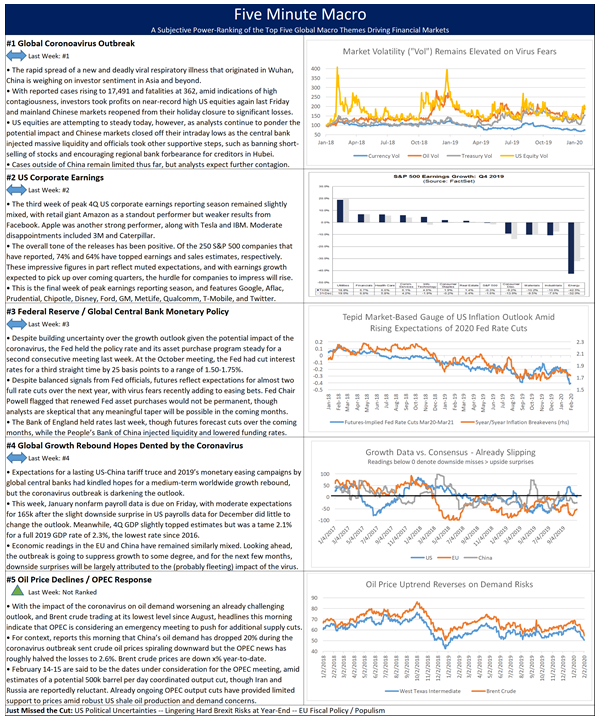

This weeks rankings are led by the Corona Virus, Corporate Earnings, Central Banks and Global Growth, while Oil joins the party this week.

Skip to content