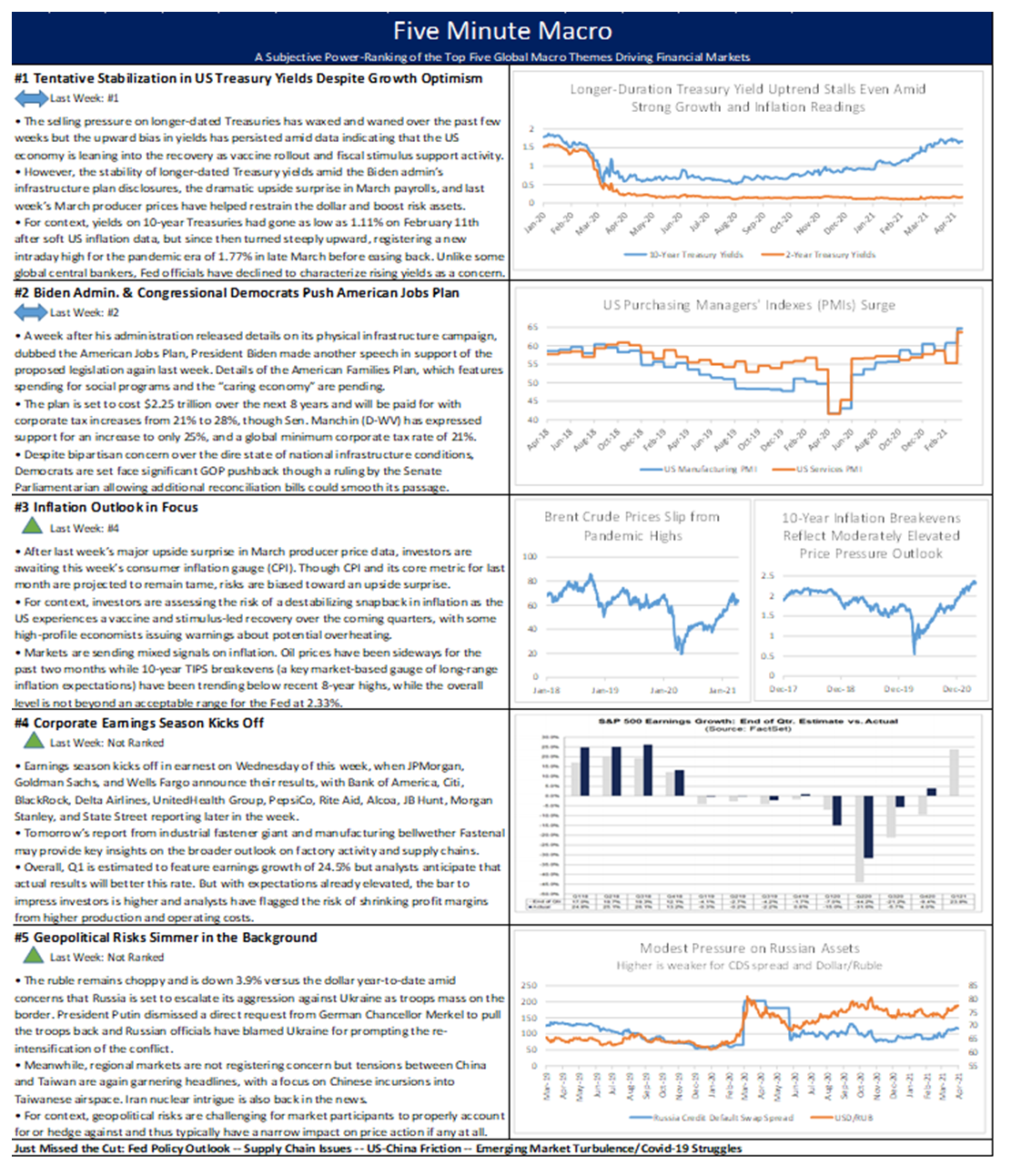

The stabilization in Treasury yields calms markets while the Biden Administration pushes the Jobs Plan. CPI data tomorrow is in focus along with the beginning of 1Q 21 earnings season. Finally, geopolitical risks continue to simmer.

The stabilization in Treasury yields calms markets while the Biden Administration pushes the Jobs Plan. CPI data tomorrow is in focus along with the beginning of 1Q 21 earnings season. Finally, geopolitical risks continue to simmer.

Looking Ahead – Procedural Thriller

Please join us today at 2:30 PM ET for a call on the Biden Administration’s American Jobs Plan spending proposals and accompanying tax increases. We will be joined by our colleagues at Hamilton Place Strategies, Meghan Pennington and Bryan DeAngelis. Both have extensive experience on Capitol Hill and will have insights on the reconciliation process, as well as perspective on what elements are likely to make their way into the final bill and what may not have the votes. We will also touch on other themes, like US corporations being embroiled in politics, whether over voting rights, pay/unions, taxes, etc.

Please reply to Jeff Easter (jeff.easter@marketspolicy.com) if you would like to join the call.

Some of the key questions we will be pondering are as follows:

The Biden administration has split this massive legislative campaign into two main fronts – physical infrastructure (the American Jobs Plan) and social programs/caring economy (the yet-to-be unveiled American Families Plan). The total price tag of the combined proposals is estimated to be around $4 trillion. What is the reason for this bifurcated approach?

Related to question 1 above, what is the importance of this week’s ruling by the Senate Parliamentarian, which indicated that Democrats could utilize budget reconciliation an additional time to bypass Republican support with a simple Senate majority. The ruling permits Democrats to revisit the fiscal 2021 budget resolution that Congress used to approve the $1.9 trillion relief bill earlier this year, in effect creating three opportunities to use reconciliation to pass a significant portion of the administration’s economic agenda before the midterm elections in 2022.

Related to question 2 above, if the Biden administration goes for an omnibus approach to this next bill, what might they use their third and final budget reconciliation procedure for later this year?

How does this physical infrastructure bill cut across party lines? Is there any hope of a bipartisan segment, such as a smaller infrastructure package free of tax hikes that would potentially draw out some GOP support? Would that be worth doing from a political and policy standpoint?

Senator Manchin has come out with some strong statements on the current American Jobs Plan draft, pushing back on the increase in corporate taxes to 28% and expressing a preference for 25%, while indicating that he is uncomfortable with the overall size of the package and favors a more bipartisan approach. He has a lot of political capital, but does he have enough to truly steer this bill in a radically different direction if in fact that is what he wants to do?

So much of the focus is on what Senator Manchin wants, but with such a slim majority in the House, will the Blue Dog contingent have a similar power over what makes it in?

Looking ahead to next week, the macro calendar features some consequential global economic data, with US consumer price inflation figures in sharp focus, while March retail sales and industrial production for the US and EU could highlight their diverging economic fortunes. Economic sentiment gauges for the US, Germany, and Australia are also due, alongside first quarter Chinese GDP and key growth metrics for March.

Global Economic Calendar: In bloom

Monday

Eurozone’s retail trade slumped 5.9% m/m in January, the steepest decline since last April’s record slump and compared with market expectations of a 1.1% drop, as a number of member states re-imposed or extended coronavirus lockdown measures. Non-food products sales plunged 12%, despite a 7.1% increase in on-line trade, while fuel sales were down 1.1%. Meanwhile, food, drinks and tobacco trade rose 1.1%, compared with a 2.3% growth in December. On a yearly basis, retail sales shrank 6.4% , also the largest decrease since April.

The NAB business confidence index in Australia rose 4 points from the previous month to 16 in February 2021, its highest level since early 2010, with all states and industries reporting gains, except for retail. In addition, the gauge measuring business conditions climbed 6 points to 15, matching the December reading, which was the highest level since August 2018, with all three sub-components improving: trading, profitability and employment. Meantime, capacity utilization and capex continue to rise and have now exceeded pre-virus levels and their long-run averages. Forward orders also rose and are now well above average. “Business conditions and confidence are both at multi-year highs and, importantly, we’re starting to see an uptrend in business hiring and investment activity.” said Alan Oster, NAB Group Chief Economist.

Chinese Balance of Trade showed a trade surplus of $103.25 billion in January-February 2021 combined, rebounding sharply from a $7.21 billion deficit in the same period a year earlier, and easily beating market consensus of a $60 billion surplus, as the economy recovered from the disruption caused by COVID-19, with more factories resuming their production. Exports surged 60.6% y/y, the eighth straight month of increase, while imports rose at a softer 22.2%, the fifth consecutive month of growth. China’s trade surplus with the US for the first two months of the year stood at $51.26 billion, much larger than a surplus of $25.37 billion in the corresponding period a year earlier. To smooth distortions due to the Lunar New Year festival, Chinese customs combine January and February trade data.

Tuesday

The UK Balance of Trade showed the trade deficit fell to £1.6 billion in January, the smallest trade shortfall in five months, as both imports and exports fell at a record pace following the end of EU exit transition period and the reintroduction of COVID-19 restrictions on activity. Imports declined 18.5% to £43.03 billion, with purchases of goods slipping 22.8% and services imports falling 2.4%. Meantime, exports fell at a record 11.2% to £41.40 billion, as goods shipments slumped 18.3% and services sales decreased 0.9%.

The ZEW Indicator of Economic Sentiment for Germany rose by 5.4 points from the previous month to 76.6 in March, not far from September’s 20-year high of 77.4 and slightly above market expectations of 74.0. Optimism surrounding the economic outlook continued to improve, with investors anticipating a broad-based recovery of the German economy and at least 70 percent of the population to be offered a COVID-19 vaccine by autumn. In addition, the survey showed inflation is seen increasing further and long-term interest rates are forecast to be higher.

The Consumer Price Index (CPI) increased 0.4% m/m in February, slightly higher than 0.3% in January but matching market forecasts. The gasoline index continued to increase, up 6.4%, accounting for over half of CPI gain. The electricity, and natural gas indexes also increased and the energy index rose 3.9%. The food index edged up 0.2%. This pushed annual CPI up to 1.7% from 1.4% in January, and in-line with market forecasts of 1.7%. Core CPI, which excludes food and energy, inched up 0.1%, less than forecast of 0.2%, with increases seen in cost of shelter, recreation, medical care, and motor vehicle insurance while falls were seen for airline fares, used cars and trucks and apparel. Annual Core CPI, rose 1.3%, the least since June 2020 and missing expectations of a 1.4% advance.

The Westpac-Melbourne Institute Index of Consumer Sentiment increased by 2.6% to 111.8 in March, just 0.2 points below the December level which was a ten-year high driven by are improving economic conditions and prospects, both domestically and abroad, particularly as they relate to our labor market. Australia’s success in containing COVID-19, the promise of vaccine rollouts bringing an end to the pandemic, and support from stimulatory government policies have all contributed to the sustained lift. All components of the index were higher in March. Confidence around the economic outlook led the gains with the ‘economy, next 12 months’ sub-index up 3.7% and the ‘economy, next 5 years’ sub-index up 2.3%.

Wednesday

Industrial production in the Eurozone rose 0.8% m/m in January, rebounding from a downwardly revised 0.1% fall in December and compared with market expectations of a 0.2% increase. Output of durable consumer goods, such as televisions and washing machines, rose 0.8%, after a 0.9% advance in the previous month. Production also grew for non-durable consumer goods, capital goods, energy and intermediate goods. On a yearly basis, industrial production was up 0.1% in January, ending a 26-month period of contraction and compared with forecasts of a 2.4% decline.

US Import prices increased 1.3% m/m in February, easing from an upwardly revised 1.4% rise in January, which was the largest monthly advance since March 2012. Still, the reading came in above market expectations of 1.2%. Nonfuel import prices increased 0.4%, due to higher prices for nonfuel industrial supplies and materials; foods, feeds, and beverages; capital goods; consumer goods; and automotive vehicles. Meantime, prices for import fuel advanced 11.1%, the most since July 2020, mainly due to an 11.3% rise in petroleum prices and an 11.2% advance in natural gas prices. Year-on-year, import prices jumped 3%, the most since October 2018 as petroleum cost surged.

US Export Prices rose 1.6% m/m in February, after a 2.5% advance in January which was the largest increase since records began in December 1988. It also compared with market expectations of a 0.9% gain. The price index for agricultural exports rose 2.9% and nonagricultural export prices rose 1.5%. Year-on-year, export prices jumped 5.2% in February, the largest over-the-year increase since June 2018.

The Australian Employment Report showed the seasonally adjusted unemployment rate fell to 5.8% in February from 6.4% a month earlier and below market consensus of 6.3%. This was the lowest jobless rate since March 2020, as the economy recovered further from the disruption caused by the COVID-19 shocks. The number of unemployed declined by 69,900 to 805,200 people, as people looking for full-time work was down by 39,800 to 576,700 and those looking for only part-time work decreased by 30,100 to 228,500. Employment grew by 88,700 to a one-year high of 13,006,900, easily beating market estimates of an increase of 30,000, as full-time employment went up by 89,100 to 8,895,000, while part-time employment dropped 500 to 4,111,900. The participation rate stayed at 66.1% and below forecasts of 66.2%. The underemployment rate rose 0.4 points to 8.5%, and the underutilization rate fell 0.1 points to 14.4%. Monthly hours worked in all jobs gained 102 million hours, or 6.1% to 1,767 million hours.

Thursday

US Retail sales shrank 3% m/m in February, following an upwardly revised 7.6% jump in January and much worse than market forecasts of a 0.5% fall. It is the biggest decline since a record drop in April of 2020 amid unusually cold weather and winter storms in Texas and some other parts of the South region during the month. Biggest decreases were seen in sales at department stores, sporting goods, hobby, musical instruments and book stores, non-store retailers, auto dealers, furniture, miscellaneous retailers, building material and garden equipment, clothing, food services and drinking places, electronics and appliances and health and personal care. In contrast, sales at gasoline stations jumped 3.6%. Retail Sales Excluding Autos decreased 2.7% m/m, much worse than forecasts of a 0.1% fall, amid unusually cold weather in the South.

Initial and Continuing Claims will be in focus after the latest reading featured another disappointing degree of deterioration. Last week, the number of Americans filing for unemployment benefits rose for the second straight week, after a surprise drop to 658 thousand in late March, up to 744 thousand, from the previous period’s revised figure of 728 thousand, and well above market expectations of 680 thousand. The weekly report followed on the heels of news last week that that nonfarm employment rose by 916 thousand in March, the most in seven months, while the number of job openings hit their highest level in two years in February. In total, 18.164 million Americans received some sort of federal assistance, down slightly from 18.215 million.

Industrial production slumped 2.2% m/m in February, following an upwardly revised 1.1% growth in the previous month and missing market expectations of a 0.3% increase. It was the steepest contraction in industrial output since April’s record 12.7% slump, due to the severe winter weather in the south-central region of the country in mid-February. Most notably, some petroleum refineries, petrochemical facilities, and plastic resin plants suffered damage from the deep freeze and were offline for the rest of the month. Manufacturing output and mining production fell 3.1% and 5.4%, respectively, the utilities output increased 7.4%.

The NAHB housing market index fell 2 points to 82 in March compared to forecasts of 83. It is the lowest reading in 7 months amid rising interest rates and building materials costs, especially lumber. Current sales conditions for the single-family segment fell 3 points to 87 while sales expectations in the next six months increased 3 points to 83. Also, the prospective buyers’ sub-index was unchanged at 72.

Business inventories went up 0.3% m/m in January, in line with market expectations and easing from an upwardly revised 0.8% growth in December. It was the seventh consecutive month of gains in business inventories. Stocks at manufacturers edged up 0.1%, slowing from a 0.3% advance in the previous month and inventories at retailers fell 0.5%, down from a 1.7% rise. Meantime, stocks at wholesalers rose faster. Year-on-year, business inventories dropped 1.8%.

China’s fixed-asset investment (FAI) surged 35% y/y to CNY 4.52 trillion in January-February 2021, accelerating from a 2.9% advance in 2020 but below market consensus of a 40% growth, as the economy continued to recover from the pandemic crisis. Public investment jumped 32.9% and private investment soared by 36.4%. Investment in the primary industry grew 61.3%, and that in the tertiary industry expanded 34.6% boosted by transport, storage & postal industry; water conservancy, environment and public facilities management industry; education; health and social work; and culture, sports and entertainment industry. Also, investment in the secondary industry jumped 34.1%. In January-February 2020, fixed-asset investment had plunged by a record 24.5% due to the coronavirus pandemic.

China’s 1st Quarter GDP will be released. China has set its 2021 economic growth target at more than 6%, Premier Li Keqiang said in his annual work report on Friday. Chinese leaders announced that the world’s second-largest economy intends to keep consumer price inflation at around 3% and seeks a budget deficit goal of about 3.2% of GDP. The government also aims for an urban unemployment rate of approximately 5.5% and plans to create more than 11 million new urban jobs. In 2020, the country’s GDP expanded 2.3%, the slowest pace in more than four decades.

Friday

Eurozone’s trade surplus widened to €6.3 billion in January from €1.6 billion in the corresponding month of the previous year. Still, it was the smallest trade surplus since last April, linked to the reintroduction of coronavirus restrictions in several European countries. Imports declined 14.1% from a year earlier to a five-month low of €156.8 billion. China was the main partner for the EU due to an increase of exports while imports decreased. Trade with the US recorded a significant drop in both imports and exports.

The Eurozone consumer price index is expected to accelerate to 1.3% y/y in March, the highest level since January 2020 and in line with market expectations, a preliminary estimate showed. Energy prices should rebound 4.3%, compared with a 1.7% drop in February, and services inflation is seen picking up to 1.3% from 1.2%. Meanwhile, cost will probably rise at a slower pace for both non-energy industrial goods and food, alcohol & tobacco. The annual core inflation, which excludes volatile prices of energy, food, alcohol & tobacco and at which the ECB looks in its policy decisions, is expected to slow to 0.9% in March, below market forecasts of 1.1%.

US Housing starts sank 10.3% m/m to an annualized rate of 1.421 million in February, the lowest reading in six months and well below forecasts of 1.56 million. Housing starts reached the highest rate in 14 years in December as people moved away from the big cities due to the coronavirus pandemic. In February, single-family housing starts were at a rate of 1.040 million, 8.5% below January and the rate for units in buildings with five units or more dropped 14.5% to 372,000. Starts fell in the Northeast, the Midwest and the South but rose in the West.

Building permits tumbled 10.8% m/m to a seasonally adjusted annual rate of 1.682 million in February, down from the previous month’s 15-year high of 1.886 million and below market expectations of 1.75 million. Single-family authorizations plunged 10.0% to a rate of 1.143 million while permits for the volatile multi-segment dropped 12.5% to a rate of 539 thousand. Across regions, permits went down in the South, the West, and the Northeast. Meanwhile, building permits in the Midwest rose 1.2% to 249 thousand.

The University of Michigan’s consumer sentiment was revised higher to a one-year high of 84.9 in March of 2021, up from a preliminary estimate of 83 and above market forecasts of 83.6. It was also the largest increase in consumer morale since May 2013, as households welcomed the third disbursement of relief checks and a better than anticipated vaccination progress. Meanwhile, expectations were revised higher to 79.7 from 77.5 and compared to February’s 70.7. The current conditions gauge rose to 93, above a preliminary of 91.5 and up from February’s 86.2. Inflation expectations for the year ahead decreased to 3.1% from 3.3% in the previous month, matching initial figures; while the 5-year outlook rose to 2.8% from 2.7%, above preliminary figures of 2.7%. “The data clearly point toward robust increases in consumer spending.”

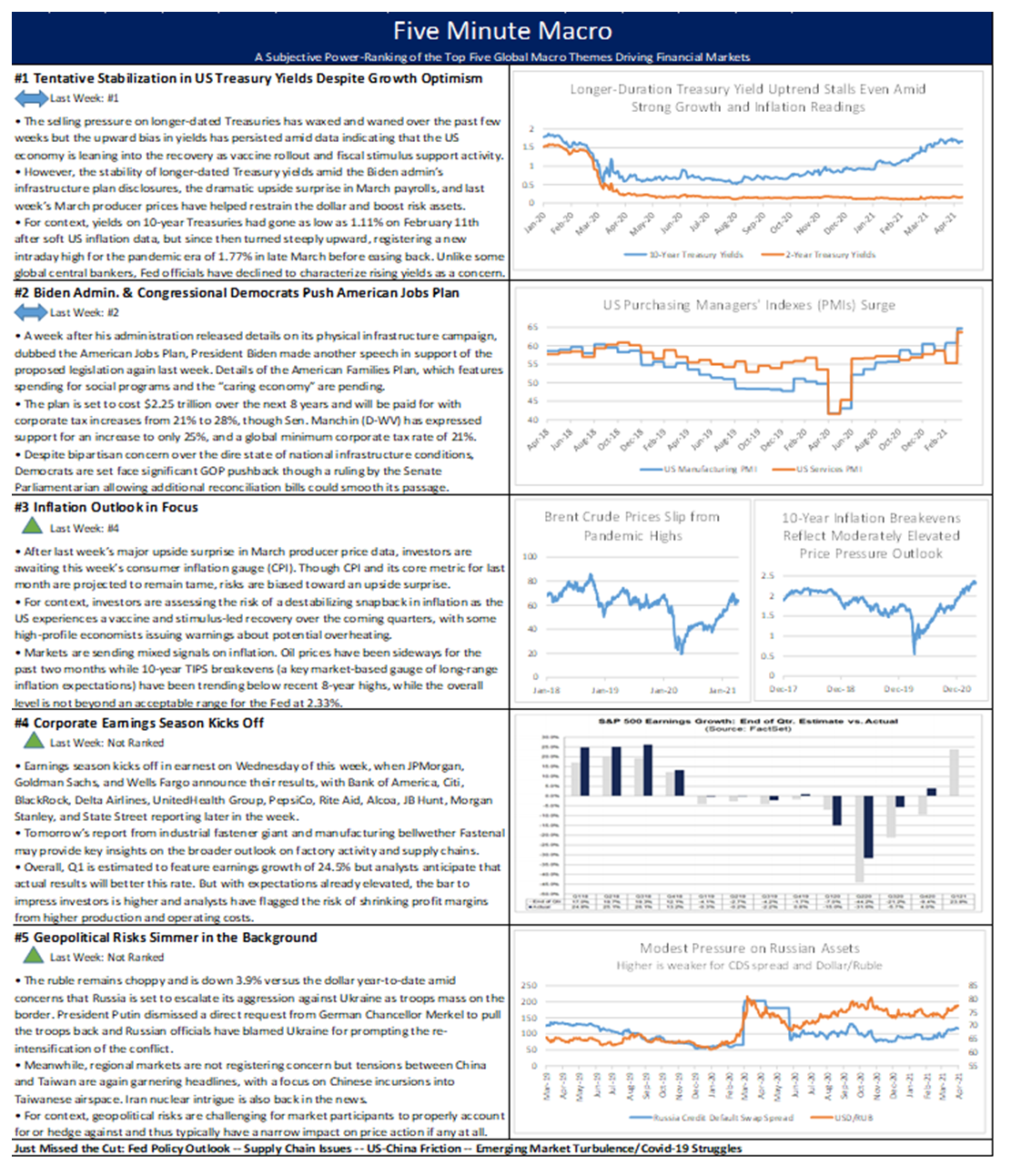

The stabilization of Treasury yield is helping risk sentiment, while the market digests the details of the Biden infrastructure proposal. Wednesday brings FOMC Minutes as inflation fears still remain. Finally, India grapples with Covid surge amid EM asset volatility.

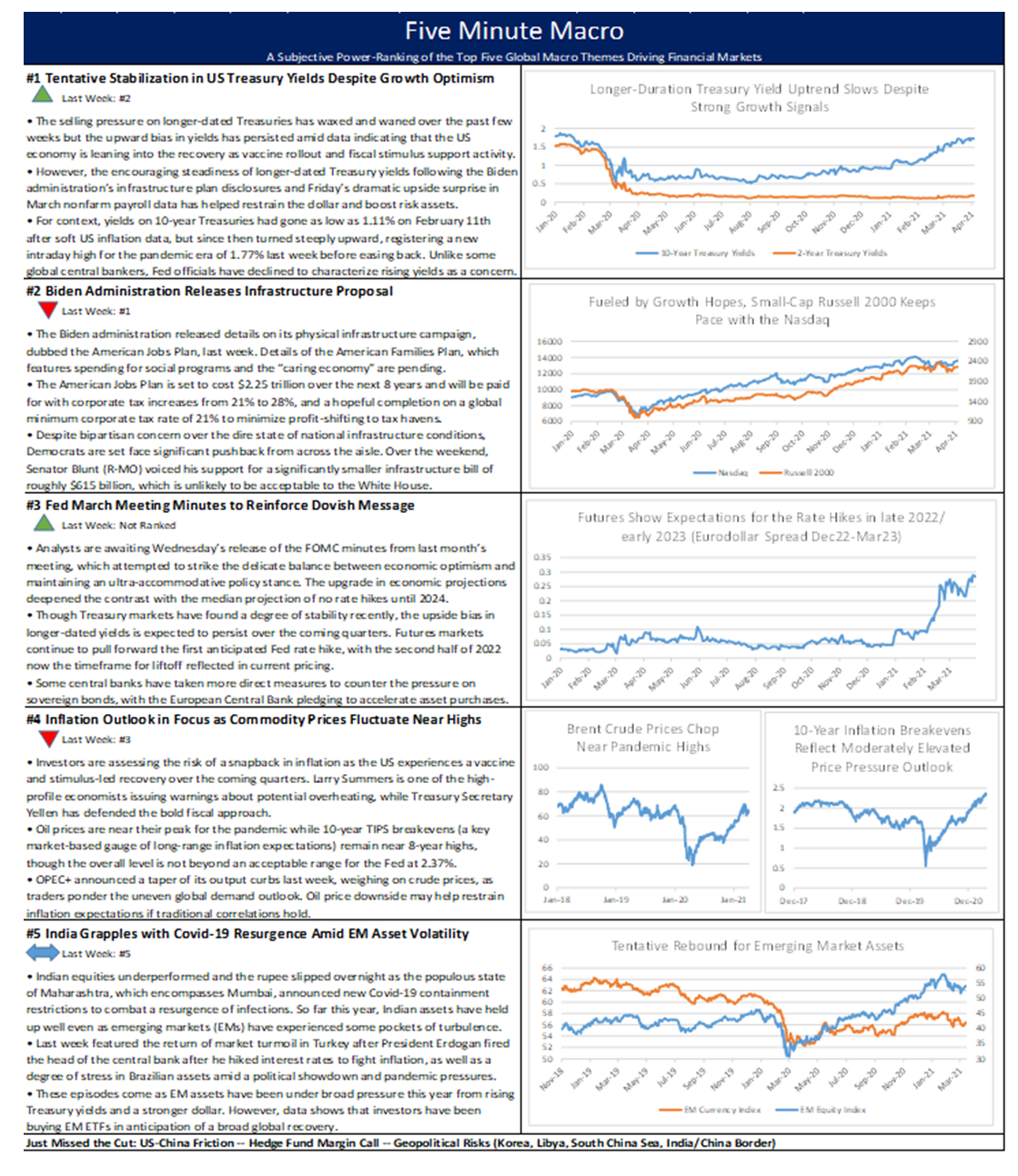

Details of the next major spending package come this week as Treasury yields remain biased higher. The inflation outlook debate continues to percolate and supply chain dislocations are having varying impacts across the globe. Finally, Turkey market turbulence feeds into Emerging Markets.

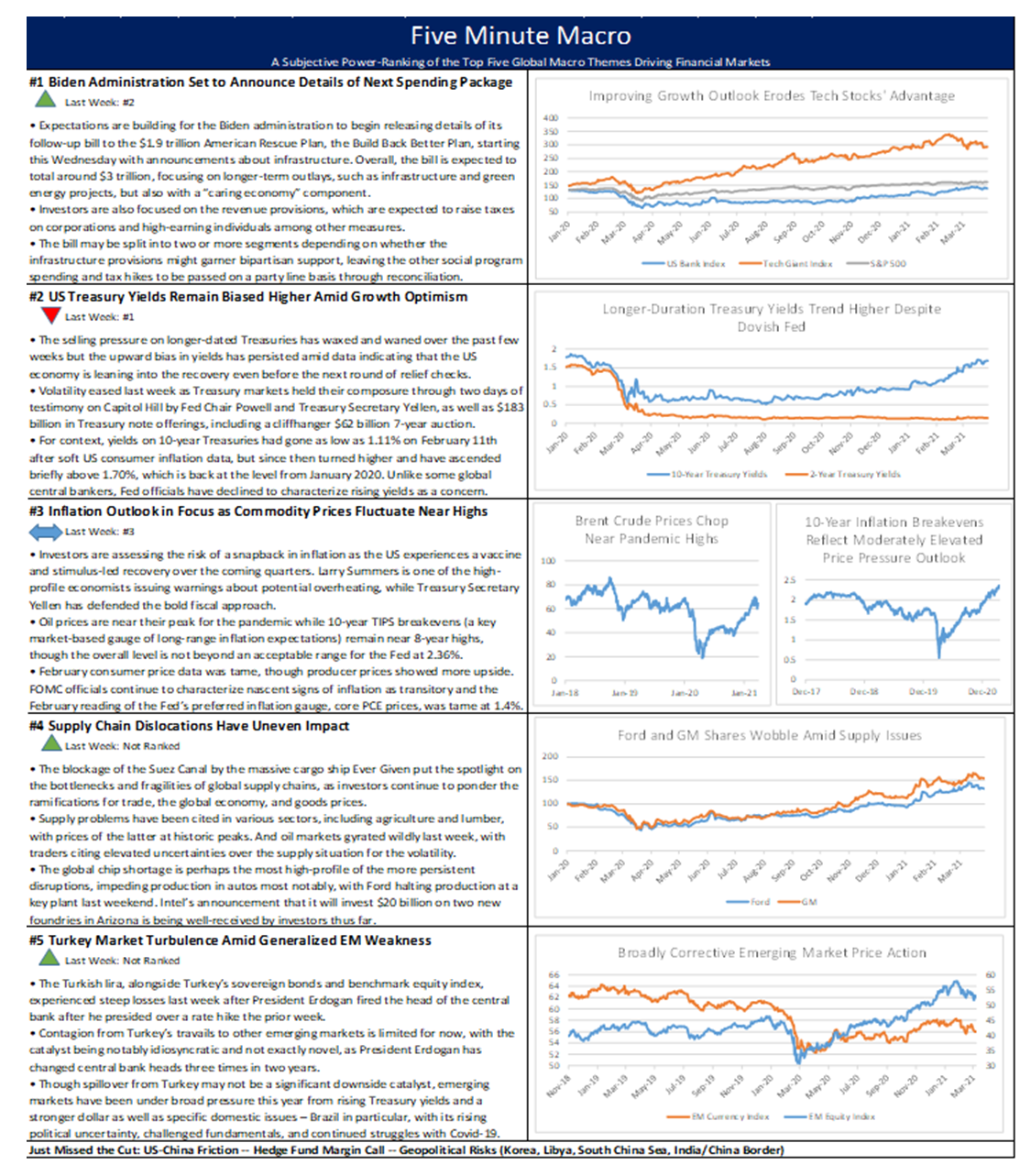

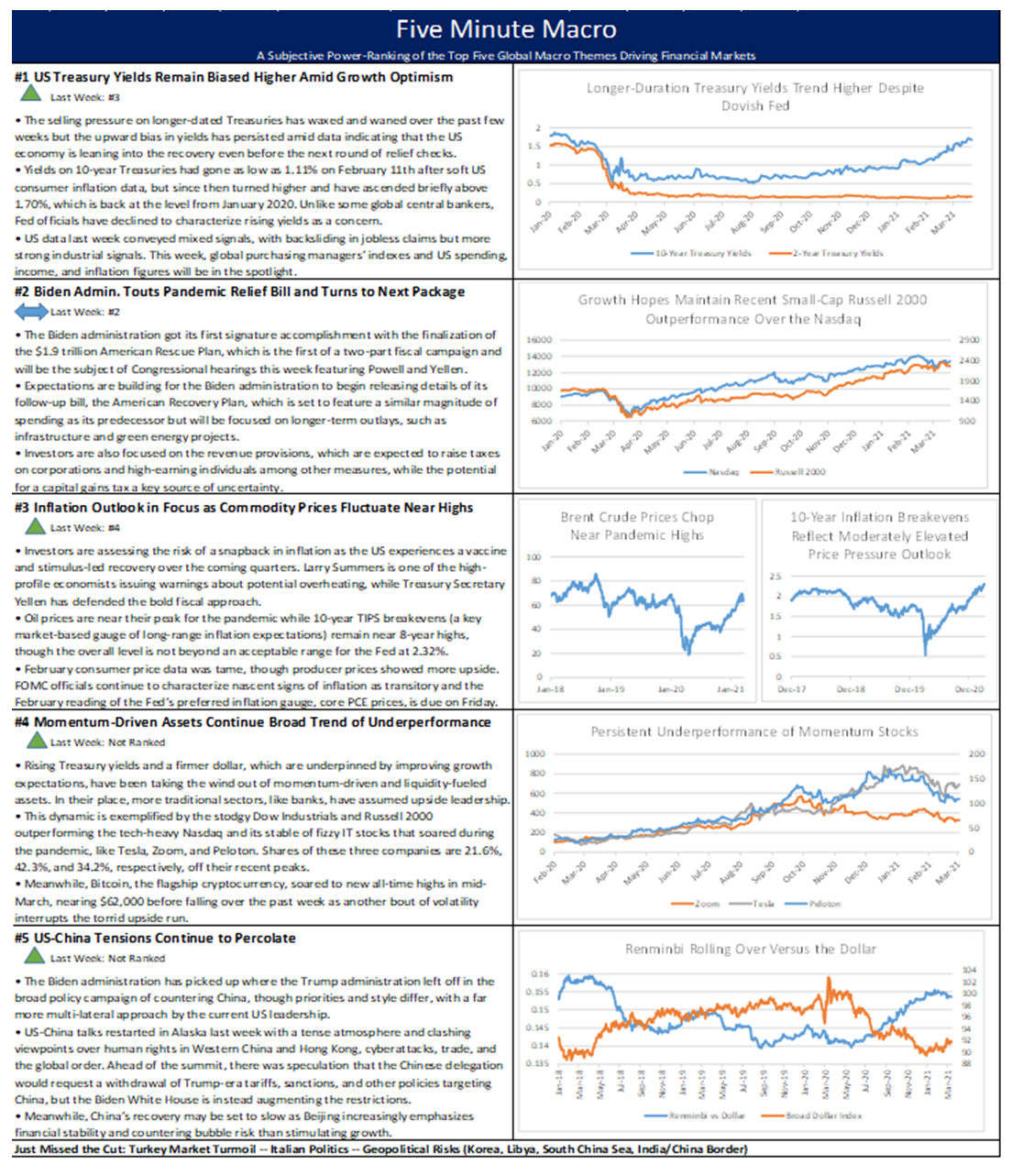

Fluctuating Treasury yields remain the driving force behind market moves, followed by the Biden Build Back Better bill. Inflation remains a major concern, which has taken the wind out of momentum driven asset performance. Finally, China relations continue to percolate.

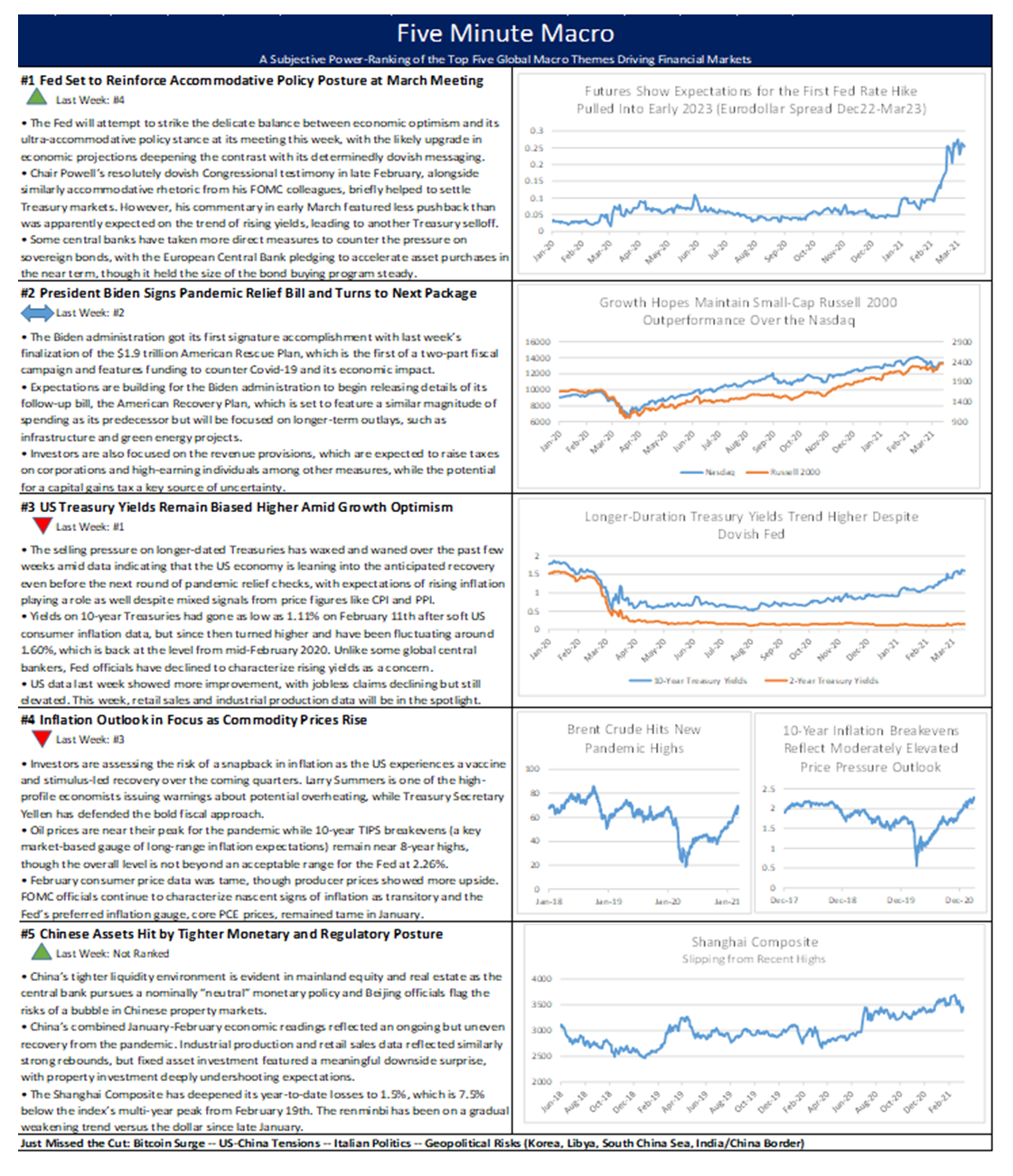

The Fed meeting and Stimulus plans are front and center on market participant’s minds. However, rising Treasury yields and concerns over rising inflationary pressures lurk. Finally, Chinese markets sell off due to tighter monetary and regulatory decisions.

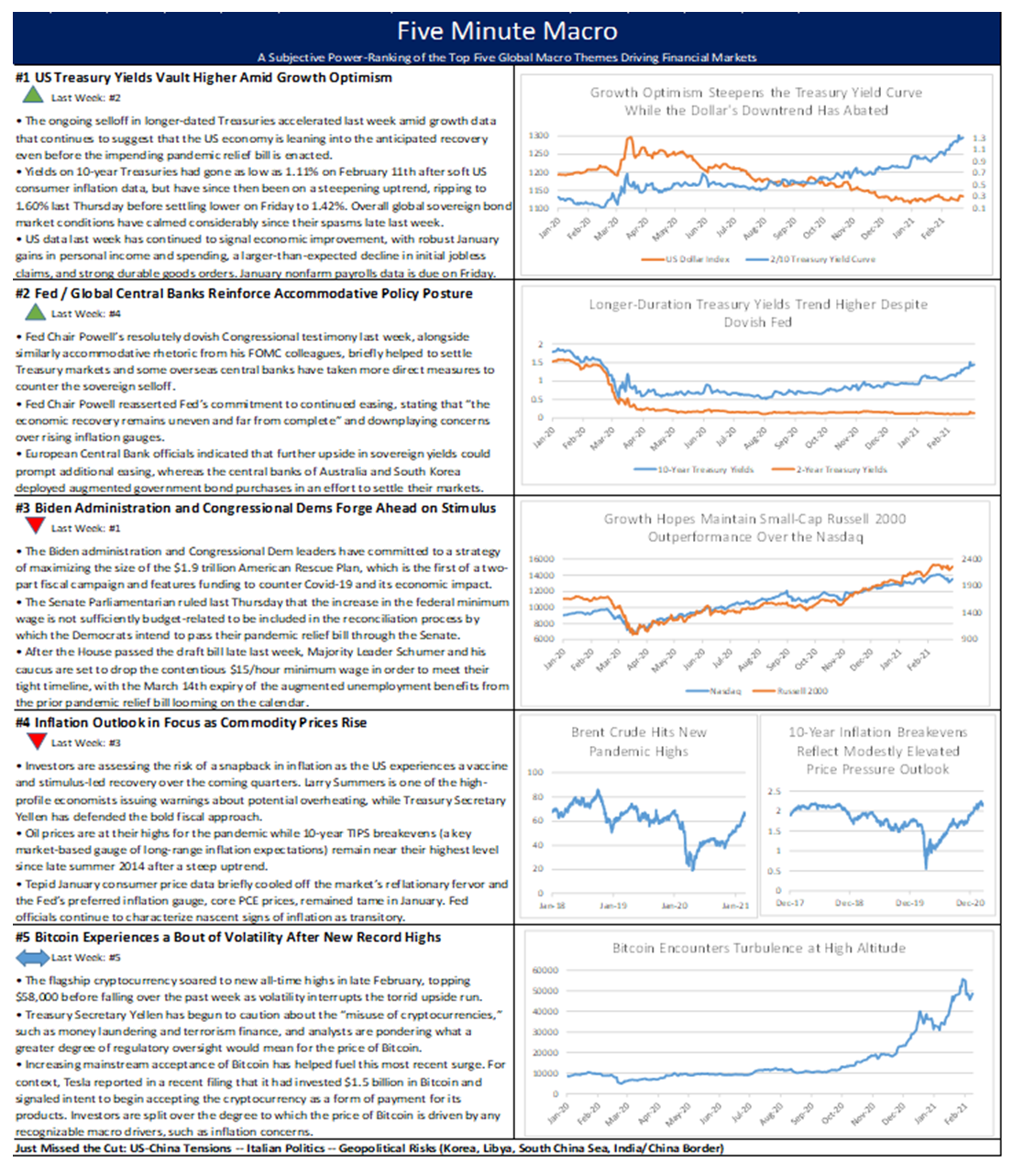

In this week’s Five Minute Macro, elevating Treasury yields moves into the first spot, followed by accommodative central banks. The Covid relief bill moves down to third and the inflation forecast into fourth, with Bitcoin highs remaining at the fifth spot.

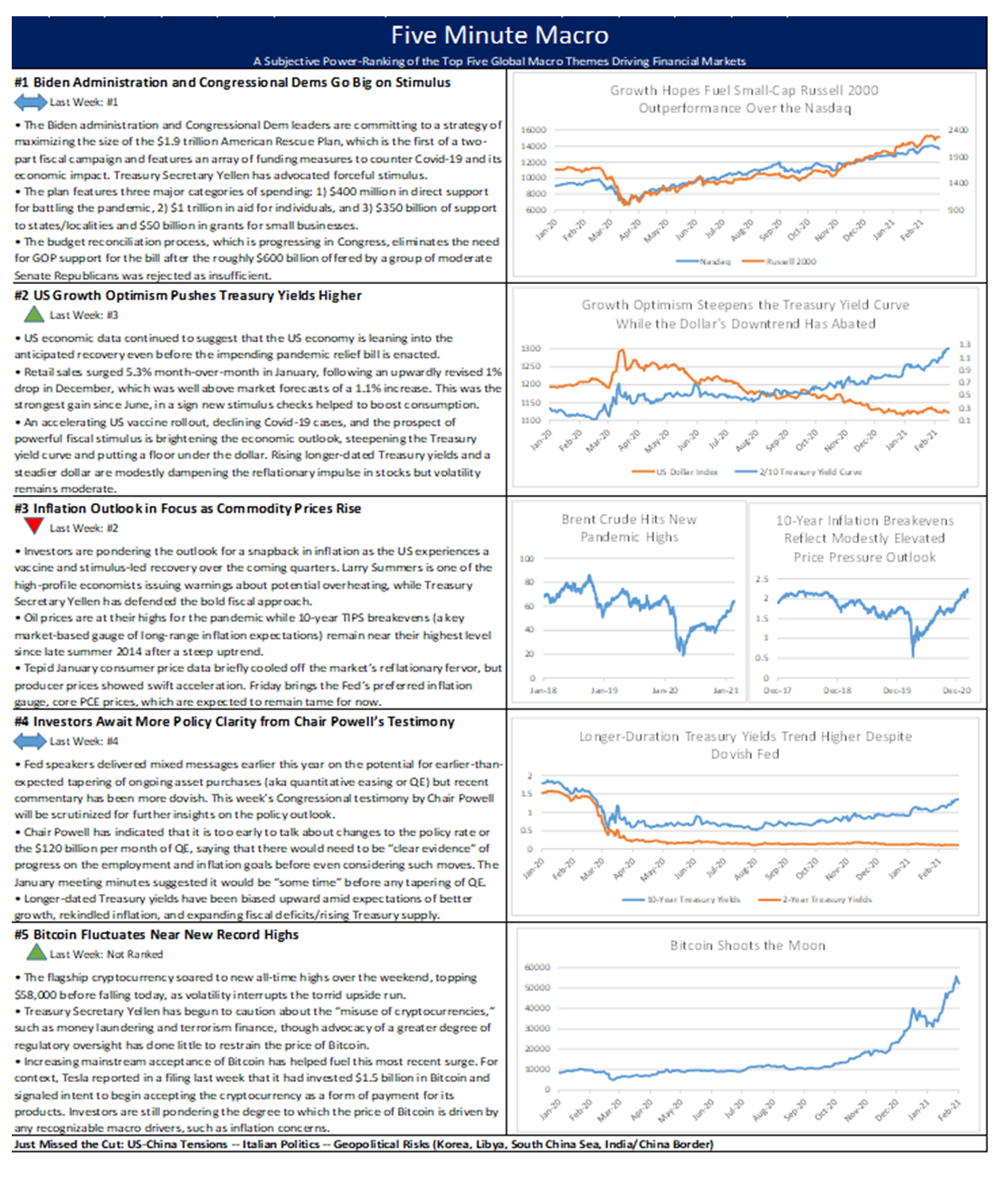

In this week’s 5 Minute Macro stimulus spending remains in the tops spot, with higher Treasury yields moving up to the second spot and inflation outlook dropping a spot. Powell’s testimony to Congress and Bitcoin at new highs round out the top five.

Summary and Price Action Rundown

US equities chugged higher today as January’s highly-anticipated jobs report evidenced modest improvement but missed estimates, pulling the dollar off its recent multi-month highs. The S&P 500 added 0.4% to register its second consecutive record close, bringing the ascent for the index to 4.7% on the week and 3.5% year-to-date. The Euro Stoxx Index posted similar gains, while Asian equities were mostly higher overnight. A broad dollar index retreated from its strongest level since early December after the moderately disappointing payroll figure, while longer-dated Treasuries remained under slight pressure, with the 10-year yield climbing to 1.17%. Brent crude advanced above $59 per barrel, spurred on by continued OPEC+ supply curbs and growing optimism over the demand outlook.

Nonfarm Payrolls Show a Tepid Jobs Rebound

After upside surprises in ADP payrolls and initial jobless claims data earlier this week, hopes had been raised for a more upbeat January jobs number. In January, the US economy added 49K jobs, missing the consensus estimate of a 100K rise. In December, COVID restrictions on businesses started to ease as case numbers and hospitalizations decreased and vaccine distribution increased. Last month saw notable job gains in professional and business services and both public and private education were offset by losses in leisure and hospitality, retail trade, health care, as well as transportation and warehousing. However, it is a small gain leaving the economy about 10 million jobs short from the peak in February 2020. Additionally, the change in total nonfarm payroll employment for November was revised down by 72K to 264K, and the change for December was revised down by 87K to -227K. With this, employment in November and December combined was 159,000 lower than previously reported.

Average hourly earnings rose by 6 cents to 29.96 or 0.2% after a 1% increase in December, below market expectations of a 0.3% gain. Average hourly earnings of private sector production and nonsupervisory employees did not change much at $25.18. The large employment fluctuations over the last few months complicate the analysis of recent trends in average hourly earnings, especially in industries with lower-paid workers. Year-on-year average hourly earnings have increased by 5.4%, the same as in the month before and above market expectations of 5.1%. – MPP view: This modest downside miss does little to dispel the overall impression that the US economy is leaning into the recovery before the double doses of stimulus are even really making much of an impact. The outsized move in the dollar seems to be more about trading dynamics after its sharp bounce rather than broader doubts about the US growth rebound, as the Treasury yield curve continued to steepen and the growth-sensitive Russell 2000 small caps outperformed meaningfully today, rising 1.4% to put year-to-date gains at a gaudy 13.1%.

Progress Toward Super-Sized Pandemic Relief Bill

The Biden administration and Congressional Democrats move ahead with unilateral approach to the American Rescue Act. After a night-long slog of partisan amendments, the Senate approved 51-50 a measure, with minor amendments, allowing Democrats to pass Biden’s relief plan through budget reconciliation. Votes for the measure fell strictly along partisan lines, with Vice President Harris casting the tie-breaking vote. Small amendments, including holding off on minimum wage increases and ensuring that wealthy Americans do not receive the $1400 stimulus payments, were added during the session, though none remain binding. The measure now returns to the House for a vote on the amended measure and, if passed, will proceed to the indicated committees for finalization by March. President Biden plans to meet with House Committee Chairs today to discuss the timeline of his rescue plan. The President spoke today emphasizing that the COVID-19 relief bill stands as a higher priority than bipartisanship, offering his strongest criticism of Republican lawmakers since taking office and indicated that the Democrats would go it alone. if necessary, to get needed aid to struggling Americans. Speaker Pelosi has stated that the budget resolution will be brought to the floor later today and that committees will begin working on the specifics of the bill starting Monday. Democratic leadership is pushing aggressively for the bill’s speedy passage in the wake of poor unemployment figures from December and standstill numbers in January. The US economy remains 9.9 million jobs below its pre-pandemic level. – MPP view: Though not every penny is likely to make it through, the Biden administration has strongly committed to the upper end of its stimulus spending range and put the marker down that it will aggressively pursue its legislative agenda, and so far it appears that Dem moderates like Senator Manchin are disinclined to stand in the way, all of which is positive for stocks and growth.

Additional Themes

Earnings Season Continues to Provide Little Direction for Stocks – Fourth quarter (Q4) corporate results continue to be overshadowed by overarching market themes, like the GameStop episode and the brightening growth outlook, and today’s calendar is light. Next week features the last major concentration of reports, with Twitter, GM, Coca-Cola, Disney, and Expedia among the most high-profile. With 292 of the S&P 500 companies having reported Q4 results so far, 74.7% have topped sales expectations and 81.2% have beaten earnings estimates, continuing the pandemic trend of overly conservative analyst forecasts. To this point, however, upside surprises on these quarterly figures have provided scant support for stock prices, though this week featured broadly more upbeat price action amid the waning volatility in short-squeeze stocks and better-than-expected growth data.

Regulators Focus on GameStop – Yesterday, Treasury Secretary Yellen convened a group of regulators, including the heads of the SEC and CFTC, as well as the Federal Reserve and New York Fed, to consider the proper policy response to this high-profile episode of significant market anomalies. Though no specifics of the meeting were published, a statement released by the Treasury indicated that the group would work to ensure that the events around GameStop and other affected stocks “are consistent with investor protection and fair and efficient markets” while characterizing market functionality during the episode proved “resilient.” Meanwhile, the House Financial Services Committee and Senate Banking Committee are preparing to hold hearings on this issue later this month. – MPP view: We certainly do not expect any hasty conclusions from regulators but we do expect meaningful follow-though and a policy direction that takes a more encompassing look at the evolution of systemic risk in the system, as well as considers specific regulatory fixes for discrete market issues, such as IPO allocations and retail investor protection.

Latest Podcast – On this week’s Macrocast, we unpack the complicated jobs report, discuss the Biden stimulus package and its critics, and take a moment to review the Trump economy — including discussing how the jobs numbers would have played out in an alternate universe with no pandemic. We also chat about the potential for a pandemic-related baby bust and its economic impact. Latest Macrocast

Looking Ahead – Next week, the focus will be on efforts to pass the American Rescue Act through the narrow straits of the slim Democratic majorities in both houses of Congress. On the data front, US inflation figures will be in the spotlight as market-based gauges of inflation expectations advance to multi-year highs.

Looking Ahead – Fresh Squeezed

A week ago, when shares of GameStop and other heavily-shorted companies were still soaring and exacting a heavy toll on the hedge funds caught offside, analysts had their heads on a swivel looking around for the next target of the Reddit WallStreetBets short-squeeze mob. The crosshairs locked onto silver, spiking it nearly 15% last Friday morning but, after a half-session head fake, it settled back down, with the CME not waiting long to dial up margin requirements on transactions in the precious metal. Another reason a silver short-squeeze never caught on seemed to be that positioning was not heavily short in the first place, despite what a few posts on Reddit apparently claimed, spurring plenty of dissention in the ranks of fellow Redditors.

In scanning for other areas of heightened investor vulnerability to countertrend price action, plenty of analysts flagged another asset with heavily-concentrated downside positioning that had recently halted its precipitous slide and had been showing signs of incipient reversal. But this was no penny stock or nearly bankrupt retailer but rather an asset that would be particularly insusceptible to even the most concentrated retail speculative energies – the US dollar.

Currency markets are notorious for wrongfooting consensus trades and bearish positioning on the dollar has been as consensus as they come. A fiscal flood + determined Fed dovishness + risk on = dollar weakness, right?

Sentiment on the dollar was similarly dire at the beginning of 2018, but positioning was not even as extreme as it is now, and the dollar refused to break lower for a few choppy months and then surged higher, as US economic outperformance took hold. At the time, gold prices sank and oil prices climbed (a somewhat atypical divergence), while the dollar marched upward in an almost uninterrupted two-month, 7% ascent, while US equities ran higher in tandem.

A similarly dollar- and risk-positive scenario, with US growth diverging to the upside from the G-10, may be emerging this year to upend consensus bearishness on the greenback. After a run of dismal December data amid the seasonal and mutated Covid-19 resurgence, further backsliding in early 2021 seemed like the clear base case, particularly given that that second pandemic relief bill in 2020 was delayed until late in the year. But recent US economic figures have been surprisingly resilient, despite a slight downside miss on January jobs numbers, and even outright strong in the case of housing market metrics and survey-based gauges like purchasing managers’ indexes (PMIs). Meanwhile, the Biden administration has decided that bipartisanship plays a distant second to their intent and urgency to deploy a super-sized pandemic relief package, while vaccine distribution appears to be picking up momentum after a slow start, with 35 million doses now administered and a trend that hits 100 million by mid-April – plus, the vaccines are deemed to be effective against the current set of mutations. And with the Reddit short-squeeze army regrouping in their barracks for now, the abatement of volatility has allowed investors to refocus on the brightening growth outlook.

One key distinguishing factor between the current setup and early 2018 is Fed policy. In 2018, Chair Powell was guiding the policy rate steadily upward, continuing the trajectory of 2017. Now, the FOMC is nearly unanimous in trying to tamp down speculation that they will taper their asset purchase program anytime soon, while “not even thinking about thinking about raising interest rates.” But it seems that the markets are skeptical, as futures continue to reflect expectations for incrementally earlier rate hikes than the Fed is projecting. Economic and market conditions later this year certainly seem aligned to test the Fed’s commitment to their current ultra-dovish formulation in the face of higher inflation and strong growth, which may be pivotal moment for any ongoing dollar rally.

Looking ahead to next week, the focus will be on efforts to pass the American Rescue Act through the narrow straits of the slim Democratic majorities in both houses of Congress. On the data front, US inflation figures will be in the spotlight as market-based gauges of inflation expectations advance to multi-year highs. The impeachment trial of former President Trump is also on the docket. Lastly, next week also features the last major concentration of fourth quarter earnings reports, with Twitter, GM, Coca-Cola, Disney, and Expedia among the most high-profile.

Global Economic Calendar: Price check

Monday

The week begins with German Industrial Production. In November, IP rose 0.9% m/m, following an upwardly revised 3.4% increase in October and above market forecasts of 0.7%. Output increased for intermediate and capital goods, while production of consumer goods decreased 1.7%. It is the 7th consecutive month of rising industrial production although it still was 3.8% lower than in February, the month before the pandemic began.

The evening brings the National Australia Bank’s Index of Business Confidence, which dropped sharply to 4 in December from an upwardly revised 13 in November, reflecting the impact of the Sydney COVID-19 outbreak. Sentiment deteriorated in all industries, except mining, construction, and transport & utilities. Meanwhile, business conditions rose to 14, the highest since September 2018, from 7 in November, with all three sub-indices were above average for the first time since early 2019. Capacity utilization saw further gains and is now around its long-run average and pre-virus levels, while forward orders pulled back but remain in positive territory. “The rise in the employment index is very encouraging and is consistent with the big gains we’ve seen in the official jobs data,” said Alan Oster, NAB Group Chief Economist.

Tuesday

German Balance of Trade kicks off the day. The trade surplus narrowed slightly once again to EUR 17.2 billion in November from EUR 18.5 billion a year earlier. Exports decreased 1.3% to EUR 111.7 billion, the 9th straight annual decline and imports edged down 0.1% to EUR 94.6 billion. Sales to the EU declined 1.7% and those to the Eurozone were down 2.2%. Shipments to China increased 14.3% while those to the US fell 3.1%. Imports from the EU went up 2.6% and those from China 5.4%, while purchases from the US fell 1.5%.

The NFIB Small Business Optimism Index fell to 95.6 in December, the lowest since May and compared to 101.4 in November. This month’s drop is one of the largest as the outlook of sales and business conditions in 2021 deteriorated sizably. Small businesses are concerned about new economic policy in the new administration and a further spread of COVID-19 that is causing renewed government-mandated business closures across the nation.

The Jobs and Labor Turnover Survey (JOLTS), showed the number of job openings in the US declined by 105 thousand to 6.527 million in November, remaining below its pre-pandemic level of 7 million. Job openings decreased in durable goods manufacturing by 48K, information by 45K, and educational services by 21K. The number of job openings was little changed in all four regions. Meanwhile, the number of hires rose by 67K to 6.0 million, while total separations including quits, layoffs and discharges, and other separations jumped by 271K to 5.4 million.

The Consumer Price Index in China closes out the day. In December the CPI rose by 0.2% y/y, after a 0.5% fall a month earlier and compared with market consensus of a 0.1% gain. Food prices increased 1.2%, reversing from a 2.0% fall in November, amid adverse weather and rising demand ahead of the Lunar New Year festival. Pork prices fell less after soaring last year due to the African Swine outbreak. Also, there were rises in cost of health, education, and other goods and services. At the same time, prices of household goods and services were flat for the second straight month, while cost fell for transport, rent, fuel, and utilities, and clothing. On a monthly basis, CPI increased by 0.7%, the most since February, after a 0.6% fall in November. For full 2020, consumer prices rose 2.5%.

Wednesday

Continuing the inflation data this week the day begins with the German consumer price index CPI. In January, the CPI increased 1% y/y, the first rise in seven months, preliminary estimates showed. The temporary reduction in the VAT rate aimed to revive the economy during the coronavirus crisis ended on December 31st. Higher CO2 prices and an increase in minimum wages from January also accounted for the CPI rise. On a monthly basis, inflation increased to 0.8% from 0.5%. The harmonized index went up 1.6% year-on-year and 1.4% month-over-month.

In the US, CPI increased 0.4% m/m in December, higher than 0.2% in November and in line with expectations, mainly driven by an 8.4% increase in the gasoline index, which accounted for more than 60% of the overall increase. The other components of the energy index were mixed, resulting in an increase of 4% for the month. The food index rose 0.4% in December, as both the food at home and the food away from home indexes increased 0.4%. Other increases were also seen for shelter, apparel, and new vehicles. Furthermore, Core CPI, which excludes volatile items such as food and energy, rose 0.1% m/m, following a 0.2% increase in November and matching market expectations.

Wholesale Inventories increased 0.1% m/m in December, following a flat reading in November. Nondurable goods inventories rebounded while durable ones stalled, following a 0.7% rise in October.

The day closes with the Westpac Consumer Confidence Index. Consumer Confidence in Australia decreased to 106.99 points in January from 112 points in December.

Thursday

The focus on a light data day will be US Initial and Continuing Jobless Claims. In the last week of January, 779K Americans filed for unemployment benefits, a significant decrease to from the previous week’s level of 812K, and also well below market expectations of 830K. It marks the third straight week of falls in claims and the lowest amount since the last week of November, however, still far above pre-pandemic levels of around 200K.

Friday

The UK Trade Deficit rose to GBP 5 billion in November from an upwardly revised GBP 2.3 billion in October. It was the largest monthly trade shortfall since April of 2019. Imports surged 8.9% to GBP 55.3 billion, as an 11.9% jump in purchases of goods more than offset a 1.1% decrease in acquisitions of services. Exports rose at a slower 3.9% to GBP 50.3 billion, as goods shipments increased 7.5% while services sales were down 0.3%.

UK Industrial Production edged down 0.1% m/m in November, compared to market forecasts of a 0.5% gain. It is the first decline in industrial output since a record 19.6% plunge in April, as the country was under another lockdown during the month of November to prevent the spread of the coronavirus. The decline was led by falls in mining and quarrying, electricity and gas and water and waste. In contrast, factory output rose 0.7%, led by transport equipment. Production output was 4.7% below February of 2020, the previous month of “normal” trading conditions, prior to the coronavirus pandemic. Year-on-year, industrial output sank 4.7%.

Eurozone Industrial Production rose 2.5% m/m in November 2020, a seventh consecutive month of growth and compared with market expectations of a 0.2% increase. Capital goods output jumped 7.0% and intermediate goods production advanced 1.5%. Meanwhile, output of durable consumer goods, such as televisions and washing machines, dropped 1.2%, after a 1.5% rise in the previous month. Production also fell for both energy and non-durable consumer goods.

The University of Michigan’s Preliminary Consumer Sentiment for February will close out the week. In January the index was revised lower to 79 from a preliminary of 79.2 and below 80.7 in December. There was a decrease in the assessment of current economic conditions, while the expectations component improved slightly. On the price front, both one-year inflation expectations and five-year were unchanged at 3% and 2.5%, respectively. “The overall level of the Sentiment Index has shown only relatively small variations since the pandemic started, averaging 81.5 in 2020, marginally above January’s 79.0. Needless to say, sentiment levels were well below the average of 97.0 from 2017 to 2019. Importantly, the level of key confidence indicators remained well above prior cyclical lows despite the sudden historic collapse in economic activity.”