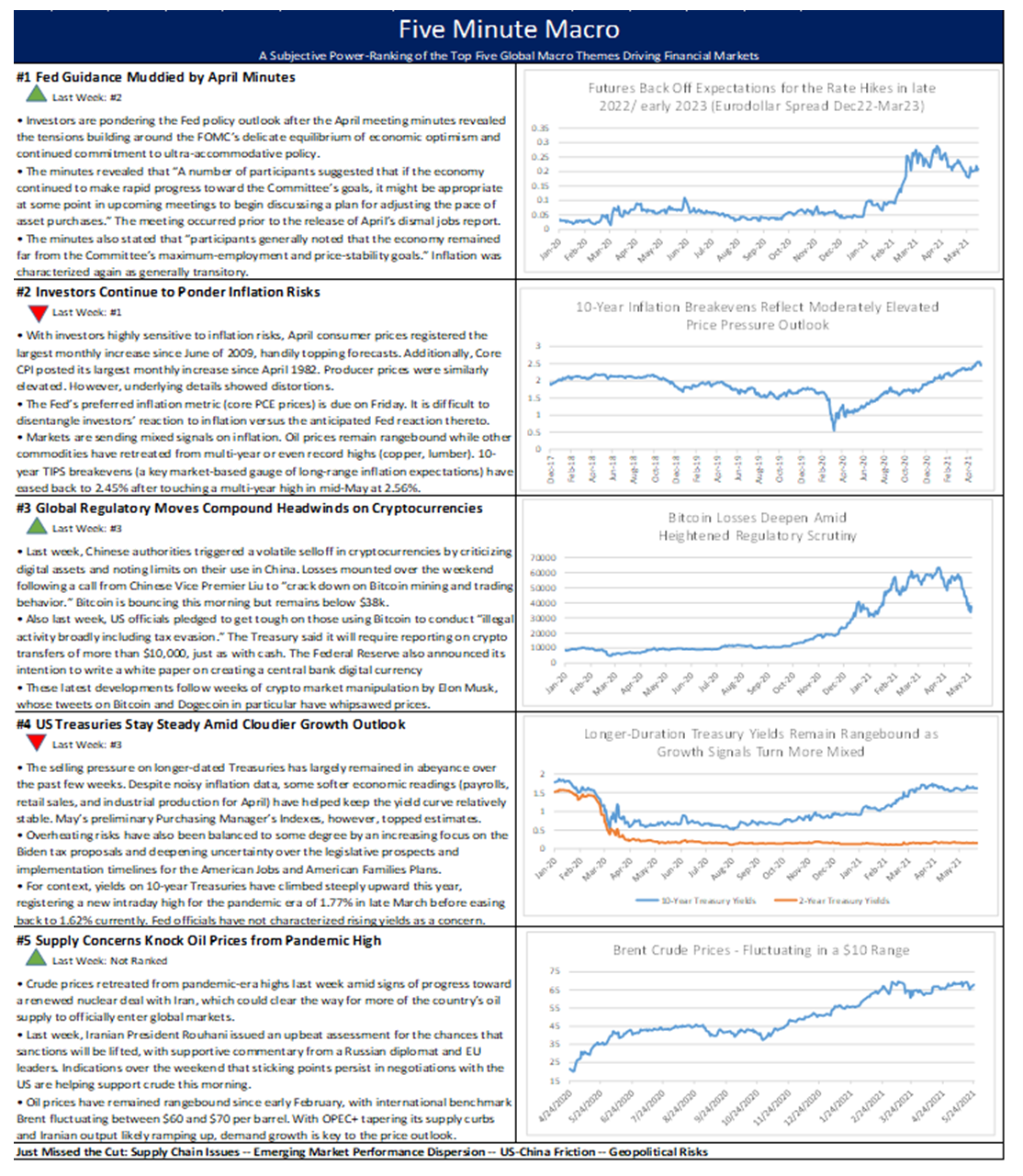

Fed guidance muddied by minutes and inflation are front and center on investor’s minds. Crypto regulation roils markets, while the Treasury market remains steady. Finally, supply concerns hit oil prices.

Fed guidance muddied by minutes and inflation are front and center on investor’s minds. Crypto regulation roils markets, while the Treasury market remains steady. Finally, supply concerns hit oil prices.

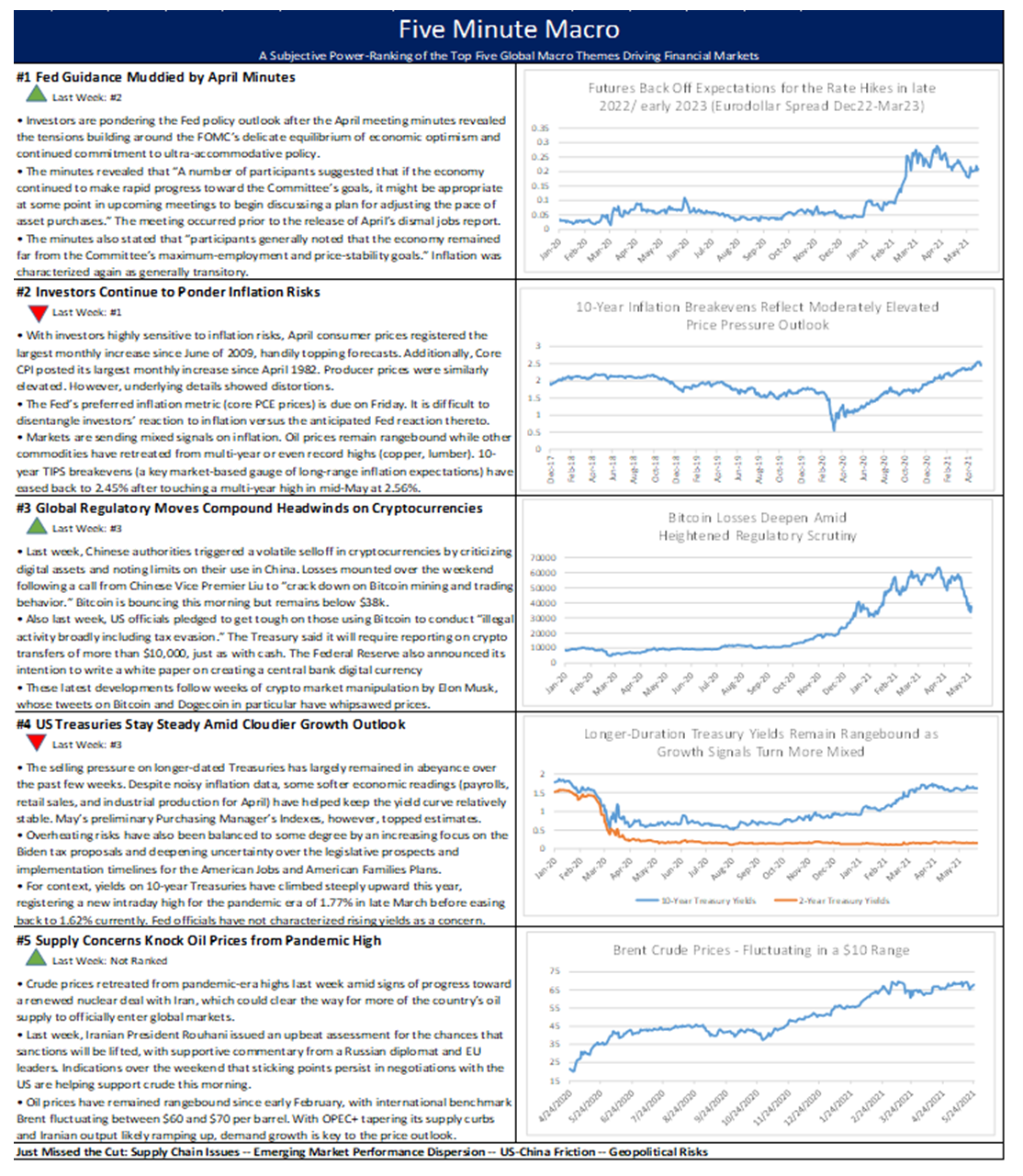

Rising inflation coupled with weak growth data remain the focus of markets. Treasury yields remain steady while regulators closely watch crypto markets. Finally, supply chain disruptions remain in focus.

Summary and Price Action Rundown

Global risk assets are mixed this morning as market participants digest last week’s rally and ponder the outlook for inflation amid high and rising commodity prices. S&P 500 futures indicate a 0.1% higher open after the index advanced 0.7% on Friday to surmount the prior week’s record high, taking year-to-date gains to 12.7%. The tech-heavy Nasdaq is set to open slightly lower after it outperformed on Friday amid doubts over the growth outlook following the lagging nonfarm payroll data. EU equities are moderately lower this morning while Asian indexes were mostly higher overnight. Longer-dated Treasuries are steady, with the 10-year yield holding at 1.58%, near the middle of its recent range. The broad dollar index remains unable to rally, sliding back to four-month lows. Oil prices continue to fluctuate at the top end of their recent range, with Brent crude nearing $69 as traders ponder the ramifications of the US pipeline shutdown (more below).

Inflation in Focus Ahead of Key Data as Commodity Price Pressures Percolate

The prospect of higher gasoline prices in the US after a cyberattack over the weekend shut down a key East Coast pipeline is spurring further attention on price pressures, with an array of US inflation data due later this week. The continued disruption of the Colonial Pipeline due to a ransomware attack over the weekend is raising the specter of gasoline shortages in the eastern US ahead of the start of the summer driving season, when millions of stir-crazy Americans are eager to hit the road. As the White House forms a task force to confront the issue, traders are grappling with the ramifications for oil and gasoline prices. US benchmark WTI crude prices are moderately higher at $65.21 per barrel but remain below their recent peak in early March of $66.09, while futures markets remain consistent with prices settling lower over the coming quarters. Gasoline futures have been more volatile, with the June contract spiking over 4% at the outset of trading but have since settled to a more modest gain of 1.5%. While oil and gasoline prices are elevated relative to pandemic-era levels but not compared to historical peaks, other commodities, like copper and lumber, are registering all-time highs. Earnings reporting season featured management broadly agreeing with the Fed’s view that these price pressures are temporary and that supply bottlenecks will be cleared over the coming year to alleviate the price picture. However, uncertainty among investors over the issue of inflation remains considerable and this week’s US consumer, producer, and import/export price data will be scrutinized for signs of continued upside momentum after the March readings greatly outpaced estimates. Breakevens on 5- and 10-year TIPS, which are the main market-based gauges of long-run inflation expectations, are at cycle highs of 2.70% and 2.50%, respectively. Though these levels are not obviously out of line with the Fed’s average 2% inflation mandate given the amount of time the gauge has spent under 2%, their recently renewed uptrend is notable. – MPP view: We don’t doubt that a supply response can be mustered over the coming quarters to moderate these price dynamics, while US growth outperformance should help firm up the dollar and moderate the reflationary impulse, which should help validate the Fed’s expectations over the next year that price pressures settle down. But our long-run view is for a secular shift to a higher plane of inflation as globalization gradually rolls back and the pendulum shifts back from the disinflationary paradigm of the last decade.

Cryptocurrency Follies Over the Weekend Highlight the Task Ahead for Treasury and the SEC

After Elon Musk called popular cryptocurrency Dogecoin a “hustle” during an appearance on Saturday Night Live, sending the coin down over 30% last weekend before partially recovering, other crypto assets are relatively unmoved by the drama. Bitcoin is slightly lower this morning while Ethereum is hitting a new record high even as the crypto community ponders the significance of the mixed messages from Dogecoin’s most famous proponent. Ahead of his jocular dig against Dogecoin on the show, Musk had stirred up more excitement over his appearance by including the coin’s Shiba Inu dog in a promotional tweet the prior day. Perhaps providing some support to the beleaguered cryptocurrency was news that Musk’s SpaceX paid for a moon satellite mission entirely with Dogecoin. Given Dogecoin’s roots as a parody of Bitcoin, some analysts are speculating that its travails are beneficial to the more mainstream cryptocurrencies rather than a poor reflection on the asset class in its entirety. – MPP view: We continue to expect that the process of mainstreaming cryptocurrencies will involve further meaningful challenges to their valuations as Treasury and the SEC establish increasingly bright-line and robust regulatory and tax oversight. Please see our video below for a discussion on the regulatory outlook for crypto.

MPP Video: The Crypto Dome – Markets Policy Partners enters the Nucleus195 Crypto Dome, joining Adam Blumberg from Interaxis to discuss the shifting regulatory environment for cryptocurrencies, how the Treasury is likely to work in conjunction with the SEC, and what it all means for RIA’s and the individual investor. MPP Crypto Video

Additional Themes

UK Pound Rallies as Scottish Independence Movement Hits Potholes – The Scottish National Party, which is intent on pushing toward another vote on Scotland’s independence from the UK, fell one seat short of an outright majority in the Scottish parliament but upped its tally to 64 of the 129 seats. Combined with the Green Party, analysts expect a strong pro-independence majority but still foresee a difficult road ahead for the movement. UK Prime Minister Johnson opposes another independence referendum for Scotland following the 2014 vote which resulted in a win for the unionists, though it is not clear if he will be able to block the effort. Market participants contemplate a lengthy process, clearing the near-term outlook for the pound, which is 0.8% higher versus the dollar this morning to re-approach February’s multi-year high.

MPP Video: NFP Shocker – Brendan and John discuss the disappointing jobs number, the new Fed messaging and the patent waiver proposal. Enjoy the weekend! MPP Macro Video

Latest Podcast – Well That Number Was Unexpected – Tony, John, and Brendan are joined by Stratton Kirton, Managing Director at HPS, to break down the surprising April jobs numbers. The gang discusses why predictions may have missed the mark and what the numbers mean for the state of economic recovery. They also discuss Treasury Secretary Janet Yellen stepping on the Fed’s toes and the implications of the Biden administration’s COVID-19 vaccine patent decision. Latest Macrocast

Looking Ahead – This week features a major array of economic data, with the US consumer price index (CPI), the producer price index (PPI), retail sales, and industrial production, initial jobless claims, consumer sentiment, and small business optimism all due. Global inflation readings will also be in focus, with China’s CPI and PPI, along with CPI for Germany and France. UK GDP and EU industrial production data is also on the calendar, amid a recent trend of upside surprises for regional economic figures. The barrage of Fed communications will continue, with Vice Chair Clarida, Fed Governor Brainard, and hawkish outlier Dallas Fed President Kaplan all delivering remarks. OPEC will also issue its monthly oil report with crude prices fluctuating at recent highs.

Despite mixed growth signals, Treasury yields remain steady, while there continues to be more and more signs of inflationary pressures. Meanwhile, the disappointing jobs number bolsters the Fed’s dovish guidance, which is contributing to a weakening of the dollar. Finally, Dogecoin follies highlights the conundrum the sector poses for regulators.

Summary and Price Action Rundown

US equities hit new records today as disappointing US jobs data eased overheating fears and reinforced the accommodative policy posture of the Federal Reserve, keeping Treasuries tame and sinking the dollar. The S&P 500 advanced 0.7% today to surmount last week’s record high, taking year-to-date gains to 12.7%. The tech-heavy Nasdaq outperformed as a hint of doubt crept in over the growth outlook following the lagging nonfarm payroll data. The Euro Stoxx Index also registered solid gains while Asian bourses were mixed overnight. Longer-dated Treasury yields fluctuated but closed little changed, with the 10-year edging up to 1.58%, while the dollar fell back to a more than two-month low. Oil prices continued to chop near the top of their recent range, with Brent crude closing just above $68 per barrel.

April Jobs Figures Miss Estimates by a Country Mile

After a series of economic readings earlier this week that were strong but slightly below expectations and encouraging initial jobless claims yesterday, the nonfarm payroll tally for last month was a major disappointment, lending further credence to the Fed’s cautious guidance. The US economy added 266 thousand jobs in April, following a downwardly revised 770 thousand rise in March and well below market expectations of 978 thousand, as employers face worker shortages. Job gains were centered in leisure and hospitality, with 331 thousand and local government education with 31 thousand. However, these gains were partially offset by losses in temporary help services, losing 111 thousand and in couriers and messengers, losing 77 thousand. Jobs also fell 18 thousand in manufacturing and 15 thousand in retail trade and were unchanged in construction. In April, nonfarm employment is down by 8.2 million, or 5.4%, from its pre-pandemic level in February 2020. Furthermore, the unemployment rate rose to 6.1%, from 6.0% in March and well above market expectations of 5.8%, as more workers began looking for work and re-entered the labor market. The number of unemployed people increased by 102 thousand to 9.81 million and the number of employed was up by 328 thousand to 151.2 million, while the activity rate rose to 61.7% from 61.5%. Unemployment levels were down considerably from their recent highs in April 2020 but remained well above their levels prior to the coronavirus pandemic.” – MPP view: We’re going to see a lot of fluky numbers like this over the coming months but this downside surprise was consequential. Our base case had been that the market eventually would come around to believing the Fed’s guidance but not until the FOMC had been forced to get more explicit about the taper timeline – we may have to reassess this as today’s data is making more market participants true believers (like we are) in the Fed’s staunchly accommodative posture.

Fed Communications Focus on the Long Path to Recovery

Sagging payrolls underscore the Fed’s cautious messaging, as markets reprice policy expectations to align more closely with the dovish guidance. During a call with reporters earlier this morning, Minneapolis Fed Chair, Neel Kashkari, said it was essential to maintain the current ultra-accommodative monetary policy stance following the dramatically substandard monthly gain in US jobs. The regional Fed president noted that today’s subpar jobs report is an example of just how far the economy remains from the Fed’s employment goals, and he doesn’t “see any reason right now to change something that is working.” Kashkari expressed that the most important step right now is “to rebuild this labor market and put them back to work,” and in the future, “there will be plenty of time to normalize monetary policy,” he said. In a separate speech this morning, Richmond Fed President, Thomas Barkin, speculated that today’s disappointing jobs figure might be attributable to the growing challenges of matching unemployed job-seekers to available positions. He additionally conjectured that the stimulus checks deployed earlier this year are allowing low-wage workers to be “a little choosy” when selecting from available positions.

Elsewhere, Treasury Secretary Yellen spoke during today’s White House press briefing, and stated that while “today’s jobs report underscores the long haul climb back to recovery,…the 266,000 jobs added in April represent continued progress,” and “we should also be encouraged by the ongoing expansion of the labor force.” She continued on to state that “we will reach full employment next year.” Nonetheless, Yellen noted the unevenness present within the labor market recovery, and tied the Biden administration’s $4 trillion fiscal plans to invest in American families and workers to achieving “a strong, prosperous economy this year and in 2022,…[and to] our country’s long-term economic health.” President Biden additionally delivered remarks today and firmly defended his $1.9 trillion pandemic relief package. “When we passed the American Rescue Plan, I want to remind everybody, it was designed to help us over the course of a year, not 60 days,” he said. Markets reacted accordingly to today’s overall discourse, broadly improving as the continuation of fiscal and monetary support was again firmly acknowledged by lead policymakers. Yields on the benchmark 10-year Treasury fell below 1.5% this morning, though bounced back to 1.58%, with futures markets repriced rate expectations to incrementally push back the anticipated timing of hikes. – MPP view: Please see our Market Viewpoint this weekend for a deeper dive into the Federal Reserve outlook.

Additional Themes

MPP Video – Brendan and John discuss the Biden administration and its proposed $1.8 trillion American Families Plan, which is the more social and softer infrastructure-focused. The all-important Fed communications and what a massive earnings season. Enjoy the weekend! MPP Macro Video

MPP Video: The Crypto Dome – Markets Policy Partners enters the Nucleus195 Crypto Dome, joining Adam Blumberg from Interaxis to discuss the shifting regulatory environment for cryptocurrencies, how the Treasury is likely to work in conjunction with the SEC, and what it all means for RIA’s and the individual investor. MPP Crypto Video

Latest Podcast – Well That Number Was Unexpected – Tony, John, and Brendan are joined by Stratton Kirton, Managing Director at HPS, to break down the surprising April jobs numbers. The gang discusses why predictions may have missed the mark and what the numbers mean for the state of economic recovery. They also discuss Treasury Secretary Janet Yellen stepping on the Fed’s toes and the implications of the Biden administration’s COVID-19 vaccine patent decision. Latest Macrocast

First Quarter (Q1) Earnings Season Wraps Up with Stellar Headline Numbers and Muted Market Reactions – The overarching theme of Q1 earnings season was the lack of apparent investor enthusiasm over blockbuster headline results, suggesting that much good news was already priced into stocks. A key subplot was management commentary on rising input costs and the potential for those increases to abate over the coming quarters as supply chains are reassembled. Overall, among the 438 of the S&P 500 companies that have reported, 70.7% have topped sales estimates and 87.0% have beaten earnings forecasts, which are historically high rates of upside surprises. Nevertheless, reporting companies have, on average, experienced a 0.2% decrease in share price in the trading session following the release of their results, and while the S&P 500 is up 2.2% since the start of earnings season.

Looking Ahead – Next week will be a major week of economic data, with the US consumer price index (CPI), the producer price index (PPI), retail sales, and industrial production, initial jobless claims, consumer sentiment, and small business optimism all due. Global inflation readings will also be in focus, with China’s CPI and PPI, along with CPI for Germany and France. Industrial production data for the EU is also on the calendar, amid a recent trend of upside surprises for regional economic figures. The barrage of Fed communications will continue, with Vice Chair Clarida, Fed Governor Brainard, and hawkish outlier Dallas Fed President Kaplan all delivering remarks. OPEC will also issue its monthly oil report with crude prices fluctuating at recent highs.

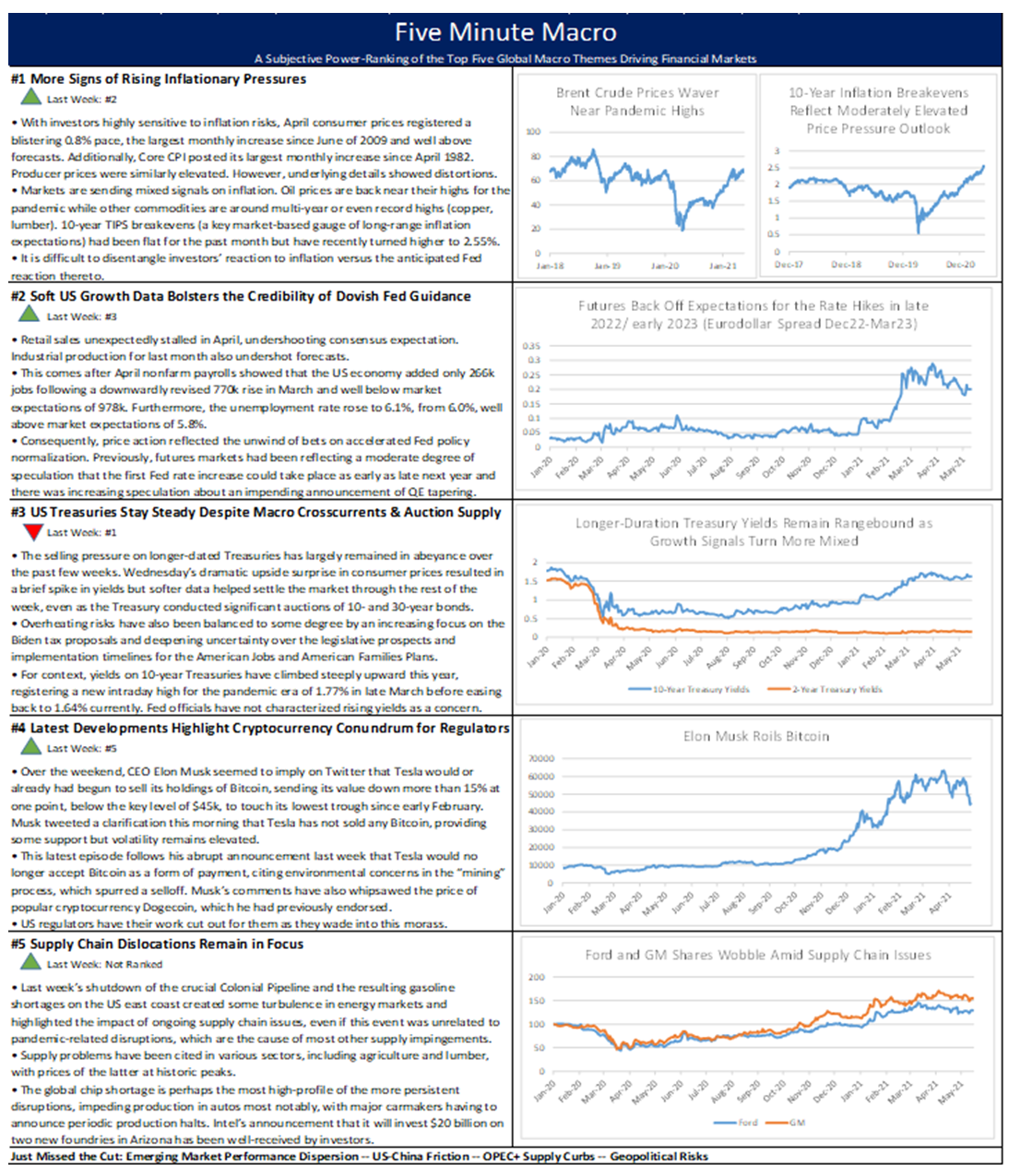

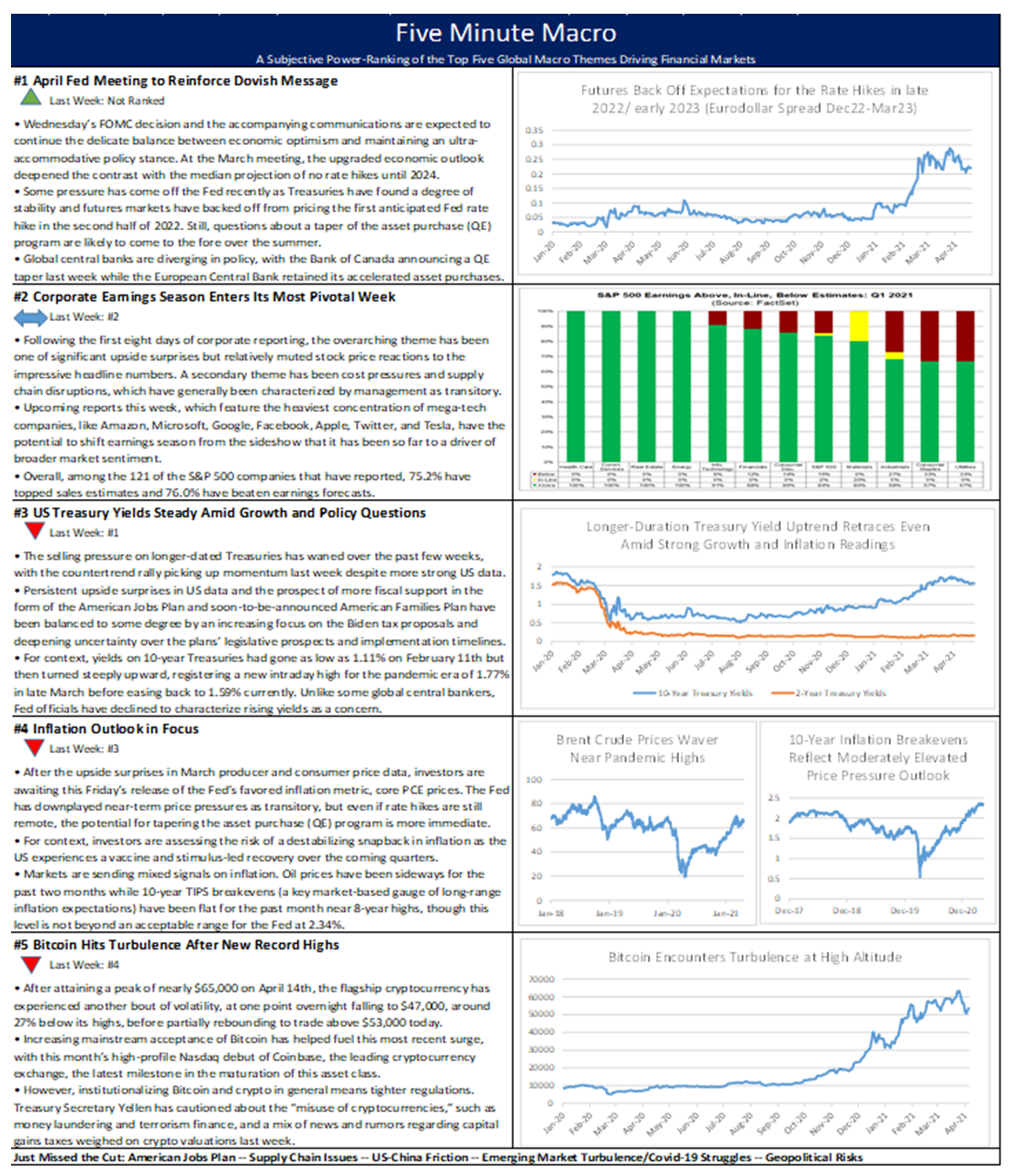

All eyes are on the Federal Reserve Meeting, while 1Q earnings season continues. Treasury yields remain steady while inflation concern continue to fester. Finally, Bitcoin volatility returns after hitting all-time highs.

Looking Ahead – Wile E. Coyote

We at Markets Policy Partners do not claim to be experts on cryptocurrency – if we were, we would probably be on a yacht somewhere rather than pounding out these briefings and reports. But while the crypto crowd can give you their latest prediction for the price outlook of Dogecoin or the merits of Ethereum versus XRP, they may not have as good a handle on how US policymakers are reorienting their approach to these assets under the Biden administration.

As we wrote this morning, Bitcoin, the flagship cryptocurrency, is trading below $50k today, which represents a 22% loss from its all-time high of nearly $64k last Thursday, with the ongoing downtrend accelerating over the past day amid news of the Biden administration’s reported proposal to hike the capital gains tax rate to 39.6% for those earning more than $1 million. These worries were compounded by rumors on Twitter yesterday that Treasury Secretary Yellen will advocate a capital gains rate of 80% on cryptocurrencies. Other popular cryptocurrencies, like XRP and Ethereum, are experiencing similar corrective episodes after their steep valuation gains year-to-date.

We doubt that Secretary Yellen will propose such a lofty capital gains tax rate targeting Bitcoin and cryptocurrencies – in fact, Treasury officials may well have had a chuckle over this probably unfounded report at their senior staff meeting this morning. But we cannot rule out its veracity, and neither should crypto speculators. US policymakers have all kinds of policy justifications for a more heavy-handed approach to an asset class that is associated with tax evasion, money laundering, and other illicit activities, not to mention being a vehicle for rampant speculation, securities fraud, and investor protection problems. It is certainly to the benefit of policymakers to keep the crypto crowd on notice, as rumors like this might on the margin curb some of the ongoing criminal behavior in this space and cool the speculative frenzy through the sentinel effect (i.e. Uncle Sam is watching). For US economic policymakers, a rough patch for Bitcoin also brings the benefit of suppressing the animal spirits that have been running wild in financial markets and have threatened to make the Fed’s job of maintaining appropriately easy monetary conditions harder to achieve without risking an adverse degree of asset price froth.

Over the past few months, we had pondered whether Bitcoin and crypto in general could buck the downtrend in other “bubble basket” assets (like Tesla and the ARK Innovation ETF) and keep diverging to the upside, but they finally appear to have had a Wile E. Coyote moment over the past week, where they stop running, look down, and drop. News that the Treasury will be more proactive in taxing cryptocurrencies should come as no surprise, but it seems to have for some – and we suspect that the process of mainstreaming Bitcoin will involve further meaningful challenges to its valuation.

Plus, investors are well aware that big, splashy IPOs/listings at market highs (like Coinbase last Wednesday) can mark an inflection point (Blackstone’s IPO in 2007 was a last hurrah for the financial sector, as was the Glencore IPO in 2011 for commodity prices). Yes, these are big cyclical industries and it is clear that cryptocurrencies play by a different set of market rules, but it would not be surprising if we look back on the past week as a turning point (at least an interim turning point) for the digital asset complex.

Looking ahead to next week, Thursday’s Federal Reserve decision is the headliner, which will be preceded by a Bank of Japan meeting overnight Monday, with both expected to retain their current dovish settings. On the data front, US personal income, spending, and prices (the Fed’s favored inflation metric) for March are due on Friday, with EU and German preliminary Q1 GDP prints earlier in the week, along with EU regional economic confidence gauges, China’s March PMI, and durable goods and jobless claims in the US. Meanwhile, corporate earnings reporting will feature the heaviest concentration of mega-tech companies, like Amazon, Microsoft, Google, Facebook, Apple, Twitter, and Tesla, which bring a greater potential for these reports to drive broader market sentiment.

Global Economic Calendar: Fed decision time

Monday

The Ifo Business Climate indicator for Germany rose to 96.6 in March, the highest level since June 2019 and comfortably above market expectations of 93.2. Companies became optimistic regarding developments over the coming months, while their assessments of the current situation were also better. Sentiment among manufacturers improved firmly as export expectations exploded due to strong demand from the US and China, while that among service providers also rose markedly. Business confidence among constructors was also back in positive territory and that among traders became less negative.

US Durable Goods Orders unexpectedly sank 1.1% m/m in February, compared to market forecasts of a 0.8% increase. It is the first decline in durable goods order in ten months, mainly due to a 1.6% drop in transportation, namely motor vehicles. Other declines were also seen in orders for computers and electronic products, fabricated metals, communication equipment, machinery and primary metals. Orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, dropped 0.8%, reversing from a 0.6% gain in January. Excluding transportation, new orders decreased 0.9% and excluding defense, new orders fell 0.7%.

The day closes with a Bank of Japan Interest Rate Decision. The BoJ left its key short-term interest rate unchanged at -0.1% and maintained the target for the 10-year Japanese government bond yield at around 0% during its March meeting, as widely expected. Meantime, the central bank decided to widen the band at which it allows long-term interest rates to move around its 0% target, amid efforts to make its ultra-easy policy more sustainable on the back of the COVID-19 pandemic and a continued battle to boost inflation. Policymakers removed their explicit guidance to buy ETF at an annual pace of roughly JPY 6 trillion, saying they would buy it when necessary and maintain a JPY 12 trillion ceiling for annual purchases. The BoJ also mentioned that it would allow long-term rates to move up and down by 0.25% from its target, instead of by 0.2%.

Tuesday

The S&P CoreLogic Case-Shiller 20-city home price index in the US jumped 11.1%y/y in January, following an upwardly revised 10.2% growth in the previous month and slightly above market expectations of 11%. It is the biggest annual increase in house prices since March of 2014. Phoenix, Seattle, and San Diego continued to report the highest year-over-year gains among the 20 cities in January. Considering the whole nine US census divisions, house prices increased 11.2%, the highest price growth since February of 2006 and following a 10.4% rise in November. House prices have been rising at faster pace in the past year amid strong house demand supported by low interest rates, the need of more space and as many people moved away from the big cities due to the coronavirus pandemic.

Retail sales in Japan declined by 1.5% y/y in February, following a 2.4% drop a month earlier and compared with market expectations of a 2.8% fall. Sales continued to fall for: general merchandise, fabrics, apparel & accessories, food & beverages, fuel, and medicine & toiletry. On the flip side, sales grew for motor vehicles, machinery & equipment, and others. On a monthly basis, retail sales rose by 3.1% in February, the most since June 2020.

The annual inflation rate in Australia unexpectedly was at 0.9% in Q4 2020, compared with market consensus and the prior quarter’s figure of 0.7%. This was the highest reading in three quarters, amid a rise in tobacco excise and the introduction, continuation, and conclusion of childcare fee subsidies and home building grants. Prices increased faster for both alcohol & tobacco and education. Also, there were rises in cost of food, furnishings & household equipment, and insurance & financial services. At the same time, cost of recreation & culture was flat. In contrast, cost fell further for housing, transport, clothing & footwear, and communication. On a quarterly basis, consumer prices also went up by 0.9%, after a 1.6% gain in Q3 and above forecasts of a 0.7% gain.

Wednesday

The GfK Consumer Climate Indicator in Germany increased to -6.2 heading into April, the highest level for five months and well above market expectations of -11.9, due to the gradual easing of lockdown measures to contain the rapid spread of coronavirus. However, the survey took place from March 3rd to 15th, before the extension of German lockdown until April 18th and the temporary suspension of Astra Zeneca COVID-19 shots. The income expectations sub-index increased 15.8 points to 22.3, while the gauge for economic outlook rose 9.7 points to 17.7, the willingness to buy indicator increased 4.9 points to 12.3, and consumer climate rose 2.8 points to -12.7 “Another hard lockdown will seriously damage the consumer climate and the current improvement will remain a flash in the pan”, GfK consumer expert Rolf Buerkl said.

Retail sales in Canada dropped 1.1% m/m in January, less than market forecasts of a 3% decline. Still, it marks the second consecutive month of falls in retail sales as the resurgence of COVID-19 cases led to the reintroduction of physical distancing measures, which directly affected the retail sector. Approximately 14% of retailers were closed at some point in January for an average of three business days. Sales at motor vehicle and parts dealers contracted 1 percent. Core retail sales which exclude gasoline stations and motor-vehicle, and parts dealers also posted their second consecutive decline, falling 1.4 percent because of lower sales at clothing and clothing accessories stores, furniture and home furnishings stores, and sporting goods, hobby, book and music stores. In contrast, sales at gasoline stations rose 0.9%.

Wholesale inventories in the US increased 0.6% m/m in February, after a 1.4% rise in January and above a preliminary estimate of a 0.5% advance. It was the seventh consecutive month of gains in wholesale inventories. Nondurable goods stocks rose 1.1% and durable goods inventories were up 0.3%. On a yearly basis, wholesale inventories advanced 2% in February.

The US Goods Trade Balance showed a record deficit record of $86.7 billion in February from $84.6 billion in January. Exports of goods were $130.1 billion, $5.1 billion less than January exports. The biggest decreases were seen in sales of capital goods, autos, consumer goods and food and beverages. Imports of goods were $216.9 billion, $3.0 billion less than in the previous month, dragged down by a 10.7% slump in purchases of autos.

The main event of the week will be a Fed Interest Rate Decision. Minutes of the last meeting in March showed Fed officials commented on the notable rise in Treasury yields and generally viewed it as reflecting the improved economic outlook, some firming in inflation expectations, and expectations for increased Treasury debt issuance. Also, the outlook for inflation is seen broadly balanced while supply disruptions and strong demand could push it up more than anticipated. The Fed also noted that asset purchases would continue at least at the current pace until substantial further progress toward maximum-employment and price-stability goals would be realized and highlighted the importance of clearly communicating its assessment of progress toward its goals well in advance of a change in the pace of asset purchases. At the meeting, the Fed left the target range for its federal funds rate unchanged at 0-0.25% and signaled a strong likelihood that there may be no rate hikes through 2023.

Thursday

The unemployment rate in Germany inched down to 4.5% in February, remaining close to the previous month’s five-and-a-half-year high of 4.6%, as the number of unemployed went down 0.3% to 2.01 million while employment was little-changed at 42.16 million. Still, the number of persons in employment in February was down by 1.7%, or 765,000, February 2020, the month before restrictions were imposed due to the coronavirus pandemic in Germany. The youth unemployment rate, measuring job seekers under 25 years old, declined to 6.1% percent from 6.3%.

Consumer prices in Germany increased 1.7% y/y in March, in line with preliminary estimates and following a 1.3% rise in February. It is the highest inflation rate since February of 2020 as the temporary reduction of the VAT rates ended. Reduced VAT rates came into effect on July 1st 2020 for six months, as part of government measures to support the economy during the pandemic. Higher commodity prices, a CO2 charge introduced at the beginning of the year and a base effect as last year the inflation fell, also contributed to the rise in the CPI. Main increases were seen for energy, namely heating oil, motor fuels, natural gas, fruit and dairy products and tobacco. On a monthly basis, consumer prices were up 0.5%, also in line with early estimates.

The Advanced Estimate of First Quarter GDP is expected to be 6.3%. The US economy expanded an annualized 4.3% on quarter in Q4 2020, higher than 4.1% in the second estimate, mainly due to an upward revision to private inventory investment that was partly offset by a downward revision to nonresidential fixed investment. Still, the expansion was slower compared to a record 33.4% growth in Q3 as the continued rise in COVID-19 cases and restrictions on activity moderated consumer spending. Considering full 2020, the GDP shrank 3.5%, the most since 1946 and following a 2.2% growth in 2019. The outlook for 2021 seems brighter than a few months ago as the vaccination campaign continues, the $1.9 trillion aid bill was approved, and Americans already started receiving stimulus checks.

Initial and Continuing Jobless Claims. Last week the number of Americans filing new claims for unemployment benefits dropped to 547 thousand from 586 thousand and now the lowest level since the beginning of the pandemic in March 2020. Claims came in well below market expectations of 617 thousand, as continued moves to reopen the economy continued to support the labor market, as now 50% of adults are vaccinated. An additional 133 thousand people filed for Pandemic Unemployment Assistance, up from the previous week’s which saw 131 thousand. Furthermore, continuing jobless claims, which measure unemployed people who have been receiving unemployment benefits for a extended period of time, fell to 3.67 million in the week ending April 10th, from 3.71 million in the previous period and in line with market expectations. In total, 17.405 million people received some sort of Federal assistance in the week of April 3, up from 16.913 in the previous week.

Pending home sales in the US fell 0.5% y/y in February, following an upwardly revised 13.5% rise in January. It is the first decline since May as interest rates edged up and supply was near all-time lows. On a monthly basis, pending home sales shrank 10.6%, the second consecutive month of declines. “The demand for a home purchase is widespread, multiple offers are prevalent, and days-on-market are swift but contracts are not clicking due to record-low inventory. Only the upper-end market is experiencing more activity because of reasonable supply. Demand, interestingly, does not yet appear to be impacted by recent modest rises in mortgage rates”, said Lawrence Yun, NAR’s chief economist.

Japan’s unemployment rate stood at 2.9% in February, unchanged from the previous month and slightly below market consensus of 3.0%. The number of unemployed was flat at 2.03 million in February, while employment rose by 30 thousand to 66.97 million. The non-seasonally adjusted labor force participation rate edged up to 61.9%. Meantime, the jobs-to-application ratio decreased to 1.09 from 1.10. A year earlier, the unemployment rate was at 2.4%.

Industrial production in Japan dropped 1.3% m/m in February, compared with a preliminary estimate of 2.1% decline and following a downwardly revised 3.1% jump a month earlier. The industries that mainly contributed to the decline were motor vehicles, electrical machinery, and information and communication electronics equipment, transport equipment, petroleum and coal products and food and tobacco, pulp, paper and paper products. On a yearly basis, industrial output fell 2.0% in February, after an upwardly revised 5.3% decrease in January.

The official NBS Manufacturing PMI for China rose to 51.9 in March from 50.6 in February, beating market consensus of 51.0. This was the highest reading since December 2020, as factories resumed their production after being closed for the Lunar New Year holiday. Output, new orders, and buying levels all grew the most in three months, export sales returned to expansion and employment rose for the first time in eleven months. As for prices, both input costs and output charges continued to rise at a solid pace. Looking ahead, business sentiment remained upbeat.

Friday

The consumer confidence index in Japan increased by 2.2 points from the previous month to 36.1 in March, the highest since February last year, as all main sub-indices have improved: overall livelihood, income growth, willingness to buy durable goods, and employment perceptions.

Germany will release First Quarter 2021 Flash GDP Estimates. The German economy expanded 0.3% on quarter in the last three months of 2020, much better than initial estimates of a 0.1% growth, led by an 8.3% jump in gross capital formation, namely in construction and inventories. Net trade also contributed positively while consumer and government spending shrank due to the second coronavirus wave and another lockdown imposed from November. Year-on-year, the economy contracted 3.7%. Full 2020 drop was revised lower to -4.9% from a preliminary -5.3%. The German economy is seen expanding 3% in 2021, according to government estimates from late January 2021.

The consumer price index in the Eurozone was confirmed at 1.3% y/y in March, the highest since January 2020, driven mainly by higher cost for services and energy. On the other hand, prices rose at a softer pace for non-energy industrial goods and food, alcohol & tobacco. The ECB has said already it is expecting a spike in headline inflation on the back of base effects and temporary factors, warning that it may even exceed the central bank’s target by the end of the year. Meanwhile, the annual core inflation, which excludes volatile prices of energy, food, alcohol & tobacco eased to 0.9% from 1.1% in February. On a monthly basis, consumer prices climbed 0.9% in March.

The Eurozone will release the Flash Estimate for First Quarter 2021 GDP. The Eurozone economy shrank by 0.7% in the fourth quarter of 2020, following a record 12.5% expansion in the previous three-month period and an unprecedent 11.6% contraction in the second quarter due to the COVID-19 crisis. Household consumption decreased by 3.0%, and net external demand contributed negatively to the GDP as exports rose less than imports. Meanwhile, fixed investment grew by 1.6% and changes in inventories added 0.6% points to growth. Among the bloc’s largest economies, France, Italy and the Netherlands contracted in the fourth quarter, while GDP growth in Germany and Spain slowed sharply. For the year 2020 as a whole, GDP fell by 6.6%, following a 1.3% expansion in 2019.

US Personal income declined 7.1% m/m in February, down from an upwardly revised 10.1% jump in January and compared to market expectations of a 7.3% drop. It is the biggest fall on record reflecting a decrease in government social benefits to persons. Within government social benefits, “other” social benefits, specifically the economic impact payments to households, decreased. The CRRSA Act authorized a round of direct economic impact payments that were mostly distributed in January.

US Personal spending declined 1.0% m/m in February, following an upwardly revised 3.4% growth in January and compared with market consensus of a 0.7% drop. It was the largest decline in consumer spending since the April 2020 record slump as the cold weather weighed on demand and the boost from a second round of stimulus checks faded. Consumption of durable goods slumped 4.7% and that of non-durable goods dropped 2.0%. Meanwhile, spending on services was up 0.1%. Real PCE fell 1.2% in February, due to decreases in spending for both goods and services.

The personal consumption expenditure price index went up 0.2% m/m in February of 2021, easing from a 0.3% rise in January. Cost of goods increased 0.3%, easing from a 0.6% advance in the previous month, while services inflation was steady at 0.2%. Excluding food and energy, Core PCE edged up 0.1%, slowing from a 0.2%. Year-on-year, the PCE price index advanced 1.6%, the biggest gain in a year as energy cost increased and the core index increased 1.4%.

The MNI Chicago Business Barometer increased by 6.8 points to 66.3 in March, the highest level since July 2018 and above market expectations of 60.7. Among the main five indicators, production saw the largest gain, followed by new orders while order backlogs saw the biggest drop. Through the first quarter the index gained 4.4 points to 63.2, the strongest reading since Q3 2018.

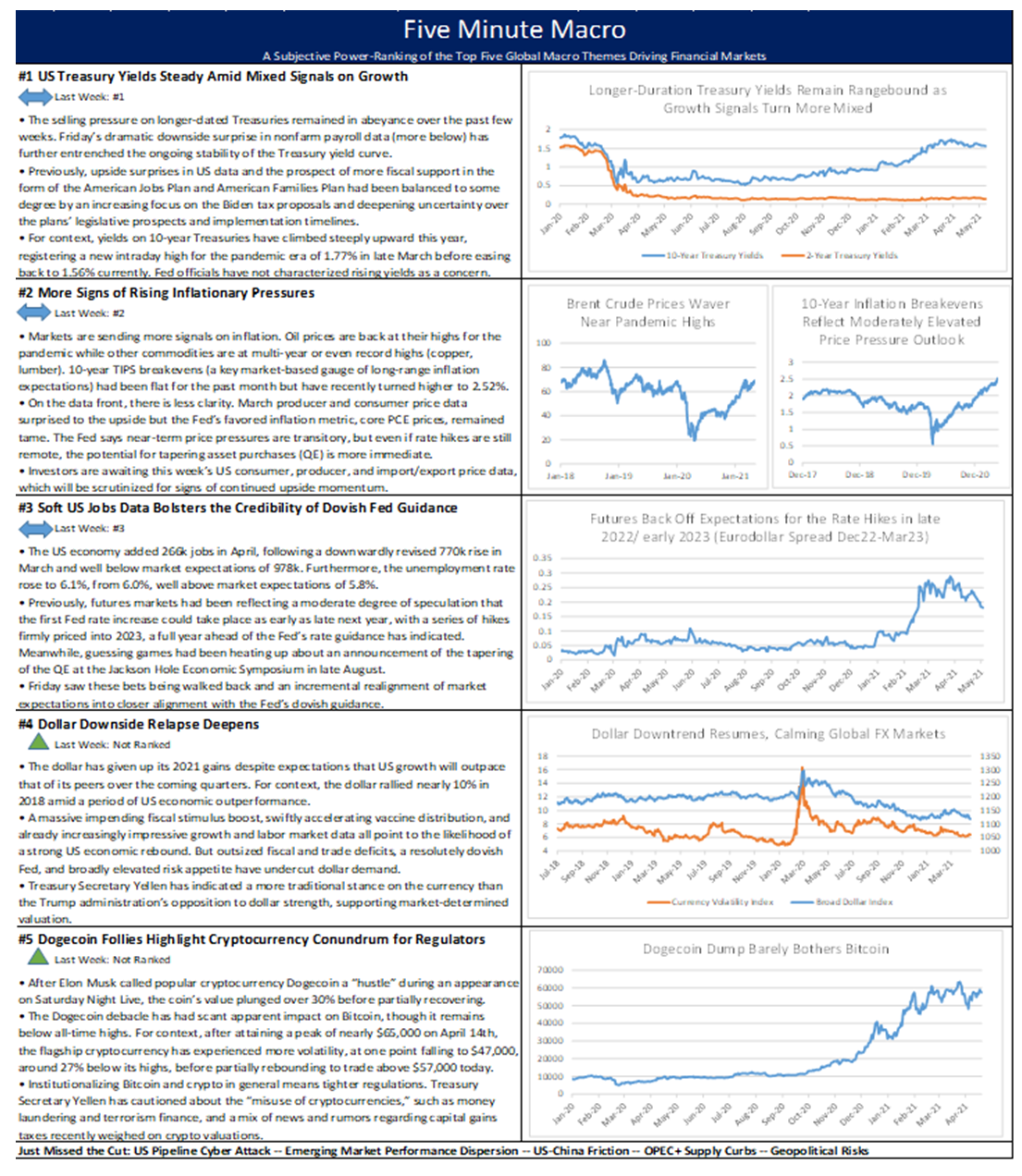

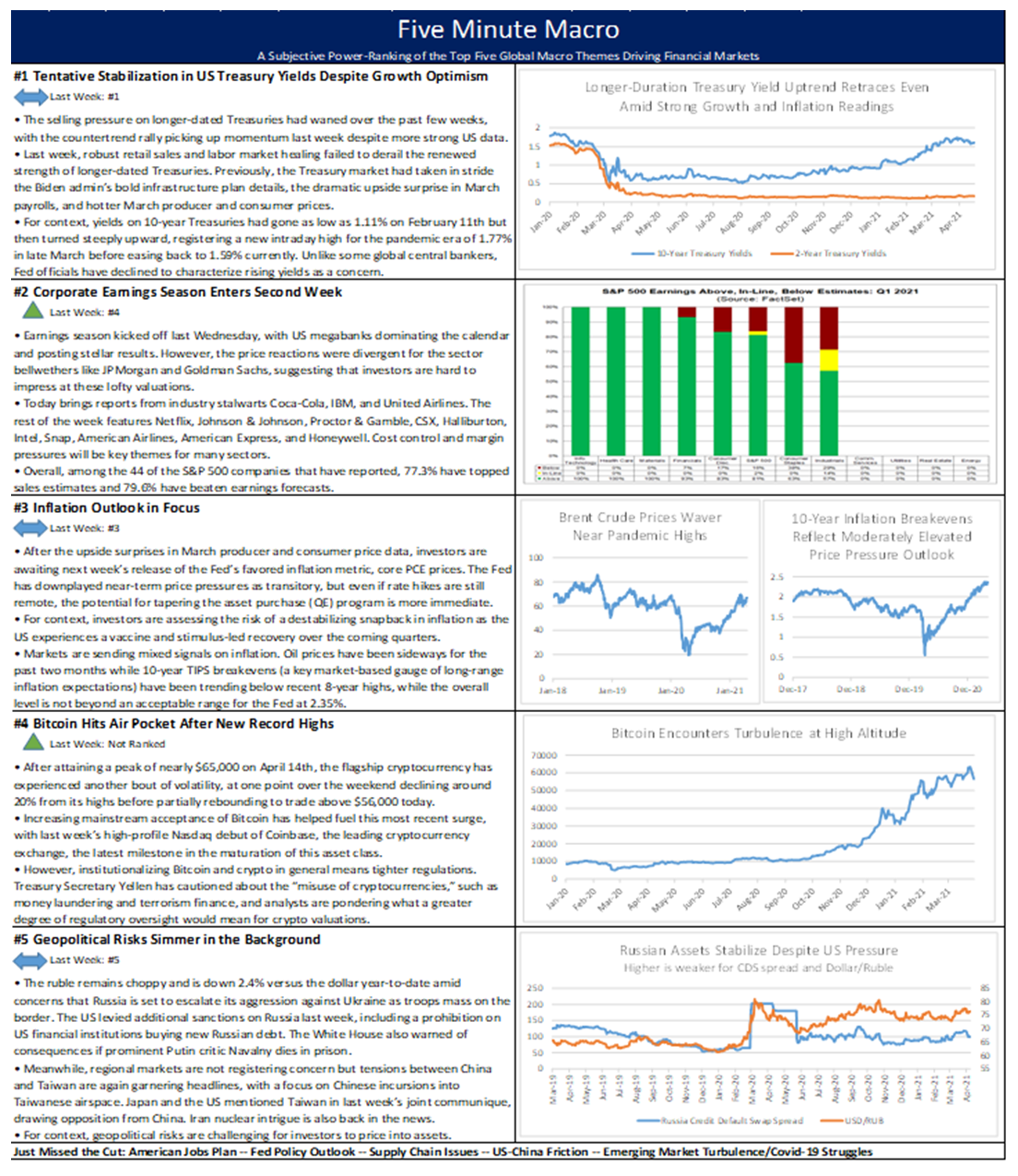

Stable Treasury yields continues to help rally markets, while peak earnings season continues. Inflation worries remain the main concern for markets and crypto markets see increased volatility, while geopolitical risks continue to simmer.

Summary and Price Action Rundown

Global risk assets are tentatively higher this morning as corporate earnings reporting season kicks off in earnest today with megabank results, while investors await more key US economic data tomorrow. S&P 500 futures point to slightly higher open after the index rose 0.3% yesterday, posting a new record high and upping year-to-date gains at 10.3%. EU equities are posting modest upside, while Asian equities mostly rallied overnight. Longer-dated Treasuries are holding most of their recent gains, with the 10-year yield trading at 1.63%, which is toward the bottom of its three-week trading range. Meanwhile, the broad dollar index is flat around its lowest level since mid-March. Oil prices are extending this week’s rebound, with Brent crude climbing toward $65 per barrel, amid a continued sideways trading pattern.

Treasury Market Equanimity Continues Ahead of More Key US Economic Data

Longer-dated Treasuries have evidenced encouraging stability in the face of upside inflation and labor market metrics over the past few weeks, though the tests to this newfound placidity will continue. Yesterday’s highly-anticipated data release indicated that the US Consumer Price Index (CPI) rose 0.6% month-on-month in March, up from 0.4% in February and above consensus expectations of 0.5%. Gasoline prices were the biggest contributor to the monthly gain, surging 9.1% in March and responsible for about half the overall CPI increase. Gasoline is up 22.5% from a year ago, part of a 13.2% increase in energy prices. Food was up 0.1% overall, with food away from home the largest contributor at 3.7%. The shelter component also came in above expectations at 0.3%. This pushed the annual rate up to 2.6%, above expectations of 2.5% and well above February’s 1.7%, as the base effects of the pandemic take hold. Furthermore, Core CPI, which excludes the more volatile food and energy components, rose 0.3% m/m and 1.6% y/y, both above expectations of 0.2% and 1.5%.

Despite headline CPI growth of 0.6% marking the fastest increase in consumer prices since 2012, investors were seemingly cognizant of base-effect and other distortions in the data, which Fed officials have repeatedly flagged, as both equity and Treasuries rallied notably following the CPI numbers. Adverse headlines regarding Johnson & Johnson’s Covid-19 vaccine may have also added to the bid for safe haven Treasuries, with solid demand also evident in the afternoon’s auction of $24 billion in 30-year notes.

The next test for the newfound stability of the Treasury yield curve will be tomorrow’s retail sales data and, to a lesser extent, industrial production figures for March, with both expected to surge after a weather-related setback in February. Today’s import and export price figures will be noted, along with commentary from the Fed’s Beige Book report, but none of these are expected to elicit a market response. – MPP view: We still believe that the current Treasury equanimity will run into questions about a taper over the summer, amid an accelerating recovery, unless the Fed begins to message more forcefully about the continuation of QE over the coming months rather than focusing on rate hikes, as the two are inextricably linked and the taper fires the starting gun on the process of accommodation withdrawal. Some analysts are predicting an announcement of the taper as early as the June meeting, whereas we expect the Fed over the next few months to begin to ramp up its signaling of a steady path of QE to year-end.

Mega-Bank Results Mark Official Start to Earnings Reporting Season

The first quarter (Q1) is projected to feature robust earnings growth, but analysts are questioning whether the good news is already reflected in equity prices, while today’s reports from leading US banks will be scrutinized for margin improvement amid rising interest rates. Earnings reporting season kicks off in earnest today, with JPMorgan, Goldman Sachs, and Wells Fargo announcing their results before the opening bell, along with Bed, Bath & Beyond and First Republic Bank also reporting today. Thus far, JPMorgan’s figures have topped estimates but its shares are trading lower in the pre-market as investors ponder the nuances of the report. Yesterday, Fastenal stock lost 1.4%, though off the lows of the morning, after the industrial fastener giant and manufacturing bellwether lagged sales expectations and cited rising production costs and the challenges of meeting a shifting demand preference for mainstream product lines at the expense of safety products in Q1. Tomorrow features a continuation of mega-bank results, including Bank of America and Citi, with other industry mainstays like BlackRock, Delta Airlines, UnitedHealth Group, PepsiCo, Rite Aid, Alcoa, and JB Hunt reporting. Overall, Q1 is estimated to feature earnings growth of 24.5% but analysts anticipate that actual results will better this rate to rival the torrid 26.1% pace in Q3 2018, with a statistical lift from the comparison to last year’s challenged start to the year amid the onset of the pandemic. But with expectations already elevated, the bar to impress investors is higher and analysts have flagged the risk of shrinking profit margins from higher production and operating costs. – MPP view: The last few earnings seasons have delivered quite nuanced price reactions during the course of reporting but have not durably altered the broad equity market trends, and we anticipate that this will pattern will repeat. More traditional economy stocks, which have outperformed in anticipation of the post-Covid recovery, will be more impacted by rising input prices than the tech sector, for instance. Overall, it may be hard for equities to establish clear directionality amid all the noise and crosstalk from these results and management guidance, but we do not think that anything will amount to a gamechanger for either the bull market or the relative advantage of value stocks as the economic recovery builds momentum.

Additional Themes

Bitcoin Surges Ahead of Coinbase Public Trading Debut – Coinbase, the leading cryptocurrency exchange, will be listed on the Nasdaq today, with analysts noting the expected valuation of approximately $100 billion and noting the somewhat rare direct listing approach, as opposed to the typical IPO process. Meanwhile, increasing the buzz over the Coinbase debut, Bitcoin, the flagship cryptocurrency, is registering an all-time high this morning above $64K. Though anticipation of increasing mainstream acceptance and demand for digital assets is fueling interest in the Coinbase listing and optimism for further upside in cryptocurrency valuations, some analysts express wariness over the heightened regulatory scrutiny that will inevitably follow. Treasury Secretary Yellen has made broadly balanced statements on Bitcoin and cryptocurrencies, but has been consistent in her concerns over their use for tax avoidance and illicit funding purposes. – MPP view: So far, Bitcoin has weathered the 2021 storm for momentum-driven assets admirably, displaying a lack of correlation that investors/speculators are certainly taking note of – the ARK Innovation ETF, Tesla shares, and the SPAC index all remain well off their highs from earlier this year.

Mixed EU Economic Data – Industrial production for the EU contracted 1.0% month-on-month (m/m) in February, bettering expectations of a 1.3% retrenchment but deteriorating from the 0.6% the prior month. This translates into a -1.6% year-on-year pace, highlighting the persistent challenges to the regional recovery during a period of Covid-19 resurgence and reintroduction of containment measures in various areas. This comes after yesterday’s ZEW economic expectations survey for the EU reflected deterioration in April, slipping from 74.0 the prior month to 66.3, though this remains at the high end of the survey range. Germany’s ZEW outlook reading showed a similar pattern of backsliding, though overall levels remained high. The euro has managed a roughly 2% rally versus the dollar this month as the ongoing uptrend in longer-dated Treasury yields paused, removing a key source of lift for the greenback. – MPP view: We expect the widening economic divergence between the US and EU over the coming months will rekindle dollar strength against the euro to some degree, with the Fed’s decision to taper or not to taper (that is the question) over the summer offering the most salient catalyst for renewed upside pressure on longer-dated Treasuries and the greenback.

Summary and Price Action Rundown

US equities were mostly higher today as Treasuries rallied amid today’s key inflation data and adverse Covid-19 vaccine news, while investors await tomorrow’s unofficial start to first quarter earnings reporting. The S&P 500 rose 0.3% today, posting a new record high and upping year-to-date gains at 10.3%. The Euro Stoxx Index closed slightly higher while Asian equities were mixed overnight. Longer-dated Treasuries rallied after today’s inflation print delivered only a modest upside surprise and the 30-year auction was well-received (more below), with the 10-year yield declining to 1.62%, which is on the lower side of the recent trading range. Meanwhile, the dollar extended its recent reversal from multi-month highs. Oil prices gained but remained well shy of recent highs, with Brent crude rising toward $64 per barrel after an upbeat OPEC report.

Treasuries Sail Through Today’s Challenges

With a highly-anticipated inflation data release and a 30-year note auction on the calendar, traders were wary of the potential for renewed volatility in Treasuries but the actual price reaction was encouragingly favorable. The Consumer Price Index rose 0.6% month-on-month in March, up from 0.4% in February and above consensus expectations of 0.5%. Gasoline prices were the biggest contributor to the monthly gain, surging 9.1% in March and responsible for about half the overall CPI increase. Gasoline is up 22.5% from a year ago, part of a 13.2% increase in energy prices. Food was up 0.1% overall, with food away from home the largest contributor at 3.7%. The shelter component also came in above expectations at 0.3%. This pushed the annual rate up to 2.6%, above expectations of 2.5% and well above February’s 1.7%, as the base effects of the pandemic take hold. Furthermore, Core CPI, which excludes the more volatile food and energy components, rose 0.3% m/m and 1.6% y/y, both above expectations of 0.2% and 1.5%.

Despite headline CPI growth of 0.6% marking the fastest increase in consumer prices since 2012, investors were seemingly cognizant of base-effect distortions in the data, as both equity and sovereign bond markets were notably indifferent. Traders instead focused on the announcement from US federal health officials calling for a suspension of Johnson & Johnson’s Covid-19 vaccine amid the rare formation of blood clots in a handful of inoculated individuals. The statements rattled market confidence in the nation’s vaccination campaign, as the Dow Industrials opened lower following the announcement. Shares of J&J dropped 3% in premarket but closed only 1.3% lower in today’s trading. Jeff Zients, the White House Covid-19 response coordinator, assured the public that “this announcement will not have a significant impact on our vaccination plan.” Vaccine production from Pfizer and Moderna currently comprise 95% of weekly allocated vaccines with J&J accounting for the remaining 5%. The White House stated the US expects to have enough vaccine supply to meet demand by May despite the suspension.

Meanwhile, longer-dated Treasuries yields declined this morning amid broad market circumspection, and further descended following today’s auction of $24 billion in 30-year debt. The US Treasury offered the 30-year notes at an auction high-yield of 2.32%, falling below the when-issued rate of 2.34%, and the bid-to-cover ratio of 2.47 outpaced the six-month average of 2.28. The benchmark 10-year rate headed to 1.62% after the sale, which is its lowest level since late March. – MPP view: Nice win for the Fed here, with the data very much adhering to their story of a transient boost and market participants clearly looking for an upside surprise that exceeded today’s magnitude. We still believe that the current equanimity will run into questions about a taper over the summer unless the Fed begins to message more forcefully about the continuation of QE over the coming months rather than focusing on rate hikes, as the two are inextricably linked and the taper fires the starting gun on the process of accommodation withdrawal.

OPEC Conveys Upbeat Signals

As some of the world’s wealthiest nations continue to struggle with resurgent Covid-19 rates, the Organization of the Petroleum Exporting Countries reported that a brightening outlook ahead and historic stimulus packages will boost both economic activity and oil demand this year. OPEC increased its 2021 global demand forecast by 100,000 barrels a day and raised its forecast for global economic growth by 0.3 percentage points to 5.4%. The increased demand forecast driven by a better than expected second half of the year forecast is credited to stimulus programs, ease of pandemic lockdowns, and an acceleration in the vaccination rollout mainly in wealthy nations. For context, OPEC and its allies (OPEC+) have maintained disciplined supply cuts that helped support oil prices since the crash last spring but announced a taper of the curbs at their most recent meeting earlier this month. Also, Iran, which is exempt from the cuts of the OPEC+ alliance, increased its output by 137,000 barrels a day in March. China has been importing more oil from Iran in recent months, with Tehran circumventing US sanctions. Investors have been closely monitoring indirect talks between Iran and the US as the two sides consider reviving the 2015 nuclear deal that could possibly have Washington lift those sanctions that currently prevent Tehran from exporting oil at will. Additionally, the cartel slightly reduced its forecast for the 2021 supply growth from outside of OPEC, decreasing its forecast by 30,000 barrels a day. – MPP view: Since they just announced a taper of output curbs, the cartel is certainly incentivized to put the best face on the demand outlook and it is hard to tell whether they are tapering because they can’t keep their members disciplined or whether they really see demand improving so much, we suspect that this report contains some meaningful element of wishful thinking.

Additional Themes

US Small Businesses Grow More Confident – The NFIB Small Business Optimism Index increased to 98.2 in March, the highest in 4 months, from 95.8 in February. While seven of the ten components increased in a positive sign, the uncertainty index increased to 81 from 75 which was the lowest since April last year, as owners struggle if it is a good time to expand their businesses. NFIB Chief Economist Bill Dunkelberg added, “Main Street is doing better as state and local restrictions are eased, but finding qualified labor is a critical issue for small businesses nationwide. Small business owners are competing with the pandemic and increased unemployment benefits that are keeping some workers out of the labor force. However, owners remain determined to hire workers and grow their business.”

SPACs in Focus– Following the SPAC (Special Purpose Acquisition Company) boom of the last few years, the SEC issued new guidance that warrants, which are issued to early investors in the deals, might not be considered equity instruments and may instead be liabilities for accounting purposes. This is likely to disrupt filings for new SPACs until the issue is resolved. The SEC has been raising concerns that investors are not being properly informed on risks related to what are often described as blank check companies. The SEC has been reaching out to accountants last week and the judgment is that it is unlikely the SEC will declare any registration statements effective until they rule on the warrant issue. More than 550 SPACs have filed to go public in 2021, seeking to raise a combined $162 billion, which exceeds the total for all of 2020, during which SPACs raised more than every prior year combined. In an April 8 statement, John Coates, the SEC’s top official for corporate filings, warned against viewing SPACs as a way to avoid securities laws.

However, deals are still getting done through existing SPACs, evidenced by Southeast Asia’s ride-hailing giant Grab announcement that they will go public through a SPAC merger with Alimeter Growth Corp. The deal values that company at $39.6 billion, which would be the largest blank-check merger to date. As part of the deal, SoftBank-backed Grab will receive about $4.5 billion in cash, which includes $4 billion in a private investment in public equity arrangement, managed by BlackRock, Fidelity, T. Rowe Price, Morgan Stanley’s Counterpoint Global fund and Singapore’s sovereign wealth fund Temasek.