammered out with House Speaker Pelosi last week and outlining the basics of a massive follow-up package. Mnuchin indicated that this third stimulus bill would feature up to $1.2 trillion in spending, encompassing “checks to Americans… in the next two weeks,” assistance for small and medium sized businesses, and liquidity for impacted industries, alongside $300 billion in tax payment deferrals as the April 15 deadline is pushed back for three months. Mnuchin downplayed concerns over the ballooning federal deficit and reportedly warned Republican lawmakers that unemployment could reach 20% in the absence of fiscal countermeasures. Meanwhile, analysts are noting a leaked US government report suggesting that the pandemic response could last 18 months and may require direct intervention in private sector by the executive branch, which is authorized during wartime conditions. While the US Treasury market appears to be absorbing the prospect of enormously increased supply, investors are noting dislocations in EU sovereign bond markets overnight, with sharp selloffs in the periphery, particularly Italy, but also in safe have German bunds. The European Central Bank is reportedly intervening to calm Italian bond market this morning.

Some Easing of Systemic Stress Signals Amid Forceful Fed Moves

With the Federal Reserve enacting increasingly muscular liquidity programs, analysts are noting signs of selective improvement. After the extraordinary easing announced on Sunday night, including a steep rate cut and a return to quantitative easing (large scale asset purchases), the Fed has continued to activate crisis-fighting programs. Yesterday, it upped liquidity injections into short-term funding markets, announced support measures for the commercial paper market (with backing from the Treasury), and activated a lending program for primary dealers, accepting a wide range of collateral for the loans. Analysts are noting positive effects in US short-term funding markets, although repo rates remain choppy, and signs of interbank pressures and overseas dollar scarcity have moderated. However, credit markets remain consistent with a broad and worsening solvency crisis, and the commercial paper (CP) market is also experiencing continued stress despite Fed intervention.

Additional Themes

Increasingly Evident Economic Fallout from the Outbreak – In Germany, the ZEW Economic Sentiment Index plunged by 58.2 points to -49.5 in March, the lowest level since December 2011. Meanwhile, US February retail sales dropped 0.5% month-on-month (m/m), which was the largest decline in sales since December 2018. Economists expect a worldwide recession.

Boeing and US Airlines Request Government Support – An industry group has put forth a suggestion for up to $58 billion in aid and Boeing is seeking $60 billion in government support.

Morning Markets Brief 3-17-2020

Summary and Price Action Rundown

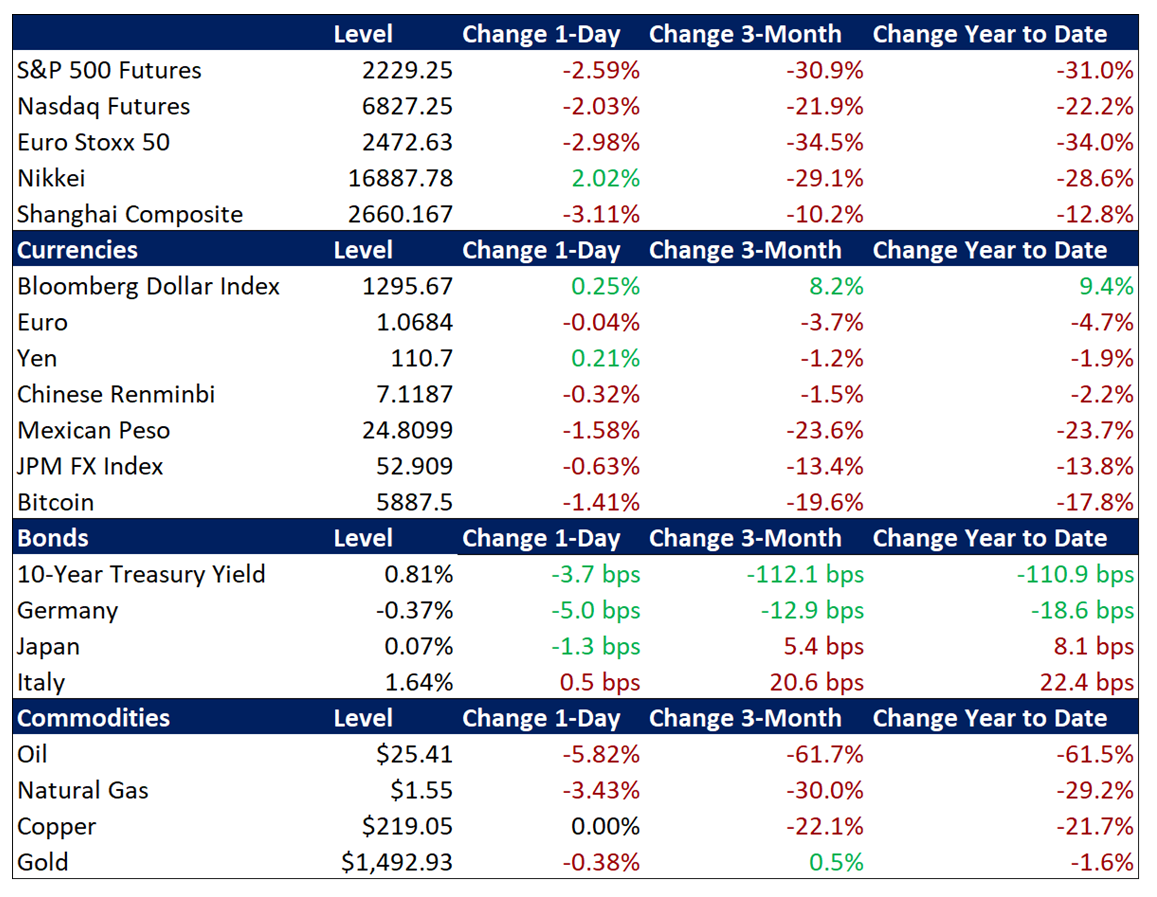

Global financial markets are attempting to stabilize this morning amid increasingly forceful stimulus and support measures from central banks and governments, though historic levels of volatility and some heightened indications of systemic risk persist. S&P 500 futures have been choppy this morning but remain in positive territory despite surrendering more significant gains overnight. The index is still struggling to rally even after shedding 12.0% in yesterday’s session, the worst percentage point loss since “Black Monday” in 1987, while the past week has featured multiple sessions with moves of over 9%. Amid these wild swings, the S&P 500 is down 26.1% on the year, and 29.5% below its mid-February record high, as investors come to grips with the unprecedented ramifications of the pandemic and question the potential for government measures to counterbalance the multifaceted economic and financial fallout. Equities in Asia were mixed but relatively steady overnight while EU stocks have retreated from their earlier highs of the day. Treasuries are pausing their rally, with the 10-year yield rising to 0.81%, while the dollar is reaccelerating to the upside amid overseas demand. Oil prices remain depressed, but international benchmark Brent crude is edging above $30 per barrel.

Policy Countermeasures Arrayed to Quell Market Panic

With the intensifying magnitude of the pandemic forcing investors to contemplate potentially severe economic and personal hardship over the coming months, policymakers are seeking to enact even more radical measures to confront the interlocking public health, economic, and financial crises. Yesterday’s panicky price action, even after powerful easing on Sunday evening by the Federal Reserve, shifted the focus back to the fiscal and public health response, as investors grapple with the fact that broad swaths of the US economy, businesses and workers alike, will need direct and significant financial support from the government to make it through the coming weeks and months. Though some analysts cited President Trump’s remark that countermeasures against the virus could last into late summer months as adding to yesterday’s pessimism, others noted that contemplation of such an adverse outlook should help stiffen the resolve and focus the efforts of US policymakers. On the public health side, travel restrictions and quarantines continued to tighten in the US and overseas, with increasing numbers of cities and states ordering restaurants, cafes, and bars to close. On the fiscal front, Treasury Secretary Mnuchin is urging the Senate to quickly pass the emergency bill that he hammered out with House Speaker Pelosi last week. Mnuchin is reportedly set to propose a third stimulus bill that would offer $850 billion in economic support, though much of the total is said to be a payroll tax cut, a proposal which received a chilly reception on Capitol Hill last week. In addition to any such broad stimulus, analysts expect that large-scale industry bailouts will also be necessary.

Some Easing of Systemic Stress Signals Amid Forceful Fed Moves

With the Federal Reserve enacting major liquidity programs on Sunday, short-term funding and interbank markets appear calmer, though some significant fundamental strains remain evident in global financial markets. Analysts have been monitoring significant and rising pressure in short-term funding markets (which first emerged in September), overseas dollar liquidity, credit market metrics, commercial paper markets, and interbank funding. The Fed’s actions on Friday and over the weekend appear to have had a positive effect on US short-term funding markets, although repo rates remain choppy, and some signs of interbank pressures have moderated, while major US banks have agreed to tap the Fed’s discount window in unison in an attempt to facilitate its wider use (as in 2008). Still, overseas dollar liquidity gauges have worsened further. Also, credit markets remain consistent with a broad and worsening solvency crisis, particularly in some of the most impacted sectors, like energy, which is suffering further damage from the Saudi versus Russia oil price war. The commercial paper (CP) market is also experiencing continued stress, with some analysts suggesting that the Fed should begin to directly purchase CP in an effort to unfreeze this key source of corporate funding.

Additional Themes

Boeing and US Airlines Request Government Support – With President Trump expressing an intention to support US airlines, an industry group has put forth a suggestion for up to $58 billion in aid of various kinds, including tax rebates and grants. Airline stocks moderately outperformed the broader S&P 500 yesterday but have suffered outsized year-to-date losses between 40% and 60% for the major US carriers. Boeing is also seeking government aid.

Increasingly Evident Economic Fallout from the Outbreak – While US data has only evidenced a minor impact of the outbreak thus far, the New York region manufacturing activity gauge for March crashed from 12.9 to -21.5, its worst level since 2009, providing a grim harbinger of the economic damage to come. Today’s retail sales and industrial production numbers for February are expected to remain steady before almost certainly contracting steeply this month.